Why It Matters

Understanding January’s market signals and the Fed’s policy trajectory helps investors gauge the likelihood of continued equity gains and sector opportunities, especially in energy. The political shift in Fed leadership adds uncertainty, making the host’s outlook on future rate cuts crucial for strategic planning.

Running of the Bulls

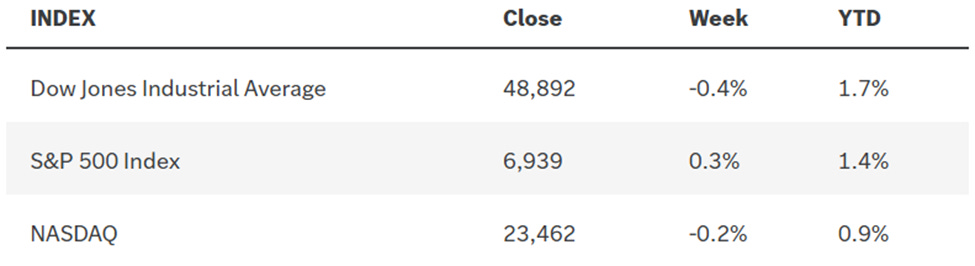

The modest changes in the major market indexes last week are deceiving, because the volatility across asset classes was anything but modest. I was exhausted by Friday afternoon. The most relevant data point is that we finished the month of January with a gain for the S&P 500. When the index posts a positive return for the month of January, it has resulted in a positive return for the year 86% of the time with an average gain of 16%. When the index declines in January, the average annual return for the year falls to 2.3%, and it is positive just 61% of the time. This is another win for the bulls, but I think the performance for the energy sector so far this year is even more encouraging.

[

](https://substackcdn.com/image/fetch/$s_!MHCt!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1c9ae801-f1fa-49f8-bb87-5321553ea077_975x266.png)

As expected, the Fed left its benchmark rate unchanged last week, as Chairman Powell gave a relatively upbeat outlook for the economy, emphasizing that the labor market had stabilized, while inflation still remains elevated. While services inflation has eased this year, goods inflation has picked up due to tariffs, but those price increases will roll off the annualized rate starting in June. While it is unlikely that we will see another rate cut at the March or April meeting, June is a different story, as President Trump’s new Fed Chair will at the helm, but he will still have to sway a majority of the voting members.

[

](https://substackcdn.com/image/fetch/$s_!2o9C!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff991c929-ee7b-4803-b877-92f5eb2f7d0c_975x551.png)

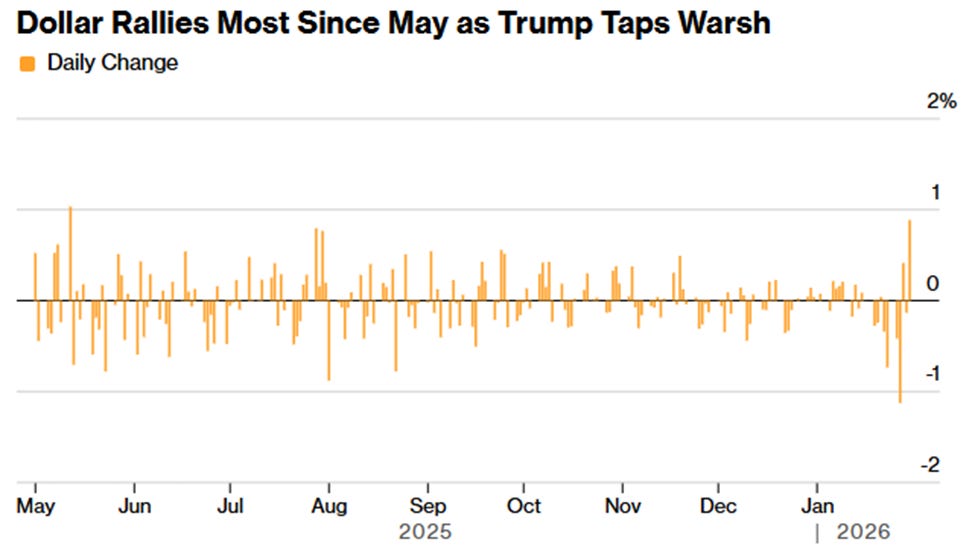

President Trump selected former Fed Governor Kevin Warsh to be the new Fed Chairman. That was an odd pick, because I don’t perceive him to be any more dovish than Chairman Powell. Warsh was a hawk during his tenure on the Fed board from 2007-2011 and has been a sharp critic of bond purchases by the central bank, otherwise known as quantitative easing. That runs counter to the tune he clearly had to sing to be chosen. This is why the dollar spiked immediately following the announcement, driving stock and commodity prices lower. Regardless, he is qualified, brings experience, and is much better than some of the other people that could have been chosen. Regardless, I still think we will have at least two more rate cuts during the second half of this year to address a soft labor market, as lower rates of inflation resume, which is in line with the market’s view. We don’t need the rate cuts today.

0

Comments

Want to join the conversation?

Loading comments...