Minority Recap

United Maritime Sells €13 Million Stake in Norwegian ECV Joint Venture

•February 18, 2026

0

Participants

Why It Matters

The cash inflow sharpens United’s focus on its core bulker business and strengthens liquidity amid volatile freight markets, signaling strategic discipline among Greek shipowners.

Key Takeaways

- •Sold JV stake for €13 million, net €1.7 million profit.

- •Vessel delivery scheduled Q2 2027, built in Norway.

- •Fleet now five vessels after Cretansea sale and Dukeship charter.

- •Exited tanker market, earned ~$60 million profit.

- •Capital reshuffle boosts liquidity for core bulker focus.

Pulse Analysis

United Maritime’s decision to divest its equity in the Norwegian energy‑construction vessel joint venture underscores a disciplined capital‑management approach that many Greek shipowners are adopting. The €13 million sale not only locks in a €1.7 million profit but also removes exposure to a project that will not be delivered until the second quarter of 2027. By exiting at an early stage, United converts a long‑term, capital‑intensive commitment into liquid assets that can be redeployed across its core bulk‑carrier portfolio. The transaction reflects the company’s original blueprint of early entry, value creation and timely exit.

The offshore construction market is undergoing rapid transformation as renewable projects and subsea oil‑gas developments drive demand for specialized vessels such as energy‑construction ships. However, the long build cycles and financing requirements make these assets vulnerable to market volatility. United’s move signals a cautious stance, preferring to preserve balance‑sheet strength while the sector calibrates. At the same time, the firm’s recent fleet actions—selling the 81,508‑dwt kamsarmax Cretansea and securing a bareboat charter for the 181,453‑dwt capesize Dukeship—illustrate a broader trend of portfolio optimisation among mid‑size owners.

With the JV proceeds and cash from the Cretansea sale, United Maritime is positioned to reinforce its five‑vessel operating fleet, which now comprises one capesize, one kamsarmax and three panamaxes. The liquidity boost can fund debt reduction, future acquisitions, or strategic partnerships that enhance earnings per share. Moreover, the company’s earlier exit from the tanker segment, which generated nearly $60 million, demonstrates its willingness to pivot away from non‑core segments. Observers will watch whether United leverages this capital to capture higher freight rates in the evolving bulk‑shipping market.

Deal Summary

Nasdaq‑listed Greek bulker owner United Maritime agreed to sell its equity interest in a Norwegian joint venture developing an energy construction vessel for about €13 million, generating a €1.7 million profit. The transaction is expected to close by the end of May 2026.

Article

Source: Splash 247

Nasdaq-listed Greek bulker owner United Maritime has agreed to sell its stake in a Norwegian joint venture developing an energy construction vessel (ECV), locking in a profit as it reshuffles capital

United Maritime, the Nasdaq‑listed Greek bulker owner, has agreed to sell its stake in a Norwegian joint venture that is developing an energy construction vessel (ECV), securing a profit as it reshuffles capital.

The Stamatis Tsantanis‑led spinoff of Seanergy Maritime said it will sell its equity interest for about €13 million ($15.4 million), generating a profit of roughly €1.7 million. The deal is expected to close by the end of May, after which United will no longer hold a stake in the project.

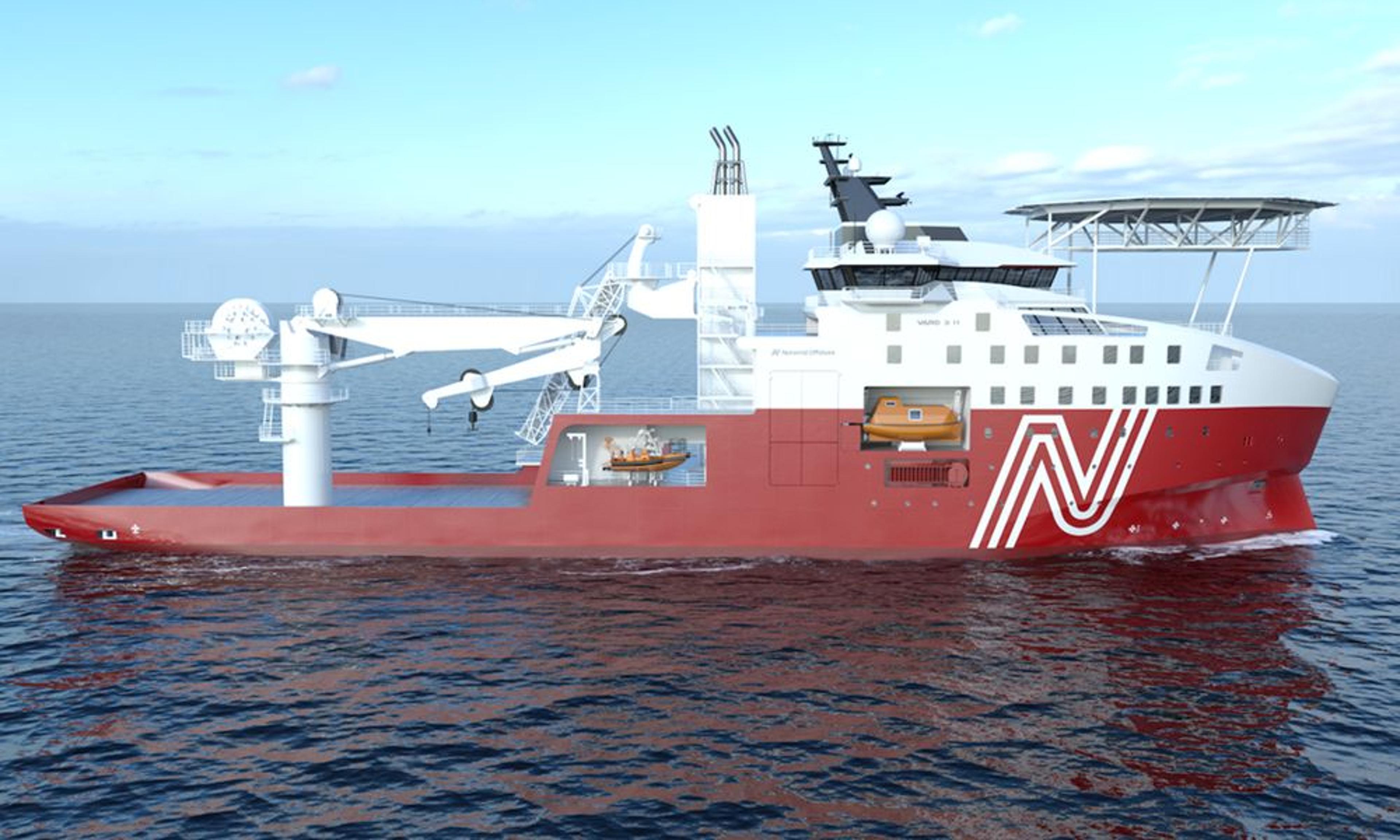

United entered the ECV newbuilding in July 2024 at an early stage, targeting exposure to the offshore energy market across subsea oil and gas and renewables. As the project advanced and valuations firmed, the company increased its participation and became the largest individual shareholder.

The vessel, ordered in 2024, is under construction in Norway with delivery slated for the second quarter of 2027. The project was developed alongside the founders of Wind Energy Construction and Norwind Offshore, with backing from RGI Marine and United as the cornerstone investor.

Tsantanis said the sale reflects the company’s strategy of early entry, value creation and timely exit, adding that the transaction delivers a meaningful cash return.

The offshore exit comes alongside further fleet moves.

-

In January, United agreed to sell the 2009‑built 81,508 dwt kamsarmax Cretansea for a net price of $14.7 million. The vessel is due for delivery to its new owners by May 25. After debt repayment, net cash proceeds are expected at around $6 million.

-

In February, the company also took delivery of the 2010‑built 181,453 dwt capesize Dukeship under an 18‑month bareboat charter from Seanergy. United paid a $5.5 million down payment under the deal, which carries a daily rate of $9,450 and includes a $22.1 million purchase obligation at the end of the charter period.

Following completion of the Cretansea sale, United’s operating fleet will stand at five vessels: one capesize, one kamsarmax and three panamaxes. The company, established in 2022, also briefly entered the tanker market with the acquisition of two aframaxes and two LR2s, later exiting those positions at a reported profit of nearly $60 million.

0

Comments

Want to join the conversation?

Loading comments...