🎯Today's Large Cap Stocks Pulse

Updated 1h agoWhat's happening: Amazon unveils $200B capex plan, boosting AI chip partner Marvell

Amazon announced a $200 billion capital‑expenditure budget for 2026, up $70 billion from the prior year, with a sizable portion earmarked for AI‑focused data‑center capacity. AWS’s custom‑chip business now generates over $10 billion in revenue and is expanding at triple‑digit rates, driven by its Trainium accelerator line. The company also reaffirmed its five‑year partnership with Marvell Technology.

News•Feb 20, 2026

REIT Fears Could Give Way to Opportunity with This ETF

Commercial real‑estate REITs have recently slumped amid AI‑related worries, but the dip may create a buying window for investors. The NEOS Real Estate High Income ETF (IYRI) stands out with an almost 11% distribution rate and a 3.15% 30‑day SEC yield, offering both income and limited upside through its covered‑call overlay. Bank of America research flags a resilient macro backdrop and predicts 2026 as the "best setup in years" for REIT equities. Meanwhile, REIT valuations are 15‑20% below NAV, the deepest discount since the 2008 crisis.

By ETF Trends (VettaFi)

Social•Feb 20, 2026

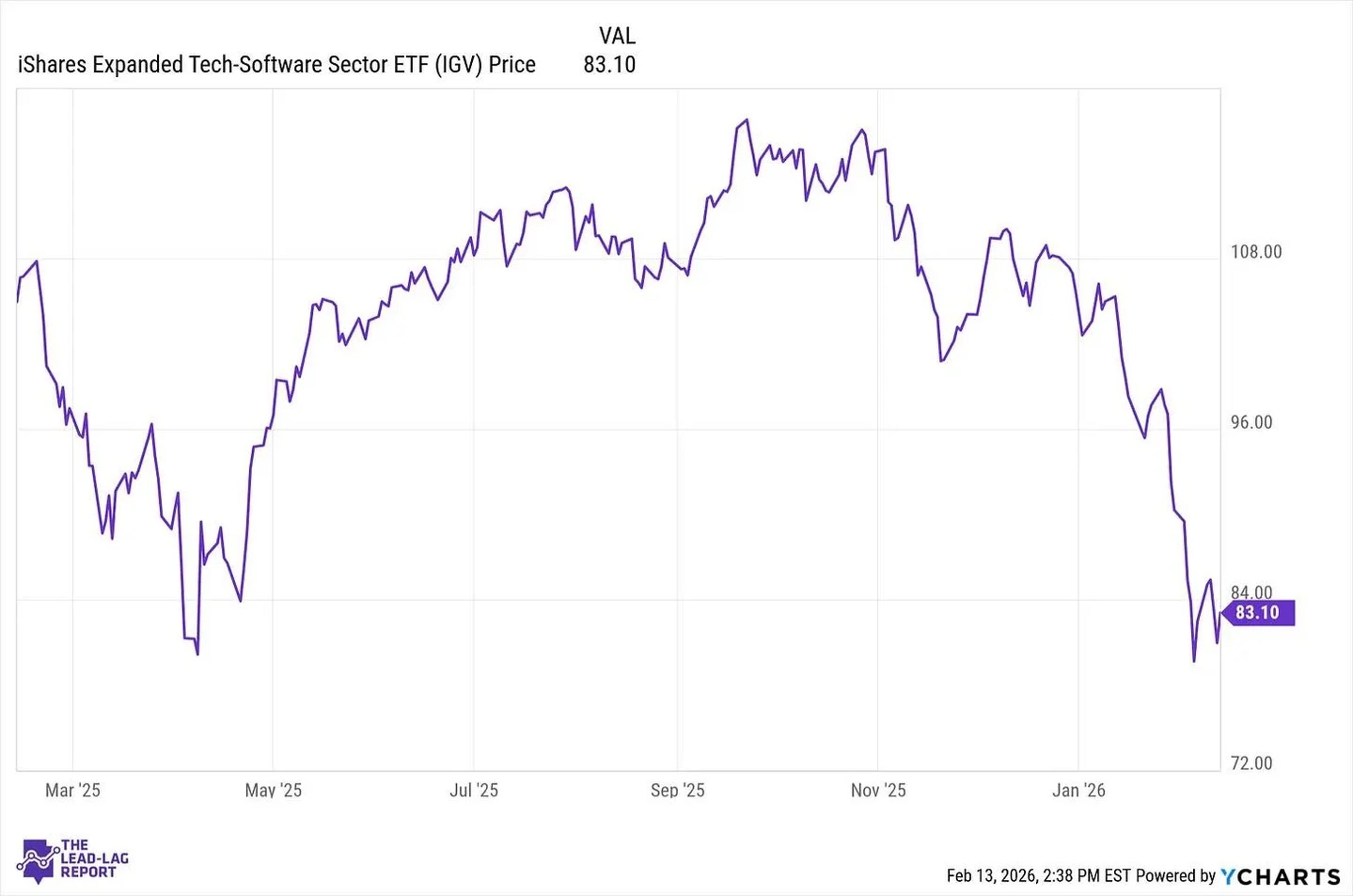

Software’s Value Mispriced; Embedded Platforms Gain From AI

Software Is Not Dead. It’s Being Mispriced. AI disruption fears, multiple compression, and why embedded platforms may be the real beneficiaries of automation. Read here: https://www.leadlagreport.com/p/software-is-not-dead-its-being-mispriced

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 20, 2026

US Stock Market Hits Record Concentration: Top 10 Own 40%

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile...

By Global Markets Investor (newsletter author)

News•Feb 19, 2026

Lynx Investment Advisory Buy $5 Million of Akre Focus ETF

Lynx Investment Advisory disclosed a new $5.73 million position in the Akre Focus ETF (AKRE) during Q4 2025, purchasing 87,467 shares. The holding accounts for 3.1 % of Lynx’s reportable assets under management, though it sits outside the firm’s top five holdings....

By Yahoo Finance – Top Financial News

News•Feb 19, 2026

2 Incredibly Cheap Dividend Stocks to Buy Now

Enterprise Products Partners (EPD) trades around $36 with a forward P/E just above 13 and a dividend yield near 6%, positioning it as a cheap, high‑yield mid‑stream energy play. Bristol Myers Squibb (BMY) offers a 4.2% dividend and a forward...

By Motley Fool Investing

News•Feb 19, 2026

Amazon Just Shared Great News for This AI Chipmaker (Hint: Not Nvidia)

Amazon announced a $200 billion capital‑expenditure plan for 2026, a $70 billion jump from the prior year, with a sizable portion earmarked for AI‑focused data‑center capacity. AWS’s custom‑chip business now runs over $10 billion in revenue and is expanding at triple‑digit rates, driven...

By Motley Fool Investing

News•Feb 19, 2026

2 Top Quantum Computing Stocks to Buy in 2026

Quantum‑computing stocks have fallen sharply in early 2026, making IonQ and IBM attractive entry points. IonQ (IONQ) trades around $33, bolstered by a 222% YoY revenue jump and recent acquisitions including SkyWater to control chip manufacturing. IBM (IBM) trades near...

By Motley Fool Investing

News•Feb 19, 2026

Live Nation 2025 Revenues Top $25B

Live Nation Entertainment posted a record $25 billion in 2025 revenue, a 9% increase over 2024. Quarterly earnings reached $6.3 billion, surpassing analysts’ $6.1 billion estimate. Concert sales climbed to $20.9 billion, while sponsorship revenue grew 11% to $1.33 billion, and the company reported a...

By Pollstar News

News•Feb 19, 2026

Is Compass Stock a Buy After Kanen Added 1.6 Million Shares to Its Position?

Kanen Wealth Management disclosed a $14.36 million purchase of 1,573,950 Compass shares in its Q4 2025 filing, lifting its holding to 20.5% of the firm’s $329.38 million assets under management. The transaction pushed the value of Kanen’s Compass stake to $67.59 million, reflecting both...

By Motley Fool Investing

News•Feb 19, 2026

The Best Stocks to Invest $10,000 in Right Now

The article highlights Broadcom and IBM as top picks for a $10,000 investment, emphasizing their AI and hybrid‑cloud growth. Broadcom’s custom AI accelerator chips surged 65% to $20 billion in FY2025, now accounting for 31% of revenue and driving projected 52%...

By Motley Fool Investing

News•Feb 19, 2026

Overlooked and Undervalued: Why Novo Nordisk Stock Deserves Attention

Novo Nordisk’s shares have slumped 66% from their 2024 peak, reflecting weak 2026 guidance and fierce competition from Eli Lilly in the GLP‑1 arena. The Danish firm recently introduced the first oral GLP‑1 pill, positioning it ahead of Lilly’s upcoming tablet and...

By Motley Fool Investing

News•Feb 19, 2026

Booking Holdings Announces a Massive 25-for-1 Stock Split. Here's What Investors Need to Know

Booking Holdings announced its first-ever forward stock split, converting each share into 25 shares. The 25‑for‑1 split will take effect on April 6, 2026, after distribution on April 2, with shares trading on a split‑adjusted basis. The move follows a...

By Motley Fool Investing

Social•Feb 19, 2026

Buybacks Drop as Capex Takes Priority, ESO Dilution Fades

There are two reasons why buybacks are falling and likely to fall more 1. CApex as a use of FCF is deemed more important than share count reduction or SBC dilution offset 2. To the extent stocks fade the ESO awards provided...

By Andy Constan

News•Feb 19, 2026

Just Bare® Delivers $1 Billion in Annual Retail Sales as Pilgrim’s Accelerates Momentum in Prepared Foods

Just Bare®, Pilgrim’s fast‑growing chicken brand, topped $1 billion in retail sales for 2025, marking a 45% year‑over‑year increase. The brand surged from 1% to 13% market share in the fully cooked chicken segment within three years, now leading sales pace...

By The Manila Times Business

News•Feb 19, 2026

Canadian Large Cap Leaders Split Corp. Declares Distribution

Canadian Large Cap Leaders Split Corp. announced a cash distribution of $0.18 per Class A share, payable on March 13, 2026 to shareholders of record as of February 27, 2026. The company also offers a commission‑free Distribution Reinvestment Plan (DRIP) that lets Class A investors automatically...

By The Manila Times Business

News•Feb 19, 2026

Toll Brothers Announces New Luxury Home Community Coming Soon to Webster, Texas

Toll Brothers announced its newest luxury community, Toll Brothers at Midline, in Webster, Texas. The development will feature 25 single‑family homes on 70‑foot‑wide lots, priced from the upper $600,000s and ranging from 3,386 to over 4,651 square feet. Site work...

By The Manila Times Business

News•Feb 19, 2026

Roper Technologies Announces Dividend

Roper Technologies’ board approved a quarterly dividend of $0.91 per share, payable on April 22, 2026 to shareholders of record as of April 6, 2026. The announcement underscores the company’s ongoing commitment to returning excess cash to investors. Roper, a...

By The Manila Times Business

News•Feb 19, 2026

UBS Raises Dana Holding Stock Price Target on Margin Outlook

UBS upgraded its outlook on Dana Holding Corp., raising the 12‑month price target after a stronger‑than‑expected margin outlook. The Swiss bank lifted the target to $12.00 from $9.00, implying roughly 33% upside from the current share price. UBS highlighted improved...

By Investing.com – News

News•Feb 19, 2026

Earnings Call Transcript: Deere & Company Q1 2026 Sees Strong Earnings Beat

Deere & Company posted a Q1 2026 earnings surprise, reporting EPS of $2.42 versus the $2.02 consensus and revenue of $9.61 billion, well above the $7.59 billion forecast. The equipment operations segment drove growth, delivering an 18% jump in net sales to $8.0 billion....

By Investing.com – News

News•Feb 19, 2026

Earnings Call Transcript: Nutrien Q4 2025 Misses Forecasts, Stock Dips

Nutrien Ltd. reported Q4 2025 earnings that fell short of forecasts, posting EPS of $0.83 versus the expected $0.92 and revenue of $5.34 billion against a $5.38 billion outlook. The miss triggered a 0.87% pre‑market decline in the stock despite a 13% rise...

By Investing.com – News

News•Feb 19, 2026

Dow Jones, S&P 500, Nasdaq Drop Amid Walmart's Muted Outlook, AI-Related Concerns — Details Here

U.S. equity indexes slipped on February 19 as Walmart issued a muted earnings outlook and investors grew uneasy about artificial‑intelligence regulatory risks. The Dow Jones fell about 0.8%, the S&P 500 dropped 0.7%, and the Nasdaq slipped roughly 0.9%. Walmart’s guidance...

By Mint (LiveMint) – Markets

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

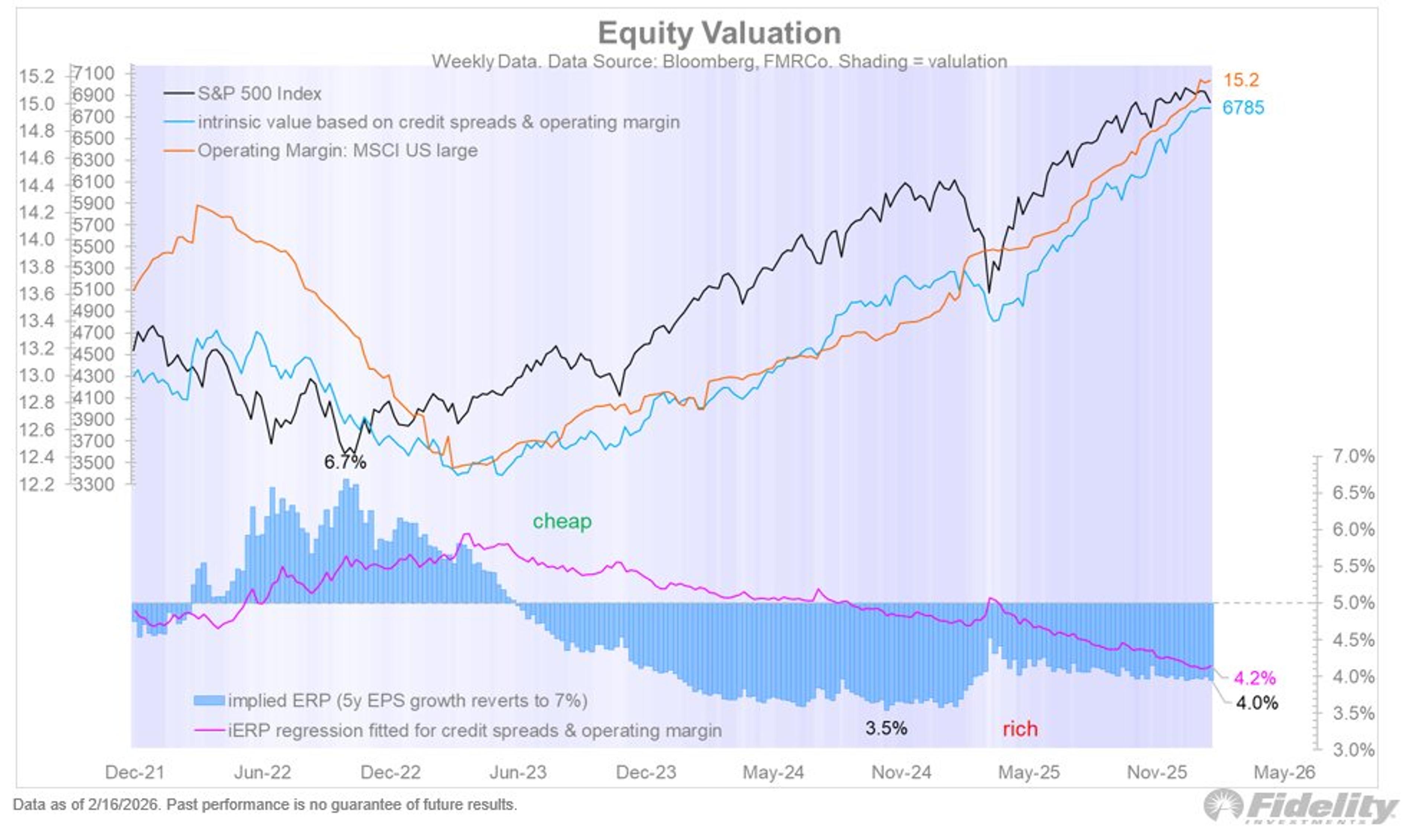

Rising Capex May Curb Buybacks, Pressure Valuations

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

News•Feb 18, 2026

Bloomberg Intelligence: Berkshire Slashes Amazon Stake (Podcast)

Berkshire Hathaway has cut its Amazon stake by 75%, reducing a once‑$15 billion holding to roughly $10 billion. The move, disclosed in a Bloomberg Intelligence podcast, reflects Warren Buffett’s bearish view on the e‑commerce giant’s growth prospects. It marks a rare portfolio...

By Bloomberg — Business

Social•Feb 19, 2026

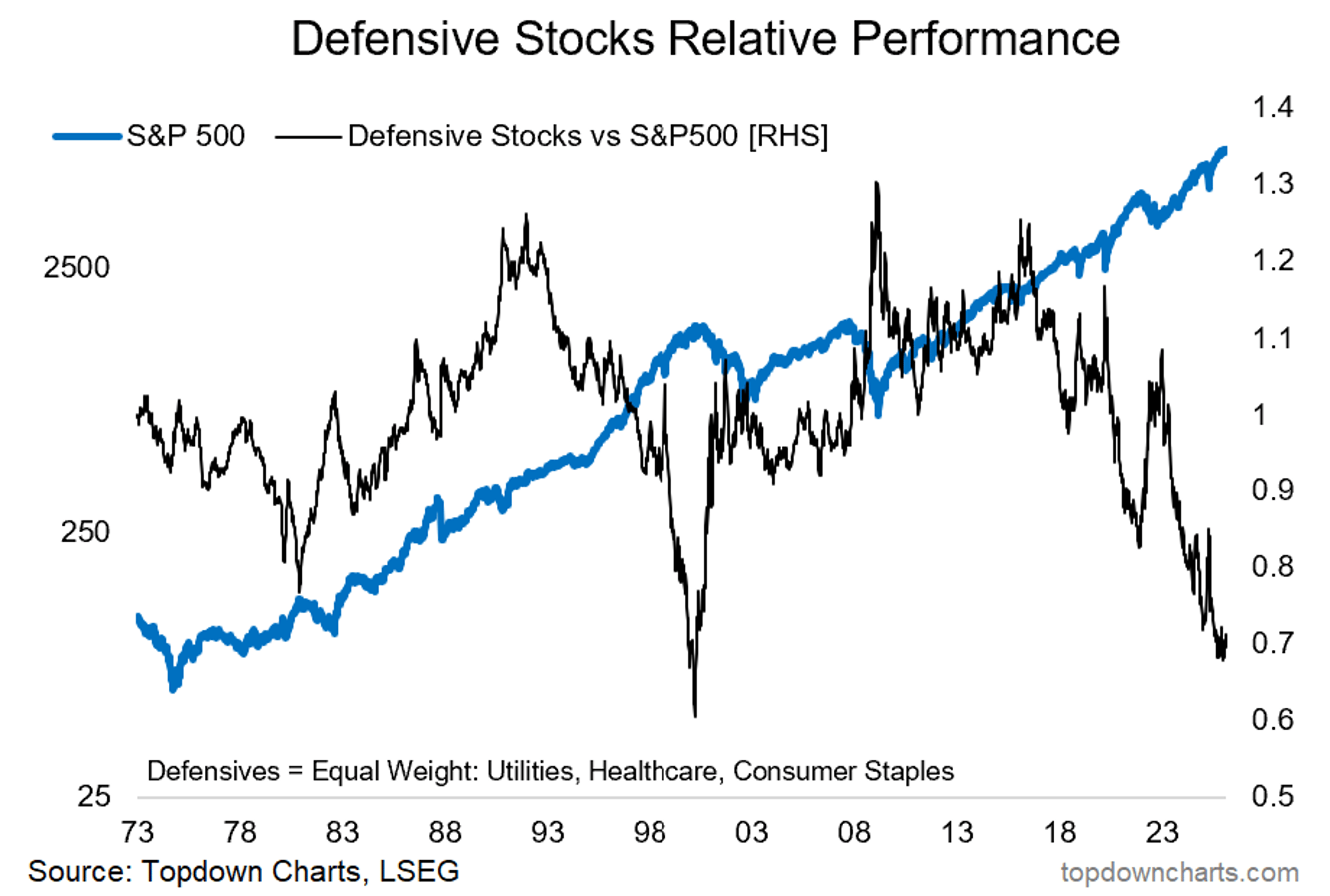

Defensives Hit Dot‑Com Lows, Poised for Rally

Chart of the Week - Defensives With tech in trouble (+a number of macro risks lurking on the horizon), defensives are starting to look interesting… Defensives (i.e. an equal-weighted basket of: Utilities, Healthcare, Consumer Staples) are turning up vs the S&P500 —after...

By Callum Thomas

Social•Feb 19, 2026

Big Tech Lagged S&P; Past Winners Not Guaranteed

S&P 500 is up 77% over the last 5 years. These tech stocks didn't beat it: Amazon: +27% Netflix: +46% And these stocks got destroyed: Nike: -55% Disney: -42% PayPal: -86% Shopify: -18% Past winners aren't always future winners.

By The Market Hustle

News•Feb 18, 2026

Dow Jones Industrial Average Gains 200 Points as Fed Minutes Loom and Nvidia Rallies on Meta Deal

The Dow Jones Industrial Average rose about 300 points, or 0.65%, as investors returned to equities ahead of the Federal Reserve’s January minutes. Nvidia surged over 2% after Meta announced an expanded AI‑chip partnership worth tens of billions, reinforcing Nvidia’s...

By FXStreet — News

Social•Feb 19, 2026

McGough’s CVNA Sell Call Beats CNBC’s Coverage

Great SELL call by McGough @HedgeyeRetail on $CVNA that CNBC failed, once again, to cover

By Keith McCullough

Social•Feb 19, 2026

TCS Likely to Meet Lower Targets Despite Chart Decline

TCS will still achieve my lower targets I think - the chart is already wrecked - targets given by Indiacharts Research

By Rohit Srivastava

News•Feb 18, 2026

Market Trading Guide: Bank of India Among 2 PSU Bank Stocks Offering up to 8% Upside

The Nifty 50 logged a third straight gain, breaking above the 25,500 support and 25,800 resistance as consumer, financial and metal stocks led the rally. Bank of India and Bank of Maharashtra each posted decisive breakouts from consolidation zones, prompting...

By The Economic Times – Markets

Social•Feb 19, 2026

AI Era Demands Open Access, Not User Lock‑In

the software playbook used to be: lock users in, protect the workflow, build the moat. a day before blowout earnings, @zoink told us the opposite, don't be sacred about locking in users in the AI era. "Start anywhere, go everywhere."...

By Deirdre Bosa

Social•Feb 19, 2026

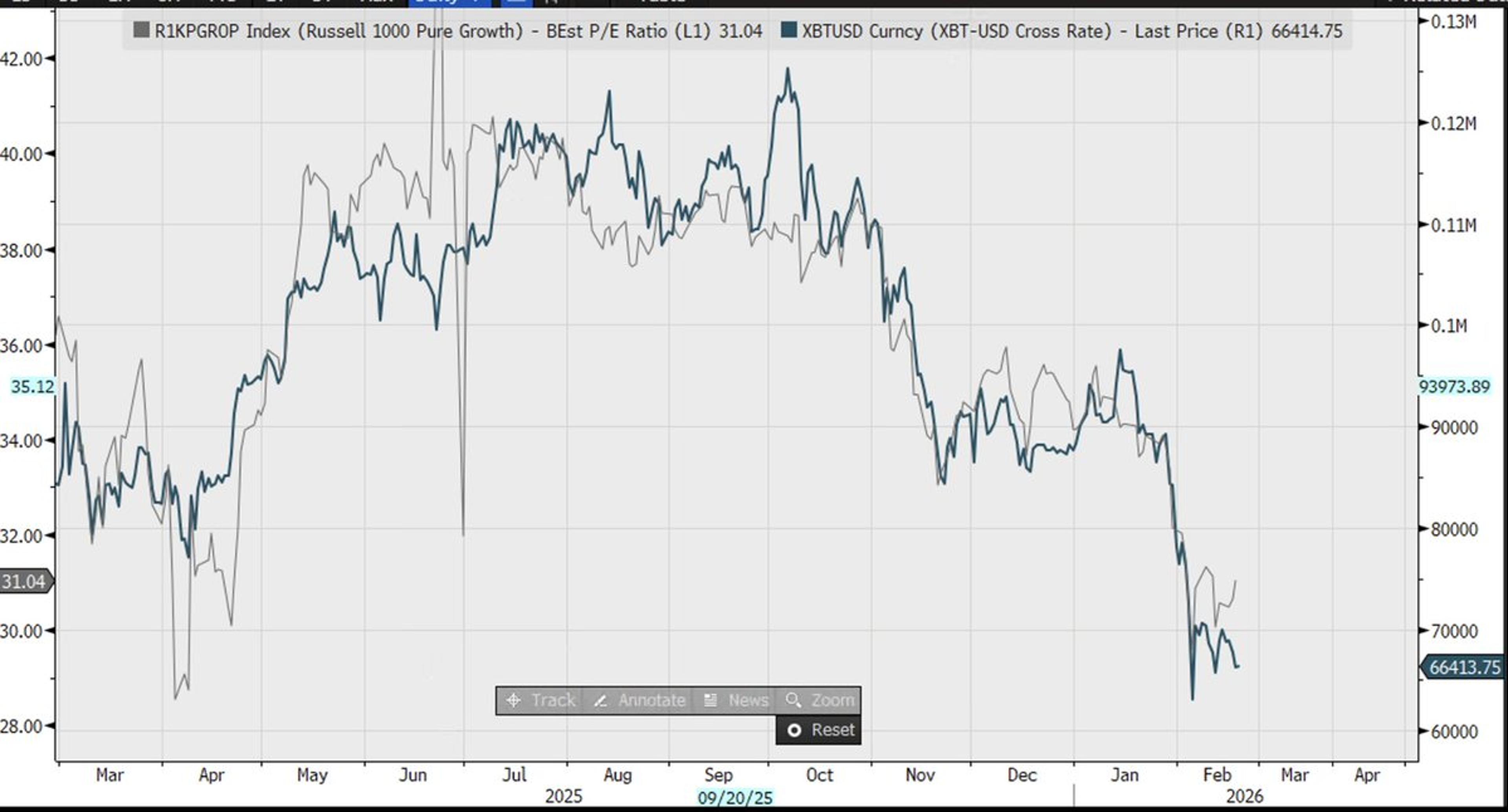

Long‑duration Assets Like Bitcoin, Growth Stocks Lose Favor

Bitcoin's drop has coincided with a decline in the Russell 1000's Pure Growth P/E. What do they have in common? Both are long-duration, and are being shunned during the underlying rotation into shorter-duration (cyclical) securities (think value, dividend payers, Energy...

By Michael Kantro

News•Feb 18, 2026

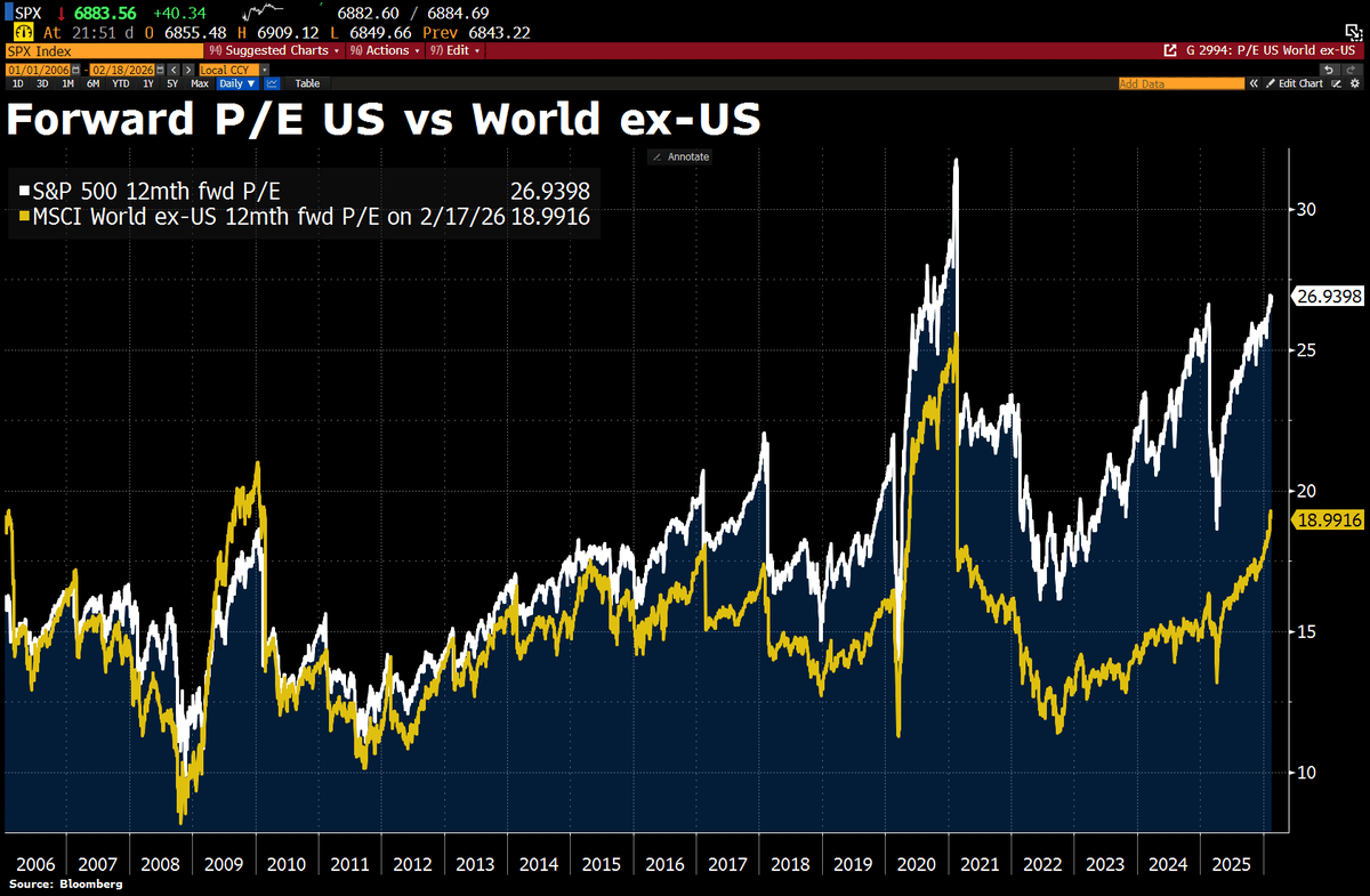

The 'Ex-America' Trade Is Off to a Roaring Start in 2026

Global equities have surged ahead of the U.S. market in 2026, with the MSCI EAFE up roughly 8% and the MSCI ACWI ex‑U.S. gaining about 8.5% year‑to‑date, while the S&P 500 is down 0.5%. Goldman Sachs notes this is the widest...

By Quartz — Economy/Markets (site-wide feed)

Social•Feb 18, 2026

AI Won’t Kill SaaS; Governance Still Essential

Narratives can crush multiples faster than fundamentals change. Markets are pricing “software is dead” as if AI will commoditize SaaS overnight. But enterprises still need governance, permissioning, audit trails, compliance, uptime, and data orchestration. AI may change workflows, but it doesn’t...

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 18, 2026

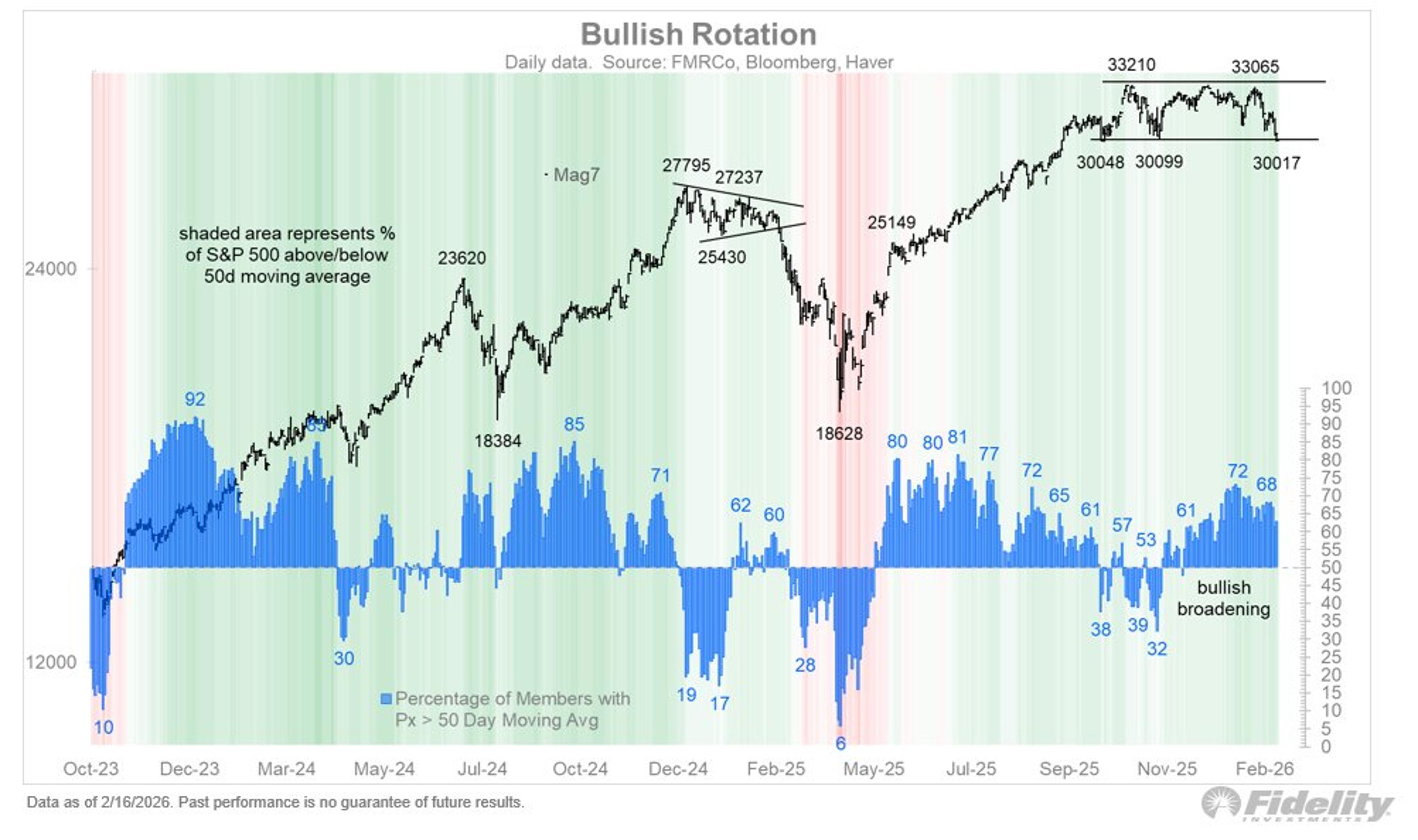

US Large‑Cap Valuations Still Overpriced, Risks Loom

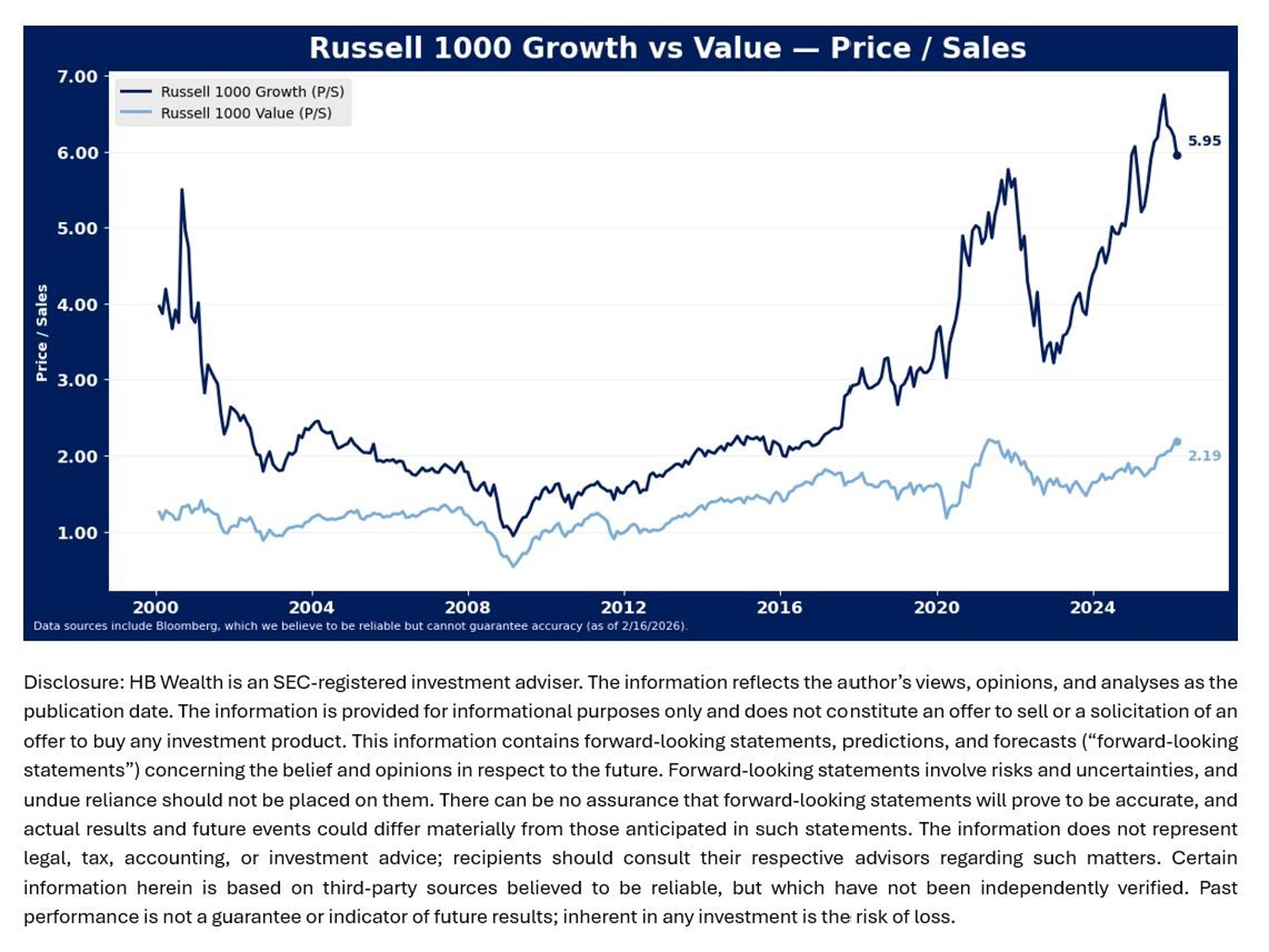

Recent rotation has helped resolve some of U.S. large cap stocks’ valuation excesses, but risks remain to the downside for U.S. multiples. Large cap growth’s sales multiple is still near its all-time high, at about 6X, and growth’s earnings multiple may...

By Gina Martin Adams, CMT, CFA

News•Feb 18, 2026

Defence Giant BAE Hails Record Sales as Workers Remain on Strike

BAE Systems announced record 2025 results, with sales rising 10% to £30.7 billion and pre‑tax profit climbing to £2.6 billion. The company highlighted a historic order backlog as global defence budgets surge amid geopolitical tension. Meanwhile, Unite union members at the Lancashire...

By BBC News – Business

Social•Feb 18, 2026

Software Stocks Face Fear‑Driven Selloff, Not Real Decline

Software is getting hit on fear of substitution more than evidence of structural deterioration in enterprise spending. When price action gets ahead of reality, the re-rating can be violent if the narrative cools.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 18, 2026

US Stock Premium at Risk as Tech Capex Rises

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world. That premium could shrink further if big tech companies lose their...

By Holger Zschaepitz

Blog•Feb 18, 2026

Dispersion Trade ‘Cash-In’ Risks Index Vol Spike

A historic surge in dispersion across large‑cap U.S. equities has pushed the one‑month change in average S&P 500 constituent values to unprecedented levels. The spike stems from a confluence of early‑year sector rotation, the AI disruption theme, and divergent earnings outcomes....

By Heisenberg Report

Social•Feb 18, 2026

Analyst's PANW Recommendation Misses, Stock Tanks

I was astonished that Bryn Talkington's feet were not held to the fire today after she recommended (confidentally) $PANW yesterday. Four hours later the company guided lower and the stock tanked. Does the network basically not give a shit (about their most...

By Doug Kass

Social•Feb 18, 2026

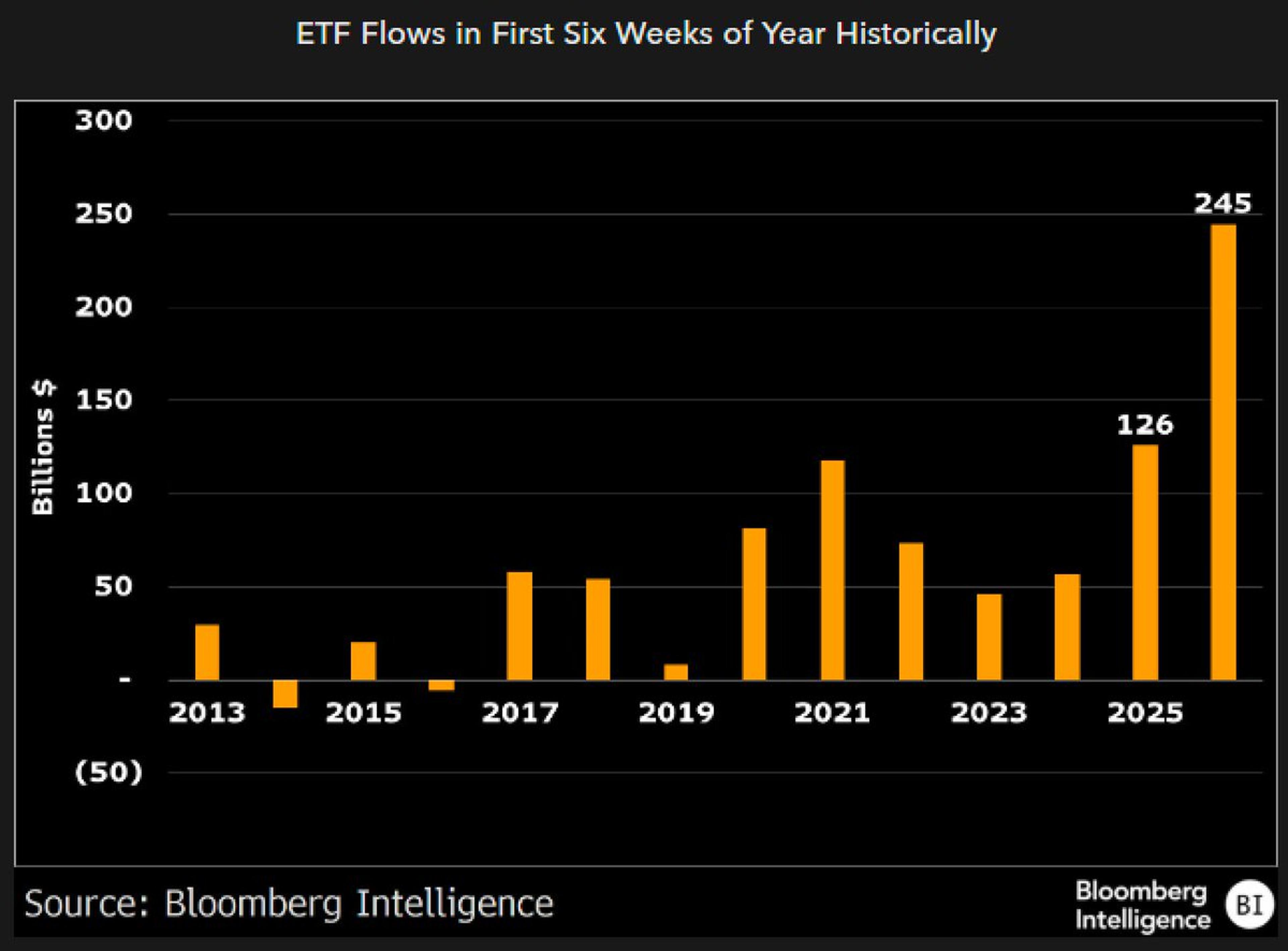

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

News•Feb 18, 2026

Bumi Resources Minerals Says Palu Operations Unaffected by Site Closure

Bumi Resources Minerals (BRM) confirmed that the government‑ordered closure of a contested gold mine in its Palu concession will not disrupt its core operations because the site was never active. The enforcement action targeted an area where illegal miners had...

By The Jakarta Post – Business (site)

Social•Feb 18, 2026

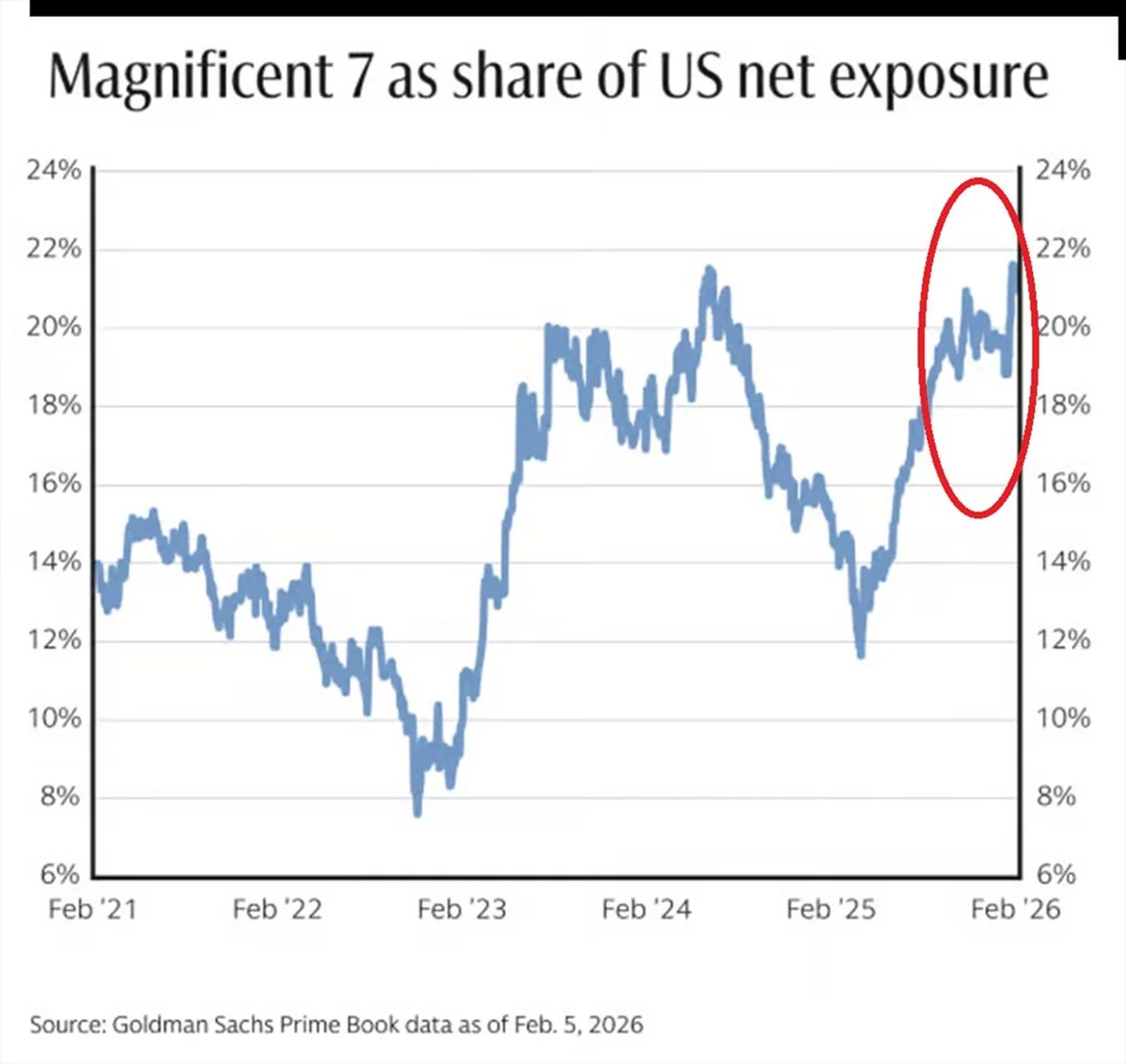

Record Hedge Fund Bet on Magnificent 7 Risks Collapse

⚠️Almost everybody is piling into the SAME TRADE: Hedge fund net allocation to Magnificent 7 stocks is up to a RECORD 22%. This is more than DOUBLE the level seen in 2022. At the same time, these stocks remain among the most popular...

By Global Markets Investor (newsletter author)

News•Feb 18, 2026

From Slump to Surge: Renault Korea’s Strategic Turnaround

Renault Korea has reversed a sales slump by launching the Aurora Project and a hybrid‑first Grand Koleos, boosting domestic sales 31.3% to 52,271 units in 2025. The model’s 86.5% hybrid mix drove 40,877 domestic deliveries, while exports dropped 46.7%, signalling a...

By The Korea Herald – Business

Social•Feb 18, 2026

M7 Tech Stocks Test Low, Threatening Repeat Correction

However, as the AI narrative continues to unfold, from euphoria a few months ago to handwringing now (over the commodification of the SaaS stocks and the unknown ROI of hyperscaler capex), the Might Mag 7 is showing some strains. The...

By Jurrien Timmer

Social•Feb 18, 2026

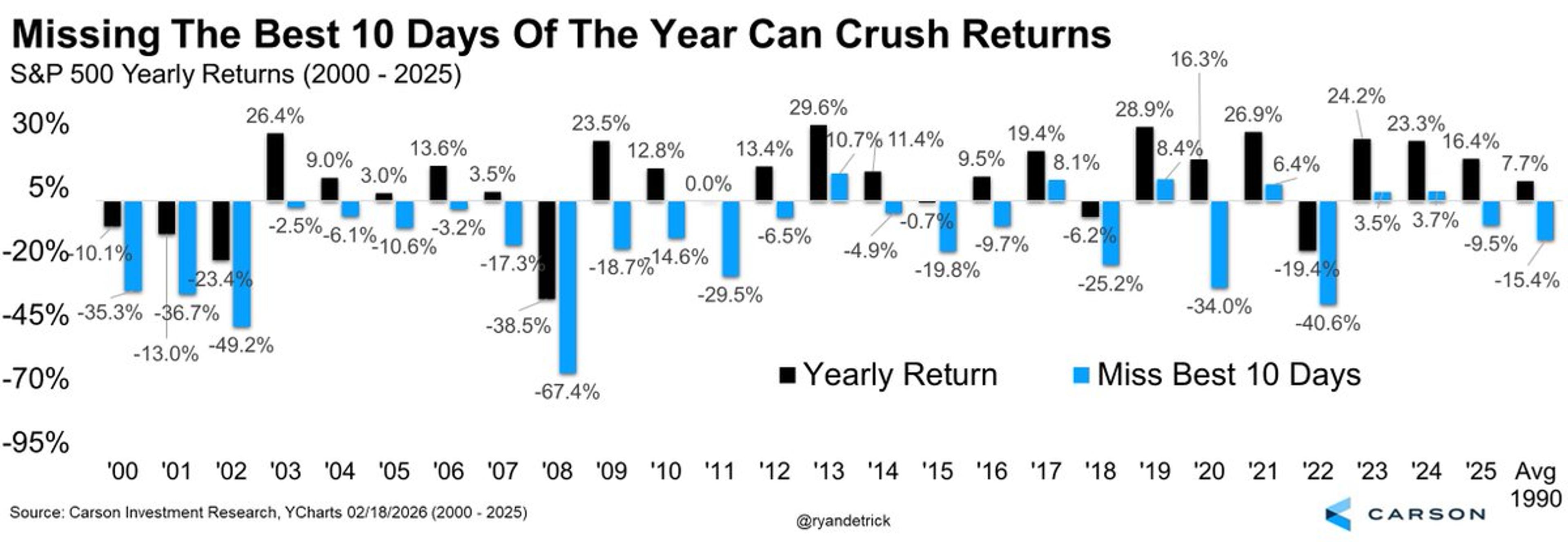

Missing Top 10 Days Slashes Stock Returns

Last year, the S&P 500 gained 16.4%, but if you missed the best 10 days that dropped to minus 9.5%. Since '90, stocks have gained 7.7% a year, but if you missed the 10 best days each year? It goes down...

By Ryan Detrick

News•Feb 18, 2026

US Market | Inflation, AI and Hiring Trends in Focus as Fed's Mary Daly Outlines Policy Priorities

San Francisco Fed President Mary Daly warned that while artificial intelligence could eventually lift productivity, the Federal Reserve must still ensure inflation moves sustainably lower. She highlighted the limited macro evidence of an AI‑driven productivity surge and cautioned that narrow...

By The Economic Times (India) – RSS hub

News•Feb 18, 2026

Dilip Buildcon Shares Rally 4% as Lowest Bidder for Rs 702 Crore Gujarat Flood Control Project

Dilip Buildcon was named the lowest bidder (L‑1) for Gujarat's ₹702 crore flood‑control project on the Narmada River. The EPC‑based contract spans 24 months and adds a significant order to the company's pipeline. Shares rallied about 4% after the announcement, trading...

By The Economic Times (India) – RSS hub

News•Feb 18, 2026

India’s AIF Industry Crosses Rs 15 Lakh Crore as Domestic Capital & Liquidity Reshape Private Markets

India’s alternative investment fund (AIF) sector has crossed the ₹15.05 lakh crore mark, underscoring rapid scale and emerging maturity. Equity‑oriented AIFs have delivered roughly 8.7 % alpha over the BSE Sensex across multiple cycles, highlighting consistent outperformance. Domestic investors now contribute about 55 %...

By The Economic Times (India) – RSS hub

News•Feb 18, 2026

Infosys Shares in Focus on AI-First Framework to Capture $400 Bn Services Opportunity. What Are Brokerages Saying?

Infosys unveiled its AI‑first value framework, Topaz, aimed at capturing a $300‑$400 billion services opportunity by 2030. The platform is already embedded in 90 % of its top 200 clients, contributing 5.5 % of revenue, and supports new partnerships such as Infosys‑Cognition and...

By The Economic Times (India) – RSS hub