Video•Feb 20, 2026

WMT Downgrade, DECK Upgrade, TXRH Double Miss in Earnings

Texas Roadhouse (TXRH) gained Friday morning despite posting a double miss in earnings. HSBC downgraded Walmart (WMT) to hold from buy over growth concerns. Deckers (DECK) stepped up thanks to an upgrade from Argus. Diane King Hall talks about the analyst and earnings movers to watch on the last day of the trading week. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe to the Market Minute newsletter - https://schwabnetwork.com/subscribe Download the iOS app - https://apps.apple.com/us/app/schwab-network/id1460719185 Download the Amazon Fire Tv App - https://www.amazon.com/TD-Ameritrade-Network/dp/B07KRD76C7 Watch on Sling - https://watch.sling.com/1/asset/191928615bd8d47686f94682aefaa007/watch Watch on Vizio - https://www.vizio.com/en/watchfreeplus-explore Watch on DistroTV - https://www.distro.tv/live/schwab-network/ Follow us on X – https://twitter.com/schwabnetwork Follow us on Facebook – https://www.facebook.com/schwabnetwork Follow us on LinkedIn - https://www.linkedin.com/company/schwab-network/ About Schwab Network - https://schwabnetwork.com/about #walmart #deckers #texasroadhouse #economy #finance #investing #marketnews #stock #stockmarket #trading #live #schwabnetwork #wmt #deck #txrh #earnings #guidance #retail #ecommerce #shoes #ugg #hoka #restaurant #chart

By Schwab Network (ex‑TD Ameritrade Network)

Video•Feb 20, 2026

Today on Taking Stock | Markets Slide With Earnings and Oil in Focus

By NYSE Official

Video•Feb 20, 2026

Stocks Slide as Oil Jumps on Rising US-Iran Tensions | The Close 2/19/2026

The Close highlighted a sharp equity sell‑off on Feb 19, 2026 as Brent crude surged to its highest level since July amid escalating U.S.–Iran tensions. The S&P 500 slipped about 0.6% and the Nasdaq 100 fell roughly 0.7%, while the VIX nudged back...

By Bloomberg Television

Video•Feb 19, 2026

Thursday's Final Takeaways: Trade Deficit Narrows & Tech Rotation Continues

Beyond today's stock movers, Marley Kayden and Sam Vadas turn to the broader market perspective by discussing the narrowing trade deficit and the continuing rotation out of tech. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe...

By Schwab Network

Video•Feb 19, 2026

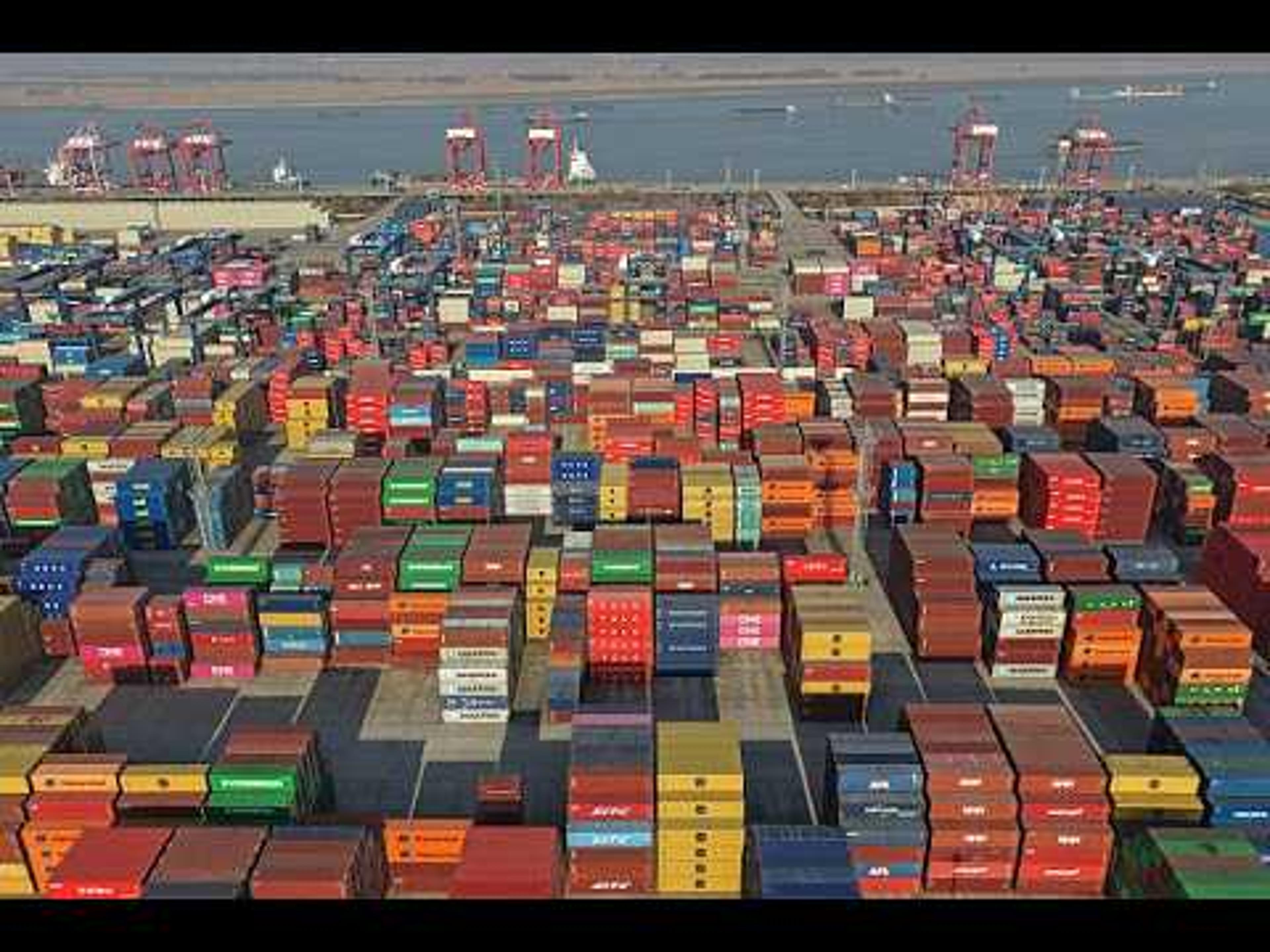

US Runs Annual Trade Deficit Up to $901 Billion, One of Biggest Since 1960

U.S. trade data released this week showed the annual deficit expanding to $901 billion, the widest gap since the early 1960s. After a brief narrowing in the first half of last year, imports surged in the second half, pushing the balance...

By Bloomberg Television

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 19, 2026

Stocks Slide as Oil Spikes on US–Iran Tension | Closing Bell

The closing bell showed U.S. equities slipping as oil prices spiked on renewed U.S.–Iran tensions. The S&P 500 and Nasdaq each fell roughly 0.3%, while the Russell 2000 managed a modest gain, underscoring the market’s mixed reaction to geopolitical risk. Energy‑related concerns lifted...

By Bloomberg Television

Video•Feb 19, 2026

Figma Gains on Strong Growth Outlook that Eases AI Fears

Figma’s latest earnings call highlighted a bullish growth outlook that directly counters lingering industry anxieties about artificial‑intelligence disruptions. The company emphasized that as AI improves, its own product suite becomes more powerful, positioning the design platform to benefit rather than...

By Bloomberg Television

Video•Feb 19, 2026

Charting DE After Earnings Send Shares to All-Time High

Agriculture companies have taken a much bigger investor focus to start 2026, and no company may have muscled more gains than Deere & Co. (DE). Shares of the company have climbed more than 40% in the last few weeks, helped...

By Schwab Network

Video•Feb 19, 2026

Amazon Dethrones Walmart

The video highlights that Amazon finally eclipsed Walmart in total sales for 2025, reporting $717 billion versus Walmart’s $713.2 billion, cementing a shift from the traditional Walmart‑Target rivalry to a direct Amazon‑Walmart showdown. Analysts note Walmart’s strategic pivot toward technology: a $40 billion free‑cash‑flow...

By Yahoo Finance

Video•Feb 19, 2026

Finding "Goldilocks" Crude Oil Price & ETFs Tying Energy to AI Boom

$70 crude oil will be the "goldilocks" price, says Rob Thummel as the commodity ticks higher due to geopolitical risk. He talks about the risk premium due to tensions between the U.S. and Iran, and how an "oversupply" in oil...

By Schwab Network

Video•Feb 19, 2026

Why U.S. & Iran Tensions Power Energy Price Surge #shorts

Nicole Petallides explains why the latest tensions between the U.S. and Iran led to significant price action to the upside for crude oil and energy-tied stocks. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe to the...

By Schwab Network

Video•Feb 19, 2026

"Damage Already Done" To MSFT? Sell-Off Presents New Mag 7 Opportunity

Microsoft (MSFT) hit 9-month lows and currently trades around $400 after shares hit $555 last summer. @CharlesSchwab's Ben Watson highlights key levels in Microsoft's chart that offer opportunities for bulls following the Mag 7 stock's substantial repricing. Kevin Hincks joins...

By Schwab Network

Video•Feb 19, 2026

'This Is a Global Bull Market, and We Don't Think It's Going to End Any Time Soon': Detrick

Ryan Detrick, chief market strategist at Carson Group, told viewers that the S&P 500 is poised for double‑digit gains this year, underscoring a broader belief that the current rally is part of a global bull market that shows no signs of...

By BNN Bloomberg

Video•Feb 18, 2026

10-Year T-Note Futures Declined After Hawkish Fed Minutes. 2/18/26

The market focus on February 18 was the decline in 10‑year Treasury note futures after the Federal Reserve released its minutes. Futures slipped for a second straight session, retreating from a two‑and‑a‑half‑month high and trading around the 112.29 level. Two catalysts...

By CME Group