Economy & Earnings Are Heating Up

•February 3, 2026

0

Why It Matters

These projections signal a bullish equity environment and a tight monetary stance, shaping portfolio allocations across stocks, bonds, and commodities for investors and policymakers alike.

Key Takeaways

- •S&P 500 projected at 7,700 by year‑end

- •10‑year Treasury yield forecast 4.25‑4.75% this year

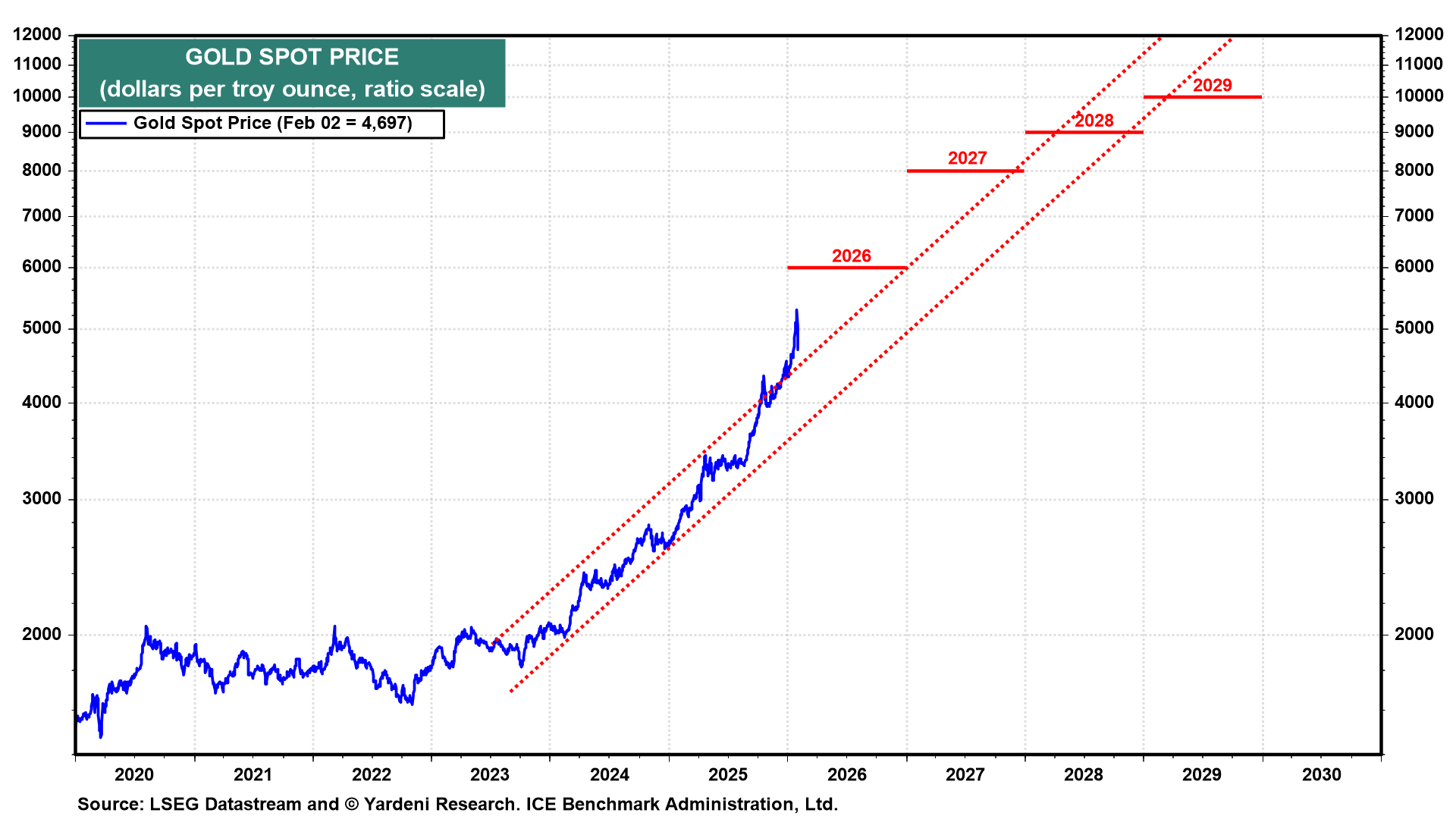

- •Gold target $6,000/oz now, $10,000/oz decade

- •No Fed rate cut expected through June meeting

- •Inflation to hit 2% by year‑end, 3% summer

Pulse Analysis

Equity markets appear poised for a strong rally as analysts lift the S&P 500 target to 7,700 by the close of 2026, driven by vigorous earnings growth and continued fiscal stimulus. This outlook reflects confidence in corporate profit margins and consumer demand, suggesting that investors may prioritize growth‑oriented sectors while still monitoring valuation metrics. The decade‑long ambition of reaching 10,000 underscores a long‑term bullish bias that could influence fund managers’ strategic asset allocations.

On the fixed‑income front, the 10‑year Treasury yield is expected to stay within a 4.25%‑4.75% band, indicating a relatively tight credit environment despite the absence of rate cuts. Such yield levels support a modestly higher cost of capital, yet they also provide a clear benchmark for mortgage and corporate borrowing rates. Simultaneously, gold is forecast to climb to $6,000 per ounce this year and $10,000 by 2030, reflecting heightened safe‑haven demand amid lingering inflation concerns and potential geopolitical risks. Investors may therefore balance bond exposure with precious‑metal positions to hedge against market volatility.

Monetary policy remains a pivotal driver, with the Federal Reserve unlikely to lower rates through the June FOMC meeting, even if Kevin Warsh assumes the chairmanship. The projection that inflation will settle at the Fed’s 2% target by year‑end, after a summer plateau around 3%, suggests a gradual de‑escalation rather than abrupt tightening. This trajectory, combined with expansive fiscal measures, points to a continued economic boom but also raises questions about long‑term debt sustainability. Market participants should therefore stay vigilant on policy cues, as any shift could quickly reshape equity valuations, bond yields, and commodity price dynamics.

Economy & Earnings Are Heating Up

There's never a dull moment in our business these days. Events impacting the financial markets are happening so fast that we probably need to stop every now and then to update you on our latest forecasts.

We are still targeting the S&P 500 at 7,700 by the end of this year and 10,000 by the end of the decade. The 10-year Treasury bond yield should range between 4.25% and 4.75% this year. We are still targeting a gold price of $6,000 per ounce by the end of this year and $10,000 by the end of the decade (chart).

We don't expect any rate cut by the Fed through the June FOMC meeting, which will be the first one with Kevin Warsh as Fed chair if his appointment is confirmed by the Senate. We think that inflation will moderate to the Fed’s target of 2.0% y/y by the end of this year, but it could remain sticky around 3.0% through the summer. The economy should be booming this year thanks to the very stimulative fiscal and monetary policies. If so, then there may be no Fed rate cut at all this year. (See today's Financial Times for my op-ed "Markets are set to test Warsh.")

Let's review the latest booming economic data and then do the same for the booming earnings data:

0

Comments

Want to join the conversation?

Loading comments...