Video•Feb 20, 2026

Sky News Gains Rare Access to Bank of England's Gold Vaults

Sky News has been granted rare and exclusive access to the Bank of England's gold vault in London. It's the second largest gold reserves in the world, with around 400,000 bars now worth close to £600 billion. The vast majority is held on behalf of the UK Government and central banks from across the globe. That includes Venezuela's reserves, which has been tied up in a long-running legal battle. Sky's economics and data editor Ed Conway reports. Read more: https://news.sky.com/story/sky-news-gains-rare-access-to-bank-of-englands-gold-vaults-13509266 #bankofengland #gold #skynews SUBSCRIBE to our YouTube channel for more videos: http://www.youtube.com/skynews Follow us on Twitter: https://twitter.com/skynews Like us on Facebook: https://www.facebook.com/skynews Follow us on Instagram: https://www.instagram.com/skynews Follow us on TikTok: https://www.tiktok.com/@skynews For more content go to http://news.sky.com and download our apps: Apple https://itunes.apple.com/gb/app/sky-news/id316391924?mt=8 Android https://play.google.com/store/apps/details?id=com.bskyb.skynews.android&hl=en_GB Sky News Daily podcast is available for free here: https://podfollow.com/skynewsdaily/ To enquire about licensing Sky News content, you can find more information here: https://news.sky.com/info/library-sales

By Sky News

Video•Feb 19, 2026

Stocks Slide as Oil Spikes on US–Iran Tension | Closing Bell

The closing bell showed U.S. equities slipping as oil prices spiked on renewed U.S.–Iran tensions. The S&P 500 and Nasdaq each fell roughly 0.3%, while the Russell 2000 managed a modest gain, underscoring the market’s mixed reaction to geopolitical risk. Energy‑related concerns lifted...

By Bloomberg Television

Video•Feb 19, 2026

How Hedgeye’s Global Process Is Beating Consensus

Most U.S. investors are still heavily concentrated in the same exposures: the classic 60/40 portfolio, U.S. large-cap growth, and The Hoodie's latest crypto disaster. But while those portfolios have been getting hit, our country-level allocations have been smoking the consensus exposures...

By Hedgeye

Video•Feb 19, 2026

Stop Reading Candles… Start Reading STRENGTH vs WEAKNESS 🔥

Traders are urged to move beyond the simplistic red‑vs‑green candle view and focus on candle strength. The presenter explains three classifications—strong, weak, neutral—determined by the relationship between the body and the wicks. Strong bullish candles exhibit a large body that closes...

By Akil Stokes (Tier One Trading)

Video•Feb 18, 2026

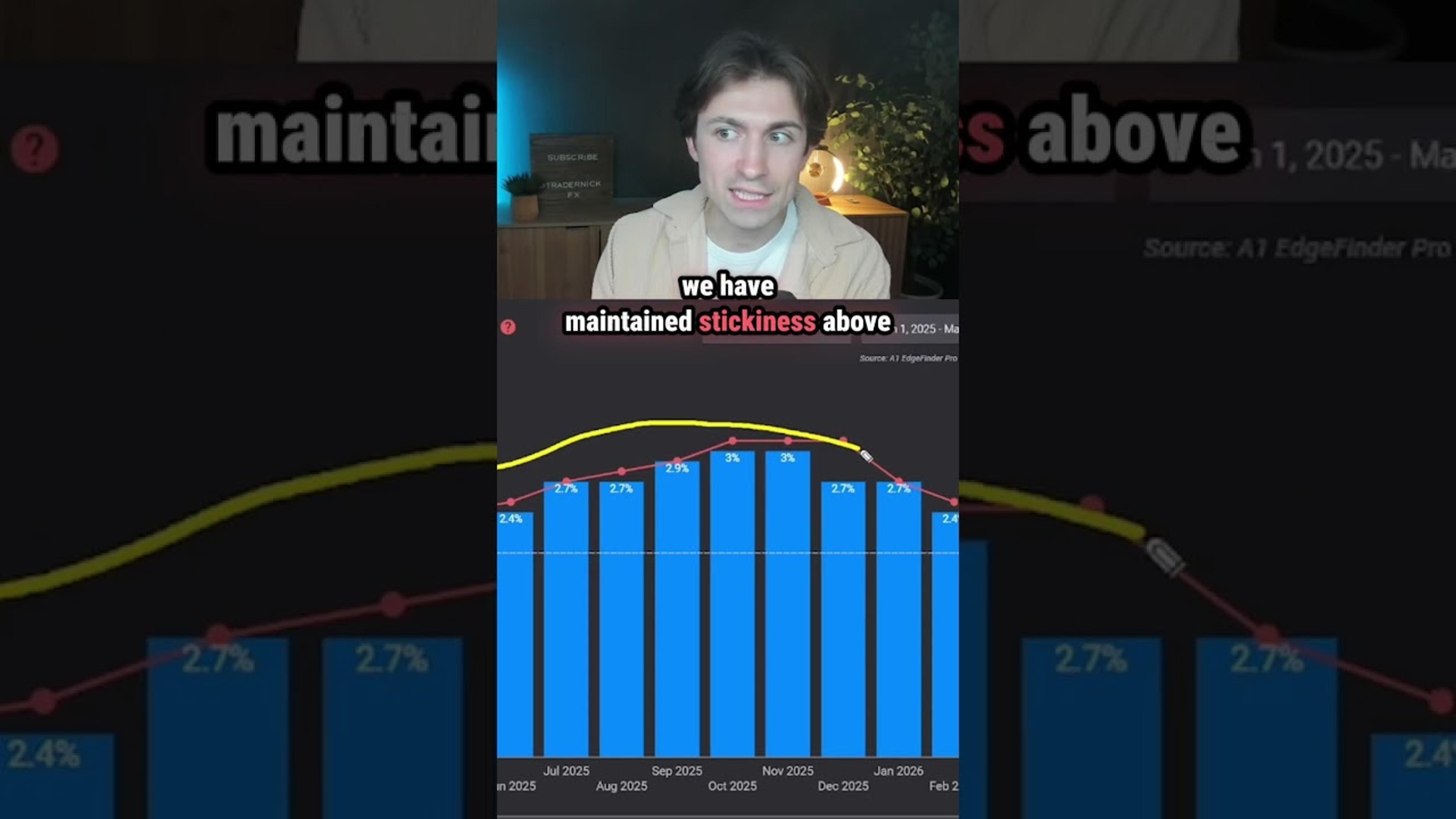

Is the Fed About to HIKE Rates...?

The video explores a less‑likely but plausible scenario in which the Federal Reserve shifts from cutting rates to hiking them, based on recent Fed meeting minutes that suggested some participants would back a two‑sided outlook if inflation stays above target....

By TraderNick

Video•Feb 18, 2026

How Traders Actually Use Barchart's Technical Opinion (Strength vs Direction)

The webinar introduces Barchart’s Technical Opinion tool, a consolidated dashboard that blends thirteen distinct technical indicators into a single buy‑or‑sell rating for stocks, ETFs, futures, and forex. John Roland likens the interface to a race‑car instrument panel, providing traders an...

By Barchart

Video•Feb 18, 2026

Governor Anna Breman Explains the February 2026 Monetary Policy Statement

Governor Anna Breman announced that the Reserve Bank of New Zealand’s Monetary Policy Committee kept the Official Cash Rate unchanged at 2.25% in its February 2026 meeting, emphasizing a cautious stance aimed at sustaining the nascent economic recovery. The committee highlighted...

By Reserve Bank of New Zealand

Video•Feb 16, 2026

How Chasers Get Trapped

The video titled “How Chasers Get Trapped” dissects a common market dynamic where price discounts create a narrow range that aggressive sellers exploit to ensnare inexperienced buyers, often called “chasers.” It frames the scenario as a battle between sellers who...

By Urban Forex (Navin Prithyani)

Video•Feb 16, 2026

Momentum Shift? Spot It BEFORE the Market Turns ⚡

The video explains the rising wedge—a chart pattern that indicates a loss of momentum in an uptrend. Using a ball‑throwing analogy, the presenter shows how price initially climbs steeply before the upward thrust slows and the trajectory flattens, mirroring a...

By Akil Stokes (Tier One Trading)

Video•Feb 15, 2026

“A Huge Problem for Everybody” | Paul Krugman on China, the Dollar, A.I., & More

In a recent Monetary Matters episode, Nobel laureate Paul Krugman examined the durability of the U.S. dollar, the consequences of China’s export‑driven model, and the looming threat of a disjointed global monetary order. Krugman noted micro‑data showing tariffs have lifted consumer...

By Monetary Matters Network

Video•Feb 15, 2026

How To Spot a Butterfly Pattern (Before It Reverses 🦋)

The video walks viewers through spotting a butterfly harmonic pattern, a high‑probability reversal setup, by anchoring the analysis on the initial X‑leg swing high to swing low. The instructor explains that when the price retraces to the 78.6% Fibonacci level of...

By Akil Stokes (Tier One Trading)

Video•Feb 13, 2026

Nasdaq-100 and S&P 500 Futures Finished Lower for a Second Week. 2/13/26

The market focus this week centers on U.S. Treasury yields, which have slumped across the curve—from the 5‑year to the 30‑year—dragging the 10‑year rate to its lowest point since October 28, 2024. The yield plunge helped the dollar close its weakest week...

By CME Group

Video•Feb 11, 2026

Did the Bank of Japan Intervene Today??

The video examines a possible Bank of Japan (BOJ) intervention that coincided with the release of the U.S. non‑farm payroll (NFP) data. The narrator points to an abrupt one‑minute candle on the USD/JPY pair that erased the gains generated by...

By TraderNick

Video•Feb 10, 2026

My Exact Steps to Trade Ranges Profitably Using Multi Timeframe

Mariana walks viewers through a step‑by‑step NZD/CAD range trade that netted 33 pips with roughly a 2:1 risk‑to‑reward ratio, emphasizing a top‑down, multi‑timeframe approach. She begins on the four‑hour chart, spotting a clear uptrend through higher highs, higher lows and...

By Urban Forex (Navin Prithyani)

Video•Feb 9, 2026

Volume in a Range

The video focuses on how trading volume behaves inside price ranges and why those zones should be viewed as strategic assets rather than obstacles. It argues that volume clusters forming in a consolidation area often become critical support levels and...

By Urban Forex (Navin Prithyani)