Deals•Feb 20, 2026

Magellan Power Raises A$15 Million Strategic Investment From Viburnin Funds

Perth‑based energy storage specialist Magellan Power announced a strategic investment from Viburnum Funds, which took a minority stake worth A$15 million. The funding will support Magellan’s expansion, including local manufacturing of its Karri home‑battery and community‑scale storage systems. The deal was reported earlier this week and is the company’s first private‑equity investment.

RenewEconomy

Deals•Feb 20, 2026

LanzaJet Secures $47M Funding Led by IAG and Shell

Chicago‑based LanzaJet, a sustainable aviation fuel technology provider, announced a $47 million first‑close of a $135 million equity round at a $650 million pre‑money valuation. The round was led by IAG and Shell, with participation from Groupe ADP, LanzaTech, Mitsui and a grant...

FinSMEs

Deals•Feb 19, 2026

Samsung SDI to Sell Minority Stake in Samsung Display to Fund ESS Pivot

Samsung SDI announced it will divest its minority stake in Samsung Display as part of a strategic shift toward energy storage systems (ESS). The sale, valued at an undisclosed amount, will provide funding for the company's ESS pivot. The transaction...

The Korea Herald – Business

Deals•Feb 19, 2026

Power Ministry Sets Up Panel to Monitor PFC-REC Merger

The Indian Power Ministry created a high‑level committee to track the progress of the proposed merger between Power Finance Corporation (PFC) and Rural Electrification Corporation (REC), which have in‑principle approved the deal. The panel will meet weekly to oversee integration,...

The Hindu BusinessLine – Companies

Deals•Feb 19, 2026

Golden Energy Offshore Services Sells PSV for $27.25M

Norwegian vessel owner Golden Energy Offshore Services (GEOS) completed the sale of its platform supply vessel (PSV) Energy Partner for a gross price of $27.25 million. The transaction follows a binding sales agreement signed weeks earlier by GEOS’s subsidiary Energy...

Offshore Energy

Deals•Feb 19, 2026

Consolidated Energy Secures Discounted Loan in Largest Discount Since 2023

Consolidated Energy has been offered a loan at the biggest discount since 2023, marking a significant debt financing event for the energy firm. The loan, priced at a steep discount, reflects market confidence and provides the company with needed liquidity.

Bloomberg – Markets

Deals•Feb 19, 2026

INOXGFL Group Acquires Wind World India's IPP and O&M Units in ₹2,800 Cr Deal

India’s INOXGFL Group has secured a National Company Law Tribunal (NCLT) order to acquire the independent power producer (IPP) and operations & maintenance (O&M) businesses of Wind World India. The transaction, valued at an estimated ₹2,800 crore, expands INOXGFL’s footprint in...

The Hindu BusinessLine – Companies

Deals•Feb 19, 2026

Kenya Pipeline IPO Closure Extended to Tuesday Amid Weak Demand

The Capital Markets Authority approved a three‑day extension of the Kenya Pipeline Company IPO, moving the closing date to Tuesday after only 20% of the Sh106.3 billion target was sold. The state‑owned pipeline firm priced its shares at Sh9 each, with...

The East African – RSS hub

Deals•Feb 19, 2026

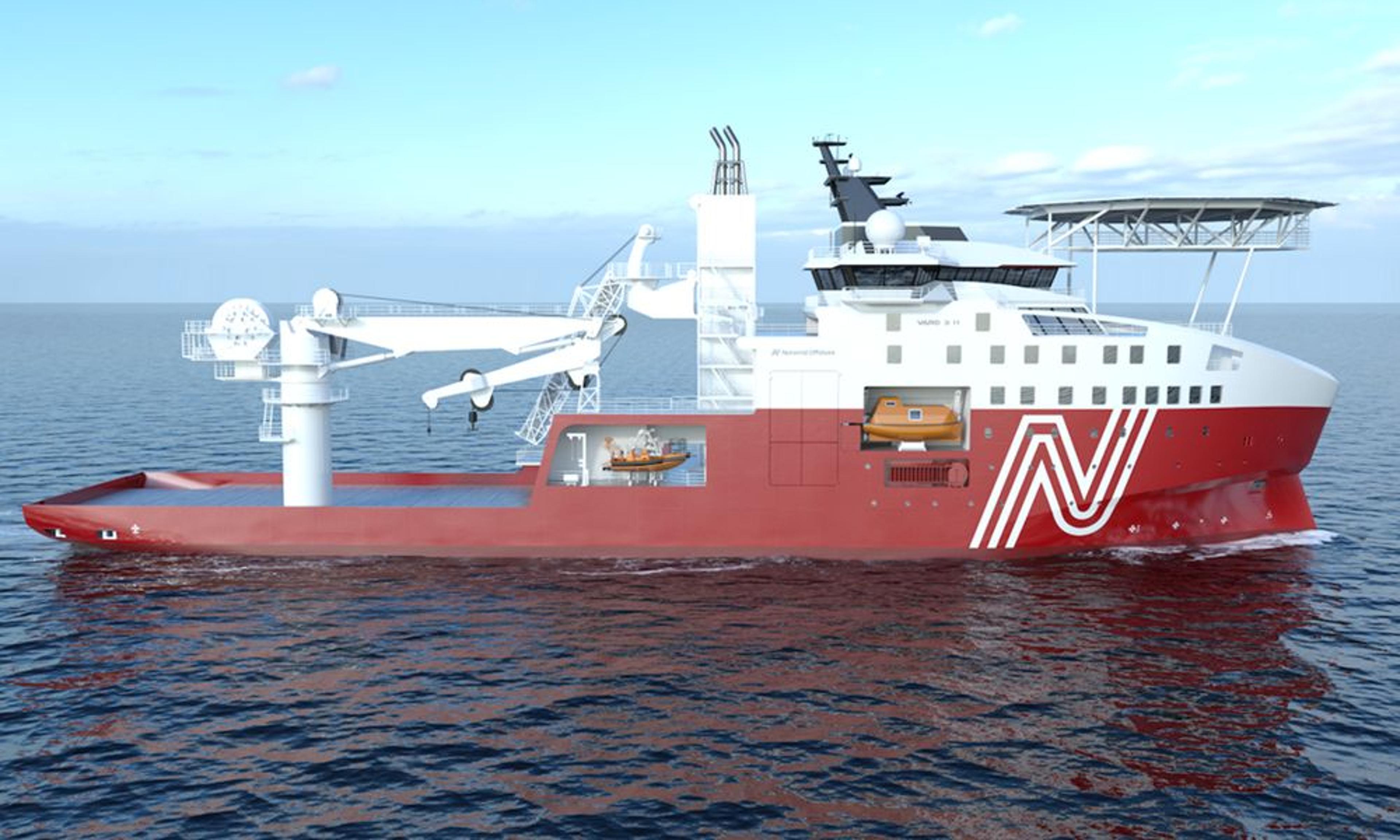

DOF Group to Acquire Two High-End AHTS Vessels for $100M and Sell One Vessel

DOF Group ASA announced an agreement to purchase the Aurora Saltfjord and Aurora Sandefjord AHTS vessels for a net investment of about $100 million, with $30 million cash and the remainder financed by debt, while also divesting the Skandi Laser...

Euronext — News (RSS)

Deals•Feb 18, 2026

United Maritime Sells €13 Million Stake in Norwegian ECV Joint Venture

Nasdaq‑listed Greek bulker owner United Maritime agreed to sell its equity interest in a Norwegian joint venture developing an energy construction vessel for about €13 million, generating a €1.7 million profit. The transaction is expected to close by the end of May...

Splash 247

Deals•Feb 18, 2026

Perch Energy Acquires Solstice to Expand Community Solar Portfolio

Community solar platform Perch Energy announced the acquisition of Solstice, a customer acquisition and management firm. The deal adds 550 MW of contracted solar projects and expands Perch’s portfolio to over 3 GW across 1,000+ projects in 16 states. Financial terms were...

Solar Power World

Deals•Feb 18, 2026

Lydian Energy Secures $689M Debt Financing for US Solar and BESS Projects

Lydian Energy announced it has secured $689 million in financing to develop three U.S. projects—a 150 MW/733 MWh BESS in Utah and solar PV projects in New Mexico and Texas. The financing, comprising construction‑to‑term, tax‑credit bridge, co‑investment bridge loans and a letter of...

Energy Storage News

Deals•Feb 18, 2026

Rio Tinto Takes Majority Control of Nemaska Lithium, Plans $300M Investment

Rio Tinto announced it now holds a 53.9% stake in Nemaska Lithium, giving it majority control and management responsibilities. The miner plans to invest over $300 million this year to expand the Quebec lithium operation, while the Quebec government will contribute...

MINING.com – Gold

Deals•Feb 18, 2026

Metafuels Raises $24M in New Funding Round

Swiss ClimateTech startup Metafuels announced a $24 million financing round led by UVC Partners, Energy Impact Partners, Contrarian Ventures, RockCreek, Verve Ventures and Fortescue. The new capital builds on earlier €7.4 million investments and will accelerate development of its Aerobrew sustainable kerosene...

Deutsche Startups

Deals•Feb 18, 2026

Statiq Raises $18M in Equity‑debt Round Led by Tenacity Ventures

India’s EV‑charging network provider Statiq announced a new $18 million funding round, led by Tenacity Ventures, with participation from Y Combinator, Shell Ventures and RCD Holdings. The mixed equity‑debt round will fund expansion of its charging infrastructure across Tier‑1 and Tier‑2 cities...

ET EnergyWorld (The Economic Times)