Despite 4 Years of Mass-Layoffs at Alphabet & Amazon, Headcount Rose in 2025, Nearly Flat with Peak, as Hiring Continued

•February 10, 2026

0

Why It Matters

The data shows that even amid headline‑grabbing layoffs, tech giants are still expanding core talent pools to support AI‑driven growth, reshaping labor dynamics in the sector.

Key Takeaways

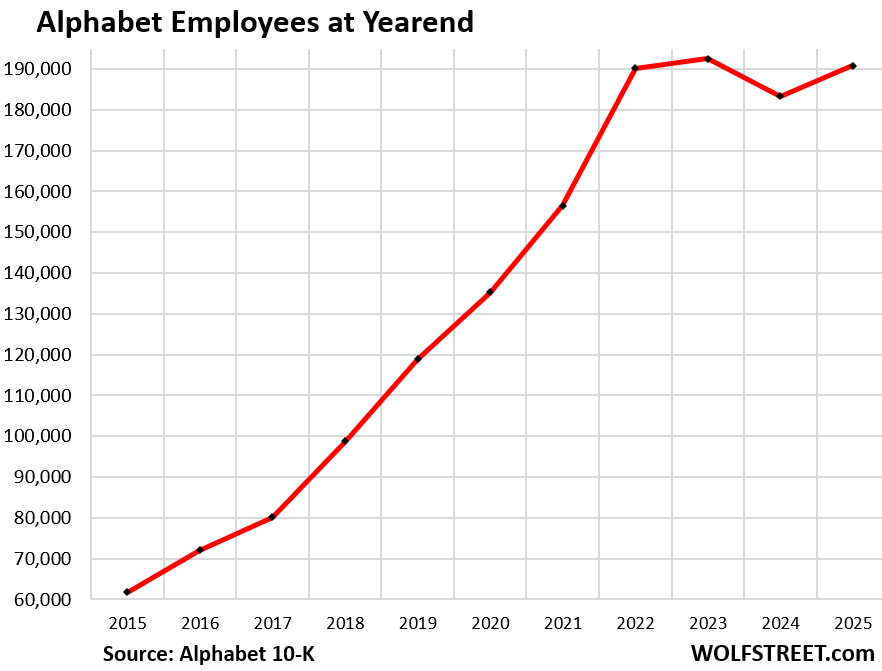

- •Alphabet added 7,500 employees in 2025, near 2023 peak.

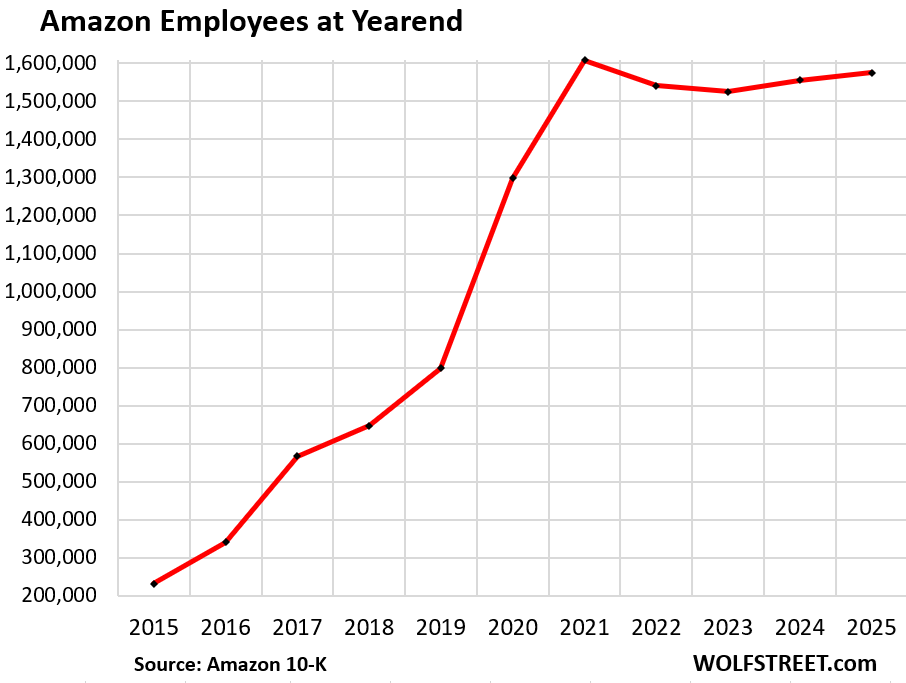

- •Amazon's 2025 headcount rose 20,000, still 2% below 2021 high.

- •Both firms swapped staff: layoffs plus targeted hiring.

- •Over‑hiring in 2020‑21 doubled Amazon, grew Alphabet 60%.

- •AI capex fuels fresh talent demand despite workforce cuts.

Pulse Analysis

The 2020‑2021 hiring frenzy across Silicon Valley was fueled by pandemic‑induced demand for digital services and aggressive expansion into cloud and e‑commerce. Companies like Amazon and Alphabet recruited at unprecedented rates, often hiring remote workers on a massive scale. This rapid scaling created a bloated workforce that later required systematic pruning as growth forecasts adjusted and automation initiatives took hold. The resulting over‑capacity set the stage for the large‑scale layoffs that dominated headlines in 2022‑2023.

By the close of 2025, both Alphabet and Amazon demonstrated a nuanced staffing strategy. Alphabet’s modest 7,500‑person increase and Amazon’s 20,000‑person gain reflect a shift from blanket hiring to selective talent acquisition, especially in AI, cloud, and logistics. Simultaneously, each firm eliminated a significant share of middle‑management roles, streamlining decision‑making and reducing overhead. This dual approach—targeted hiring paired with strategic cuts—has kept overall headcount near historical peaks while positioning the companies to deploy new technologies efficiently.

The broader implication for the tech sector is clear: massive layoff announcements do not signal a retreat from growth, but rather a reallocation of resources toward high‑value capabilities. With AI‑related capital expenditures projected to exceed $700 billion in 2026, demand for specialized engineers and data scientists will outpace generic workforce reductions. Companies that balance prudent cost control with aggressive talent investment are likely to capture market share, while the labor market will continue to experience churn as workers transition to emerging, AI‑centric roles.

Despite 4 Years of Mass-Layoffs at Alphabet & Amazon, Headcount Rose in 2025, Nearly Flat with Peak, as Hiring Continued

By [Wolf Richter](https://wolfstreet.com/author/wolf-richter/) for WOLF STREET

Amazon and Alphabet – and other tech companies – keep announcing serial layoffs and buyout‑encouraged departures. But they’re still hiring too.

Alphabet’s global headcount on December 31, 2025, reported in its 10‑K filing, rose by 7,497 year‑over‑year, was a hair above where it had been at the end of 2022, when these layoffs started, and only a hair below peak headcount at the end of 2023.

But in the two years 2020 and 2021, its headcount had surged by 60 %, as it hired helter‑skelter and in massive numbers people who worked remotely, amid stories that began circulating of people having two or three full‑time remote jobs and pulling in huge amounts of money while skiing or whatever. Exaggerated or not, what was clear is that there would be a lot of sorting out and cleaning up to do afterwards.

The afterwards began in late 2022. Turns out, the cleanup included sweeping out 35 % of its managers that were overseeing small teams, Brian Welle, VP of Analytics & Performance Management at Google, told employees in August last year. “So a lot of fast progress there,” he said.

Lots of people gone, and the headcount is up. So what is clear is that Google is swapping out workers, pushing lots of people out, and hiring lots of people, with the effect that the headcount had remained roughly unchanged for four years, after the biggest and wildest hiring binge ever in 2020 and 2021.

And Amazon’s gigantic headcount at the end of December 2025 rose by 20,000 year‑over‑year, to 1.576 million, according to its 10‑K filing on Friday. In the prior year, it had risen by 31,000.

But in 2022 and 2023, headcount had dropped by 16,000 and 67,000.

Its headcount at the end of 2025 was down by 32,000, or by just 2.0 %, from the peak year 2021.

But in the two years of 2020 and 2021, its headcount had shot up by 810,000 people, from 798,000 at the end of 2019 to 1.608 million at the end of 2021, having more than doubled (+102 %) in two years.

In the seven years 2015 to 2021, its headcount exploded by 1.377 million, or by 600 % (headcount had multiplied by 7).

In 2020 and 2021, Amazon overhired in one of the most amazing hiring binges ever seen, increasing its staff by 810,000 people in just two years. Many of its workers also quit during that time, so the hiring to replace the quits and add the 810,000 must have been gigantic and chaotic.

And since then, it has been trying to sort through who it really needs and who it doesn’t need, trying to get rid of the deadwood, the recalcitrant remote workers, the workers in projects that it shut down, the workers that it replaced with automation, etc., while hiring where it needed fresh blood.

So it’s not like there is no movement in employment at these companies. There is lots of movement, with big layoffs and buyouts, accompanied by lots of hiring.

Intuit was an explicit example of that in July 2024, when it announced 1,800 layoffs, about 10 % of its workforce, including 1,000 for not meeting performance expectations, while it also announced plans to hire 1,800 people to accelerate its push into AI. Layoffs are quicker to pull off than hiring workers for AI‑related roles. So one came first, and the other has been slower to materialize.

In case you missed it: AMZN, GOOG, MSFT, META, ORCL Plan $700 Billion in Largely AI‑Related Capex in 2026. Here’s Where the Cash Will Come From

0

Comments

Want to join the conversation?

Loading comments...