Eaglestone Management: Experience Forged in Global Infrastructure Finance

•February 16, 2026

0

Why It Matters

The blend of capital‑market fluency and on‑the‑ground delivery gives Eaglestone credibility to mobilize financing for complex projects in emerging markets, where funding gaps persist.

Key Takeaways

- •Pedro Neto oversaw €50bn projects across five continents

- •Nuno Gil structured deals in 12 African and European markets

- •Eaglestone blends banking discipline with operator execution expertise

- •Leadership spans energy, transport, mining, and concession sectors

- •Platform targets sustainable infrastructure financing in emerging markets

Pulse Analysis

The global push for resilient infrastructure has outpaced traditional financing channels, especially in emerging economies where political risk and fragmented regulatory environments deter many investors. Firms that can marry rigorous banking discipline with a practical understanding of project delivery are increasingly valuable. Eaglestone Management positions itself at this nexus, leveraging a leadership pedigree that spans both capital‑markets and on‑the‑ground operations. By doing so, the firm aims to close the financing gap for large‑scale energy, transport and concession projects that are critical for economic growth.

Pedro Neto, Eaglestone’s chief executive, epitomises the banker‑builder hybrid. Over three decades he has overseen transactions exceeding €50 billion, covering five continents and a portfolio that includes power plants, rail corridors and multi‑year concession agreements. His tenure at Espírito Santo Investment Bank honed an ability to align diverse stakeholders, manage sovereign and commercial risk, and secure long‑term credibility for high‑profile deals. This blend of strategic oversight and operational insight equips Eaglestone to navigate the complex due‑diligence and governance requirements that institutional investors demand.

Nuno Gil complements Neto’s macro‑level experience with hands‑on structuring expertise across Europe and Sub‑Saharan Africa. Having advised governments on nine major road concessions and led project‑finance teams for multilateral lenders, Gil excels at crafting financing packages that balance fiscal robustness with delivery certainty. His familiarity with varied legal regimes and public‑private partnership models enables Eaglestone to tailor solutions for each market’s risk profile. As climate‑aligned infrastructure pipelines expand, the firm’s disciplined approach positions it to attract capital and drive sustainable development.

Eaglestone Management: Experience Forged in Global Infrastructure Finance

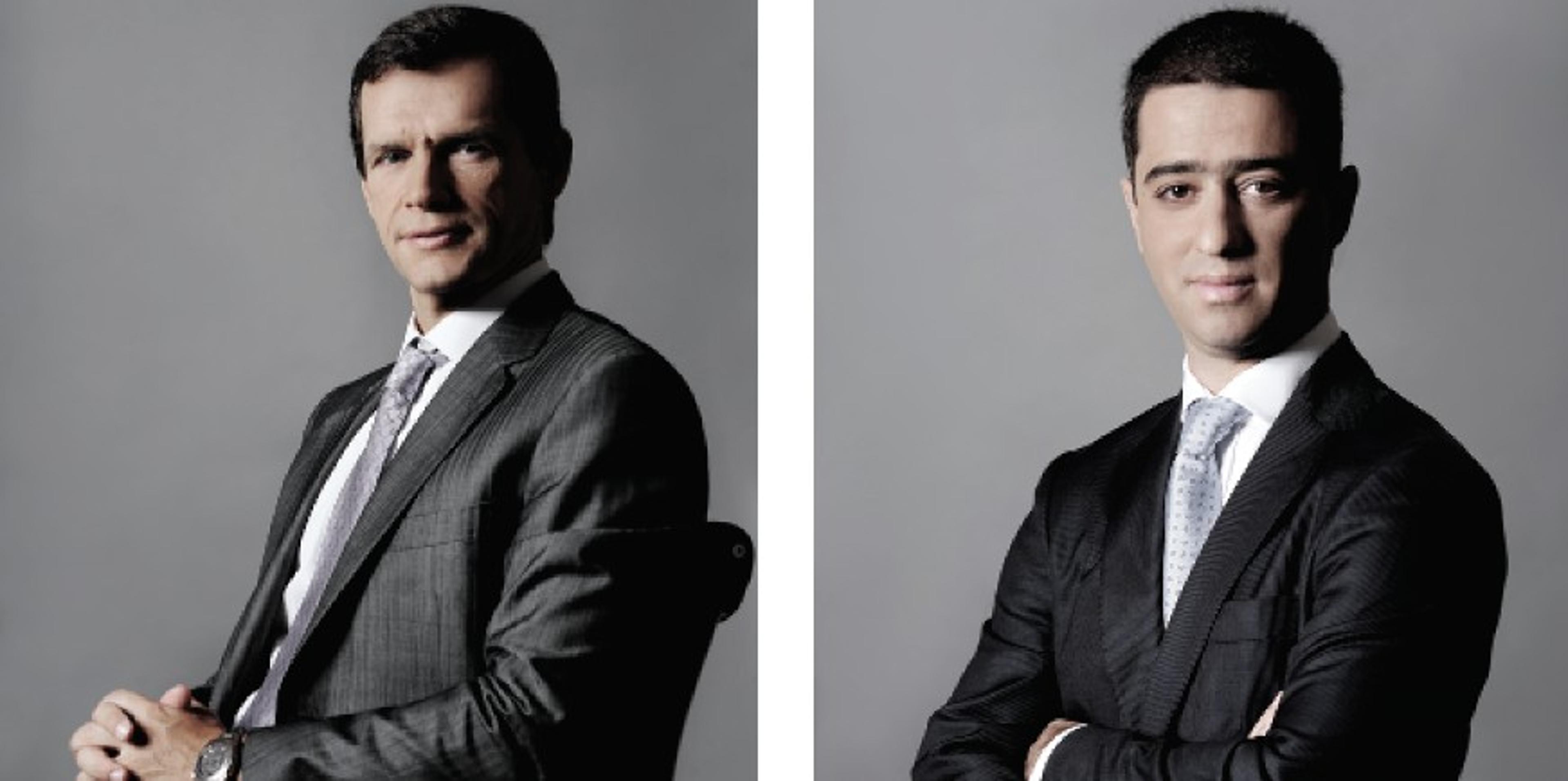

Eaglestone’s leadership team reflects the firm’s positioning at the intersection of banking discipline and real-economy delivery. With deep roots in international project finance and a long track record across infrastructure, energy, transport and concessions, the management combines capital markets fluency with an operator’s understanding of what it takes to execute complex programmes in diverse jurisdictions. Two profiles, in particular, define the calibre and direction of the platform: Pedro Neto, Chief Executive Officer and Founding Partner, and Nuno Gil, Managing and Founding Partner.

Pedro Neto: A Banker’s Discipline, a Builder’s Perspective

CEO & Founding Partner: Pedro Neto

Pedro Neto is Chief Executive Officer and Founding Partner of Eaglestone. With more than 30 years of experience in international banking and infrastructure finance, he is widely regarded as a seasoned executive with a proven record across global markets. Over the course of his career, he has been involved in projects representing more than €50bn of investment, spanning five continents and covering sectors as varied as energy, transport, natural resources and large-scale concession frameworks.

Between 2000 and 2011, Neto served as Executive Vice-Chairman of Espírito Santo Investment Bank (ESIB), where he led the project finance activities of Grupo Banco Espírito Santo. During this period, ESIB strengthened its reputation for structuring complex, high-value transactions, working across Europe, Latin America, the Middle East and Sub-Saharan Africa. The work demanded more than technical execution; it required an ability to align multiple stakeholders, manage risk across jurisdictions, and bring credibility to transactions where scale, tenor and political economy all shaped the outcome.

His exposure to Africa deepened during his tenure as Chief Investment Officer at ESCOM, the Espírito Santo Group company dedicated to diversified investments across the region, with a particular focus on Angola. In that role, Neto helped drive major initiatives spanning infrastructure, mining and industrial development, contributing to the Group’s expansion into emerging markets and building a practical understanding of the operating realities that accompany capital-intensive projects. It was an experience that complemented his investment banking background with a sharper lens on delivery, local partnership and the long-term conditions required for sustainable growth.

Neto also served as Chairman of ES Concessões, overseeing the Group’s investments in global concession projects, and held a supervisory board seat at Ascendi, a recognised player in mobility and road infrastructure. These roles broadened his perspective on the full lifecycle of infrastructure assets, from procurement and financing through to operational performance, governance and value creation over extended periods.

His earlier governance appointments included serving as an Executive Board Member of BES Oriente and as a Non-Executive Board Member of BES Investimento Brasil and BES Angola. Together, these positions expanded his strategic visibility into banking operations across distinct regulatory and market environments, reinforcing an executive profile shaped by cross-border complexity and institutional accountability.

Nuno Gil: Structuring for Delivery Across Europe and Africa

Managing & Founding Partner: Nuno Gil

Nuno Gil is Managing and Founding Partner of Eaglestone, bringing more than 25 years of specialist experience in project finance and infrastructure advisory across Europe and Africa. Over his career, he has developed a reputation as a versatile, internationally engaged adviser, having led or participated in mandates spanning Angola, Mozambique, Portugal, Greece, Ireland, Bulgaria, Hungary, Poland, Senegal, Morocco and Cape Verde. The breadth of this footprint speaks to an ability to operate across varied legal systems, procurement frameworks and risk profiles — and to maintain discipline under conditions where execution is rarely straightforward.

His sector experience covers roads, railways, ports, logistics platforms, airports, energy and mining. This cross-sector capability has positioned him as a trusted partner to governments, sponsors and lenders seeking to navigate complex infrastructure development and mobilise capital at scale. Gil is recognised for structuring transactions that balance financial robustness with practical delivery, particularly in environments where innovation is required but must be matched by rigorous risk management and credible counterparties.

Before co-founding Eaglestone, Gil served as Managing Director in the Project Finance team at Espírito Santo Investment Bank in Lisbon. In that capacity, he led the bank’s project finance advisory practice, overseeing high-profile transactions and strengthening relationships with international investors, development finance institutions and government stakeholders. The role reinforced his ability to bridge commercial objectives with public-interest constraints, and to design structures capable of surviving scrutiny from multiple constituencies.

Earlier in his career, Gil worked at Banco Efisa, where, as Assistant Manager, he advised the Portuguese Government in the evaluation and negotiation of nine major road concession programmes. The experience provided a formative grounding in public-private partnerships, long-term infrastructure planning and the contractual architecture that underpins performance over decades. It also sharpened a core feature of his approach: transactions must not only close; they must endure.

Today, Gil continues to drive Eaglestone’s strategic vision, helping shape infrastructure investment across Sub-Saharan Africa and beyond. His leadership reflects a consistent commitment to technical excellence, strategic clarity and disciplined structuring, with an emphasis on sustainable projects that deliver lasting economic impact. In combination with Neto’s global transaction record and governance experience, Eaglestone’s management embodies a platform designed for scale, credibility and long-term partnership.

The post Eaglestone Management: Experience Forged in Global Infrastructure Finance appeared first on CFI.co.

0

Comments

Want to join the conversation?

Loading comments...