🎯Today's Investment Banking Pulse

Updated 1h agoWhat's happening: Omnitech Engineering targets Rs 583 crore IPO to fund growth

Omnitech Engineering announced an IPO priced at Rs 216‑227 per share, aiming to raise Rs 583 crore and valuing the firm at over Rs 2,800 crore. The issue includes a Rs 418 crore fresh‑issue and a Rs 165 crore promoter sell‑down, opening on Feb 25 and closing on Feb 27, with anchor bidding on Feb 24 and a stock‑market debut slated for March 5.

Also developing:

By the numbers: Union Pacific eyes $85bn Norfolk Southern merger

Deals•Feb 20, 2026

Allstate Raises $1.2bn Target for Sanders Re III & IV Catastrophe Bonds

Allstate announced it has increased its target for the dual Sanders Re III and Sanders Re IV catastrophe bond issuances to $1.2 billion, seeking $600 million of reinsurance limit per series. The bonds, issued by Sanders Re III Ltd. and Sanders Re IV Ltd., will provide multi‑peril, occurrence‑based reinsurance protection across the U.S. (excluding Florida).

Artemis (ILS/cat bonds)

News•Feb 20, 2026

JSW Infra to Issue Shares to Meet Minimum Public Stake Norm

JSW Infrastructure approved an equity raise of up to 25 crore shares, valued at roughly ₹6,325 crore, to satisfy SEBI’s requirement of a 25% public shareholding within three years of its October 2023 listing. The proceeds will back a ₹39,000 crore capital‑expenditure programme that...

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

Novartis to Divest India Unit to Private Equity-Led Consortium for $159M

Novartis announced the sale of its majority stake in its Indian generics and prescription business to a private‑equity‑led consortium for $159 million. The transaction transfers control of a portfolio that includes both off‑patent generics and branded medicines to the buyers. The...

By Endpoints News

News•Feb 20, 2026

Salesforce Acquires Momentum

Salesforce announced the acquisition of Momentum, a San Francisco‑based conversational‑insights platform, with the purchase price undisclosed. The transaction is slated to close in the first quarter of Salesforce’s fiscal year 2027, pending standard conditions. Momentum’s technology captures and structures data from Zoom,...

By FinSMEs

Social•Feb 20, 2026

HSBC Cuts US DCM, Shifts Focus to Asian Banks

Macro: HSBC trims ~10% of US DCM in broader $1.8bn cost overhaul and pivot to Asia/Middle East. Key factors: management cuts, M&A/ECM pullback. Risk: execution/credit cycles. Trade: favor Asian bank equities. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 20, 2026

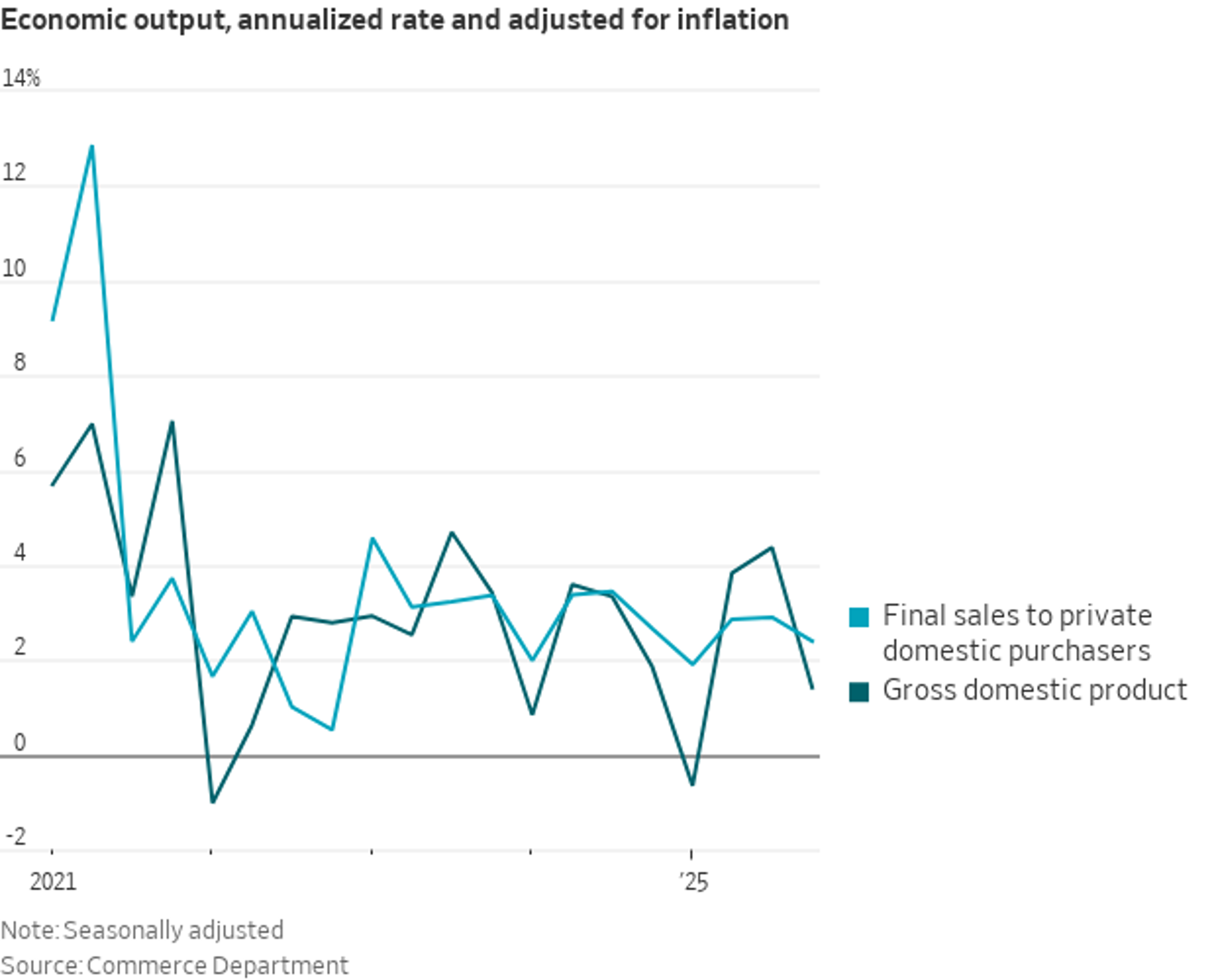

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Deals•Feb 20, 2026

Eurazeo Completes Exit of Minority Stake in Ex Nihilo to L Catterton

Eurazeo has completed the sale of its minority stake in the Paris‑based luxury fragrance house Ex Nihilo to private equity firm L Catterton. The transaction, announced on February 20, 2026, marks Eurazeo’s exit from the brand. Deal value was not...

PE Hub

Deals•Feb 20, 2026

Omnitech Engineering to Float Rs 583 Cr IPO on Feb 25

Omnitech Engineering announced an IPO to raise Rs 583 crore, with a price band of Rs 216‑227 per share. The offering includes a fresh issue of Rs 418 crore and an offer‑for‑sale of Rs 165 crore, open to the public from Feb 25 to Feb 27, with anchor bidding...

The Economic Times (India) – RSS hub

Deals•Feb 20, 2026

Manilam Industries Announces IPO with Price Band and Subscription Details

Manilam Industries has filed for an initial public offering, releasing details on the global minimum price (GMP), price band, and subscription process. The IPO is slated for the near term, and investors can review the offering particulars on the stock...

The Economic Times (India) – RSS hub

Social•Feb 19, 2026

SPAC Activity Slumps: 21 IPOs, Just One Deal

Month-to-date SPAC statistics: IPOs: 21 Definitive agreements: 1 As Jerry Seinfeld said, "That's not gonna be good for anybody."

By Julian Klymochko

Deals•Feb 19, 2026

Vale Base Metals Partners with Exiro, Orion and Canada Growth Fund to Form Exiro Nickel Company with $200M Investment

Vale Base Metals announced a partnership with Exiro Minerals Corp, Orion Resource Partners LP and Canada Growth Fund Inc to create a new joint venture, Exiro Nickel Company, to invest up to $200 million in the Thompson Mine Complex in...

International Mining (IM-Mining)

Deals•Feb 19, 2026

SageSure and SureChoice Underwriters Reciprocal Exchange Close Record-Breaking $670M Cat Bond

SageSure, a managing general underwriter, and SureChoice Underwriters Reciprocal Exchange (SURE) have closed the Gateway Re Ltd. Series 2026-1 catastrophe bond with an original principal amount of $670 million, the largest issuance for SageSure to date. Structured and bookrun by...

Reinsurance News

Deals•Feb 19, 2026

Lee County Port Authority Announces $681.3M Bond Issuance for Southwest Florida International Airport Concourse E

Lee County Port Authority announced a $681.3 million bond issuance to fund the construction of Concourse E at Southwest Florida International Airport. The offering includes $464.1 million of AMT‑eligible Series 2026A‑1 bonds, $169.8 million of Series 2026A‑2 bonds, and $47.3 million of Series 2026B tax‑exempt bonds. BofA Securities...

The Bond Buyer (municipal finance)

Deals•Feb 19, 2026

Host Hotels & Resorts Sells Two Four Seasons Resorts for $1.1B

Host Hotels & Resorts announced the sale of two Four Seasons Resorts for $1.1 billion, marking a major divestiture for the hotel operator. The deal, valued at $1.1B, transfers the resorts to an undisclosed buyer.

Hotel News Resource

Video•Feb 19, 2026

Bloomberg Surveillance 2/19/2026

Jonathan Ferro, Lisa Abramowicz and Annmarie Hordern speak daily with leaders and decision makers from Wall Street to Washington and beyond. No other program better positions investors and executives for the trading day. Chapters: 00:00:00 - Bloomberg Surveillance starts 00:03:45 - Max Kettner,...

By Bloomberg Markets and Finance

News•Feb 19, 2026

TIP Solar Raises $179.7 Million in ABS From Residential Solar, PPA Leases

TIP Solar, backed by GoodLeap’s residential solar leases and PPAs, has issued $179.7 million in asset‑backed securities. The ABS are collateralized by 7,812 leases held by Jaguar Solar Owner 2026‑1 and structured into A‑ and B‑tranches with anticipated repayments through March 2033 and...

By Asset Securitization Report

Blog•Feb 19, 2026

4 Vital Steps to Become an M&A Analyst

The guide breaks down how recent graduates can land a coveted M&A analyst role, outlining core responsibilities such as valuations, research, and memorandum preparation. It details the educational background most banks prefer, from finance and economics to engineering, and recommends...

By DealRoom – Blog

News•Feb 19, 2026

New Faces of Finance: Hands-On Work Is Key for Development

The latest "New Faces of Finance" roster spotlights emerging finance professionals who credit hands‑on experience as the catalyst for their rapid advancement. Each profile details a blend of early‑stage operational roles, mentorship, and digital fluency that propelled them into senior...

By Private Funds CFO

Blog•Feb 19, 2026

New SPAC: NewHold Investment Corp. IV (NHIVU) Files for $175M IPO

NewHold Investment Corp. IV (NHIVU) has filed a Form S‑1 to raise $175 million through an initial public offering, positioning itself as the latest special purpose acquisition company targeting a merger within the technology sector. The filing, submitted on Feb 19 2026, lists...

By SPACInsider

Blog•Feb 19, 2026

M&A Trends: Outlook for Healthcare, Tech, Banking, & More

Mergers and acquisitions in 2026 are being reshaped by several converging forces. Artificial intelligence is streamlining due‑diligence, while ESG considerations are increasingly factored into valuations and integration plans. Cross‑border activity is surging, especially in Asia‑Pacific, and private‑equity firms are expanding...

By DealRoom – Blog

News•Feb 19, 2026

Janus Launches Higher Risk-Return CLO ETF for Institutional Investors

Janus Henderson has launched a new CLO exchange‑traded fund that targets AA to A‑rated CLO tranches, offering a modestly higher expected return than its existing AAA‑focused CLO ETF. The product is designed specifically for institutional investors seeking greater yield without...

By Creditflux

News•Feb 19, 2026

Private Equity Deals Hit $2.6T in 2025

Private equity deal value surged to $2.6 trillion in 2025, a 19% increase over 2024 and the second‑largest total on record. The total number of deals fell 9%, continuing a post‑2021 decline in transaction volume. Holding periods have stretched, with the...

By CFO.com

News•Feb 19, 2026

Protos Security CFO on the Convergence of Finance and Operations

Anthony Escamilla, CFO of Protos Security, says the modern CFO has morphed from a budget keeper into a strategic leader who oversees finance, data analytics, technology, risk and even operational functions. He highlights the accelerating pace of decision‑making, with stakeholders...

By CFO.com

News•Feb 19, 2026

Ballard Spahr Public Finance Team Moves to Barnes & Thornburg

Barnes & Thornburg has hired the entire public finance and infrastructure team from Ballard Spahr, adding 35 attorneys—including 25 partners—to its Government Services and Finance Department. The acquisition more than doubles Barnes’ public finance bench to 56 lawyers and expands its...

By The Bond Buyer (municipal finance)

Deals•Feb 19, 2026

Franklin Global Trust and Invesco Global Equity Income Trust Near Merger Completion

Franklin Global Trust (FRGT) and Invesco Global Equity Income Trust (IGET) are closing in on the completion of a merger after the first of two shareholder votes succeeded. The merger, announced earlier, is expected to combine the two trusts' assets...

Investment Week – ETFs

Deals•Feb 19, 2026

Union Pacific to Resubmit $85bn Norfolk Southern Merger Filing

Union Pacific CEO Jim Vena announced the railroad will resubmit its merger filing with Norfolk Southern at the end of April after the Surface Transportation Board rejected the initial application. The $85bn tie‑up would combine the two carriers, creating a...

The Loadstar

Deals•Feb 19, 2026

Winning Group Set for Sale to Private Equity Firm Ellerston Capital

Australian retail conglomerate Winning Group is slated for sale to private equity firm Ellerston Capital, according to sources. The transaction marks a strategic move for Ellerston to expand its portfolio in the retail sector. Deal terms and valuation remain undisclosed.

Inside Retail Australia

Deals•Feb 19, 2026

Kenya Pipeline IPO Closure Extended to Tuesday Amid Weak Demand

The Capital Markets Authority approved a three‑day extension of the Kenya Pipeline Company IPO, moving the closing date to Tuesday after only 20% of the Sh106.3 billion target was sold. The state‑owned pipeline firm priced its shares at Sh9 each, with...

The East African – RSS hub

Deals•Feb 18, 2026

UMB Bank Closes $400M BSL CLO Warehouse

UMB Bank announced the closing of a $400 million BSL CLO warehouse, marking a milestone in its expansion from a private credit administrator to a broader structured finance service provider. The transaction, completed on February 18, 2026, underscores UMB's growing...

Structured Credit Investor

Deals•Feb 18, 2026

BayPine to Acquire Broker Relation From Aquiline

BayPine announced it will acquire Broker Relation, a broker relationship platform owned by Aquiline. The deal expands BayPine's capabilities in the insurance distribution market. Financial terms were not disclosed.

Insurance Journal

Deals•Feb 18, 2026

Blackstone, EQT, and CVC Submit Acquisition Offers for Volkswagen Unit

Private equity firms Blackstone, EQT and CVC have each submitted acquisition offers for a Volkswagen unit, intensifying competition for the German automaker's subsidiary. The bids come as Volkswagen evaluates strategic options for the unit, with the firms aiming to expand...

Financial Times – Work & Careers