Why It Matters

Enterprises continue to pay premium for precision and reliability, cementing proprietary models’ revenue streams, while cost‑sensitive developers and consumers gravitate toward open‑source alternatives, reshaping competitive dynamics.

Key Takeaways

- •Open-source AI holds ~23% market share despite lower cost

- •Proprietary models retain pricing power for mission‑critical workloads

- •Chinese models erode DeepSeek’s dominance, now 40% share

- •Programming drives most usage; roleplay dominates consumer segment

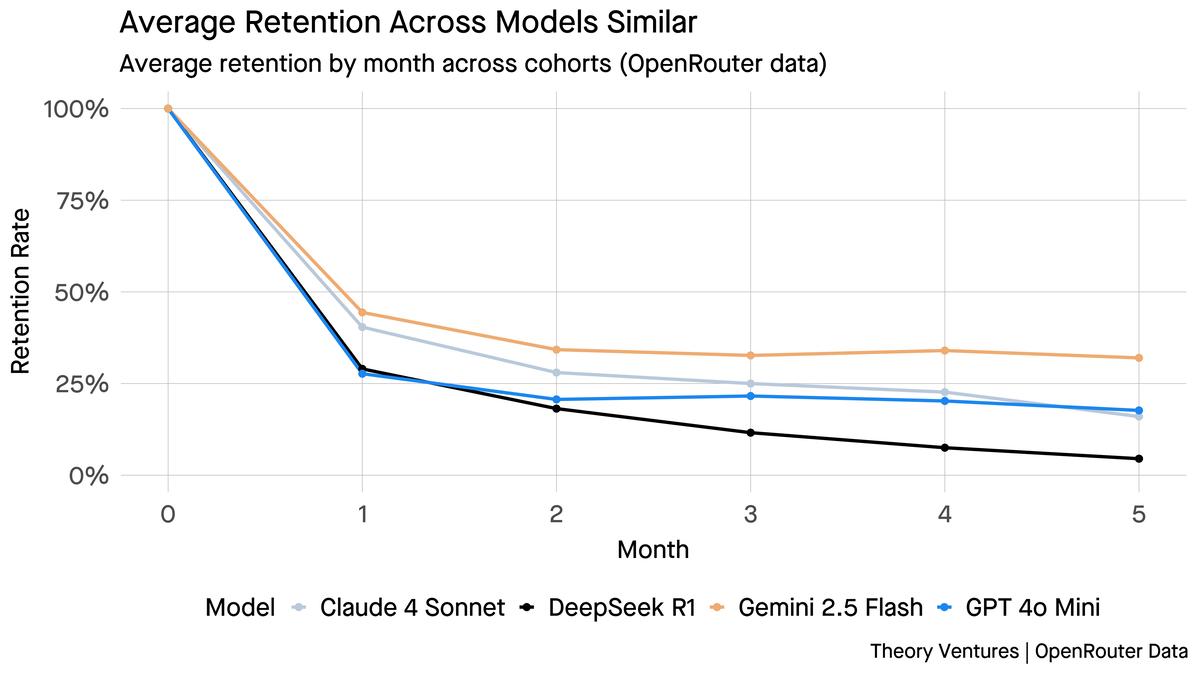

- •Claude 4 Sonnet and Gemini 2.5 Flash show higher retention

Pulse Analysis

The divergence between open‑source and proprietary AI reflects a classic price‑elasticity paradox. While open‑source models can be produced at a fraction of the cost of commercial offerings, the demand curve for mission‑critical applications remains steeply inelastic. Enterprises prioritize accuracy, security, and support guarantees, allowing vendors like Anthropic, OpenAI, and Google to command premium rates without losing market share. This pricing resilience underscores the strategic value of differentiated capabilities over sheer cost advantage.

Meanwhile, the open‑source landscape is undergoing rapid realignment. Early 2025 saw DeepSeek capture nearly 80% of the OSS segment, but the influx of Chinese models such as Qwen has halved its share. This shift is not merely geographic; it signals a maturing ecosystem where multiple contributors can vie for niche dominance. The data also reveal a clear segmentation of use cases: programming workloads dominate across the board, whereas role‑play—driven by entertainment and casual interaction—accounts for the bulk of consumer traffic, especially on platforms like DeepSeek.

Retention metrics further illuminate the market split. Models that have achieved product‑market fit, exemplified by Claude 4 Sonnet and Gemini 2.5 Flash, enjoy month‑one retention rates of 40‑50%, indicating deeper integration into professional workflows. In contrast, lower‑priced or less‑specialized models such as GPT‑4o Mini and DeepSeek R1 see churn rates exceeding 60%, reflecting their role as disposable, cost‑driven tools. For investors and product leaders, the takeaway is clear: sustainable growth will come from building stickiness through specialized, high‑value features rather than competing on price alone.

The Bifurcation in the AI Market

0

Comments

Want to join the conversation?

Loading comments...