Emerging Markets Continuing To Emerge

•February 10, 2026

0

Why It Matters

A sustained tilt toward emerging markets could reshape global capital flows and dilute US dominance in the world equity pool. Understanding this shift helps investors and policymakers anticipate changes in liquidity, valuation, and risk exposure.

Key Takeaways

- •US MSCI lagging behind global peers in 2025

- •Emerging markets like Korea, Brazil, Mexico outperform US

- •US share of MSCI world index fell from 65%

- •Japan gains 5.7% after LDP supermajority election

- •De‑dollarization not driving US MSCI underperformance

Pulse Analysis

The recent underperformance of the US MSCI index reflects a broader diversification wave among global investors. After years of US‑centric allocation, the market’s 65% weighting in the All‑Country World MSCI has become a concentration risk, prompting fund managers to seek exposure in regions delivering stronger earnings momentum. Emerging markets such as South Korea, Brazil, Mexico, and Taiwan have posted robust returns, buoyed by favorable commodity cycles, technology exports, and resilient consumer demand, making them attractive alternatives to a comparatively stagnant US equity landscape.

Political developments also play a pivotal role. Japan’s 5.7% rally, sparked by the Liberal Democratic Party’s supermajority win, underscores how policy certainty can quickly translate into market optimism. The LDP’s ability to pass fiscal stimulus without gridlock has revived investor confidence in the country’s growth trajectory, contrasting with the United States where fiscal debates remain contentious. This divergence highlights that market performance is increasingly tied to governance stability and the capacity to implement growth‑enhancing reforms.

While some analysts speculate that de‑dollarization is eroding US market primacy, the data suggests otherwise. Foreign capital continues to allocate to US assets for their depth, liquidity, and innovation edge. However, the shift toward emerging markets signals a more balanced global portfolio construction, reducing reliance on a single economy. Stakeholders—from asset managers to corporate strategists—must monitor these dynamics, as they influence capital costs, valuation benchmarks, and the competitive landscape across sectors worldwide.

Emerging Markets Continuing To Emerge

Author and publication date not provided.

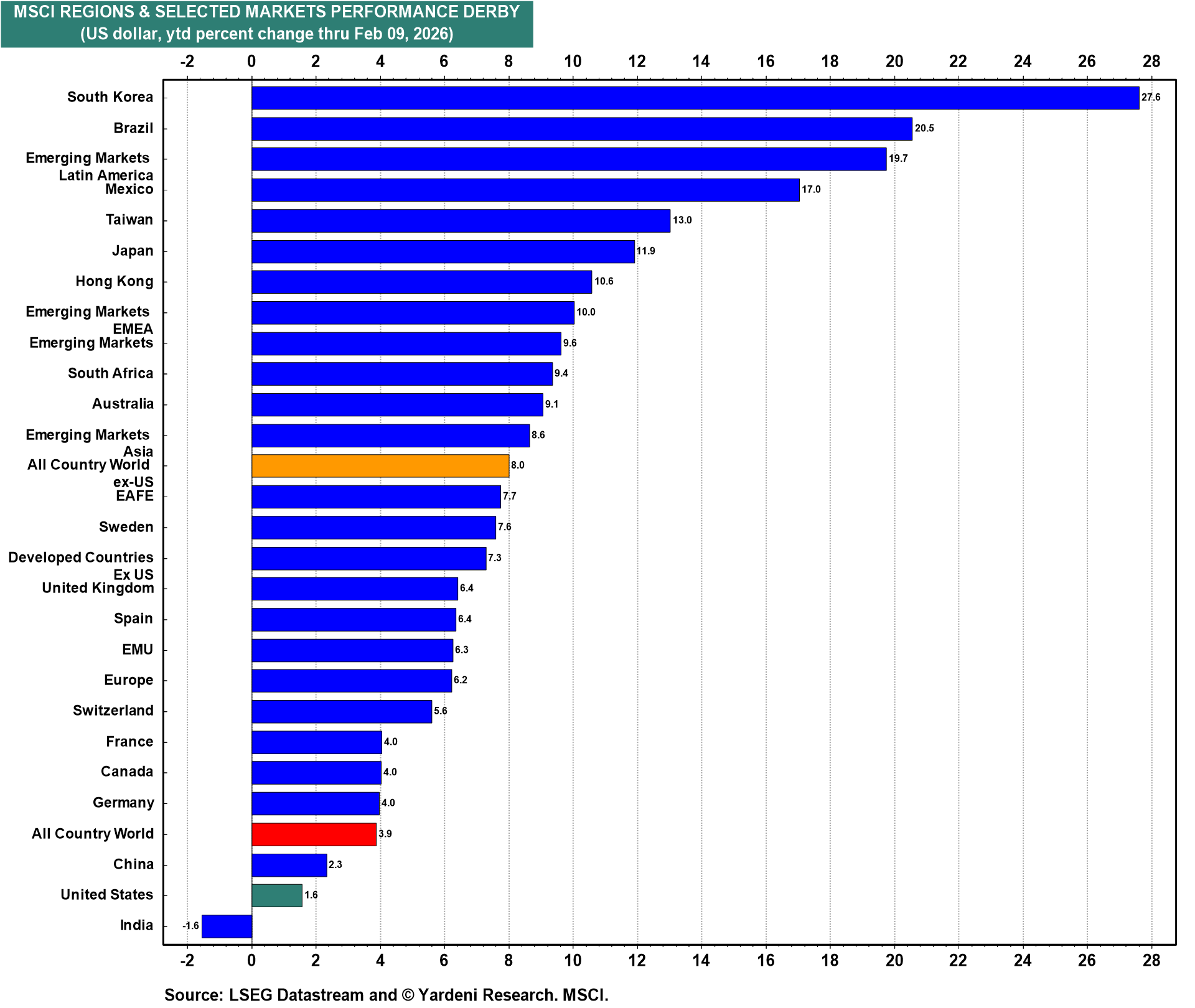

The US MSCI continues to underperform in the global stock market derby as it did last year (chart). Does this mean that American exceptionalism, which was touted as recently as 2024, is kaput? Is this another sign of de‑dollarization? We don't think so. America remains exceptional, and foreigners continue to invest in the US. However, there are plenty of exceptional companies overseas that have also attracted global investors.

But why did the US MSCI start to underperform in 2025? Perhaps investors have been impressed with the resilience of the global economy in the face of Trump’s Tariff Turmoil last year. Late last year, we also concluded that the outperformance of the All‑Country World ex‑US MSCI might be sustainable for a while, as global investors sought to rebalance away from the US because it accounted for a whopping 65 % of the All‑Country World MSCI’s market capitalization.

So far, the star performers in the global MSCI derby have been South Korea, Brazil, Mexico, Taiwan, and Japan. All of them, except Japan, are included in the Emerging Markets MSCI. Japan’s stock market rose by as much as 5.7 % today after the LDP won a “supermajority” (two‑thirds of the seats) in Sunday’s House of Representatives election. This result effectively removes political gridlock, allowing the government to proceed with fiscal programs to stimulate the economy.

The ratios of the US MSCI to the Emerging Markets MSCI (in local currencies and in US dollars) have been on an upward trend since 2010 (chart). These ratios peaked at the start of 2025 and have been trending lower since then.

0

Comments

Want to join the conversation?

Loading comments...