Why It Matters

Any disruption in Hormuz could instantly tighten global oil and LNG supplies, forcing price spikes and reshaping risk calculations for energy investors. The outcome of the Istanbul talks will signal whether markets must brace for a broader supply shock or can maintain current pricing assumptions.

Key Takeaways

- •US F‑35 downed Iranian drone near Arabian Sea carrier.

- •Istanbul talks aim to defuse US‑Iran tensions.

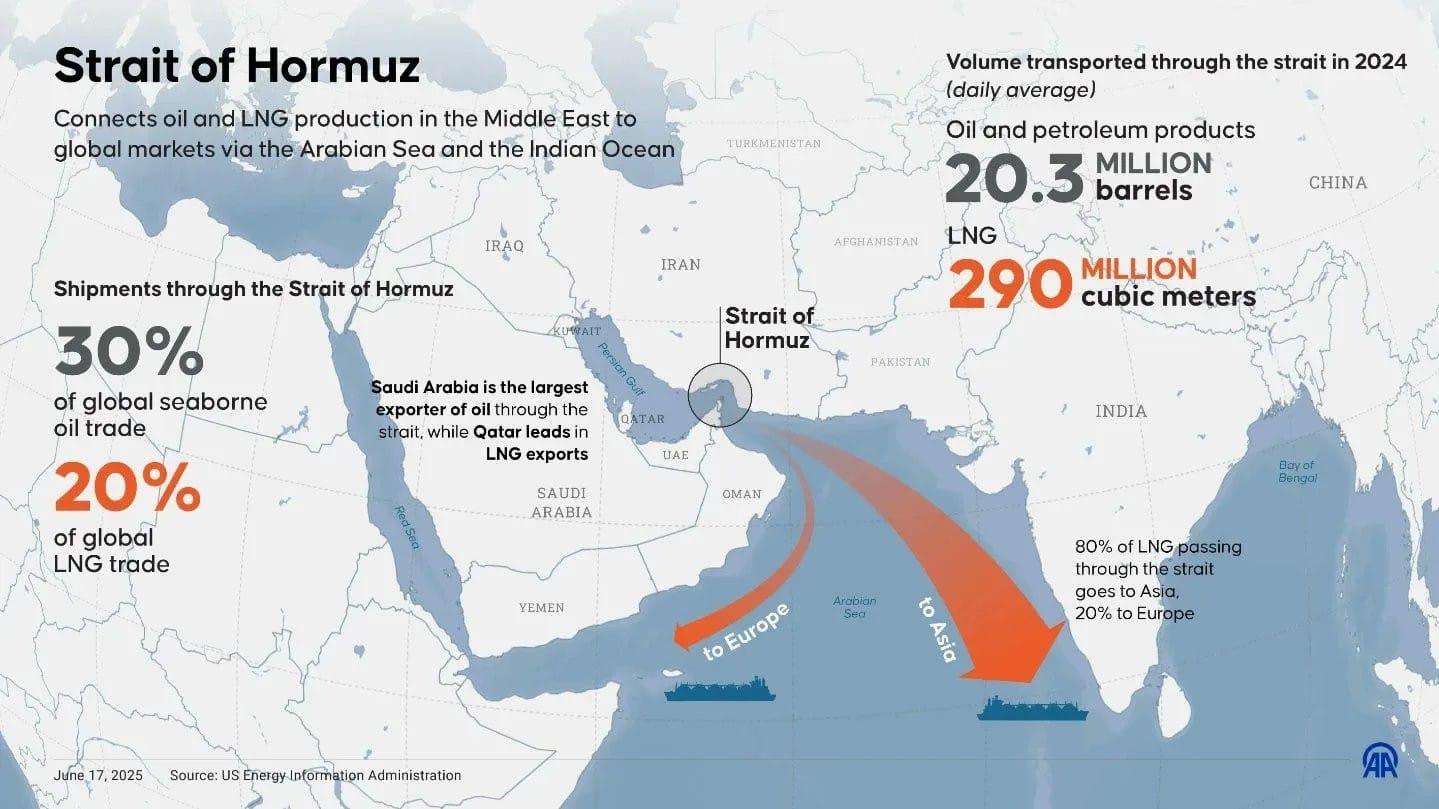

- •Strait of Hormuz handles 20% global LNG exports.

- •Potential flare‑up could spike shipping and gas price risk.

- •Markets may underprice geopolitical disruption probabilities.

Pulse Analysis

The latest incident, in which a U.S. F‑35 intercepted an Iranian drone, underscores the fragile balance of power in the Arabian Sea. While both governments have agreed to meet in Istanbul, the presence of a sizable U.S. carrier group signals a hard‑line posture that could quickly turn a diplomatic spat into a naval confrontation. Analysts note that President Trump’s warning about “bad things” adds a rhetorical weight that may influence Tehran’s calculus, making the upcoming talks a critical juncture for regional stability.

The Strait of Hormuz remains a linchpin for global energy flows, funneling not only crude oil but also a substantial share of LNG, especially from Qatar’s export hub. With more than 1.5 million tonnes of LNG—about one‑fifth of world supply—transiting the narrow passage each week, any interruption could reverberate through spot markets, freight rates, and storage strategies. Traders in Europe and North America are already factoring heightened congestion risk into forward curves, even as weather and supply fundamentals dominate headlines.

For market participants, the key challenge lies in quantifying the probability of a disruption versus its potential impact. Historical data shows that even low‑probability events can command outsized risk premiums when they involve chokepoints. Consequently, energy firms and investors should stress‑test portfolios against scenarios ranging from brief vessel delays to a full‑scale closure of Hormuz, adjusting hedges and liquidity buffers accordingly. By integrating geopolitical analytics with traditional supply‑demand models, stakeholders can avoid the common pitfall of under‑pricing fast‑moving risk in an increasingly volatile Middle East landscape.

Hormuz on the brink?

Middle East tensions are on a yo-yo string, as the US once again dials up the pressure on Iran amid a brutal crackdown on protestors opposed to the Islamic regime in Tehran.

Tensions appeared to ease last weekend when officials from both sides agreed to hold talks in Istanbul this Friday, 6 February. But yesterday, a US F-35 fighter jet shot down an Iranian drone that approached its aircraft carrier in the Arabian Sea.

The stakes at Friday’s talks could not be higher. The build-up of US Navy warships in the region adds gravitas to President Donald Trump’s warning that “probably bad things would happen” if no deal is reached.

Energy markets have grown numb to Middle East geopolitics in recent months, with natural gas traders focussing instead on weather runs, storage levels, and LNG flows as critical triggers of major price moves. But in today’s febrile markets, geopolitics is never far away.

Qatar’s perennial headache

As geostrategic signalling intensifies ahead of crunch talks, high-level LNG executives are currently gathered in Qatar for a major industry conference.

The implications of a potential military flare-up in the Strait of Hormuz, the maritime bottleneck for Persian Gulf oil and gas exports, will be weighing on minds in Doha.

Every week, Qatar exports more than 1.5 million tonnes of LNG, or 20% of worldwide supply, along this narrow sea passage to global markets, primarily in Asia.

Infographic by Anadolu Ajansı

Understanding the nuances of Hormuz gunboat diplomacy and the many unexpected ways this febrile situation could unfold is vital to evaluating geopolitical risk premia being priced into gas trading hubs in Europe and North America.

Today’s Deep Dive explores spiralling US-Iran brinksmanship, the burgeoning risk of unintended escalation, and asks whether markets are today under-pricing risk even though a full-blown conflict remains improbable.

The article is a guest post co-written by three esteemed authors with extensive knowledge and expertise in Gulf regional security, diplomacy, and energy issues:

-

Naeem Yahya Mir is a veteran oil and gas industry professional who served as Managing Director and CEO of Pakistan State Oil (PSO) from January 2012 to July 2013

-

Imran Nasir Sheikh is a seasoned naval aviator with extensive operational experience in maritime surveillance and anti-submarine warfare

-

Asim Riaz holds an M.Phil in Strategic Studies from the National Defence University, Islamabad, with degrees in Energy Management and Mechanical Engineering

IN THIS ISSUE:

-

Hormuz as a financial pressure valve: why fear reprices energy faster than missiles ever could

-

How military “signalling” could accidentally morph from careful deterrence into an escalation machine with no one fully in control

-

The structural reason chokepoints favour the weaker actor, and how weaponising congestion would unleash a loose cannon

-

Why markets don’t need lost barrels to panic, only credible disruption probabilities based on incomplete information

-

The under-discussed endgame risk that’s far more dangerous than conflict: fragmentation, and prolonged disorder

💥 Article stats: 3,000 words, 12-min reading time

The US-Iran standoff is often framed as whether war starts or is averted. This article looks beyond that black-and-white framing to face the substantive question for energy professionals: the many ways markets can misprice fast-moving events long before the first shot.

The Middle East crisis is all about how risk quietly metastasises, through shipping rates, spot LNG, inflation, and global growth. The potential for an outsized correction in risk pricing is considerable, even if the worst-case scenario fails to materialise.

Subscribe now to read the full analysis of the brinkmanship transforming this narrow waterway into a global energy market pressure cooker. Upgrade to Premium unlock this article & the entire Energy Flux archive

0

Comments

Want to join the conversation?

Loading comments...