Uranium Market Gathers Momentum in 2026: Sprott

•February 10, 2026

0

Why It Matters

The price breakout reflects a strategic pivot toward upstream uranium, positioning the metal as a critical component of U.S. energy security and future nuclear expansion. Investors and utilities must navigate tightening supply and policy‑driven demand to manage cost and risk.

Key Takeaways

- •Spot uranium price tops $100/lb, first in two years

- •Sprott added 4 million lb, total holdings near 79 million lb

- •US Section 232 designates uranium as critical national security mineral

- •Congress allocated $2.7 billion for domestic enrichment over decade

- •Kazakhstan curtails exploration, limiting future production incentives

Pulse Analysis

The early‑2026 uranium price rally marks a decisive shift from the volatility that characterized 2025, as investors refocus on the upstream supply chain. Sprott’s aggressive accumulation—adding 4 million lb to its portfolio—signals confidence that the market’s fundamentals are improving. Policy momentum, especially the Trump‑era Section 232 designation, elevates uranium to a strategic asset, prompting a $2.7 billion federal commitment to domestic enrichment and a broader ambition to quadruple U.S. nuclear capacity by 2050. These moves not only bolster demand forecasts but also create a regulatory environment conducive to higher price floors.

Supply dynamics are tightening on the production side. Kazakhstan, the world’s top producer, has signaled reduced exploration incentives, effectively capping future output unless prices rise substantially. This constraint, combined with a historically under‑invested mine development pipeline, widens the anticipated supply‑demand gap. As utilities continue to under‑contract—missing replacement rates for a 13th consecutive year—the market faces a “coiled‑spring” effect where deferred purchases could trigger sharp price spikes when demand materializes in the early 2030s.

For stakeholders, the convergence of policy support, constrained supply, and lagging contracting creates a compelling investment narrative. Energy firms eyeing stable fuel costs may consider forward contracts or equity stakes in miners, mirroring trends in other critical minerals. Meanwhile, financiers and asset managers can leverage Sprott’s positioning as a benchmark for exposure to the uranium upside. Understanding these interlinked forces is essential for navigating the evolving nuclear fuel landscape and capitalizing on the sector’s emerging momentum.

Uranium market gathers momentum in 2026: Sprott

The global uranium market entered 2026 with great momentum, with spot prices surging by about a quarter in January to above $100 a lb. for the first time in two years.

According to Sprott Asset Management, the rally towards its 2024 peak suggests that the uranium sector has a bigger supportive backdrop than last year, which was marked by volatility. Prices declined during the first few months, before bouncing from the low $60s to the high $80s in the second half.

Sprott’s ETF products director Jacob White said the gains in January reflect “an important shift in investor attention” from downstream nuclear themes back to the upstream supply chain, largely due to improvements in policy clarity fundamentals.

The firm has been amongst the biggest buyers of uranium, adding 4 million lb. to its uranium fund this year, which now has a total holding of nearly 79 million.

Policy drivers

In a note published this week, the Sprott analyst pointed to the Trump administration’s Section 232 framework on critical minerals as a key catalyst, as it explicitly proclaims uranium’s importance to US energy and national security.

A heightened strategic status could lead to further policy support and tangible actions taken by the US government, such as the recently announced $2.7 billion funding to strengthen domestic

uranium enrichment services over the next decade, the report noted.

“More broadly, these actions sit within a clear ambition to quadruple US nuclear capacity by 2050, including another target to have 10 new large reactors under construction by 2030. If the US were to quadruple nuclear capacity, it would require an extraordinary amount of incremental uranium supply,” White wrote.

He also hypothesized that the US government could begin to take up equity stakes in uranium miners in exchange for offtake agreements with price floors.

“We are seeing these types of transactions in other critical materials, so why not uranium?”

Supply tightening

On market fundamentals, the Sprott analyst pointed to December 2025 as a defining moment for its bull market thesis, when top producer Kazakhstan tightened exploration control on uranium. The current prices, according to its state miner Kazatomprom, do not provide enough incentives to unlock future production. As such, supply would be constrained in the coming years unless higher uranium prices are realized.

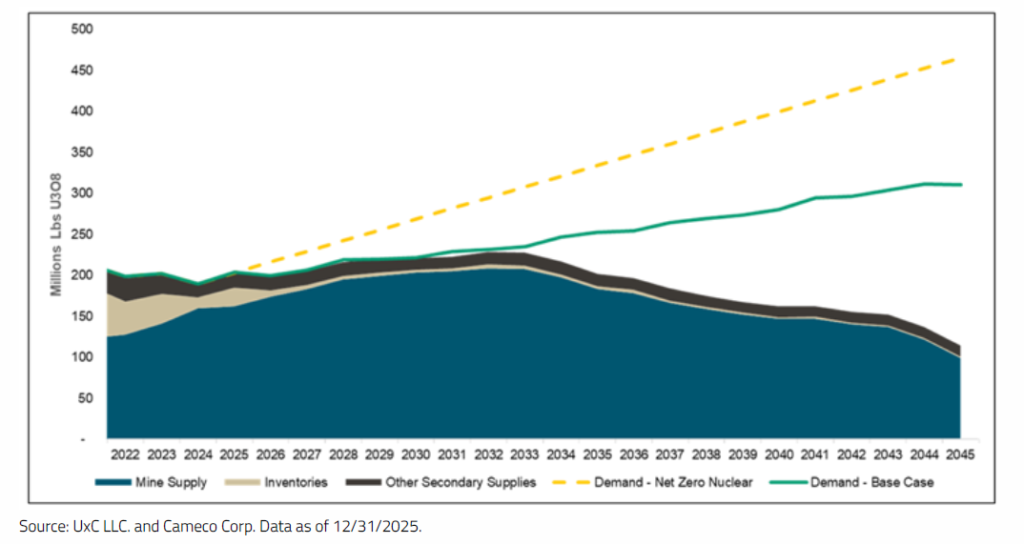

Uranium supply-demand imbalance may likely grow. Credit: Sprott

Globally, the slow pace of mine development and a concentrated, underinvested supply base are set to widen the market deficit, Sprott added, citing producer data. The supply problem would be exacerbated by rising demand for nuclear energy and continued buildout of AI data centers, it said.

Contracting in catch-up mode

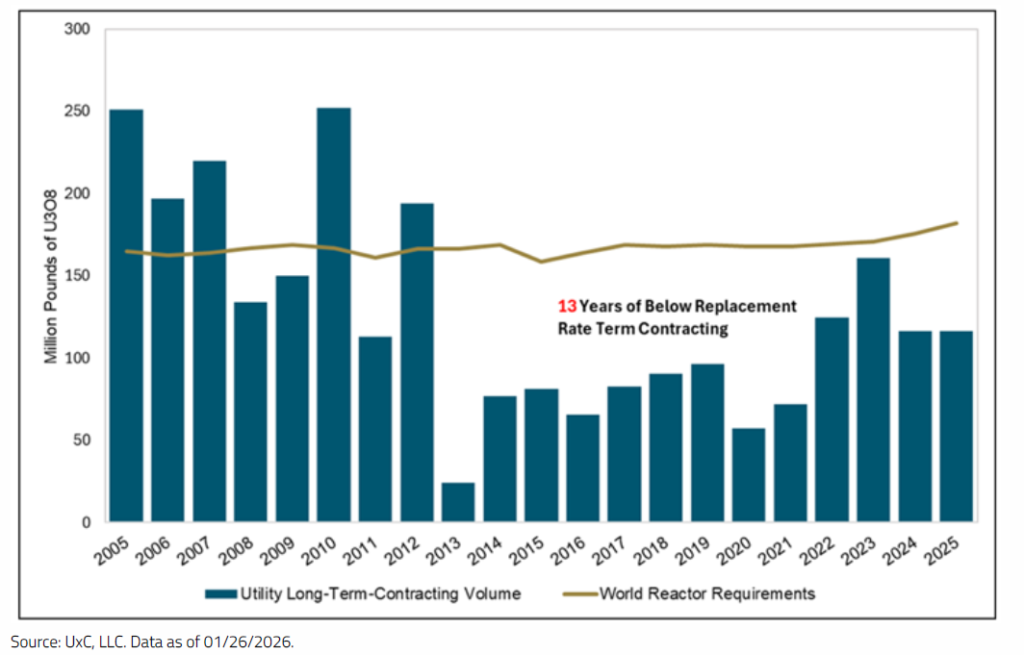

Sprott’s report also highlighted that uranium contracting has been falling behind for years, which could further boost prices and market momentum.

Utilities buy nuclear fuel years ahead, but contracting has undershot the replacement rate for a 13th straight year in 2025, pushing uncovered needs into the future. This deferred procurement builds pressure, it said, raising the risk that utilities will have to return to the market later with larger volumes to secure, fewer options and higher prices.

Uranium contracting a coiled spring? Credit: Sprott

According to Sprott, the timing is particularly acute in 2026, as current decisions will shape early-2030s supply. Early signs of this catch-up emerged in late 2025, with contracting picking up after a subdued first nine months amid uncertainty.

Taken together, uranium enters 2026 with an increasingly constructive setup, White wrote, adding that “January delivered an early reminder of uranium’s non-linear behavior when fundamentals tighten and sentiment turns.”

0

Comments

Want to join the conversation?

Loading comments...