🎯Today's Banking Pulse

Updated 1h agoWhat's happening: Banks eye six tech trends to stay competitive in 2026

Banks are under mounting regulatory, economic and consumer pressure, prompting a shift toward targeted technology investments. nCino outlines six 2026 trends, from AI‑driven mobile banking that functions as a personal financial command centre to AI‑powered verification that can dramatically cut loan‑processing time. The focus moves from blanket AI deployments to purpose‑built solutions that boost efficiency and compliance.

Also developing:

By the numbers: Bank of America pledges $25bn private credit fund

News•Feb 16, 2026

Firms Report Improved Financial Performance Linked to Use of Embedded Finance

A new PYMNTS Intelligence study of 515 senior leaders shows embedded finance is now a strategic imperative for mid‑size and large firms. Nearly 90% of respondents prioritize strengthening customer and employee relationships, while 75% plan technology upgrades within the next year, many within six months. Despite 93% reporting integration friction, satisfaction with embedded finance remains equally high, indicating strong business value. The research also reveals that most companies outsource delivery, choosing partners based on trust and alignment rather than cost.

By PYMNTS

News•Feb 16, 2026

Stablecoin Payments Show Up at Checkout Despite Crypto Markets Slump

Despite a broad crypto market downturn, stablecoin‑linked cards are gaining traction at U.S. checkout counters. Monthly payment flows through these cards have surpassed $1.5 billion, and annualized spend now tops $18 billion. The growth is driven by card networks embedding stablecoins as...

By PYMNTS

News•Feb 16, 2026

Rethinking SARs in the Fight Against Financial Crime

Suspicious Activity Reports (SARs) remain the cornerstone of global AML frameworks, yet many institutions misunderstand their purpose, treating them as accusations rather than suspicion flags. Regulatory pressure and soaring transaction volumes have driven firms to prioritize filing speed over narrative...

By Fintech Global

Social•Feb 16, 2026

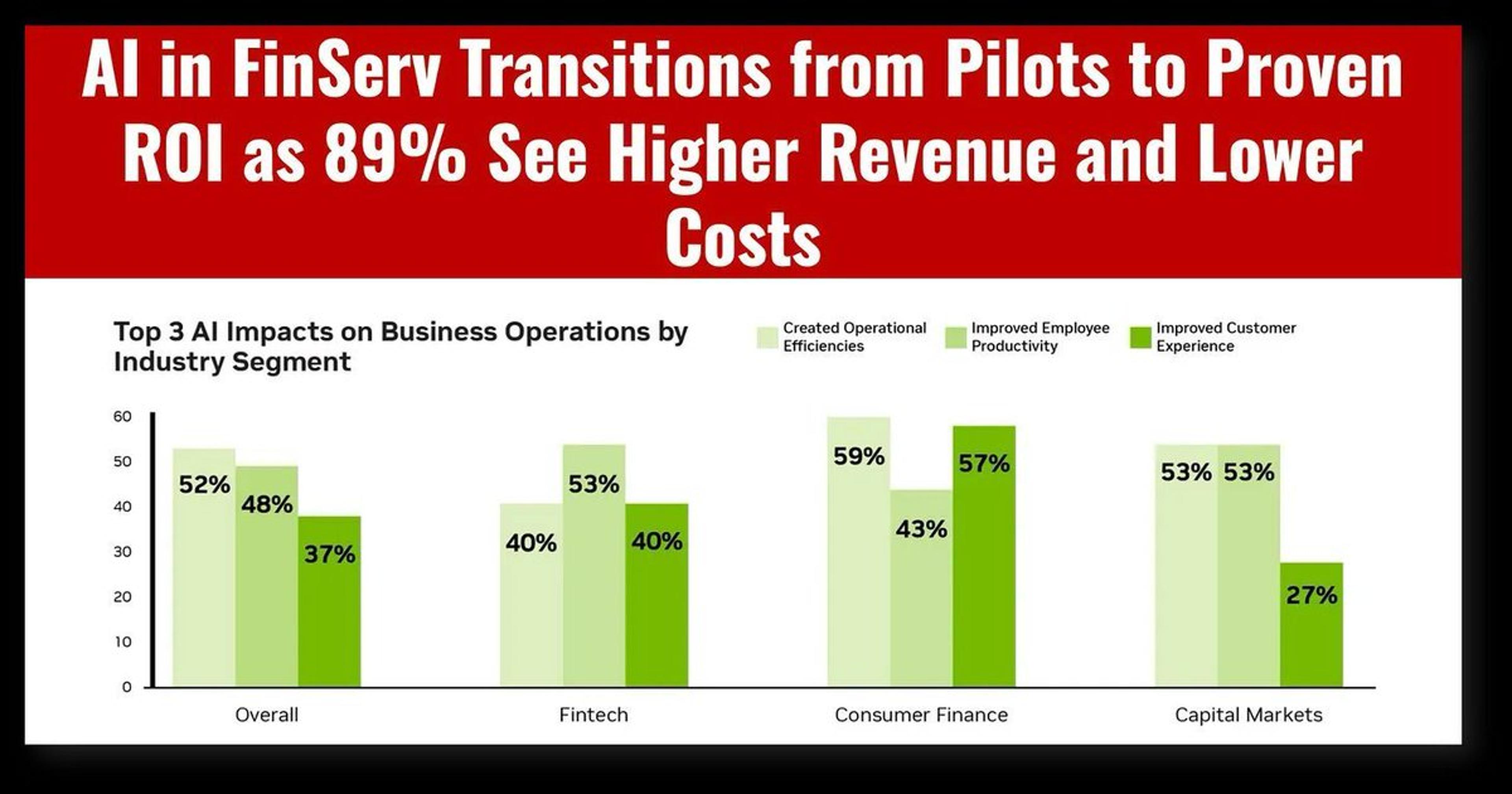

96% AI Adoption, 89% See Revenue Gains—Too Late for Many

AI in Banking Special: From Pilots to Profits – 96% Adoption, 89% See Revenue/Cost Wins Topics: ↳ AI in FinServ Transitions from Pilots to Proven ROI as 89% See Higher Revenue and Lower Costs ↳ GenAI in APAC Banks: 70% of Value...

By Richard Turrin

News•Feb 16, 2026

Bitpanda Teams Up with LuLu Financing Holdings to Support Digital Assets Trading

Bitpanda has partnered with LuLu Financial Holdings to embed regulated crypto trading into LuLuFin's existing digital and physical channels across the MENA, APAC and Indian subcontinent regions. Leveraging Bitpanda’s VARA‑compliant brokerage infrastructure, LuLuFin users will be able to buy, sell...

By Crowdfund Insider

Social•Feb 16, 2026

Open Architecture Drives Southeast Asian Wealth Management Transformation

Strategic Transformation in Southeast Asian #WealthManagement: The Case for Open Architecture – The most successful transformations share common elements: clear strategic positioning, authentic partnerships with #FinTech and #WealthTech platforms, and the courage to fundamentally rethink operating models. Read my latest article on...

By Urs Bolt

News•Feb 16, 2026

Bahrain Courts Stablecoin Issuers as AlloyX Taps Fintech Hub

AlloyX, a digital‑asset infrastructure firm owned by Solowin Holdings, has partnered with Bahrain FinTech Bay to develop a regulated stablecoin in the Gulf. The collaboration gives AlloyX access to Bahrain's fintech ecosystem while it seeks regulatory approval under the Central...

By Crowdfund Insider

Blog•Feb 16, 2026

Crypto-Derivatives Regulation Is Too Fragmented

A new comparative study finds crypto‑derivatives regulation is highly fragmented across major financial hubs, despite the products mirroring traditional derivatives in structure and risk. Regulators have forced crypto‑derivatives into existing regimes, leading to divergent rules based on settlement method, underlying...

By CLS Blue Sky Blog (Columbia Law School)

News•Feb 16, 2026

Koxa, Bottomline Announce ERP Embedded Banking Partnership

Koxa and Bottomline have formed a partnership to embed banking services directly within ERP systems, leveraging Koxa’s platform and Bottomline’s Commercial Digital Banking API framework. The joint solution lets banks offer integrated payments, approvals, reconciliation and statement access without building...

By Crowdfund Insider

News•Feb 15, 2026

How Are NHIs Ensuring Protected Data Exchanges in Financial Services?

The episode explores how Non‑Human Identities (NHIs), or machine identities, are essential for securing protected data exchanges in financial services. It explains the lifecycle of NHIs—from discovery and classification to secret rotation and decommissioning—and why holistic management platforms outperform point...

By Security Boulevard

News•Feb 15, 2026

Singapore to Form National AI Council Chaired by PM Wong

Singapore will establish a National AI Council chaired by Prime Minister Lawrence Wong to coordinate AI policy and accelerate adoption across the economy. The council will review regulations, create sandboxes, and launch four national AI Missions targeting advanced manufacturing, connectivity,...

By Crowdfund Insider

Social•Feb 15, 2026

AI Chatbots Turn Into Digital Real Estate for Ads

AI chatbots are becoming the next digital real estate, and ads are moving in. As usage scales and infrastructure costs rise, monetisation models are shifting from subscriptions alone to advertising layers embedded in conversation. The real question is not whether ads will...

By Spiros Margaris

News•Feb 15, 2026

ZeroDrift Announces $2M Round to Automate Compliance

ZeroDrift emerged from stealth with a $2 million pre‑seed round led by a16z speedrun, aiming to automate compliance for financial‑services communications. The AI‑native platform acts as a real‑time firewall that encodes SEC, FINRA and firm‑specific policies into machine‑readable rulepacks. By integrating...

By Crowdfund Insider

Social•Feb 15, 2026

Goldman Sachs Makes AI Core of Finance Operations

Goldman Sachs is embedding Anthropic’s Claude into accounting and compliance to automate high volume, rules based back office work. After six months of co building, executives were surprised that AI handled complex financial processes, not just coding tasks. The ambition is clear,...

By Spiros Margaris

Social•Feb 15, 2026

Empower Employees, Not Just Automate, to Meet Expectations

Automation alone is not the answer. Institutions that replace people instead of empowering them will struggle to meet rising customer expectations. https://t.co/3KhyMMpnPe

By Jim Marous

News•Feb 14, 2026

Marriott Bonvoy Launches Its First Ever Co-Brand Credit Card in Indonesia with Bank Mandiri

Marriott Bonvoy and Bank Mandiri have launched Indonesia’s first Marriott co‑branded credit card. The Marriott Bonvoy Mandiri Credit Card provides Indonesian members with welcome bonus points, elite status, and up to 5× points on eligible spend. The card is linked to...

By Breaking Travel News

Social•Feb 14, 2026

Buy Manappuram on Pullbacks Amid RBI

Macro: PE flows target Indian NBFCs. RBI cleared Bain's up to 41.7% in Manappuram; ₹43.85bn injected. Risk: regulatory scrutiny. Trading insight: buy Manappuram on pullbacks. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

AI Threat Looms Over $3.5T Credit Market

Credit markets could be the next AI casualty. A UBS analyst flags the $3.5T leveraged loan and private credit space as vulnerable, with AI disruption moving faster than expected. Up to $120B in fresh defaults this year would turn the AI boom...

By Spiros Margaris

News•Feb 13, 2026

New Rules for M&A Financing, Loans Against Shares

The Reserve Bank of India issued final guidelines allowing banks to fund acquisitions only when the acquirer already controls the target and seeks to increase its stake from 26% to 90%. Borrowers must have at least ₹500 crore net worth, three...

By The Economic Times (India) – Economy

Social•Feb 14, 2026

Banks Grant AI Direct Control Over Money Flows

Banks are quietly moving AI beyond chatbots and into the plumbing of money itself. Inside compliance queues and cash dashboards, AI agents are starting to initiate tasks and move funds based on live signals. This is the real inflection point: not smarter...

By Spiros Margaris

Social•Feb 14, 2026

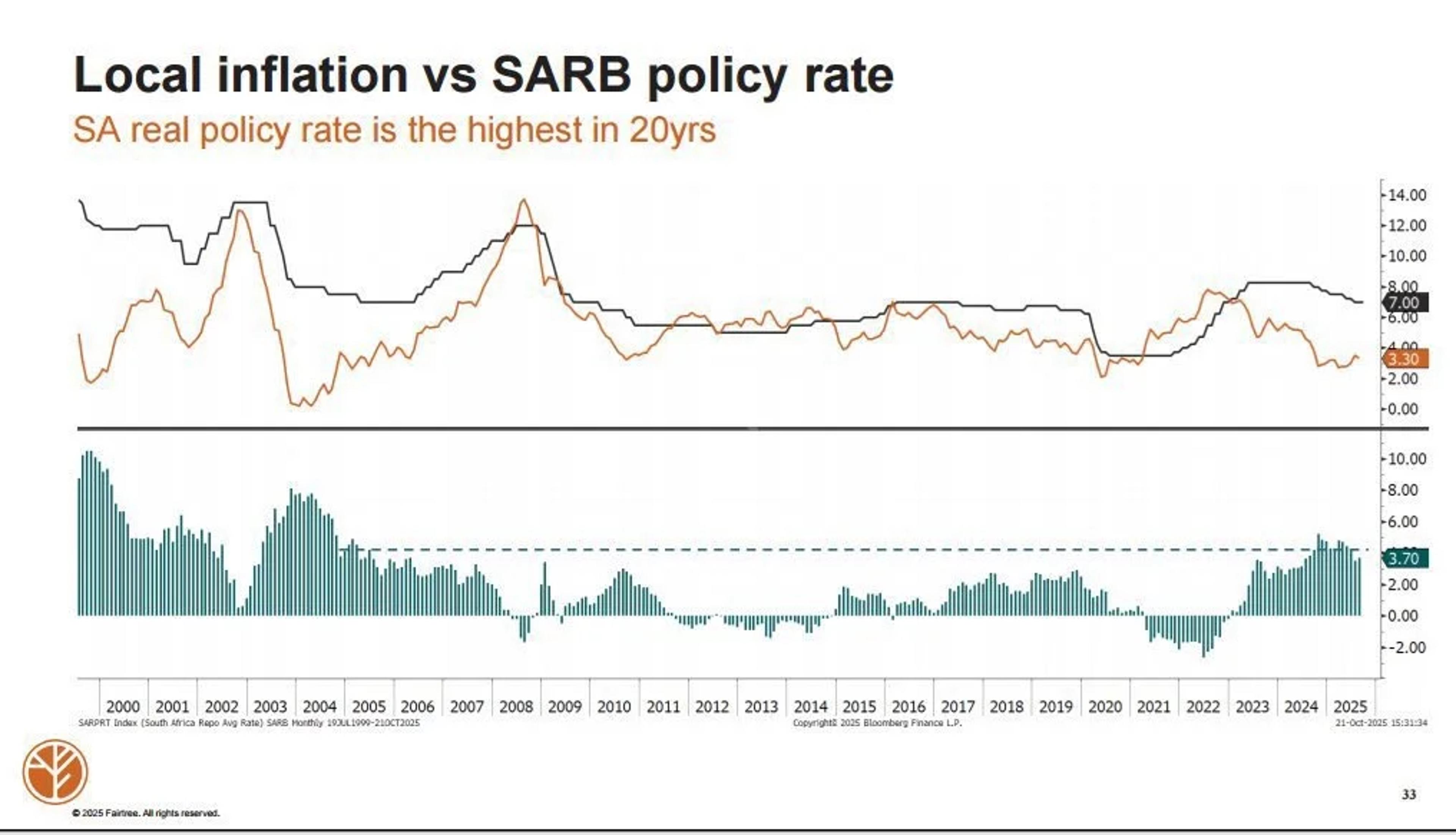

South Africa's Record Real Rates Prompt Slow, Steady Cuts

South African rates are restrictive. The real policy rate is the highest it’s been in 20 years, and they expect growth. They are suffocating the economy with high real rates. However, we can expect more rate cuts throughout the year,...

By Talk Cents

News•Feb 12, 2026

Consultation: The Appointed Representatives Regime

The UK government has opened a consultation to amend the Appointed Representatives (AR) regime, which lets non‑financial firms provide financial services without full authorisation. The move follows an August 2025 policy statement that flagged weak oversight of certain ARs and the...

By HM Treasury – Atom feed

Social•Feb 14, 2026

Stablecoins Undermine Local Growth, Not Banks

Local deposits => local loans => local growth. For our 125 years, that formula has built a thriving community. Stablecoin outside of banking destroys local economic growth. The below post makes that clear. Banks aren’t threatened by stablecoin, our local...

By Jill Castilla

Social•Feb 13, 2026

38% of Clients Drive 75% of Capitec Revenue

𝟯𝟴% 𝗼𝗳 𝗰𝘂𝘀𝘁𝗼𝗺𝗲𝗿𝘀 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗲 𝟳𝟱% 𝗼𝗳 𝗖𝗮𝗽𝗶𝘁𝗲𝗰’𝘀 𝗿𝗲𝘃𝗲𝗻𝘂𝗲 Capitec’s interim results for the period ending August 2025 show a very clear picture of where the bank’s income is really coming from: 🔸Non-interest income = R13,358 bn 🔸Net interest income = R...

By Talk Cents

News•Feb 11, 2026

Lloyds Banking Group to Close Another 95 Branches

Lloyds Banking Group announced it will shut 95 more branches – 53 Lloyds, 31 Halifax and 11 Bank of Scotland locations – between May 2024 and March 2027. The closures will leave the group with about 610 branches after the...

By BBC News – Business

Social•Feb 13, 2026

Unified Data Turns Branches Into Profit Engines

Branches can become profit engines, not cost centers, if supported by unified data and modern infrastructure. Execution is the difference. We discuss this with Benjamin Conant of @alkamitech and Co founder of @Mantl_tech. Watch the full video now: https://t.co/Jamreeb077 https://t.co/L1lau9ecEU

By Jim Marous

Social•Feb 13, 2026

Fintechs Must Prioritize Financial Health Over Services

#FlashbackFriday | In 2020, I argued that fintechs should stop selling financial services and start selling financial health, this wasn’t a buzzword, but a different way of thinking about the financial sector itself: https://t.co/bL1ZTqv4Uf Yesterday’s future. Progress optional. https://t.co/s7x485LBB3

By Dave Birch

News•Feb 11, 2026

Commonwealth Bank of Australia (CMWAY) Q2 2026 Earnings Call Transcript

Commonwealth Bank of Australia reported a solid second‑half 2025 performance, with cash net profit climbing 6% and earnings per share increasing $0.19. The bank highlighted disciplined growth across its core retail and business segments despite cost‑of‑living pressures and global uncertainty....

By Seeking Alpha — Site feed

Social•Feb 13, 2026

EU DLT Pilot Firms Demand Faster Regulations to Match US

EU DLT Pilot firms ask for urgent regulatory changes to keep up with US - Ledger Insights - blockchain for enterprise https://t.co/cYWCIYHmZg https://t.co/9rMftFnQUk

By Oliver Bussmann

Social•Feb 13, 2026

User‑centric Design Key to CBDC Resilience, Says IMF

"CBDCs... most significant resilience potential lies in user-centric design features, including offline functionality, flexible front-end solutions, and programmability for crisis response" Not my words. The IMF. https://t.co/aauwvtxTG8 https://t.co/O4sEWC2AN2

By Dave Birch

News•Feb 11, 2026

The High Cost of Going Cashless: Why Payment Choice Is Essential for Economic Equity

The push toward a cashless economy is accelerating, but the hidden fees and infrastructure demands are creating a financial burden for low‑income and unbanked consumers. As merchants adopt digital terminals and fintech platforms expand, cash‑only transactions become increasingly costly or...

By PaySpace Magazine

Social•Feb 12, 2026

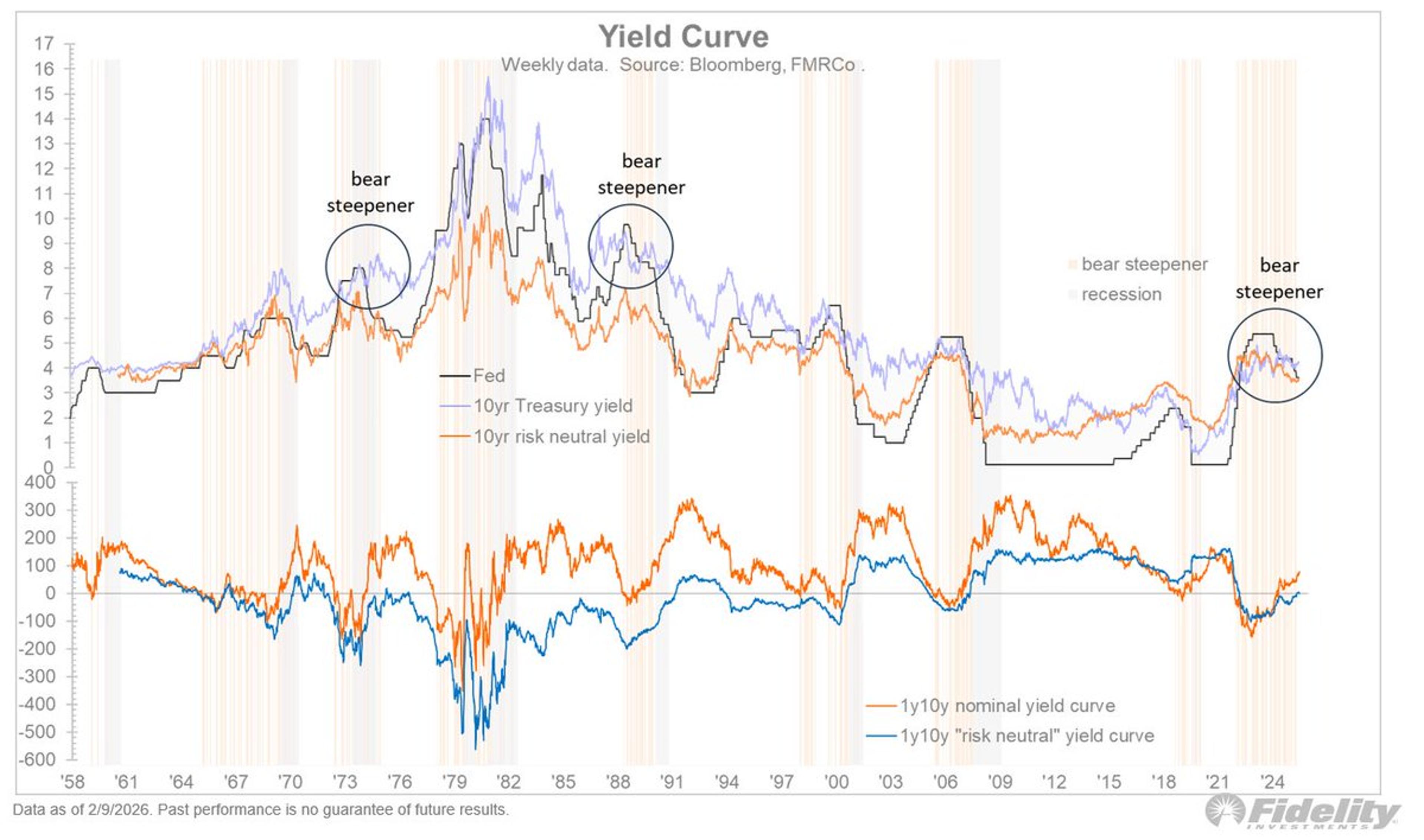

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

Social•Feb 12, 2026

Venezuelan Crypto App Kontigo Secures License From Top Official

It appears Y Combinator-backed Venezuelan crypto app Kontigo received a new license from SUNACRIP. License is signed by Anabel Pereira Fernández, who also holds roles as Venezuela’s economy minister, vice president of the central bank, and on the board of...

By Jason Mikula

News•Feb 11, 2026

EximPe Gets Final PA-CB Licence to Process UPI Cross-Border Payments

EximPe, a cross‑border payment startup, has secured the Reserve Bank of India’s final Payment Aggregator Cross‑Border (PA‑CB) licence. The authorisation lets the firm enable global merchants to collect Indian consumer payments via UPI, cards, wallets and other methods, with settlements...

By Entrackr

Social•Feb 11, 2026

Banks Poured $429B Into Steel; Capital Isn’t the Hurdle

"Between 2016 and mid-2023, 354 banks provided $429 billion to the 100 biggest steel producers, suggesting that finding capital isn’t the main challenge." https://www.bloomberg.com/news/articles/2026-02-11/banks-backing-green-steel-fund-false-solutions-report-says

By Akshat Rathi

Social•Feb 11, 2026

India Plans to Lift Bank FDI Cap, Boosting Lending

India’s government is considering raising the foreign direct investment (FDI) cap for banks from 20% to 49%. SMART MOVE. MORE FDI = MORE BANK CAPITAL = MORE LENDING CAPACITY https://t.co/agaPK9vbzO

By Steve Hanke

News•Feb 11, 2026

Spark Looks to Build Building a Safe Bridge Between Onchain Capital and TradFi

Spark introduced Spark Prime and Spark Institutional Lending, extending more than $9 billion of stablecoin liquidity to hedge funds, trading firms and fintechs operating under traditional custody rules. The offerings combine over‑collateralized loan structures with a unified risk framework that spans...

By CoinDesk

News•Feb 11, 2026

ESAs Publish Joint Guidelines on ESG Stress Testing

The European Supervisory Authorities (EBA, EIOPA and ESMA) released joint Guidelines on ESG stress testing, offering a unified framework for national banking and insurance supervisors. The document outlines how to embed environmental, social and governance risks into existing stress‑test models...

By ESMA – Press

News•Feb 11, 2026

Principles for Risk-Based Supervision: A Critical Pillar for ESMA’s Simplification and Burden Reduction Efforts

ESMA has published a set of Principles for Risk‑Based Supervision to create a unified supervisory culture across the EU. The framework outlines how regulators should identify, assess, prioritize and address risks to investor protection, financial stability and market order. By...

By ESMA – Press

News•Feb 11, 2026

ESMA Promotes Clarity in Communications on ESG Strategies

On 14 January 2026, the European Securities and Markets Authority (ESMA) issued its second thematic note addressing sustainability‑related claims, specifically ESG integration and ESG exclusions. The guidance highlights the varied interpretations of these terms and warns that ambiguous usage can...

By ESMA – Press

News•Feb 11, 2026

The European Supervisory Authorities and UK Financial Regulators Sign Memorandum of Understanding on Oversight of Critical ICT Third-Party Service Providers...

The European Supervisory Authorities (EBA, EIOPA and ESMA) have signed a Memorandum of Understanding with the Bank of England, the Prudential Regulation Authority and the Financial Conduct Authority to coordinate oversight of critical ICT third‑party service providers under the Digital...

By ESMA – Press

News•Feb 10, 2026

Fund Manager FINQ Lets AI Run US ETFs

FINQ has introduced two U.S. large‑cap equity ETFs—AIUP and AINT—where an artificial‑intelligence model exclusively selects, weights and rebalances holdings. The AI engine ranks every S&P 500 component daily using market, financial and textual data, guiding long‑only and long‑short exposures respectively. The...

By PYMNTS

News•Feb 10, 2026

How Printable Check Designs Simplify Modern Business Payments

Printable check designs are gaining traction as businesses seek to modernize traditional payment methods while retaining the benefits of paper checks. By using on‑demand templates, companies can generate professional checks directly from accounting software, eliminating bulk ordering and reducing turnaround...

By TechBullion

News•Feb 10, 2026

US Private Credit Market Adapts to Post Rate Hike Environment : Analysis

PitchBook’s latest report shows U.S. private credit remaining resilient despite a modest year‑over‑year dip in January transaction volume. Eight mega‑deals exceeding $1 billion offset the slowdown, while mid‑market issuance stayed robust, highlighting depth in smaller opportunities. Leveraged‑buyout transactions shifted toward fewer,...

By Crowdfund Insider

News•Feb 10, 2026

Goldman Sachs Holds Over $2 Billion in Crypto

Goldman Sachs disclosed $2.36 billion in crypto assets in its Q4 2025 13F filing, marking a modest rise from the prior year. The portfolio is split between $1.1 billion of Bitcoin, $1 billion of Ethereum, $153 million of XRP, and $108 million of Solana, representing less...

By Crowdfund Insider

News•Feb 10, 2026

StanChart CFO Abruptly Exits for Apollo

Standard Chartered announced that group CFO Diego De Giorgi is leaving immediately to join Apollo Global Management as a partner and head of EMEA. Peter Burrill, the bank's group head of central finance, will serve as interim CFO while a permanent replacement is...

By CFO Dive

Social•Feb 10, 2026

I’m Unable to View the Linked Content, so I Can’t Generate a Headline.

👀 https://lnkd.in/etCquTsi

By Caitlin Long

Social•Feb 10, 2026

Software Creators Not Liable for Users' Money Transmission Violations

“You shouldn't be found guilty of unlicensed money transmision only because other people used your software” https://t.co/afdHBJ8VQK

By Laura Shin

News•Feb 10, 2026

Toast Links Dining to Instacart’s Marketplace; Ingenico Launches Its 360 Platform Plus AXIUM Terminals

Toast announced a partnership with Instacart, linking its restaurant platform to the Instacart Marketplace and making Instacart Business available for same‑day grocery procurement. The integration adds SmartScan barcode optimization and catalog attribution tools, enabling restaurants to quickly add items and...

By Digital Transactions

Social•Feb 10, 2026

Executive Backing Turns Data Governance From Reactive to Strategic

Data governance is critical but tough. Without executive support, clear roles, and resources, committees stay reactive. Done right, it drives strategic decisions and strengthens both insights and cyber resilience. https://t.co/brZ80xsiyu

By Cristina Dolan