Y-Combinator’s New Batch Doubles Down on Production-Ready AI, Unconventional Tactics for Validating Your Startup Ideas & Measuring True Efficiency in Venture Exits.

•October 31, 2025

0

Why It Matters

The trends reshape capital allocation: investors must adjust expectations, startups need scalable AI stacks, and talent strategies must align with longer‑term value creation.

Key Takeaways

- •Paid AI adoption dips 0.7% while spend per contract triples.

- •YC's 2025 batch emphasizes AI agents and enterprise infrastructure.

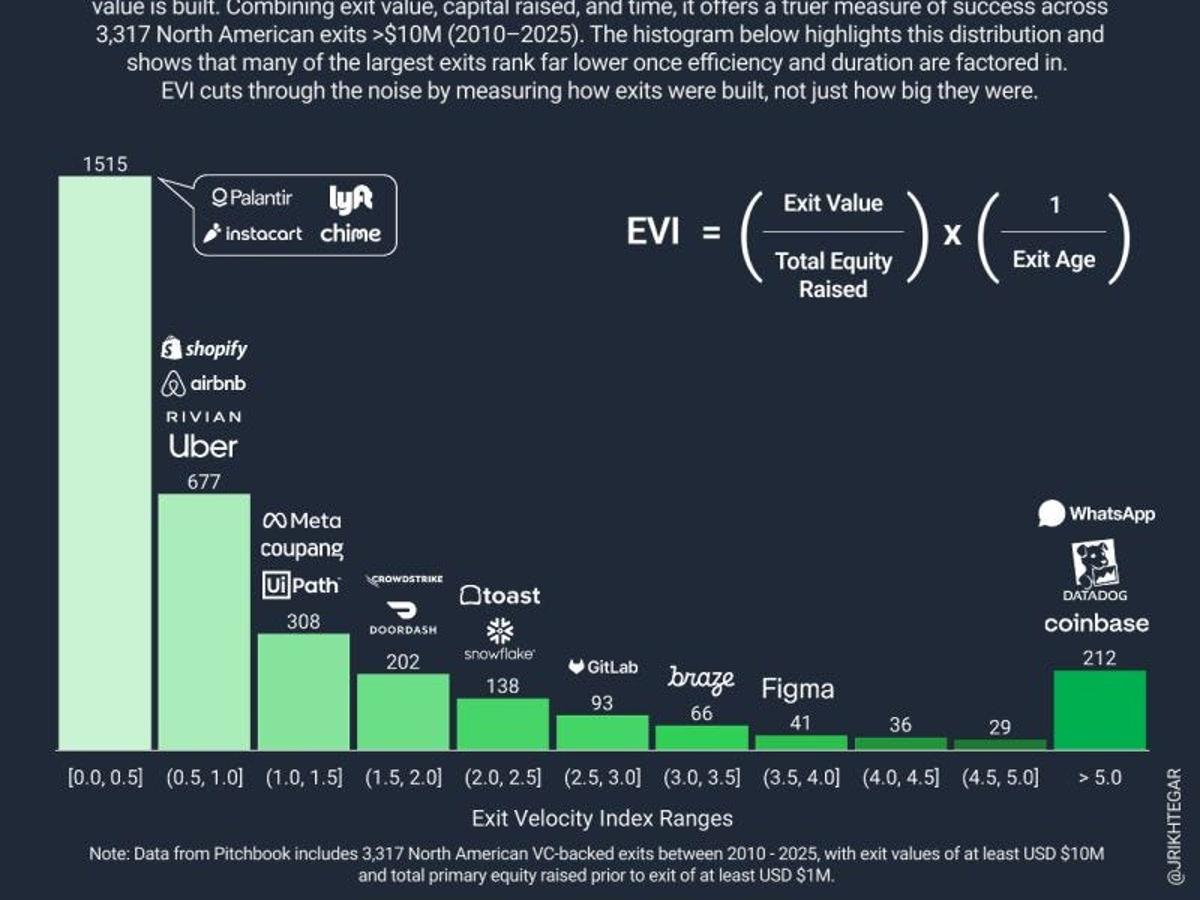

- •Venture seed returns compress as rounds grow and exits delay.

- •Founder compensation shifts toward equity transparency and milestone alignment.

- •Efficiency, latency, and sustainability become AI adoption priorities.

Pulse Analysis

The latest AI Index shows that the explosive growth phase is giving way to a consolidation period where enterprises are willing to spend significantly more per vendor to embed AI into core processes. This shift is less a retreat and more an indication that AI tools have crossed the proof‑of‑concept threshold, prompting firms to prioritize retention, integration depth, and total cost of ownership. For investors, the rising contract values signal a lucrative runway for vendors that can demonstrate measurable ROI and robust governance, while smaller players risk marginalization unless they carve out niche moats.

Y‑Combinator’s Summer 2025 cohort underscores the industry’s pivot toward production‑ready AI. With nearly half the batch building agent‑centric platforms and a strong emphasis on verticalized solutions—especially in regulated sectors like finance and insurance—the accelerator is betting on infrastructure that can scale reliably. Startups focusing on low‑latency inference, energy‑efficient data‑centres, and proprietary training data are positioning themselves as essential suppliers for large enterprises, accelerating the transition from experimental models to mission‑critical services. This trend is likely to intensify competition among AI tooling providers, driving innovation in monitoring, debugging, and cost‑optimization layers.

Meanwhile, the venture capital landscape is feeling the strain of larger seed rounds and protracted exit horizons. As median time to IPO stretches past eleven years, liquidity pressures force limited partners to seek secondary market exits, often at discounted valuations. Early‑stage founders, aware of diluted ownership and tighter return expectations, are recalibrating compensation philosophies—leaning on transparent equity grants tied to performance milestones rather than inflated cash salaries. This alignment not only preserves runway but also cultivates a culture of shared risk, which is increasingly vital in a market where efficiency, sustainability, and long‑term value creation dominate strategic decision‑making.

Y-Combinator’s new batch doubles down on production-ready AI, Unconventional tactics for validating your startup ideas & Measuring true efficiency in Venture exits.

0

Comments

Want to join the conversation?

Loading comments...