Here We Go Again on Inflation: Used Vehicle Prices Jump in January, Expected to Jump More in Record Tax-Refund Season

•February 6, 2026

0

Why It Matters

Higher wholesale costs will lift retail used‑car prices, feeding into the CPI and signaling renewed inflationary risk for the broader economy.

Key Takeaways

- •Jan used‑vehicle auction prices rose 2.4% month‑over‑month.

- •Tax‑refund season expected to push prices higher.

- •Supply tight: 26.6 days versus 32‑day historic average.

- •ICE prices up 2.2%; EVs up only 0.4%.

- •Higher wholesale costs likely lift retail CPI soon.

Pulse Analysis

The January surge in Manheim’s Used Vehicle Value Index reflects a confluence of fiscal stimulus and market scarcity. Tax refunds, amplified by the One Big Beautiful Bill’s expanded credits, are providing consumers with sizable down‑payments that dealers readily accept, driving auction prices well above historical seasonal norms. This influx of cash coincides with a post‑pandemic inventory squeeze, creating a buyer’s market where demand outpaces supply and prompting dealers to raise wholesale bids.

Inventory constraints are a central driver of the price rally. At the end of January, the industry’s days‑supply metric fell to 26.6 days, a sharp decline from the 32‑day average seen in pre‑COVID years. The bulk of auction stock—rental fleet retirements, off‑lease returns, repossessions, and fleet disposals—has thinned, leaving dealers to compete for fewer units. Notably, the price gap between internal‑combustion‑engine (ICE) and electric vehicles (EVs) is widening; ICE models posted a 2.2% jump, while EVs rose a modest 0.4%, underscoring divergent demand dynamics and differing depreciation curves.

The ripple effect reaches macroeconomic indicators. Wholesale price gains translate into higher dealer acquisition costs, which are typically passed on to consumers, feeding directly into the Bureau of Labor Statistics’ used‑vehicle CPI component. As the CPI incorporates these higher retail prices in the coming months, inflation readings may climb, complicating the Federal Reserve’s recent easing cycle. Stakeholders—from policymakers to investors—should monitor the interplay of tax‑refund‑driven demand, supply tightness, and price transmission as early signals of renewed inflationary pressure.

Here We Go Again on Inflation: Used Vehicle Prices Jump in January, Expected to Jump More in Record Tax-Refund Season

Tax refunds make great down‑payments which are great for higher prices. Every year, the industry salivates over tax refund season. But this year will be special.

By Wolf Richter for WOLF STREET.

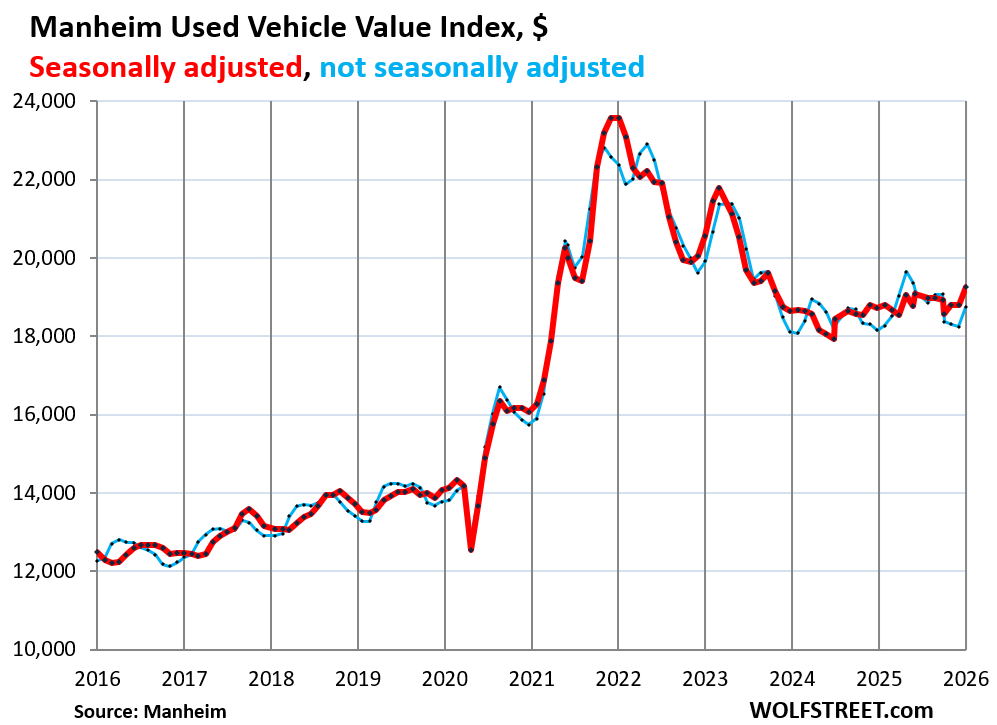

Prices of used vehicles sold at auctions where franchised and independent dealers replenish their inventories jumped by 2.4 % in January from December, adjusted for mix, mileage, and seasonality (red in the chart), amid tight supply and “strengthening demand” despite the harsh winter weather in a big part of the country.

Unadjusted prices jumped by 2.7 %, much more than the normal price increase in January (blue), which over the long term averaged 0.4 %, according to today’s Manheim Used Vehicle Value Index (MUVVI). Manheim, a division of Cox Automotive, is the largest auto auction house in the US.

The 2022‑through‑mid‑2024 plunge in used‑vehicle prices – after the horrendous spike in 2020 and 2021 – contributed substantially to the cooling of inflation. Now there’s new energy being infused into prices: “The spring bounce for wholesale markets looks like it started early this year, and stronger tax refunds and lower used supply may keep it running for longer than typically seen,” Manheim said in the report.

The Manheim Market Report (MMR) index for three‑year‑old vehicles jumped by 1.5 % in January from December, “more than is typical for this period,” Manheim said.

Sales conversion at the auctions, at 60.7 % in January, was 3.2 percentage points higher than the average over the past three years, and 6.5 percentage points higher than in December, indicating “strengthening demand, as the metric remains above usual levels for this time of year,” Manheim said.

Year‑over‑year, unadjusted prices were up by 2.5 % in January, after being nearly flat for the prior three months (0.2 %, 0 %, 0.7 % year‑over‑year).

This tax refund season will be special

The One Big Beautiful Bill (OBBB) included seven tax credits, deductions, and exclusions – new or increased – that will lower the tax bill for individuals for the tax year 2025 by $129 billion, according to estimates by the Tax Foundation.

But the IRS did not adjust its withholding tables for 2025, and so the refunds, to be paid out during tax‑refund season in 2026, will be larger than normal. Republicans have recently stated that this was planned so that consumers would get this cash and feel good and spend it, and that it would boost the economy just before the mid‑term elections and thereby boost support for Republicans.

And consumers will largely spend their tax refunds. Tax refunds make great down‑payments for used‑vehicle purchases, and big down‑payments are great for higher prices. Every year, the industry salivates over tax‑refund season. But this year will be special.

Manheim is seeing this already:

“We had planned for a stronger January from a pricing perspective, but wholesale values moved even faster than we expected on the back of strong retail demand, driving the MUVVI to its highest reading since September 2023.

“With tax‑refund season officially starting last week, we are expecting that more consumers will be getting refunds – and that the size of those refunds will hit a new record. Those factors should help consumers punch the ticket on some big‑ticket purchases, even as we have seen a more muted impact on market interest rates in the face of three Fed cuts since September.”

Supply at these auctions comes from rental fleets that sell vehicles they pulled out of service, from finance companies that sell their off‑lease vehicles and repos, from corporate and government fleets, from other dealers, etc.

But wholesale supply is tight, at 26.6 days’ supply at the end of January, compared to 32 days on average for the end of January in the years before the pandemic.

These auction prices form the costs for dealers. And those higher costs then flow into retail prices if consumers go for those higher prices — and this time they will, armed with big tax refunds.

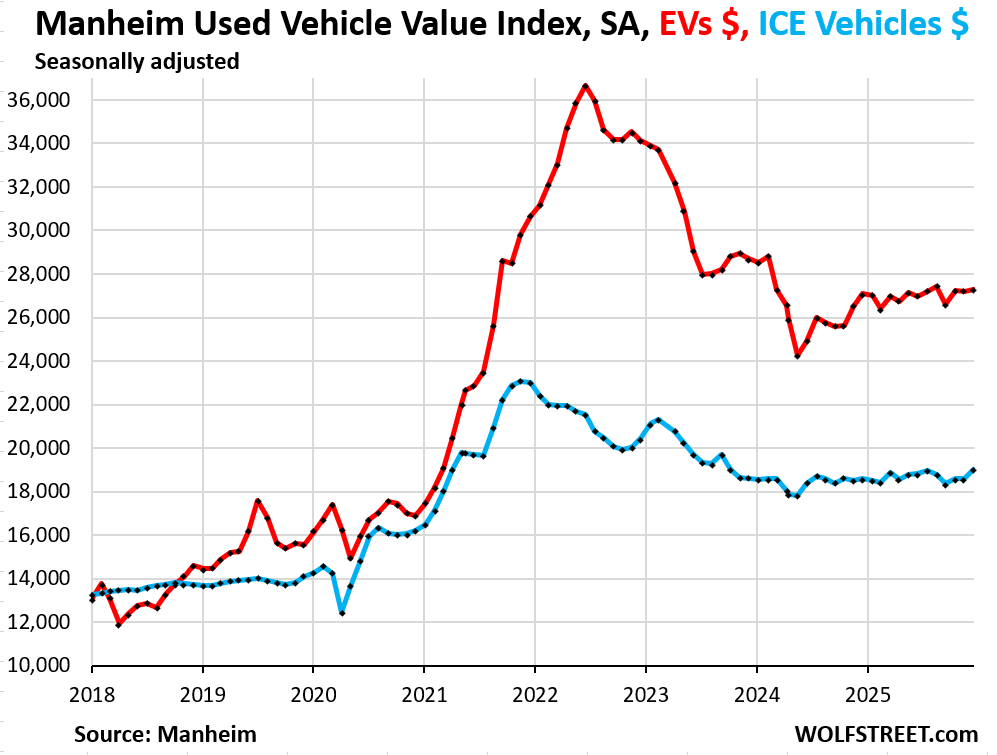

Prices of EVs versus ICE vehicles

Prices of used EVs rose by 0.4 % in January from December from already very high levels, to $27,298 (red).

Prices of ICE vehicles jumped by 2.2 % for the month to $19,105 (blue).

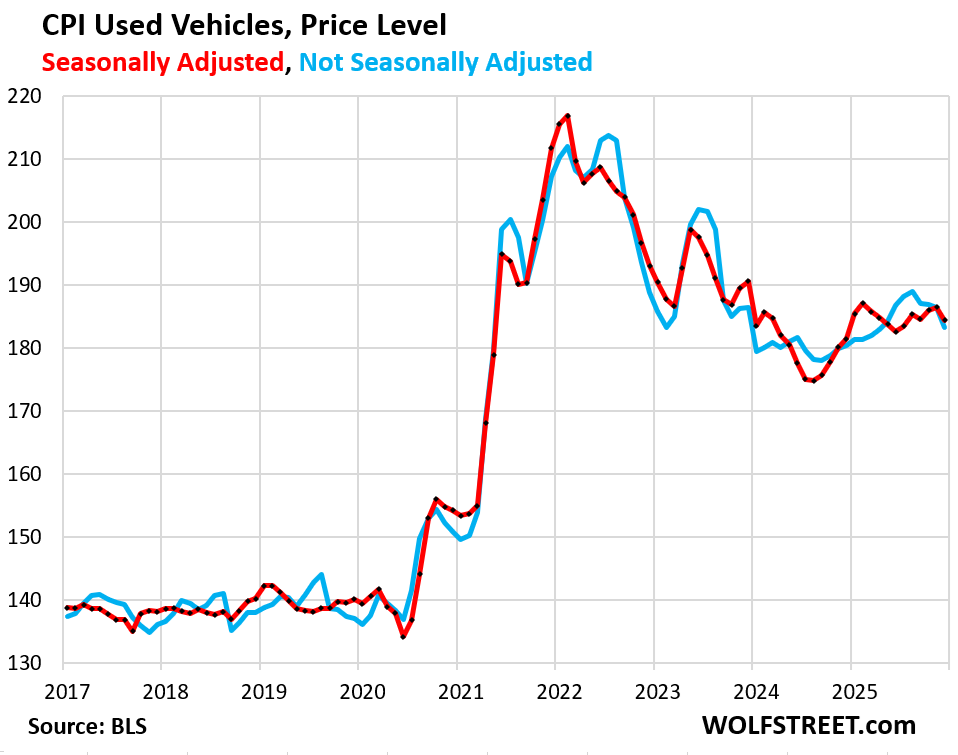

Retail prices for used vehicles in January will be reflected in the CPI for used vehicles, to be released maybe next week by the Bureau of Labor Statistics. For December, the CPI for used vehicles declined from November by 1.1 % seasonally adjusted (red) and by 1.6 % not seasonally adjusted (blue).

Since the used‑vehicle CPI reacts with a lag to wholesale prices, the impact of the jump in wholesale prices in January, and going forward through tax‑refund season, will start showing up in the CPI in a month or two.

0

Comments

Want to join the conversation?

Loading comments...