WELL: What To Do When Your Stock Gets Overvalued

•February 9, 2026

0

Why It Matters

Overvalued positions can erode portfolio returns if left unchecked, and timely, measured exits protect gains while preserving upside potential. The discussion highlights practical tactics for investors facing rapid price appreciation in high‑growth sectors.

Key Takeaways

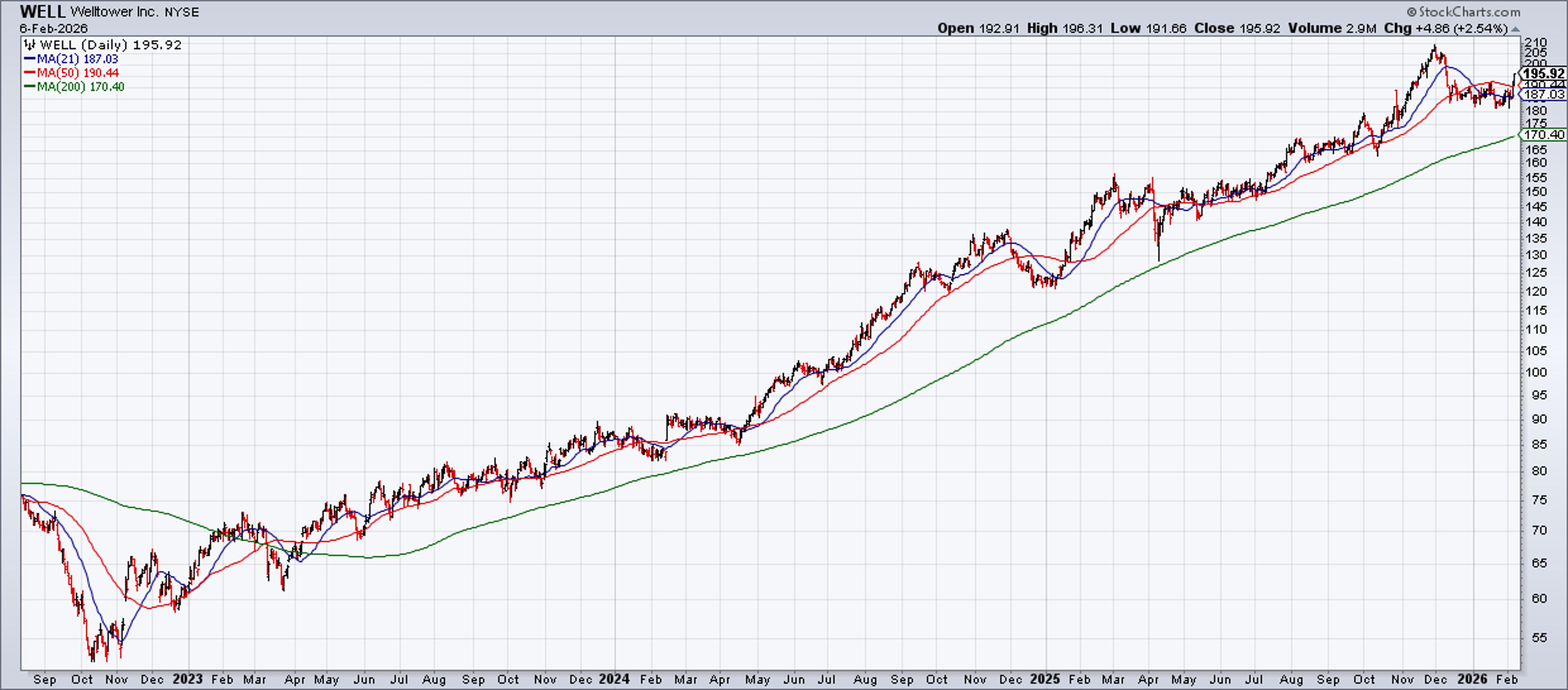

- •Welltower shares up ~200% in three years

- •Baby Boomer demand drives senior housing REIT growth

- •Author recommends partial sales or covered calls for hot stocks

- •Process‑oriented approach prevents emotional decisions during valuation spikes

- •Overvaluation may precede correction, but timing remains uncertain

Pulse Analysis

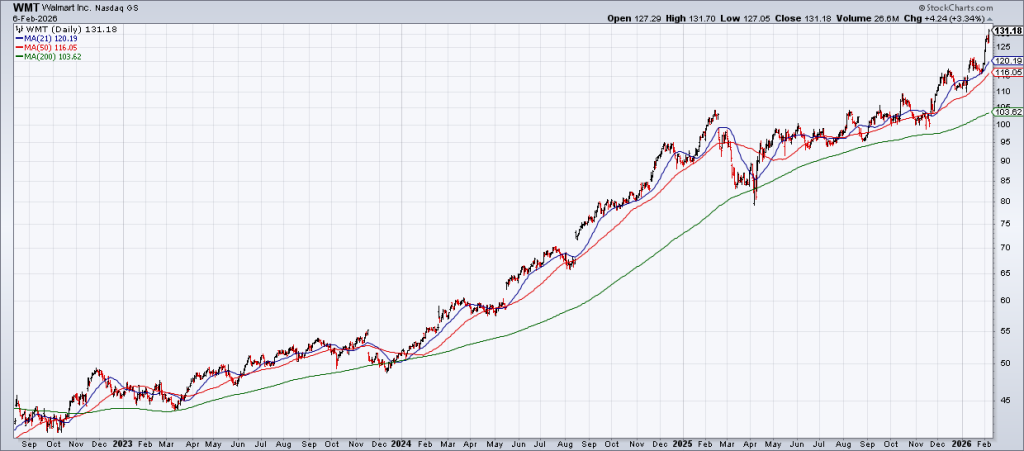

When a stock’s valuation stretches beyond fundamentals, even the most steadfast buy‑and‑hold investors must reassess. The author’s experience with Walmart illustrates this dilemma: a forward P/E that ballooned from 30x to 50x forced a partial sale and covered‑call overlay. Although the timing left money on the table, the disciplined exit strategy prevented exposure to a potential correction and reinforced the value of a clear, repeatable process. This case underscores that overvaluation is not a binary signal to sell, but a cue to adjust exposure strategically.

Welltower (WELL) exemplifies a sector riding a powerful demographic wave. As the Baby Boomer cohort ages into their 80s, demand for premium senior‑housing and care services accelerates, providing a secular tailwind for REITs focused on this niche. The stock’s 200% appreciation over three years reflects both strong earnings growth and investor enthusiasm for the demographic story. However, such rapid price gains compress valuation multiples, raising the risk of a pull‑back if earnings growth falters or market sentiment shifts.

Portfolio managers can navigate these scenarios by blending partial profit‑taking with option‑based income strategies. Selling a fraction of holdings preserves capital while retaining upside, and writing covered calls on the remainder generates premium that cushions potential declines. Maintaining a process‑oriented framework—defining valuation thresholds, position sizing, and exit tactics—helps avoid emotional decisions and aligns actions with long‑term objectives. By applying these tools, investors can manage overvalued positions like WELL without abandoning the core philosophy of buying quality businesses for the long haul.

WELL: What To Do When Your Stock Gets Overvalued

For the most part I am an advocate of “Buy right and sit tight”. That is: Buy great companies and hold on for the ride as the real money is made in the long swing as great companies compound earnings over long periods of time – and the stock price follows. (For more on this philosophy get my Free Report: “Buy Right and Sit Tight: How The Big Money Is Made In Stocks”).

But sometimes a stock simply gets too expensive and some sort of adjustment is required. I am currently facing this issue with senior housing REIT Welltower (WELL) heading into earnings Tuesday afternoon. But I previously dealt with it with Walmart (WMT) at the end of 2024 and it’s worth revisiting how I handled things then and how things have subsequently played out.

On August 17, 2024 I wrote a blog subsequent to WMT’s 2QFY25 earnings report titled “Why I Won’t Sell WMT Even Though It’s Overvalued and Overextended; Old Partridge”. At the time the stock was trading in the mid-$70s with a forward P/E ~30x.

Three months later, the stock had continued to climb and I started to feel uncomfortable. Ahead of their 3QFY25 earnings report I wrote a blog titled “WMT Is Overvalued and Overextended Heading Into Earnings; How I’m Protecting My Profits” (November 16, 2024). Since my previous blog, WMT had added another $10 and was trading in the mid-$80s with a forward P/E ~35x.

This time I sold a chunk of my position ahead of earnings and $88 strike price covered calls on the remaining shares. In the event, the stock surged even further on earnings and the last of my remaining shares were called away from me.

Looking back 15 months later, the stock did correct after its 4QFY25 earnings report in early 2025 – only to find a bottom and roar even higher over the last year. WMT shares closed Friday at an incredible $131.18 on Friday giving it a 50x P/E on FY26 guidance (FY26 ended on January 31, 2026 and WMT will report shortly).

In retrospect, I sold too early leaving a lot of money on the table. But who could have predicted that WMT would reach a valuation of 50x? WMT is a great but mature business. Its growth rate barely justifies a multiple half of 50x.

If we’re going to be results oriented, I made a mistake. But I’m happy with my process. I don’t think this valuation is sustainable and WMT is setting up for a nasty correction – though I have no idea exactly when it will occur.

The same thing is happening now with WELL. WELL is printing great quarter after great quarter with the secular tailwind of the first of the Baby Boomers (1946-1964) turning 80 in 2026 and the rest of them to come over the next 18 years. The Baby Boomers hold most of the wealth in the country and are willing to pay up for premium senior housing when they need it.

The stock is up ~200% over the last three years and I’m sitting on some good profits. I’m at about the stage I was when I wrote the first WMT blog on August 17, 2024. I’m concerned about overvaluation – but I’m not ready to unload my position yet. Should the stock surge after earnings on Tuesday, however, I will likely reach the stage when I wrote the second blog three months later where I sold a chunk and covered calls on the remaining shares.

The subject of this blog primarily falls under a category I call “Portfolio Management”. While “Buy right and sit tight” is the perennial philosophy, there are exceptions and positions sometimes have to be managed.

Two principles apply. One: Be process oriented. While a great stock that has momentum can continue to run after you rightly sell it, that doesn’t mean you made a mistake. Two: You don’t have to sell everything. You can sell 1/3 or 1/2 or 2/3 and/or you can sell covered calls on your position. Investing is an art not a science and these are the prudent things to do when a stock you own simply becomes too hot to handle.

0

Comments

Want to join the conversation?

Loading comments...