NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

•February 20, 2026

0

Companies Mentioned

Why It Matters

The comments dampen short‑term rate‑hike expectations, pressuring regional currencies and shaping investor positioning ahead of upcoming data releases.

Key Takeaways

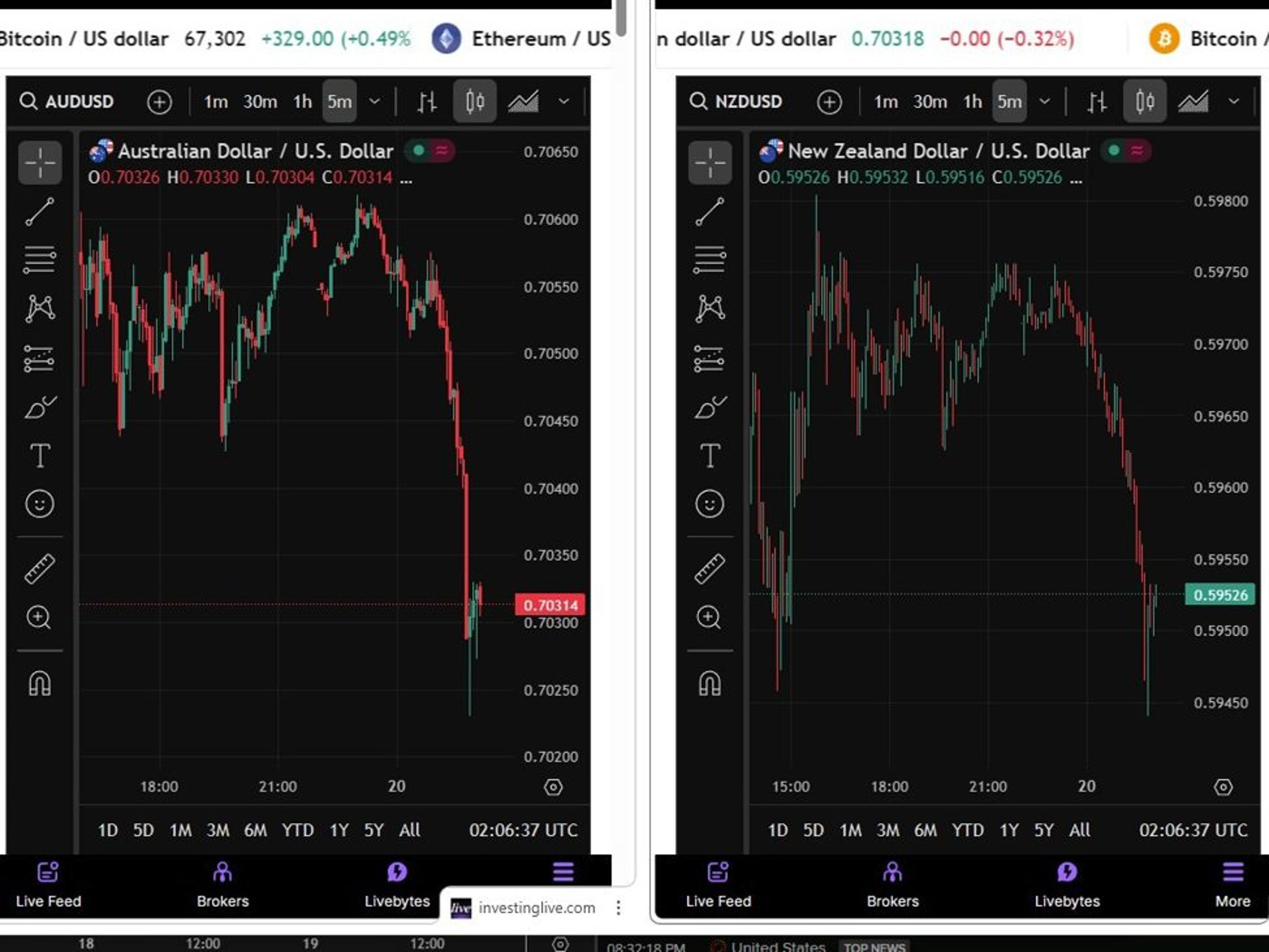

- •NZD drops as RBNZ sees inflation within target

- •AUD slides alongside Kiwi amid regional risk sentiment

- •RBNZ stresses data‑dependent policy, no preset tightening path

- •Governor warns against “trigger‑happy” rate hikes

- •Inflation expected to hit 2% midpoint within 12 months

Pulse Analysis

The Reserve Bank of New Zealand’s latest remarks have injected a measured calm into the market, suggesting that the disinflation process is on track. By indicating that consumer price growth has already re‑entered the 1‑3% band and is likely to settle around the 2% midpoint within twelve months, the RBNZ reduces the urgency for further tightening. This data‑driven stance, coupled with the explicit rejection of a predetermined policy path, signals to investors that future moves will hinge on fresh economic evidence rather than a pre‑ordained schedule.

Across the Tasman, the Australian dollar mirrored the Kiwi’s decline, underscoring the tight correlation between the two currencies in risk‑on environments. While the Reserve Bank of Australia recently delivered its first rate hike in two years, markets remain cautious about additional increases, especially as regional sentiment softens. The RBNZ’s dovish cues have amplified this caution, prompting traders to reassess short‑term rate expectations and adjust their exposure to both NZD and AUD.

For portfolio managers and corporate treasurers, the RBNZ’s forward‑looking yet flexible approach reshapes the near‑term FX outlook. The combination of confidence in inflation returning to target and a reluctance to over‑react to data surprises suggests a lower probability of aggressive rate hikes in the coming months. Consequently, businesses with New Zealand or Australian exposure may find hedging costs easing, while investors seeking yield will need to look beyond the region for higher‑return opportunities.

NZD, AUD fall as RBNZ says inflation returning to target, no preset path

RBNZ signals steady hand on rates, nudging NZD lower and dragging AUD with it.

Summary:

-

NZD and AUD both fall, with Kiwi leading declines during Asian trade.

-

RBNZ Governor Breman says inflation likely already back inside target band in Q1.

-

RBNZ confident inflation will return to the 2% midpoint within 12 months.

-

Policy is not on a pre-set course, decisions remain data dependent.

-

Chief Economist Paul Conway says the RBNZ “won’t be trigger happy” with rate hikes.

-

Tone reads steady-to-dovish at the margin despite confidence on inflation trajectory

The New Zealand and Australian dollars weakened in Asian trade following remarks from Reserve Bank of New Zealand officials that, while broadly constructive on inflation, signalled no urgency to tighten policy further.

RBNZ Governor Breman said the path back to 2% inflation “has been bumpy,” but added that inflation is expected to already be back within the target range in the first quarter of this year. She reiterated confidence that inflation will return to the 2% midpoint within the next 12 months.

Crucially for markets, Breman emphasised that being forward-focused does not imply policy is on a pre-set course. The central bank will adjust plans as new information arrives, maintaining flexibility in response to evolving data.

RBNZ Chief Economist Paul Conway reinforced that message, stating the Bank “won’t be trigger happy” with rate hikes, a line that appeared to weigh on the Kiwi at the margin.

The tone suggests the RBNZ sees inflation progress as broadly on track, reducing the need for aggressive follow-up tightening unless data surprise to the upside. That combination, confidence in disinflation alongside a cautious tightening stance, can dampen short-term rate expectations and pressure the currency.

The Australian dollar moved lower alongside the Kiwi, reflecting regional FX correlation and broader risk sentiment rather than any direct domestic catalyst.The Reserve Bank of Australia recently delivered its first rate hike in roughly two years and markets continue to price the risk of further increases.

Be sure to be following us, we had Breman's comments hours ago.

This article was written by Eamonn Sheridan at investinglive.com.

0

Comments

Want to join the conversation?

Loading comments...