🎯Today's Banking Pulse

Updated 20m agoWhat's happening: Banks eye six tech trends to stay competitive in 2026

Banks are under mounting regulatory, economic and consumer pressure, prompting a shift toward targeted technology investments. nCino outlines six 2026 trends, from AI‑driven mobile banking that functions as a personal financial command centre to AI‑powered verification that can dramatically cut loan‑processing time. The focus moves from blanket AI deployments to purpose‑built solutions that boost efficiency and compliance.

Also developing:

By the numbers: Bank of America pledges $25bn private credit fund

News•Feb 20, 2026

Upcoming Changes to the Euribor Panel

The European Securities and Markets Authority (ESMA) announced that Barclays Bank PLC will withdraw from the Euribor panel, with its final contribution date set for 27 February 2026. ESMA and the Euribor College of Supervisors assessed the impact and concluded that the departure does not jeopardise the benchmark’s representativeness. The panel has recently expanded, adding three new banks since 2022, and EMMI signals that another institution will join shortly. ESMA continues to encourage additional credit institutions to participate to strengthen the benchmark.

By ESMA – Press

Social•Feb 20, 2026

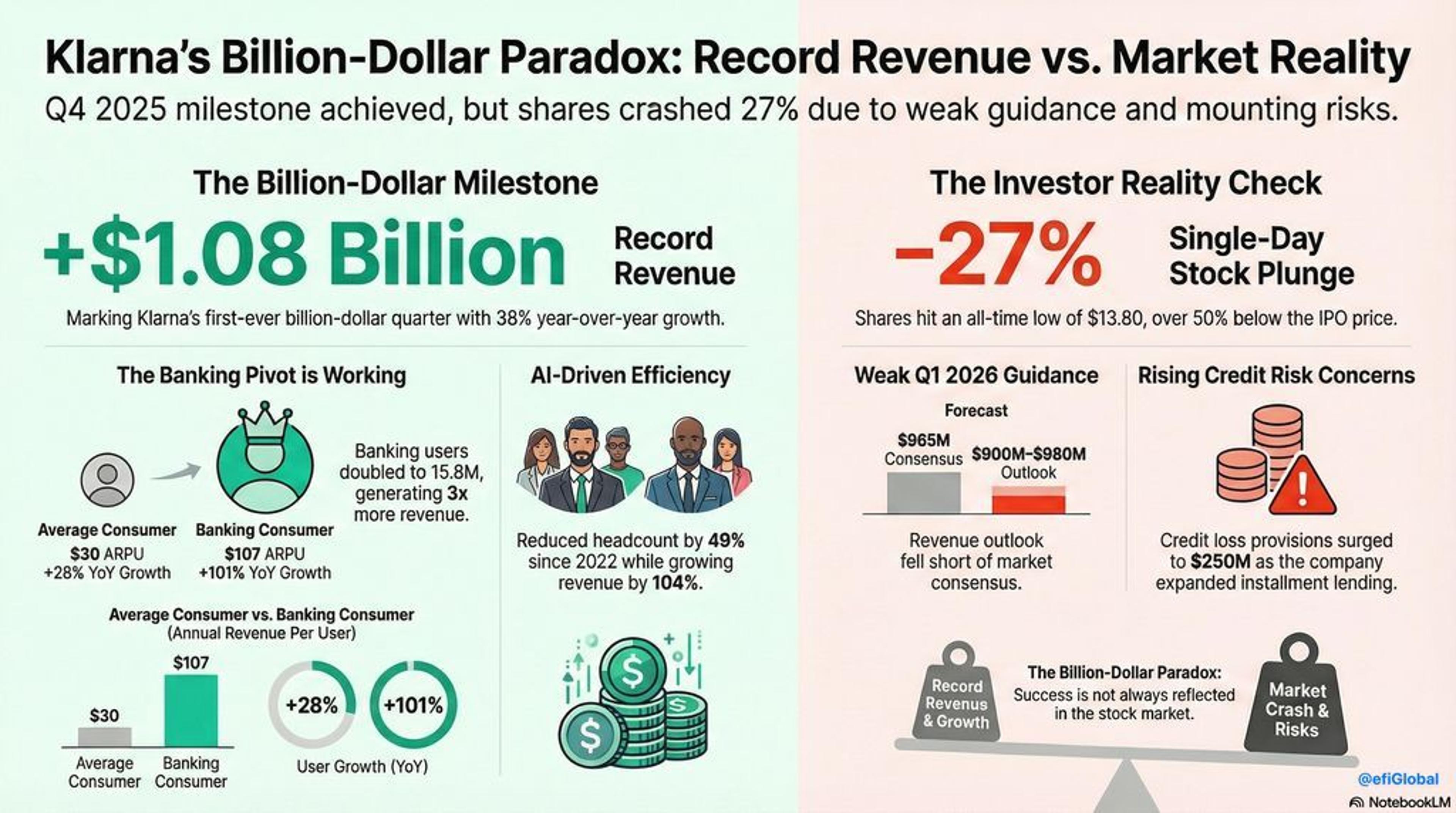

Klarna Hits $1B, Doubles Users, yet Stock Plunges

Klarna just posted its first $1B revenue quarter, successfully doubling its banking users to 15.8 million. The pivot from a pure BNPL provider to a global digital bank is underway. But Wall Street just handed them a massive 27% stock drop....

By Efi Pylarinou

Social•Feb 20, 2026

Policy-as-Code Guardrails Preempt AI Compliance Violations

Agentic AI Gating Layer: Policy-as-Code = gating layer for agentic AI Controls AI actions by: Separating free-form reasoning (AI decides) from allowed execution (policy permits) Improving auditability (clear what AI can/can't do) Preventing compliance violations before they happen Guardrails, not post-incident cleanup. 📰 Intelligent compliance for...

By Efi Pylarinou

News•Feb 20, 2026

European Central Bank Analysis Highlights Stabilizing Euro Area Property Investment Amid Mixed Drivers

The European Central Bank’s latest focus piece finds euro‑area property investment has likely bottomed out in late 2024, with a brief, modest rebound in early 2025 that quickly faded. After a sharp decline that began in 2022, housing investment remains about 7 %...

By Crowdfund Insider

Social•Feb 20, 2026

Local Deposits Multiply Small Business Lending, Not Government Debt

Local deposit ➡️ Local loan ➡️ Local growth A $1,000 local bank deposit can support up to $30,000 in #smallbiz lending over 5 yrs. The same $1,000 in stablecoin backs government debt. Local deposits build communities. Stablecoin reserves fund Washington. #banklocal

By Jill Castilla

Blog•Feb 20, 2026

Nexi Unveils ‘Nexi Ready’ as Europe Embrace ‘Buy’ Model

Nexi Group has launched Nexi Ready, a fully managed digital‑issuing platform that lets banks, corporates and fintechs outsource technology, scheme compliance and day‑to‑day operations while keeping their brand and customer data. The service is positioned as a new “plug‑and‑play” issuing...

By Payments Cards & Mobile (Payments Industry Intelligence)

News•Feb 20, 2026

The Six Tech Trends Banks Need on Their Radar for 2026

Banks face mounting regulatory, economic and consumer pressures as digital expectations rise, and their technology choices will dictate future competitiveness. nCino outlines six 2026 tech trends, from AI‑driven mobile banking that acts as a personal financial command centre to AI‑powered...

By Fintech Global

News•Feb 20, 2026

UK’s Lloyds Banking Group Provides £200M Credit Facility to Sovereign Network Group (SNG)

Lloyds Banking Group has granted Sovereign Network Group a £200 million revolving credit facility, bolstering its capacity to deliver new affordable homes and upgrade existing stock. SNG, formed from a 2023 merger and managing over 85,000 homes, aims to build 25,000...

By Crowdfund Insider

News•Feb 20, 2026

Databricks Reports Steady Growth, May Positively Impact Fintech and Web3 Sector

Databricks announced a $5.4 billion annual revenue run‑rate, marking 65 % year‑over‑year growth in Q4 2025. Its AI‑focused offerings alone surpassed a $1.4 billion run‑rate, while net revenue retention stayed above 140 %. The company now serves over 20,000 customers, including more than 60 %...

By Crowdfund Insider

Blog•Feb 20, 2026

FBI Warns of Surge in ATM Jackpotting, $20 Million Lost in 2025

The FBI has issued a flash alert warning of a sharp rise in ATM jackpotting, with losses exceeding $20 million in 2025 and 1,900 incidents reported since 2020. Criminal groups are deploying sophisticated malware such as Ploutus, which hijacks the XFS...

By Security Affairs

News•Feb 20, 2026

Central Bank of Ireland Calls for Stronger Economic Initiatives and Strategic Investments in 2026

Ireland’s central bank warned that the country must deepen economic resilience as it enters 2026, despite current strength. Governor Gabriel Makhlouf and Deputy Governor Vasileios Madouros outlined five domestic priorities, including targeted infrastructure, stronger indigenous businesses, fiscal buffers, household market...

By Crowdfund Insider

News•Feb 20, 2026

Banking’s Crisis of Meaning: When Purpose Disappears

Dharmesh Mistry warns that AI‑driven automation is stripping banking jobs of their intrinsic purpose, turning roles into mere button‑pressing tasks. He argues that a superficial brand slogan like “better banking” won’t survive when machines already deliver superior products. Instead, banks...

By Fintech Futures

News•Feb 20, 2026

US Market | Credit Concerns Mount: Blue Owl Shake-Up Weighs on US Financial Stocks

Blue Owl Capital announced the sale of $1.4 billion of assets across three credit funds and permanently halted redemptions in one fund to return capital and reduce leverage. The announcement triggered a broad sell‑off in listed alternative‑asset managers such as Apollo,...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Can MAS Financial Sustain Its Outperformance on Strong Growth Momentum?

MAS Financial Services (MFSL) posted double‑digit year‑on‑year growth in assets under management, revenue and net profit for the December 2025 quarter and the first nine months of FY 26, driving its stock up 9% versus the BSE Financial Services index. The...

By Economic Times — Markets

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Social•Feb 19, 2026

Retail Banking Strategies Lag Behind Execution in 2026

The 2026 Retail Banking Trends research reveals a clear gap between strategy and execution across digital, payments, AI, and partnerships. Watch the full video: https://t.co/qrsFZDRVT6 https://t.co/pesk3Lrhfe

By Jim Marous

Video•Feb 19, 2026

How Temenos Is Powering the Future of Global Money Movement

The global payments landscape is changing rapidly — with rising volumes, expanding rails, and growing expectations for speed, intelligence, and resilience. In this video, we explore how Temenos is helping banks, fintechs, PSPs, and EMIs modernise money movement through unified, scalable,...

By FF News | Fintech Finance

Video•Feb 19, 2026

What Are Payment Rails?

Payment rails are the underlying networks and infrastructure that move money from one party to another. See how they define how payments are authorized, cleared, and settled—whether through cards, ACH, wires, or real-time systems.

By PYMNTS Media

Deals•Feb 19, 2026

Banco De Bogotá Buys Back 2026 Notes

Colombian lender Banco de Bogotá announced it will repurchase close to half of its subordinated notes due in May 2026, reducing its outstanding debt. The buyback is part of the bank's effort to manage its balance sheet and improve liquidity....

LatinFinance

Deals•Feb 19, 2026

Bank of America Commits $25bn to Private Credit Lending

Bank of America announced a $25bn commitment to expand its private credit lending activities, aiming to capture more opportunities in the sector as concerns rise about its health. The move follows similar initiatives by other Wall Street institutions.

Financial Times — Companies

Deals•Feb 18, 2026

Monte Dei Paschi Moves to Take Mediobanca Private

Italian bank Banca Monte dei Paschi di Siena announced plans to take Mediobanca private, aiming to delist the investment bank from the stock exchange. The move sparked a rise in Mediobanca's share price. Deal terms and valuation were not disclosed.

Handelsblatt (English)

Deals•Feb 17, 2026

NatWest Group to Acquire Evelyn Partner for £2.7bn

NatWest Group announced it will acquire UK wealth manager Evelyn Partner in a £2.7bn deal, expanding its wealth management footprint. The acquisition, revealed last week, aims to combine NatWest’s large customer base with AI-driven wealth services. The move underscores NatWest’s...

diginomica (ERP/Finance apps)

Deals•Feb 16, 2026

Banks Prepare to Sell €4 Billion BASF Coatings Buyout Debt

Banks are preparing to market and sell €4 billion of buyout debt issued by BASF Coatings, a division of chemical giant BASF. The transaction, valued at €4 billion, is being arranged by a syndicate of banks ahead of a secondary market offering.

Bloomberg – Markets

Video•Feb 16, 2026

Why Is Now the Right Time for More Sovereign Tokenisation Developments?

London’s Digital Assets Forum highlighted Lloyd’s Banking Group’s Great British Tokenized Deposit (GBTD) initiative, a UK‑driven effort to issue interoperable, bank‑backed digital money on blockchain. The project aims to replace a fragmented stable‑coin market with a single, regulated token that...

By Finextra

Deals•Feb 16, 2026

The Access Bank UK to Acquire Zempler Bank

The Access Bank UK announced it will acquire Zempler Bank, an SME-focused lender. The transaction has received regulatory approval and is expected to close in the coming weeks.

Fintech Futures

Deals•Feb 13, 2026

MUFG to Acquire 20% Stake in Shriram Finance in $4.4B Deal

Japan's Mitsubishi UFJ Financial Group (MUFG) is set to acquire a 20% stake in India's Shriram Finance, valued at $4.4 billion. The Reserve Bank of India has cleared the transaction without requiring prior approval, and the deal has secured shareholder consent,...

Mint (LiveMint) – Companies

Deals•Feb 13, 2026

Quantum Systems Secures €150M Financing Package From EIB and Major European Banks

Munich‑based Quantum Systems announced a €150 million financing package to fund its growth and industrial scaling in Europe. The package includes a €70 million loan from the European Investment Bank and additional funding from Commerzbank, Deutsche Bank and KfW, combining debt and...

EU-Startups

Deals•Feb 13, 2026

Santander Bank to Acquire Webster Bank for $12.2 Billion

Santander Bank announced a $12.2 billion acquisition of Webster Bank, aiming to expand its U.S. retail banking presence. The deal, pending regulatory approval, is expected to close later this year and will create one of the largest banking consolidations in the...

Doctor of Credit

Deals•Feb 12, 2026

Gulf Development Raises Stake in Kasikornbank to 10%

Gulf Development Plc increased its shareholding in Kasikornbank to 10.03% after acquiring additional shares on Feb 12, 2026, as disclosed in a filing on Feb 16. The stake remains below Thailand's 10% regulatory threshold, avoiding central bank approval, and is...

Bangkok Post – Investment (subset within Business)

Video•Feb 10, 2026

Crypto Winter or Correction? This Analyst Explains the Difference

The interview centers on whether today’s crypto slump constitutes a prolonged "crypto winter" or merely a market correction. Analyst Andrew argues the former is inaccurate, noting that while Bitcoin has fallen about 45% and Ethereum roughly 55% since October, development...

By Yahoo Finance

Video•Feb 10, 2026

Russia Is Becoming a Second-Rate State Under Putin, Says Eurasia Group's Ian Bremmer

Ian Bremmer of Eurasia Group warned that Russia is slipping into a second‑rate state under Putin, while the United States is abandoning its traditional role as the guarantor of collective security, free trade and democratic norms. Bremmer argued that the U.S....

By Bloomberg Television

Video•Feb 10, 2026

PayPal Is Running Out of Time, Says Former President

In a candid interview, former PayPal president and LightSpark CEO David Marcus warned that Bitcoin’s recent price weakness is less a market correction than a structural shift toward institutional ownership. He argued that the October 10, 2026 events accelerated the transition from...

By Bloomberg Television

Video•Feb 10, 2026

Why the Rising Federal Debt Could Limit AI and Overall Economic Growth

The Wharton Future of Finance conference tackled a looming fiscal dilemma: the United States’ trajectory toward $2 trillion‑a‑year budget deficits could starve the economy of the capital needed to sustain AI research and broader digital transformation. Professors Gomez and Goldstein warned...

By Knowledge at Wharton

Video•Feb 5, 2026

President Lagarde Presents the Latest Monetary Policy Decisions – 5 February 2026

President Christine Lagarde’s February 5 press conference confirmed that the European Central Bank kept its three key policy rates on hold, emphasizing a data‑dependent stance as inflation eases toward the 2% medium‑term target. The meeting also marked Bulgaria’s accession to...

By European Central Bank

Video•Feb 5, 2026

ECB Governing Council Press Conference - 5 February 2026

The European Central Bank’s Governing Council met on 5 February 2026 and left its three policy rates unchanged, underscoring a data‑dependent, meeting‑by‑meeting approach. The press conference also marked Bulgaria’s formal entry into the euro area on 1 January, bringing the bloc’s membership to...

By European Central Bank