Why It Matters

Understanding that markets can discount chaotic news and still reflect underlying economic strength helps investors maintain confidence and avoid over‑reactive defensive moves. As geopolitical headlines intensify, recognizing the market’s role as a forward‑looking indicator is crucial for strategic asset allocation and risk management.

Discounting the Chaos

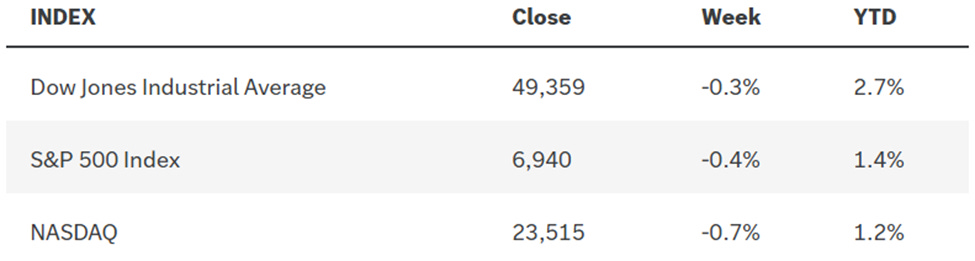

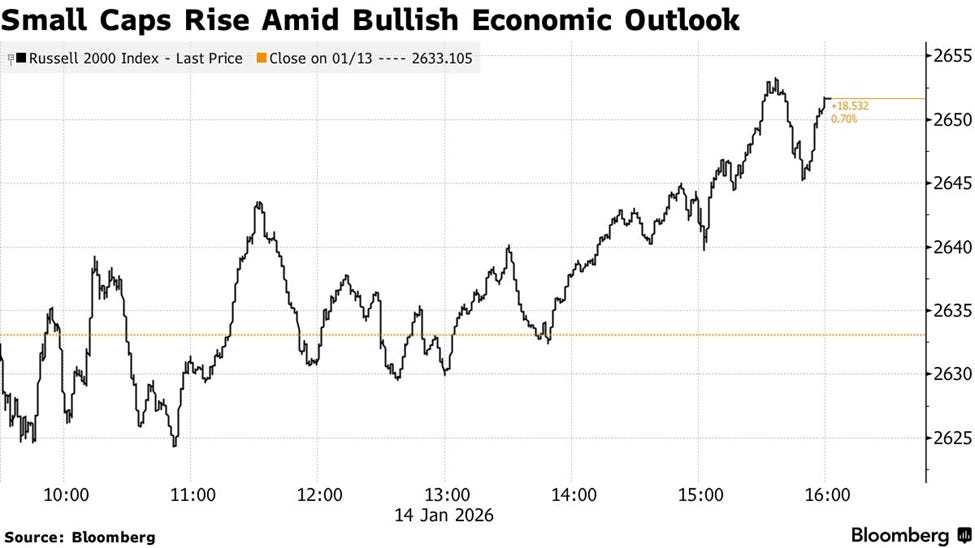

To say that the geopolitical news flow has been chaos since the beginning of this year would be an understatement. From the removal of President Maduro in Venezuela to the risk of an attack on Iran to concerns about Fed independence to threats to invade Greenland, investors have had a plethora of daunting headlines to digest. Yet while uncertainty abounds, the stock market continues to serve as an unbiased and fundamentally based discounting mechanism of future economic events. On that front, it indicates the economic expansion remains on track. The rate of economic growth is expected to be north of 5% in the fourth quarter, while the latest inflation readings for December showed the core rate falling to a three-year low of 2.6%, and corporate profits are expected to post another double-digit gain.

[

](https://substackcdn.com/image/fetch/$s_!rHCG!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4b96f495-0bbb-4ec9-a71c-08548264a4a7_975x261.png)

Whether the economy’s resilience is despite government policies or because of them is not a topic that concerns me as an investor. What is relevant is that it continues, because if it does not it will require a far more defensive investment strategy. At this point, the stock market is breeding nothing but confidence in the outlook, as 18% of the stocks in the S&P 500 are up 10% or more so far this year, which is double the average of 9.4% at this point in January over the past five years. That said, the robust year-to-date gains will inevitably invite another pullback, which could be instigated by the latest threats over Greenland.

[

](https://substackcdn.com/image/fetch/$s_!FWdN!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa281ac85-806a-4867-a916-a53fc72d857d_975x548.png)

0

Comments

Want to join the conversation?

Loading comments...