Rising Health Costs Outpace Social Security for Retirees

•February 11, 2026

0

Why It Matters

The disparity between health‑care cost growth and Social Security benefits erodes retirees’ purchasing power and pressures public and employer‑based health programs. Addressing this gap is critical for the financial security of an aging workforce.

Key Takeaways

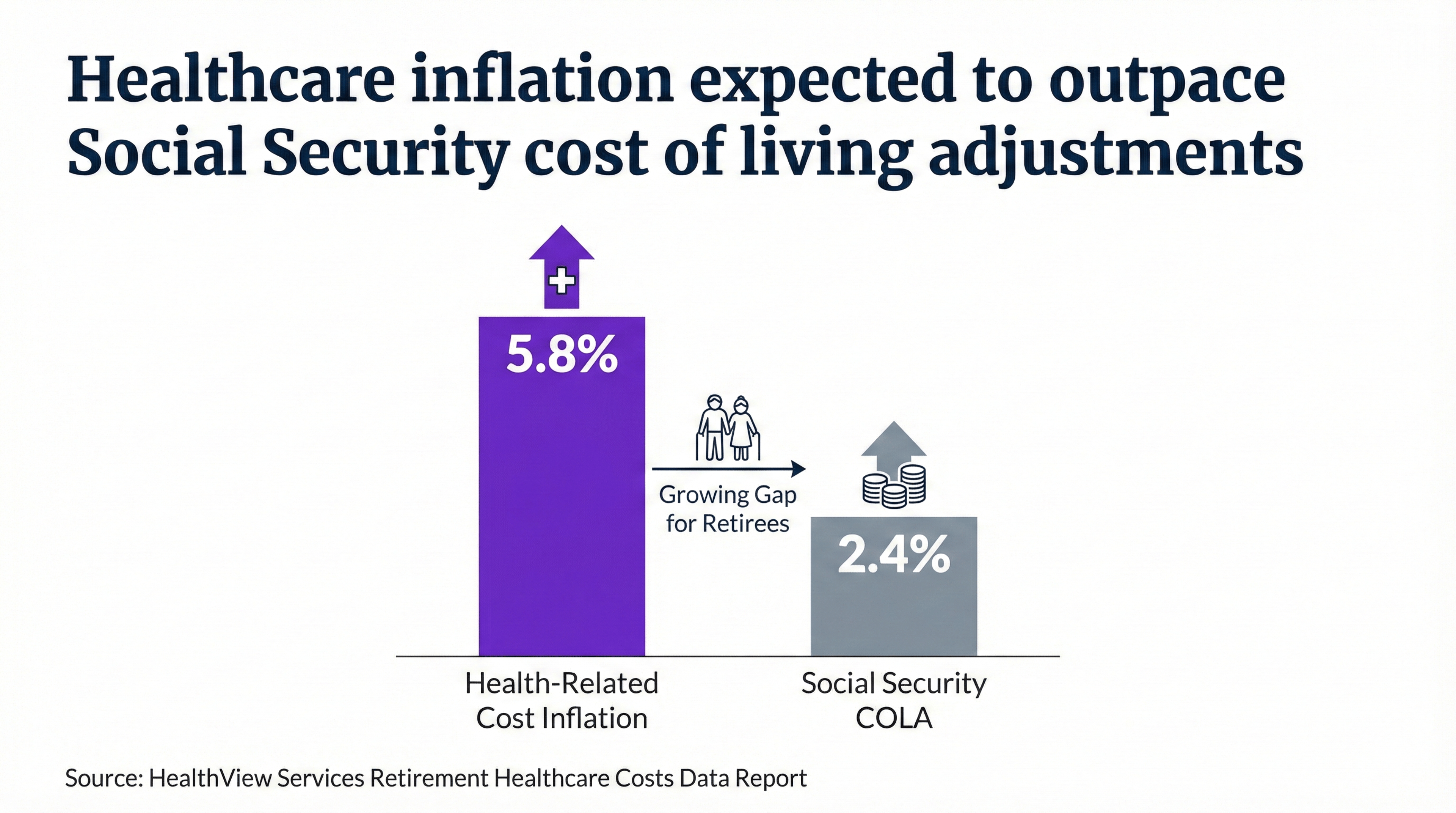

- •Health cost inflation 5.8% outpaces 2.4% COLA.

- •Medicare Part B/Advantage premiums rose 9.7% in 2026.

- •Part D drug premiums up 50% since 2022.

- •Lifetime Medicare costs vary by state, up to $1.05M.

- •HSAs and benefit calculators can mitigate budgeting gaps.

Pulse Analysis

The accelerating pace of health‑care inflation is reshaping retirement economics. While Social Security’s automatic cost‑of‑living adjustments have steadied at roughly 2.4% per year, the HealthView Services report flags a 5.8% annual rise in medical expenses. This divergence means that each dollar of Social Security income now covers a smaller slice of a retiree’s health budget, amplifying financial vulnerability for seniors who rely heavily on fixed income streams.

Medicare’s own pricing dynamics compound the challenge. In 2026, premiums for Part B and Medicare Advantage climbed 9.7%, reflecting broader market pressures from hospitals operating near break‑even and pharmaceutical price hikes. Part D drug costs have surged 50% since the Inflation Reduction Act’s 2022 provisions, leaving high‑spending retirees especially exposed. Moreover, state‑level cost differentials are stark—annual lifetime medical expenses can range from $878,000 in Washington to over $1 million in Missouri—underscoring the geographic dimension of the problem and its ripple effects on small‑business benefit plans.

Financial planners and HR leaders are urged to counteract these trends with proactive tools. Maximizing Health Savings Account contributions allows retirees to grow tax‑advantaged funds that can offset out‑of‑pocket spending, while Social Security optimization calculators help individuals time benefit claims for maximum lifetime value. By integrating these resources into employee benefits education, companies can improve retirement readiness and alleviate the looming strain on both private and public health‑care safety nets.

Rising health costs outpace Social Security for retirees

Visualization created with AI assistance based on original reporting.

-

Key Insight: Learn why health‑cost inflation is outpacing retirement income growth, reshaping retiree budgeting.

-

What’s at Stake: Rising retiree medical spending could strain employer benefits and public program sustainability.

-

Supporting Data: Health inflation projected 5.8 % versus Social Security COLA 2.4 % annually.

-

Source: Bullets generated by AI with editorial review

Inflation will continue to drive up healthcare costs for retirees, despite legislative efforts to stem rising expenses, according to a new report.

HealthView Services outlines the many challenges that retirees are expected to face when budgeting for medical expenses. One of the biggest issues, the report points out, is the growing difference between the long‑term inflation rate for health‑related costs and projected Social Security cost‑of‑living adjustments.

Social Security COLAs are expected to rise 2.4 % annually, but health‑related cost inflation is forecast to remain stubbornly high at 5.8 %. That gap means retirees will need a growing portion of Social Security benefits to cover expenses.

“After a decade of publishing these data reports, the cost of health‑related care in retirement still comes with sticker shock,” says Ron Mastrogiovanni, CEO of HealthView Services. “The report serves as a somewhat chilling reminder of the limited impact of legislative changes to reduce the burden of these costs.”

The Retirement Healthcare Costs Data Report also highlights the rising cost of Medicare programs: Medicare Part B (medical insurance) and Medicare Advantage premiums directly deducted from Social Security increased by 9.7 % for 2026, and the national average Medicare Advantage inflation rate was 6.6 %.

Additionally, premiums for Medicare Part D (drug coverage) have increased by 50 % since the passage of the Inflation Reduction Act in 2022, which reduced the cap on catastrophic prescription costs.

What’s driving up the costs?

There’s no single answer as to why healthcare costs keep climbing, says Mastrogiovanni. Providers blame the insurance companies and drug manufacturers, while the insurance companies blame the drug manufacturers and hospital systems.

But one fundamental problem, Mastrogiovanni says, is that many hospitals are essentially operating near break‑even.

“You have a number of people who don’t have any insurance, and they can’t pay but still have to be cared for,” Mastrogiovanni says. “Then you have the group on Medicare. They typically pay more than people who don’t have anything, but they pay less than those who are insured through an employer.

“So what ends up happening is the employers typically get hit the hardest in terms of coverage, especially the smaller employers, because that’s where the hospitals can generate more money.”

HealthView’s report also calls attention to the importance of taking key variables—health condition, income, state of residence and gender—into account when planning for medical expenses in retirement. Lifetime costs vary greatly by state: a couple living in Missouri could pay as much as $1,053,252, while in Washington state those same services would cost $878,565.

Income is another important factor—Medicare’s Income‑Related Monthly Adjustment Amount policy determines how much recipients pay for Medicare Parts B and D. In effect, the higher a retiree’s income, the greater their premiums for Medicare coverage.

Planning for retirement

Benefit leaders can help employees plan for retirement by promoting helpful tools, such as a health savings account (HSA) or Social Security optimization calculator, Mastrogiovanni says.

Individuals and families should aim to max out their annual HSA contributions and pay out‑of‑pocket for medical expenses. This approach allows them to invest their HSA funds and earn compound interest over time.

Social Security optimization calculators can be especially helpful for retirement planning because they show how the timing of a claim affects lifetime income. They factor in elements like life expectancy, spousal benefits, survivor benefits and projected benefit growth.

“Those are important numbers to know,” Mastrogiovanni says. “I think this is an area that HR should be more focused on because it really helps people, especially families with young kids.”

Reporter, Employee Benefits News

0

Comments

Want to join the conversation?

Loading comments...