Social•Feb 10, 2026

US Refineries Pivot From Canadian to Venezuelan Heavy Crude

US refinery heavy crude sourcing from Canada (red) vs Venezuela (pink), compared to refinery capacity (blue) 2010 on the left, 2024 on the right https://t.co/nKOX5T7tGn

By Rory Johnston

Social•Feb 10, 2026

Gulf Coast Refineries Boost Capacity, Replace Imports with Shale Oil

US Gulf Coast refineries (PADD3) have continued to grow distillation capacity while dramatically shrinking imports, displacing imported light and medium crudes with domestic light tight oil from the Shale Patch https://t.co/6EezXrbiQL

By Rory Johnston

Social•Feb 10, 2026

USDA Cuts Global Corn, Wheat Stocks; Soy up on Brazil

USDA's estimates for global corn and wheat ending stocks come in below expectations/last month (ending wheat's run of surging each month as harvests surpassed predictions). Soy stocks are up on a massive 180 mmt Brazilian crop. https://t.co/kM88lO1Zbq

By Karen Braun

Social•Feb 10, 2026

Bitcoin Faces Downside Risk; Gold Remains Strong

Technical analysis made simple with Kevin Wadsworth of Northstar & Bad Charts. We break down his case for more downside risk (bitcoin to bottom in Q3/Q4?) and the Capital Rotation Event: why many assets look bearish while gold holds strong. https://lnkd.in/gfkuCG2A

By Natalie Brunell

Social•Feb 10, 2026

USDA Lifts Brazil 2025/26 Soybean Forecast to 180 Mt

USDA pushes Brazil's 2025/26 soybean harvest to 180 million metric tons. No changes to corn or to Argentina's crops. https://t.co/D2KarYYtVJ

By Karen Braun

Social•Feb 10, 2026

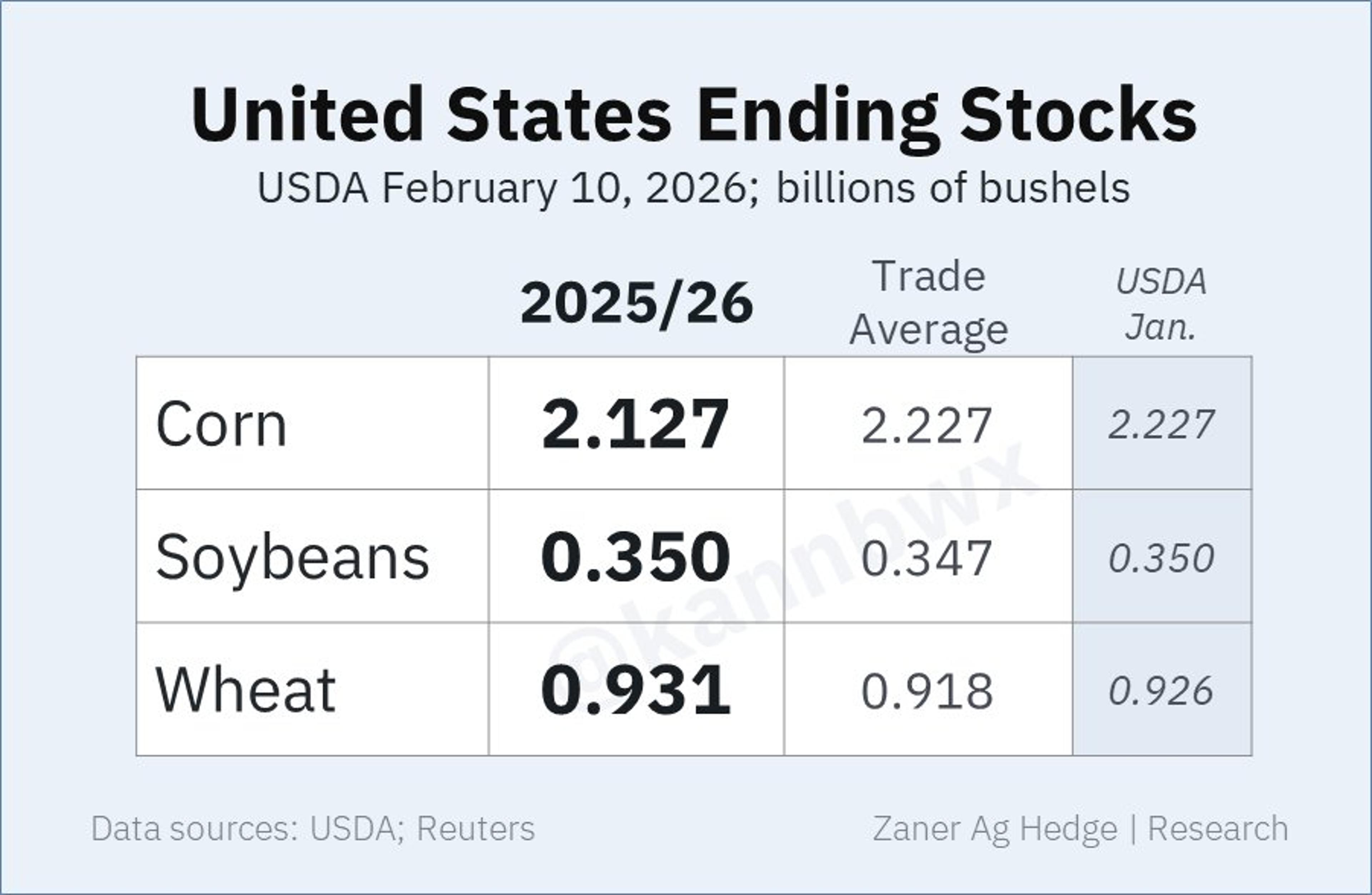

USDA Lifts Corn Export Outlook, Cuts Ending Stocks

U.S. corn ending stocks decrease from last month as USDA bumps exports to 3.3 billion bushels. Minimal/no changes in wheat and beans. https://t.co/FpMZKyhSPO

By Karen Braun

Social•Feb 10, 2026

Gold and Silver Bull Market Persists, Keep Cash Ready

I had a great chat with Peter Spina @goldseek at #VRIC. We covered why this still looks like a real gold/silver bull market, why I keep cash ready, and where early-stage opportunity is hiding. Full interview 👇

By Jeff Clark

Social•Feb 10, 2026

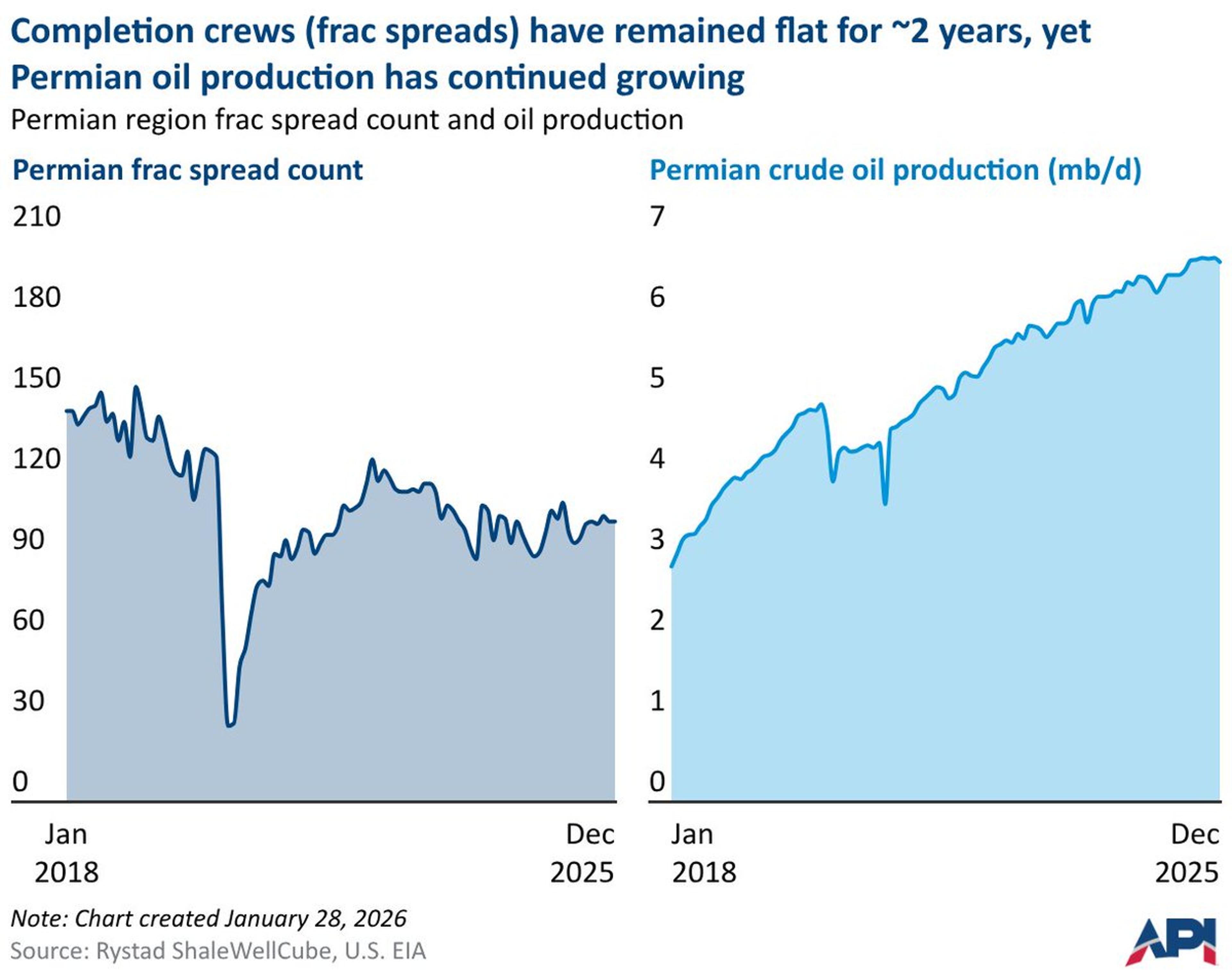

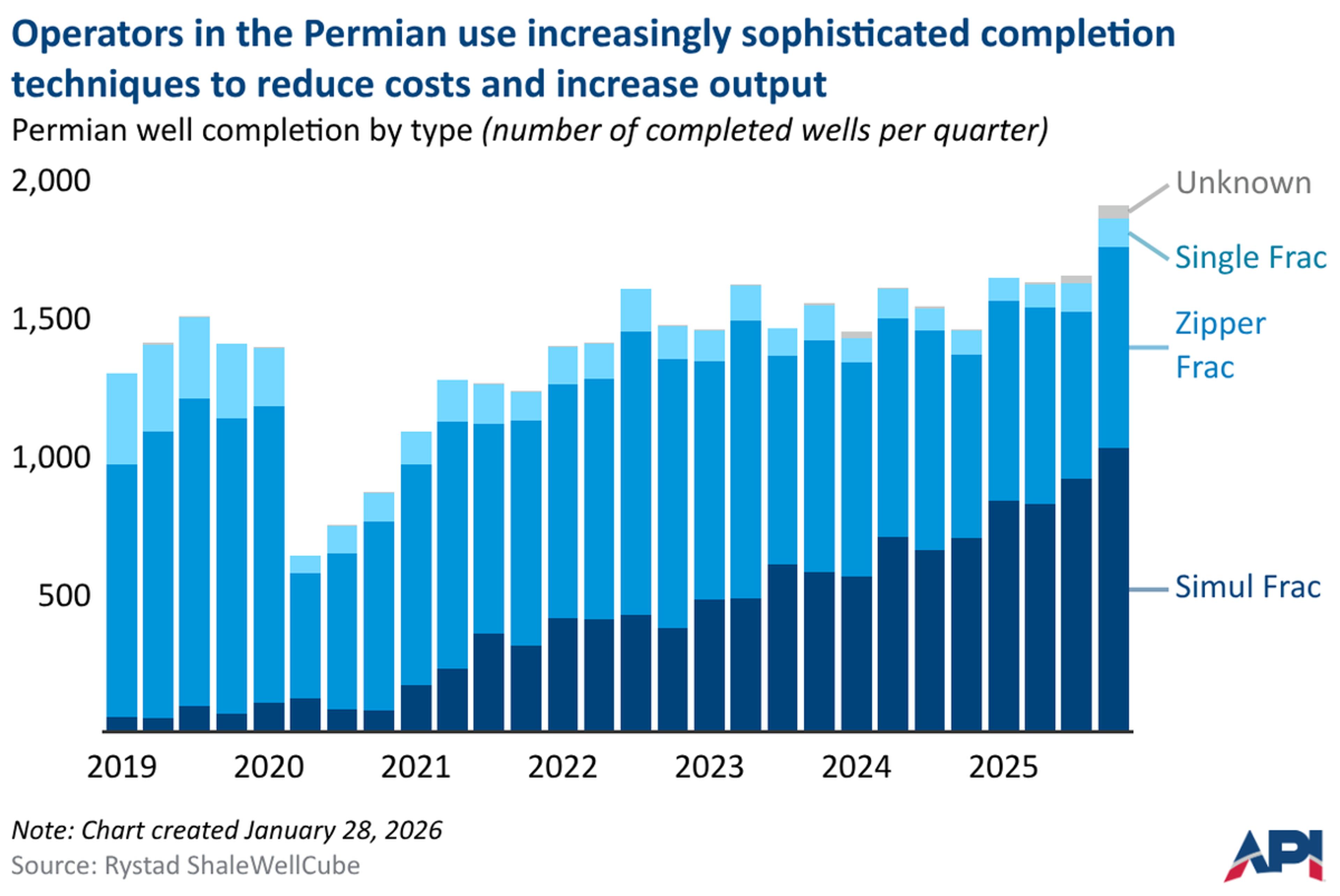

Permian Wells Surge 13% as Crews Work Smarter

The frac spread count measures the number of completion crews actively fracturing a well. In the Permian, the frac spread count averaged ~100 crews in 2025, 3% higher than the 2024 average. Yet operators completed a total of ~6,800 wells,...

By T. Mason Hamilton

Social•Feb 10, 2026

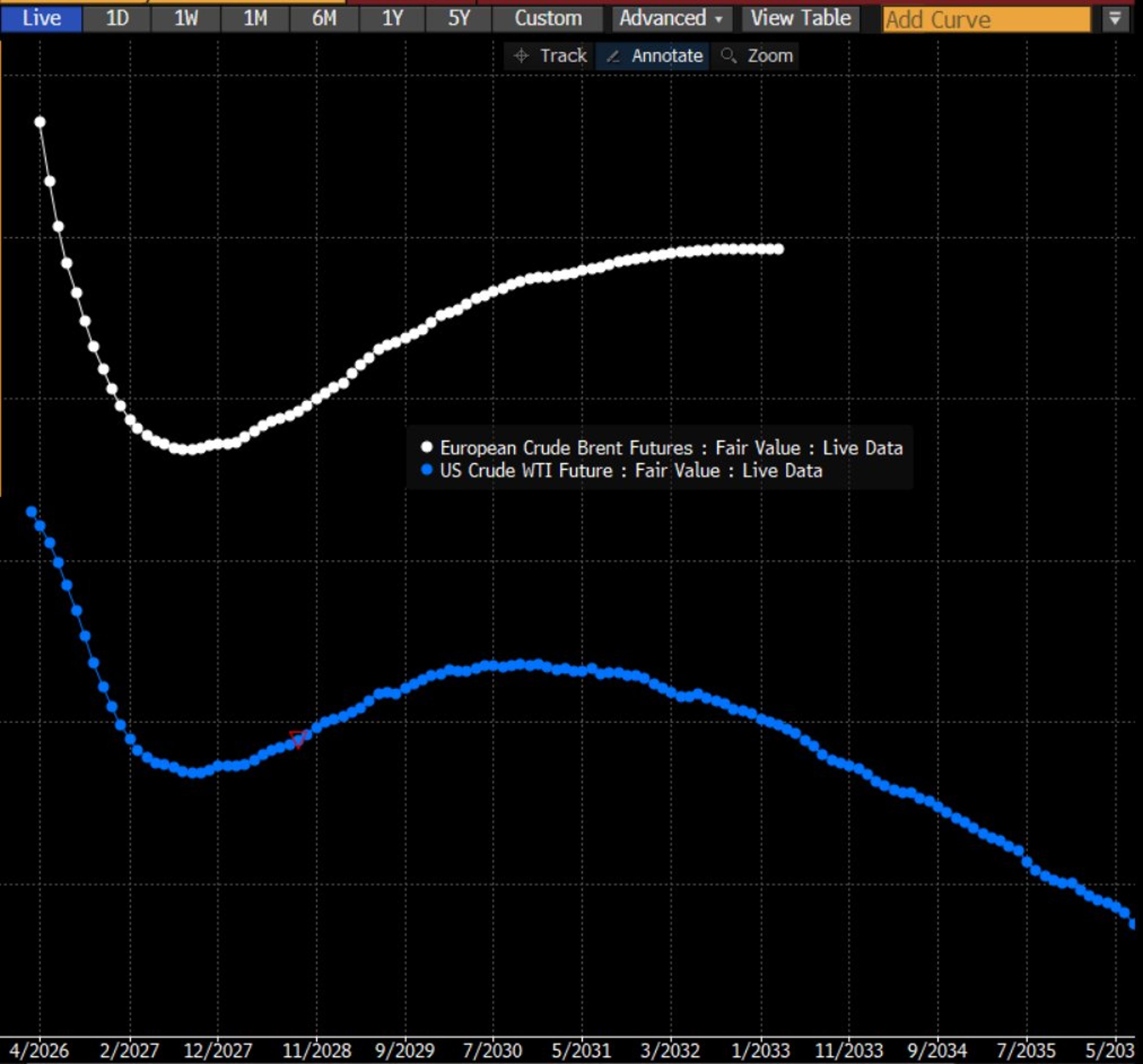

Brent Futures Steepen Backwardation, WTI Weakens

The Brent (white) and WTI (blue) futures curves are telling rhyming but importantly different stories right now Both have a backwardated front, depressed belly into contango past 2027 But Brent curve seeing steepening prompt backwardation (70c/bbl now) while WTI weakening (20c) https://t.co/5ZyF18ZPDO

By Rory Johnston

Social•Feb 10, 2026

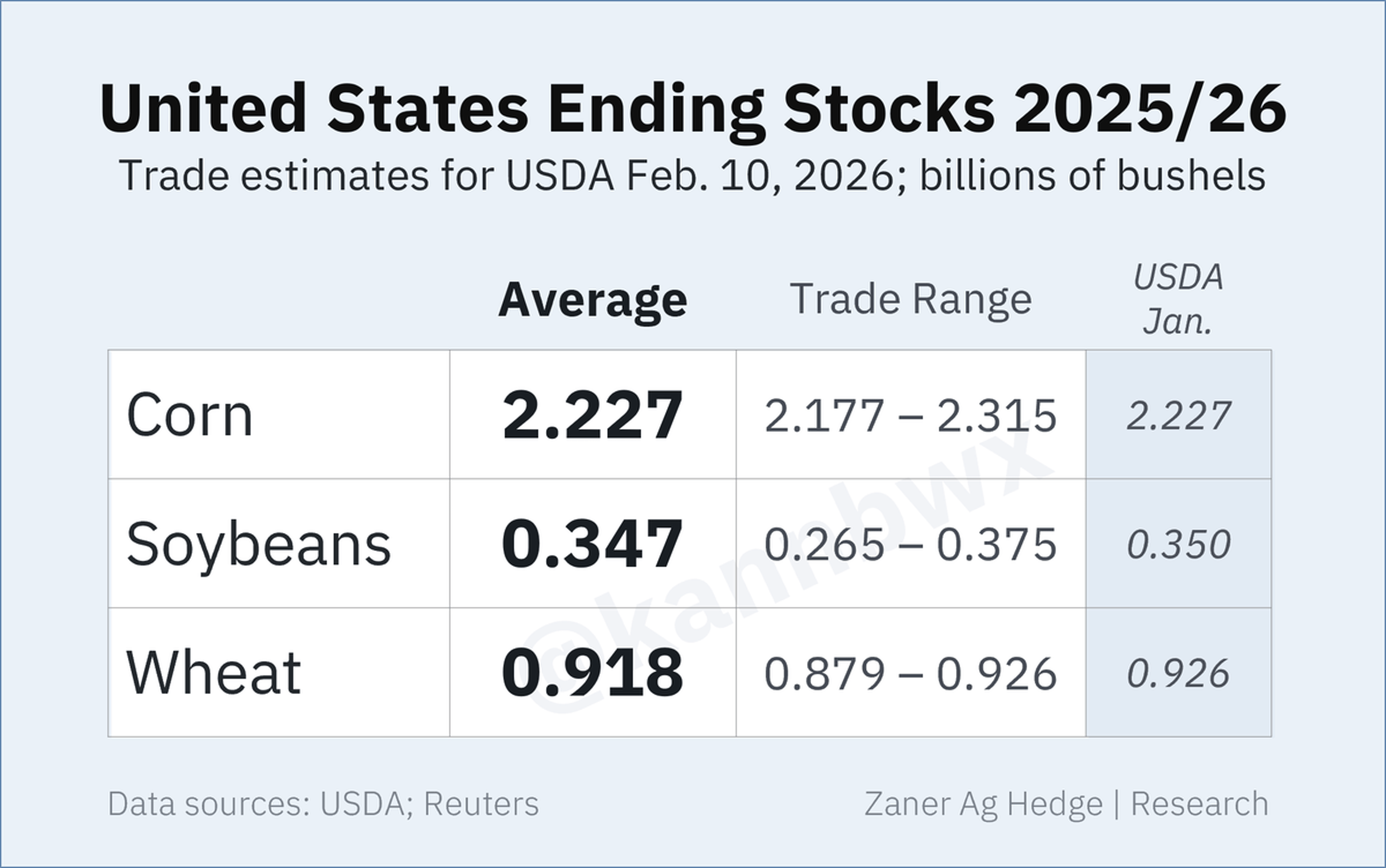

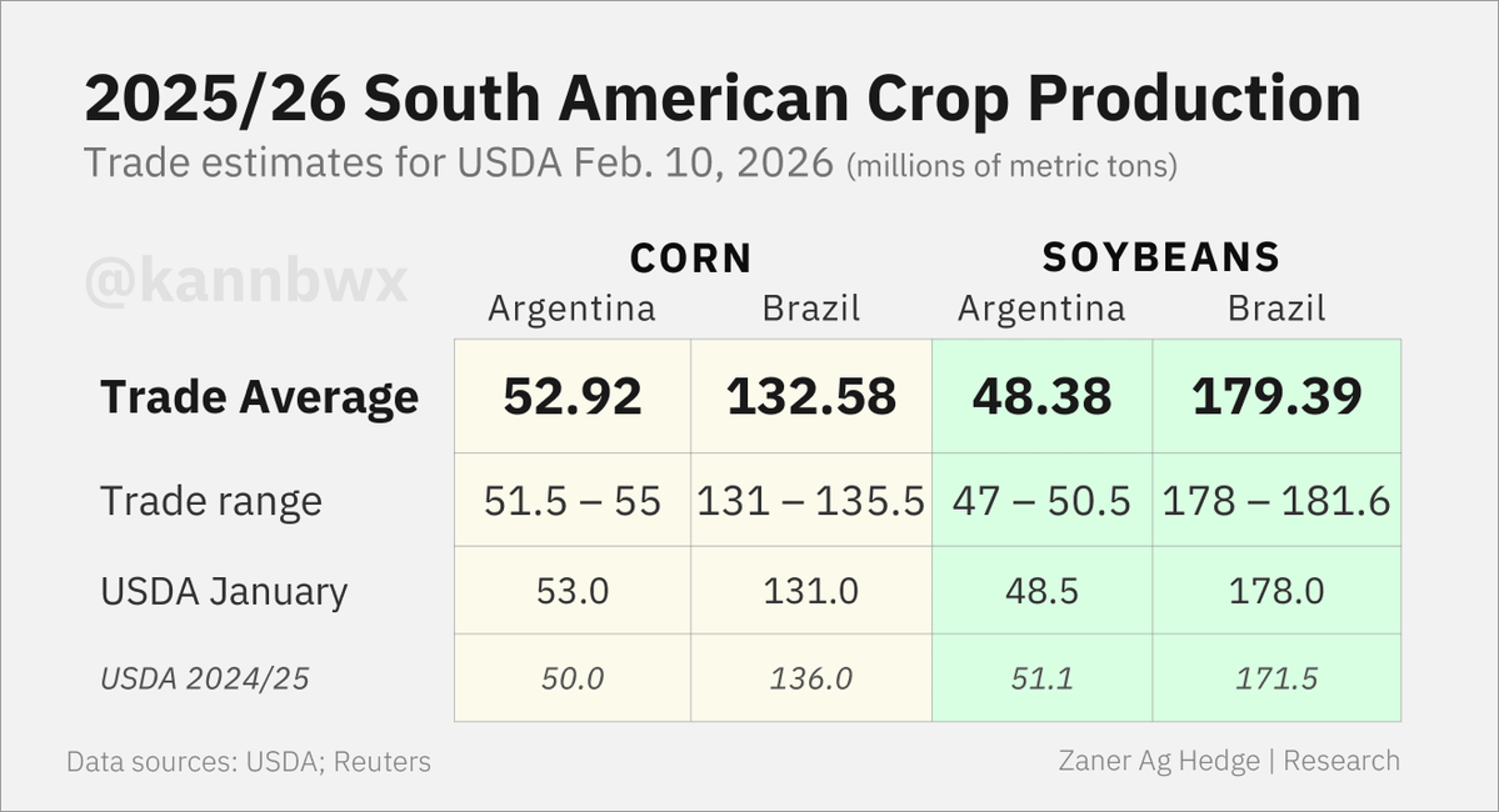

Analysts Anticipate Stable US/World Stocks, Brazil Crop Gains

All trade estimates for USDA's supply & demand report due Tuesday at 11 am CT. On average, analysts don't expect major changes to U.S. and world stocks, though Brazil's corn and soybean crops could increase. U.S. demand will also be...

By Karen Braun

Social•Feb 10, 2026

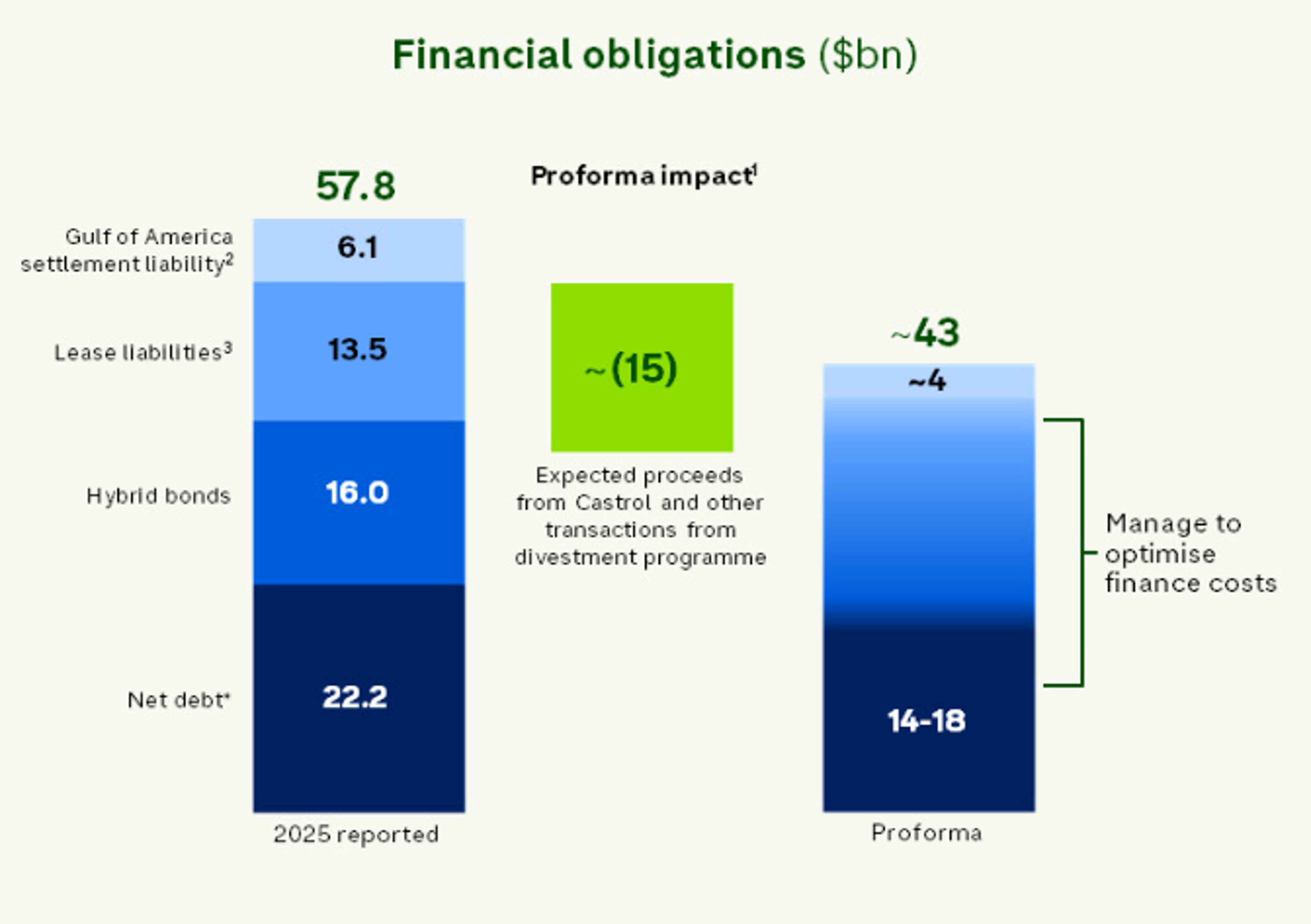

BP Finally Admits Debt Exceeds $50 Billion, Not $22 Billion

Regular readers know we at @Opinion had flagged BP had far more debt than the company's prefered metric (~$22 bn). Look at net debt + hybrids + leases + off-balance sheet items and it's >$50 bn. Now, BP acknowledges the issue...

By Javier Blas

Social•Feb 10, 2026

Gold Surges Past $5,000 Amid Debt Monetization Fears

Gold is back above $5,000. The rise in gold is one manifestation of the debasement trade, which is about markets seeking safe havens from debt monetization. Big thanks to @DavidWestin from @BloombergTV for all the right questions and a great...

By Robin Brooks

Social•Feb 10, 2026

BP's Looney and Auchincloss Tenure a Board‑Enabled Disaster

Further thought on BP: Today proves, if ever there was a need of further proof, what a disaster the tenure of Bernard Looney and Murray Auchincloss were for the UK oil major. (...all permited / encouraged by a weak board...)

By Javier Blas

Social•Feb 10, 2026

BP Halts $750M Quarterly Buyback Over Mounting Debt

In view of BP's announcement this morning it's cancelling its $750-million-a-quarter share buyback, let me re-publish yesterday's @Opinion note arguing the British oil major couldn't afford it anymore. It comes down to debt -- lots of debt. https://t.co/23vNRD4Nsw

By Javier Blas

Social•Feb 10, 2026

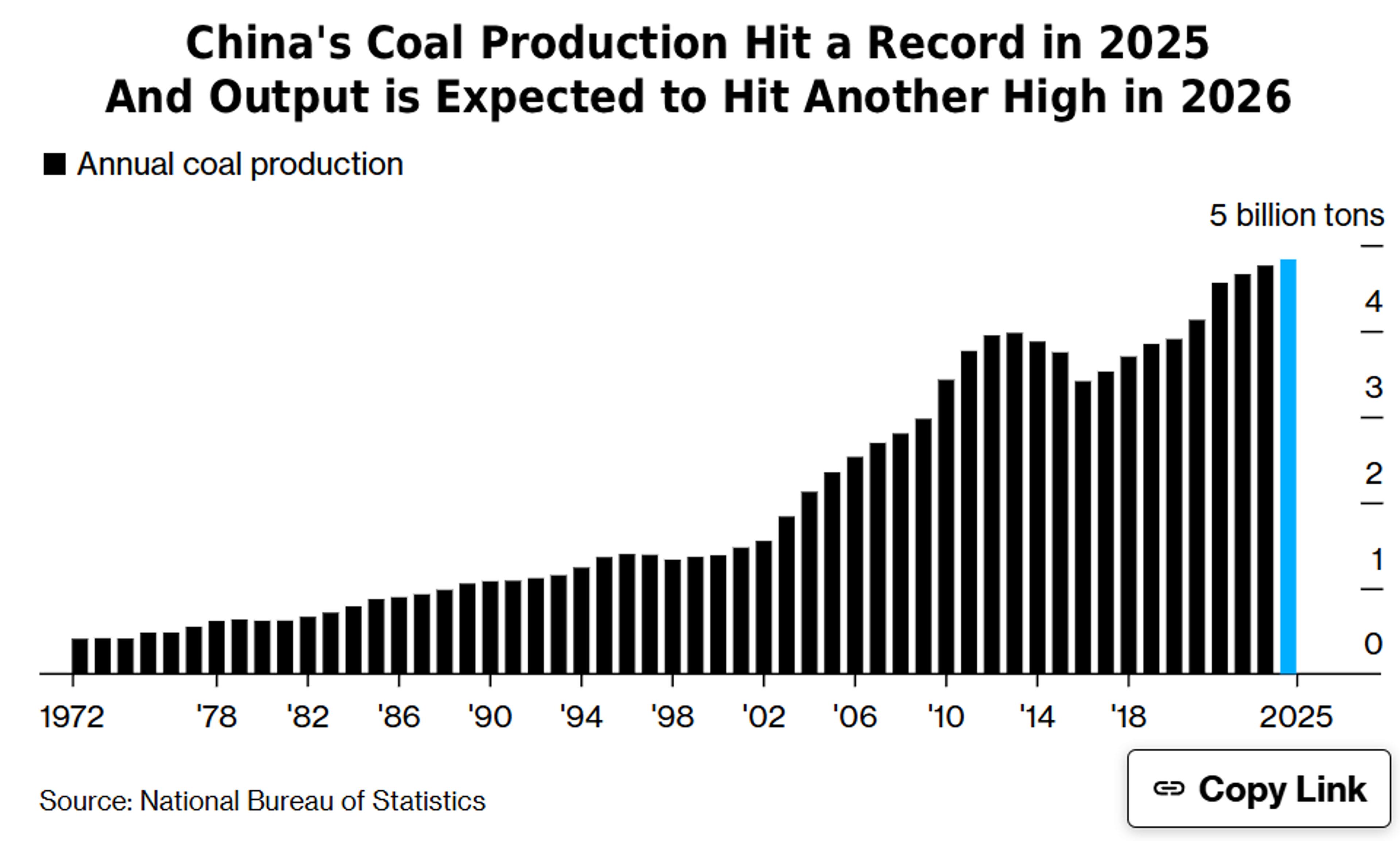

China May Smash Coal Output Record if Imports Fall

Will China's coal production hit another record this year? 🇨🇳🪨 China’s main coal industry body warns that imports may fall if Indonesia moves to restrict shipments They see production hitting a record 4.86 billion tons in 2026, but could go higher if...

By Stephen Stapczynski

Social•Feb 10, 2026

Russian Tankers Route to Singapore Despite Sanctions, China Shift

Russian oil tankers list Singapore as destination amid sanctions and shift to China, LSEG data shows https://t.co/1md44bH813

By Guy Faulconbridge

Social•Feb 10, 2026

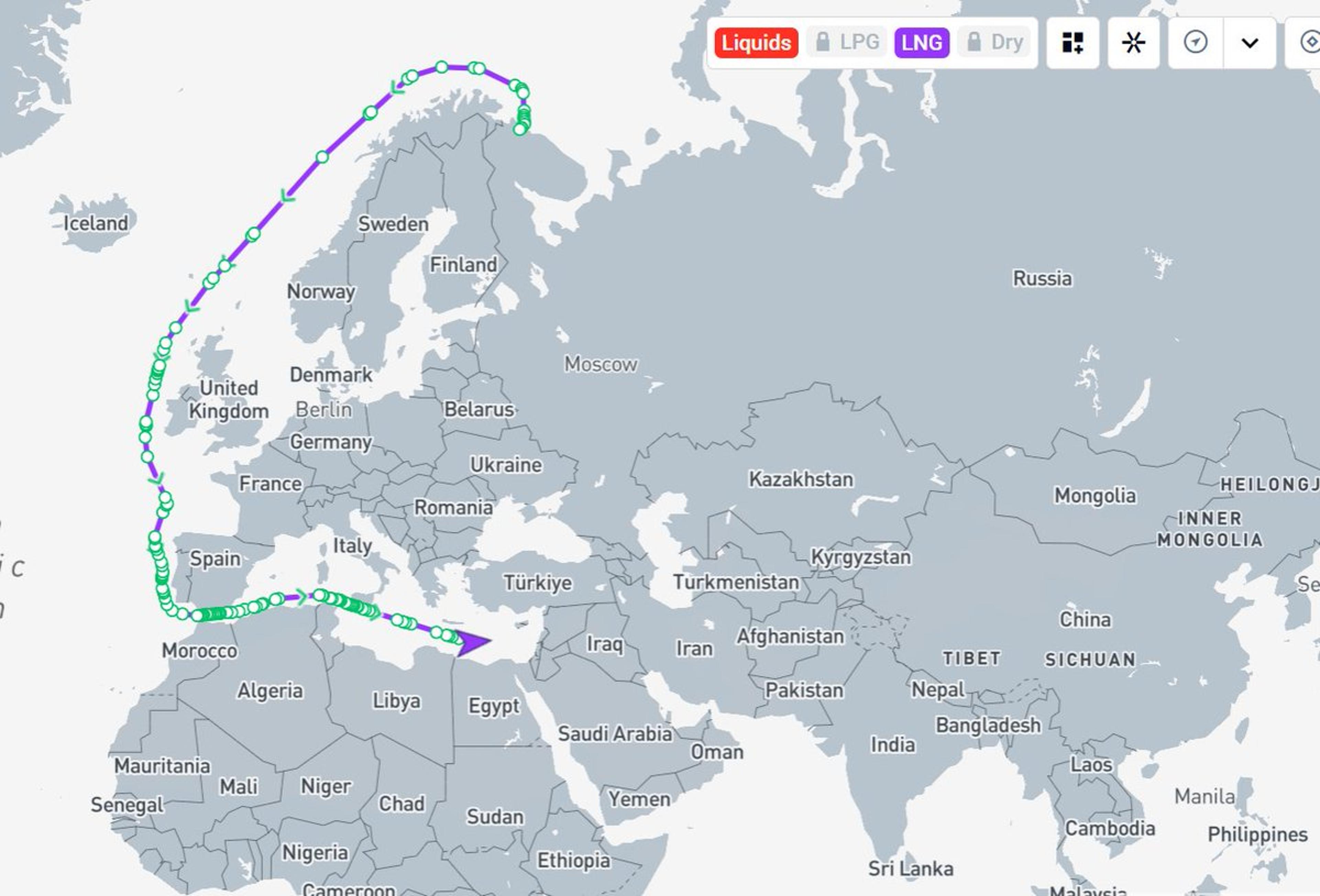

Seventh Sanctioned Russian LNG Tanker Navigates Red Sea

⛄️⛄️⛄️Sanctions? What sanctions? Where are you going, Zarya? This is going to be the 7th LNG carrier passing the Red Sea carrying Russian LNG. This is a sanctioned tanker carrying LNG from the sanctioned Arctic LNG 2. Map from @Kpler

By Anas Alhajji

Social•Feb 10, 2026

India Shuns Urals, China Gets Cheaper Russian Oil

🇮🇳Indian refiners' reluctance to take Russian Urals crude shipments is pushing these discounted cargoes toward buyers like China & others, making them even cheaper in those markets—while the Indian refiners turn to replacement crudes at international prices. An Urals cargo...

By Anas Alhajji

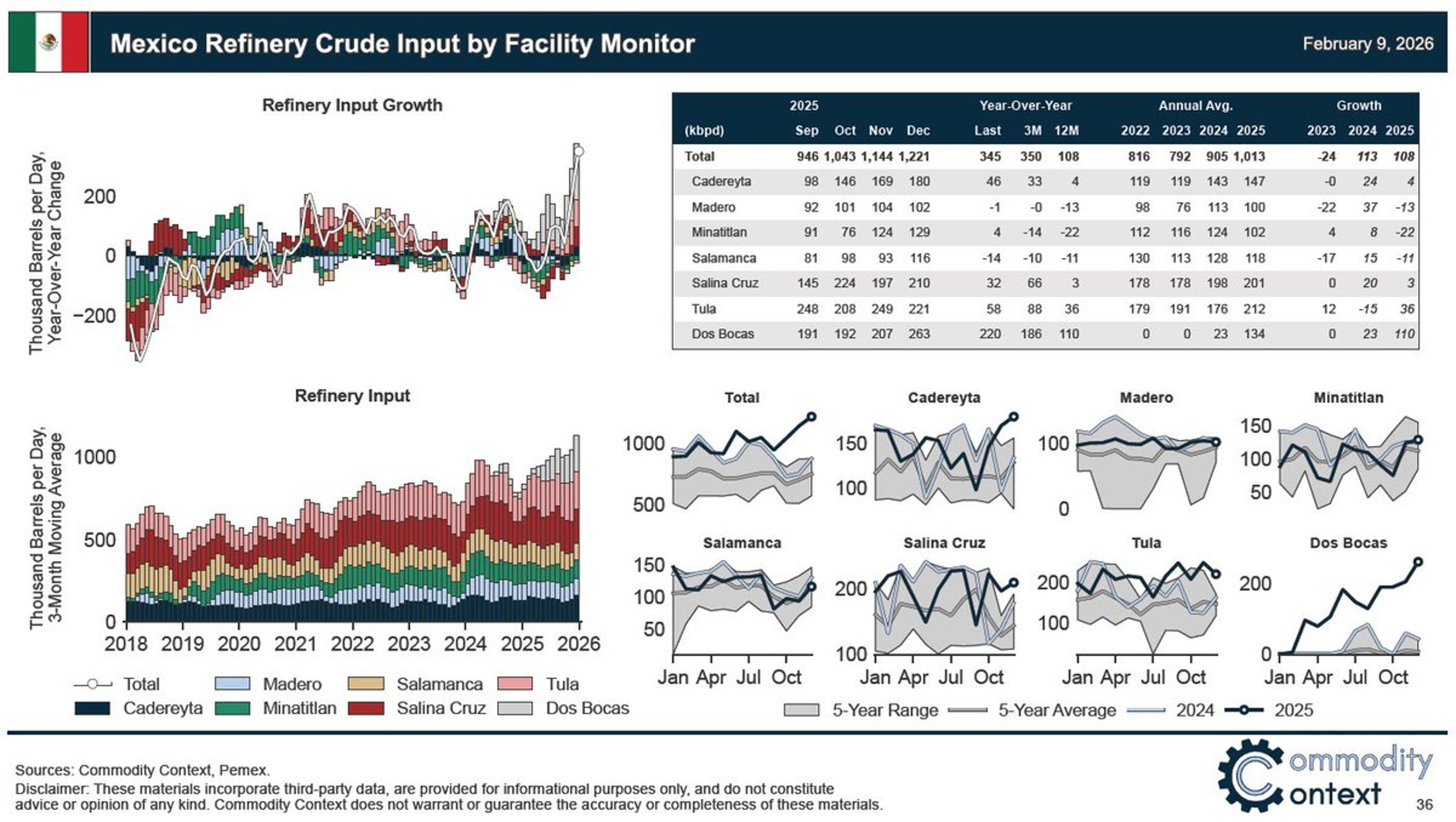

Social•Feb 9, 2026

Mexico’s Refineries Hit Highest Crude Processing Since 2014

🇲🇽🏭 Mexican refineries are processing more crude right now than any time since 2014. Thanks most obviously to the start-up of the Dos Bocas refinery, but helped along by high utilization across other large facilities. https://t.co/wEpnmiM8He

By Rory Johnston

Social•Feb 9, 2026

Gold Surges Past $5,000 Amid Reckless Fiscal Policy

Gold is back above $5,000. The rally in precious metals is reckless and crazy, but so is global fiscal policy. At some point over the past 20 years, policy makers who believe in keeping public debt stable stopped existing. Makes...

By Robin Brooks

Social•Feb 9, 2026

Brazil's Corn, Soybean Harvests Expected to Rise; Argentina Steady

🇧🇷Analysts are expecting upside to Brazil's corn and soybean harvests in USDA's report on Tuesday. 🇦🇷Argentina's crops, on average, are not predicted to move much from the January forecast. https://t.co/D3Jg3BAIYv

By Karen Braun

Social•Feb 9, 2026

Canadian Oil Output Hits Record, Boosting Continental Production

📊 Fresh N. American Oil Data 📊 Continental petroleum output hits fresh high-water mark with Canadian supply reaching all-time highs amidst a bounceback in oilsands activity, offsetting flat-ish production in the US and Mexico Check out the Full report: https://t.co/7Xk7El7r1l

By Rory Johnston

Social•Feb 9, 2026

Wheat Export Inspections Outpace USDA Target by 61 M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 61 million bushels, up from 56 million bushels the previous week. #oatt

By Arlan Suderman

Social•Feb 9, 2026

LNG Tightens Longer as Qatar, US Delays Stall Supply

Global LNG market is at risk of being tighter for longer 🚢 ⚠️ 🇶🇦 Qatar is pushing back start of its massive expansion to end 2026 🇺🇸 Golden Pass plant in the US delayed to at least March Supply chain bottlenecks threaten...

By Stephen Stapczynski

Social•Feb 9, 2026

US Corn, Wheat Inspections Beat Forecasts; Beans Headed to China

🇺🇸U.S. corn & wheat export inspections exceeded all trade estimates last week. Two-thirds of the week's inspected bean cargoes were destined for China, predominantly out of the Gulf. https://t.co/e3b34Q6I3g

By Karen Braun

Social•Feb 9, 2026

Corn and Soybean Export Inspections Top Weekly Totals

Export inspections for the week ending Feb. 5 (mln bu) #corn 51.5, grain sorghum 4.9, #soybeans 41.7, #wheat 21.3 #oatt

By Arlan Suderman

Social•Feb 9, 2026

Permian Operators Complete 3,600 Wells via Simul Frac

U.S. operators in the Permian region of Texas and New Mexico completed ~3,600 wells in 2025 using simultaneous hydraulic fracturing (simul frac), a technique that minimizes completion crew time on well pad sites by completing two wells simultaneously. https://t.co/FxdE8jlBs7 Well completion occurs...

By T. Mason Hamilton

Social•Feb 9, 2026

Cuba's Fuel Shortage Forces Airport Closures and Hotel Shutdowns

Cuba is running out of oil. The island warned airlines that they wouldn't be able to re-fuel at its 9 major airports from Tuesday for at least one month. The Communist government has closed international hotels to save fuel, too. In...

By Javier Blas

Social•Feb 9, 2026

USDA Confirms 264

USDA confirms the sale of 264,000 tons of U.S. soybeans for delivery to China in 2025/26.

By Karen Braun

Social•Feb 9, 2026

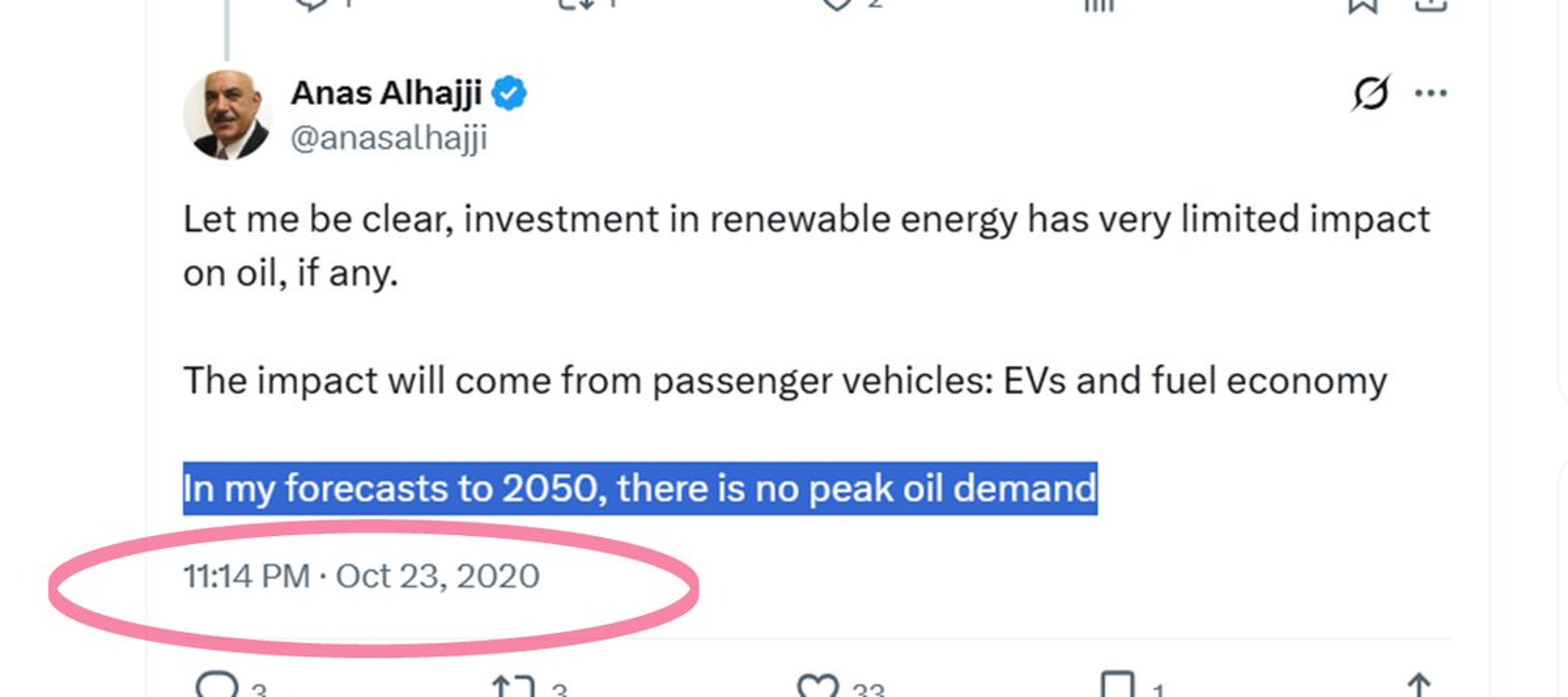

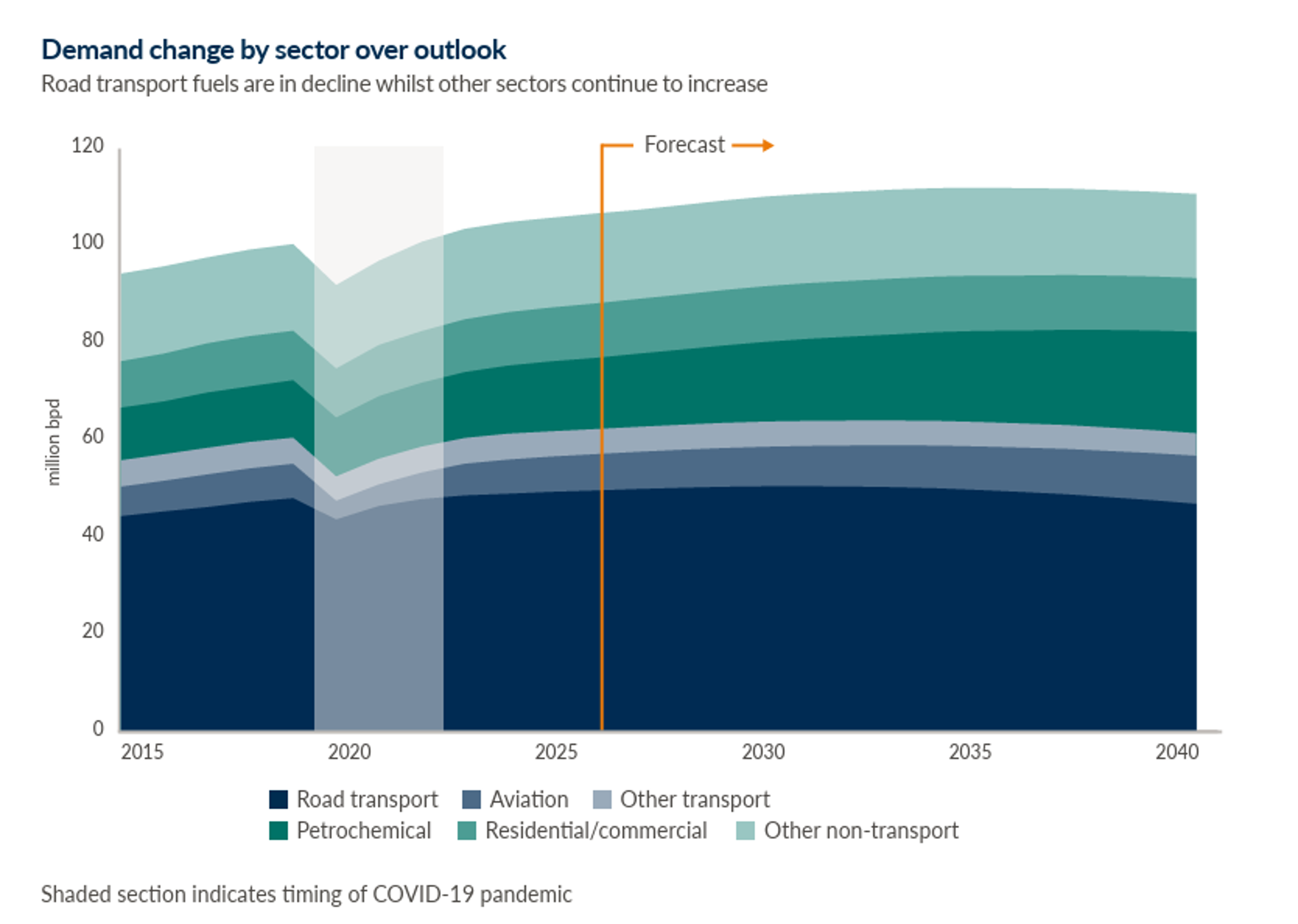

2020 Model Predicted No Oil Peak; Experts Now Retreat

🚨Today's news vs my prediction 5 years ago: 👔My model to 2050 showed no peak in oil demand. That was in 2020. 🪶Many have retreated from their "peak demand" predictions. The latest is from Vitol: 🐼Vitol Pushes...

By Anas Alhajji

Social•Feb 9, 2026

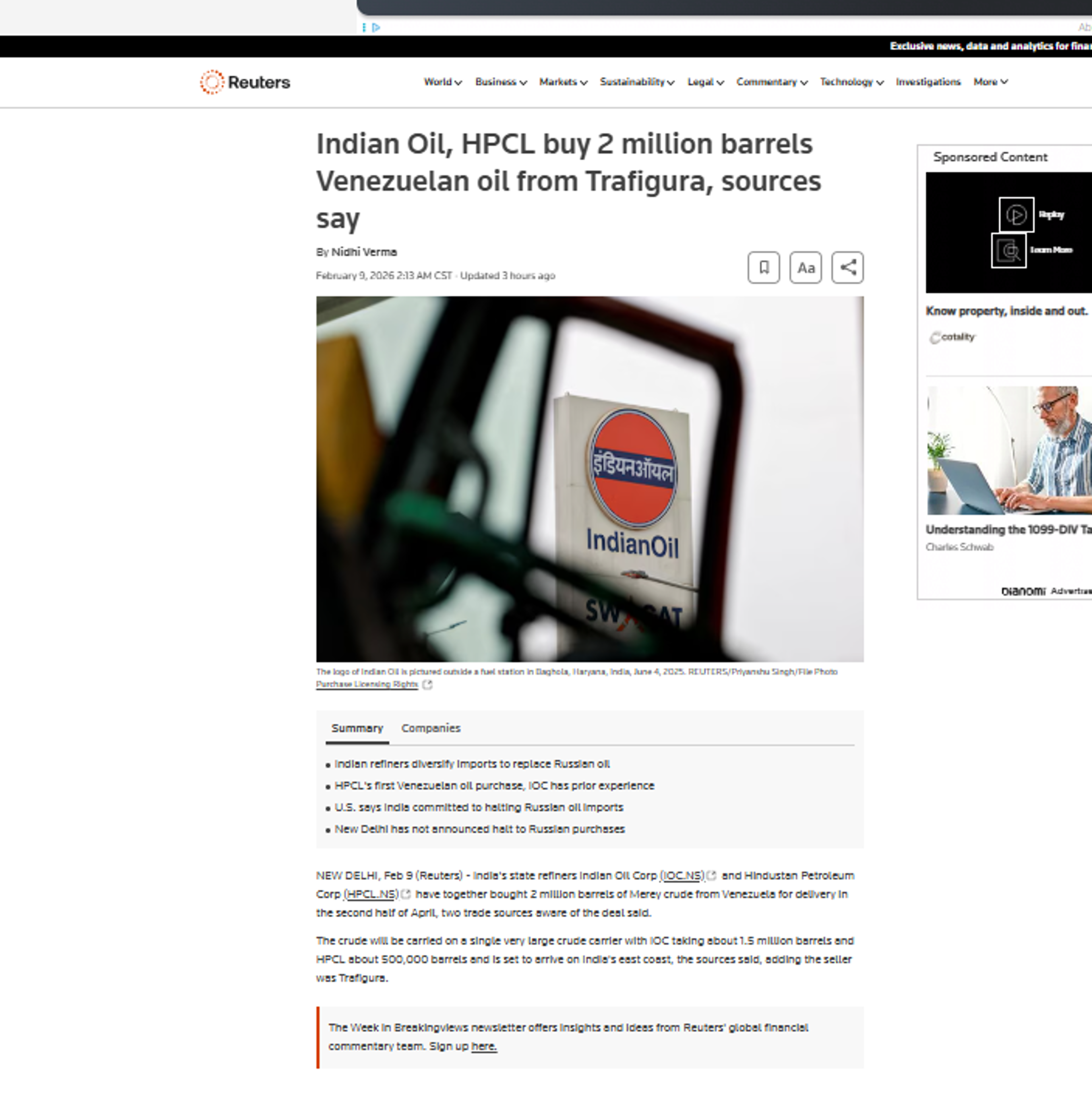

Trump Tariff Keeps India From Returning to Venezuelan Oil

🔴 Here is something to think about: 🇮🇳 If President Trump had not imposed the additional 25% tariff on India for importing Russian oil—and with Venezuelan crude now becoming available—would Indian refineries resume buying Venezuelan oil, as they did in the...

By Anas Alhajji

Social•Feb 9, 2026

BP Should Halt $750M Buybacks for New CEO

COLUMN: Britrish oil giant BP should suspend its $750 million quarterly share buybacks to give incoming CEO Meg O'Neill (who arrives in April) extra financial breathing room. @Opinion $BP https://t.co/23vNRD4Nsw

By Javier Blas

Social•Feb 9, 2026

Vitol Pushes Global Oil Demand Peak to Mid‑2030s

CHART OF THE DAY: Vitol, the world's largest independent oil trader, shifts its view on global peak oil demand: higher and later. Now, Vitol sees a peak by the "mid" 2030s (previously it anticipated "early" 2030s). Peak demand seen at ~112m...

By Javier Blas

Social•Feb 9, 2026

Illegal Iran-India Fuel Smuggling Fuels Refineries, Not Politics

This has nothing to do with Trump's phone call. These are very small shipments of smuggled petroleum products (not crude) that are illegal in both Iran and India. (One of the ships was empty.) These are usually managed by gangs,...

By Anas Alhajji

Social•Feb 7, 2026

Russia's Gold Reserves Top $400 Billion for First Time

🚨 Russia’s gold reserves have officially crossed the $400 billion mark for the first time ever. The milestone reflects years of aggressive gold accumulation, accelerated by rising prices and a strategic shift away from reliance on foreign currencies. Follow for more macro...

By cryptosauce_

Social•Jan 31, 2026

Silver Suffers Steepest One‑day Drop Since 1921

January 30, 2026 . . . . Worst one day % drop in silver prices since 1921.

By Errol Anderson