Video•Feb 16, 2026

Why Is Now the Right Time for More Sovereign Tokenisation Developments?

London’s Digital Assets Forum highlighted Lloyd’s Banking Group’s Great British Tokenized Deposit (GBTD) initiative, a UK‑driven effort to issue interoperable, bank‑backed digital money on blockchain. The project aims to replace a fragmented stable‑coin market with a single, regulated token that can be issued by any licensed bank and backed by central‑bank reserves. Peter Left explained that tokenized deposits will retain full banking compliance—KYC, AML, and deposit guarantees—while gaining blockchain’s composability. By allowing deposits from Lloyd’s, HSBC, NatWest and others to be fungible, the network effect creates a unified, programmable money layer that can integrate with smart contracts and existing payment rails. He cited Sarah Breeden’s recent speech on next‑generation payments, noting that tokenized deposits, interoperability and stablecoins were top priorities. The GBTD model mirrors traditional fiat backing—sterling deposits are underpinned by UK loans—yet offers programmable features that could streamline cross‑border settlements and new customer journeys. If successful, the UK could set a global standard for sovereign tokenization, prompting other jurisdictions to launch comparable schemes. Financial institutions stand to gain new revenue streams, while regulators gain a transparent, auditable framework that mitigates fraud without sacrificing the benefits of digital assets.

By Finextra

Video•Feb 16, 2026

US Stocks to Lag European Peers on AI

The discussion centered on a potential rotation from U.S. equities, especially AI‑driven large‑cap stocks, to overseas markets as the AI rally shows signs of fading. Panelist Adam Lynn highlighted that the Nasdaq and S&P 500 may struggle to sustain gains...

By Bloomberg Television

Video•Feb 16, 2026

💡 Loans vs Bonds Explained for IB Interviews

The video breaks down the fundamental differences between senior loans and bonds, a staple topic in investment‑banking interview prep. It highlights that senior loans are secured and usually carry floating rates tied to LIBOR or its successor, while bonds are unsecured,...

By Wall Street Oasis

Video•Feb 15, 2026

“A Huge Problem for Everybody” | Paul Krugman on China, the Dollar, A.I., & More

In a recent Monetary Matters episode, Nobel laureate Paul Krugman examined the durability of the U.S. dollar, the consequences of China’s export‑driven model, and the looming threat of a disjointed global monetary order. Krugman noted micro‑data showing tariffs have lifted consumer...

By Monetary Matters Network

Video•Feb 15, 2026

Beyond the Buzzwords: True Differentiation #saas #podcast #shorts #ai #stuut

Beyond the buzzwords, the speaker argues that SaaS firms must move past generic AI claims and craft a distinct brand narrative. By pairing clear messaging with a tightly aligned marketing‑sales engine, companies can stand out in a crowded fintech space. The...

By Ben Murray

Video•Feb 15, 2026

📘 Deduction for Half of Self-Employment Tax — Taxation Course | Enrolled Agent (EA) | CPA Exam

The video explains the self‑employment tax deduction that allows self‑employed filers to write off half of the tax they pay on net earnings. Professor Farhat walks through the mechanics of the 15.3% self‑employment tax—12.4% for Social Security and 2.9% for...

By Farhat Lectures (CPA & Accounting)

Video•Feb 15, 2026

Create Clickable Tabs Inside an Excel Sheet

The video demonstrates how to build fully clickable, color‑changing tabs inside a single Excel worksheet, turning a static table into an interactive budget dashboard. The process starts by converting raw data into an Excel table (Ctrl T), naming a cell “selected_month”, and...

By Kenji Explains

Video•Feb 15, 2026

Santacruz Silver (TSXV:SCZ) - 2026 Set for More Gains as Large Treasury Builds

Santa Cruz Silver (TSXV:SCZ) outlined its 2026 growth trajectory, emphasizing a fully cleaned balance sheet, a recent NASDAQ listing, and operational upgrades across its Bolivian and Mexican assets. The CEO highlighted that the company eliminated Glenor royalty and streaming obligations,...

By Crux Investor

Video•Feb 15, 2026

Roger Urwin: What a Total Portfolio Approach Looks Like in Practice

The podcast revisits Roger Owen’s Total Portfolio Approach (TPA), focusing on how the framework has moved from a niche concept to mainstream practice after the pivotal 2025 “cross‑the‑chasm” year. Owen explains that large institutional investors such as the Dutch pension fund...

By CFA Institute

Video•Feb 14, 2026

$40 Million Milestone: Major Series A Funding Achievement! #saas #podcast #shorts #ai #stuut

The podcast announces that the SaaS company has secured a total of $40 million in funding, highlighted by a $29.5 million Series A round led by Active and Coastal Ventures. The capital will be deployed primarily into product development and initiatives that help existing...

By Ben Murray

Video•Feb 14, 2026

📘 Penalty on Early Withdrawal — Taxation Course | CPA Exam

Professor Farad explains that early‑withdrawal penalties on CDs are deductible adjustments to AGI, not itemized deductions. The penalty reduces the taxable portion of interest earned, while the full interest amount remains reportable on Form 1040. The lecture walks through Schedule 1, line 18, showing...

By Farhat Lectures (CPA & Accounting)

Video•Feb 14, 2026

Build Your First Power BI Report in One Hour (Free Masterclass + Sample Files 📂)

The livestream walks viewers through building a complete Power BI report in roughly an hour, using a fictitious "Awesome Clinic" dataset. The instructor opens a blank Power BI file, imports three pre‑packaged tables—patients, doctors, and a calendar—then demonstrates how to clean, model,...

By Chandoo

Video•Feb 13, 2026

📘 Filing Requirements — Enrolled Agent (EA) | CPA Exam (REG)

The video explains when a tax return is legally required, emphasizing that filing is not automatic but triggered by gross income surpassing the filing threshold for a taxpayer’s status and age. It outlines the 2025 thresholds – $15,750 for single...

By Farhat Lectures (CPA & Accounting)

Video•Feb 13, 2026

Are Private Markets the New Small-Caps?

The conversation centered on whether private‑market companies are the new small‑cap arena, as they remain private far longer than traditional small caps. Hosts compared recent small‑cap value ETF performance to the broader market and debated the relevance of IPOs in...

By ETF.com

Video•Feb 13, 2026

Public Services Are Breaking — and These Private Stocks Are Cashing In

The video examines accelerating shift from publicly funded services to private sector as governments confront mounting debt and demographic pressures, arguing that “demographics is destiny” for long‑term portfolio construction. It highlights fiscal tightening in the US and looming UK austerity, noting...

By Investors’ Chronicle

Video•Feb 12, 2026

Hindalco Industries Ltd Q3 FY2025-26 Earnings Conference Call

Hindalco Industries Ltd held its third‑quarter FY26 earnings conference call, presenting a mixed performance picture. While consolidated profit after tax plunged 45% year‑on‑year, primarily because of exceptional items such as the Nobelisgo plant fire, the company highlighted resilient growth in...

By AlphaStreet India

Video•Feb 12, 2026

IBM’s “Client-Zero” Approach Is a Blueprint for AI Transformation

IBM’s “client‑zero” model positions the company as both tester and showcase for end‑to‑end AI transformation, applying its own hybrid‑cloud, data‑management and orchestration stack to real‑world business processes. The initiative has already delivered measurable gains in HR, IT and procurement, with 95%...

By Wharton School

Video•Feb 12, 2026

Establishing A Mission, A Culture And Trust Is Key To Building A High Performing FP&A Team - Aswin

The episode centers on building a high‑performing FP&A function through clear mission, culture, and trust, featuring Aswin Saravana, head of FP&A at Qualrix. He frames great FP&A as a strategic partner that proactively delivers insights, holds the business accountable, and...

By Paul Barnhurst

Video•Feb 11, 2026

Taking the Long View of Reporting Season | the Advisory

Reporting season is back, and investors are bombarded with earnings headlines and market swings. Morningstar’s personal‑finance director Mark L‑Monica joins the advisory to argue that the frenzy can obscure the longer‑term view that disciplined investors need. L‑Monica notes that quarterly results...

By ausbiz

Video•Feb 11, 2026

Xometry: 3 Takeaways on Traction, Risks, and Outlook

The Motley Fool Scoreboard dissected Xometry (XMTR), an AI‑powered platform that matches manufacturers with suppliers, aiming to streamline fragmented supply chains. Analysts Dan Caplinger and Lou Whiteman evaluated the company’s business model, leadership, financial health, and valuation prospects, ultimately assigning...

By The Motley Fool

Video•Feb 10, 2026

Robinhood's Stock Fell on Earnings, but This Analyst Is Still Bullish

Robinhood reported fourth‑quarter results that fell short of Wall Street forecasts, sending the stock down about 8% in after‑hours trading. The company posted $1.28 billion in revenue and earnings of 66 cents per share, both below consensus expectations. Transaction‑based revenue came in at...

By Yahoo Finance

Video•Feb 10, 2026

Crypto Winter or Correction? This Analyst Explains the Difference

The interview centers on whether today’s crypto slump constitutes a prolonged "crypto winter" or merely a market correction. Analyst Andrew argues the former is inaccurate, noting that while Bitcoin has fallen about 45% and Ethereum roughly 55% since October, development...

By Yahoo Finance

Video•Feb 10, 2026

Russia Is Becoming a Second-Rate State Under Putin, Says Eurasia Group's Ian Bremmer

Ian Bremmer of Eurasia Group warned that Russia is slipping into a second‑rate state under Putin, while the United States is abandoning its traditional role as the guarantor of collective security, free trade and democratic norms. Bremmer argued that the U.S....

By Bloomberg Television

Video•Feb 10, 2026

PayPal Is Running Out of Time, Says Former President

In a candid interview, former PayPal president and LightSpark CEO David Marcus warned that Bitcoin’s recent price weakness is less a market correction than a structural shift toward institutional ownership. He argued that the October 10, 2026 events accelerated the transition from...

By Bloomberg Television

Video•Feb 10, 2026

Software Companies' Business Models Are 'Under Assault' From AI

The conversation centered on how generative AI is fundamentally reshaping software business models, forcing a sharp repricing of legacy enterprise‑software stocks such as Salesforce, Workday and ServiceNow. Host Eric expressed bullishness on AI itself but warned that traditional software firms,...

By Yahoo Finance

Video•Feb 10, 2026

📖 Going Concern Assumptions — CPA Exam (AUD) | Auditing Course

The video walks auditors through the final‑stage assessment of a client’s going‑concern status during the subsequent‑events period, after fieldwork is finished and all adjustments are posted. At this point the auditor revisits analytical procedures—liquidity, profitability, leverage and cash‑flow ratios—to determine...

By Farhat Lectures (CPA & Accounting)

Video•Feb 10, 2026

Expect the Unexpected: A Blueprint for 2026

The CBS Spring 2026 Global Markets Update opened with senior scholar Brett House introducing Abby Joseph Cohen, a former Goldman Sachs chief US investment strategist, to dissect the economic and market landscape heading into 2026. The session, co‑hosted by the Chazen Institute...

By Columbia Business School

Video•Feb 10, 2026

Why the Rising Federal Debt Could Limit AI and Overall Economic Growth

The Wharton Future of Finance conference tackled a looming fiscal dilemma: the United States’ trajectory toward $2 trillion‑a‑year budget deficits could starve the economy of the capital needed to sustain AI research and broader digital transformation. Professors Gomez and Goldstein warned...

By Knowledge at Wharton

Video•Feb 10, 2026

📘 Prior Year Tax Return — Enrolled Agent

The video walks tax preparers through leveraging a client’s prior‑year return as the starting point for the current filing. Professor Farhad emphasizes that the earlier return contains essential data—filing status, dependents, address, elections, and recurring income sources—making it a practical...

By Farhat Lectures (CPA & Accounting)

Video•Feb 10, 2026

Webcast 7: Overview of the Revised Section 23 Revenue From Contracts with Customers

The webcast reviews the revised Section 23 of the IFRS for SMEs, which now mirrors IFRS 15’s five‑step revenue model and introduces expanded disclosure requirements. This second session focuses on the Appendix’s application guidance and the transition options that SMEs must consider...

By IFRS Foundation

Video•Feb 10, 2026

Key Takeaways From Aviation Week’s Engine Financing Event

The Aviation Week Engine Financing event in Tampa highlighted shifting dynamics in aircraft‑engine leasing as operators grapple with constrained supply. Participants noted lease contracts stretching from the traditional 12‑18 months to three‑five years, reflecting operators’ desire to lock in scarce assets....

By Aviation Week

Video•Feb 9, 2026

Oracle Stock Jumps Over 30% Based On This One Metric | SaaS Metrics School

Oracle’s shares vaulted more than 30% after the company disclosed a dramatic rise in its Remaining Performance Obligation (RPO), a metric that captures the value of contracted, yet‑to‑be‑delivered software and services. The earnings release showed RPO climbing 359% year‑over‑year, adding $317 billion...

By Ben Murray

Video•Feb 9, 2026

Storytelling with Data Podcast: #95 Structure Liberates – Why Your Data Needs a Style Guide with ...

The episode of the Storytelling with Data podcast delves into the need for formal data‑visualization style guides, arguing that a clear structure actually frees creators to concentrate on narrative impact rather than pixel‑level decisions. Host Simon introduces Maxine Graves, a...

By Storytelling with Data

Video•Feb 9, 2026

How INSEAD Is Driving Business Education Forward in Asia

INSEAD’s Singapore campus is being promoted as a cultural and intellectual hub where diverse ideas converge to shape future business leaders across Asia. The school highlights its commitment to diversity, impact‑driven leadership, and a global ethos that resonates with both...

By INSEAD

Video•Feb 7, 2026

5 Mistakes to Avoid With Your Investment Portfolio in 2026

The Morningstar video, hosted by Margaret Jazz and featuring personal‑finance director Christine Benz, outlines five common portfolio mistakes investors should dodge in 2026. The discussion centers on why past performance should not dictate future allocations and how disciplined diversification can...

By Morningstar

Video•Feb 6, 2026

The Economic Reality Behind Billionaires Taxes and State Budgets

The video examines the political push for a billionaire wealth tax, focusing on California’s recent proposal and the broader debate about using ultra‑rich assets to close budget gaps. Kent Messrs, director of the Penn Wharton Budget Model, runs a “worst‑case” scenario...

By Knowledge at Wharton

Video•Feb 6, 2026

How Influence Really Works in Modern Leadership

The Think Ahead podcast episode examines how influence operates in modern leadership, especially under layered crises such as supply‑chain disruptions, rapid AI change, and climate threats. Professor Nerra Sivanatan presents cross‑national research covering 69 countries and 140,000 respondents, showing that...

By London Business School

Video•Feb 6, 2026

IASB Podcast on the January 2026 Meeting Highlights

The IASB’s January 2026 podcast recapped two major agenda items: the ongoing Intangible Assets project and the post‑implementation review (PIR) of IFRS 16. The Intangible Assets initiative, launched in April 2024 after the Third Agenda Consultation, is being pursued through two work...

By IFRS Foundation

Video•Feb 5, 2026

Strategies for Firm Growth and Beating Burnout - Feb. 5

The AICPA Town Hall featured Jeff Weiner, former Marcum CEO, discussing how his firm grew from a seven‑person shop to a $1.3 billion practice and the strategies that can help other accounting firms scale. Weiner highlighted the pivotal role of disciplined...

By AVCJ

Video•Feb 5, 2026

North Africa: Connecting Continents, Creating Opportunities

The high‑level conference in Algiers framed North Africa as a strategic conduit between Europe’s industrial demand and Sub‑Saharan Africa’s demographic dynamism. Speakers highlighted the region’s current trade skew—over 60% of exports flow to Europe while intra‑African exchange remains under 5%—and...

By International Monetary Fund (IMF)

Video•Feb 5, 2026

'This Was the Right Play': GE Vernova CEO Talks Splitting Off From GE and Nukes | At Barron's

The interview with Scott Strazik, CEO of GE Vernova, centered on the company’s recent full separation from General Electric and its evolving portfolio across gas, wind, nuclear and grid‑electrification. Strazik highlighted that Vernova now supplies roughly a quarter of the world’s...

By Barron's

Video•Feb 5, 2026

How to ACTUALLY Use AI + PYTHON to Analyze Data (Real-Time Example)

The video demonstrates how AI tools like Google Gemini can write Python code in real time to load, merge, and analyze a hospital data set within Google Colab. The presenter walks through three escalating tasks—basic exploratory analysis, answering a specific...

By Chandoo

Video•Feb 5, 2026

How Public Funding Unlocks Private Innovation

The video argues that a tiny slice of U.S. patents—just 2 % of all filings—drives roughly one‑fifth of medium‑term productivity and GDP growth, and that these patents are publicly funded yet privately owned. Research shows the patents originate from university labs and...

By London Business School

Video•Feb 5, 2026

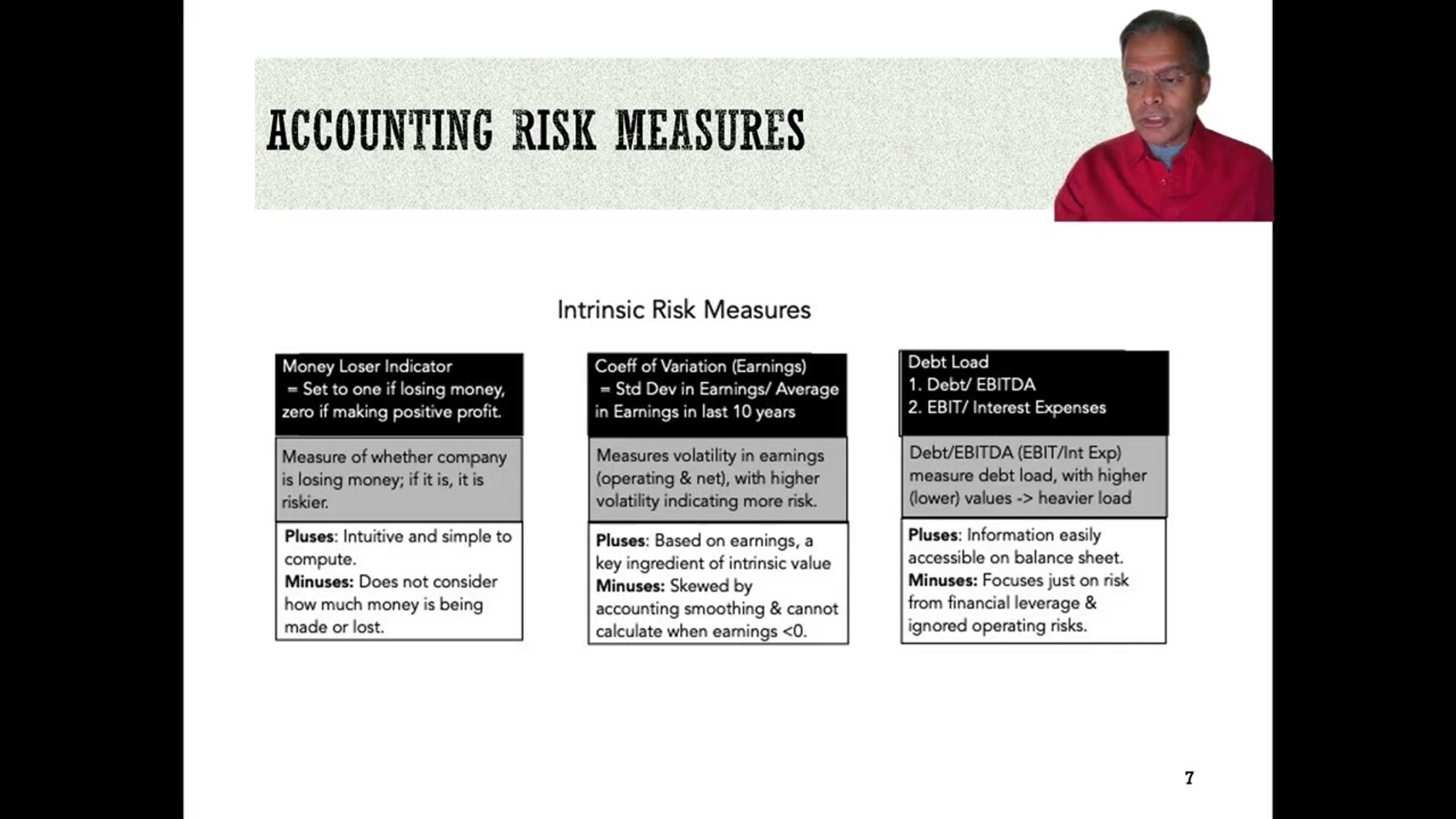

Data Update 5 for 2026: Risk and Hurdle Rates - The 2026 Edition!

The video, the fifth data update for 2026, focuses on how companies’ risk profiles drive hurdle‑rate calculations. After reviewing market‑level performance in earlier updates, the presenter shifts to firm‑level risk divergence and why precise risk measurement is essential for finance...

By Aswath Damodaran

Video•Feb 4, 2026

Cam Harvey: Gold’s Wild Week: Why Prices Surged Then Fell 11%

Cam Harvey explains the wild week in gold, where the metal climbed past $5,000 in mid‑January before plunging 11% on Jan 30, marking the most dramatic single‑day move since the 1980s. The rally was fueled by a meme‑like frenzy: Chinese investors drove...

By Duke Fuqua

Video•Feb 4, 2026

Cash Flow From Operations: Real Life Vs. Investopedia

The video walks through cash flow from operations, contrasting textbook simplicity with real‑world complexity, using Target, Watches of Switzerland and Telstra as case studies. It explains the indirect method—starting with net income, adding back depreciation, amortisation, deferred taxes and other non‑cash...

By Mergers & Inquisitions / Breaking Into Wall Street

Video•Feb 4, 2026

Finfluencers: What Drives Them, & How Should Regulation Evolve

The CFA Live 25 conference panel examined the rise of "finfluencers" – content creators who translate complex finance topics into bite‑size social media posts. Speakers highlighted how these creators fill an information gap for retail investors, especially younger audiences,...

By CFA Institute

Video•Feb 3, 2026

BISness Podcast - Shifting Currents in FX & Interest Rate Derivatives

The BIS’s latest triennial survey, conducted in April 2025 amid heightened policy uncertainty, reveals a dramatic expansion in both foreign‑exchange (FX) and interest‑rate derivatives markets. Daily turnover in the FX segment reached $9.5 trillion – roughly 30% higher than the 2022 survey...

By Bank for International Settlements (BIS)

Video•Feb 3, 2026

In Conversation with Aaryani Dogra | Master of Finance

The video features Aaryani Dogra, a former risk‑management professional, discussing why she chose the EMFIN Master of Finance program and how it reshaped her career trajectory. She explains that after working in insurance and risk, she sought a more strategic,...

By Cambridge Judge Business School

Video•Feb 3, 2026

Excel Just Made File Imports Ridiculously Simple (New Functions)

Microsoft Excel has added two native functions—IMPORTCSV and IMPORTTEXT—that let users pull data from CSV and plain‑text files directly into a worksheet using a single formula. Both functions accept a file path (local or URL) and expose optional arguments for delimiter,...

By MyOnlineTrainingHub