🎯Today's Banking Pulse

Updated 3h agoWhat's happening: Banks eye six tech trends to stay competitive in 2026

Banks are under mounting regulatory, economic and consumer pressure, prompting a shift toward targeted technology investments. nCino outlines six 2026 trends, from AI‑driven mobile banking that functions as a personal financial command centre to AI‑powered verification that can dramatically cut loan‑processing time. The focus moves from blanket AI deployments to purpose‑built solutions that boost efficiency and compliance.

Also developing:

By the numbers: Bank of America pledges $25bn private credit fund

News•Feb 9, 2026

North’s Merchant Management API: CRM‑Level Control for Modern Payments Partners

North introduced a Merchant Management API that gives Wholesale ISOs, Full Service Providers, and Payment Facilitators CRM‑level control over merchant portfolios. The write‑capable interface lets partners view, update, and synchronize merchant data—including pricing, risk limits, compliance, and terminal settings—in real time. By exposing a single set of endpoints, the API supports both internal dashboards and branded merchant self‑service portals, eliminating the need for multiple legacy portals or ticket‑based changes. Access is limited to qualified partners with significant scale and underwriting expertise.

By Digital Transactions

News•Feb 9, 2026

Has the CFPB Reached the End of the Road?

The Consumer Reports press release warns the Consumer Financial Protection Bureau is on “life support” after an acting director ordered a work stoppage and halted new funding. The agency has also abandoned more than 22 enforcement actions and reversed 20...

By Digital Transactions

Social•Feb 9, 2026

IDEAL's A2A Shift Powers Pan‑European Payment Sovereignty

iDEAL to phase into Wero starting in 2026 Strategic implications: Account-to-account payments (A2A) eliminating card network intermediaries. iDEAL processes 1.5B transactions annually with 100% Dutch consumer reach—now gets pan-European scale. Payment sovereignty meets network effects https://t.co/Qmf2G62B8k

By Efi Pylarinou

News•Feb 9, 2026

IRRBB Management in Emerging Market and Developing Economies: The Role of Derivatives in Supporting Financial Stability and Economic Development

Interest rate risk in the banking book (IRRBB) is emerging as a top priority for banks and regulators across emerging market and developing economies (EMDEs). Monetary tightening and persistent macro‑volatility are making balance‑sheet exposures more fragile, exposing the limits of...

By ISDA — News & analysis feed

News•Feb 9, 2026

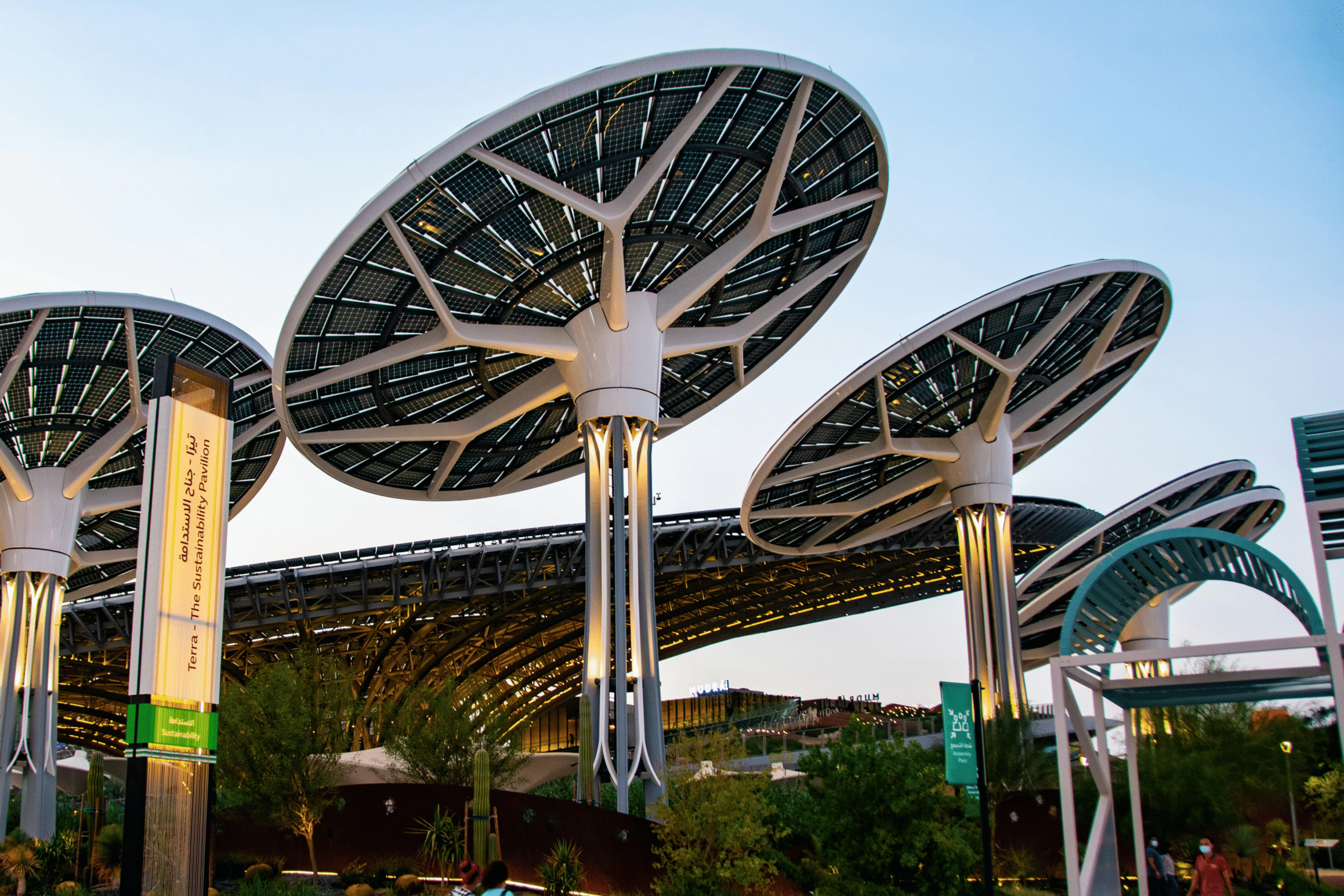

From Vision to Ambition: Evolving ESG Strategies in GCC Banking

GCC banks are shifting from ESG ambition to execution as regional regulations tighten and net‑zero targets loom. Mashreq Bank leads the field by securing end‑to‑end AA1000AS assurance for its integrated ESG report and embedding sustainability KPIs into senior management objectives....

By Euromoney

News•Feb 9, 2026

Uber Deepens Adyen Ties and Other Digital Transactions News Briefs From 2/9/26

Uber announced it will broaden its partnership with payment processor Adyen, extending the use of Adyen’s Checkout API to additional geographies and more payment options. Honor Capital is collaborating with ePayPolicy to provide financing for insured customers making premium payments...

By Digital Transactions

Social•Feb 9, 2026

Institutions Favor Ripple’s Integrated Stack; DeFi Chooses Flexibility

Will the vertical integration (Ripple closed loop model - stablecoin + settlement layers) or horizontal distribution (Paxos/Circle model) dominate institutional adoption? Institutions might prefer the seamless Ripple stack, but developers and DeFi protocols favor the flexibility of multi-chain stablecoins.

By Efi Pylarinou

News•Feb 9, 2026

Exclusive: Nandan Nilekani’s Fundamentum Leads Olyv’s $23 Mn Series C Round

Olyv, the Indian personal‑lending marketplace formerly known as SmartCoin, secured Rs 207 crore ($23 million) in a Series C round. The round was led by Nandan Nilekani’s Fundamentum Partnership Fund, which invested Rs 120 crore, with SMBC Asia contributing Rs 87.5 crore. Post‑fundraising, Olyv is valued at roughly Rs 1,045 crore...

By Entrackr

News•Feb 9, 2026

Supermicro Secures 1st Syndicated Loan in Taiwan

U.S.-based AI server maker Super Micro Computer secured its first syndicated loan in Taiwan, amounting to $1.765 billion. The loan was administered by CTBC Bank and attracted participation from 21 financial institutions, resulting in an almost 1.8‑times oversubscription. Lenders cited Supermicro’s...

By Focus Taiwan (CNA) – English News

Social•Feb 9, 2026

Banks' AI Strategies Miss the Mark, Says Speaker

Excited to be speaking at the NextGen Payments & RegTech Forum in March. I'll explore why many financial institutions are missing the mark in my keynote 'Your Bank’s AI Strategy Is Wrong.' To register and access the full agenda: https://t.co/XIQySs0LfD @qubevents https://t.co/kTlwtWVXVs

By Dave Birch

Blog•Feb 9, 2026

Gradual End of Bank Dominance in India

India’s household financial portfolio is shifting away from traditional safe assets toward equities and managed funds. Between March 2021 and March 2025, bank deposits fell from roughly 47.5% to 43.5% of total financial assets, while mutual‑fund and pension holdings rose...

By Prof. Jayanth R. Varma’s Financial Markets Blog

Social•Feb 9, 2026

Hong Kong and Singapore Emerge Top Picks for Diversifying Investors

🇭🇰🇸🇬Hong Kong & Singapore to be biggest winners as global capital flows shift to #Asia: HK & SG are best choices for global investors seeking to diversify their portfolios amid geopolitical risks. DBS CEO Tan Su Shan via @SCMPNews. #WealthManagement https://t.co/j34B1J9Kz1

By Urs Bolt

Social•Feb 9, 2026

Digital IDs Unite Identification, Authentication, and Authorization

The Promise of Digital Identities (IDs) https://t.co/ZELeCaUzpS "A digital ID combines the three pillars of secure transactions—identification, authentication, and authorization". Not my words, the Feds. Well, to be fair, my words too. Albeit some time ago. https://t.co/aTC5u5N9wx

By Dave Birch

Blog•Feb 7, 2026

How the U.S. Treasury Engineered a Dollar Squeeze in Iran

The U.S. Treasury, through OFAC, reclassified key Iranian banks and instituted secondary sanctions that block dollar‑clearing for Iran’s oil trade. By cutting off access to the SWIFT network and threatening non‑U.S. firms that facilitate dollar transactions, the Treasury forced a...

By The Blind Spot

Podcast•Feb 6, 2026•1h 24m

Bringing Empathy to Every Member Touchpoint with Derrick Aguilar.

In this episode of the Digital Banking Podcast, Josh DeTar talks with Derrick Aguilar, Chief Experience Officer at PenAir Credit Union, about embedding empathy into every member interaction. Aguilar explains that while digital tools and reliable services are essential, the...

By Digital Banking Podcast

News•Feb 6, 2026

A New POS Terminal Emerges While Tap To Pay Figures in a New App

Clip introduced the Clip Total 3 point‑of‑sale terminal, a $899 device that adds order management, inventory catalog, a customer‑facing screen, high‑speed printer and dual cameras for Mexican merchants, especially restaurants. At the same time, Mexico‑based SeoSamba launched a Stripe‑powered POS app...

By Digital Transactions

News•Feb 6, 2026

Affirm Supports Mobile Devices and Other Digital Transactions News Briefs From 2/6/26

Affirm announced financing for Virgin Media O2 customers, extending its buy‑now‑pay‑later (BNPL) reach into the UK mobile‑device market. The company also broadened its partnership with Wayfair, adding installment‑payment options for shoppers in Canada and the United Kingdom alongside its existing...

By Digital Transactions

Blog•Feb 6, 2026

Their Role Wasn’t to Question Customers, Just as a Sewage Company Doesn’t Ask What You Ate for Dinner

The episode examines how U.S. Congressman Wright Patman reshaped banking regulation, turning banks from passive cash conduits into active gatekeepers tasked with monitoring and reporting suspicious activity. It contrasts the pre‑Patman view of banks as mere plumbing with the post‑Patman...

By Payments:Unpacked

News•Feb 6, 2026

Policy Paper: Joint Readout of the First UK-China Financial Working Group

The UK‑China Financial Working Group held its inaugural meeting on 31 January 2026 in Beijing, bringing together senior officials from HM Treasury, the Bank of England, the PRA, the FCA and their Chinese counterparts from the People’s Bank of China, the Ministry...

By HM Treasury – Atom feed

News•Feb 5, 2026

Evertec Acquires Dimensa

Puerto Rican fintech Evertec announced the acquisition of Brazilian fintech Dimensa for $181 million, pending regulatory clearance from Brazil’s antitrust authority CADE. Dimensa, a former TOTVS spin‑out, provides core banking, transaction processing and investment‑fund administration software to more than 15,000 institutions....

By LatamList

Blog•Feb 5, 2026

Unpacking PayPal’s Missed Moment: 7 Takeaways

Former PayPal president David Marcus posted a candid post‑mortem outlining why the company’s silent turnaround lost steam. He argues that a shift from product‑led conviction to pure financial optimization eroded PayPal’s core checkout moat. The analysis distills seven actionable takeaways,...

By Future Nexus (formerly Fintech Nexus)

Podcast•Feb 4, 2026•9 min

How the SCAM Act Would Encourage Platforms to Go After Scammers

In this episode, Paul Benda explains the SCAM Act introduced by Senators Ruben Gallego and Bernie Moreno, which would impose new know‑your‑customer and ad‑takedown obligations on major tech platforms that profit from fraudulent advertising. He outlines why current market incentives...

By ABA Banking Journal Podcast

News•Feb 3, 2026

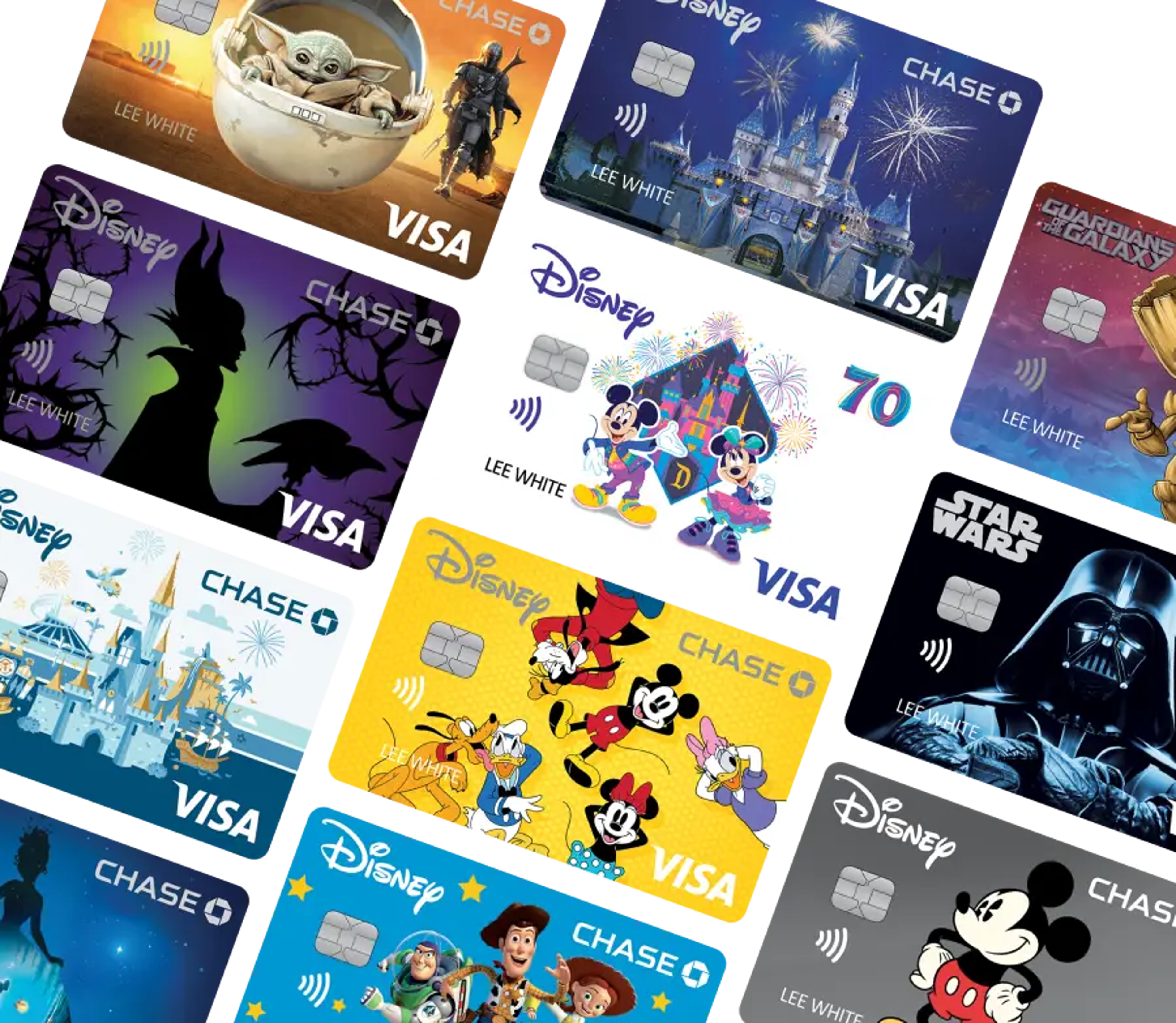

New ‘Disney Inspire’ Visa Card Revealed | List of All Benefits + How to Earn Rewards

Disney and Chase launched the Disney Inspire Visa Card on Feb 3, 2026, adding a premium offering to the existing Disney Visa lineup. The card carries a $149 annual fee and bundles a $300 statement credit after $1,000 spend in the first...

By Attractions Magazine

News•Feb 3, 2026

Scotiabank’s Global Head Of FICC On Staying Agile In A Volatile Market

Scotiabank’s Global Head of FICC, Stephanie Larivière, said heightened U.S. dollar strength and tariff‑driven trade uncertainty have spurred a surge in demand for structured foreign‑exchange hedges. Clients are increasingly looking beyond the dollar, favoring non‑dollar crosses such as the Mexican peso,...

By Global Finance Magazine

News•Feb 3, 2026

HSBC Buys Out Hang Seng Bank

HSBC has finalized the buyout of Hang Seng Bank, marking Hong Kong's largest privatization and the biggest financial services acquisition in the market. The transaction delists Hang Seng, aiming to merge digital banking capabilities while preserving distinct brand identities. HSBC...

By Global Finance Magazine

News•Feb 3, 2026

Saudi Arabia Opens Financial Markets To Foreign Investors

Saudi Arabia has removed the Qualified Foreign Investor (QFI) framework, permitting any international investor to trade directly on the Tadawul exchange as of February 1. The reform ends the $500 million asset threshold that previously limited foreign participation to large institutions. Foreign...

By Global Finance Magazine

Blog•Feb 2, 2026

Tom Ilube CBE Appointed Chair of LINK

The episode announces Tom Ilube CBE as the new Chair of LINK, the UK’s cash access and ATM network, highlighting his extensive background in technology, finance, education, and philanthropy. Ilube emphasizes the importance of maintaining cash access for millions as...

By Payments:Unpacked

Blog•Feb 2, 2026

Regulators at the Heart of the National Payments Vision

In his keynote at the Payments Regulation and Innovation Summit, David Geale, MD of the Payment Systems Regulator, outlined how the FCA and PSR are steering the National Payments Vision by focusing on system trust, resilience through choice, and upcoming...

By Payments:Unpacked

Blog•Feb 2, 2026

Scarce Reserves

Federal Reserve Governor Christopher Warsh is pushing to restart quantitative tightening, signaling a shift toward shrinking the central bank’s balance sheet. This move comes even as the Fed recently expanded its holdings to ease strains in the funding market. Warsh’s...

By Fed Guy

News•Feb 2, 2026

Tailor-Made Banking From High School to Retirement

Spain’s aging population, projected to hit 30% by the mid‑2050s, coincides with a surge in digital banking adoption—75% of Spaniards used online services in 2024. CaixaBank responded by creating a life‑stage ecosystem: the fully digital neobank imagin for youth and...

By Euromoney

Podcast•Jan 30, 2026•37 min

TKG Joins The Pack - Wolf X TKG

In this episode of This Month in Banking, hosts Jeff Marsico and Scott Baranowski discuss the recent partnership between Wolf & Company and TKG, exploring how TKG’s integration expands the firm’s service offerings and client reach. They break down the...

By This Month in Banking

Blog•Jan 29, 2026

What Does 2026 Hold for Fintech?

Founders and investors see 2026 as a turning point for fintech, with stablecoins poised to become core infrastructure for cross‑border payments. AI is rapidly moving from theory to production, driving faster product launches and embedding agentic capabilities in financial workflows....

By Future Nexus (formerly Fintech Nexus)

News•Jan 29, 2026

The Fate of Japan’s $6trn Foreign Portfolio Rattles Global Markets

Japan’s financial institutions now own roughly $6 trillion in foreign securities, a stock that has doubled over the past two decades as low domestic rates and a weak yen pushed investors abroad. About 50% of this portfolio is invested in U.S....

By The Economist – Finance & Economics

Podcast•Jan 26, 2026•0 min

The Evolution of Direct Debit

In this episode, host Mike Chambers sits down with Richard Ransom of Bottomline and Mike Hutchinson of The Regular Payments Marketing Company to trace the half‑century history of direct debit, examining current transaction volumes, value trends, and the evolving supply...

By Payments:Unpacked

News•Jan 26, 2026

January 22, 2026 – Closed Meeting

The Federal Deposit Insurance Corporation announced a closed‑door board meeting held on January 22, 2026, providing only a brief notice and a contact for information requests. The meeting’s agenda was not disclosed, reflecting standard practice for discussing confidential supervisory and resolution matters....

By FDIC – Press Releases

Blog•Jan 26, 2026

From Electrum to Sterling: A Brief History of Money

The episode traces the evolution of money from the first electrum coins minted in Lydia around 640 BC, through the early experiments with paper money in China and Sweden, to the rise of national central banks that backed notes with government...

By Payments:Unpacked

Podcast•Jan 23, 2026•1h 8m

Technology Meets Trust: The Real Role of Digital Banking, with Frank Hopkins.

In this episode, host Josh DeTar talks with Frank Hopkins, founder and CEO of Hopkins Leadership, about how community banks can stay relevant amid rapid technological change and competition from larger institutions. Hopkins emphasizes that a bank’s true advantage lies...

By Digital Banking Podcast

News•Jan 23, 2026

A CFO’s Greatest Asset? Getting Comfortable With Complexity

Heather Luck, CFO of Five Star Bank, highlights the expanding complexity of the finance function in community banking. She balances board relations, SEC reporting, regulatory compliance, treasury, budgeting, and HR while driving geographic expansion into the San Francisco Bay Area and...

By StrategicCFO360 (Chief Executive Group)

Podcast•Jan 20, 2026•6 min

Fed Independence Goes Before the Supreme Court

The episode examines the Supreme Court case questioning whether a president can fire a sitting Federal Reserve governor, focusing on President Donald Trump's attempt to remove Governor Lisa Cook. Experts discuss the legal precedent of presidential authority over other federal...

By Marketplace Morning Report

News•Jan 19, 2026

Bank-Backed Stablecoins: A New Chapter for Payments in Europe?

European banks, led by CaixaBank and peers, are creating a euro‑denominated, bank‑backed stablecoin. The initiative, organized through the Qivalis consortium, complies with the EU’s MiCA regulation and targets enterprise‑level payments. It aims to enable instant, programmable, cross‑border settlements that improve...

By Euromoney

Podcast•Jan 19, 2026•29 min

The Future of Risk: Integrating AI and Human Intelligence for Proactive Mitigation with Garry Singh

In this 29‑minute episode, Garry Singh, President of IIRIS Consulting, explains how AI can shift risk management from a reactive to a predictive discipline. He outlines practical steps for leaders to embed machine learning into risk identification, while emphasizing the...

By The Risk Management Show

Podcast•Jan 16, 2026•22 min

A Lone Star Banking Perspective

In this episode, Ron Butler, chairman of the Texas Bankers Association and CAO of First Financial Bank, explains why Texas’s economy—large enough to rank eighth globally if it were a country—makes the state a magnet for investment and out‑of‑state bank...

By ABA Banking Journal Podcast

News•Jan 15, 2026

January 22, 2026 — Sunshine Act Meeting Notice

The Federal Deposit Insurance Corporation (FDIC) will hold its Board of Directors meeting on January 22, 2026, streamed publicly via webcast. The agenda features an amendment to the FDIC’s Guidelines for Appeals of Material Supervisory Determinations, a final rule on official signs...

By FDIC – Press Releases

Podcast•Jan 14, 2026•26 min

Could a Cap on Credit-Card Rates Really Hurt Consumers?

The episode examines President Trump's proposal to impose a temporary 10% cap on credit‑card interest rates, exploring the arguments from big banks that such a limit could restrict credit availability and disproportionately affect vulnerable borrowers. It also touches on soaring...

By BBC World Service – World Business Report

Blog•Jan 14, 2026

Xero’s Jolly on Building a Tech Roadmap to Level Playing Field for Small Businesses

Xero has launched an AI‑powered analytics suite aimed at small‑business owners, a move driven by chief product and technology officer Diya Jolly. After acquiring Syft and Melio, Xero now offers customizable dashboards, cash‑flow managers, health scorecards and instant AI‑generated insights....

By Future Nexus (formerly Fintech Nexus)