Solaris Energy Signs 500MW AI Data Center Power Deal

•February 16, 2026

0

Companies Mentioned

Why It Matters

The agreement positions Solaris as a key natural‑gas power supplier for AI data centers, a segment with rapidly rising electricity demand, and demonstrates the viability of long‑term, behind‑the‑meter power models.

Key Takeaways

- •Solaris signs 500MW rental for AI data center

- •Deal runs ten years starting 2027

- •Option to extend five years

- •Parent guarantees 50% of rental fees

- •Solaris expands natural‑gas data‑center portfolio

Pulse Analysis

The surge in artificial‑intelligence workloads is driving data‑center operators to secure reliable, low‑carbon power sources. While many firms chase renewable contracts, natural‑gas solutions like Solaris’s modular units offer dispatchable capacity that can balance intermittent renewables and meet the high, continuous demand of AI training clusters. By bundling equipment rental with a prospective Power Purchase Agreement, Solaris provides a turnkey offering that reduces capital expenditure for data‑center owners and aligns with the industry’s shift toward behind‑the‑meter generation.

Solaris’s strategy reflects a broader trend of energy providers targeting the high‑margin data‑center niche. The company’s product line—available in 5.7 MW, 16.5 MW, and 35 MW increments—allows it to scale installations to match the specific load profiles of AI facilities, which often exceed traditional cloud workloads. The 500 MW contract, equivalent to roughly 10–15 large‑scale data‑center sites, illustrates the scalability of Solaris’s platform and its confidence in securing long‑term revenue streams through equipment‑rental models backed by parent guarantees.

From a financial perspective, the deal mitigates risk for both parties. The 30‑day termination clause coupled with a 50 % fee on remaining rentals protects Solaris against early cancellations, while the parent guarantee ensures cash‑flow stability. For Hatchbo, the arrangement locks in predictable power costs and sidesteps the upfront capital outlay of building its own generation fleet. As AI adoption accelerates, such hybrid financing and supply structures are likely to become a standard blueprint for powering the next generation of compute‑intensive facilities.

Solaris Energy signs 500MW AI data center power deal

Signed with Hatchbo · February 16 2026 · By Zachary Skidmore

Houston‑based energy solutions firm Solaris Energy Infrastructure has signed a long‑term equipment‑rental deal to supply more than 500 MW of power‑generation capacity to an AI‑focused data‑center customer.

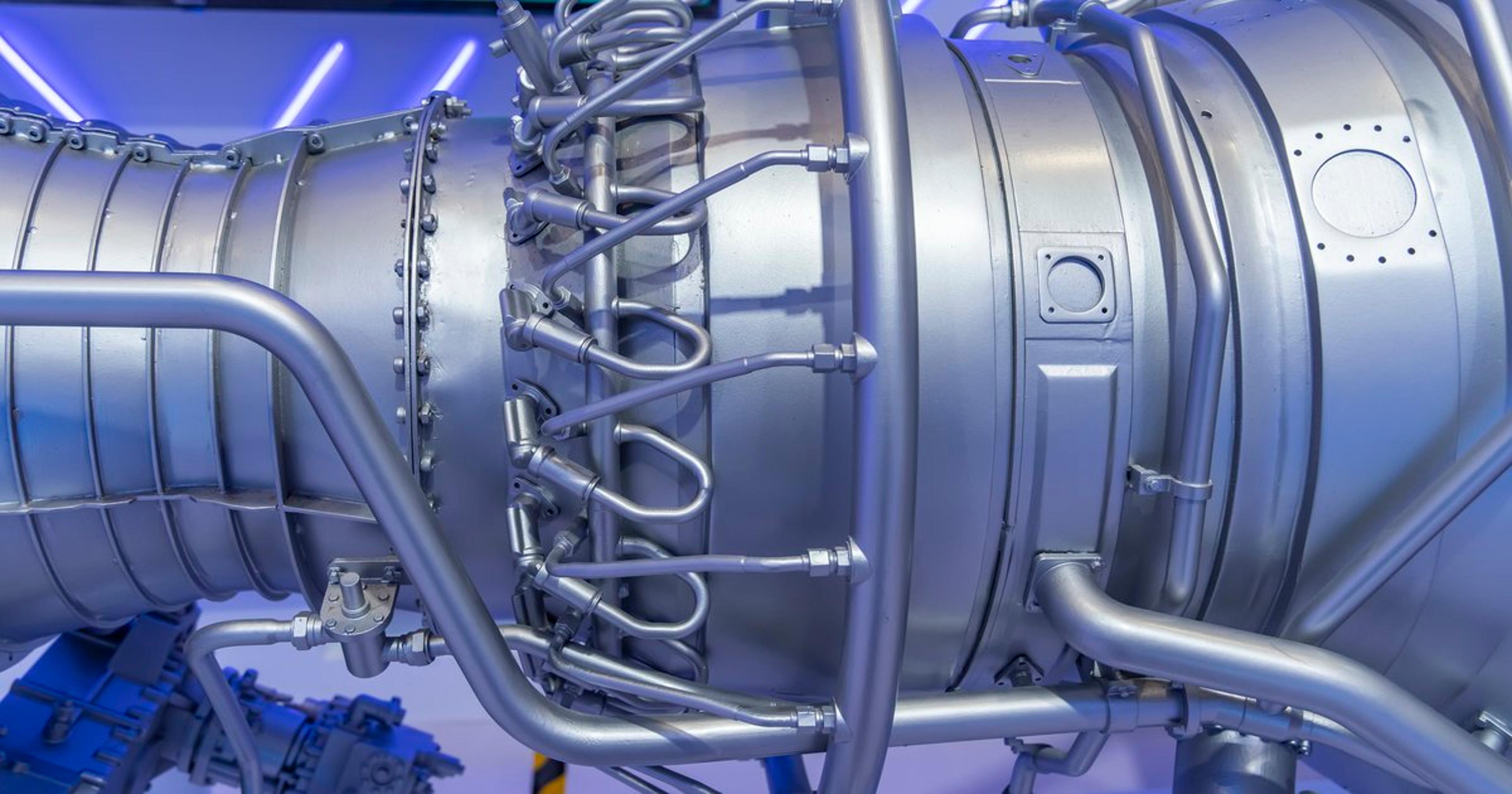

![Image: gas]

Getty Images

The agreement will see Solaris subsidiary Solaris Power Solutions supply the capacity to Hatchbo, a Delaware‑based limited‑liability company described as an affiliate of an investment‑grade global technology company operating in AI computing. DCD has reached out to both companies for further information.

The initial rental term is scheduled to begin on January 1 2027 and run for ten years, with an option to extend for a further five years.

Under the terms of the deal, Solaris will provide generation equipment to meet power demand from the data centre. In addition, the parties intend to negotiate a separate Power Purchase Agreement (PPA), expected to last at least as long as the rental agreement. If completed, Solaris would own, install, and operate the equipment and associated balance‑of‑plant infrastructure.

The customer may terminate the rental agreement within 30 days of signing, provided it is not in default. In that case, it must pay a fee equal to 50 % of the remaining rental payments on the affected equipment through the end of the term.

As a backstop to the agreement, the customer’s parent company has issued a guarantee covering up to 50 % of total rental fees for the initial term. The guaranteed amount declines each year but remains at least 50 % of the future payments during that period.

Solaris did not disclose financial terms or the location of the deployment. It said that it will reveal further details on the agreement in its next annual report.

Solaris is predominantly a natural‑gas power supplier and, over recent years, has increasingly targeted the data‑center market. The company has developed an integrated power solution for the data‑center market, offering behind‑the‑meter natural‑gas power in increments of 5.7 MW, 16.5 MW, and 35 MW.

Last April, the company extended a power‑supply agreement with a “major” data‑center client from 500 MW to 900 MW, with the capacity expanded to power a data centre operated by a joint venture between Solaris and the customer.

0

Comments

Want to join the conversation?

Loading comments...