🎯Today's Banking Pulse

Updated 1h agoWhat's happening: Banks eye six tech trends to stay competitive in 2026

Banks are under mounting regulatory, economic and consumer pressure, prompting a shift toward targeted technology investments. nCino outlines six 2026 trends, from AI‑driven mobile banking that functions as a personal financial command centre to AI‑powered verification that can dramatically cut loan‑processing time. The focus moves from blanket AI deployments to purpose‑built solutions that boost efficiency and compliance.

Also developing:

By the numbers: Bank of America pledges $25bn private credit fund

News•Feb 19, 2026

Subprime Demand Drives US Loan Growth to New Heights

Subprime borrowers propelled U.S. unsecured loan balances to a record $276 bn, a 10% increase year‑over‑year, with 26.4 million consumers holding such loans. Credit‑card issuers expanded lending to lower‑income customers, pushing total balances 4% higher to $1.15 trillion, but responded by trimming initial credit limits. Delinquency rates have inched upward as consumers use loans to offset stagnant wages and higher living costs. TransUnion expects slower growth ahead, forecasting a 5.7% rise in new unsecured loans in 2026 alongside modest mortgage and refinancing gains, while auto loans are set to dip 1.5%.

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 19, 2026

Retail Banking Strategies Lag Behind Execution in 2026

The 2026 Retail Banking Trends research reveals a clear gap between strategy and execution across digital, payments, AI, and partnerships. Watch the full video: https://t.co/qrsFZDRVT6 https://t.co/pesk3Lrhfe

By Jim Marous

Social•Feb 19, 2026

Real‑time 24/7 Global Payments Now Available Instantly

At @Lightspark we first focused on the most difficult global money movement problem: realtime, 24/7 P2P for banks. It gave us superpowers now available for B2B, B2C payouts, global pay-ins/virtual accounts, and treasury management. Same day setup: https://t.co/1cRJucmFKd

By David Marcus

News•Feb 19, 2026

World Briefs | Rwanda Hikes Lending Rate on Higher Inflation

Rwanda’s central bank raised its key lending rate by 50 basis points to 7.25% on Thursday, reacting to a jump in consumer price inflation to 8.9% year‑on‑year in January. The move aims to bring inflation back within the bank’s 2‑8%...

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 19, 2026

Armstrong Blames Trade Groups, Urges Banks to Embrace Stablecoin Yields

NEW: Brian Armstrong says banking trade groups, not individual banks, are blocking crypto market structure progress, and that banks should see stablecoins with yield as an opportunity, not a threat https://t.co/fU43imp3Gg

By Wendy O

News•Feb 19, 2026

Elizabeth Warren Has Questions About the Shake-Up Inside the Fed’s Banking Regulator

Senator Elizabeth Warren wrote to Federal Reserve Vice Chair for Supervision Michelle Bowman demanding details on recent internal changes within the Fed’s banking‑supervision division, including reported job cuts and the sidelining of senior examiners. The request also asks for a...

By The Wall Street Journal – Markets

Social•Feb 19, 2026

UBS Accelerates AI to Transform Banking Operations

UBS Steps Up AI Initiatives to Reshape Banking Operations - Fintech Schweiz Digital Finance News - FintechNewsCH https://t.co/lzgbtiumUP

By Oliver Bussmann

Social•Feb 19, 2026

Fintech Digitizes 2,000‑year Red Packet Tradition

🌏🧧How #Fintech is transforming the 2,000-year Red Packet tradition: Technology is not only transforming how business is done within the industry but even culture itself. Today, an increasing number of red packets are being shared via online solutions at banks during...

By Urs Bolt

Blog•Feb 19, 2026

Banker Calls for Peak Banker

National Australia Bank CEO Andrew Irvine warned that Australia has hit "peak Australia," signalling that without a productivity boost the economy will stagnate. Real wages fell for the first time in two years, underscoring the pressure on living standards. Irvine...

By MacroBusiness (Australia)

Social•Feb 19, 2026

Payments: Platform Convenience vs Crypto Sovereignty Showdown

Will #payments be controlled by platforms or executed by open protocols? #BigTech prioritises convenience and consumer protection, while #crypto emphasises user sovereignty and broader agent-level execution.

By Urs Bolt

Social•Feb 18, 2026

Past Success Can Sabotage Future Bank Performance

How past success can doom banks to weak performance in the future. New in @AmerBanker @BankThink https://t.co/pa0WB3Dh6V

By JP Nicols

News•Feb 18, 2026

Tech-Powered Credit Reform Could Add £7bn to the UK’s GDP, Report Claims

ClearScore’s new white paper argues that modernising credit‑worthiness assessments with open‑banking data and AI could add up to £7 bn to the UK’s annual GDP. It highlights that 17 million adults face a £2 bn credit supply gap, with up to 60% of...

By UKTN (UK Tech News)

News•Feb 18, 2026

Milo Tops $100 Million in Crypto-Backed Mortgages, Closes Record $12 Million Deal

Milo, a U.S. crypto‑lending firm, has originated more than $100 million in crypto‑backed mortgages, highlighted by a record $12 million loan. The company operates in ten states and offers loans up to $25 million secured by Bitcoin or Ether, with interest starting at...

By CoinDesk

News•Feb 18, 2026

Businesses Move to Rein In AI in the Shift to Autonomous Finance

Enterprises are granting AI agents authority to initiate payments, approve refunds, and orchestrate cross‑functional workflows, shifting from assistance to autonomous action. Security researchers warn that more than 1.5 million deployed agents could be exposed to misuse, expanding the attack surface faster...

By PYMNTS

News•Feb 18, 2026

Wells Fargo Sees ‘YOLO’ Trade Driving $150B Into Bitcoin and Risk Assets

Wells Fargo analyst Ohsung Kwon predicts that a surge in U.S. tax refunds could channel up to $150 billion into risk‑on assets, notably equities and Bitcoin, by the end of March. The influx is tied to a revival of the retail “YOLO”...

By Cointelegraph

News•Feb 18, 2026

EBA Issues Opinion to the European Commission on the Draft Amended European Sustainability Reporting Standards

The European Banking Authority (EBA) has issued an Opinion to the European Commission on the draft amended European Sustainability Reporting Standards (ESRS) prepared by EFRAG. While the EBA welcomes the simplifications that reduce reporting costs, it warns that permanent reliefs...

By EBA – News

News•Feb 18, 2026

Matic and nCino Embed Home Insurance Into Digital Mortgages

Matic and nCino have teamed up to embed a home‑insurance marketplace directly into nCino’s digital mortgage platform. The integration lets borrowers compare and purchase policies from more than 70 carriers without leaving the loan application flow. Lenders gain earlier access...

By Fintech Global

News•Feb 18, 2026

Experience Economy Pushes Payments to $20B Super Bowl Test

The 2026 Super Bowl generated roughly $20.2 billion in experience‑economy spending, spanning tickets, merchandise, streaming and legal wagering. Paysafe’s CEO Bruce Lowthers highlighted the need for payment platforms that can process massive, real‑time transactions across multiple methods without friction. AI‑driven fraud...

By PYMNTS

News•Feb 18, 2026

As Tax Refunds Tackle Debt, Installment Payments Become a Budget Tool

Tax refunds rose 10.9% to an average $2,290, but tariffs on consumer goods have erased 70‑95% of their purchasing power for most households. The 2024 One Big Beautiful Bill Act expanded tax cuts, yet higher tariffs and price inflation offset...

By PYMNTS

News•Feb 18, 2026

Nearly Half of Digital Bank Customers Prefer Digital Wallets

A PYMNTS Intelligence survey of 2,071 U.S. bank customers finds that 44.6% of digital‑bank users prefer paying with digital wallets, outpacing other groups. When paired with discounts and clear buyer protection, 35.4% say they would shift account‑to‑account spending to pay‑by‑bank....

By PYMNTS

Blog•Feb 18, 2026

Britain’s Renewed Appetite for Credit Cards

The UK credit‑card market has rebounded, with net lending up 12.4% year‑on‑year in December 2025 and outstanding balances reaching a record £78 billion. Despite higher unemployment and elevated household debt, arrears sit at just 1.2%, and debt‑service ratios are roughly half...

By Payments Cards & Mobile (Payments Industry Intelligence)

News•Feb 18, 2026

Banco Itaú Teams Up with iCapital to Enhance Private Markets Offering with New Tech Solution

Banco Itaú International and Banco Itaú (Suisse) have expanded their partnership with fintech platform iCapital, embedding iCapital’s technology into the bank’s private‑markets offering. The integration delivers an end‑to‑end digital ecosystem covering marketing, onboarding, documentation, reporting and analytics, and introduces iCapital’s...

By Crowdfund Insider

News•Feb 18, 2026

Standard Chartered Partners with B2C2 to Enhance Institutional Crypto Access

Standard Chartered has teamed up with digital‑asset liquidity provider B2C2 to create a seamless bridge between traditional banking infrastructure and crypto markets. The alliance will give institutional investors—such as asset managers, hedge funds, corporates and family offices—direct access to spot...

By The Fintech Times

News•Feb 17, 2026

IPO-Bound Kissht's NBFC Arm Gets Crisil Rating Upgrade on Strong Growth

Kissht’s NBFC subsidiary Si Creva Capital Services received a CRISIL rating upgrade, moving its long‑term rating to A‑/Stable and short‑term to A1. The upgrade follows a surge in assets under management, which climbed to Rs 5,533 crore by September 2025, driven by rapid expansion...

By The Economic Times – Markets

Social•Feb 17, 2026

Ethiopia Deploys Real-Time National Payment Switch

Ethiopia Launches National Instant Payment System with Swiss BPC In a leap for African fintech, Ethiopia has launched its instant payment switch built on BPC’s SmartVista. The system enables 24/7 transfers and QR payments across all banks, providing the "Real-Time Rail"...

By Efi Pylarinou

Blog•Feb 17, 2026

ZeroLend Shuts Down After Liquidity Dries Up Across Layer 2s

ZeroLend announced it will wind down after three years as liquidity on the Layer‑2 networks it served evaporated. TVL plummeted from a November 2024 peak of $359 million to roughly $6.6 million, a 98% decline, and the ZERO token is down 99%...

By Laura Shin

Social•Feb 17, 2026

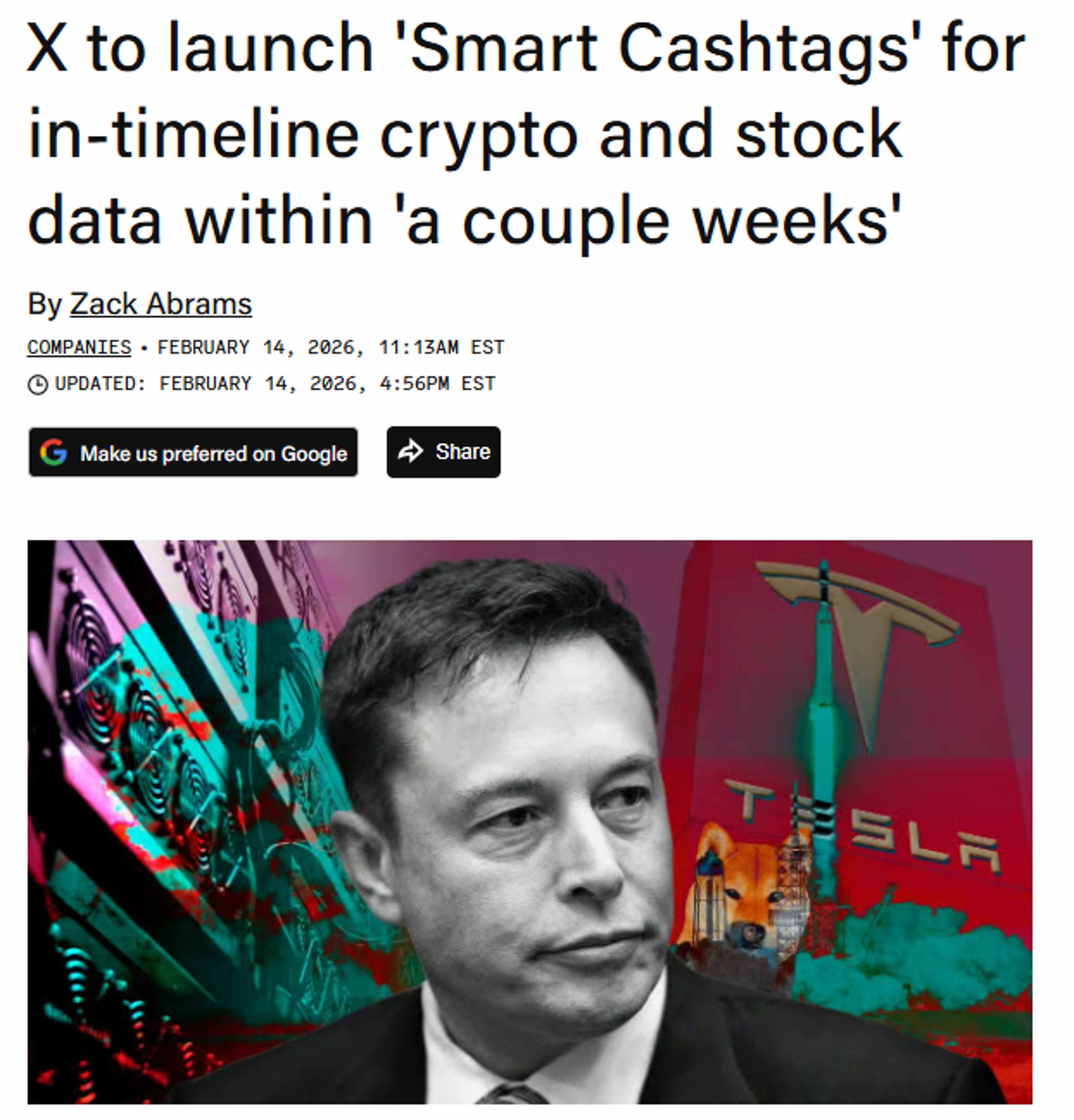

X Adds Finance Tools: Smart Cashtags and Visa‑backed Money

The platform that popularized ragebait is bringing you better gambling: 📉 @X will roll out Smart Cashtags, enabling users to view data on stocks and cryptocurrencies directly from their timeline. 💸 X Money is currently in closed beta with employees. A public...

By Nik Milanovic

News•Feb 17, 2026

Carlyle, BlackRock Buy Cheap Software Loans to Boost CLO Profits

Carlyle Group, BlackRock, Benefit Street Partners and Oak Hill Advisors are buying pools of low‑yield, software‑focused bank loans. The acquisitions are intended to seed new collateralized loan obligations (CLOs) after a year of compressed margins in the loan market. Buyers...

By Bloomberg — Business

News•Feb 17, 2026

Thai Banks’ Bad Loans Dip Slightly

Thai banks’ non‑performing loan ratio slipped to 2.84% at December, down from 2.94% in September. Bank lending fell 1.1% in Q4 2025, marking the sixth straight quarter of contraction, driven by tighter credit to SMEs and consumers. Household debt remains...

By Bangkok Post – Investment (subset within Business)

Blog•Feb 17, 2026

Indian Banks: From Credit Provision to Liquidity Provision?

India’s corporate funding is increasingly sourced domestically as the yield gap with US Treasuries narrows to about 2.5%, eroding the cost advantage of foreign‑currency debt. Deepening private‑credit markets now finance even near‑investment‑grade borrowers, exemplified by a recent $3.4 billion rupee‑denominated deal....

By Prof. Jayanth R. Varma’s Financial Markets Blog

News•Feb 17, 2026

Velera’s Chuck Fagan: ‘Speed to Member Impact’ Is the Only KPI That Matters for Credit Unions

Chuck Fagan, CEO of Velera, told PYMNTS that credit unions must make "speed to member impact" their primary KPI, measuring how quickly they deliver solutions from concept to market. He warned that the term "credit" alienates millennials and Gen Z,...

By PYMNTS

News•Feb 17, 2026

What CFOs Need From Banks and FinTechs in Cross-Border Payments

Cross‑border payments are undergoing a structural shift as CFOs demand more predictable, liquid, and compliant solutions. FinTech firms have accelerated speed and API‑driven usability, opening new corridors and transparent pricing. At the same time, banks are investing in modern settlement,...

By PYMNTS

News•Feb 17, 2026

Nairagram Completes ₦10 Billion Capital Raise to Deepen Financial Connectivity Across Africa

Pan‑African payments firm Nairagram completed a ₦10 billion commercial paper issuance, fully subscribed within 48 hours after regulatory clearance from the Central Bank of Nigeria. The capital will fund operations across 37 African countries, accelerating expansion in key markets such as Nigeria,...

By Techpoint Africa

News•Feb 17, 2026

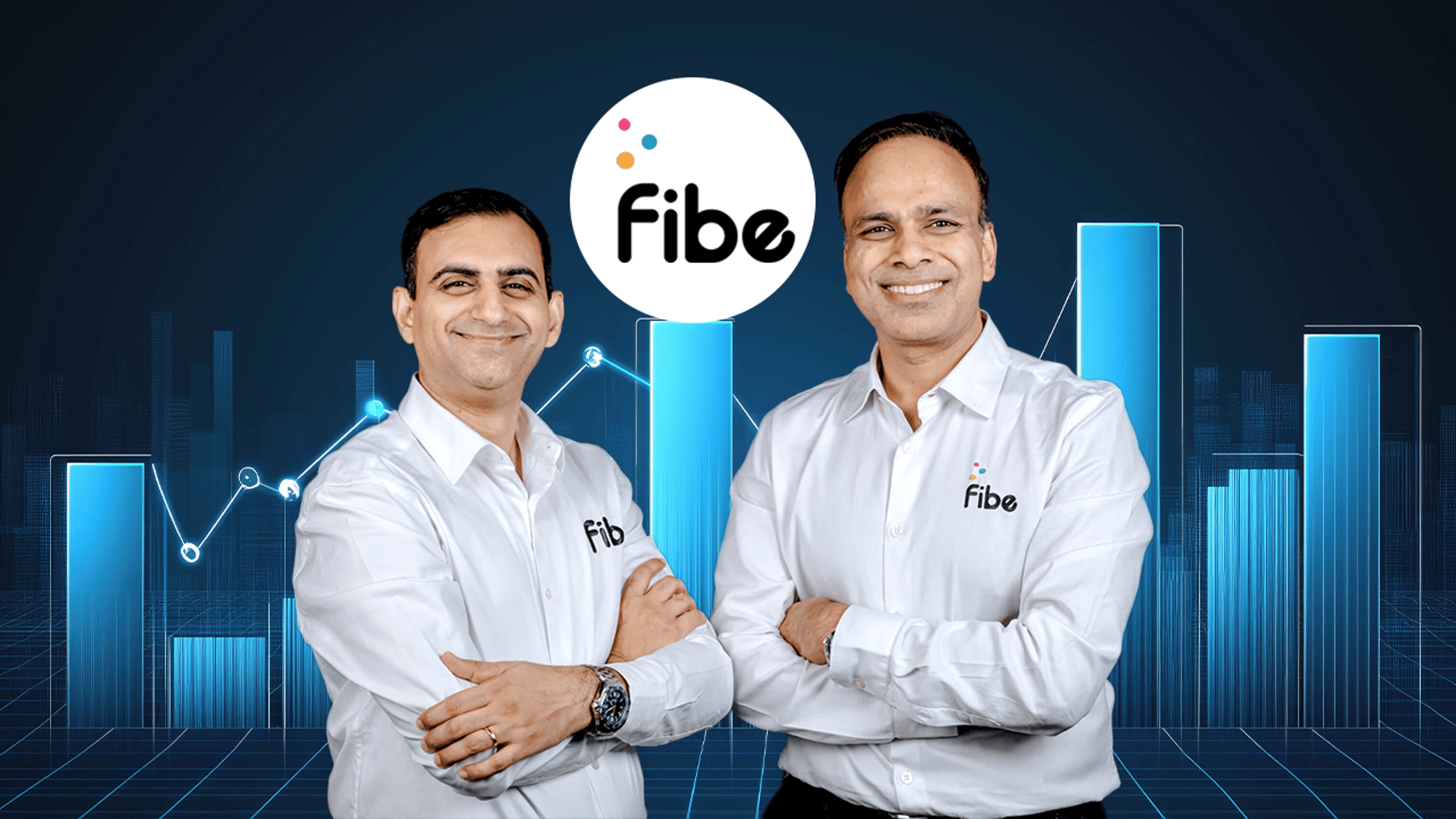

Fibe Crosses Rs 1,200 Cr Revenue in FY25; Profit Spikes 13%

Fibe, the former EarlySalary, posted FY25 operating revenue of Rs 1,228 crore, a 49% increase from the prior year, while net profit rose 13% to Rs 114 crore. Interest on loans remained the dominant revenue stream, exceeding Rs 1,000 crore and representing over...

By Entrackr

Podcast•Feb 17, 2026•34 min

Sponsor Bank 101: Everything Fintechs Need to Know Before Signing a Contract

In this episode, Lindsay Borgeson, President of Partner Banking at Core Bank, explains how her community bank built the CoreX Banking‑as‑a‑Service platform from the ground up, emphasizing a compliance‑first mindset, early regulator engagement, and careful tech‑partner selection. She highlights the...

By Fintech Confidential

Blog•Feb 16, 2026

Banks Are Starting to Price Liquidity by the Hour

Banks are moving from traditional overnight benchmarks to quoting liquidity rates on an hourly basis, reflecting tighter funding conditions and the rise of electronic trading platforms. The shift provides more granular price signals, allowing lenders to capture real‑time balance‑sheet pressures...

By The Blind Spot

/file/dailymaverick/wp-content/uploads/2025/08/GettyImages-1952436000.jpg)

News•Feb 16, 2026

MONETARY POLICY: Sarb Proposes Major Reform — Ditching Prime Lending Rate for Repo Rate

The South African Reserve Bank (Sarb) has released a consultation paper proposing to scrap the prime lending rate (PLR) and use the repo rate, known as the SARB policy rate (SPR), as the benchmark for loan pricing. The PLR currently...

By Daily Maverick – Business

News•Feb 16, 2026

Andrew Baker Is New CIO of Capitec

Andrew Baker has been promoted from chief technology officer to chief information officer at Capitec, succeeding Wim de Bruyn who led the role since 2014. Baker joins the CIO post after four years driving Capitec’s migration to Amazon Web Services and...

By TechCentral (South Africa)

Social•Feb 16, 2026

AI Agents Drive Traffic Surge, Prompt New Security Controls

As AI Agents Take on Tasks in the Real World, New Risks Emerge By 2026, human website visits drop 20% while machine-initiated traffic surges 40%. Zero-click economy emerging where personal AI negotiates on your behalf. Banks must authenticate agents, not just...

By Efi Pylarinou

Social•Feb 16, 2026

Future‑Ready Infrastructure Must Pivot With Market Shifts

Resilience today means being future ready. Can your infrastructure pivot as rates change, markets shift, or new competitors emerge? https://t.co/jCrVklXEuZ

By Jim Marous

News•Feb 16, 2026

Letters to the Editor Dated February 16, 2026

The Hindu BusinessLine letters highlight three regulatory concerns. First, they argue that the credit‑deposit ratio alone cannot gauge bank health and call for abolishing the Cash Reserve Ratio to improve deposit mobilisation amid RBI’s new risk‑based insurance premiums. Second, they...

By The Hindu Business Line – All

News•Feb 16, 2026

RBI Issues Draft Norms for Reporting on Forex Derivative Transactions Involving Rupee

The Reserve Bank of India released draft norms requiring Authorised Dealer Category‑I banks to report all rupee‑denominated foreign‑exchange derivative transactions undertaken by their related parties worldwide. This follows earlier steps that mandated primary dealers and banks to disclose rupee interest‑rate...

By The Economic Times – Markets

Social•Feb 16, 2026

AI Threat: Controlling Institutional Knowledge Over Job Replacement

The real fear is not replacement. It’s ownership of knowledge. AI systems are capturing workflows, decisions and expertise that once lived inside employees’ heads. The strategic question is no longer who loses a job, but who controls the institutional intelligence being built....

By Spiros Margaris

News•Feb 16, 2026

Brokers to Approach RBI as Tighter Norms Squeeze Funding for Proprietary Desks

The Reserve Bank of India’s new capital‑market exposure framework, effective April 1 2026, mandates 100 percent collateral backing for all bank loans to brokerage firms and bars banks from financing proprietary trading desks. Brokers plan to petition the RBI for clarifications as the...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Fed's Bowman Wants to Boost Banks' Share of Mortgage Market

Federal Reserve Vice Chair for Supervision Michelle Bowman announced that the Fed will soon propose two mortgage‑related regulatory changes aimed at lowering banks' capital costs and encouraging greater bank participation in mortgage origination and servicing. The proposals could revise Basel...

By American Banker Technology

News•Feb 16, 2026

RBI Approves Rajan Bajaj as MD and CEO of Slice

Fintech firm Slice announced that its founder Rajan Bajaj has been appointed Managing Director and Chief Executive Officer, with the appointment cleared by the board, shareholders and the Reserve Bank of India. Bajaj, who previously served as Executive Director, steered Slice...

By Entrackr

News•Feb 16, 2026

Eaglestone Management: Experience Forged in Global Infrastructure Finance

Eaglestone Management’s leadership team combines deep project‑finance banking experience with hands‑on infrastructure execution. CEO Pedro Neto brings over 30 years and involvement in more than €50 billion of global projects across energy, transport and concessions. Managing Partner Nuno Gil adds 25...

By CFI.co (Capital Finance International)

News•Feb 16, 2026

FCA Exchanges Letters on Cooperation with India Regulator, IFSCA

The Financial Conduct Authority (FCA) has signed an Exchange of Letters with India’s International Financial Services Centres Authority (IFSCA), the regulator for GIFT City. The pact commits both bodies to share regulatory knowledge and best‑practice insights, aiming to strengthen links...

By UK FCA – News

News•Feb 16, 2026

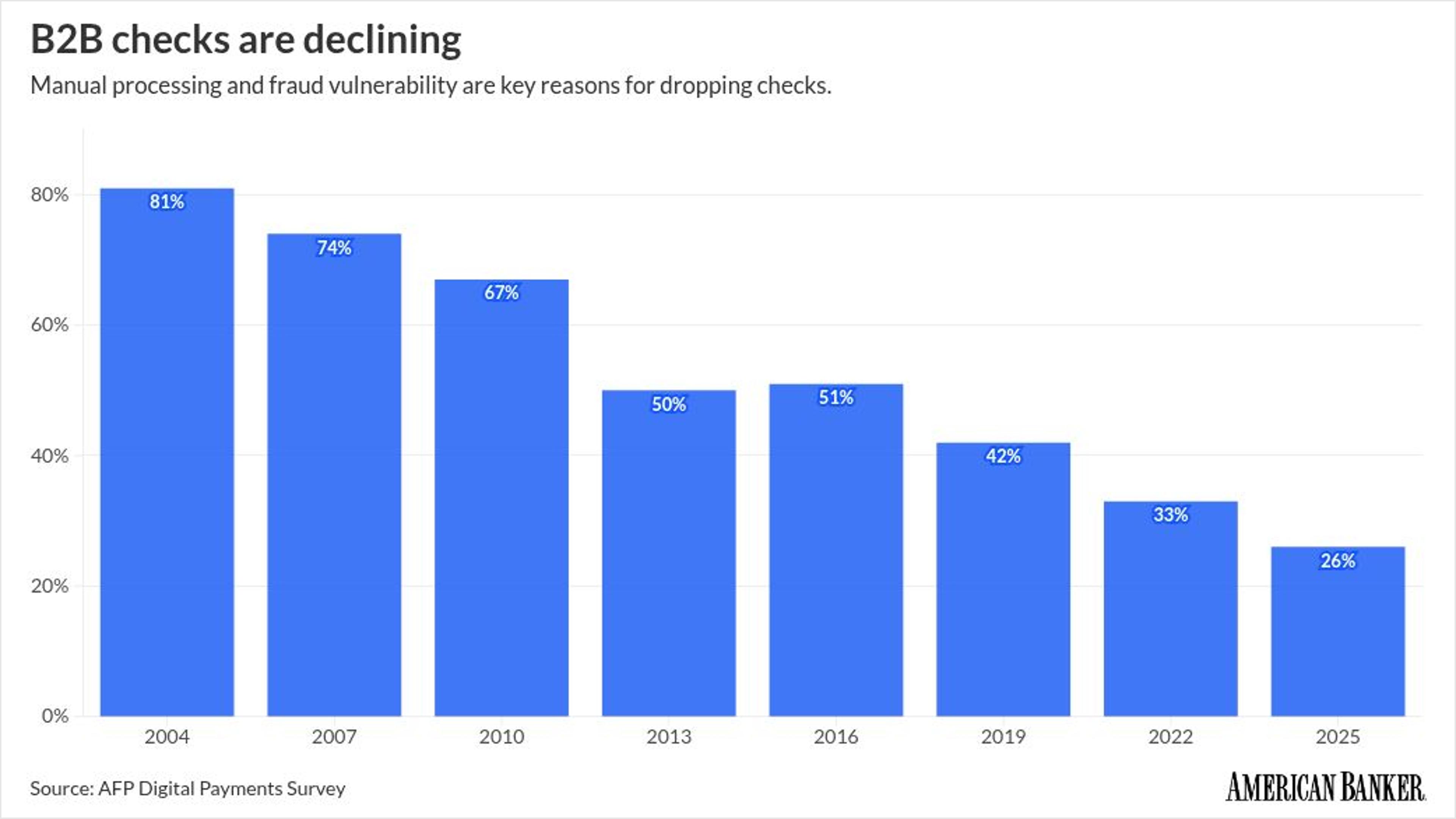

ACH Volume Is Soaring. Here's How that Threatens Banks.

ACH network volume surged in 2025, reaching 35.2 billion payments worth $93 trillion, a 5 percent rise year‑over‑year. Person‑to‑person transfers grew 19.8 percent and business‑to‑business payments rose 9.9 percent, while check usage in B2B fell to 26 percent. Nacha has proposed lifting the same‑day ACH transaction...

By American Banker

News•Feb 16, 2026

Whistleblowing Quarterly Data 2025 Q4 – Financial Conduct Authority | FCA

The Financial Conduct Authority (FCA) released its Q4 2025 whistleblowing report, revealing a 12% rise in total disclosures compared with the previous quarter. The data shows 1,842 new reports, with fraud and market abuse accounting for 58% of cases. Of...

By Crowdfund Insider