News•Jan 29, 2026

The Fate of Japan’s $6trn Foreign Portfolio Rattles Global Markets

Japan’s financial institutions now own roughly $6 trillion in foreign securities, a stock that has doubled over the past two decades as low domestic rates and a weak yen pushed investors abroad. About 50% of this portfolio is invested in U.S. assets, with another 20% routed through the Cayman Islands to facilitate American investments. Analysts warn that a rapid pull‑back of these funds would reverberate across global equity, bond and currency markets. The article explores how such a sell‑off could reshape liquidity and pricing worldwide.

By The Economist – Finance & Economics

News•Jan 28, 2026

Clay, an A.I. Sales Start-Up, Lets Employees Cash Out. Again.

Clay, an AI‑driven sales and marketing startup, announced a second employee tender offer, letting staff sell shares at a $5 billion valuation—up from $1.5 billion in its first tender. The new offer arrives nine months after the initial buyback and follows a...

By The New York Times – DealBook

News•Jan 28, 2026

Federal Reserve Issues FOMC Statement

The Federal Reserve’s Federal Open Market Committee held the federal funds rate target range steady at 3.5 percent to 3.75 percent on Jan. 28, 2026. The statement noted solid economic expansion, low job gains, and a stabilizing unemployment rate, while inflation remains modestly above...

By Federal Reserve Board – All press releases

News•Jan 28, 2026

Finding Quality Niches for Infrastructure Investments

Christian Schwenkenbecher of MPC Capital says energy infrastructure offers niche investment opportunities for institutional investors amid Europe's push for decarbonisation and high‑interest‑rate caution. The firm targets majority‑owned renewable generation assets—onshore wind, solar PV, storage—and seeks partnerships across the full value...

By World Finance

News•Jan 27, 2026

Boeing Posts Fourth-Quarter Profit Despite Losses in Commercial Aircraft, Defense Units

Boeing reported a fourth‑quarter profit of $8.2 billion, buoyed by the $10.6 billion sale of its Jeppesen software unit and a record 160 commercial aircraft deliveries. However, its Commercial Airplanes and Defense, Space & Security divisions posted losses of $632 million and $507 million...

By Aerospace America (AIAA)

News•Jan 27, 2026

The West and Ukraine Are Capsizing Russia’s Shadow Fleet

Western naval forces, aided by Ukrainian intelligence, are disrupting Russia's clandestine oil‑shipping network, known as the shadow fleet. On Jan 22, French helicopters boarded the tanker *Grinch* off Spain, discovering a false Comorian flag and 730,000 barrels of sanctioned Russian crude....

By The Economist – Finance & Economics

News•Jan 27, 2026

SECURE 2.0 Amendment Deadline Extended for IRAs, Other Retirement Plans

The IRS issued Notice 2026‑9, pushing the deadline for amending IRAs, SEP and SIMPLE IRA plans to comply with the SECURE 2.0 Act to at least Dec. 31 2027. The extension follows the agency’s need to finalize model amendment language that will guide trustees, custodians...

By The Tax Adviser (AICPA & CIMA)

News•Jan 27, 2026

Dear IRS, Give Us the Practitioner Party Line NOW

The article revives a 2020 tweet urging the IRS to create a “practitioner party line” that lets tax professionals on hold talk to each other. It explains the nostalgic concept of party lines from the pre‑internet era, where callers shared...

By Going Concern

News•Jan 27, 2026

The Changing Shape of Variation Margin Collateral

Variation margin (VM) collateral, long dominated by cash, is facing pressure from higher funding costs, stricter regulations, and market stress, prompting firms to explore non‑cash alternatives. A Risk.net survey of 114 collateral specialists shows 57% of sell‑side and 33% of...

By Risk.net — Fixed Income topic

News•Jan 27, 2026

Profit Warnings Citing Global Upheaval Hit ‘Record High’

EY’s latest analysis shows 240 UK‑listed firms issued profit warnings last year, the lowest total since 2021 but the highest proportion citing policy and geopolitical uncertainty. About 42 percent of those warnings named regulatory flip‑flops, tariffs and wage hikes as profit‑dragging...

By City A.M. — Markets

News•Jan 26, 2026

Why AI Won’t Wipe Out White-Collar Jobs

Since ChatGPT’s debut in late 2022, AI has sparked both excitement and anxiety among white‑collar professionals. While managers see cost‑cutting potential, many desk‑bound workers fear displacement. Analysts argue that AI will primarily expand the scope of these roles, automating routine...

By The Economist – Finance & Economics

News•Jan 26, 2026

January 22, 2026 – Closed Meeting

The Federal Deposit Insurance Corporation announced a closed‑door board meeting held on January 22, 2026, providing only a brief notice and a contact for information requests. The meeting’s agenda was not disclosed, reflecting standard practice for discussing confidential supervisory and resolution matters....

By FDIC – Press Releases

News•Jan 26, 2026

The Dissonance of Davos 2026: Capital Allocation in an Age of Fragmentation and the AI–Energy Nexus

The 56th World Economic Forum in Davos revealed a widening gap between political climate rhetoric and the market‑driven push for an infrastructure‑led energy transition. While the United States delegation framed energy policy as a nationalist, fossil‑friendly agenda, Europe repositioned renewables...

By CFI.co (Capital Finance International)

News•Jan 26, 2026

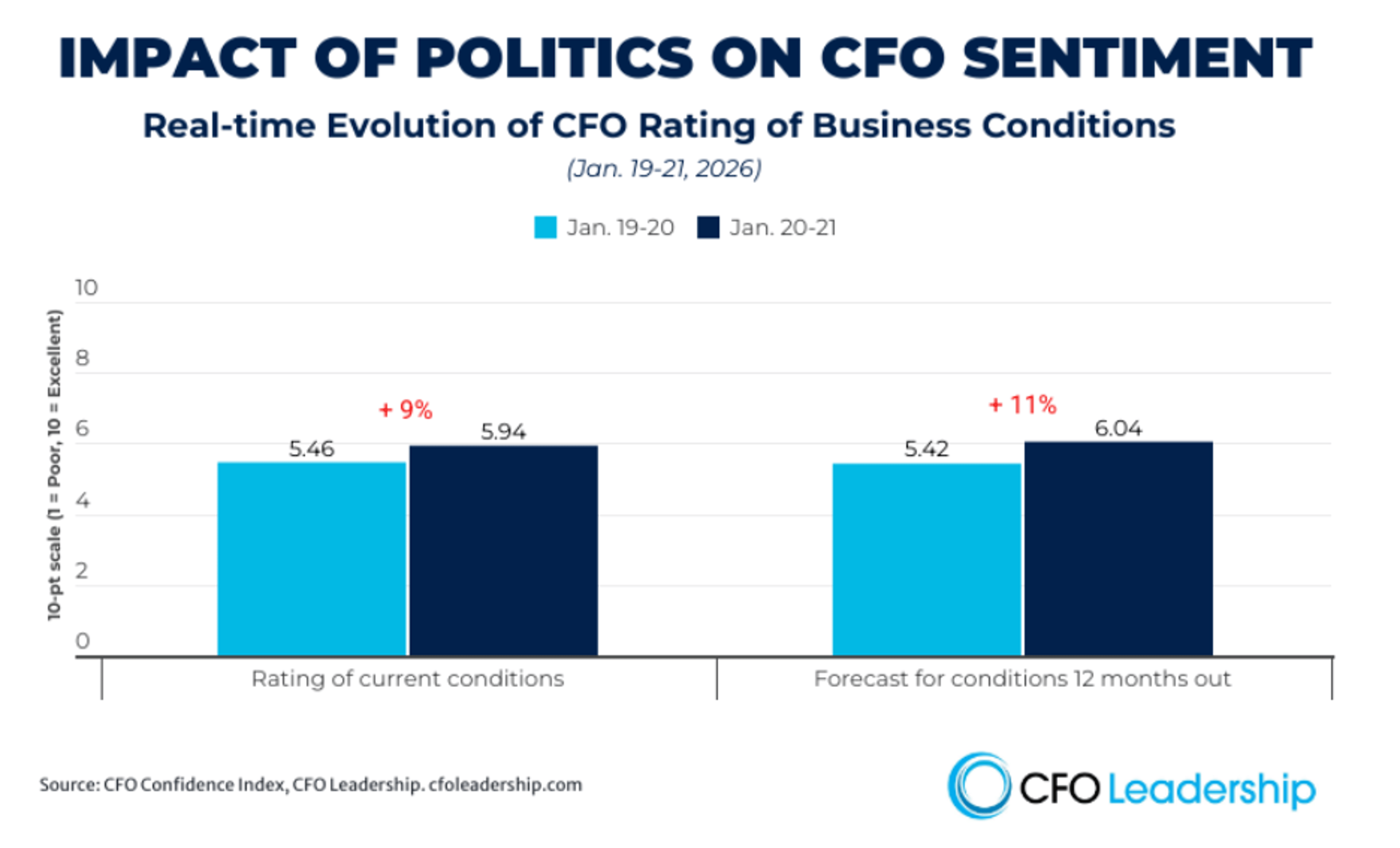

CFO Confidence Slips Amid Washington Uncertainty

The Q1 2026 CFO Leadership Confidence Index shows U.S. finance chiefs reacting sharply to Washington’s policy volatility. Before President Trump’s tariff warning, 130 CFOs rated current business conditions at 5.5, a 9% decline from Q4, but after a NATO deal...

By StrategicCFO360 (Chief Executive Group)

News•Jan 26, 2026

The Birth of Modern Investing

The documentary *Tune Out the Noise* chronicles how University of Chicago scholars in the 1960s forged the efficient‑market hypothesis and modern portfolio theory, turning investing into a data‑driven science. Their work birthed the index fund, first launched by Wells Fargo in...

By World Finance

News•Jan 26, 2026

Repo Clearing: Expanding Access, Boosting Resilience

Repo clearing is gaining traction as market liquidity tightens and regulators push for more transparency. LSEG’s RepoClear head Michel Semaan discussed how mandatory clearing and new haircut rules could enhance resilience while potentially shifting liquidity. Buy‑side firms, including hedge funds...

By Risk.net — Fixed Income topic

News•Jan 23, 2026

IRS Releases FAQs on Qualified Overtime Pay Deduction Under H.R. 1

The IRS issued Fact Sheet 2026‑01, a FAQ document clarifying the qualified overtime compensation deduction created by H.R. 1. It specifies that only the portion of overtime pay mandated by the Fair Labor Standards Act—typically the half‑rate above regular pay—qualifies for the...

By The Tax Adviser (AICPA & CIMA)

News•Jan 23, 2026

A CFO’s Greatest Asset? Getting Comfortable With Complexity

Heather Luck, CFO of Five Star Bank, highlights the expanding complexity of the finance function in community banking. She balances board relations, SEC reporting, regulatory compliance, treasury, budgeting, and HR while driving geographic expansion into the San Francisco Bay Area and...

By StrategicCFO360 (Chief Executive Group)

News•Jan 22, 2026

The Ascent of India’s Economy

India’s economy is transitioning from the historically sluggish “Hindu rate of growth” to become the world’s fastest‑growing large economy, edging toward the fourth‑largest global ranking. Recent reforms—such as the Goods and Services Tax, streamlined foreign‑direct investment rules, and labor law...

By The Economist – Finance & Economics

News•Jan 22, 2026

How Do You Know if Your Price Is Right?

Accountants face a crossroads in 2026 pricing, weighing freezes, modest inflation‑linked increases, reductions, or bold hikes. While fee freezes effectively act as cuts in a high‑inflation environment, modest increases tied to CPI or RPI are generally client‑acceptable. Reducing fees may...

By AccountingWEB (UK)

News•Jan 21, 2026

American Decay versus American Dynamism

AkademikerPension, Denmark's university staff pension fund, announced the sale of its American government bond holdings. The decision was framed as a response to perceived excessive U.S. fiscal spending rather than any geopolitical tension over Greenland. Fund managers emphasized that the...

By The Economist – Finance & Economics

News•Jan 21, 2026

Fashion Industry’s Supply Chains Fight a Tariff Storm

New U.S. tariffs are straining fashion supply chains, exposing weak supplier relationships. A 2025 US Fashion Industry Association survey shows all 25 leading brands cite protectionism as a top challenge, with over half fearing retaliatory tariffs. Unlike other sectors that...

By World Finance

News•Jan 21, 2026

The Evolving Role of the CFO

The CFO’s role has shifted from traditional budgeting and reporting to a strategic partnership that drives growth, risk management, and value creation. Surveys such as Egon Zehnder’s Super CFO reveal that 82% of finance leaders now own ESG, M&A, and corporate...

By World Finance

News•Jan 20, 2026

‘Build For Scale From Day One’

Calero CFO Darian Hong argues that finance must be built for scale from day one, aligning the function with corporate strategy and investing in scalable infrastructure. He stresses delegating operational work to free CFOs for strategic oversight and fostering cross‑functional...

By StrategicCFO360 (Chief Executive Group)

News•Jan 20, 2026

Keith E. Cassidy Named Director of the Division of Examinations

The U.S. Securities and Exchange Commission appointed Keith E. Cassidy as Director of the Division of Examinations, confirming his role after serving as acting director since May 2024. Cassidy previously led the division’s Technology Controls Program and the SEC’s CyberWatch...

By U.S. SEC – Press Releases

News•Jan 19, 2026

China Hits Its GDP Target—In a Weird Way

China reported a 5% year‑on‑year GDP increase for 2025, meeting its official growth target for the third consecutive year. The expansion occurred despite a faster‑than‑expected population decline and a slowdown in domestic investment. A record trade surplus of nearly $1.2 trillion,...

By The Economist – Finance & Economics

News•Jan 18, 2026

Why America’s Bond Market Just Keeps Winning

The article argues that despite soaring federal debt and politically‑driven monetary policy, the United States bond market continues to attract robust demand. Treasury yields remain low as both domestic and foreign investors view U.S. debt as a safe‑haven asset. The...

By The Economist – Finance & Economics

News•Jan 16, 2026

IRS Advisory Council Report Defends Workers, Criticizes Budget and Staff Cuts

The IRS Advisory Council released its 2025 annual report defending the agency’s workforce while decrying recent budget rescissions and staff cuts. The report notes that more than half of the $80 billion Inflation Reduction Act funding earmarked for the IRS has...

By The Tax Adviser (AICPA & CIMA)

News•Jan 16, 2026

AICPA Tax Policy and Advocacy Successes: 2025 Highlights

The AICPA Tax Division reported over 40 advocacy victories in 2025, including eight legislative successes—seven AICPA‑backed bills enacted and the defeat of a provision that would have barred state passthrough entity tax regimes. Twelve Treasury and IRS guidance items incorporated...

By The Tax Adviser (AICPA & CIMA)

News•Jan 15, 2026

IRS and SBA Employee Allegedly Ran Pandemic Fraud Ring Right Out in the Open on Instagram

Attallah Williams, a former SBA loan officer and IRS tax‑examining technician, has been charged with conspiracy to defraud the government by submitting fraudulent Covid‑relief applications. Over a three‑year period she allegedly secured more than $3.5 million from four programs—EIDL, PPP, EIDL...

By Going Concern

News•Jan 15, 2026

No More Worlds for Accounting Software to Conquer?

The article argues that core accounting software has reached a plateau, with recent cloud‑based tools delivering mainly incremental upgrades rather than breakthrough functionality. While AI promises automation, tangible, consistent benefits for accountants remain scarce, and many AI‑driven features feel like...

By AccountingWEB (UK)

News•Jan 15, 2026

January 22, 2026 — Sunshine Act Meeting Notice

The Federal Deposit Insurance Corporation (FDIC) will hold its Board of Directors meeting on January 22, 2026, streamed publicly via webcast. The agenda features an amendment to the FDIC’s Guidelines for Appeals of Material Supervisory Determinations, a final rule on official signs...

By FDIC – Press Releases

News•Jan 14, 2026

Donald Trump’s Crusade Against Usury Reaches Wall Street

President Donald Trump has turned his anti‑usury rhetoric into a Wall Street‑focused campaign, urging the Federal Reserve to cut benchmark rates and targeting private lenders he deems predatory. The White House has begun filing formal complaints against payday‑loan operators and...

By The Economist – Finance & Economics

News•Jan 14, 2026

Is Passive Investment Inflating a Stockmarket Bubble?

A decade after a provocative Bernstein note, passive investing now dominates U.S. equity funds, holding roughly 60 % of net assets. The surge is driven by low fees, algorithmic trading, and confidence in market efficiency, concentrating ownership among a few index...

By The Economist – Finance & Economics

News•Jan 14, 2026

It’s Not Just the Fed. Politics Looms over Central Banks Everywhere

Central banks worldwide are confronting heightened political pressure, challenging long‑standing notions of independence. In the United States, President Donald Trump has publicly urged the Federal Reserve to accelerate rate cuts, intensifying a clash with Chair Jerome Powell. The tension escalated...

By The Economist – Finance & Economics

News•Jan 14, 2026

Heat Pumps That Pay: How Industrial Process Heat Is Becoming a Cost-Saving Asset

Industrial heat, the world’s largest energy end‑use, is now a balance‑sheet issue as manufacturers grapple with volatile fuel prices and rising carbon costs. A new generation of high‑temperature heat pumps can deliver up to ~200 °C, turning waste heat and low‑grade...

By CFI.co (Capital Finance International)

News•Jan 13, 2026

Audit Firm Runs Afoul of PCAOB Rules By Taking Same As Last Year Way Too Literally

The PCAOB sanctioned Southfield‑based Zwick CPA, its owner Jack Zwick, and audit manager Jeffrey Hoskow for multiple violations during the 2022 audit of energy company Genie. The firm failed to plan risk assessments, gather sufficient evidence on revenue and internal...

By Going Concern

News•Jan 12, 2026

Agencies Issue 2025 Shared National Credit Program Report

The Federal Reserve, FDIC and OCC released the 2025 Shared National Credit (SNC) report, covering syndicated loans originated through June 30, 2025. The portfolio grew 6 percent to $6.9 trillion across 6,857 borrowers, while the share of “non‑pass” loans fell to 8.6 percent of commitments....

By Federal Reserve Board – All press releases

News•Jan 12, 2026

The US Economic ‘K’

Global GDP growth in 2025 steadied at roughly 2.5‑3% despite President Trump’s aggressive tariff campaign. The U.S. economy has taken on a K‑shaped profile: technology and AI‑related firms enjoy soaring valuations while job creation stalls and wages lag for lower‑income...

By CFI.co (Capital Finance International)