News•Feb 19, 2026

LA Fire Victims Suing City Utility for Billions Win Major Ruling

Los Angeles Superior Court Judge Samantha Jessner ruled that the Los Angeles Department of Water and Power can be sued for failing to supply sufficient water during the 2025 Pacific Palisades wildfire. The decision rests on a California law that allows property owners to pursue utility negligence claims when water pressure is inadequate. Plaintiffs allege a reservoir taken offline for repairs left hydrants under‑pressurized, helping the fire spread. The ruling opens the door for hundreds of lawsuits seeking billions in damages.

By Insurance Journal

News•Feb 19, 2026

Marsh Risk Launches Excess Casualty Facility for US Digital Infrastructure

Marsh Risk has introduced Nimbus Casualty, an excess general liability facility targeting U.S. digital infrastructure construction projects. The new program offers up to $75 million of coverage with a $25 million attachment point and is underwritten by a consortium of Lloyd’s and...

By Insurance Journal

News•Feb 19, 2026

EV Collision Claims Rise Even as Sales Falter: Report

Mitchell International’s "Plugged‑In: EV Collision Insights" report shows U.S. electric‑vehicle collision claims rose 14% and Canadian claims 24% despite a 2% dip in BEV sales. Repairable claim shares grew 6% for PHEVs and 20% for MHEVs in the U.S., with...

By Carrier Management

News•Feb 19, 2026

Nevada Debuts Public Option Amid Tumultuous Federal Changes to Health Care

Nevada launched its Battle Born public option health plans last fall, aiming to lower premiums and expand coverage. Early enrollment reached just over 10,000 members, far short of the 35,000 target set by state officials. The program must cut premiums...

By KFF Health News (formerly Kaiser Health News)

News•Feb 18, 2026

Japan Accounting Group Seeks to Ease Insurer Bond Loss Rule

The Japanese Institute of Certified Public Accountants (JICPA) has proposed treating life insurers' government‑bond holdings as held‑to‑maturity, removing the need for impairment accounting when certain criteria are met. Under current rules insurers must record a loss if market value falls...

By Accounting Today

News•Feb 18, 2026

Employers Push Critical Illness Plans Amid Health Risks

Employers are increasingly adding critical‑illness insurance to their benefits portfolios to offset gaps left by high‑deductible health plans. A recent Equitable survey shows 31% of American workers filed a critical‑illness claim in the past year, yet only 49% feel confident...

By Employee Benefit News

News•Feb 18, 2026

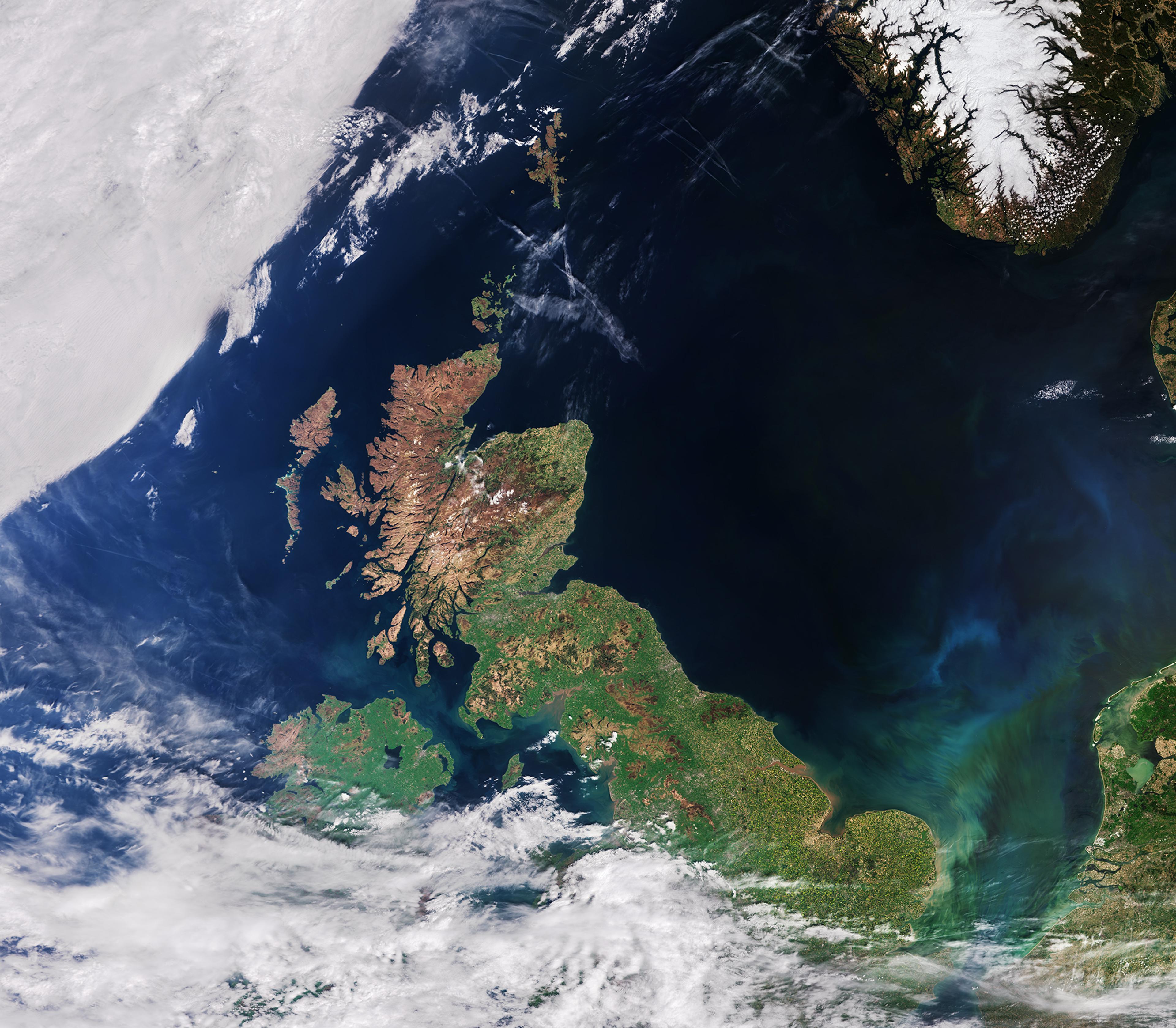

UK Caps Launch Liability in Timely Boost for Nascent Domestic Market

On February 18, the UK enacted a €60 million liability cap for launch operators under the Space Industry (Indemnities) Act 2025, replacing the previous unlimited exposure. The cap, which must be included in launch licences, is intended to make the nascent UK...

By SpaceNews

News•Feb 18, 2026

Gallagher Brings Woodruff Sawyer Under Brand in $1.2bn Deal

Arthur J. Gallagher & Co. has completed the integration of Woodruff Sawyer, fully bringing the specialist broker under the Gallagher brand after a $1.2 billion acquisition. The move adds Woodruff Sawyer’s $268 million pro‑forma revenue and $88 million EBITDAC, along with its 14...

By Fintech Global

News•Feb 18, 2026

Matic and nCino Embed Home Insurance Into Digital Mortgages

Matic and nCino have teamed up to embed a home‑insurance marketplace directly into nCino’s digital mortgage platform. The integration lets borrowers compare and purchase policies from more than 70 carriers without leaving the loan application flow. Lenders gain earlier access...

By Fintech Global

News•Feb 18, 2026

OSHA Inspector Ranks Fell Sharply Before Projected 2026 Increase, Agency Says

OSHA’s federal safety‑inspection workforce dropped sharply, falling from 812 officers at the end of fiscal 2024 to 629 by September 2025. The agency projects a rebound to roughly 1,720 inspectors in 2026, a figure that includes staff from state‑plan programs....

By Business Insurance

News•Feb 17, 2026

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re’s primary insurer, Ergo, will eliminate roughly 1,000 positions in Germany, driven by AI automation of routine telephony and claims‑processing tasks. The reductions will be phased over five years, ending in 2030, and support the group’s goal of €600 million...

By Claims Journal

News•Feb 17, 2026

Dairy Margin Coverage Signup Slow in the Dairy State

Most Wisconsin dairy producers have yet to enroll in the USDA’s Dairy Margin Coverage (DMC) program, with only 1,616 of the state’s 5,116 licensed farms—31.5%—signed up as of Feb 17. The enrollment deadline is Feb 26, prompting FSA officials and risk‑management advisors...

By Brownfield Ag News

News•Feb 17, 2026

Houston Companies to Pay $200K to Workers Fired for Asbestos Concern

The U.S. Department of Labor’s Occupational Safety and Health Administration ordered two Houston construction firms, Rise Construction LLC and Niko Group LLC, to reinstate two workers they fired for raising asbestos safety concerns during a hotel repair after Hurricane Beryl....

By Insurance Journal

News•Feb 17, 2026

Bayer to Make $10.5 Billion Push to Settle Roundup Cases

Bayer AG is set to announce a $10.5 billion settlement initiative to resolve Roundup litigation, combining a $7.5 billion class‑action proposal in Missouri with $3 billion for existing U.S. cases. The German conglomerate has already spent more than $10 billion on verdicts and settlements...

By Insurance Journal

News•Feb 16, 2026

HIMSSCast: 2026 Could Be the Most Challenging Year yet for Medicare Advantage Payers

Medicare Advantage insurers are confronting a perfect storm of rising medical costs and a flat payment increase of less than 1% announced by CMS for 2026. The new risk‑adjustment formula and stagnant reimbursement fall below the medical‑cost trend, compressing margins...

By Healthcare IT News (HIMSS Media)