🎯Today's Earnings Calls Pulse

Updated 4h agoWhat's happening: Centrica posts 41% EPS drop, pauses share buyback

Centrica reported a 41% plunge in 2025 earnings per share to GBX 11, matching FactSet consensus. After completing a £2 billion share‑buyback programme, the company announced a pause to the scheme. It lifted its 2028 EBITDA target to £1.7 billion, raised the 2025 dividend by 22%, and the stock fell about 5% on soft 2026 guidance.

Also developing:

- •Alarm.com beats revenue expectations, sees strong subscription growth

- •Transocean to discuss 2025 results on Feb 20

- •RingCentral tops EPS and revenue forecasts in Q4

Video•Feb 20, 2026

WMT Downgrade, DECK Upgrade, TXRH Double Miss in Earnings

Texas Roadhouse (TXRH) gained Friday morning despite posting a double miss in earnings. HSBC downgraded Walmart (WMT) to hold from buy over growth concerns. Deckers (DECK) stepped up thanks to an upgrade from Argus. Diane King Hall talks about the analyst and earnings movers to watch on the last day of the trading week. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe to the Market Minute newsletter - https://schwabnetwork.com/subscribe Download the iOS app - https://apps.apple.com/us/app/schwab-network/id1460719185 Download the Amazon Fire Tv App - https://www.amazon.com/TD-Ameritrade-Network/dp/B07KRD76C7 Watch on Sling - https://watch.sling.com/1/asset/191928615bd8d47686f94682aefaa007/watch Watch on Vizio - https://www.vizio.com/en/watchfreeplus-explore Watch on DistroTV - https://www.distro.tv/live/schwab-network/ Follow us on X – https://twitter.com/schwabnetwork Follow us on Facebook – https://www.facebook.com/schwabnetwork Follow us on LinkedIn - https://www.linkedin.com/company/schwab-network/ About Schwab Network - https://schwabnetwork.com/about #walmart #deckers #texasroadhouse #economy #finance #investing #marketnews #stock #stockmarket #trading #live #schwabnetwork #wmt #deck #txrh #earnings #guidance #retail #ecommerce #shoes #ugg #hoka #restaurant #chart

By Schwab Network (ex‑TD Ameritrade Network)

Video•Feb 20, 2026

Insolation Energy Ltd Q3 FY2025-26 Earnings Conference Call

The conference call presented Insulation Energy Ltd’s Q3 FY26 results and nine‑month financial update, highlighting a rapid scaling of its solar PV business. Management emphasized a 77% year‑on‑year revenue jump to ₹575 crore for the quarter and a 42% increase for...

By AlphaStreet India

News•Feb 20, 2026

Airbus Reports Full-Year (FY) 2025 Results

Airbus announced FY2025 results, delivering 793 commercial jets and generating €73.4 billion in revenue, a 6% year‑on‑year increase. Adjusted EBIT rose 33% to €7.1 billion, while net income grew 23% to €5.2 billion and EPS to €6.61. The order backlog hit a record...

By Airbus – Newsroom

News•Feb 20, 2026

Megaport Sees Record Revenue in First Half FY26

Megaport reported a record first‑half FY26, with revenue rising 26 percent to $134.9 million and annual recurring revenue climbing 49 percent to $338 million. EBITDA increased 28 percent to $35.3 million, but post‑tax profit fell to a $19.1 million loss due to $15.8 million acquisition costs. The company...

By ARN (Australia)

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 19, 2026

Figma Gains on Strong Growth Outlook that Eases AI Fears

Figma’s latest earnings call highlighted a bullish growth outlook that directly counters lingering industry anxieties about artificial‑intelligence disruptions. The company emphasized that as AI improves, its own product suite becomes more powerful, positioning the design platform to benefit rather than...

By Bloomberg Television

Video•Feb 19, 2026

Charting DE After Earnings Send Shares to All-Time High

Agriculture companies have taken a much bigger investor focus to start 2026, and no company may have muscled more gains than Deere & Co. (DE). Shares of the company have climbed more than 40% in the last few weeks, helped...

By Schwab Network

Video•Feb 19, 2026

Amazon Dethrones Walmart

The video highlights that Amazon finally eclipsed Walmart in total sales for 2025, reporting $717 billion versus Walmart’s $713.2 billion, cementing a shift from the traditional Walmart‑Target rivalry to a direct Amazon‑Walmart showdown. Analysts note Walmart’s strategic pivot toward technology: a $40 billion free‑cash‑flow...

By Yahoo Finance

Video•Feb 19, 2026

IA Financial Tumbles on Q4 EPS Miss

IA Financial’s shares tumbled after the insurer reported fourth‑quarter core earnings per share that fell short of analyst expectations, prompting a sharp market reaction. The company’s president and CEO Denis Ricard appeared on a call to contextualize the miss, emphasizing that...

By BNN Bloomberg

Video•Feb 19, 2026

What Do Airbus' Latest Results Mean For Its Future?

Our editors, Jens Flottau and Robert Wall, discuss the implications of Airbus' latest results, including the downward revision of its production targets, particularly for the A320neo family. Overall, Airbus is now targeting 870 commercial aircraft deliveries for 2026, which is 77...

By Aviation Week

Video•Feb 19, 2026

PANW Platformization Strategy: Long-Term Tailwind Amid Short-Term Headaches

After reporting a double‑beat earnings quarter, Palo Alto Networks saw its stock slide about 7.5%, prompting analysts to dissect the firm’s long‑term platformization strategy. The company highlighted a $210 billion cybersecurity addressable market and emphasized its move toward a unified, AI‑driven...

By Schwab Network (ex‑TD Ameritrade Network)

News•Feb 19, 2026

Live Nation 2025 Revenues Top $25B

Live Nation Entertainment posted a record $25 billion in 2025 revenue, a 9% increase over 2024. Quarterly earnings reached $6.3 billion, surpassing analysts’ $6.1 billion estimate. Concert sales climbed to $20.9 billion, while sponsorship revenue grew 11% to $1.33 billion, and the company reported a...

By Pollstar News

News•Feb 19, 2026

Sphere Entertainment’s Revenues Topped $1.2bn in 2025, up 8% YoY; Wizard Of Oz Has Generated $290M Since August Launch

Sphere Entertainment posted FY 2025 revenue of $1.22 billion, an 8% year‑over‑year increase, while narrowing its operating loss to $229.6 million. Adjusted operating profit surged 138% to $261.8 million, reflecting the impact of excluding depreciation, amortization and other non‑cash items. Q4 revenue jumped 28%...

By Music Business Worldwide (MBW)

News•Feb 19, 2026

Earnings Call Transcript: Deere & Company Q1 2026 Sees Strong Earnings Beat

Deere & Company posted a Q1 2026 earnings surprise, reporting EPS of $2.42 versus the $2.02 consensus and revenue of $9.61 billion, well above the $7.59 billion forecast. The equipment operations segment drove growth, delivering an 18% jump in net sales to $8.0 billion....

By Investing.com – News

News•Feb 19, 2026

Earnings Call Transcript: Nutrien Q4 2025 Misses Forecasts, Stock Dips

Nutrien Ltd. reported Q4 2025 earnings that fell short of forecasts, posting EPS of $0.83 versus the expected $0.92 and revenue of $5.34 billion against a $5.38 billion outlook. The miss triggered a 0.87% pre‑market decline in the stock despite a 13% rise...

By Investing.com – News

News•Feb 19, 2026

Centrica Earnings: In Line With Expectations, Share Buyback Pause Disappoints

Centrica reported a 41% plunge in 2025 earnings per share to GBX 11, matching FactSet consensus. After completing a £2 billion share‑buyback programme, the company announced a pause to the scheme. Soft 2026 guidance, driven by weaker gas and power trading, pushed...

By Morningstar UK – News

News•Feb 19, 2026

BAE Systems Shares Are Up 23% in 2026. Is This FTSE 100 Defense Stock a Buy?

BAE Systems posted an 8% revenue rise and a 9% jump in operating profit for 2025, expanding its order book by £2.7 bn versus 2024. The company lifted its dividend 10% to 36p per share, while its stock surged 23% year‑to‑date,...

By Morningstar UK – News

Video•Feb 18, 2026

Squawk Box Asia - 19-Feb-26

Morgan Stanley’s Squawk Box Asia segment framed current market dynamics around technological innovation and changing consumer behavior, arguing these forces are driving significant growth and industry transformation. The piece emphasizes that navigating these trends requires strategic foresight and bespoke financial...

By CNBC International Live

News•Feb 18, 2026

Stock Movers: Palo Alto, MSG Sports, Wingstop (Podcast)

Palo Alto Networks warned that adjusted earnings per share will fall between $3.65 and $3.70 for the full year and $0.78 to $0.80 for the third quarter, sending its stock to a two‑year low. MSG Sports announced that its board...

By Bloomberg — Business

News•Feb 18, 2026

South African Govt ‘Very Supportive, Great to Work with’, Glencore Highlights

Glencore reported 2025 earnings of $13.5 billion, driven by strong copper and zinc markets. CEO Gary Nagle praised the South African government as "very supportive" and "great to work with," extending beyond ferrochrome negotiations. The mining giant highlighted that the collaborative...

By Mining Weekly

News•Feb 18, 2026

ASR Nederland N.V. (ARNNY) Q4 2025 Earnings Call Transcript

ASR Nederland N.V. held its Q4 2025 earnings call on February 18, 2026, presenting full‑year results and outlining progress on its multi‑year strategy. CEO J.P.M. Baeten highlighted stronger underwriting performance and a rise in net profit, while CFO Ewout Hollegien detailed improvements in...

By Seeking Alpha — Site feed

News•Feb 18, 2026

Aware Sets Fourth Quarter and Full Year 2025 Webcast for Wednesday, March 4, 2026, at 5:00 P.m. Eastern Time

Aware, Inc. announced a webcast on March 4, 2026 at 5 p.m. Eastern to present its fourth‑quarter and full‑year 2025 financial results. The company will release the earnings press release prior to the call and host a live Q&A session. Aware highlighted that...

By GlobeNewswire – Earnings Releases

News•Feb 18, 2026

Broker’s Call: Ipca Laboratories (Buy)

Ipca Laboratories posted a robust 19% year‑on‑year EBITDA increase to ₹530 crore, surpassing broker estimates, while revenue rose 6.6% to ₹2,400 crore. Domestic formulation sales grew 12% and export formulation climbed 17%, offset by flat API sales overall but a 26% rebound...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

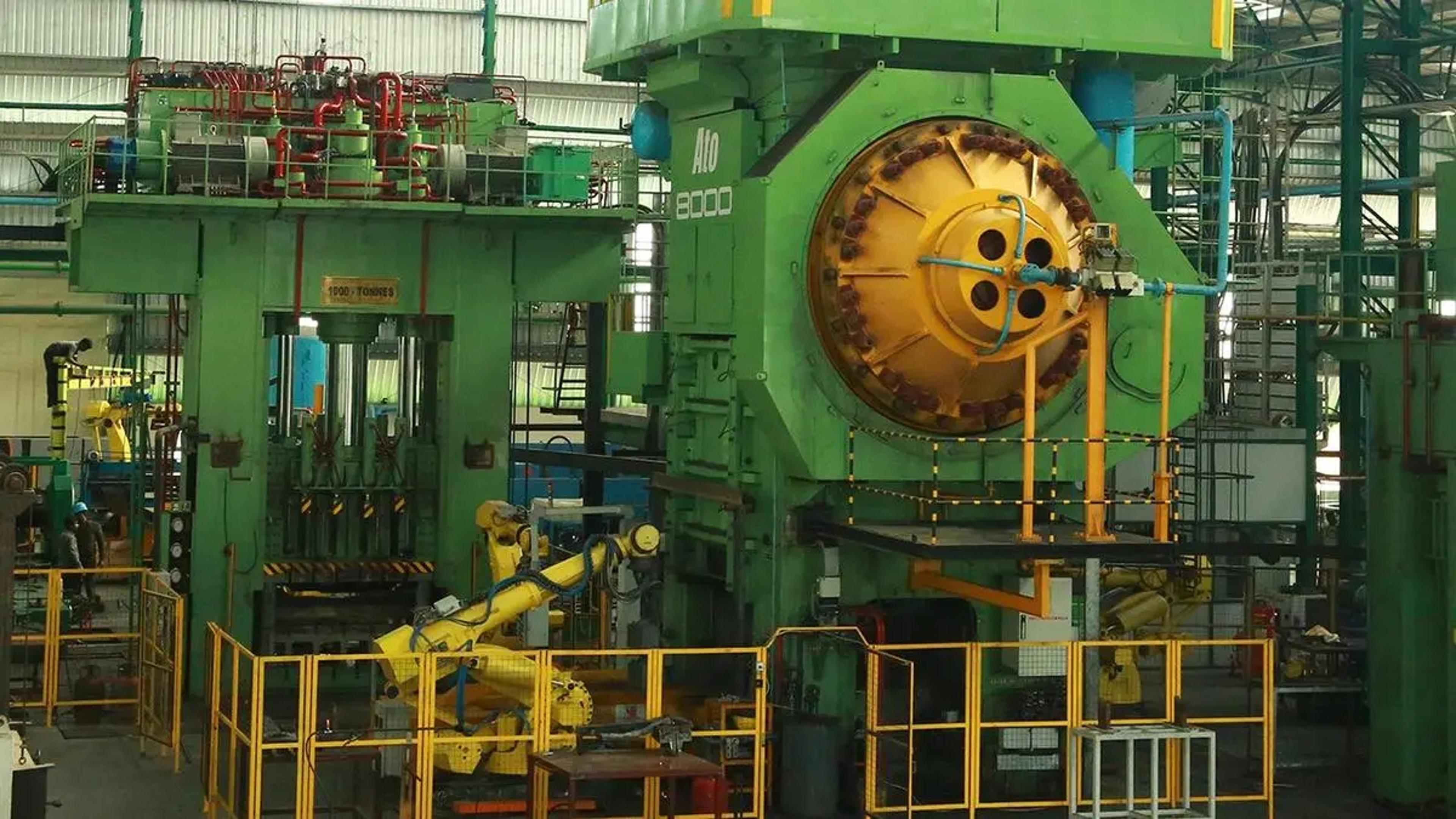

Broker’s Call: MM Forgings (Buy)

MM Forgings posted a Q3FY26 EBITDA of ₹71.6 crore, a 2% YoY decline, while revenue rose 11% to ₹405 crore, beating estimates. Domestic sales grew 14% and exports 7%, reflecting stronger overseas demand. The broker retains a BUY rating with a revised...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

Asian Paints Faces Near-Term Headwinds as Weak Q3 Dampens Sentiment

Asian Paints reported an 8% growth in decorative volumes for Q3, slowing from the 11% pace in the prior quarter, and saw its EBITDA margin expand to 20.1% on lower raw‑material costs. The company retained its FY‑26 guidance of 8‑10%...

By Economic Times — Markets