Video•Feb 20, 2026

Stocks Slide as Oil Jumps on Rising US-Iran Tensions | The Close 2/19/2026

The Close highlighted a sharp equity sell‑off on Feb 19, 2026 as Brent crude surged to its highest level since July amid escalating U.S.–Iran tensions. The S&P 500 slipped about 0.6% and the Nasdaq 100 fell roughly 0.7%, while the VIX nudged back above the 20‑point mark. The slide was amplified by a brief rise in 10‑year Treasury yields to 4.07% before they steadied, and by news that asset manager Blue Owl would restrict withdrawals from a private‑credit fund, dragging down peers such as Apollo, Blackstone and KKR. Investors also braced for a key GDP report and a pending Supreme Court decision on Trump‑era tariffs, which have yet to narrow the trade deficit or boost domestic manufacturing. BlackRock’s chief strategist Gargi Chowdhury stressed that underlying economic fundamentals remain solid—strong industrial production, resilient labor market and easing inflation—but the market’s “skittish” tone reflects positioning and AI‑related rotation. She urged diversification within the AI value chain, exposure to emerging‑market equities and defensive semiconductor holdings. Meanwhile, CRH CEO Jim Mintern highlighted a multi‑year pipeline of over 100 U.S. data‑center projects, ongoing infrastructure funding optimism, and a $40 billion investment plan that includes aggressive M&A and a review of its London listing. For investors, the confluence of geopolitical risk, rising energy prices and sector‑specific stress underscores the need for broader diversification, defensive positioning in AI‑related hardware, and alternative safe‑haven assets such as gold or liquid alternatives. Monitoring bond‑equity correlation, inflation pressures on construction inputs, and policy developments will be critical to navigating the heightened volatility.

By Bloomberg Television

Video•Feb 19, 2026

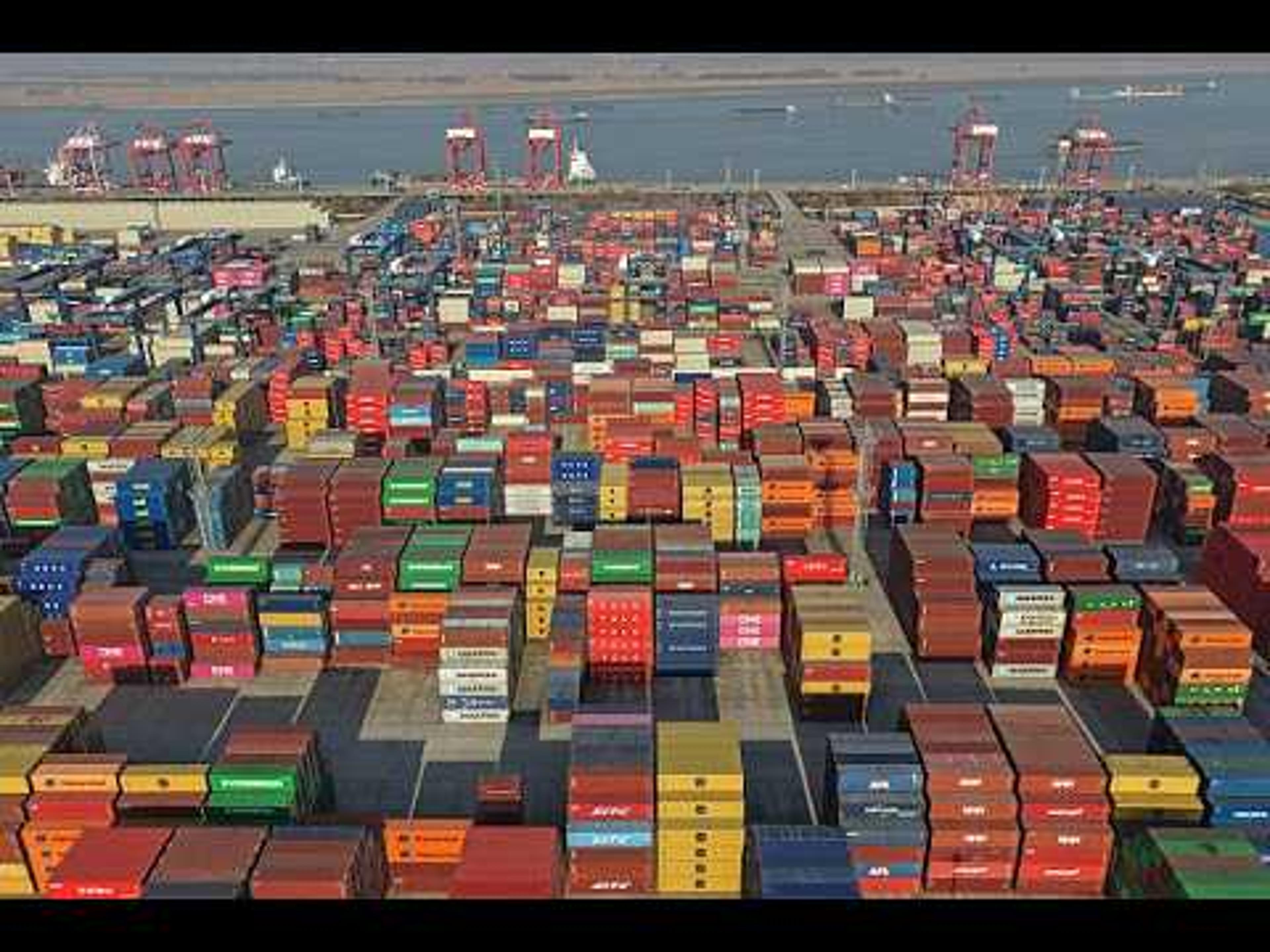

US Runs Annual Trade Deficit Up to $901 Billion, One of Biggest Since 1960

U.S. trade data released this week showed the annual deficit expanding to $901 billion, the widest gap since the early 1960s. After a brief narrowing in the first half of last year, imports surged in the second half, pushing the balance...

By Bloomberg Television

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 18, 2026

Previsico on the Next Era of Flood Intelligence for Insurers

Provisico used its ITC London stage to unveil Flood Intelligence 2.0, a next‑generation forecasting platform aimed at insurers grappling with rising surface‑water flood risk. The company, which counts Liberty, Zurich and Generali among its clients, is shifting from a deterministic single‑outcome...

By FF News | Fintech Finance

Video•Feb 17, 2026

Chesnara CEO on €110 Million Acquisition of Scottish Widows Europe, Pipeline and Future Prospects

Chesnara PLC announced the €110 million purchase of Scottish Widows Europe, adding roughly 1.4 million policies and an administrative hub in Luxembourg to its portfolio. The deal is projected to generate €250 million of lifetime cash, with about €100 million expected in the first five...

By Proactive Investors

Video•Feb 16, 2026

Stefano Bison - Generali - How Innovation In Payments Are Changing Insurance

In a recent discussion, Stefano Bison of Generali highlighted how digital payment innovations are reshaping the insurance value chain. He emphasized that the payments ecosystem is already highly monetized and digitized, allowing insurers to experiment with new payout models without...

By FF News | Fintech Finance

Video•Feb 16, 2026

Sweeping Affordable Care Act Changes Proposed for 2027 (Katie Keith)

The Health Affairs podcast aired on February 13, 2026, unpacked a sweeping 577‑page proposed rule that would reshape the Affordable Care Act for the 2027 coverage year. Released unusually late in the rule‑making cycle, the proposal gives stakeholders just weeks...

By Health Affairs