DPM Adds 20% More Gold-Silver to Extend Bulgaria Mine

•February 6, 2026

0

Why It Matters

Extending Chelopech’s life enhances DPM’s cash flow outlook and demonstrates effective reserve replacement, strengthening its position in the European mining sector.

Key Takeaways

- •Measured resources up 20% to 15.3 Mt.

- •Mine life extended from 6 to 10 years.

- •Reserves now 1.6 Moz gold, 6.23 Moz silver.

- •Production target 160,000 gold‑equivalent ounces annually.

- •New Wedge Zone Deep pending drill results.

Pulse Analysis

DPM Metals’ latest resource update underscores the growing importance of reserve optimization in a market where metal prices remain volatile. By recalibrating its cut‑off grades and assuming a gold price of $2,300 per ounce, the company lifted Chelopech’s measured and indicated tonnage by 20%, translating into a more robust reserve base. This strategic adjustment not only extends the mine’s operational horizon but also aligns DPM’s asset profile with investor expectations for long‑term value creation in the Balkans.

The extension to a ten‑year mine life carries immediate financial implications. With an anticipated annual output of 160,000 gold‑equivalent ounces, DPM can project steadier cash flows, supporting debt servicing and funding future exploration. The inclusion of the Sharlo Dere prospect and revised price assumptions signal a disciplined approach to reserve replacement, a metric closely watched by analysts assessing mining company resilience. Consequently, the market rewarded the announcement, nudging the stock higher and reinforcing the company’s market capitalization near C$10.9 billion.

Looking ahead, the undisclosed Wedge Zone Deep presents a tantalizing upside. Located 300 metres below existing infrastructure, this zone could further extend the mine’s life if drilling confirms economic grades. Such upside potential, combined with a forthcoming three‑year production outlook, positions DPM as a compelling case study in incremental resource development. For investors and industry observers, Chelopech exemplifies how strategic resource modeling and proactive exploration can drive sustained growth in a competitive global mining landscape.

DPM adds 20% more gold-silver to extend Bulgaria mine

Frédéric Tomesco · February 6, 2026, 7:50 am

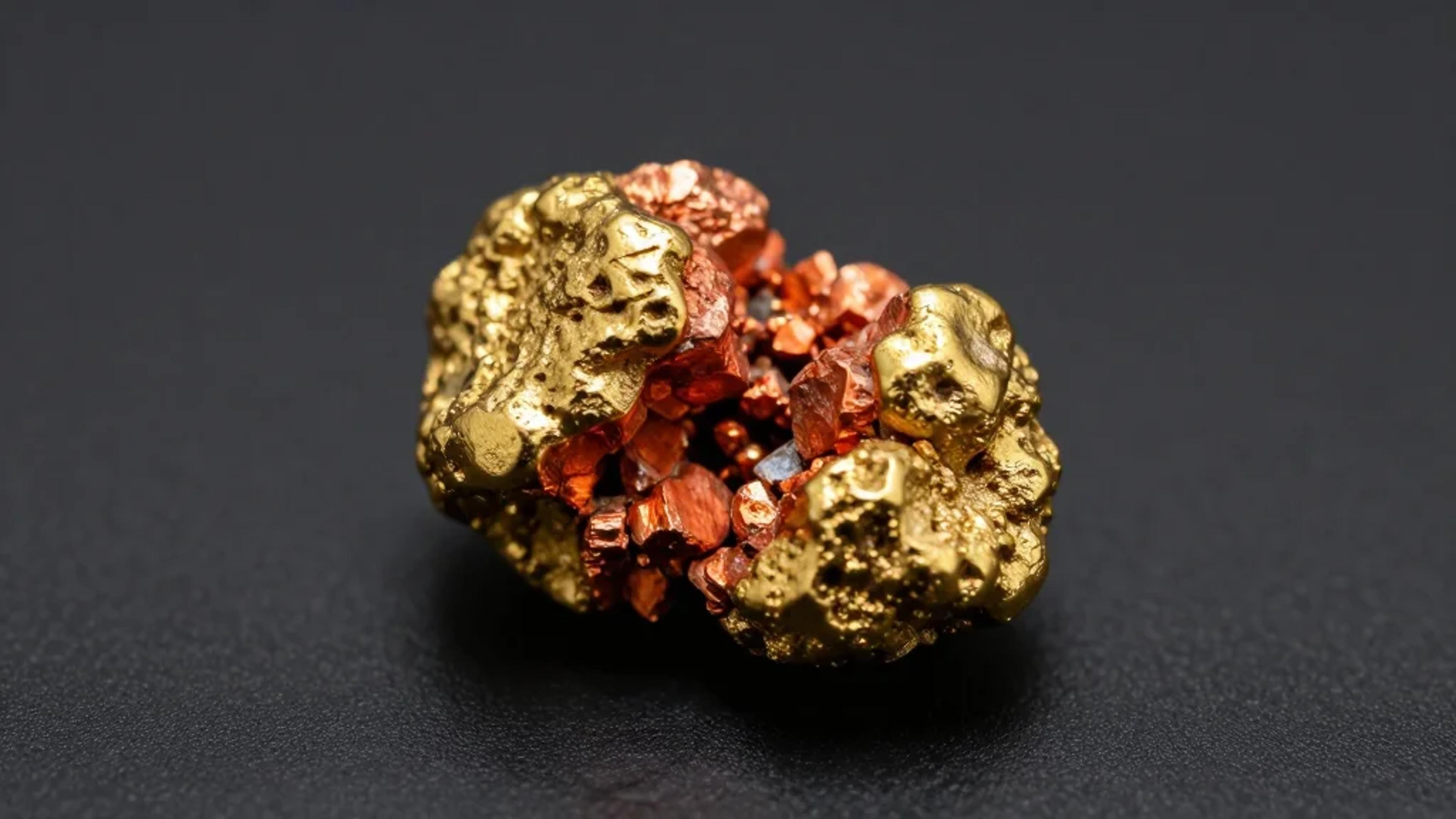

A view of the Chelopech mine site. Credit: DPM Metals.

DPM Metals (TSX: DPM) says a resource update for its Chelopech gold‑copper mine in Bulgaria has added four years to the property’s operational life.

Chelopech is now projected to have a mine life of 10 years, up from six previously, DPM said late Thursday in a statement. Measured and indicated resources jumped 20 % to 15.3 million tonnes, with total reserves now pegged at 1.6 million oz gold, 6.23 million oz silver and 308 million lb copper.

The resource update “underscores DPM’s track record of mine life extensions at Chelopech with ongoing upside potential” from several near‑mine areas, Scotia Capital mining analyst Eric Winmill said Friday in a note.

Chelopech now holds 15.3 million measured and indicated tonnes grading 2.18 g/t gold, 9.19 g/t silver and 0.64 % copper, DPM said. This translates into contained metal of 1.07 million oz gold, 4.52 million oz silver and 216 million lb copper.

It also has 9.1 million inferred tonnes grading 1.96 g/t gold, 9.38 g/t silver and 0.57 % copper for contained metal of 573,000 oz gold, 2.74 million oz silver and 114 million lb copper. All figures were accurate as of May 31.

Reserve replacement

The updated reserve is expected to sustain annual production of about 160,000 gold‑equivalent ounces. It incorporates the Sharlo Dere prospect, updated model and design parameters as well as updated cut‑off calculation assumptions. Reserve changes were primarily driven by higher metal‑price assumptions, with DPM now factoring in $2,300 per oz gold instead of $1,500 previously.

The updated reserve “is a strong indication of Chelopech’s track record of replacing mineral reserves and we believe there is potential to continue this trend going forward,” CEO David Rae said in the statement.

New zone

Resource estimates don’t include the Wedge Zone Deep discovery, which is located on the property’s northern flank and about 300 metres below existing reserves and current mine infrastructure. An update on drilling results from this zone is expected in the second quarter, DPM said.

In the meantime, DPM is scheduled to release a three‑year production outlook on Feb. 10 along with its fourth‑quarter results.

DPM shares rose 2.6 % to C$48.94 Friday morning in Toronto, giving the company a market value of about C$10.9 billion ($8 billion).

0

Comments

Want to join the conversation?

Loading comments...