Social•Feb 20, 2026

Banks Fund Old‑school Businesses, Not Modern Ventures—Pitch Right

Banks won’t lend you money for: – A nightclub – A Shopify store – A crypto token But they’ll trip over themselves to fund: – A plumbing company with 30 years history – A logistics business with 5 contracts – A clinic throwing $500K/year The capital exists. You’re just not asking for it correctly.

By Josh Li

Social•Feb 20, 2026

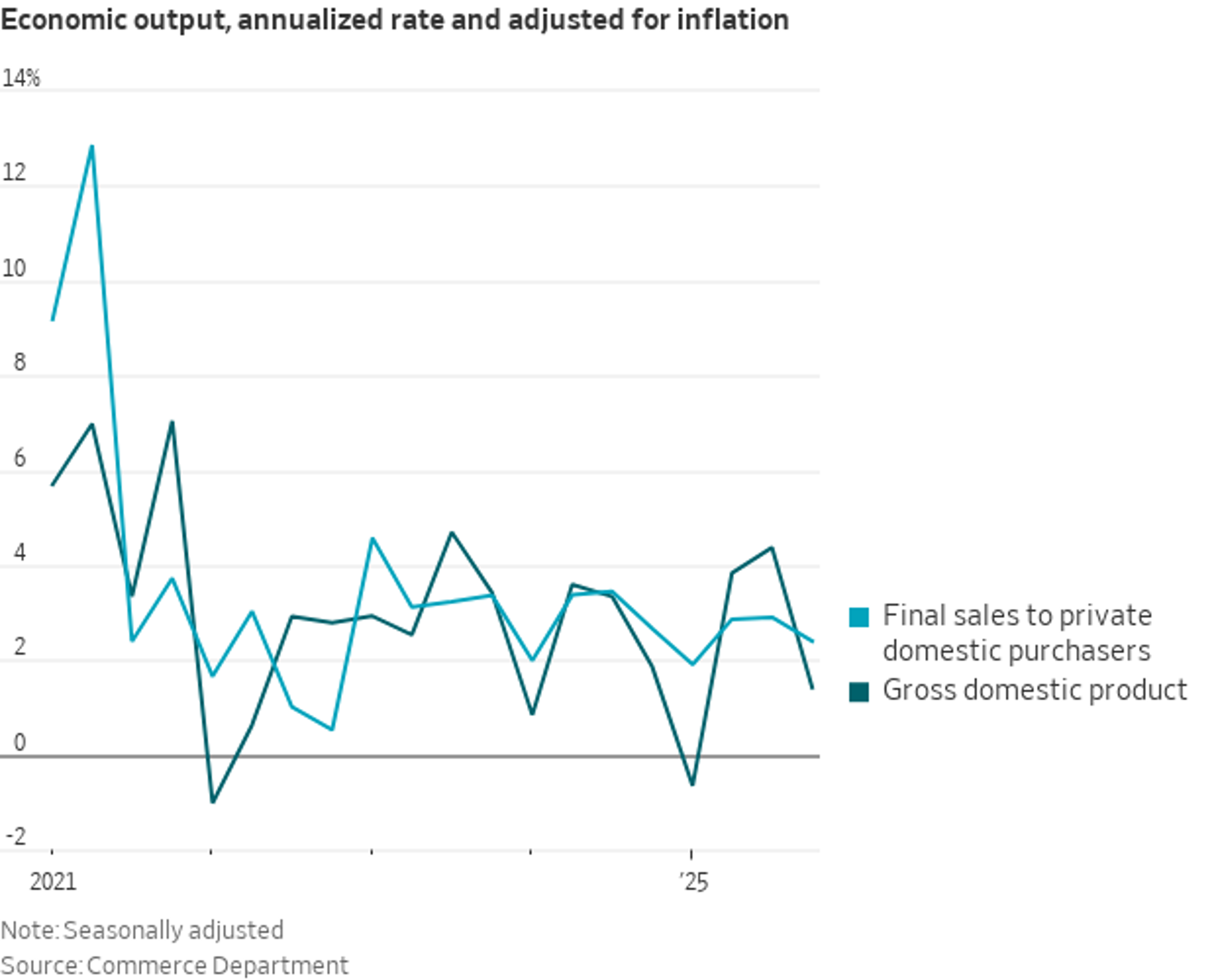

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Social•Feb 20, 2026

HSBC Cuts US DCM, Shifts Focus to Asian Banks

Macro: HSBC trims ~10% of US DCM in broader $1.8bn cost overhaul and pivot to Asia/Middle East. Key factors: management cuts, M&A/ECM pullback. Risk: execution/credit cycles. Trade: favor Asian bank equities. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

SPAC Activity Slumps: 21 IPOs, Just One Deal

Month-to-date SPAC statistics: IPOs: 21 Definitive agreements: 1 As Jerry Seinfeld said, "That's not gonna be good for anybody."

By Julian Klymochko

Social•Feb 17, 2026

Paramount Accepts Warner Offer, Pursues Tender and Proxy Fight

New: Paramount is taking Warners up on its offer. Says in statement that it's "prepared to engage in good faith and constructive discussions" while also proceeding with tender and proxy fight.

By Alex Weprin

Social•Feb 17, 2026

Armstrong Signs Deal to Acquire MCTV Ohio

🚨 News: @followarmstrong Enters into Definitive Agreement to Acquire @MCTVOhio from the Gessner family | https://t.co/fFOMiRLbGY https://t.co/VATsTCCLBE

By Ted Hearn

Social•Feb 17, 2026

FTC Clears Sony’s $460M Purchase of Peanuts Franchise

The FTC has signed off on Sony's $460 million deal to acquire the Peanuts franchise, per a Hart-Scott-Rodino filing. Deal was announced in December. https://t.co/Y9ayPm2bI8

By Alex Weprin

Social•Feb 17, 2026

Retail Favorites, IPO Timing, and Base Rates Explained

🔬 Research links: the stocks retail investors favor, the impact of IPO timing, and why base rates matter so much. https://t.co/cjmTGAY0wz chart: https://t.co/rvyduDs39u https://t.co/EKv26rorKm

By Tadas Viskanta

Social•Feb 17, 2026

Massive M&A Premiums: MASI, KW, ZIM Deals

Today's M&A notes $MASI to be acquired by $DHR for $180.00 cash, 38.3% premium, $9.9 billion $KW to be acquired by $FFH.to for $10.90 cash, 45.9% premium, $6.5 billion $ZIM to be acquired by $HLAGF for $35.00 cash, 125.8% premium, $4.2 billion https://t.co/ayupP5Rv2J

By Julian Klymochko