Mini Tech Wreck Or Repeat Of The Big One?

•February 6, 2026

0

Why It Matters

The scale of AI capex creates a new revenue engine for profitable tech firms, reducing the likelihood of a systemic crash and shaping future market dynamics.

Key Takeaways

- •AI capex projected $490B by three hyperscalers in 2026.

- •Big Four hyperscalers forecast $650B AI spending 2026.

- •Microsoft holds $625B contracted but unrecognized revenue.

- •Tech sell‑off unlikely to repeat 2000‑02 bubble.

- •Vendor earnings set to rise from hyperscaler AI investments.

Pulse Analysis

The recent slide in technology equities has reignited memories of the early‑2000s dot‑com collapse, yet the fundamentals driving today’s market are markedly different. Back then, many internet firms lacked sustainable cash flows, and the bubble burst triggered a broader recession. Today’s sell‑off is more a reaction to valuation concerns than to a structural earnings shortfall, and investors are weighing the impact of unprecedented AI‑related capital expenditures.

AI infrastructure spending is set to reshape the sector’s revenue landscape. Forecasts show the three largest hyperscalers—Alphabet, Amazon, and Microsoft—will collectively invest about $490 billion in AI by 2026, while the broader “Big Four” are expected to reach $650 billion. Microsoft’s disclosed $625 billion in contracted but unrecognized revenue highlights the depth of multi‑year cloud commitments. This cascade of spending fuels demand for semiconductor, data‑center, and software vendors, translating into higher top‑line growth for companies that supply the underlying hardware and services.

The macroeconomic implications extend beyond the tech ecosystem. Massive capex injects liquidity into the economy, supporting job creation and ancillary industries, though supply‑chain bottlenecks—particularly power availability and chip shortages—could temper the pace. Nonetheless, the sheer scale of AI investment suggests a durable growth trajectory, positioning the sector for resilience rather than a repeat of the early‑2000s downturn.

Mini Tech Wreck Or Repeat Of The Big One?

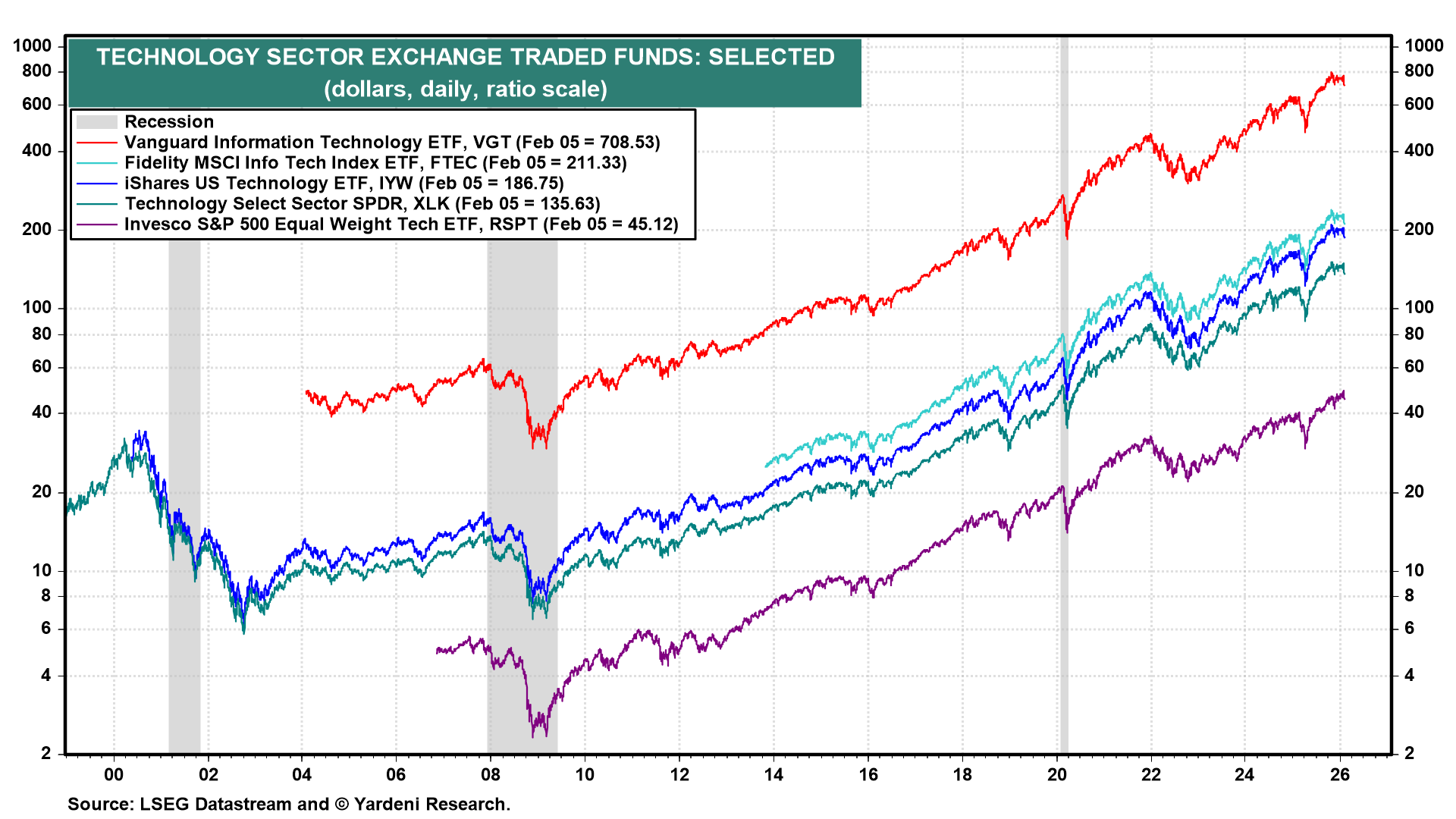

Is the sharp sell‑off in technology stocks this week the beginning of a Tech Wreck comparable to what happened from 2000 through 2002, when the tech bubble of the late 1990s burst and caused a recession (chart)?

We doubt it because this time, the industry has many more profitable companies benefiting from the enormous capital spending on AI infrastructure by hyperscalers, including Alphabet, Amazon, and Microsoft. Collectively, these three companies are projected to spend approximately $490 billion on AI in 2026. Including Meta, the “Big Four” hyperscalers are forecast to spend roughly $650 billion.

That’s freaking out investors, who are worrying that such massive spending might not pay off. However, all that spending in just this year will certainly provide lots of revenues and earnings to the companies that are vendors to the hyperscalers. The economy will also get a big boost from so much capex. Some of this spending might be delayed into next year if the data‑center projects are constrained by power and semiconductor availability.

Microsoft alone now carries roughly $625 billion in contracted but unrecognized revenue (RPO), reflecting unprecedented multi‑year AI and cloud commitments. Other hyperscalers also report rapidly expanding long‑term cloud contracts, though their RPO disclosures are not directly comparable.

0

Comments

Want to join the conversation?

Loading comments...