Social•Feb 18, 2026

Japan Commits $36B to U.S. Energy, Led by SoftBank

Japan plans to invest $36 billion in US oil, gas and critical mineral projects 🇯🇵 🤝 🇺🇸 The most significant piece is a 9.2GW gas-fired power plant in Ohio. The investment will be led by SoftBank https://t.co/5io8koo0jd

By Stephen Stapczynski

Social•Feb 17, 2026

Sanctions Spawn Shadow Fleet, Aging Tankers Scrapped in India

US sanctions squeezed Russian and Venezuelan oil shipping out of mainstream markets. A shadow fleet emerged. Now aging dark fleet tankers are arriving at Indian scrapyards at a record pace. SANCTIONS = WORKAROUNDS = UNINTENDED CONSEQUENCES. https://t.co/GddyWzZwZd

By Steve Hanke

Social•Feb 17, 2026

Wheat Export Inspections Outpace USDA Target by 59M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 59 million bushels, versus 61 million the previous week. #oatt

By Arlan Suderman

Social•Feb 17, 2026

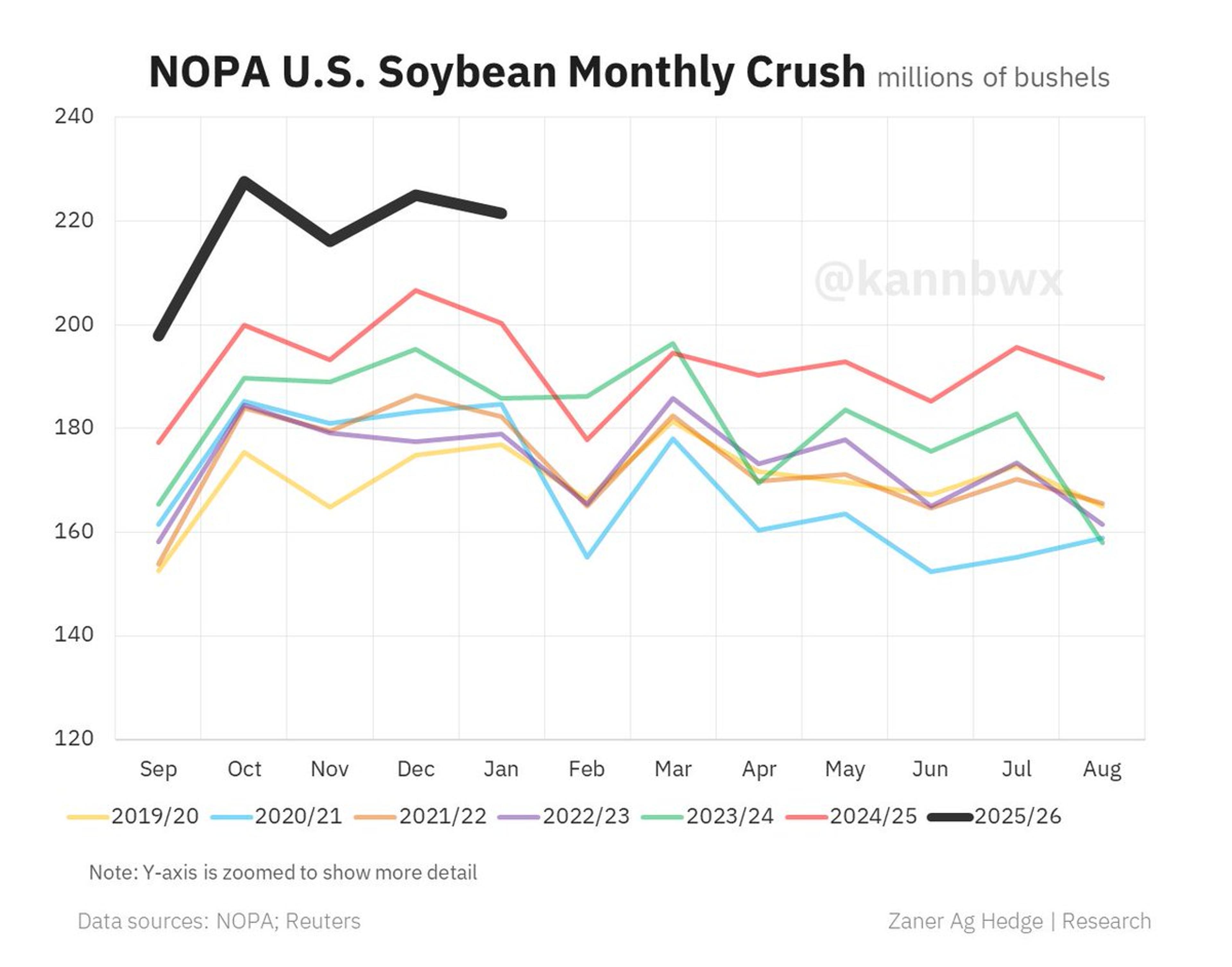

US Jan Soy Crush Beats Forecast, Stocks Surge 49%

🇺🇸NOPA U.S. crush, Jan. 2026: ▪️221.564 mln bu of soybeans ▪️Above avg trade guess of 218.52 mln ▪️+10.6% YOY; down 1.5% from Dec. 2025 ▪️Soyoil stocks 1.9 bln lbs ▪️Above all trade guesses (avg was 1.71 bln) ▪️+49% YOY; highest since April 2023 https://t.co/UItFPJlkd8

By Karen Braun

Social•Feb 17, 2026

Guyana and Exxon Profit From Venezuela's Turmoil

Been saying this for a while: Guyana (and by extension Exxon) was a big collateral winner of Venezuela developments. https://t.co/QzfRIJKK1F

By Rory Johnston

Social•Feb 17, 2026

U.S. Corn Inspections Surpass Expectations, Soy Exports to China Strong

🇺🇸Last week's U.S. corn inspections easily beat all trade expectations (though they weren't a weekly record). FYI the previous week's corn volume was hiked significantly. Soy inspections were near the top end of estimates - 57% of the beans were...

By Karen Braun

Social•Feb 17, 2026

Corn Leads Weekly Export Inspections, Soybeans Follow

Export inspections for the week ending Feb. 12 (mln bu): #corn 58.8, grain sorghum 9.5, #soybeans 44.2, #wheat 13.8 #oatt

By Arlan Suderman

Social•Feb 17, 2026

US‑Iran Oil Talks Conclude Second Round, Third Round Pending

OIL MARKET: The 2nd round of US-Iran talks has concluded, and Iranian media says there would be a 3rd round of negotiations in the “near future” after both sides consult with their respective governments.

By Javier Blas

Social•Feb 17, 2026

Iran and Russia Clash over China Oil Supply Rivalry

The oil ministers of Iran and Russia met today. Contrary to popular belief, Moscow and Tehran are now bitter rivals in the oil market as the size of the black market for crude shrinks. Both compete to supply China. (My earlier @Opinion...

By Javier Blas

Social•Feb 16, 2026

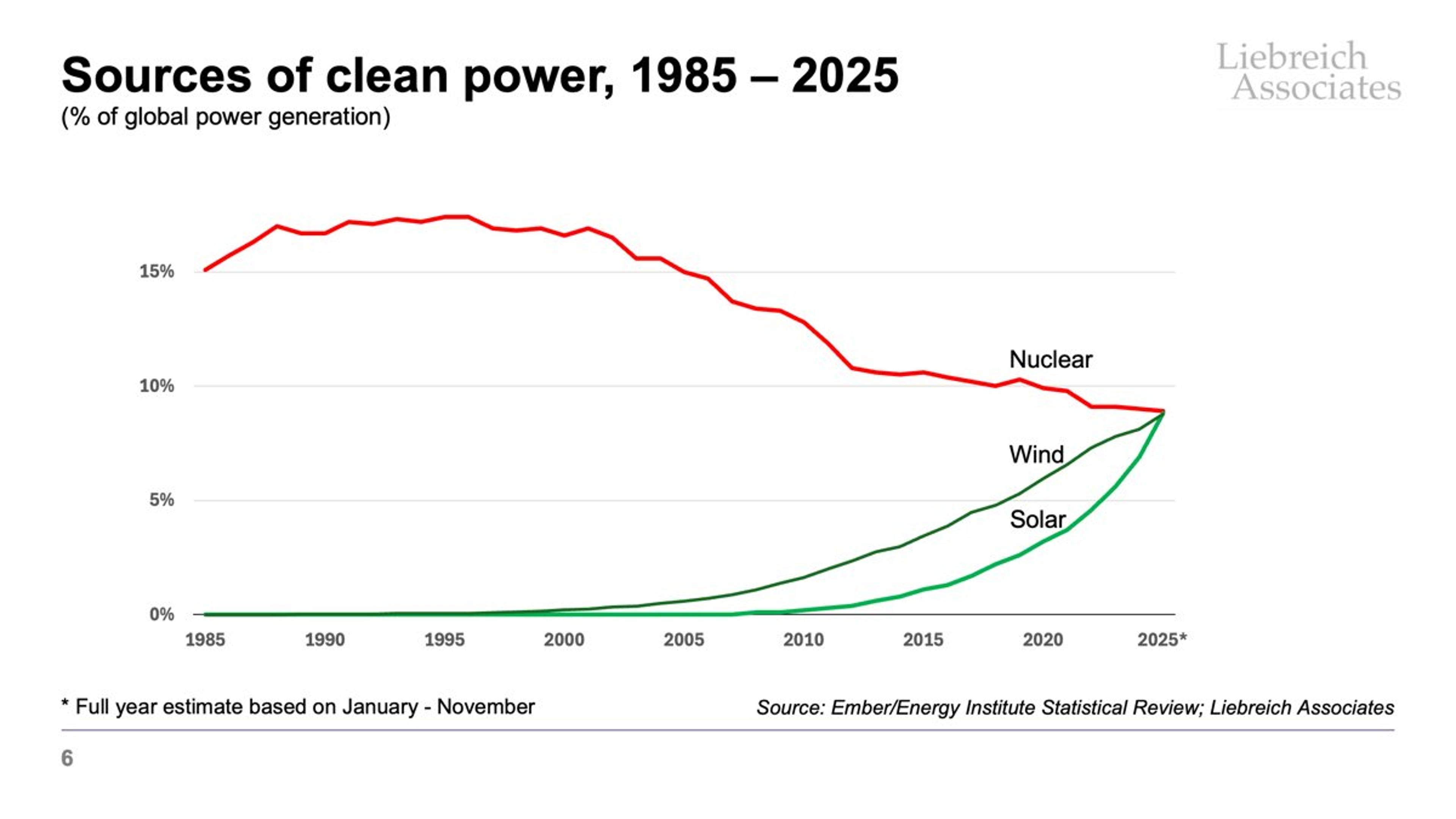

Solar Overtakes Nuclear; Nuclear Drops to Third by 2026

I've been cranking numbers. Full year 2025, it looks like nuclear power just about kept its nose ahead of wind and solar. But in H2 2025, while wind didn't quite overtake nuclear, solar did. In 2026 nuclear will drop to...

By Michael Liebreich

Social•Feb 16, 2026

Trump's Presidency Keeps Oil Prices Higher, OPEC+ Cuts Production

The best—only?—argument that Trump is bearish for oil prices is that OPEC+ wouldn't have hiked crude production as aggressively last year in a world in which Harris was sitting in the White House.

By Rory Johnston

Social•Feb 16, 2026

Metal Volatility Reveals Hidden Market Shifts

Metal Volatility Changed Everything $GLD $SLV $BTCUSD $SPX $QQQ $IGV $XLK Sharp volatility in gold, silver, crypto and equities was easier to spot than most think. And why I study sector rotation, options structure, and investor confidence. https://t.co/PYmLxcJSCJ

By Samantha LaDuc

Social•Feb 16, 2026

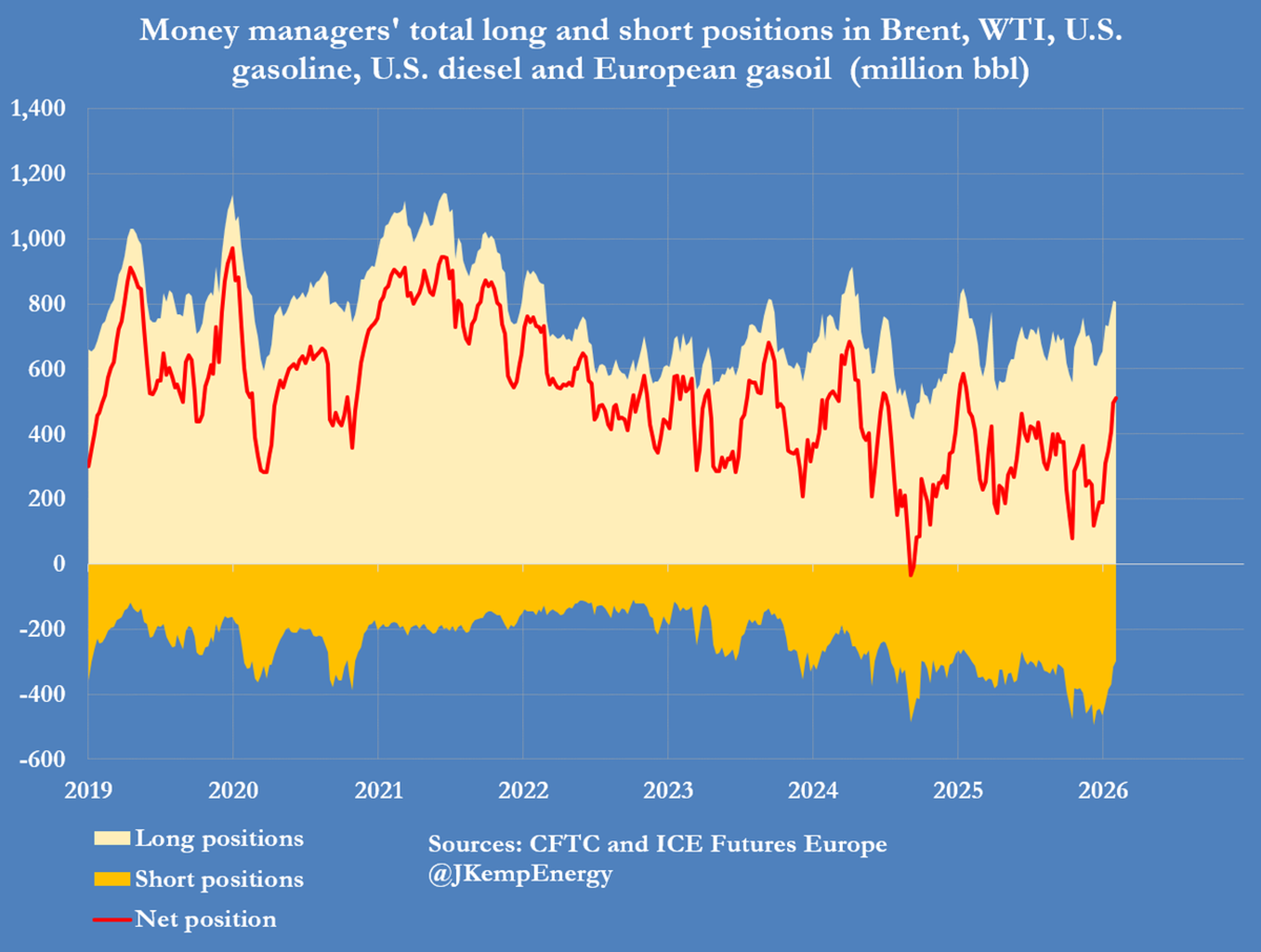

Investors Bet on Oil Amid Growing Supply Threats

Oil investors bullish on proliferating supply threats Investors are increasingly bullish about the outlook for oil prices as potential risks to production and tanker traffic multiply - including threats of U.S. military action against Iran and stricter sanctions enforcement. Hedge funds and...

By John Kemp

Social•Feb 16, 2026

Bears Dominate Oil Market Narrative After Energy Week

COLUMN: In the oil market, the bears control the narrative — at least for now. (My summary after last week's International Energy Week, the oil trading industry's annual jamboree in London) @Opinion https://t.co/Y3OHEhD4k5

By Javier Blas

Social•Feb 16, 2026

Henry Hub Drops Below $3 on Warm Weather, Shale Supply

GAS MARKET: After a cold blast triggered sild price moves, US gas benchmark Henry Hub has fallen back below $3 per mBtu. Warmer temperatures and the irresistible supply force of the US shale revolution behind the pullback.

By Javier Blas

Social•Feb 15, 2026

Stockpile Buffers Risk, Not Replaces Chinese Supply

A $12B rare earth stockpile is a step in the right direction, but buying from China on the open market isn’t independence; it’s a piggy bank with a very fragile supply chain. Until we build domestic processing, this is a...

By Peter Zeihan

Social•Feb 15, 2026

Egypt's Summer Power Surge Drives Record LNG Demand

Egypt expects electricity demand to increase by 7% this summer. That means strong demand for LNG imports. Egypt's LNG demand reached record high last year. 👇👇

By Anas Alhajji

Social•Feb 15, 2026

Europe Doubts US LNG Reliability Despite Past Optimism

A decade ago, I wrote an essay @ForeignAffairs about rise of US LNG w subhead "The benign energy superpower." https://t.co/P9r14hfb11 This week @MunSecConf, the Q I got most was whether Europe can trust US LNG to be reliable. And privately, senior...

By Jason Bordoff

Social•Feb 15, 2026

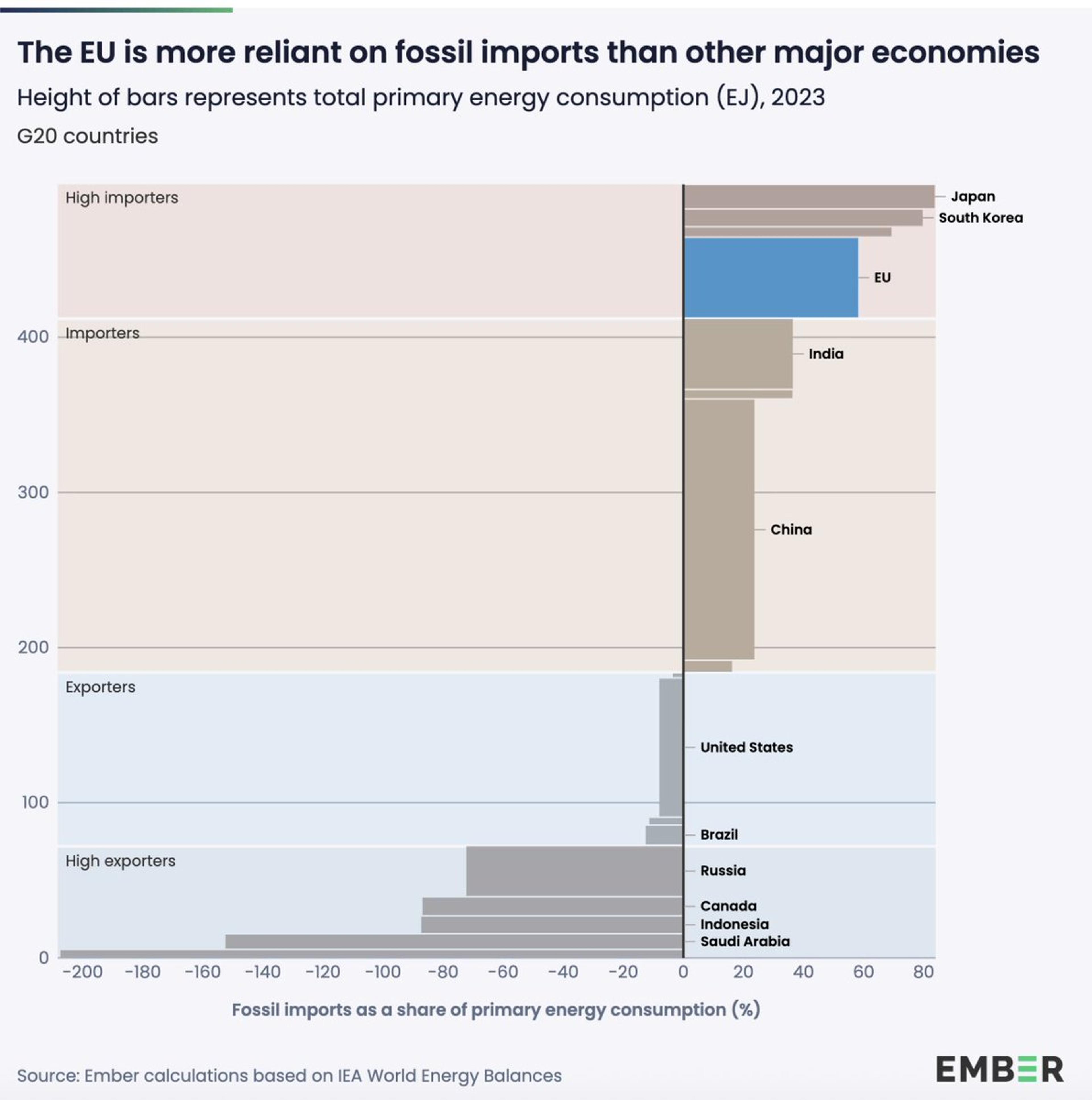

EU's Fossil Imports Hit 58% of Energy Demand.

EU fossil imports met 58% of energy demand in 2023 - near pre-crisis levels - leaving consumers exposed to price shocks. Far above China (24%) & India (37%); only Japan (84%) & S. Korea (80%) rely more on imports. Graph: @ember_energy...

By Jan Rosenow

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

Predicting Silver’s Peak and the Next Market

How I Called The Top In Silver & What Comes Next $GLD $SLV $GDX $SIL We also about my yen monetization framework, oil, AI-driven software disruption & timing a historic rotation into large-cap value. https://t.co/0A5l9bLx9C

By Samantha LaDuc

Social•Feb 14, 2026

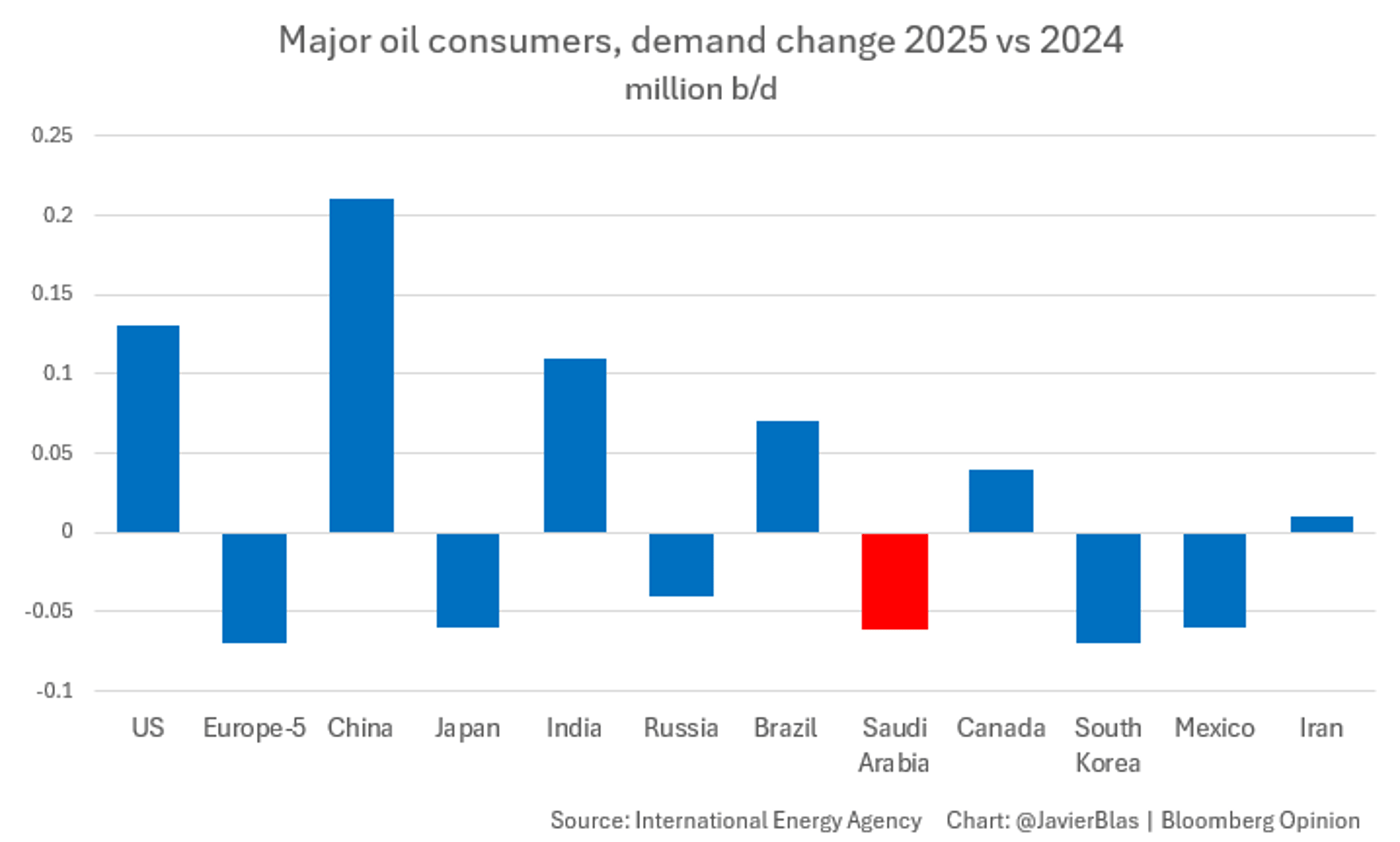

Saudi Arabia’s Oil Demand Plummets as Gas Powers Electricity

CHART OF THE DAY: Among the world's top oil consumers, a curious trend. The 2nd largest consumption drop last year ocurred in Saudi Arabia, where demand fell ~60,000 b/d (only South Korea saw a larger drop). The reason? Gas is...

By Javier Blas

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

Social•Feb 13, 2026

No Bullish Catalyst for Oil in 2026, Repeat Likely

🚦From a pure fundamentals perspective, there's simply no bullish driver in sight capable of pushing oil prices into the high $70s—or higher—in 2026. ⚽️Betting your capital on a major war with Iran or any similar geopolitical shock to spike prices isn't...

By Anas Alhajji

Social•Feb 13, 2026

Kuwait Lags UAE in Oil Capacity, Faces $90.5 Break‑Even

Kuwait's production capacity was ahead of the UAE's in 2010. Now it is 3.2 Mbpd versus 4.85 Mbpd Budget break-even is $90.5 per bbl and oil is 83% of the budget https://t.co/1si82Sc7pF

By Robin Mills

Social•Feb 13, 2026

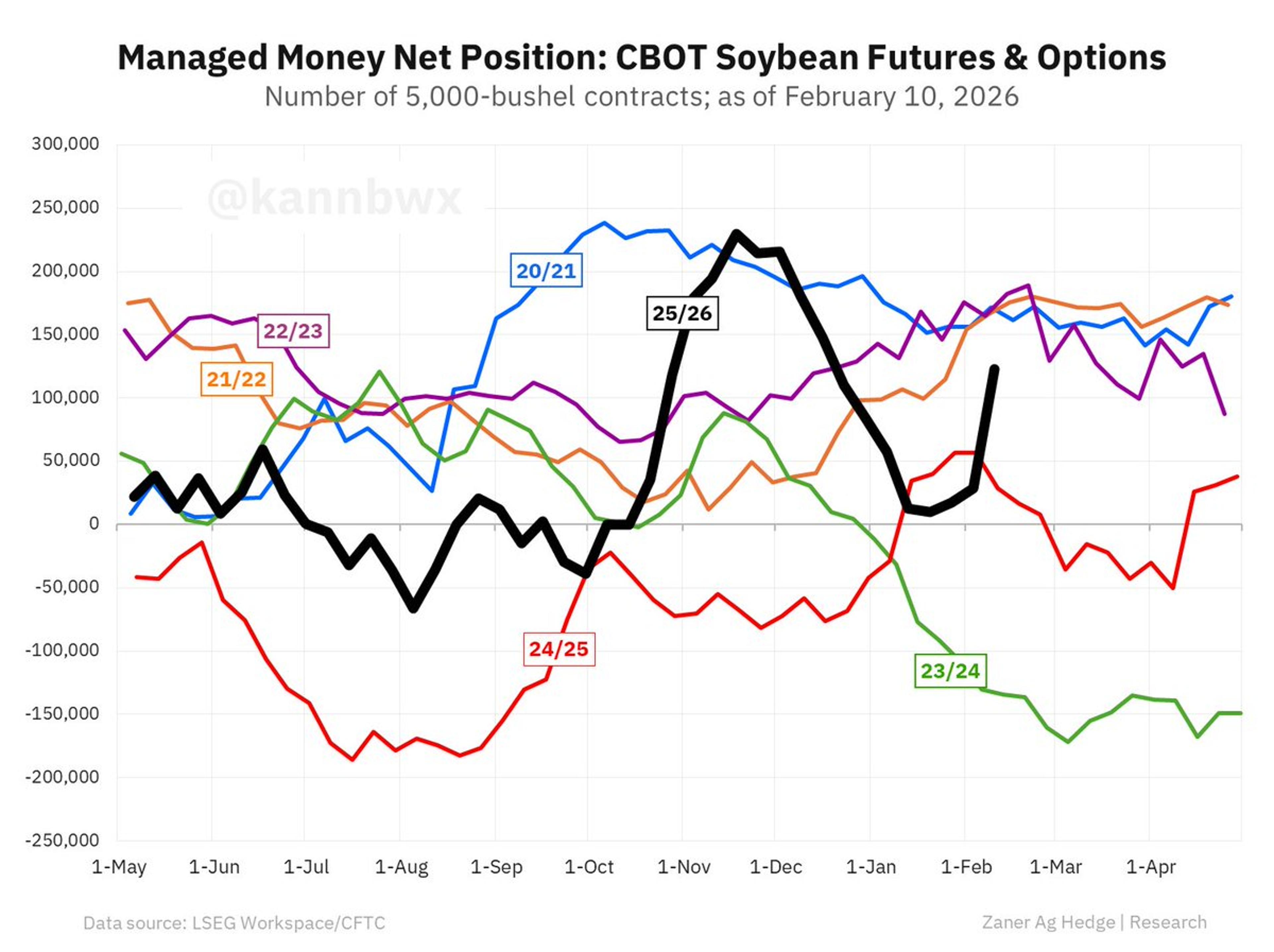

Money Managers Near Record Soybean Futures Buying on US‑China Optimism

📈Money managers staged a near record buying spree in CBOT soybean futures & options in the week ended Feb. 10 on renewed U.S.-China optimism. New net long = 123,148 contracts. Net buying of 94k contracts was the second most for any...

By Karen Braun

Social•Feb 13, 2026

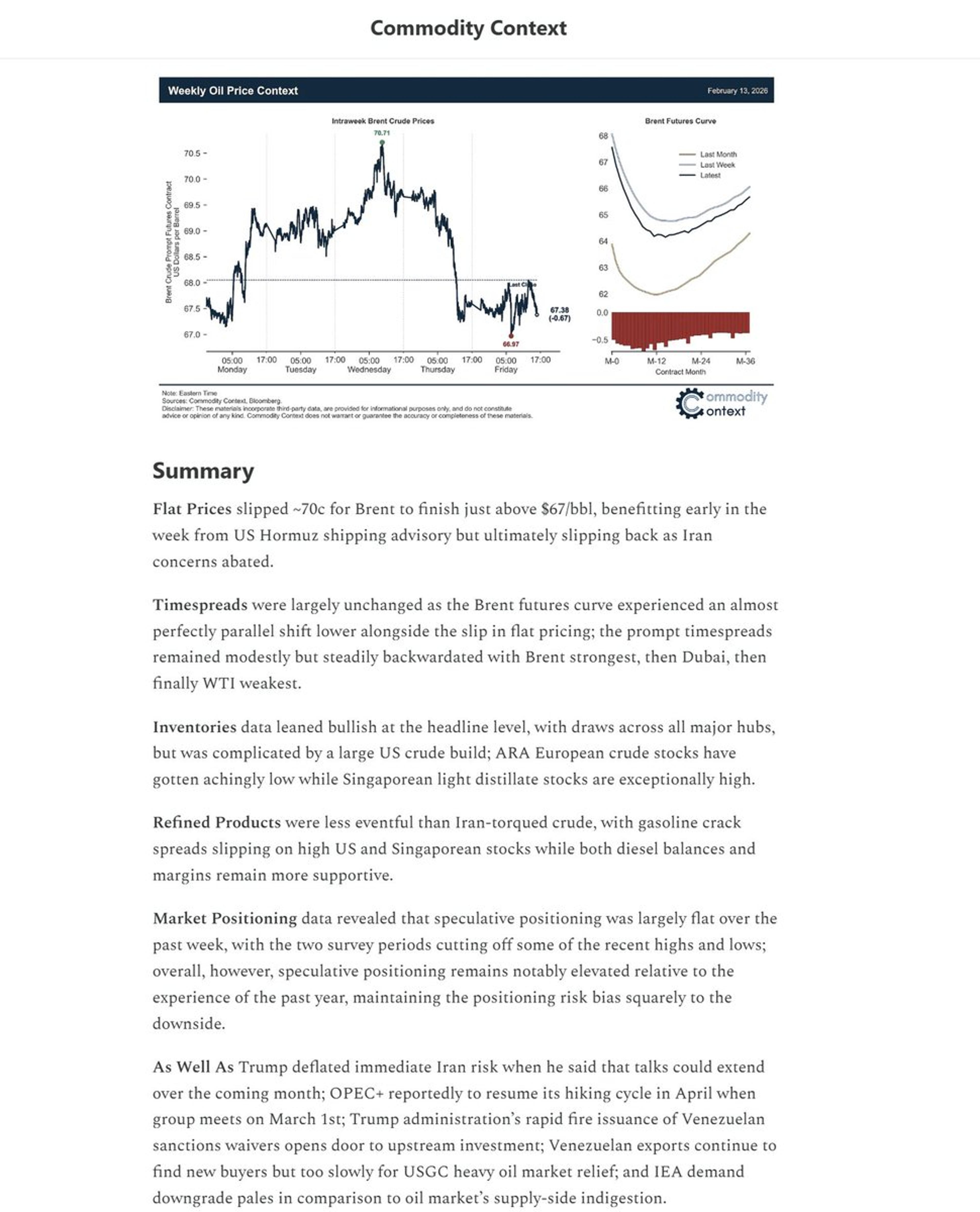

Crude Swings on Hormuz Alert, US‑Iran Talks, Venezuela Relief

🛢️ OIL CONTEXT WEEKLY 🛢️ 📈📉Crude prices rise on Hormuz advisory before falling back on the prospect of longer US-Iran talks, with headlines dotted with a flurry of US sanctions relief on Venezuela’s oil sector. Summary below, link to full report in...

By Rory Johnston

Social•Feb 13, 2026

Argus Targets Venezuelan Crude for U.S. Gulf Delivery

This is an interesting oil market transparency development. Argus "will assess three grades of Venezuelan crude oil, Merey, Hamaca and Boscan, for delivery to the U.S. Gulf coast, which Argus said is now the most likely destination for Venezuelan cargoes" https://t.co/RaKzvH53Rp

By Rory Johnston

Social•Feb 13, 2026

OPEC+ Faces March 1 Decision on Production Hikes

OIL MARKET: The core group of OPEC+ countries need to decide on March 1 whether to re-start production increases after the Jan-Mar pause. Some members in the group see scope for resuming the monthly hikes, although conversations haven't started yet....

By Javier Blas

Social•Feb 13, 2026

Cargill Shuts Milwaukee Plant, 221 Jobs Lost Amid Herd Slump

"Cargill to Close Milwaukee Beef Facility, Cutting 221 Jobs on Herd Decline" https://t.co/R3enSgd7lj "An industry turnaround isn’t expected soon, as there are few signs of a much-anticipated rebuilding of US herds." 😬

By Scott Lincicome

Social•Feb 13, 2026

Trump Admin Eyes Tariff Cuts, Citing Price Hikes, Complexity

BOMBSHELL @FT scoop: Trump admin mulls cutting steel/aluminum tariffs bc these taxes 1) raise US prices; 2) are insanely complicated; 3) had other unintented consequences (incl lobbying). They're admitting, in other words, that gravity exists. Good. https://t.co/o4RkfMWxlF

By Scott Lincicome

Social•Feb 13, 2026

Oil Returns Green, Signaling Bullish Energy Buying Opportunity

OIL: ticks back into the green and remains Bullish TREND @Hedgeye Yesterday was the 1st day where we could start buying some Energy Exposure on red https://t.co/eURgEMfFpO

By Keith McCullough

Social•Feb 12, 2026

All Markets Tumble, $3.6T Erased in 90 Minutes

-$3.6T in 90 minutes Gold fell 3.76%, wiping out nearly $1.34T in market cap. Silver dropped 8.5%, losing around $400B in market value. The S&P 500 declined 1%, erasing $620B. Nasdaq slid more than 1.6%, shedding $600B. The crypto...

By Crypto Jack

Social•Feb 12, 2026

SOLS: Cheap US Uranium Conversion Monopoly Amid Global Shortage

Thread(1/2) 🧵 We put our SOLS long thesis above the paywall in our Atoms vs. Bits primer yesterday, so I’m also going to summarize for all you degenerates on X. The story is simple: the uranium trade has resulted in nearly every...

By Citrini7 (pseudonymous)

Social•Feb 12, 2026

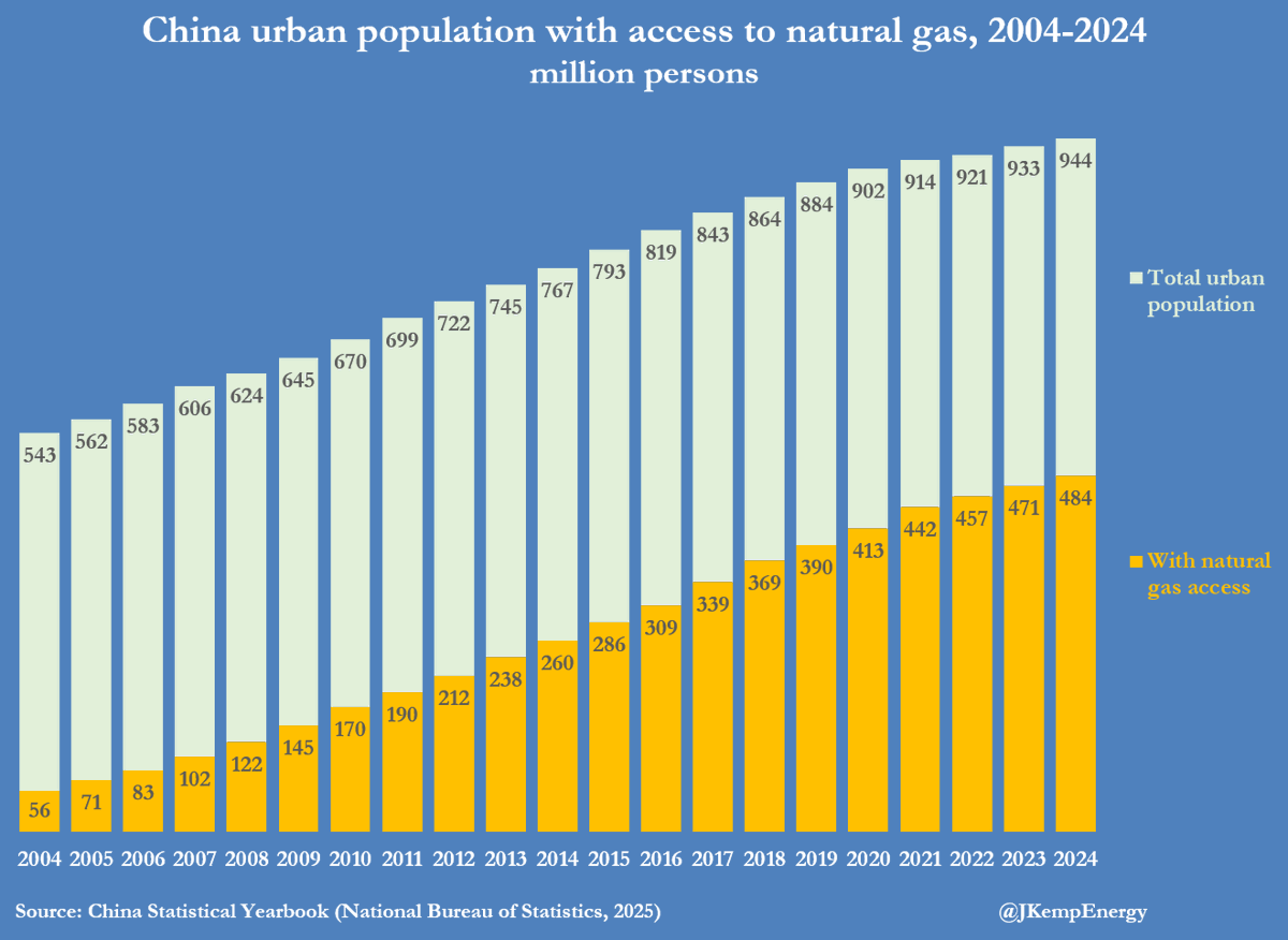

China’s Urban Gas Network Reaches 484 Million Residents

China’s residential gas revolution China has connected more than 300 million people living in urban households to the natural gas network since 2010, according to data published late last year by the National Bureau of Statistics (NBS). The number of urban...

By John Kemp

Social•Feb 12, 2026

Price Controls Trigger Chaotic, Uneven Resource Allocation

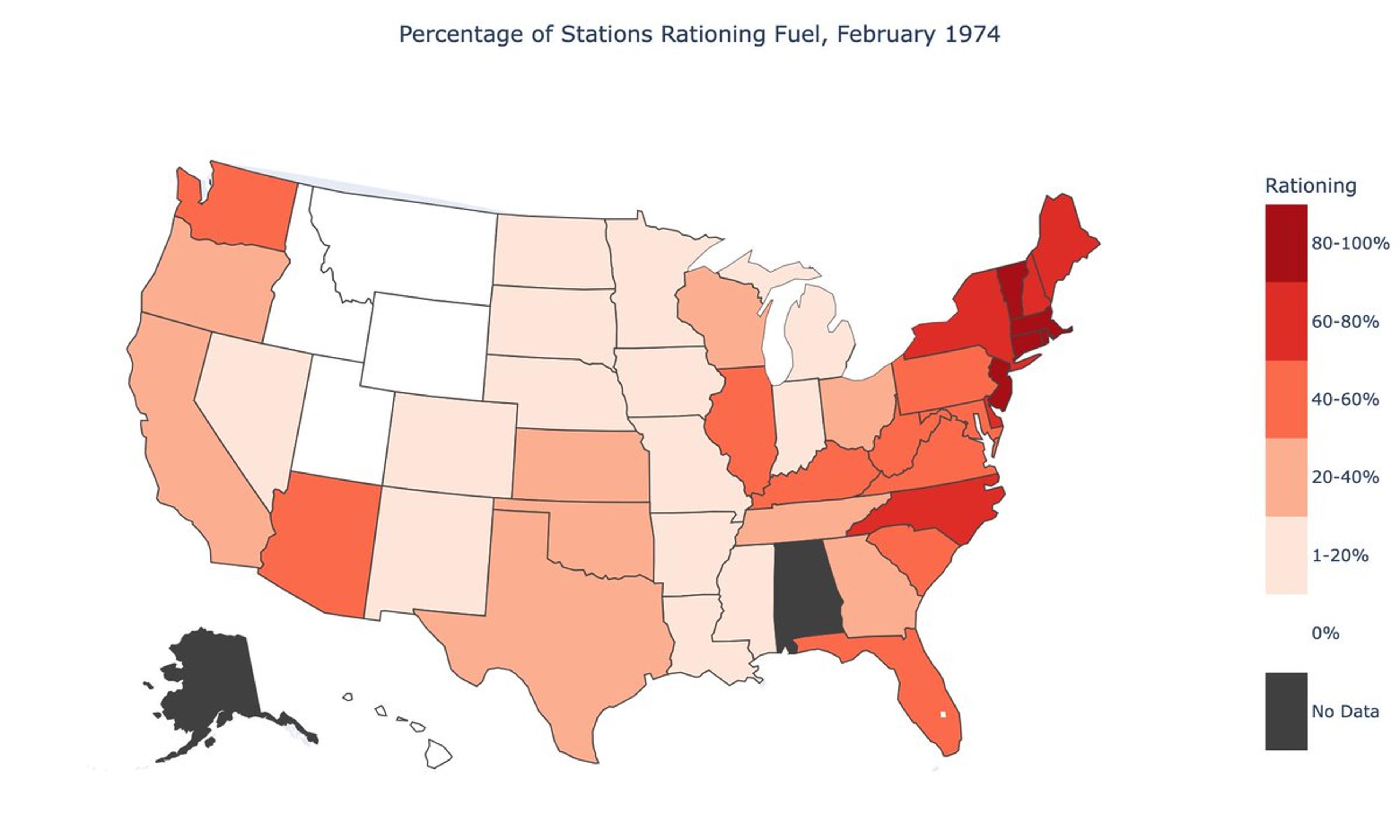

I'm super excited for my new paper with @ATabarrok and Mark Whitmeyer: "Chaos and Misallocation under Price Controls" During the 1973-74 gasoline crisis, the U.S. had about a 9 percent national shortfall. But that was far from evenly spread out. Over...

By Brian Albrecht

Social•Feb 12, 2026

Utilities Prefer Rate Hikes over Data‑center‑funded Battery Power

Culture change is hard. Utilities like @DukeEnergy would rather raise rates 15% on their ratepayers because they feel forced to pay “$3k/kW” for gas instead of adding 7,200 MWs of batteries paid for by data centers at existing solar sites...

By Jigar Shah

Social•Feb 12, 2026

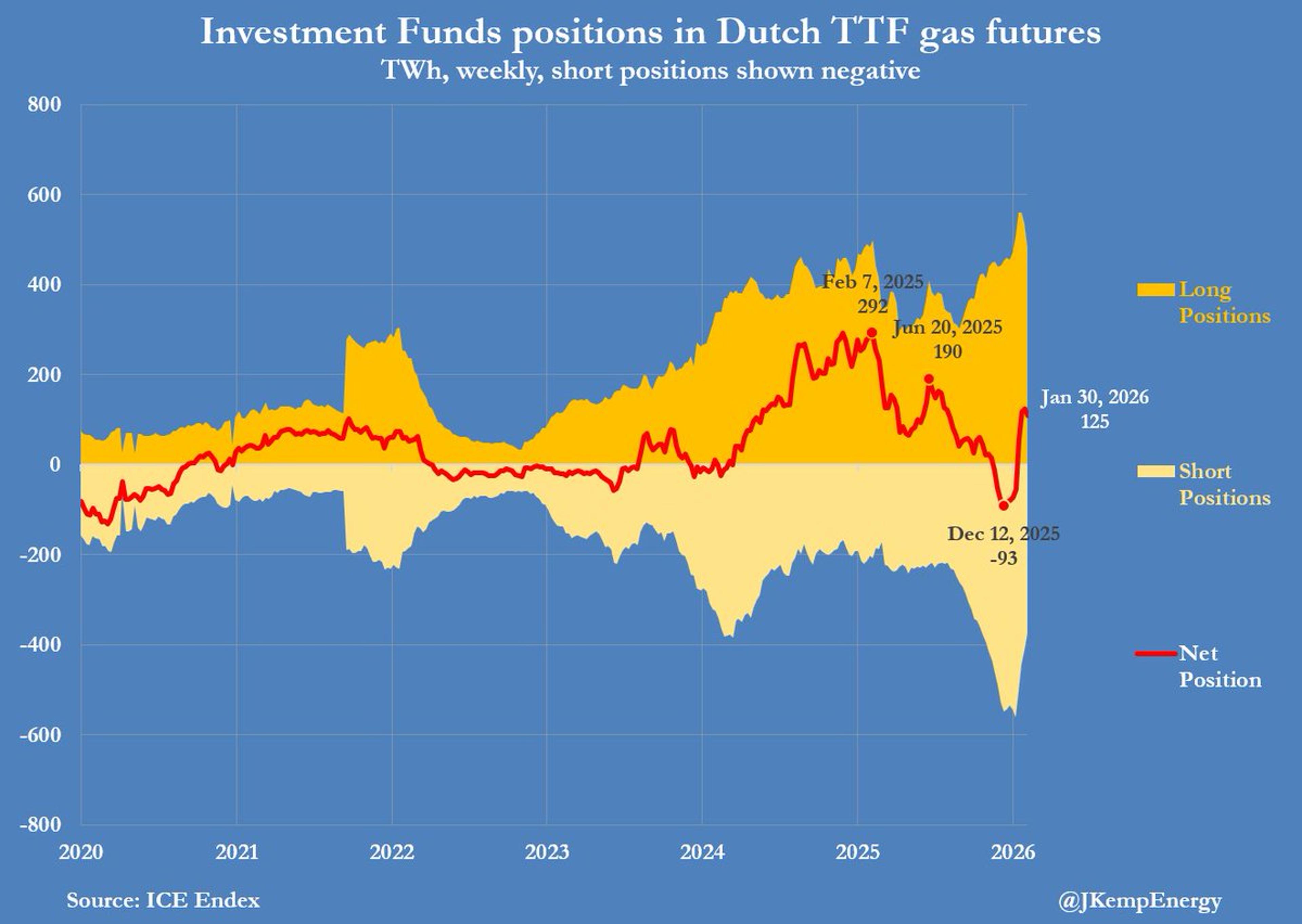

Investors Dump TTF Gas Futures as Prices Slip

INVESTMENT MANAGERS sold futures and options on the Dutch TTF European gas benchmark for the first time in eight weeks as prices retreated despite inventories well below average for the time of year. Funds sold the equivalent of 15 terawatt-hours...

By John Kemp

Social•Feb 11, 2026

Gold Peaks, Yet GameStop‑Style Demand Keeps It Alive

My entire feed says gold has peaked and Bitcoin's turn is coming. Then I sat down with Joshua Lim. He sees signs of a blow off top… BUT also GameStop-esque demand propping up the metal 😅 #gold #markets #liquidations

By Laura Shin

Social•Feb 11, 2026

US Backs Coal Revival as Indonesia Slashes Output

Two major coal developments in the last 24 hours. 1. White House announcing purchases and support to revive the industry 2. Indonesia just ordered the world's largest nickel mine to sharply cut output. They are also looking to cut coal production by...

By Quinn Thompson

Social•Feb 11, 2026

USD Soft, JPY Squeeze Persists, Oil Spikes on Iran Tension

$USD is soft ahead of the delayed jobs report. Japanese markets were closed for a national holiday, but the dramatic short squeeze of $JPY continued. WTI is up ~2% as the US-Iran confrontation seems near a climax. ...

By Marc Chandler

Social•Feb 11, 2026

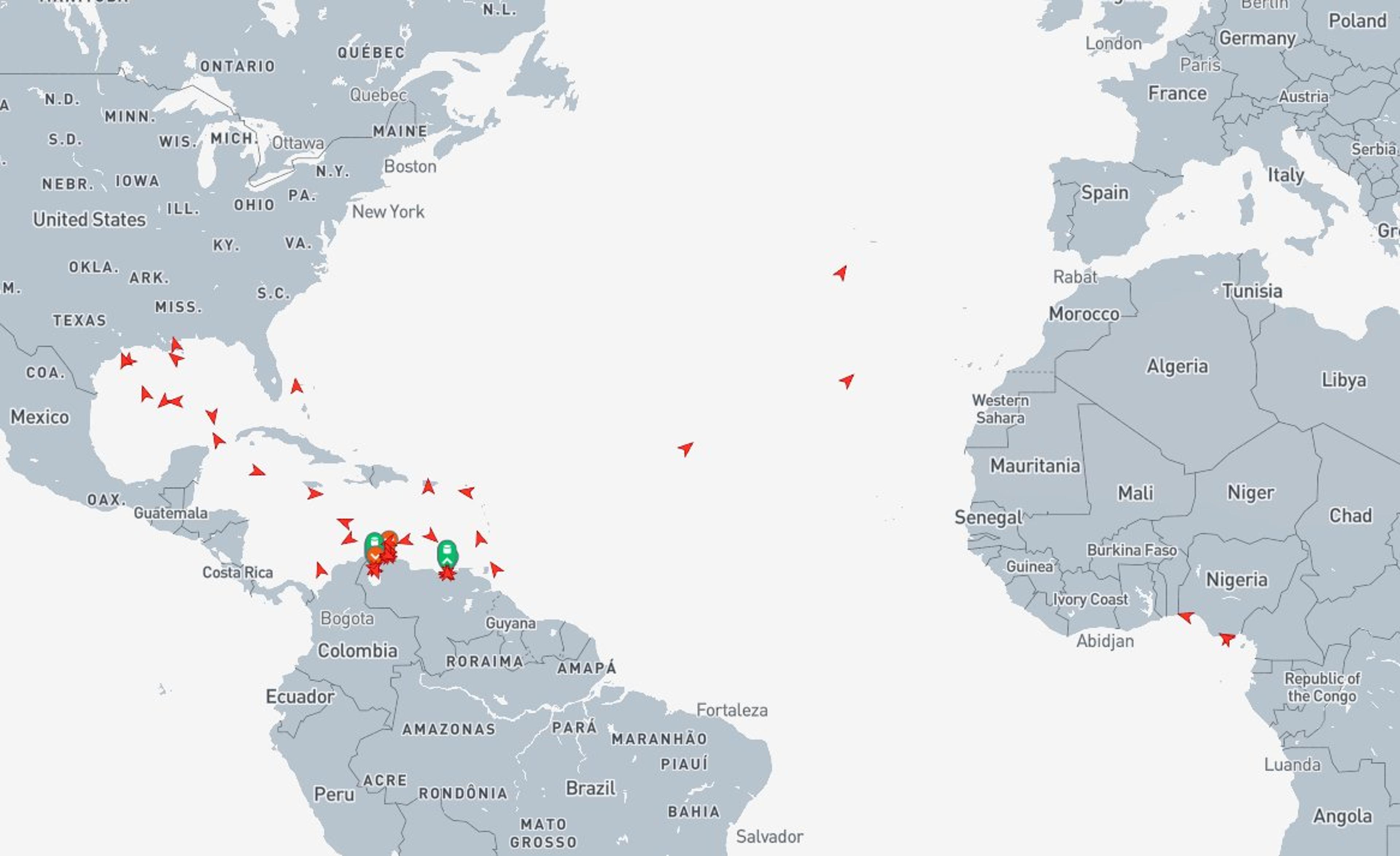

Venezuelan Crude Stuck, Limited Shipments to Europe, India

🇻🇪It seems the trading houses that bought the Venezuelan crude from the Trump administration are having trouble marketing the oil globally. Most of the oil is sent to the US. Here in the map, three tankers are going to Europe...

By Anas Alhajji

Social•Feb 11, 2026

Trump's Choice on Iran Deal Drives Oil Risk Premium

A high-stakes meeting indeed. If Trump yields to Netanyahu's demand to push for a comprehensive deal covering Iran's ballistic missiles programme and support for regional proxies, possible outcomes: -- Drawn-out negotiations under the looming shadow of military action -- Higher chances of a...

By Vandana Hari

Social•Feb 10, 2026

Growth Slows, Yields Rise—Short Treasury Duration

Macro: growth softens, yields rise. Key: sticky CPI, Fed tightening, tight labor. Risks: stagflation, policy error. Trade: short US Treasury duration as real yields climb. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 10, 2026

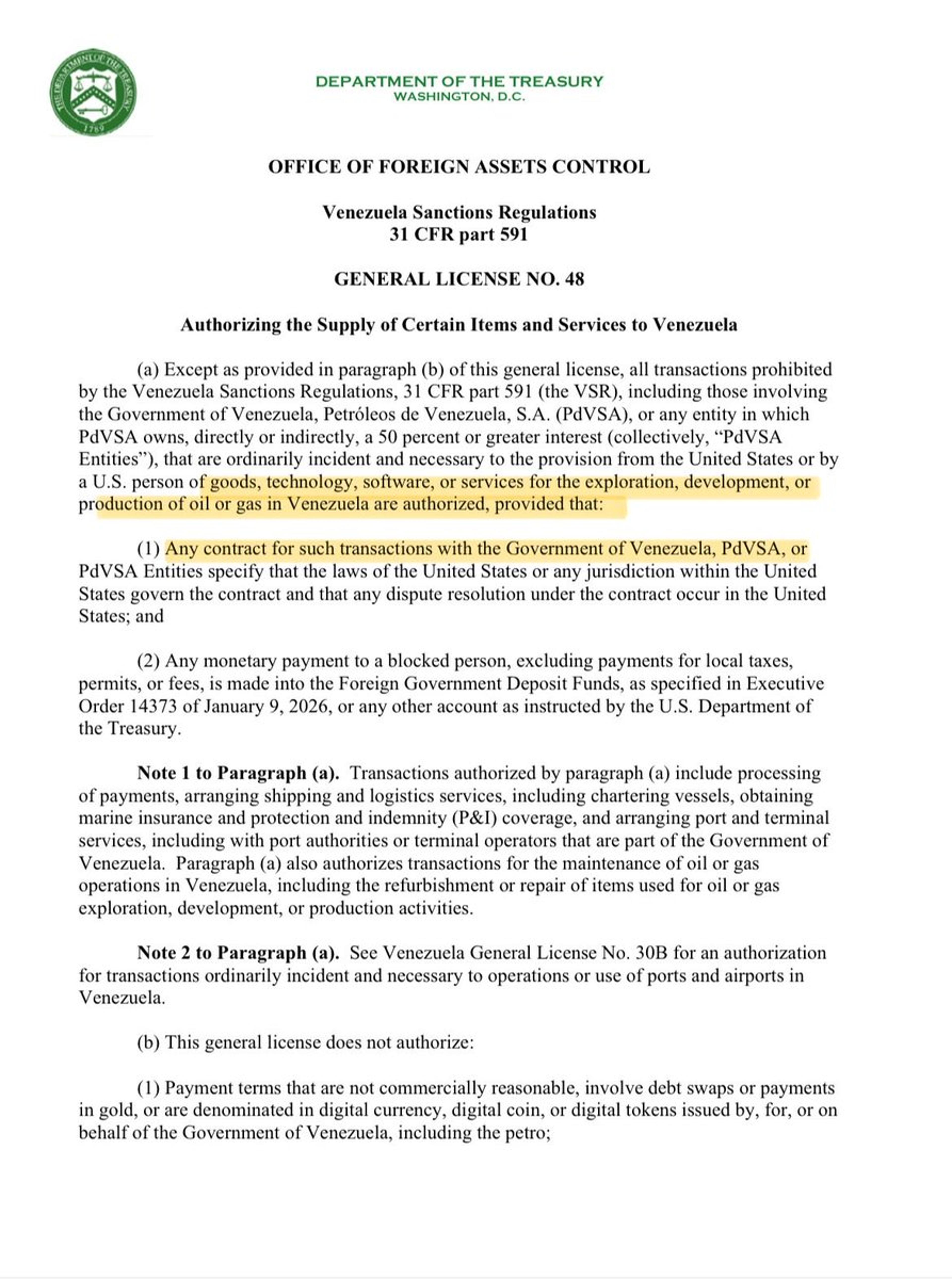

U.S. Grants License to Revive Venezuela's Oil Production

OIL MARKET: Washington issues a new general license to allow oilfield-service companies to work in Venezuela — it’s a crucial step to boost oil output in the Latin American country. https://t.co/ozdDE2MiMZ

By Javier Blas

Social•Feb 10, 2026

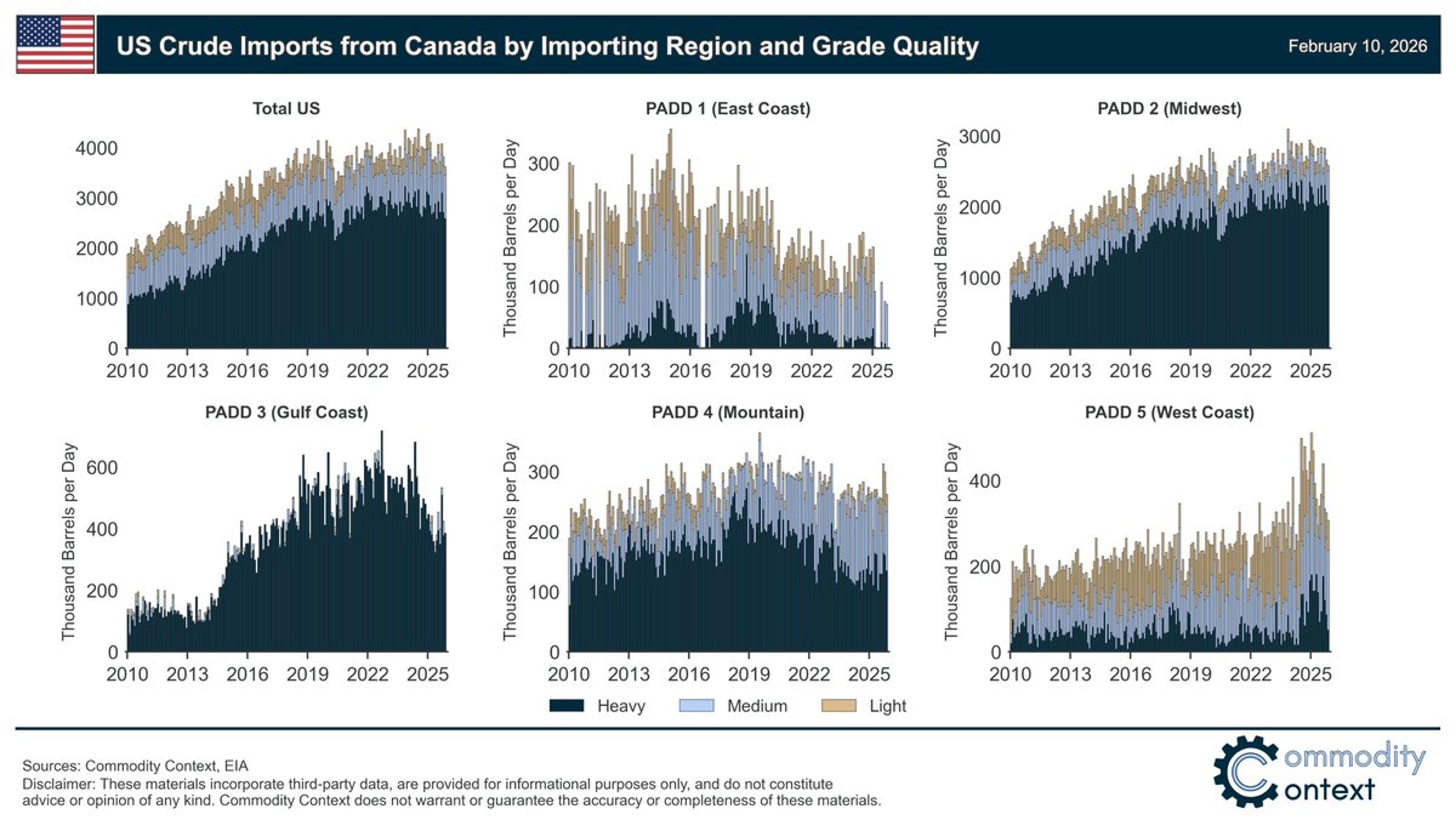

US Canadian Crude Imports Plateau; Midwest Saturated, Gulf Pressure Wanes

🇨🇦🛢️🇺🇸 US Canadian crude imports by importing region and crude grade quality Total US plateauing/rolling over Midwest still key Canadian market, but entirely saturated USGC was the pressure valve, but fell back when TMX opened (first went to West Coast, now increasingly China)...

By Rory Johnston

Social•Feb 10, 2026

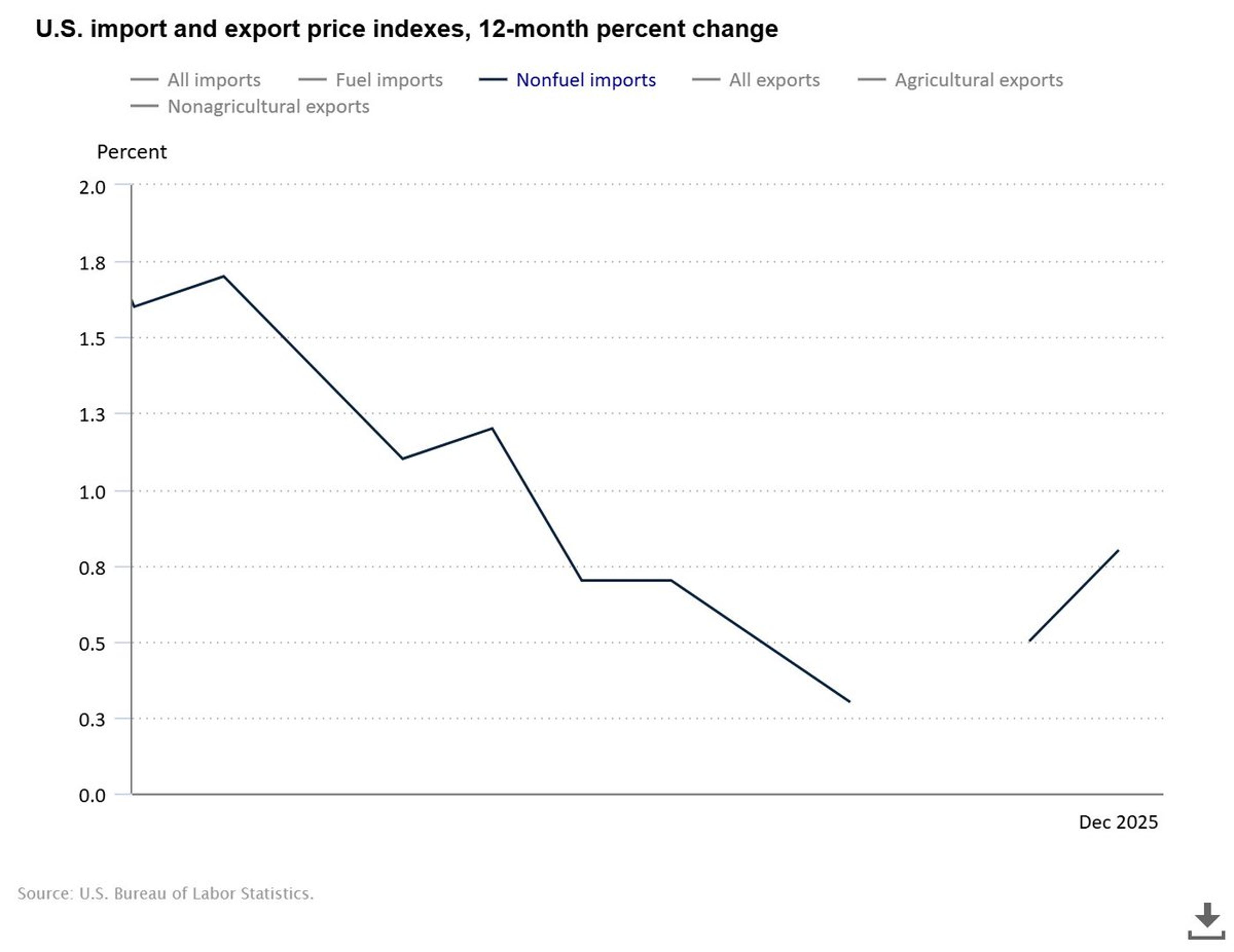

Import Prices Rise Slightly, Showing Tariffs Not Absorbed

Another month of US import price data shows - again - that foreigners aren't broadly eating Trump's tariffs (bc if they were, prices would have collapsed this year - instead they're up slightly) https://t.co/Dwv9hRwxO1 https://t.co/pF66RuUWjN

By Scott Lincicome

Social•Feb 10, 2026

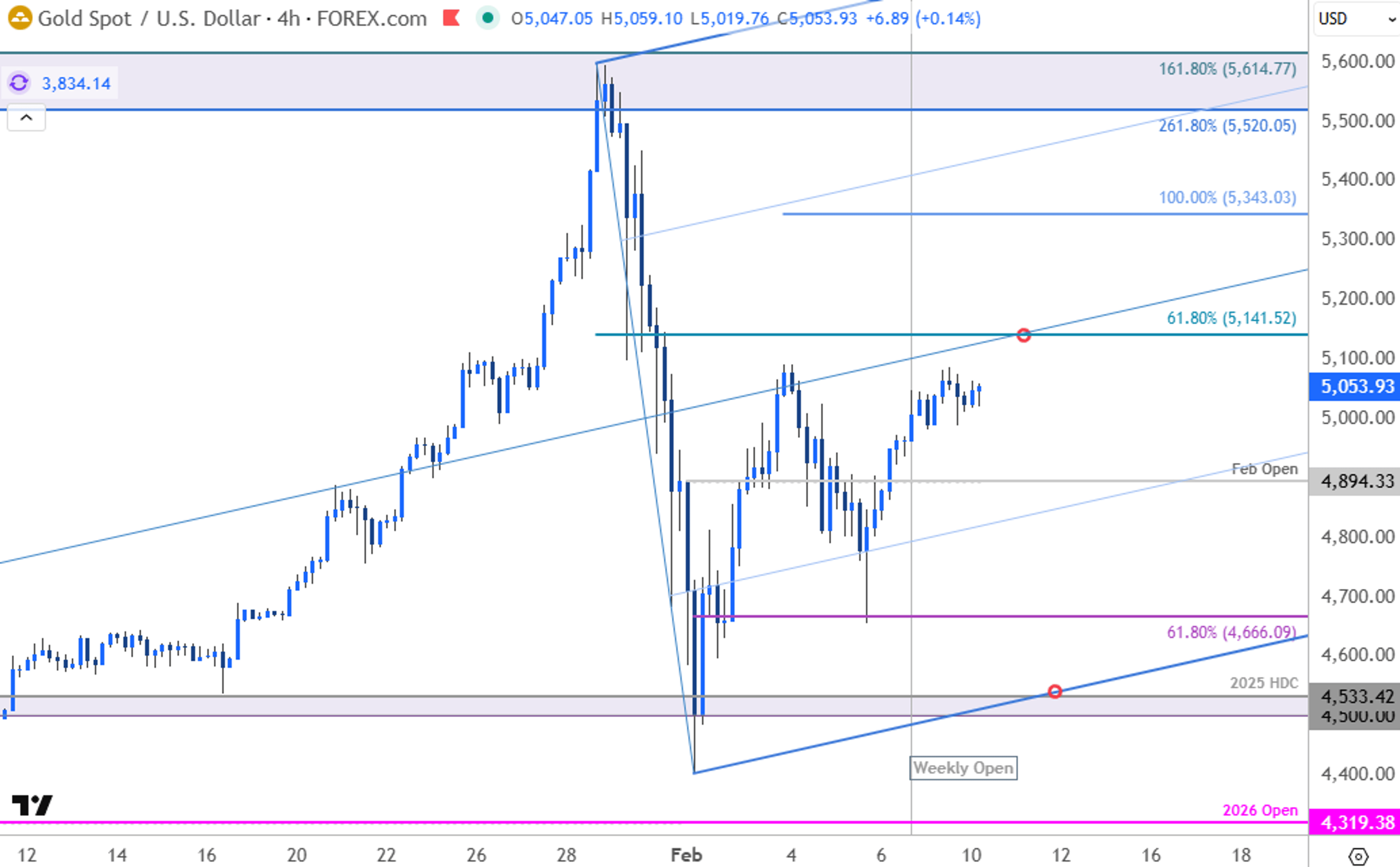

Gold Nears Breakout: From Panic to Directional Pause

Gold Price Short-term Outlook: XAU/USD From Panic to Pause- Breakout to Decide Direction https://t.co/e2vca3B4h2 $XAUUSD Daily & 240min Charts https://t.co/BsGu6wpKlh

By Michael Boutros

Social•Feb 10, 2026

Climax Top Signals Bear Market for Precious Metals

OUT NOW - @BergMilton on: - clear sign of "climax top" in gold & silver - why he expects a precious metals bear market - S&P 500, Bitcoin, Software + Korean stocks & more Apple🔊https://t.co/bNqmCOVqMV Spotify📽️https://t.co/mnN6Dn02hi 1/3 https://t.co/U3F0Pxojhy

By Jack Farley

Social•Feb 10, 2026

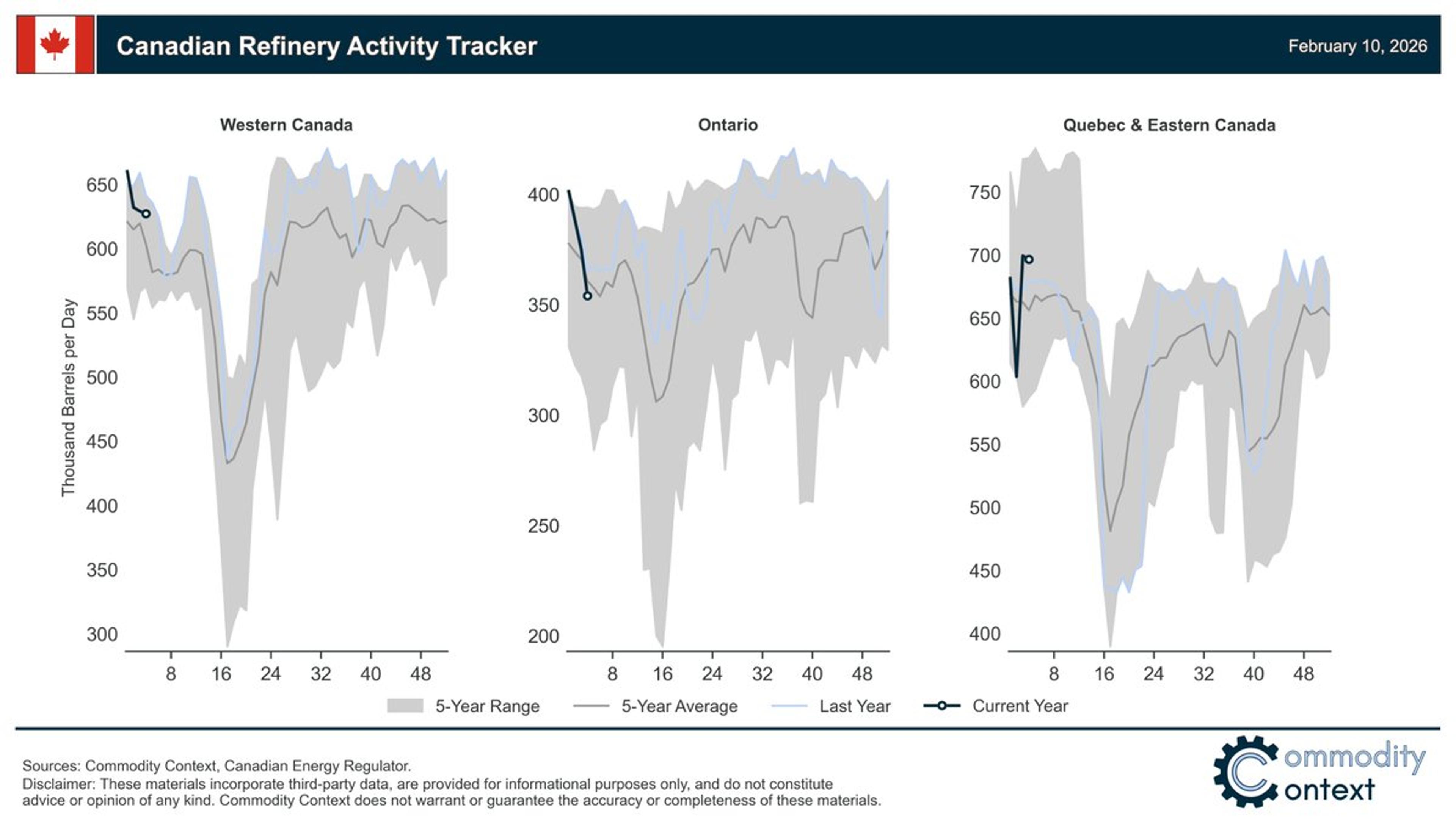

Western Canadian Refineries Thrive, Ontario Slows, East Rebounds

🇨🇦🏭⛽️ Canadian refineries are running strong in the West, have seen operations slip faster than seasonally normal in Ontario, and have had a bouncing start to the year in Quebec & Eastern Canada. https://t.co/CY8K1qOKIh

By Rory Johnston