As U.S. Companies Return to Venezuela's Oilfields — One Canadian Driller Has a Head Start

•February 12, 2026

0

Companies Mentioned

Why It Matters

Ensign’s entrenched position could yield higher revenues if foreign firms re‑enter and production ramps up, giving it a competitive edge over newcomers. The policy shift also hints at broader U.S. engagement that may redirect capital into one of the world’s largest untapped oil reserves.

Key Takeaways

- •Ensign runs two rigs in Venezuela’s Orinoco basin.

- •U.S. firms now cleared to re‑enter Venezuelan oilfield market.

- •Company owes $4.2 million for work amid sanction risks.

- •Stock outperforms TSX peers despite limited Venezuela exposure.

- •Infrastructure challenges make new entrants’ entry costly.

Pulse Analysis

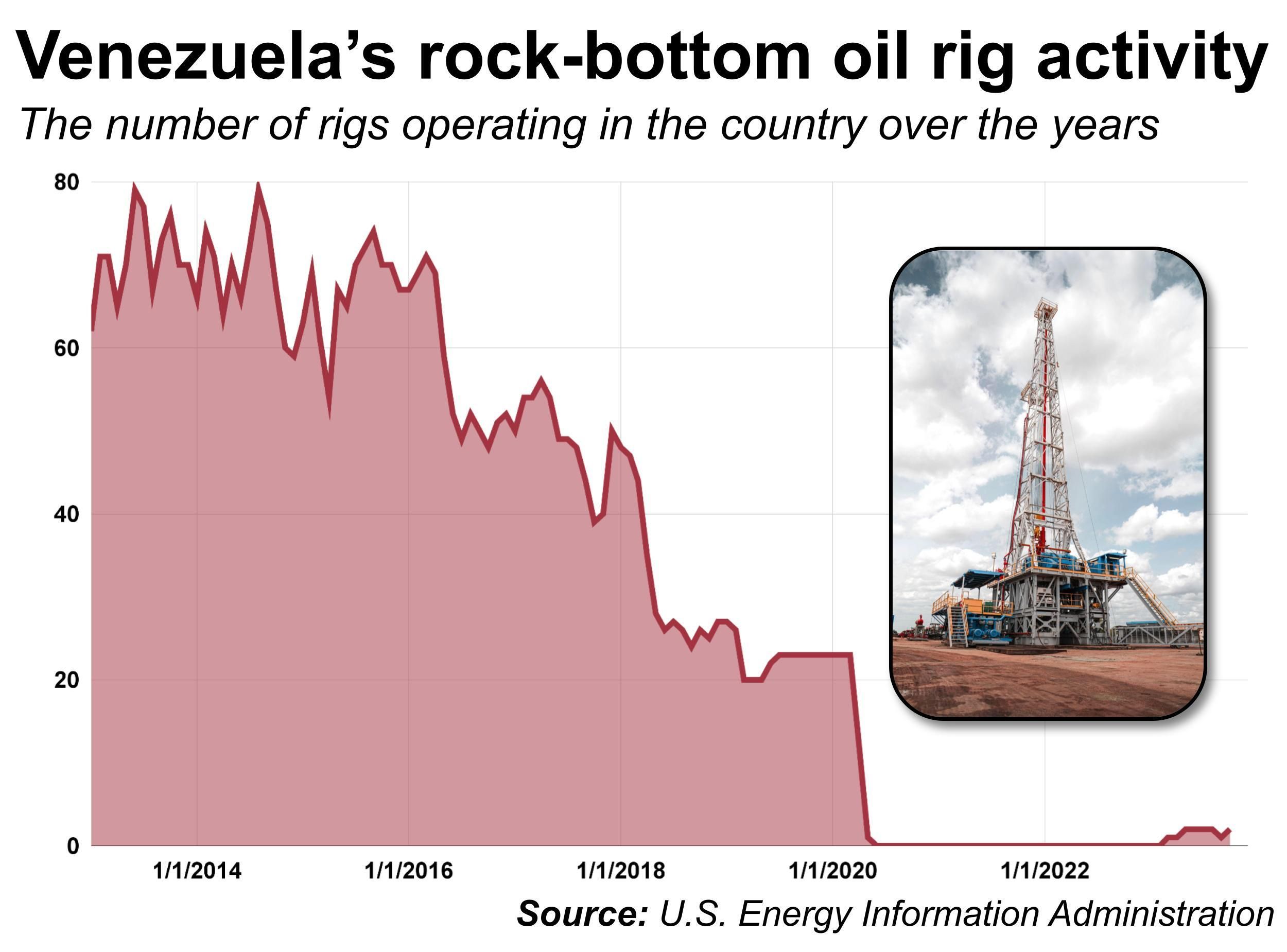

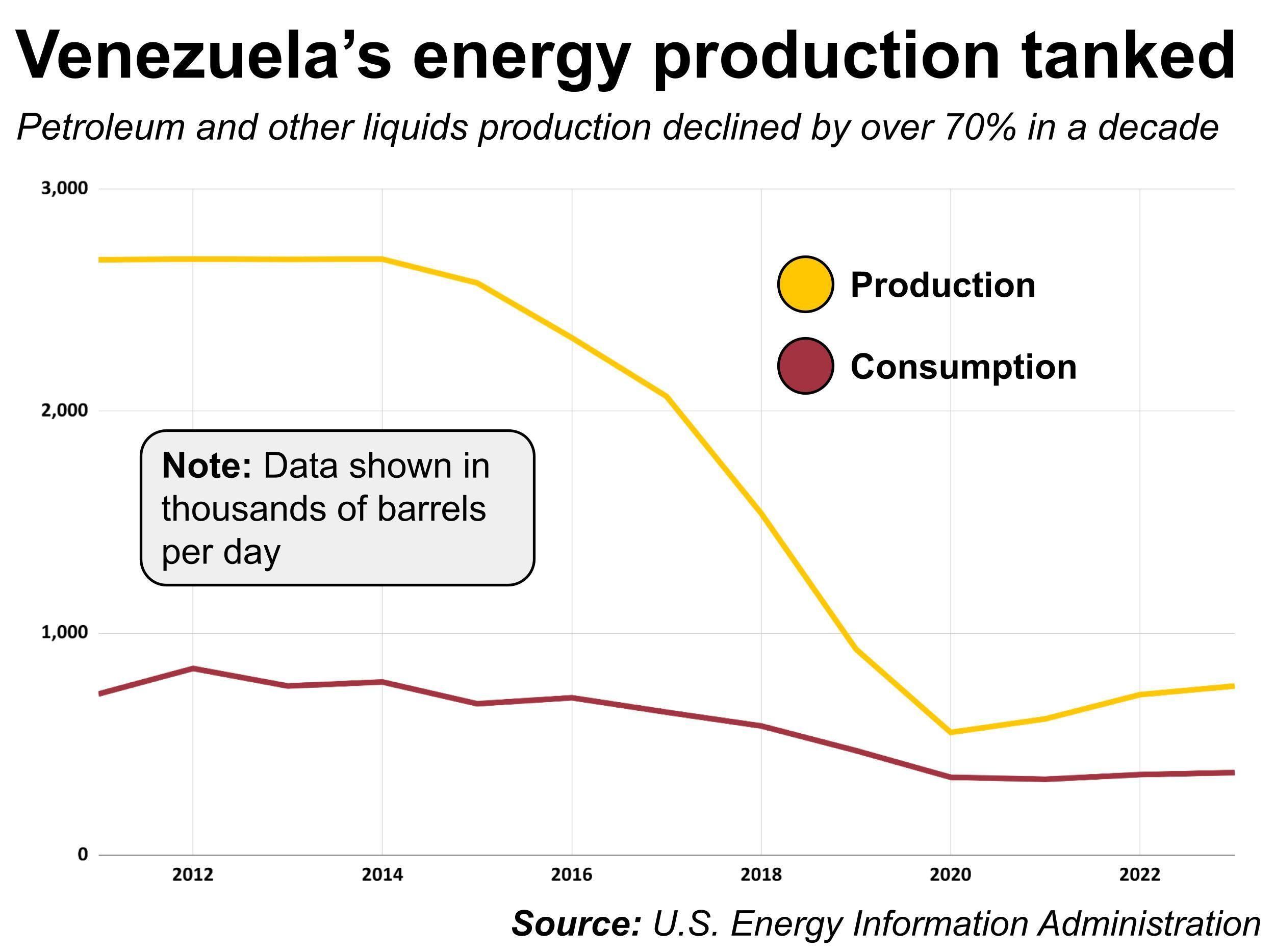

Venezuela’s oil sector has been crippled for years by U.S. sanctions that barred most American service firms from operating in the country. The Trump administration’s recent general licence relaxes those restrictions, allowing majors such as Halliburton and SLB to consider re‑entry. This policy shift reflects Washington’s broader strategy to revive crude output from the Orinoco Belt, a region that once produced over 2 million barrels per day before the economic collapse. While the licence removes a legal barrier, logistical hurdles and political volatility remain significant obstacles for any newcomer.

Ensign Energy Services, a Calgary‑based driller, has quietly maintained a foothold in Venezuela for more than 20 years, currently operating the nation’s entire active rig count. The company’s ability to navigate a “minefield” of sanctions, deteriorating infrastructure, and cash‑strapped PDVSA has given it unparalleled local expertise. However, Ensign flagged a $4.2 million receivable from its Venezuelan contracts as a credit risk, underscoring the lingering financial uncertainty tied to sanctions and payment workarounds such as oil‑in‑kind settlements. The firm’s experience also highlights the operational challenges of sourcing parts, staffing rigs, and ensuring safety in a market where supply chains can be disrupted overnight.

For investors, Ensign’s head start offers a potential upside if the U.S. policy change spurs a broader influx of capital and a gradual rebound in Venezuelan production. While analysts caution that Venezuela currently accounts for a small portion of Ensign’s global revenue, the company’s stock has outperformed other Canadian oil‑service peers, suggesting market optimism about its unique positioning. Ultimately, the scale of any production recovery will depend more on oil‑major spending decisions than on policy alone, but Ensign’s entrenched presence positions it to capture a disproportionate share of any future growth in one of the world’s most resource‑rich yet volatile oil plays.

As U.S. companies return to Venezuela's oilfields — one Canadian driller has a head start

As a new United States policy clears the way for American oilfield service companies to return to Venezuela , one Canadian driller never left — maintaining a foothold in the politically volatile , oil-rich country, despite years of upheaval and sanctions that drove competitors away.

Ensign Energy Services Inc. , a Calgary-based oilfield services company whose largest shareholder and chairman is Canadian billionaire Murray Edwards, has quietly kept rigs running in Venezuela for more than two decades. It recently accounted for the country’s entire active rig count, according to Baker Hughes data, with crews currently operating two drilling rigs in the South American country’s Orinoco heavy-oil region.

“We’re the only Canadian company — the only oilfield service drilling company — operating in Venezuela,” Bob Geddes, Ensign president and chief operating officer, said in an interview. “We’ve stuck through Venezuela, thick and thin, and here we are with a little bit of blue sky ahead.”

The Trump administration issued a general licence this week enabling U.S. oilfield service companies to work in Venezuela, easing restrictions that had previously forced oilfield majors like SLB and Halliburton to scale-back or shutdown activity entirely.

The move is in keeping with Washington’s plan to revive crude production from the beleaguered country in the wake of a U.S. military operation to remove Venezuela’s former strongman president, Nicolás Maduro, on Jan. 3.

Geddes said he first realized something serious was unfolding in Venezuela when a U.S. aircraft carrier appeared in the Caribbean Sea last November. He said he has been on calls every couple of weeks with the company’s workers since.

“They are beaming with what’s happening, and the prospect of perhaps a democratic process evolving out of this,” he said. “But I’m always so fearful of blowbacks. You just never know what’s going to happen.”

Venezuela’s oil industry has long been constrained by heavy U.S. sanctions that kept most American companies out of the country. Ensign says it has been able to continue drilling under a special licence issued by the U.S. government to its client, which has allowed work to continue despite the restrictions.

The Canadian driller is widely understood to be working with Chevron Corp., the only U.S. oil major currently authorized to produce and export Venezuelan crude under a restricted licence from Washington — though reports suggest other companies could win similar permissions in the coming months.

“It’s not for the faint-hearted,” Geddes said.

Drilling in Venezuela requires far more advance planning than in Canada or the U.S., where parts and services can be delivered within hours. Newcomers are likely to struggle to get equipment through ports and to staff rigs and run them safely and efficiently, he said.

“If you were to start up and put a rig into Venezuela — good luck,” Geddes said.

He said the company has hard-won experience after 25 years of navigating a “minefield” of U.S. sanctions, crumbling infrastructure and dealings with Venezuela’s cash-strapped state-controlled oil company, Petróleos de Venezuela, S.A. (PDVSA).

U.S. sanctions have also meant foreign companies have sometimes been forced to resort to creative workarounds to get paid in Venezuela, with Chevron reportedly taking oil in lieu of cash at times for its joint-venture revenue with PDVSA.

In its latest earnings report, Ensign disclosed it was owed about $4.2 million for work performed in Venezuela, a small sum for the driller, but one it nonetheless flagged as a credit risk, noting that “due to the continuing political unrest in the country as well as imposed sanctions there can be no assurance that (Ensign) will be successful in collecting.”

But Geddes said he’s feeling more optimistic about the country today than he was a year ago.

“That’s why we hunker down and get through the tough times, so we can enjoy the upside,” he said.

Ensign’s shares have led a resurgence in Canadian oilfield service stocks in the first few weeks of 2026, with the sector outpacing every major TSX subsector in January, according to ATB Capital Markets.

Analysts say it’s not entirely clear what’s driving the rally, though some are pointing to the modest rebound seen in crude prices since the start of the year.

“The stocks are clearly outperforming the commodity and fundamentals,” TD Cowen analyst Aaron MacNeil said, noting producers have held spending flat and are unlikely to increase activity while oil prices continue to range between US$60 to $80 per barrel.

The latest developments in Venezuela aren’t an obvious catalyst for Ensign’s stock either, MacNeil said, noting the country accounts for a small share of the driller’s overall business which operates across eight countries. “Is there an opportunity for Ensign? One hundred per cent. I just question materiality,” he said.

-

They fled Venezuela's oil collapse. Now its revival could shake their adopted home

-

As Trump remakes the global oil market, Exxon and Chevron want in

Skepticism remains that the Trump administration’s intervention will translate into large-scale foreign investment.

Ultimately, it’s likely that spending plans of oil producers — not U.S. government policy — will decide if drilling activity and production rises in Venezuela, MacNeil said.

Still, Ensign said it hopes to make the most of its head start and long experience in one of the largest and most volatile oil plays in the world.

“We’re active in Venezuela. We will become more active in Venezuela,” Geddes said. “It’s not going to turn overnight. Infrastructure takes time. I think it’ll be a decade before Venezuela gets back up to where they were pre-Chavez.

“Our position has always been: go where the oil is. And there’s a lot of oil there.”

• Email: [email protected]

We first published our interview with Bob Geddes, Ensign Energy Services’ president and chief operating officer, in our subscriber-only newsletter, FP West: Energy Insider. Sign up now to get more exclusive insights into the oilpatch delivered straight to your inbox every Wednesday morning.

0

Comments

Want to join the conversation?

Loading comments...