Health Savings Accounts Gain Popularity as Investment Vehicles

•February 10, 2026

0

Companies Mentioned

Why It Matters

The surge in HSA investing amplifies tax‑advantaged savings for a broader workforce, reshaping employee benefits strategy and creating a sizable new asset class for financial services firms.

Key Takeaways

- •4M HSAs invested, 23% YoY rise

- •HSA assets hit $159B, 46% invested

- •New law adds 3‑4M eligible participants by 2027

- •Projected 47M accounts, $208B assets by 2027

- •Employer education crucial for HSA utilization

Pulse Analysis

The rapid uptick in HSA investment reflects a maturing market that is moving beyond a simple reimbursement tool toward a long‑term wealth‑building vehicle. Tax‑advantaged growth—contributions are deductible, earnings compound tax‑free, and qualified withdrawals are untaxed—makes HSAs uniquely attractive amid rising healthcare costs. As of mid‑2025, $159 billion sits in 40 million accounts, with nearly half allocated to stocks, bonds, or mutual funds, signaling a shift in consumer behavior toward proactive financial planning for medical expenses.

Legislative changes are accelerating this trend. The One Big Beautiful Bill Act broadened eligibility to include Bronze and Catastrophic ACA plans, opening the door for lower‑income families and Gen Z workers who previously could not access HSAs. Analysts estimate an influx of 3‑4 million new participants, driving the total account count toward 47 million and assets beyond $208 billion by 2027. This expansion not only diversifies the participant base but also pressures employers to rethink benefits communication, ensuring employees understand both the spending and investment dimensions of HSAs.

For employers and financial service providers, the implication is clear: education and engagement are now strategic imperatives. HR teams must move beyond annual enrollment talks, offering year‑round guidance on contribution limits, investment options, and optimal withdrawal strategies. Financial firms can capitalize by developing tailored HSA investment platforms and advisory services that simplify decision‑making for a less‑financially sophisticated audience. As the market grows exponentially, those who embed robust HSA education into their benefits architecture will capture higher employee satisfaction and tap into a burgeoning, tax‑efficient investment pool.

Health savings accounts gain popularity as investment vehicles

Visualization created with AI assistance based on original reporting.

Key Insight: Discover how increasing HSA investing repositions accounts as long‑term healthcare savings and investment vehicles.

What’s at Stake: Employers face engagement shortfalls and potential future cost exposure if HSAs remain underutilized.

Forward Look: Expanded eligibility under recent legislation may add 3–4 million participants by 2027.

More Americans are putting their HSA dollars to work through investments, a move experts say could make it easier to cover the medical bills that come with getting older.

Around 4 million HSAs — roughly 10 % of all accounts — held at least some of their HSA dollars in investments at the middle of last year, according to the Devenir 2025 Midyear HSA Survey. That represents a 23 % year‑over‑year increase.

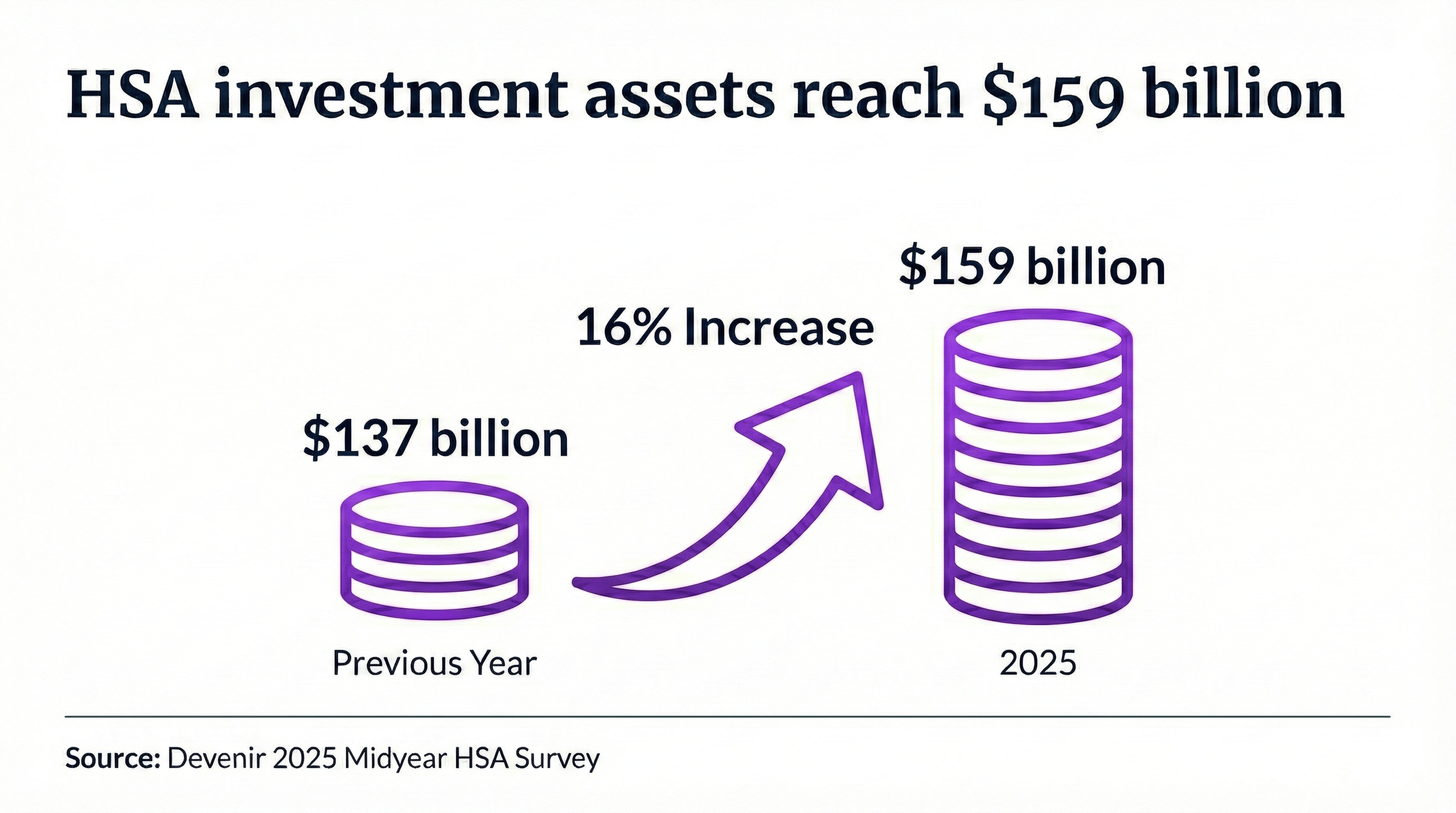

HSA assets also saw significant growth, reaching $159 billion across 40 million accounts, a 16 % year‑over‑year increase. Investment assets now represent 46 % of all HSA assets.

“HSAs saw strong growth in the first half of 2025, driven by steady contributions and market gains,” said Jon Robb, senior vice president of research and technology at Devenir, in a press release. “More account holders are choosing to invest, while many households still use HSAs for current medical costs. That dual role, both spending account and long‑term savings vehicle, continues to drive the popularity and growth of HSAs.”

When HSAs were created by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, they were designed as long‑term savings vehicles. But because of a lack of awareness and poor messaging, many account holders still don’t invest their funds, says Nick DiMauro, consumer‑benefits expert and CEO of daylii.

Investing HSA funds helps people maximize the triple‑tax advantage, DiMauro says, pointing out that contributions are tax‑deductible, the money grows tax‑free, and withdrawals for qualified medical expenses are also tax‑free.

DiMauro says one of the biggest mistakes he sees is “consumers utilizing their card instead of paying out of pocket, saving those receipts and letting their money grow that compound interest.”

Improving the messaging

Many HR leaders only talk about the benefits of HSAs during onboarding and open enrollment, but DiMauro says this conversation should continue throughout the year in order to increase engagement.

HSAs are governed by the IRS, so the rules and regulations surrounding the accounts generally remain the same year‑to‑year. HR leaders can help employees make the most of their accounts by helping them strategize how they are spending and investing their funds, DiMauro says.

“There’s a lot of complexity around HSAs, and it’s really important to take a uniformed approach for your employee group,” DiMauro says. “It all comes down to education and making sure your HR directors understand these as well, because a lot of times they don’t even understand it, so how are they going to communicate it to their employees? That’s where it gets lost.”

More people are expected to sign up for HSAs in 2026 due to legislative changes. The One Big Beautiful Bill Act passed last year expanded eligibility for HSAs, making Bronze and Catastrophic Affordable Care Act plans HSA‑eligible. According to the Morningstar 2025 Landscape Report, an additional 3 to 4 million participants could join the market.

“That’s opening up HSAs to lower‑income families and Gen Z workers,” DiMauro says.

With the expanded access, favorable tax advantages and growing need for healthcare savings, DiMauro sees a bright future for HSAs, and the research backs that up: Devenir projects the HSA market will surpass 47 million accounts and exceed $208 billion in total assets by the end of 2027.

“I think this is an area that’s going to grow pretty exponentially over the next decade,” says DiMauro, who has called HSAs one of the most under‑the‑radar investment accounts in America. “They’re an extremely powerful tool if used the right way, and I think it’s just underutilized. It’s a massive market.”

Reporter, Employee Benefits News

0

Comments

Want to join the conversation?

Loading comments...