Infographics: Key Rates & Spreads In the Modern Repo Market

•February 11, 2026

0

Why It Matters

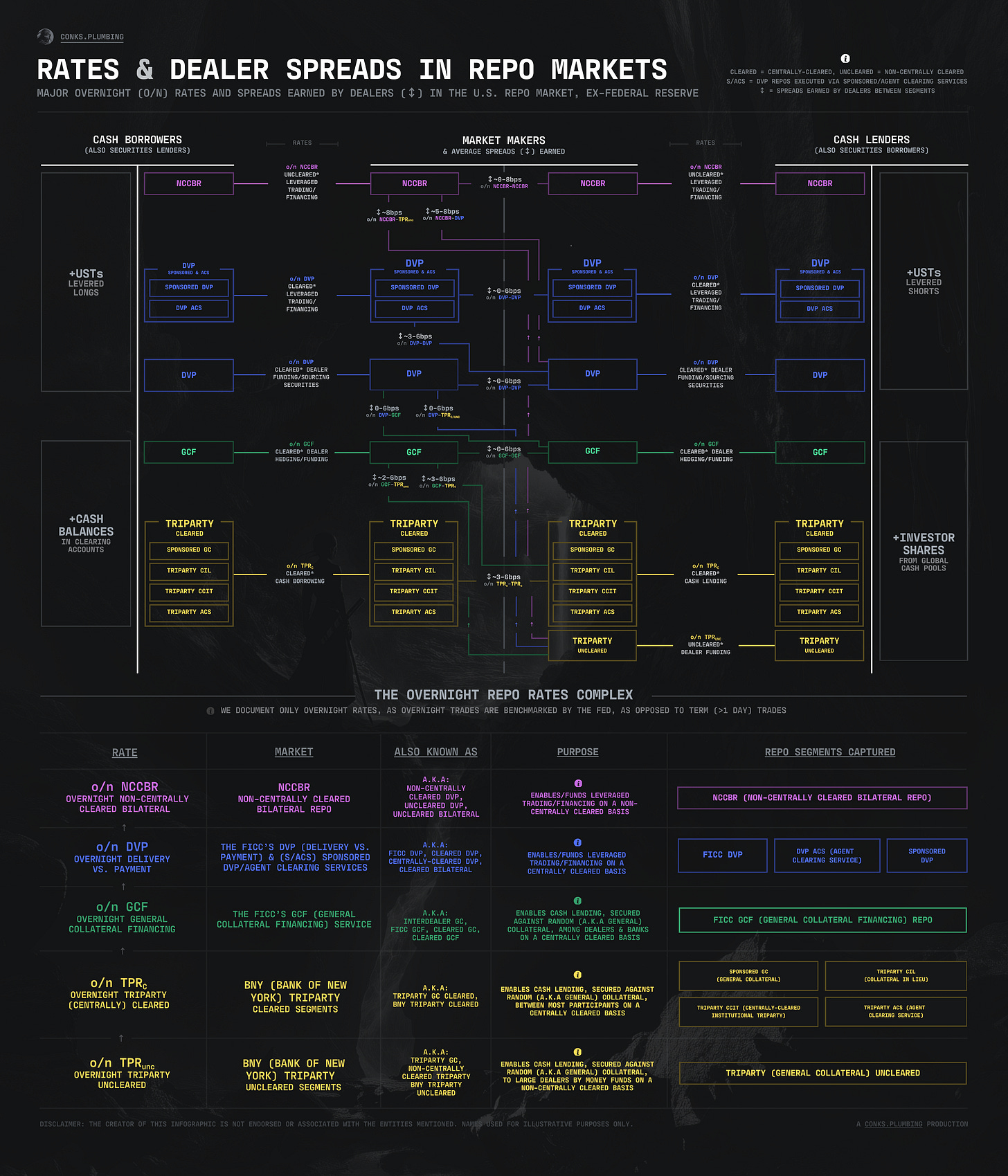

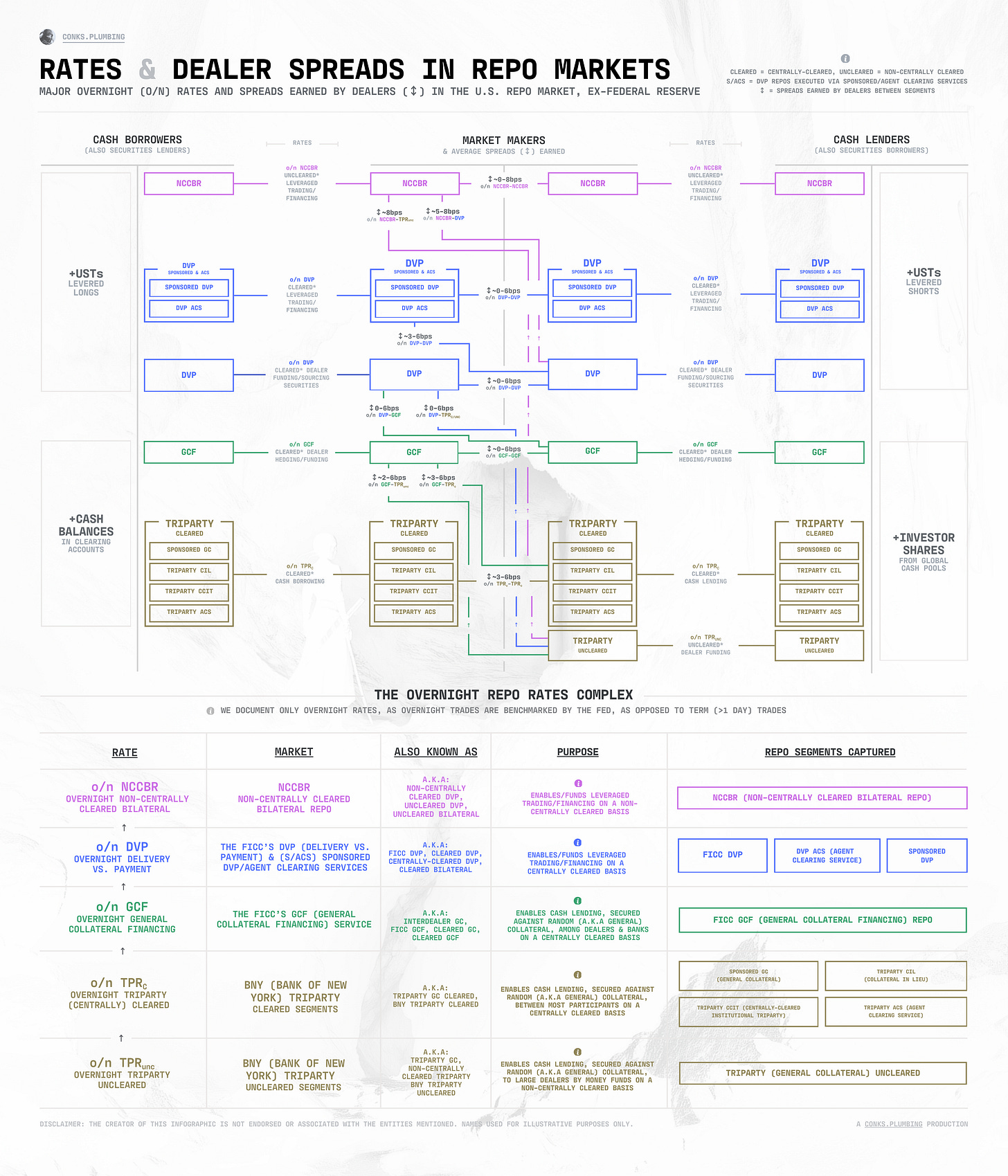

Understanding repo rate structures and dealer spreads is crucial for anyone involved in short‑term financing, as it reveals where liquidity costs are rising and where market makers can still earn profits. This insight helps investors, banks, and policymakers gauge the health of money markets and anticipate the effects of policy shifts, making the episode timely amid ongoing discussions about the Fed’s influence on repo activity.

Infographics: Key Rates & Spreads In the Modern Repo Market

— programming note: this graphic was created as part of The Fed’s New Target: Part II (upcoming). Splitting Part II into two parts may be required if it becomes (even) larger, and this could provide an interval to discuss Warsh’s impact on money markets in a separate note/series.

The paragraph below from the upcoming Part II provides context for the following infographic...

“Various repo segments produce a set of rates that cash lenders receive, cash borrowers pay, and what dealers earn as they compete with one another to connect both sides of a trade. This set also reveals the various spreads at which dealers make markets — a.k.a their profit. Rates and spreads continue to rise further up a typical hierarchy (triparty → GCF → DVP → NCCBR). As long as a dealer believes it can charge a positive spread — i.e. the cost of its cash borrowing remains cheaper than the gain on its cash lending – it will make a market. The following graphic provides an overview of o/n rates and average spreads (↕) earned by dealers and other market makers during their operations.”

The following primer explains the various (necessary) jargon used throughout:

A complete description, along with additional explanatory graphics (each too small for a dedicated post), is in progress and will be included in Part II.

Enjoy!

[

](https://substackcdn.com/image/fetch/$s_!9vFY!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcec1e10c-7513-4c25-be3a-3279b71e6356_5357x6250.png)

[

](https://substackcdn.com/image/fetch/$s_!xNf3!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F7e3db399-8c4b-4b81-ac1e-6a618bc2a412_5357x6250.png)

0

Comments

Want to join the conversation?

Loading comments...