Series D

Utility Global Secures $100M Series D Funding to Accelerate Industrial Decarbonization

•February 17, 2026

0

Why It Matters

The financing accelerates large‑scale industrial decarbonization, giving heavy‑industry players a viable path to net‑zero emissions. It also signals strong investor confidence in electrochemical hydrogen solutions as a core climate technology.

Key Takeaways

- •$100M Series D led by Ara Partners, APG Asset Management.

- •Funding accelerates deployment of H2Gen® hydrogen tech globally.

- •H2Gen® converts off‑gases to high‑purity hydrogen without electricity.

- •Produces concentrated CO₂ stream, easing carbon capture costs.

- •Modular design fits steel, chemicals, mobility, oil & gas.

Pulse Analysis

Utility Global’s $100 million Series D injection marks a pivotal moment for industrial hydrogen production. By securing backing from prominent investors like Ara Partners and APG Asset Management, the company gains the financial muscle to scale its H2Gen® platform across continents. This technology distinguishes itself by extracting energy directly from waste gases, bypassing traditional electricity‑intensive electrolysis, and delivering on‑site hydrogen with a carbon footprint that can dip into negative territory. For investors and policymakers, the deal underscores a growing appetite for solutions that marry carbon capture with clean fuel generation.

The H2Gen® system’s ability to generate a high‑purity hydrogen stream while simultaneously producing a concentrated CO₂ by‑product addresses two critical challenges in heavy industry: fuel substitution and emissions capture. Conventional hydrogen pathways often require separate, costly carbon capture infrastructure, but Utility’s integrated approach reduces both capital and operational expenditures. This dual‑output model is especially attractive to sectors like steelmaking and refining, where process gases are abundant and the economics of retrofitting are tight. As regulatory pressure mounts and carbon pricing mechanisms tighten, such cost‑effective decarbonization routes become essential for maintaining competitiveness.

Beyond the immediate environmental benefits, the modular and scalable nature of H2Gen® positions it as a plug‑and‑play solution for existing plants. Its small footprint means minimal disruption to current operations, facilitating rapid adoption across geographically dispersed assets. This flexibility not only accelerates the transition to low‑carbon production but also creates new revenue streams through carbon credit generation and potential licensing of the technology. In a market hungry for tangible net‑zero pathways, Utility Global’s funded expansion could set a new benchmark for industrial hydrogen and carbon management strategies.

Deal Summary

Utility Global announced a $100 million Series D financing round led by Ara Partners and APG Asset Management. The capital will fund the deployment of its H2Gen® technology for large‑scale hydrogen production and decarbonization across hard‑to‑abate industrial sectors.

Article

Source: VC News Daily

Utility Global Raises $100M Series D Funding

Source: Massinvestor/VC News Daily

Date: 2026‑02‑17

HOUSTON, TX – Utility Global, a global economic industrial decarbonization company enabling practical solutions for hard‑to‑abate sectors, today announced a $100 million Series D financing round.

The round was led by Ara Partners and APG Asset Management (one of the world’s largest pension investors on behalf of Dutch pension funds). This milestone financing will allow Utility to globally deploy its proprietary H2Gen® technology at industrial scale.

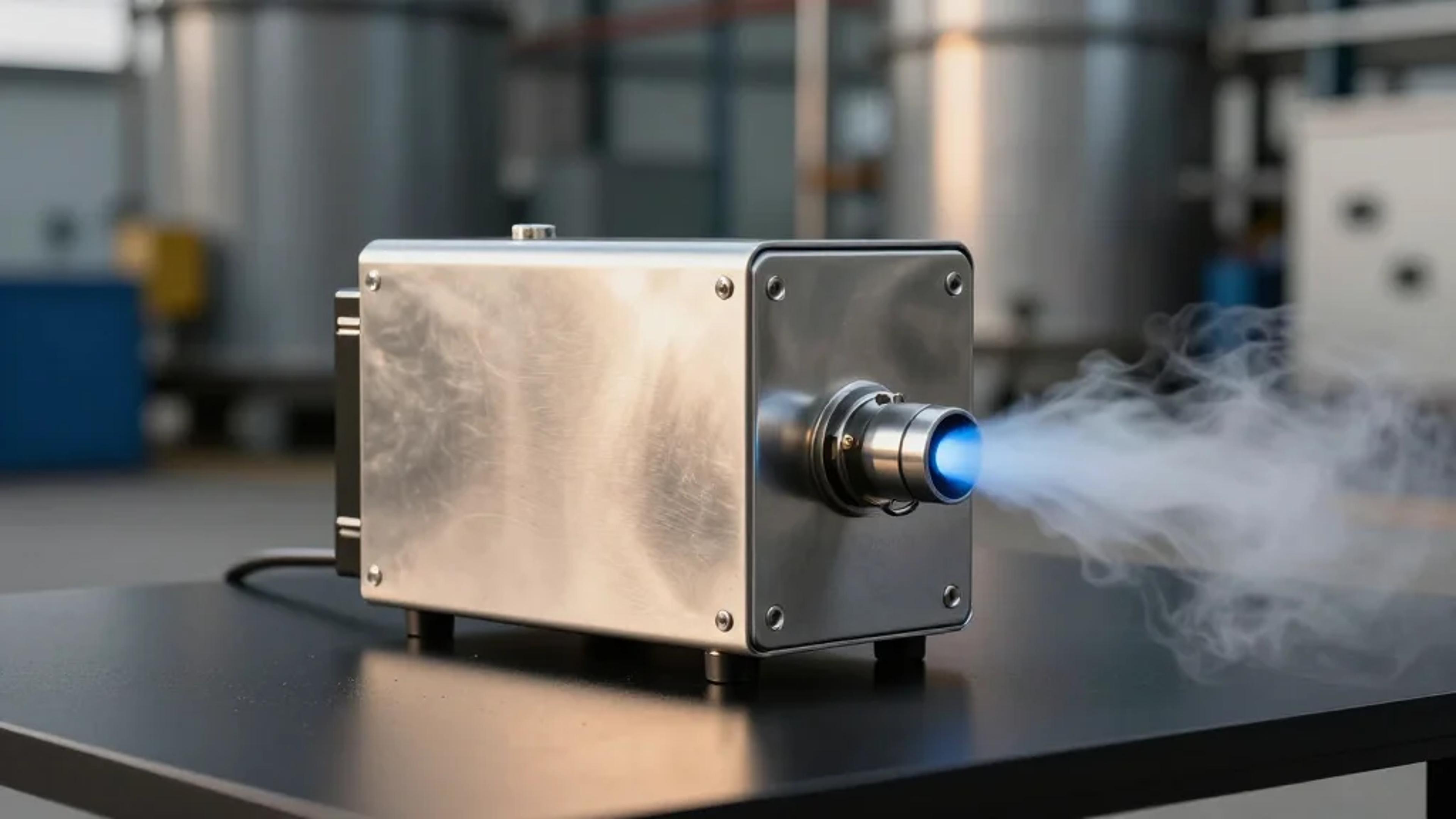

Utility delivers practical solutions that enable economic industrial decarbonization across hard‑to‑abate sectors including steel, mobility, refining, chemicals, and upstream oil & gas. The company’s breakthrough H2Gen® technology harnesses energy from industrial off‑gases and biogases to produce application‑specific, high‑purity hydrogen with low‑to‑negative carbon intensity on‑site from water, without electricity, using a proprietary electrochemical process. H2Gen® also produces a high‑concentration carbon dioxide stream, significantly reducing the cost and complexity of carbon capture. Modular, scalable, and operationally flexible, H2Gen® systems integrate seamlessly into existing industrial assets with a record‑small footprint, enabling practical and economical decarbonization.

0

Comments

Want to join the conversation?

Loading comments...