The Market Brief

•February 10, 2026

0

Why It Matters

Understanding the interplay between macro data releases and momentum-driven market moves helps traders position themselves ahead of potential volatility. By applying a structured approach to momentum and technical confluence, listeners can make more disciplined, higher‑probability investment decisions in a rapidly shifting market environment.

The Market Brief

Impact Snapshot

-

🟥 Retail Sales - 8:30am

Macro Viewpoint

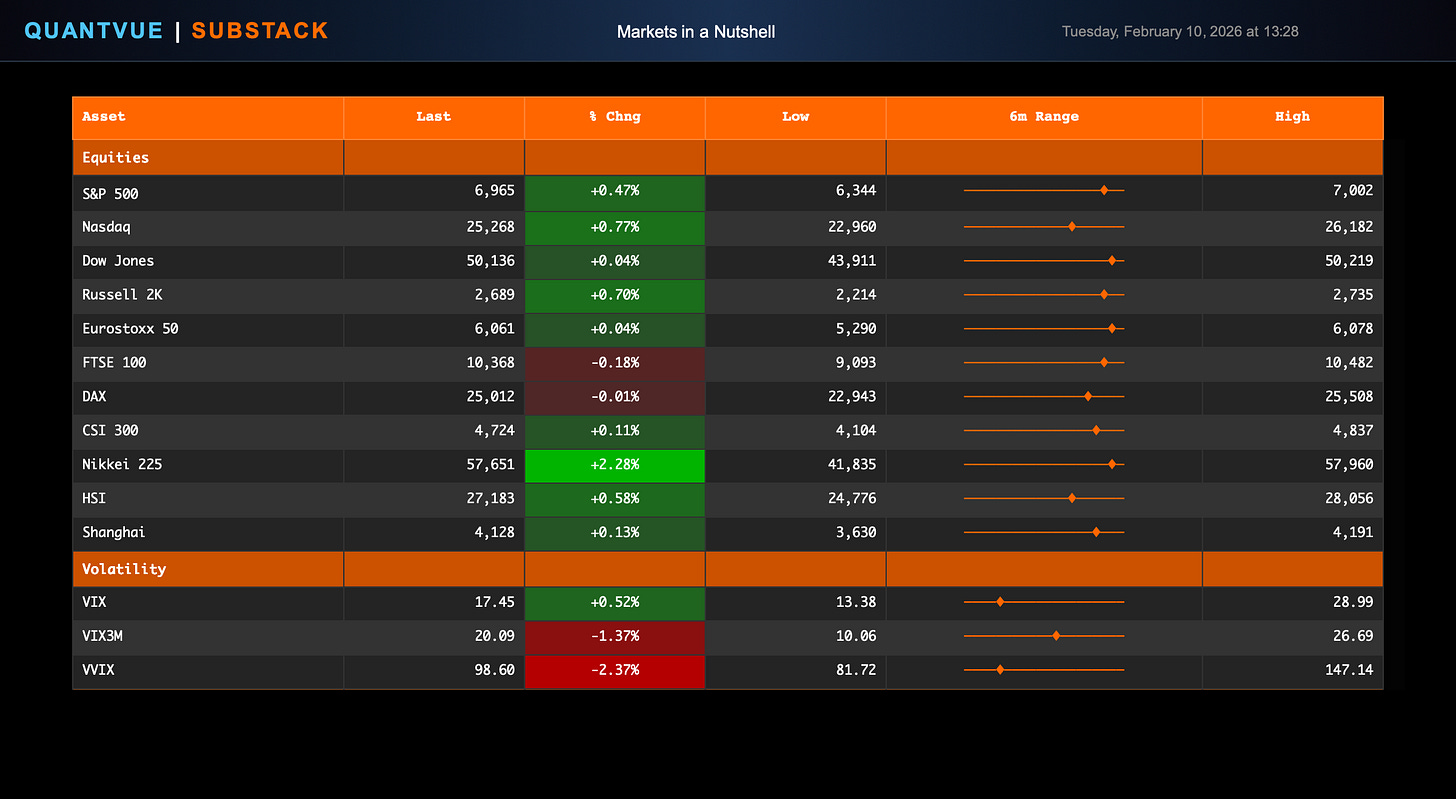

The S&P 500 rally paused just shy of all-time highs as markets await a slate of US economic data, beginning with retail sales today.

[

](https://substackcdn.com/image/fetch/$s_!MRIH!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fac2a89c8-90af-4904-bc38-930916d3ad48_2402x1318.png)

US equities closed higher Monday, building on last week's momentum and reversing early session weakness. Technology led the advance with broad-based sector buying. The AI trade found renewed support following positive OpenAI headlines, with strength extending into metals as well.

Prime Intelligence

Momentum is the leading indicator. All we’re trying to do when creating a market plan is adding context behind this momentum. When building a market plan, our goal is to layer additional structure around momentum signals to improve trade timing and execution.

Yesterday’s session presented a clean rotation opportunity at our reference levels. This video walks through how we interpret systematic strategy signals at these key zones to add confluence to our trading decisions.

By aligning momentum with defined technical levels, we can identify higher-probability setups and manage risk more effectively.

You can access our daily market plan by subscribing.👇

[

](https://substackcdn.com/image/fetch/$s_!p-wz!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F72ab6939-21f6-494e-b723-75e35612555a_1500x500.png)

0

Comments

Want to join the conversation?

Loading comments...