🎯Today's Finance Pulse

Updated 2h agoWhat's happening: LinkedIn CFO James Chuong to join Atlassian as chief financial officer

James Chuong, who has served nearly five years as LinkedIn’s chief financial officer, will become Atlassian’s CFO on March 30. His compensation includes a $600,000 base salary, a 75% target bonus, a $22 million RSU grant and a $2 million signing bonus. The move follows Atlassian’s announcement that long‑time CFO Joe Binz will step down this summer.

Also developing:

By the numbers: Novartis sells 70.68% stake in Novartis India for ₹1,446 crore

Blog•Jan 28, 2026

New Study Identifies the Top Internal Audit Priorities for 2026

The episode highlights Gartner's new survey of 119 chief audit executives (CAEs), revealing that building a culture of innovation and leveraging data analytics and generative AI are the top internal audit priorities for 2026. While 83% of audit functions are already piloting AI and 12% plan to adopt it soon, only 31% of CAEs feel highly confident they can create a tech‑savvy culture, citing data quality, skill gaps, and technology access as barriers. The discussion also stresses that broad "analytics everywhere" approaches are underperforming; instead, CAEs should concentrate resources on high‑value, targeted analytics use cases and improve thematic risk reporting to audit committees. Guest expert Margaret Moore Porter, chief of research at Gartner Risk & Audit Practice, underscores the need for bold leadership and strategic planning to turn these priorities into measurable outcomes.

By Internal Audit 360

Podcast•Jan 28, 2026•7 min

The Messy, Tricky, Hairy Task of Economic Forecasting

In this 7‑minute episode, host David Brancaccio explores the reliability and usefulness of economic forecasting, debating whether such predictions are valuable or merely speculative. He discusses how fast‑moving news cycles can quickly render forecasts obsolete, yet argues that they still...

By Marketplace Morning Report

News•Jan 28, 2026

Finding Quality Niches for Infrastructure Investments

Christian Schwenkenbecher of MPC Capital says energy infrastructure offers niche investment opportunities for institutional investors amid Europe's push for decarbonisation and high‑interest‑rate caution. The firm targets majority‑owned renewable generation assets—onshore wind, solar PV, storage—and seeks partnerships across the full value...

By World Finance

Podcast•Jan 28, 2026•31 min

CFO EQ: How Leadership Takes Shape

In this 31‑minute episode of CFO Thought Leader, hosts explore how CFOs develop true leadership not through authority or technical skill but through moments that demand emotional intelligence. Interviews with leaders like Shelagh Glaser, John McCauley, and Joe Euteneuer reveal...

By CFO THOUGHT LEADER

News•Jan 27, 2026

Boeing Posts Fourth-Quarter Profit Despite Losses in Commercial Aircraft, Defense Units

Boeing reported a fourth‑quarter profit of $8.2 billion, buoyed by the $10.6 billion sale of its Jeppesen software unit and a record 160 commercial aircraft deliveries. However, its Commercial Airplanes and Defense, Space & Security divisions posted losses of $632 million and $507 million...

By Aerospace America (AIAA)

News•Jan 27, 2026

The West and Ukraine Are Capsizing Russia’s Shadow Fleet

Western naval forces, aided by Ukrainian intelligence, are disrupting Russia's clandestine oil‑shipping network, known as the shadow fleet. On Jan 22, French helicopters boarded the tanker *Grinch* off Spain, discovering a false Comorian flag and 730,000 barrels of sanctioned Russian crude....

By The Economist – Finance & Economics

News•Jan 27, 2026

SECURE 2.0 Amendment Deadline Extended for IRAs, Other Retirement Plans

The IRS issued Notice 2026‑9, pushing the deadline for amending IRAs, SEP and SIMPLE IRA plans to comply with the SECURE 2.0 Act to at least Dec. 31 2027. The extension follows the agency’s need to finalize model amendment language that will guide trustees, custodians...

By The Tax Adviser (AICPA & CIMA)

News•Jan 27, 2026

Dear IRS, Give Us the Practitioner Party Line NOW

The article revives a 2020 tweet urging the IRS to create a “practitioner party line” that lets tax professionals on hold talk to each other. It explains the nostalgic concept of party lines from the pre‑internet era, where callers shared...

By Going Concern

News•Jan 27, 2026

The Changing Shape of Variation Margin Collateral

Variation margin (VM) collateral, long dominated by cash, is facing pressure from higher funding costs, stricter regulations, and market stress, prompting firms to explore non‑cash alternatives. A Risk.net survey of 114 collateral specialists shows 57% of sell‑side and 33% of...

By Risk.net — Fixed Income topic

News•Jan 27, 2026

Profit Warnings Citing Global Upheaval Hit ‘Record High’

EY’s latest analysis shows 240 UK‑listed firms issued profit warnings last year, the lowest total since 2021 but the highest proportion citing policy and geopolitical uncertainty. About 42 percent of those warnings named regulatory flip‑flops, tariffs and wage hikes as profit‑dragging...

By City A.M. — Markets

Blog•Jan 26, 2026

Presumptively Final Comments on Elon Musk's Delaware Travails

The episode reviews Elon Musk’s ongoing legal battles in Delaware, focusing on his controversial compensation package and recent shareholder lawsuits tied to Tesla’s sharp stock decline. It references the host’s recent articles analyzing Delaware’s historic dominance in corporate law, emerging...

By ProfessorBainbridge.com

Blog•Jan 26, 2026

The Next FATF Test: Can the West Demand Results From Pakistan?

The Financial Action Task Force will meet in February 2026 to reassess Pakistan after its 2022 removal from the grey list. While Pakistan has introduced anti‑money‑laundering laws and institutional reforms, open‑source evidence shows terrorist groups like Jaish‑e‑Mohammad and Lashkar‑e‑Taiba still...

By The Cipher Brief

News•Jan 26, 2026

Why AI Won’t Wipe Out White-Collar Jobs

Since ChatGPT’s debut in late 2022, AI has sparked both excitement and anxiety among white‑collar professionals. While managers see cost‑cutting potential, many desk‑bound workers fear displacement. Analysts argue that AI will primarily expand the scope of these roles, automating routine...

By The Economist – Finance & Economics

Blog•Jan 26, 2026

Some Internal Audit Wisdom

The article highlights a growing call for internal audit to evolve from static, quarterly reviews to continuous, risk‑focused assurance. Leaders at Pinterest and consultancy SIA argue that agile audit roadmaps and real‑time data collection better support fast‑moving businesses. Conversely, the...

By Norman Marks on Governance, Risk Management, and Internal Audit

News•Jan 26, 2026

January 22, 2026 – Closed Meeting

The Federal Deposit Insurance Corporation announced a closed‑door board meeting held on January 22, 2026, providing only a brief notice and a contact for information requests. The meeting’s agenda was not disclosed, reflecting standard practice for discussing confidential supervisory and resolution matters....

By FDIC – Press Releases

News•Jan 26, 2026

The Dissonance of Davos 2026: Capital Allocation in an Age of Fragmentation and the AI–Energy Nexus

The 56th World Economic Forum in Davos revealed a widening gap between political climate rhetoric and the market‑driven push for an infrastructure‑led energy transition. While the United States delegation framed energy policy as a nationalist, fossil‑friendly agenda, Europe repositioned renewables...

By CFI.co (Capital Finance International)

Blog•Jan 26, 2026

The Hidden Compliance Cost of Poor Records Retention

In this episode, Graham Sibley, CEO of Collabware, explains how poor records‑retention practices create a hidden compliance cost estimated at $2.3 billion annually. He highlights the “just in case” mentality that leads to over‑retention, turning organizations into “target‑rich environments” that drive...

By Compliance Perspectives

News•Jan 26, 2026

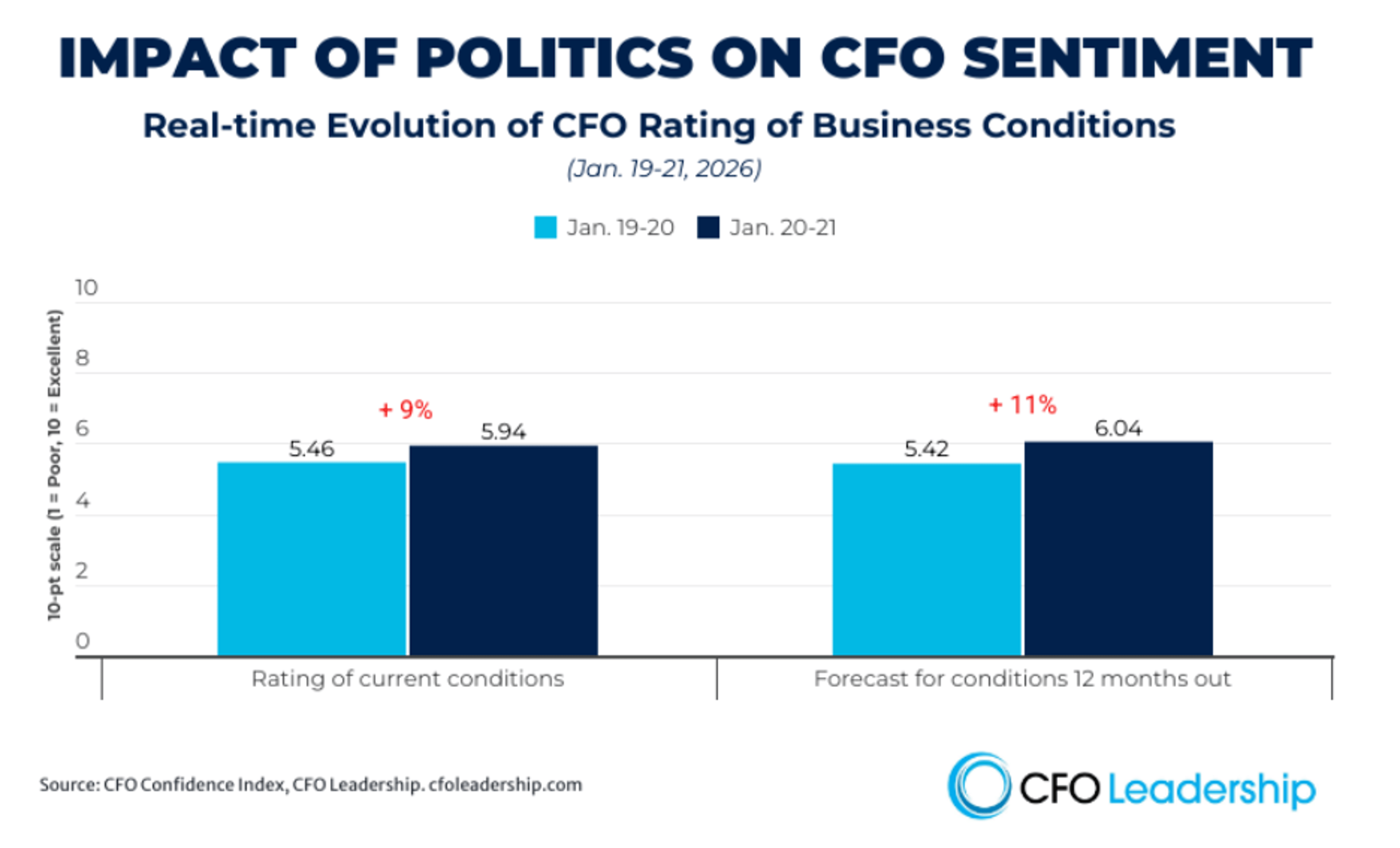

CFO Confidence Slips Amid Washington Uncertainty

The Q1 2026 CFO Leadership Confidence Index shows U.S. finance chiefs reacting sharply to Washington’s policy volatility. Before President Trump’s tariff warning, 130 CFOs rated current business conditions at 5.5, a 9% decline from Q4, but after a NATO deal...

By StrategicCFO360 (Chief Executive Group)

Blog•Jan 26, 2026

Deleveraging Operator Offers Compelling Yield

The episode examines a high‑yield note offering over 8.5% that is backed by a company aggressively reducing its debt, positioning it for a potential rating upgrade within the next two years. It highlights how the current spread reflects genuine compensation...

By Fixed Income Beacon

Podcast•Jan 26, 2026•0 min

How Finance Shows Its Value Beyond Being the “No” Department | Maria Izurieta

In this episode, CJ interviews Maria Izurieta, CFO of Huntress, about redefining finance as a connective, people‑first function that unblocks growth rather than saying "no." Drawing on her experience across VC‑backed, PE‑owned, and public firms, Maria explains how she balances...

By Mostly metrics

News•Jan 26, 2026

The Birth of Modern Investing

The documentary *Tune Out the Noise* chronicles how University of Chicago scholars in the 1960s forged the efficient‑market hypothesis and modern portfolio theory, turning investing into a data‑driven science. Their work birthed the index fund, first launched by Wells Fargo in...

By World Finance

News•Jan 26, 2026

Repo Clearing: Expanding Access, Boosting Resilience

Repo clearing is gaining traction as market liquidity tightens and regulators push for more transparency. LSEG’s RepoClear head Michel Semaan discussed how mandatory clearing and new haircut rules could enhance resilience while potentially shifting liquidity. Buy‑side firms, including hedge funds...

By Risk.net — Fixed Income topic

News•Jan 23, 2026

IRS Releases FAQs on Qualified Overtime Pay Deduction Under H.R. 1

The IRS issued Fact Sheet 2026‑01, a FAQ document clarifying the qualified overtime compensation deduction created by H.R. 1. It specifies that only the portion of overtime pay mandated by the Fair Labor Standards Act—typically the half‑rate above regular pay—qualifies for the...

By The Tax Adviser (AICPA & CIMA)

Blog•Jan 23, 2026

Accounting for Private Foundations (#389)

The episode explains what a private foundation is—a donor‑controlled, tax‑exempt nonprofit that primarily makes grants and invests its endowment. It outlines the nonprofit accounting standards they follow, emphasizing that most net assets are reported without donor restrictions and that investment...

By Accounting Best Practices with Steve Bragg

News•Jan 23, 2026

A CFO’s Greatest Asset? Getting Comfortable With Complexity

Heather Luck, CFO of Five Star Bank, highlights the expanding complexity of the finance function in community banking. She balances board relations, SEC reporting, regulatory compliance, treasury, budgeting, and HR while driving geographic expansion into the San Francisco Bay Area and...

By StrategicCFO360 (Chief Executive Group)

Social•Jan 22, 2026

Gain Control in 2026 with a Simple Cash Flow Forecast

A simple forecast lets you see what’s coming before it arrives. It helps you test scenarios, plan hiring or investment, and make choices without holding your breath. If 2026 is the year you want fewer surprises and more control, start here. We’ve...

By Michelle Kvello

Blog•Jan 22, 2026

How Overfamiliarity in Internal Audits Creates a Significant Risk to Quality

The episode examines how overfamiliarity—when the same internal audit team repeatedly audits the same operations—undermines audit quality by dulling critical thinking, limiting risk identification, and producing repetitive reports. Host Umer Iftikhar, an internal audit leader in Qatar, explains why rotation...

By Internal Audit 360

Blog•Jan 22, 2026

Failures Often Result From Weak Communication, Not Weak Processes

The episode explores how operational failures that appear to stem from flawed processes are often actually rooted in communication breakdowns. It explains that internal audits uniquely reveal these gaps by comparing documented procedures with real‑world practice, uncovering mismatched understandings, outdated...

By Internal Audit 360

Blog•Jan 22, 2026

Coming Soon: DOL’s Proposed Rules Facilitating Alternative Assets in 401(k) Plans

On January 13, 2026 the U.S. Department of Labor submitted proposed rules to the White House Office of Management and Budget that would allow 401(k) and other defined‑contribution plans to hold alternative assets such as digital currencies, private equity, private credit and...

By Employee Benefits & Executive Compensation Blog

Blog•Jan 22, 2026

High-Quality Real Estate Credit with More than Investment-Grade Spread

The episode examines a senior housing REIT whose current spread over the BBB index undervalues its credit quality, citing a strong net debt-to-adjusted EBITDA ratio, ample liquidity, and improving rent coverage. It argues that the market misreads the issuer as...

By Fixed Income Beacon

News•Jan 22, 2026

The Ascent of India’s Economy

India’s economy is transitioning from the historically sluggish “Hindu rate of growth” to become the world’s fastest‑growing large economy, edging toward the fourth‑largest global ranking. Recent reforms—such as the Goods and Services Tax, streamlined foreign‑direct investment rules, and labor law...

By The Economist – Finance & Economics

News•Jan 22, 2026

How Do You Know if Your Price Is Right?

Accountants face a crossroads in 2026 pricing, weighing freezes, modest inflation‑linked increases, reductions, or bold hikes. While fee freezes effectively act as cuts in a high‑inflation environment, modest increases tied to CPI or RPI are generally client‑acceptable. Reducing fees may...

By AccountingWEB (UK)

News•Jan 21, 2026

American Decay versus American Dynamism

AkademikerPension, Denmark's university staff pension fund, announced the sale of its American government bond holdings. The decision was framed as a response to perceived excessive U.S. fiscal spending rather than any geopolitical tension over Greenland. Fund managers emphasized that the...

By The Economist – Finance & Economics

Blog•Jan 21, 2026

How the Business of Privateering Contributed to the Evolution of Corporate Law

In this episode, the host discusses a new law review article that traces how early 19th‑century privateering statutes, especially New York’s 1814 Act, served as the United States’ first general incorporation law and a form of industrial policy. The analysis...

By ProfessorBainbridge.com

Blog•Jan 21, 2026

UK Government Abandons Long-Planned Audit Reform Bill

The UK government has scrapped the Audit Reform and Corporate Governance Bill, ending a decade of debate sparked by corporate failures like Carillion and BHS. The proposed legislation would have replaced the Financial Reporting Council with a new statutory regulator...

By Internal Audit 360

Blog•Jan 21, 2026

Employee “Betting” In Prediction Markets: New Risks for Insider Trading and Proprietary Information Disclosure

The episode explores the rapid rise of prediction markets such as Polymarket and Kalshi and the emerging compliance risks they pose when employees trade on material non‑public corporate information. It highlights high‑profile incidents—including a $32,000 bet on Venezuelan President Maduro’s...

By Compliance Perspectives

News•Jan 21, 2026

Fashion Industry’s Supply Chains Fight a Tariff Storm

New U.S. tariffs are straining fashion supply chains, exposing weak supplier relationships. A 2025 US Fashion Industry Association survey shows all 25 leading brands cite protectionism as a top challenge, with over half fearing retaliatory tariffs. Unlike other sectors that...

By World Finance

News•Jan 21, 2026

The Evolving Role of the CFO

The CFO’s role has shifted from traditional budgeting and reporting to a strategic partnership that drives growth, risk management, and value creation. Surveys such as Egon Zehnder’s Super CFO reveal that 82% of finance leaders now own ESG, M&A, and corporate...

By World Finance

Podcast•Jan 21, 2026•58 min

1157: From Deal Advisory to Operator: Learning the Hard Parts | Toby Driver, CFO, Ideagen

Toby Driver shares his journey from an apprenticeship in accounting to becoming CFO of Ideagen, highlighting how early hands‑on experience in audit and deal advisory taught him to dissect businesses quickly but left a blind spot about integration complexity. Moving...

By CFO THOUGHT LEADER

Blog•Jan 21, 2026

Discovery-Driven Planning: A Better Way to Evaluate Venture Investments

The episode explains how Discovery‑Driven Planning (DDP) transforms venture evaluation by treating every business plan as a set of testable hypotheses rather than a fixed forecast. It outlines the three core tenets of DDP—only validated assumptions receive capital, funding is...

By CFO Impulse

Blog•Jan 20, 2026

How Your Brain’s “Break-Even” Bias Creates Mispricings

In this episode, Larry Swedroe discusses a new study by Jihoon Goh, Suk‑Joon Byun, and Donghoon Kim that uncovers how the “salience effect”—investors’ attraction to stocks with dramatic past moves—interacts with the “break‑even bias,” a tendency to take riskier bets...

By Larry Swedroe on Substack

News•Jan 20, 2026

‘Build For Scale From Day One’

Calero CFO Darian Hong argues that finance must be built for scale from day one, aligning the function with corporate strategy and investing in scalable infrastructure. He stresses delegating operational work to free CFOs for strategic oversight and fostering cross‑functional...

By StrategicCFO360 (Chief Executive Group)

News•Jan 20, 2026

Keith E. Cassidy Named Director of the Division of Examinations

The U.S. Securities and Exchange Commission appointed Keith E. Cassidy as Director of the Division of Examinations, confirming his role after serving as acting director since May 2024. Cassidy previously led the division’s Technology Controls Program and the SEC’s CyberWatch...

By U.S. SEC – Press Releases

Podcast•Jan 20, 2026•7 min

American Friction

The episode examines the fallout from escalating tariff disputes between the United States and Europe, which have prompted investors to sell U.S. assets and trigger a sell‑off in global markets. It highlights Japan’s bond market stress as yields climb to...

By Reuters Morning Bid

Podcast•Jan 20, 2026•30 min

How New Finance Leaders Navigate Transition and Build Confidence with Kevin Appleby, Head of Partnerships at GrowCFO

In this episode, Kevin Appleby, Head of Partnerships at GrowCFO, guides new CFOs through the critical first hundred days, emphasizing the cultural shift from finance director to strategic leader. He outlines a structured onboarding plan, tactics for overcoming imposter syndrome,...

By CFO Weekly

Podcast•Jan 20, 2026•28 min

#267 Why Nonprofit Finance Is 10 Years Behind and How to Close the Gap with Ilana Esterrich, GrowCFO Mentor

In this episode, host Kevin Appleby talks with nonprofit finance veteran Ilana Esterrich about why nonprofit finance lags a decade behind for‑profit practices and how to modernize the CFO role. Ilana stresses that “no money, no mission,” urging nonprofits to...

By GrowCFO Show

Blog•Jan 20, 2026

Discounting the Chaos

The episode “Discounting the Chaos” examines how, despite a torrent of geopolitical turmoil—from Venezuela’s leadership shake‑up to potential conflicts involving Iran and Greenland—the stock market remains a reliable, fundamentals‑driven gauge of future economic conditions. Recent data suggest the U.S. economy...

By The Market Strategist

Blog•Jan 19, 2026

Important Risk Meetings

Norman Marks argues that the most critical risk meetings are the everyday decision‑making gatherings, not formal risk‑officer briefings. He cites procurement, hiring, and national‑security deliberations as examples where risk is implicitly evaluated. The piece urges organizations to embed risk expertise...

By Norman Marks on Governance, Risk Management, and Internal Audit

News•Jan 19, 2026

China Hits Its GDP Target—In a Weird Way

China reported a 5% year‑on‑year GDP increase for 2025, meeting its official growth target for the third consecutive year. The expansion occurred despite a faster‑than‑expected population decline and a slowdown in domestic investment. A record trade surplus of nearly $1.2 trillion,...

By The Economist – Finance & Economics

News•Jan 18, 2026

Why America’s Bond Market Just Keeps Winning

The article argues that despite soaring federal debt and politically‑driven monetary policy, the United States bond market continues to attract robust demand. Treasury yields remain low as both domestic and foreign investors view U.S. debt as a safe‑haven asset. The...

By The Economist – Finance & Economics