Social•Feb 20, 2026

Busan Deal: US Sacrific

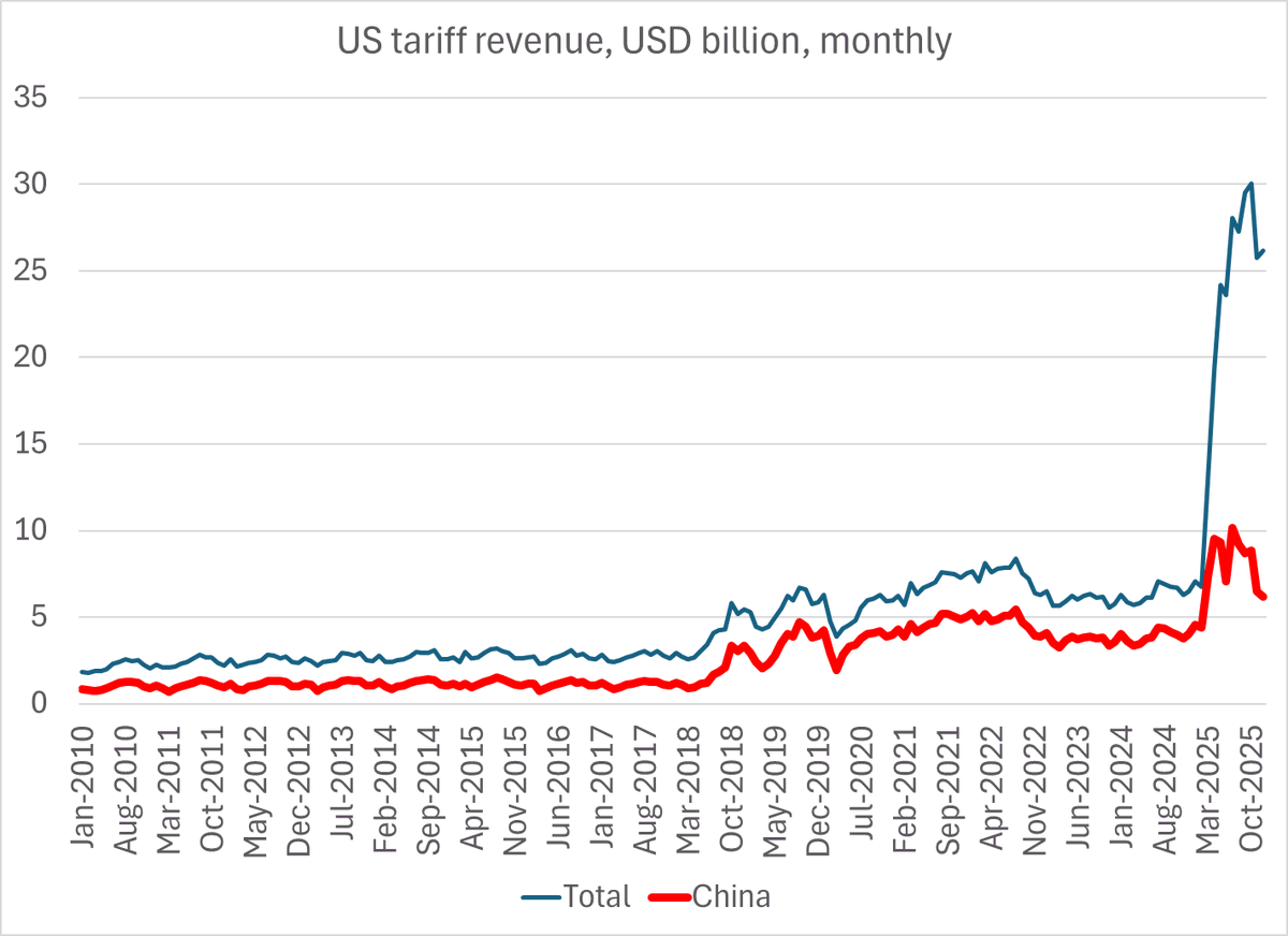

The impact of the "Busan" deal is now in the trade data -- the US clearly gave up a bit of tariff revenue (lowering the tariff on China) for a bit of supply chain peace, and the prospect of renewed 'bean exports 1/2 https://t.co/I6hpxMruNO

By Brad Setser

Social•Feb 20, 2026

Spend $33B on Flexibility, Not Idle Gas Plant

For $33B he could have solved the entire PJM capacity auction challenge with demand flexibility through 2029, but sure overpay for a gas plant that won’t run more than 20% of the year…

By Jigar Shah

Social•Feb 19, 2026

Buy Newmont on Pullbacks as Gold Rises

Macro: gold up on rate‑cut hopes & geopolitics. Key: Newmont beat as realized $4,216/oz offset 24% output drop. Risk: output erosion, volatility. Trade: buy Newmont on pullbacks. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

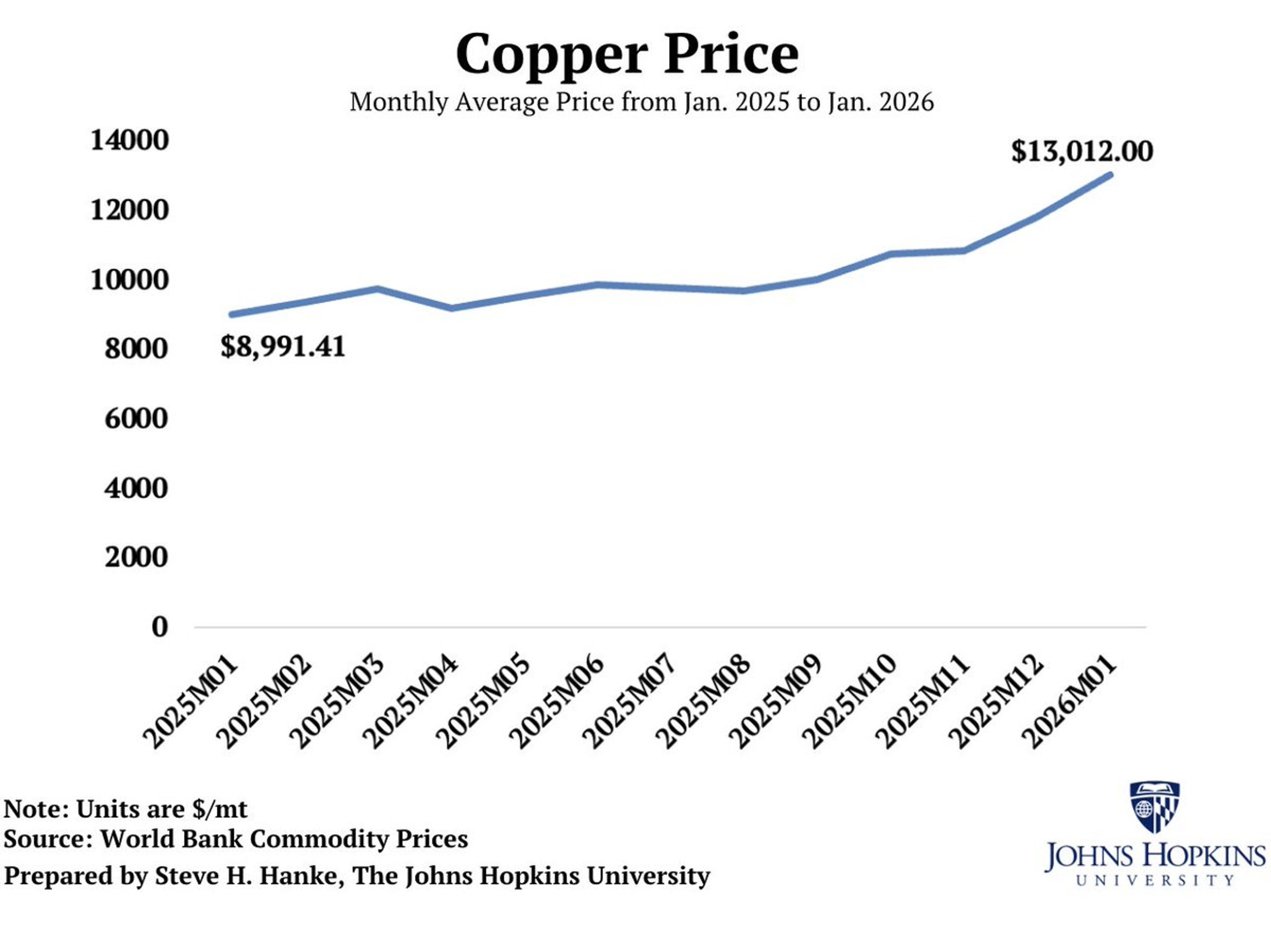

Copper Prices Jump 44% Year‑Over‑Year

Copper prices have surged to an average of $13,012/mt in January 2026 from $8,991/mt a year ago. That's a WHOPPING 44% INCREASE. BUY COPPER, WEAR DIAMONDS. https://t.co/FIhvIikhjQ

By Steve Hanke

Social•Feb 19, 2026

US Strike Risk Adds Premium to Oil Market

Expectations of a possible US strike on Iran—currently oscillating between wait-and-see and watchful anticipation—have introduced a risk premium into an otherwise well-supplied oil market. My talk w/ @KellyCNBC @CNBCTheExchange https://t.co/XwyD5XmiRg

By Daniel Yergin

Social•Feb 19, 2026

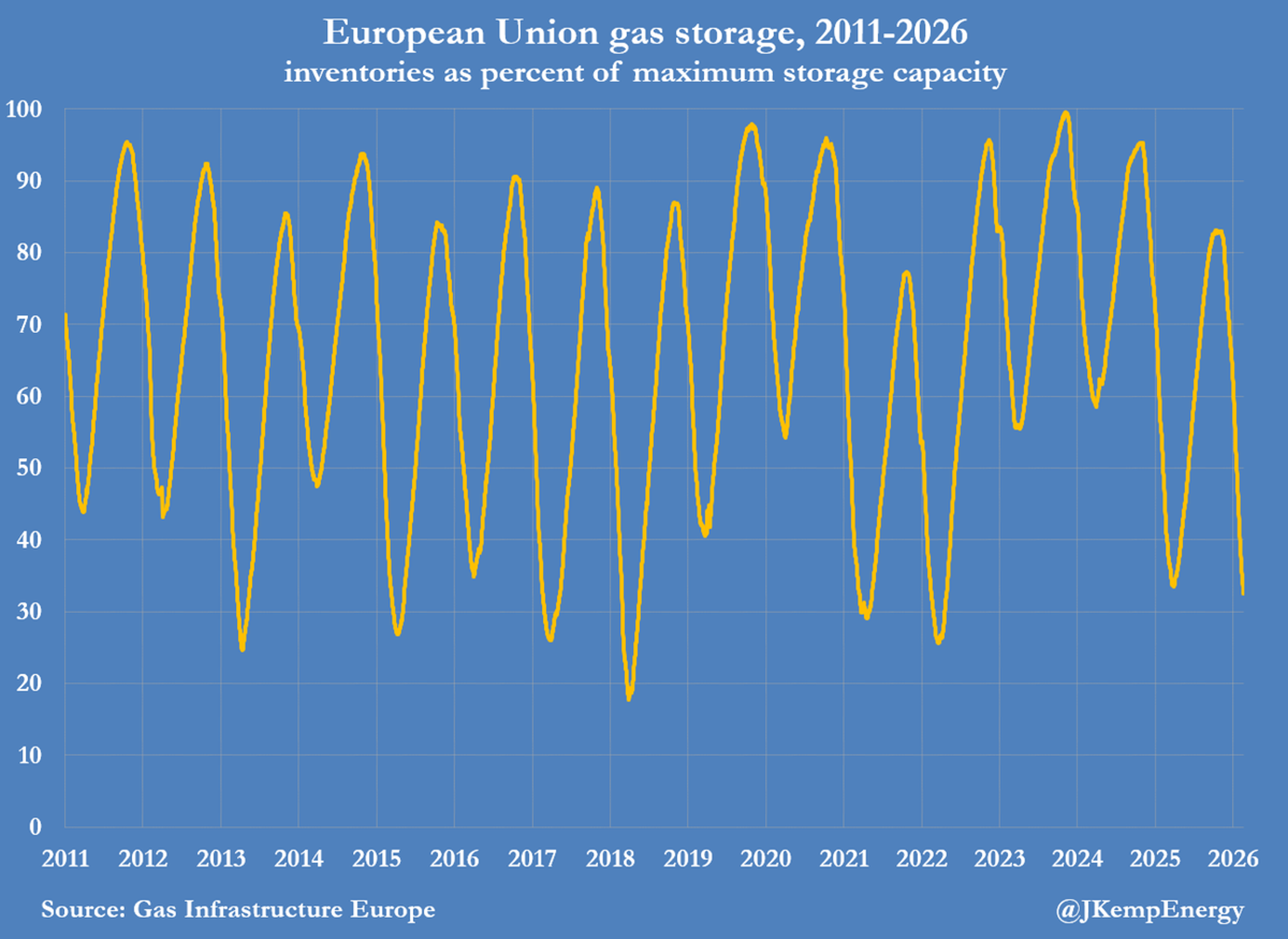

EU Gas Storage at 32%—Second Lowest Since 2011

EU GAS STORAGE facilities are now less than one-third full, with more than a month of the winter heating season probably still ahead. Storage facilities were on average 32.5% full on February 17, the second lowest seasonal fill in records...

By John Kemp

Social•Feb 19, 2026

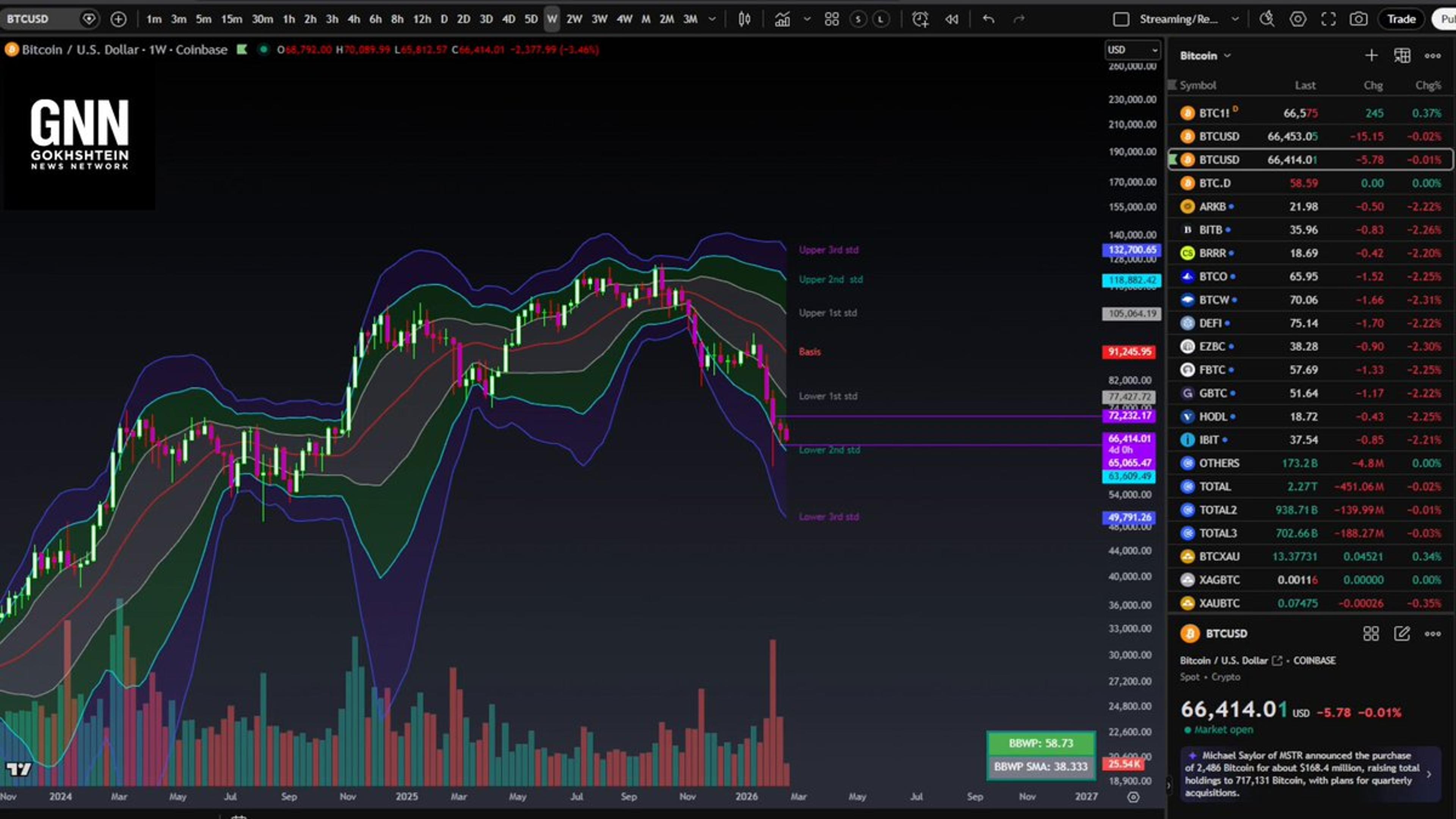

Midweek Market Snapshot Across Crypto, Commodities, and Equities

Market Update with Landy: The Wednesday Check-In 02/18/2026 $BTC $GOLD $SILVER $OIL $NG $DJI $NDX $SPY Brought to you by @davidgokhshtein @gokhshtein and hosted by @CryptoLandy. https://t.co/wB4GTwTt32

By David Gokhshtein

Social•Feb 18, 2026

Tariffs Inflate Prices and Act Like Hidden Corporate Tax

A) Many studies have examined whether tariffs have been passed through to consumer prices, and they've found significant retail price increases B) Tariff burdens absorbed by US companies are an inefficient corporate tax, paid by Americans via lower wages or share...

By Scott Lincicome

Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

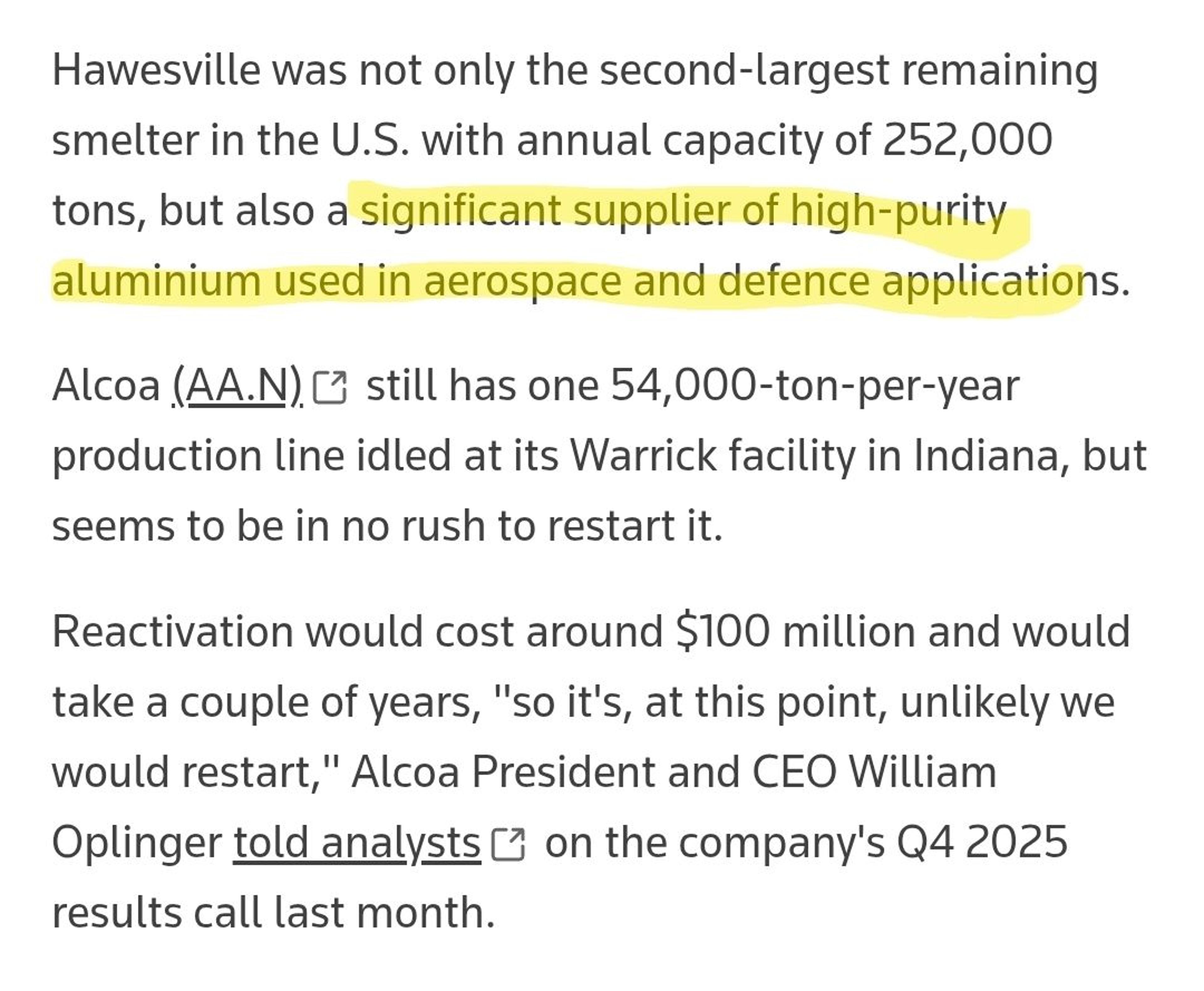

Tariffs Fail: US Down to Five Aluminum Smelters

"U.S. import tariffs haven't been enough to stop the United States losing another aluminium smelter, leaving the country with just five primary metal production plants." 😲 https://t.co/T5U4nxglb0 https://t.co/EOQY3OwzE6

By Scott Lincicome

Social•Feb 18, 2026

IEA Shifts Priorities to Security, Clean Energy, Affordability

IEA executive director Fatih Birol proposes focusing the agency's work in three areas during the next few years: 1) energy security -- "first and foremost" mission 2) new energy uptake (wind, solar, geothermal, nuclear) 3) afordability of energy "IEA 3.0" may well be...

By Javier Blas

Social•Feb 18, 2026

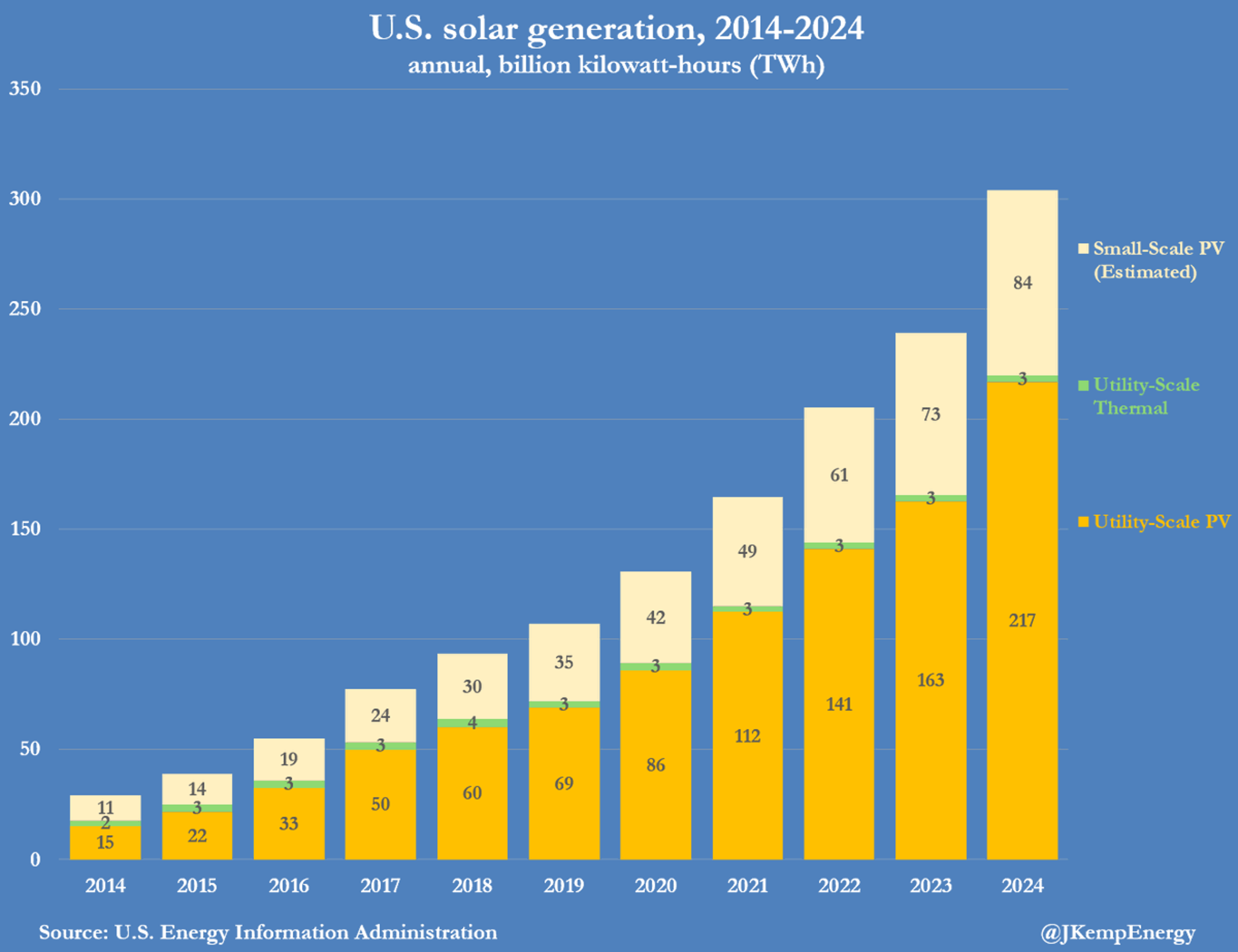

U.S. Solar Power Hits Record 304 TWh, Ten‑Fold Growth

U.S. SOLAR GENERATION increased to a record 304 billion kilowatt-hours (kWh) or 304 terawatt-hours (TWh) in 2024. Solar generation had increased ten-fold over the previous ten years from 29 billion kWh in 2014. Data prepared by the U.S. Energy Information...

By John Kemp

Social•Feb 18, 2026

Japan Commits $36B to U.S. Energy, Led by SoftBank

Japan plans to invest $36 billion in US oil, gas and critical mineral projects 🇯🇵 🤝 🇺🇸 The most significant piece is a 9.2GW gas-fired power plant in Ohio. The investment will be led by SoftBank https://t.co/5io8koo0jd

By Stephen Stapczynski

Social•Feb 17, 2026

Sanctions Spawn Shadow Fleet, Aging Tankers Scrapped in India

US sanctions squeezed Russian and Venezuelan oil shipping out of mainstream markets. A shadow fleet emerged. Now aging dark fleet tankers are arriving at Indian scrapyards at a record pace. SANCTIONS = WORKAROUNDS = UNINTENDED CONSEQUENCES. https://t.co/GddyWzZwZd

By Steve Hanke

Social•Feb 17, 2026

Wheat Export Inspections Outpace USDA Target by 59M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 59 million bushels, versus 61 million the previous week. #oatt

By Arlan Suderman