Too Many Bulls Getting Shocked As AI Turns On Humans

•February 5, 2026

0

Why It Matters

A BBR above four historically precedes market pullbacks, so investors should brace for volatility. The shift toward value and away from AI‑exposed tech could reshape portfolio allocations across the market.

Key Takeaways

- •Investors Intelligence BBR exceeds 4, indicating bullish overextension

- •S&P 500 sectors hit record highs this week

- •Value index may outpace growth amid AI-driven tech slowdown

- •AI competition pressures technology earnings expectations

- •Contrarian investors watch BBR for potential sell‑off trigger

Pulse Analysis

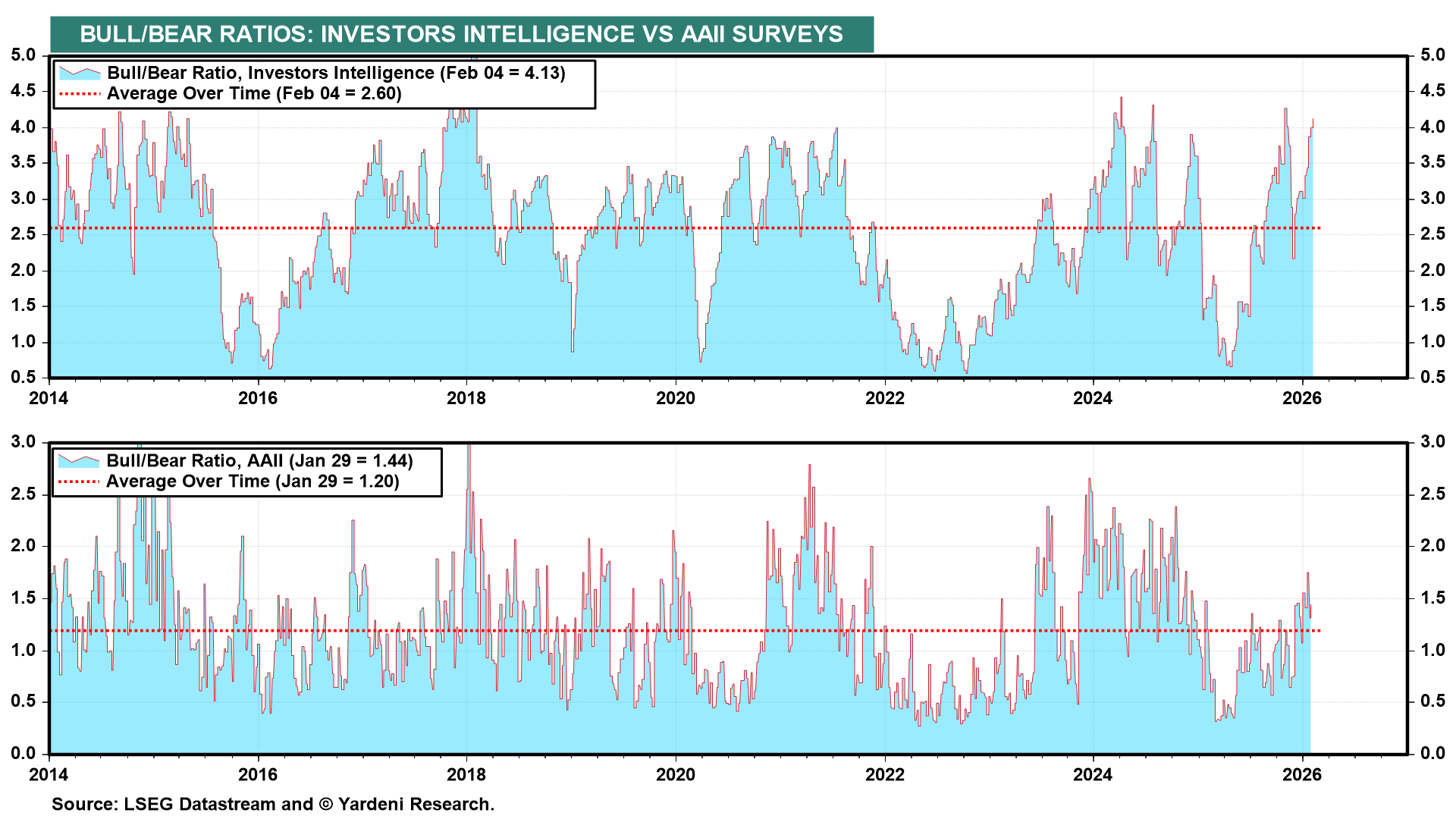

The Bull/Bear Ratio (BBR) remains a barometer for contrarian investors, and a reading above four has historically foreshadowed market corrections. By comparing the current 4.13 level to past cycles, analysts note that such extreme bullishness often precedes a shift in investor sentiment, prompting risk‑averse positioning. Understanding the BBR’s predictive power helps market participants gauge the timing of potential pullbacks, especially when other macro indicators align.

Artificial intelligence is reshaping the technology sector’s growth narrative. As AI tools proliferate, incumbent tech firms face intensified competition, compressing margins and unsettling earnings forecasts. This pressure is reflected in the emerging outperformance of the S&P 500 Value index relative to its Growth counterpart, suggesting investors are reallocating capital toward sectors perceived as less vulnerable to AI disruption. The broader implication is a re‑pricing of growth premiums, with valuation models adjusting for heightened uncertainty around future AI‑driven revenue streams.

Sector rotation is now evident across the S&P 500, with Communication Services, Consumer Staples, Energy, Industrials and Materials all hitting record highs. Such breadth indicates that while sentiment remains overly bullish, capital is seeking safety in traditionally defensive and commodity‑linked industries. For portfolio managers, this environment calls for a balanced approach: maintaining exposure to value‑oriented assets while monitoring AI‑related tech stocks for signs of earnings volatility. Strategic hedging and selective sector exposure can mitigate downside risk as the market reconciles bullish sentiment with emerging fundamental challenges.

Too Many Bulls Getting Shocked As AI Turns On Humans

Article

Last Thursday, we noted that the Investors Intelligence Bull/Bear Ratio of 3.99 suggested the market was vulnerable to a sell‑off. So far, so bad. What's worse is that the BBR rose to 4.13 this week (chart). There are still too many bulls from a contrarian perspective. But a few more days like yesterday and today would bring the BBR back down.

The good news is that the S&P 500 bull market is continuing to broaden. So far this week, the following S&P 500 sectors posted record highs: Communication Services, Consumer Staples, Energy, Industrials, and Materials. It might be another of many head‑fakes, but the S&P 500 Value stock‑price index may be starting to outperform the S&P 500 Growth stock‑price index (chart). That's if technology stocks continue to underperform as a result of increasing AI‑induced competition in the space and uncertainty about future earnings growth.

0

Comments

Want to join the conversation?

Loading comments...