2 Top Quantum Computing Stocks to Buy in 2026

•February 19, 2026

0

Companies Mentioned

Why It Matters

The price declines provide a rare valuation gap in a sector poised for breakthrough applications, potentially delivering outsized returns as quantum advantage materializes. Investors seeking exposure to next‑generation computing can capture upside while mitigating risk through established players.

Key Takeaways

- •Quantum stocks dip, creating buying opportunities.

- •IonQ acquired SkyWater for full chip production.

- •IonQ Q3 revenue rose 222% YoY.

- •IBM targets quantum advantage by 2026.

- •IBM's strong cash flow supports quantum R&D.

Pulse Analysis

The quantum‑computing sector entered 2026 with a pronounced correction after a year of speculative hype. Investor enthusiasm that peaked in late 2025 faded, sending the shares of most pure‑play quantum firms down 15‑20 percent. This pullback aligns with a classic “buy the dip” scenario, where market participants reassess fundamentals rather than chase headlines. As governments and enterprises accelerate research budgets, the underlying demand for quantum hardware and cloud services remains robust, setting the stage for companies with tangible product pipelines to capture market share at lower multiples.

IonQ has positioned itself as a vertically integrated player by acquiring SkyWater Technology, giving it direct control over semiconductor fabrication for trapped‑ion qubits. The move reduces supply‑chain dependency and could accelerate time‑to‑market for its next‑generation processors. Revenue surged to $39.9 million in Q3, a 222 % year‑over‑year increase, and the firm projects over $100 million in 2025 sales. While operating losses widened to $168.8 million, the balance sheet is bolstered by $3.5 billion in cash and no debt, offering runway for continued R&D and network expansion such as the Geneva city‑wide quantum link.

IBM leverages its massive scale and existing client base to embed quantum services within its hybrid cloud portfolio. The company’s 2025 earnings showed an 8 % revenue rise to $67.5 billion and free‑cash‑flow of $14.7 billion, underscoring financial resilience. IBM’s roadmap targets a demonstrable quantum advantage by the end of 2026 and a fault‑tolerant processor by 2029, milestones that could unlock high‑value contracts in pharmaceuticals, logistics, and materials science. With a P/E around 24 and a 2.58 % dividend yield, IBM offers a blend of growth potential and income stability for investors.

2 Top Quantum Computing Stocks to Buy in 2026

By Robert Izquierdo · Feb 19, 2026 at 4:15 PM EST

Key Points

-

Quantum computer stocks are down in 2026, creating buying opportunities.

-

Two compelling quantum stocks are IonQ and IBM.

-

Both are making advances in the field, such as IBM's goal to achieve quantum advantage this year.

IonQ (NYSE: IONQ)

Market Cap: $12 B Current Price: $33.43 (as of Feb 19, 2026, 4:00 PM ET)

Today's Change: +0.27 % ($0.09)

Investor excitement over quantum‑computing companies peaked last October with rumors of a possible Trump‑administration investment in firms like IonQ. The rumors proved false, and by 2026 the hype had cooled, with shares in these businesses dropping substantially.

-

IonQ’s stock hit a 52‑week high of $84.64 in October, but by mid‑February 2026 it was down 24 % week‑over‑week.

-

IBM’s stock fell 11 % over the same period, making both companies attractive entry points.

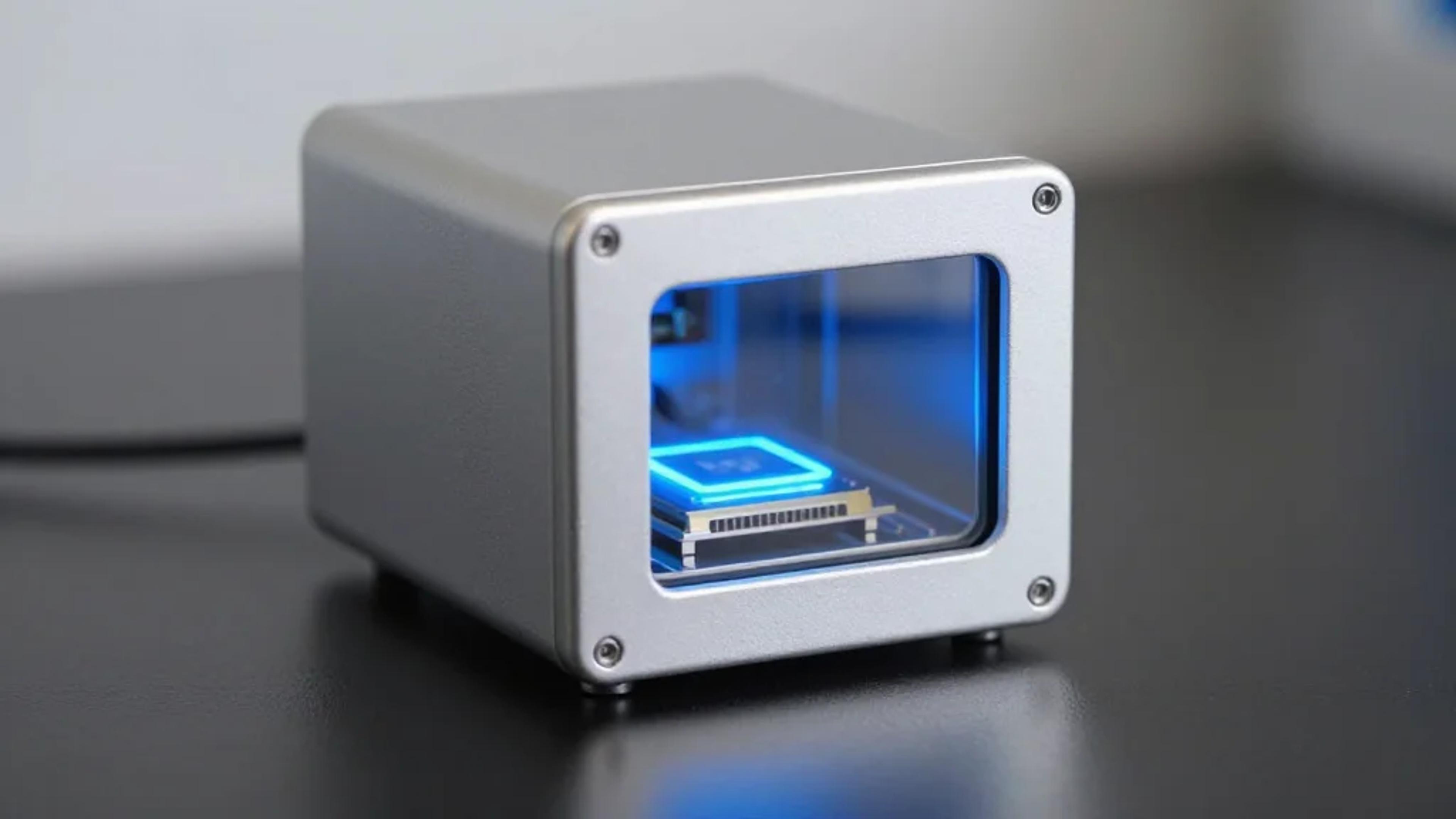

IonQ’s robust quantum platform

IonQ is strengthening its technology stack by acquiring SkyWater Technology, a semiconductor foundry that will give it end‑to‑end ownership of quantum‑chip production. Recent acquisitions also include:

-

Capella Space – satellite quantum technology

-

Skyloom and Qubitekk – quantum computer networking

IonQ deployed the first dedicated city‑wide quantum network in Geneva, Switzerland, and its rapidly rising revenue reflects the efficacy of its technology.

“Will AI create the world’s first trillionaire? One little‑known company, called an ‘Indispensable Monopoly,’ owns the technology Nvidia, AMD, and Intel cannot function without.”

In Q3, IonQ generated $39.9 M in sales—a 222 % year‑over‑year increase. The company forecasts 2025 revenue of $106 M–$110 M, more than double the $43.1 M earned in 2024.

Financial snapshot

-

Operating loss (Q3): $168.8 M (up from $53.1 M loss in 2024)

-

Balance sheet: No debt; cash, cash equivalents, and investments of $3.5 B after equity offerings (as of Nov 5).

IonQ – Quick Facts

-

Ticker: IONQ

-

Day’s Range: $31.98 – $33.58

-

52‑wk Range: $17.88 – $84.64

-

Volume: 14 M (average 20 M)

-

Gross Margin: –747.41 %

IBM (NYSE: IBM)

Market Cap: $244 B Current Price: $255.63

Today's Change: –1.98 % ($5.16)

IBM has been developing quantum‑computing technology for years. By the end of 2026 the company aims to achieve quantum advantage—the point where a quantum computer solves real‑world problems more accurately, cheaply, or efficiently than classical computers. A further milestone is a fault‑tolerant quantum computer targeted for 2029, which would correct errors in real time and accelerate adoption.

IBM – Quick Facts

-

Day’s Range: $253.74 – $258.28

-

52‑wk Range: $214.50 – $324.90

-

Volume: 199 K (average 4.6 M)

-

Gross Margin: 58.06 %

-

Dividend Yield: 2.58 %

IBM remains a profitable business with strong free‑cash‑flow generation:

-

2025 sales: $67.5 B (up 8 % YoY) → Net income: $10.6 B (up from $6 B in 2024)

-

Free cash flow: $14.7 B in 2025 vs. $12.7 B in 2024

The stock’s price‑to‑earnings ratio is about 24, near its low for the past year, suggesting an attractive valuation given the upcoming quantum milestones.

Should You Buy Stock in IonQ Right Now?

Before investing, consider the Motley Fool Stock Advisor team’s view: they have identified 10 best stocks for investors, but IonQ was not among them. The team highlights past successes (e.g., Netflix in 2004, Nvidia in 2005) to illustrate the potential upside of their picks, noting an average return of 899 % across all recommendations.

About the Author

Robert “Izzy” Izquierdo is a contributing Motley Fool stock‑market analyst covering information technology, consumer discretionary, consumer staples, and communication services sectors. Prior to The Motley Fool, he was head of product management at Target Media Partners, developing multimillion‑dollar software used by businesses such as Charter Communications. He also worked at Yahoo! and various startups on software products in connected TV, AI, consumer apps, and digital advertising. He holds a bachelor’s degree in English literature from UCLA and is certified in software product management.

Stocks Mentioned

-

IONQ – IonQ (NYSE: IONQ) – $33.43 (+0.27 %)

-

IBM – International Business Machines (NYSE: IBM) – $255.63 (‑1.98 %)

0

Comments

Want to join the conversation?

Loading comments...