PQ: Global Ad Spend Will Climb 8.8%, Composite Rises Three-Tenths Of A Point

•February 12, 2026

0

Why It Matters

The robust 2026 growth signals strong demand for advertising inventory, while the projected slowdown forces brands and agencies to re‑evaluate budget allocations and channel strategies for the coming year.

Key Takeaways

- •Global ad spend projected to rise 8.8% in 2026

- •Total marketing spend forecast to increase 9.8% this year

- •MediaPost composite growth now 7.7%, up 0.3 points

- •PQ forecasts 2027 ad spend growth of 4.4%

- •U.S. ad spend to outpace global expansion in 2026

Pulse Analysis

The 8.8% rise in global advertising spend marks the strongest year‑over‑year growth in the past decade, reflecting a blend of macro‑economic resilience and strategic brand initiatives. Even‑year events such as the Olympics and major sports tournaments are prompting marketers to allocate larger budgets, while consumers continue to spend despite higher living costs. Digital platforms remain the primary growth engine, but traditional media is also seeing incremental gains as brands pursue integrated campaigns that blend online and offline touchpoints. This environment creates abundant inventory and competitive pricing for media buyers, encouraging experimentation with emerging formats like connected TV and programmatic audio.

MediaPost’s composite forecast now averages a 7.7% increase, up 0.3 percentage points, underscoring a consensus among leading forecasters that demand is accelerating faster than previously expected. The United States stands out, with its advertising and marketing spend projected to outpace the global rate, driven by strong retail sales, tech sector marketing pushes, and a continued shift toward performance‑based digital spend. For agencies, this translates into heightened pressure to deliver measurable ROI, prompting greater investment in data analytics, attribution models, and AI‑driven media planning tools. Brands are also diversifying spend across channels to capture fragmented audiences, especially in short‑form video and social commerce.

Looking ahead, PQ anticipates a sharp deceleration to 4.4% growth in 2027, suggesting that the 2026 surge may be a short‑term boost rather than a sustained trend. The slowdown is likely tied to tightening consumer budgets, potential recessionary signals, and a natural correction after a year of aggressive spend. Marketers will need to prioritize efficiency, focusing on high‑impact media, incremental lift testing, and tighter alignment with sales pipelines. Companies that can adapt quickly—by reallocating spend to high‑performing digital assets and leveraging first‑party data for precision targeting—will be best positioned to maintain growth in a more constrained advertising landscape.

PQ: Global Ad Spend Will Climb 8.8%, Composite Rises Three-Tenths Of A Point

By Joe Mandese · 02/12/2026 (published 3 hours ago)

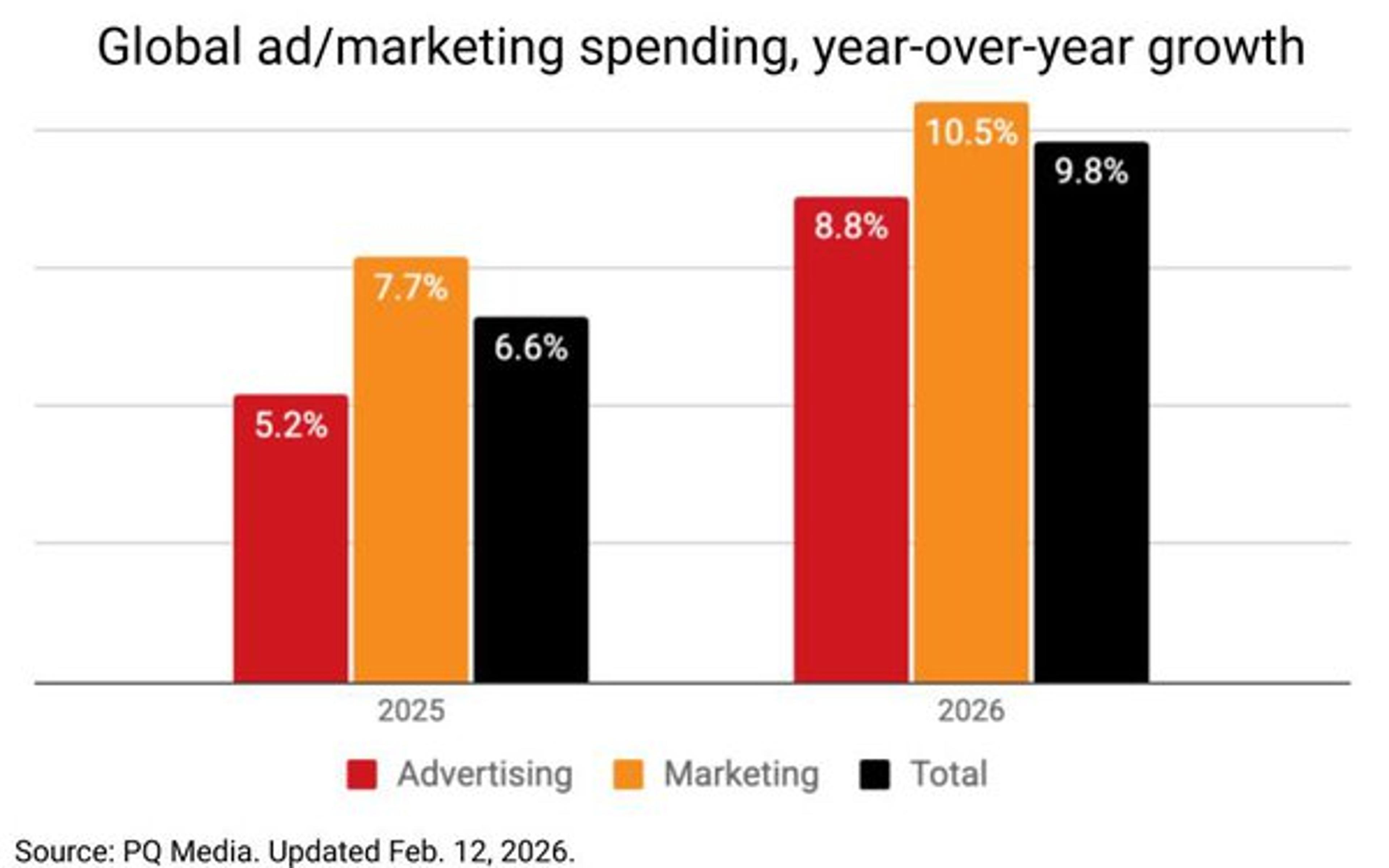

Worldwide ad spending will climb 8.8 %, while total marketing spending will rise 9.8 % this year, according to the just‑released 2026 edition of PQ Media’s annual Global Advertising & Marketing Spending Forecast.

Effective today, PQ’s global ad‑spending data has been added to MediaPost’s composite of reputable industry forecasters (see below), whose average 2026 growth rate expands to +7.7 %, an increase of three‑tenths of a point from our year‑end composite.

“Early pacing data in 2026 shows that brands are increasing their budgets for the even‑year events, but also due to consumers continuing to purchase products despite rising costs. We expect the overall advertising and marketing sector to decelerate again in 2027,” notes PQ CEO Patrick Quinn. PQ projects worldwide ad spending will expand only 4.4 % next year.

The just‑released update also includes revised estimates for U.S. advertising and marketing spending (see below), both of which are expected to outpace worldwide ad‑spending expansion.

PQ’s new ad‑spending estimates have also been added to MediaPost’s U.S. ad‑spending forecast composite (see below).

0

Comments

Want to join the conversation?

Loading comments...