🎯Today's Energy Pulse

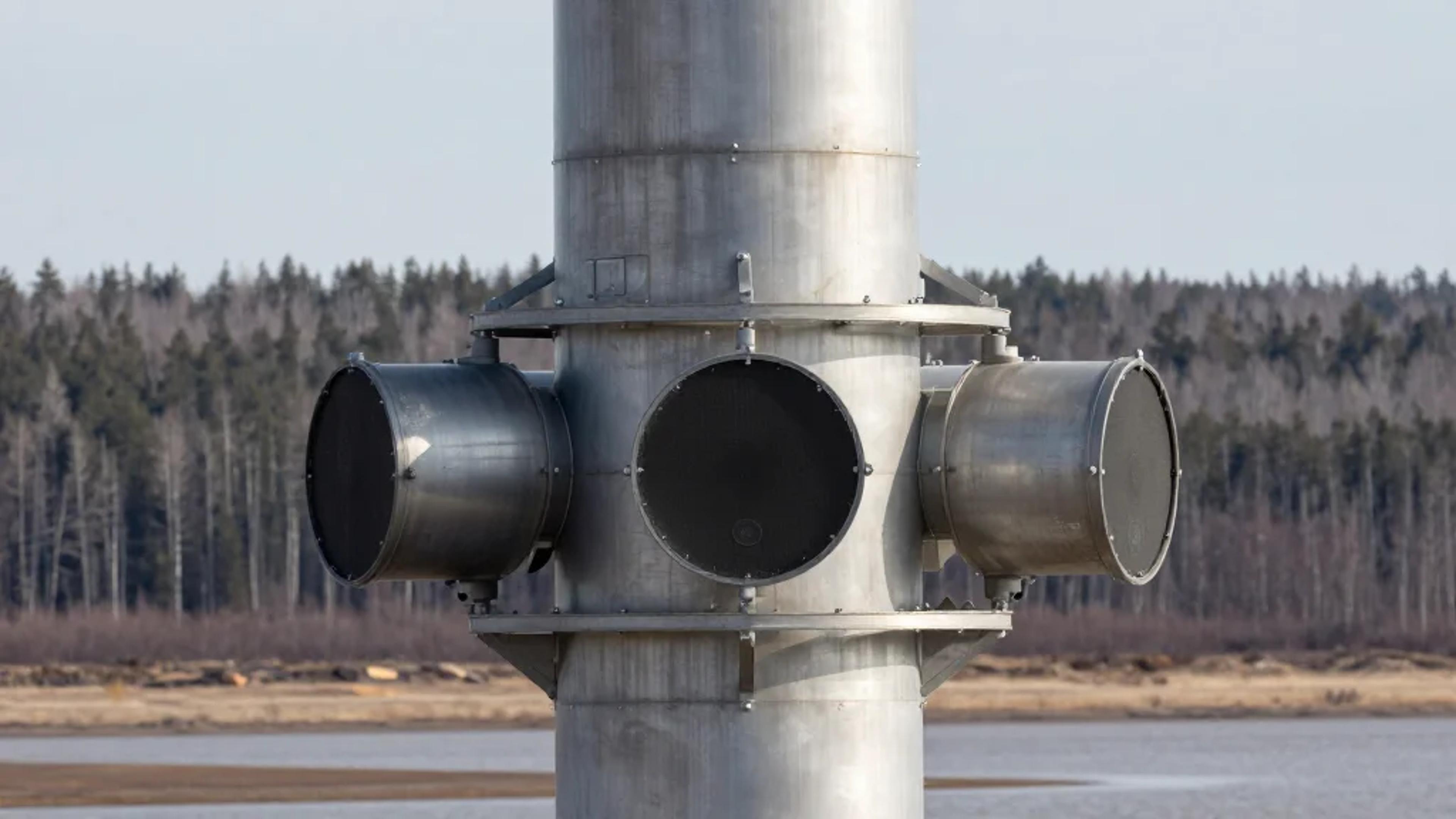

Updated 1h agoWhat's happening: Saudi Arabia pre‑qualifies firms for new gas transmission grids

The Energy Ministry has pre‑qualified eight standalone firms and seven consortia to design, build, own and operate natural‑gas transmission networks in five key industrial cities, including Al‑Kharj, Sudair and three zones in Jeddah. The BOO scheme sets a technical‑bid deadline of 23 April 2026 and targets a total of 36 industrial cities for future expansion.

Also developing:

News•Feb 15, 2026

Miliband Targets The Sky With Radical Plan To Beam Energy From Space

Britain’s new net‑zero roadmap, championed by Energy Secretary Ed Miliband, proposes orbiting solar power stations to supply the UK with continuous, large‑scale electricity. The government‑commissioned study outlines ultra‑light satellites that convert sunlight to microwave beams, received by ground rectennas. Early deployment would require substantial public backing, but cost forecasts suggest by 2040 prices could fall to £87‑£129 per MWh, comparable to offshore wind and below projected new nuclear costs. The plan positions the UK to become a leader in space‑based renewable energy.

By Orbital Today

Social•Feb 15, 2026

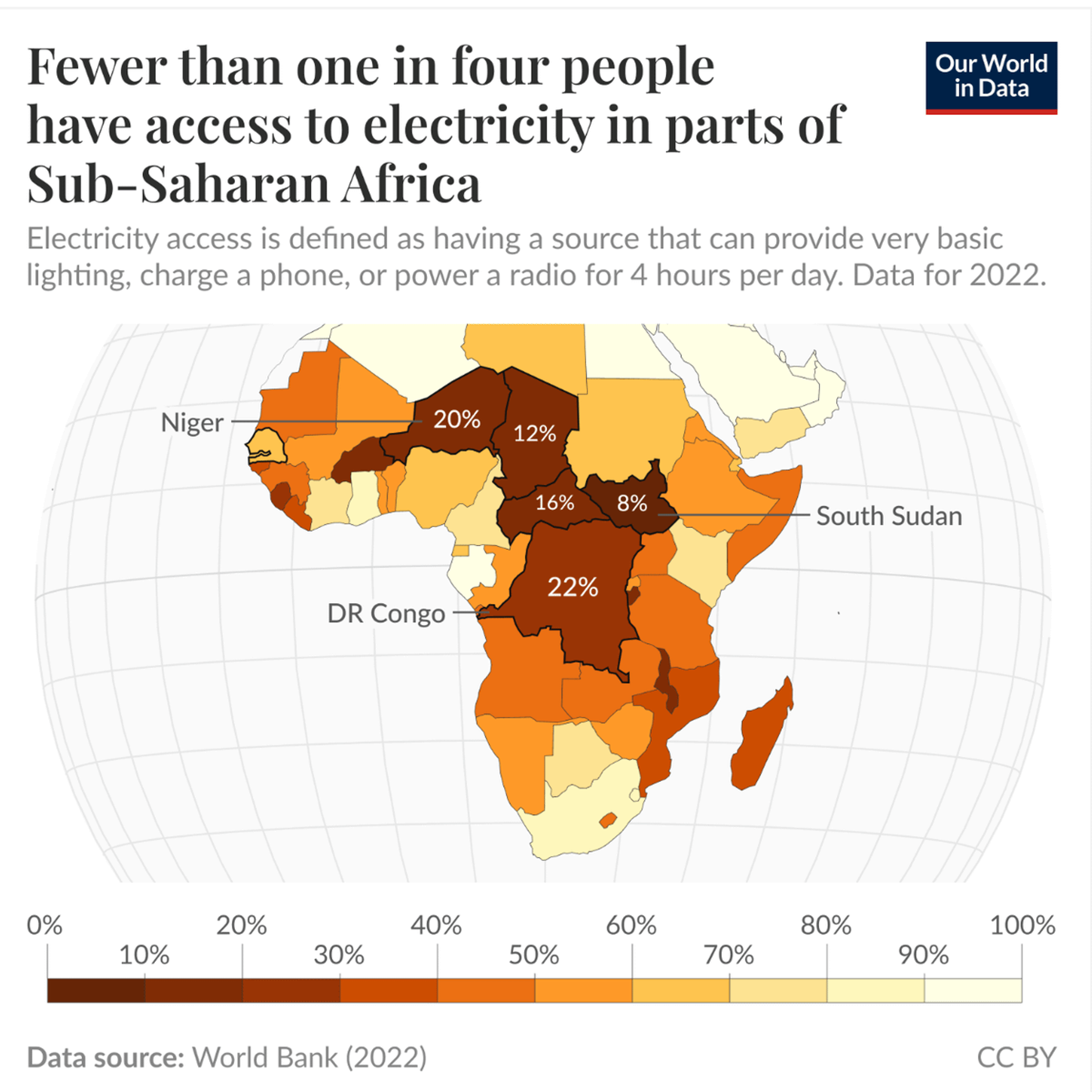

Electricity Scarcity in Africa Dwarfs Climate Panic

In some African countries, less than a quarter of the population has access to basic electricity for even four hours a day. Meanwhile in the West, our designated experts tell us that "climate change" is a global emergency. If they bothered to...

By Alex Epstein

Social•Feb 15, 2026

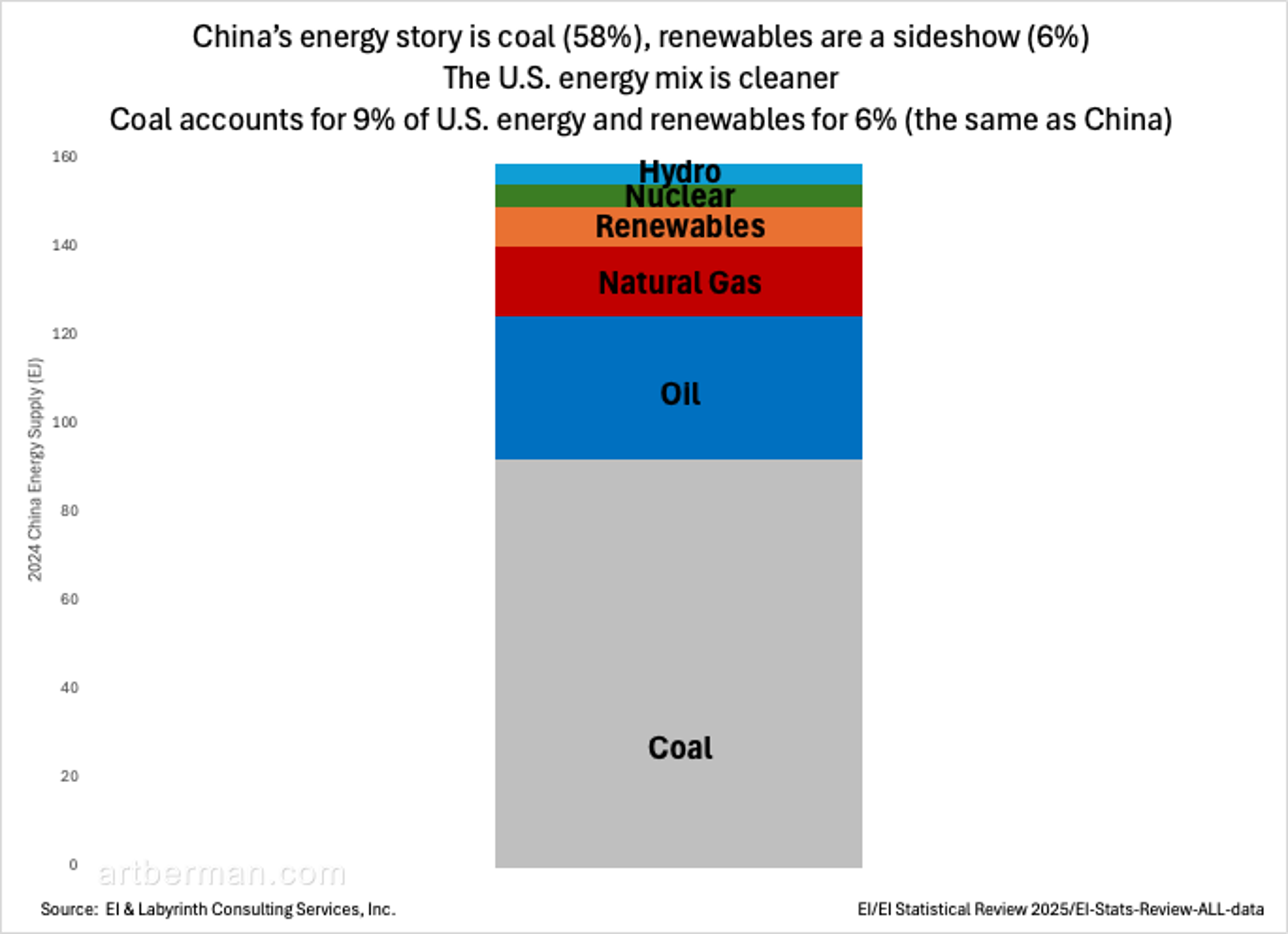

China’s Renewable Surge Fueled by Coal, Not Climate

Your green cheerleading misses the power politics @dominictsz China’s solar and wind boom is built on COAL, backed by COAL, and financed by COAL. It’s the world’s LARGEST CARBON EMITTER — and it’s not chasing climate virtue, it’s chasing energy...

By Art Berman Blog

Blog•Feb 14, 2026

Novel Calcium-Ion Battery Technology Enhances Energy Storage Efficiency and Sustainability

Researchers at HKUST have unveiled a high‑performance quasi‑solid‑state calcium‑ion battery that uses redox‑active covalent organic framework electrolytes. The QSSEs achieve 0.46 mS cm⁻¹ ionic conductivity and enable Ca²⁺ transport rates above 0.53 at room temperature. A full cell delivers 155.9 mAh g⁻¹ specific capacity...

By Nanowerk

Social•Feb 15, 2026

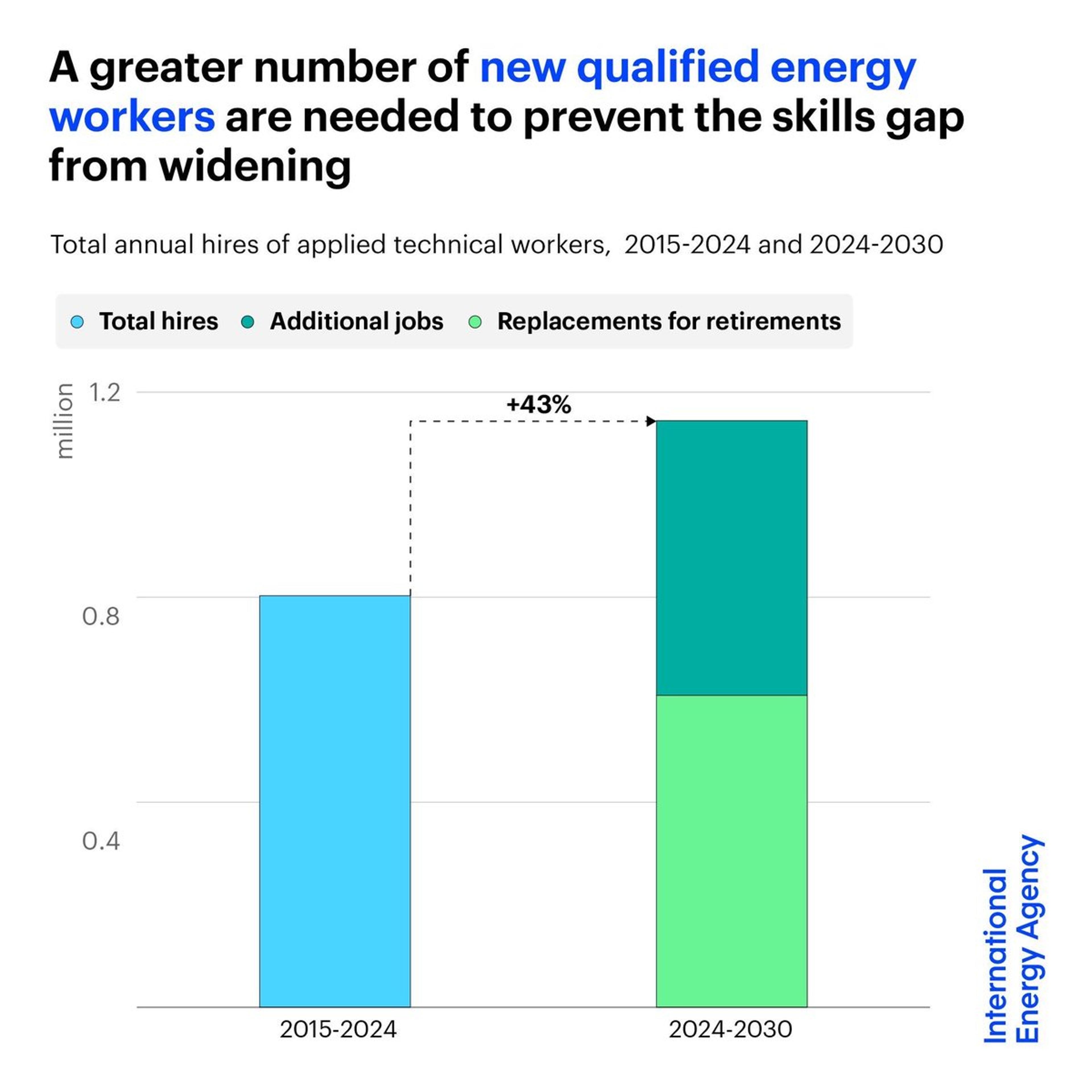

AI‑Driven Reskilling Needed to Meet Energy Workforce Gap

The global energy transition won’t scale without people. Newly qualified energy workers aren’t keeping pace with demand, and without a ~40% increase in trained entrants by 2030, the skills gap will widen fast. This is where #AI, digital skills, and reskilling become...

By Harold Sinnott

Social•Feb 15, 2026

Micro Reactors on C‑17 Promise Off‑grid Power

This Is A Nuclear Reactor Packed Into A C-17 Globemaster III Micro nuclear reactors are being seen as a way to get critical bases off the grid, but they could also have a major impact on civilian energy production. Story: https://t.co/KrommLR43d

By Tyler Rogoway

Blog•Feb 14, 2026

Fast Microwave Method Produces Advanced Carbon Materials for Efficient CO2 Capture

Scientists have introduced a microwave‑assisted synthesis that converts coal into nitrogen‑doped ultramicroporous carbon in about ten minutes. The rapid method preserves nitrogen and oxygen functional groups, creating pores of 0.6‑0.7 nm that tightly fit CO₂ molecules. The resulting adsorbent captures up...

By Nanowerk

Social•Feb 15, 2026

Cuba's Power Generation Falls Below Half Demand.

ENERGY CRISIS IN CUBA: Granma, the mouthpiece of the Cuban regime, says that electricity generation in the island is covering less than half the expected demand. The island is suffering the largest energy shortages since the collapse of the Soviet...

By Javier Blas

Social•Feb 15, 2026

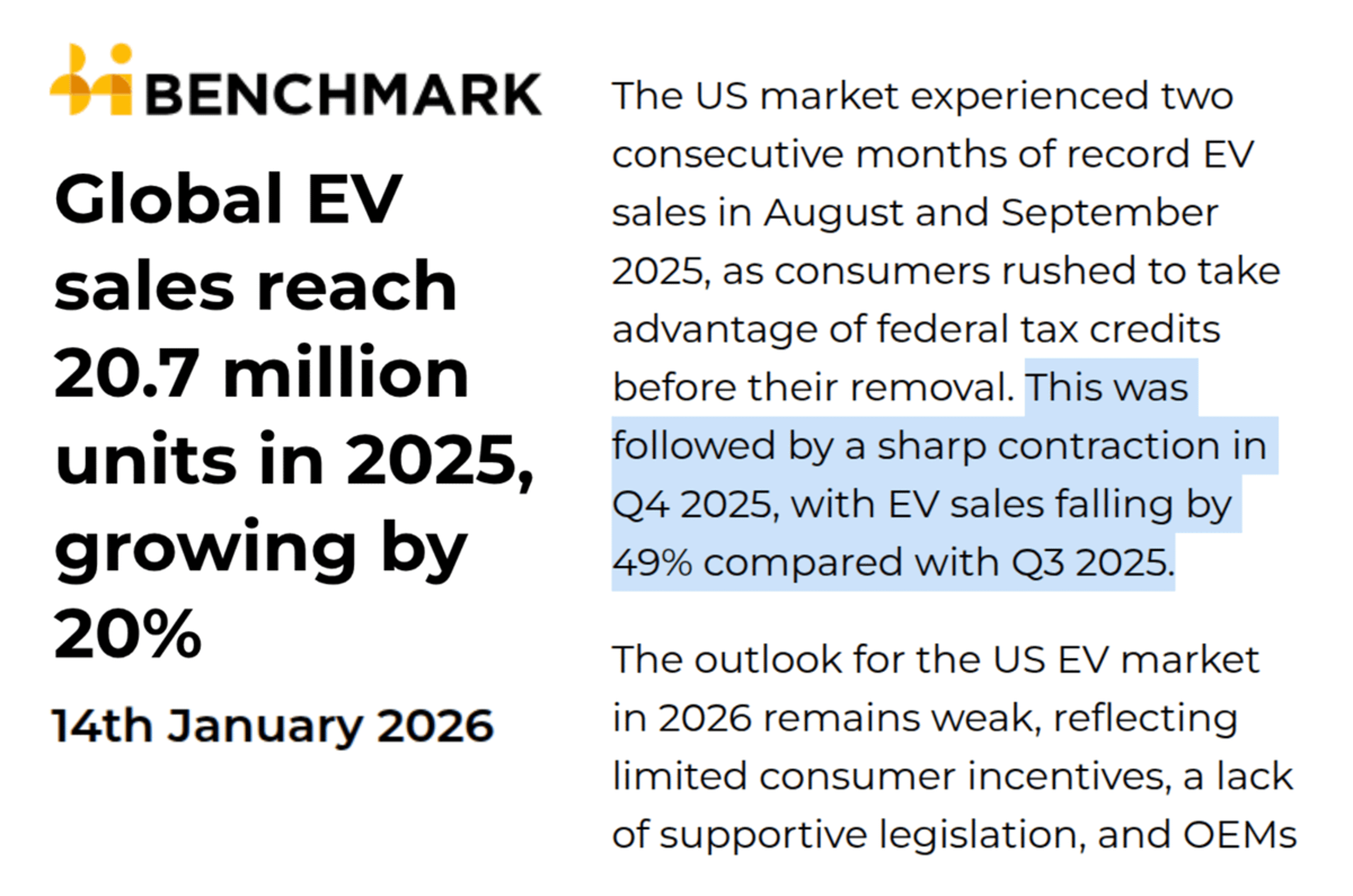

EV Demand Collapses After Congress Slashes IRA Subsidies

We constantly hear that EVs are the future of transportation. And yet, when Congress cut the IRA subsidies for EVs mid- last year, the demand for them fell dramatically. 🤔 https://t.co/Tji0vbvpat

By Alex Epstein

News•Feb 14, 2026

Why Does India Need More Energy Suppliers? Union Minister Piyush Goyal Explains

Union Minister Piyush Goyal warned that India’s rapidly expanding energy demand requires a broader base of crude oil suppliers. He argued that additional sources are essential to keep import prices competitive and to shield the economy from supply shocks. The...

By Mint (India) – Economy

Social•Feb 15, 2026

Understanding EPA's Endangerment Finding Rule and Its Future

Making Sense of the EPA Endangerment Finding Rule, by @RogerPielkeJr An excellent description of the rule, the basis for the rule, and the probable future. I appreciate Pielke's work. https://t.co/i2hp5Gjtel

By Meredith Angwin

Social•Feb 15, 2026

U.S. NatGas Spread Widens as Prompt Prices Drop

U.S. natural gas 12-month spread widened $0.10 (10%) on lower prompt price April contract fell $0.13 (4%) from $3.23 to $3.10 week ending February 13 Front-month price decreased $0.18 (5%) from $3.42 to $3.24 #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas #LNG

By Art Berman Blog

Social•Feb 15, 2026

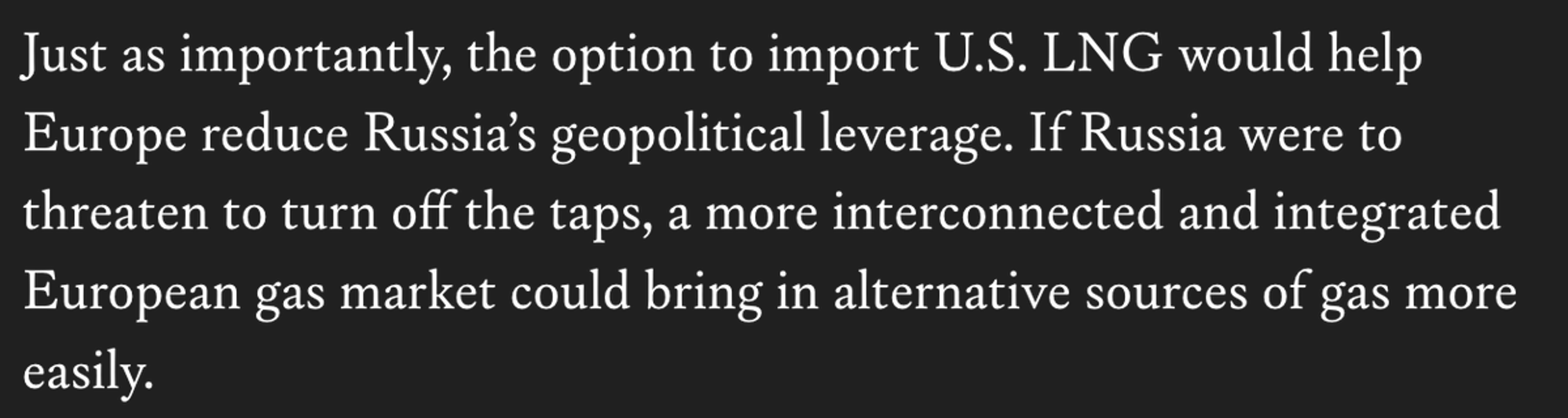

Electrification Boosts EU Energy Security with Local Power

This is why electrification means more energy security: In 2024, ~81% of EU electricity came from locally sourced fuels (57% excluding nuclear). Just 19% relied on imported fossil fuels. Fossil fuels are mostly imported. Source @ember_energy https://t.co/vHX1LedgmM

By Jan Rosenow

Social•Feb 15, 2026

Egypt's Summer Power Surge Drives Record LNG Demand

Egypt expects electricity demand to increase by 7% this summer. That means strong demand for LNG imports. Egypt's LNG demand reached record high last year. 👇👇

By Anas Alhajji

Social•Feb 15, 2026

70 Studies Confirm Hydrogen Boilers Are Economically Unviable

I stopped counting but there are now close to 70 independent studies all coming to similar conclusion: “Hydrogen boilers […] remain economically unviable.” This is what this paper which I had not yet read found comparing a range of heating...

By Jan Rosenow

Social•Feb 15, 2026

Natural Gas Prices Dip, No Rally Expected

The natural gas party is over U.S. natural gas futures price fell $0.18 (5%) from $3.42 to $3.24 week ending February 6 My outlook suggests a modest floor Increase (~$0.25), not a rally forming #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas...

By Art Berman Blog

Social•Feb 15, 2026

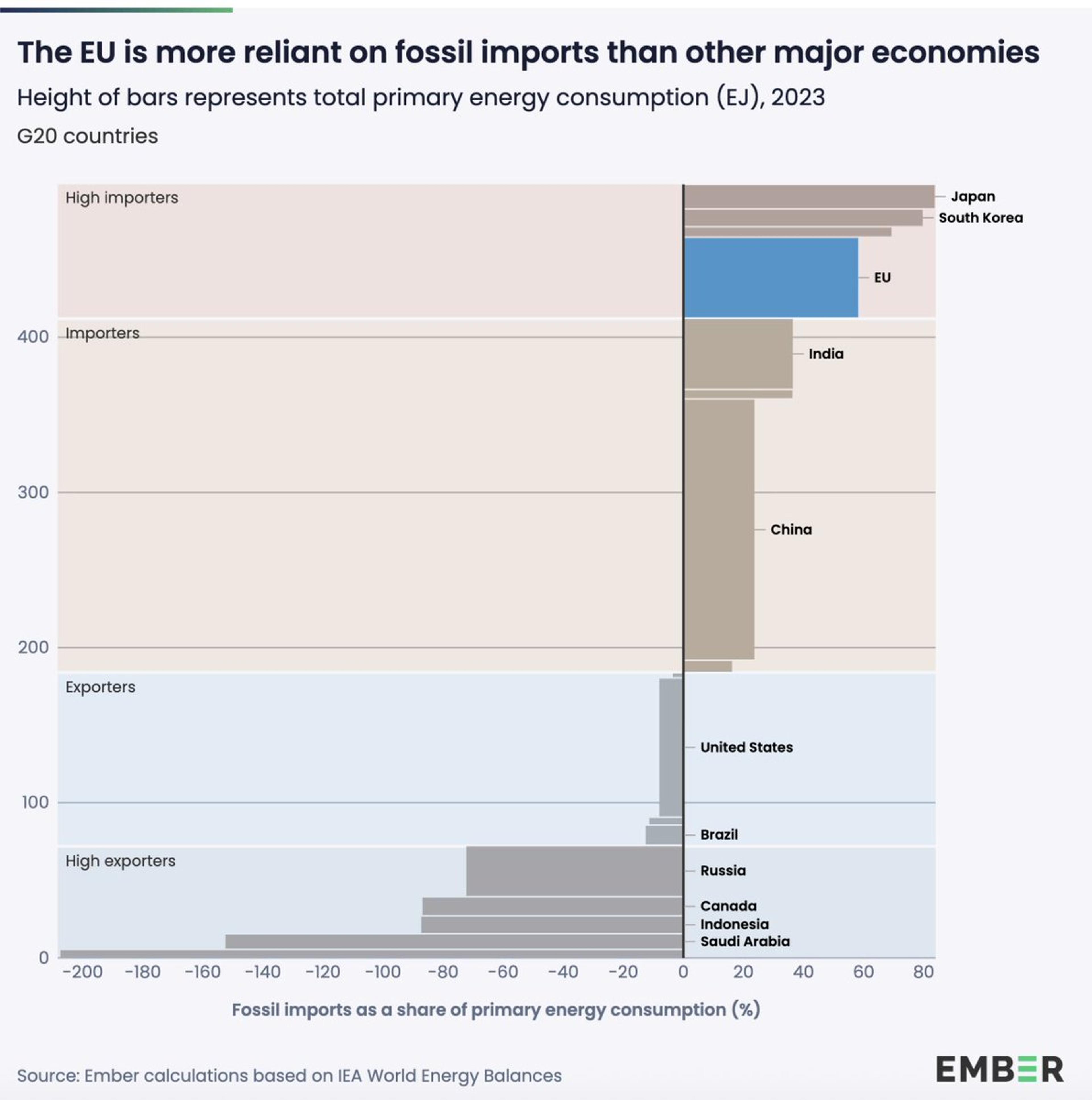

Europe Doubts US LNG Reliability Despite Past Optimism

A decade ago, I wrote an essay @ForeignAffairs about rise of US LNG w subhead "The benign energy superpower." https://t.co/P9r14hfb11 This week @MunSecConf, the Q I got most was whether Europe can trust US LNG to be reliable. And privately, senior...

By Jason Bordoff

Social•Feb 15, 2026

Speculators Turn to Oil for Stability Amid Market Turmoil

Speculative money is leaning back into oil as traders look for stability in a volatile world writes @Ole_S_Hansen Oil is becoming the preferred risk exposure in an otherwise uncertain macro landscape. Relative calm in crude contrasts with violent reversals in precious...

By Art Berman Blog

Social•Feb 15, 2026

Energy Powers AI Leadership and Secure Future

Energy is key to success in AI leadership. Thanks to @MunSecConf for partnering w @ColumbiaUEnergy to host such a diverse set of energy, political, nat’l security & tech leaders to discuss how to meet rising power needs, secure supply chains,...

By Jason Bordoff

Social•Feb 15, 2026

EU's Fossil Imports Hit 58% of Energy Demand.

EU fossil imports met 58% of energy demand in 2023 - near pre-crisis levels - leaving consumers exposed to price shocks. Far above China (24%) & India (37%); only Japan (84%) & S. Korea (80%) rely more on imports. Graph: @ember_energy...

By Jan Rosenow

Social•Feb 15, 2026

U.S. Gas Exports Set to Hit 20 Bcf/D by 2027

Drain America First U.S. natural gas exports rise toward 20 Bcf/d in 2027 #NaturalGas #EnergySecurity #ShaleGas #Permian #EnergyInfrastructure #SupplyConstraints #USGas https://t.co/rmLKJzpmpS

By Art Berman Blog

Social•Feb 15, 2026

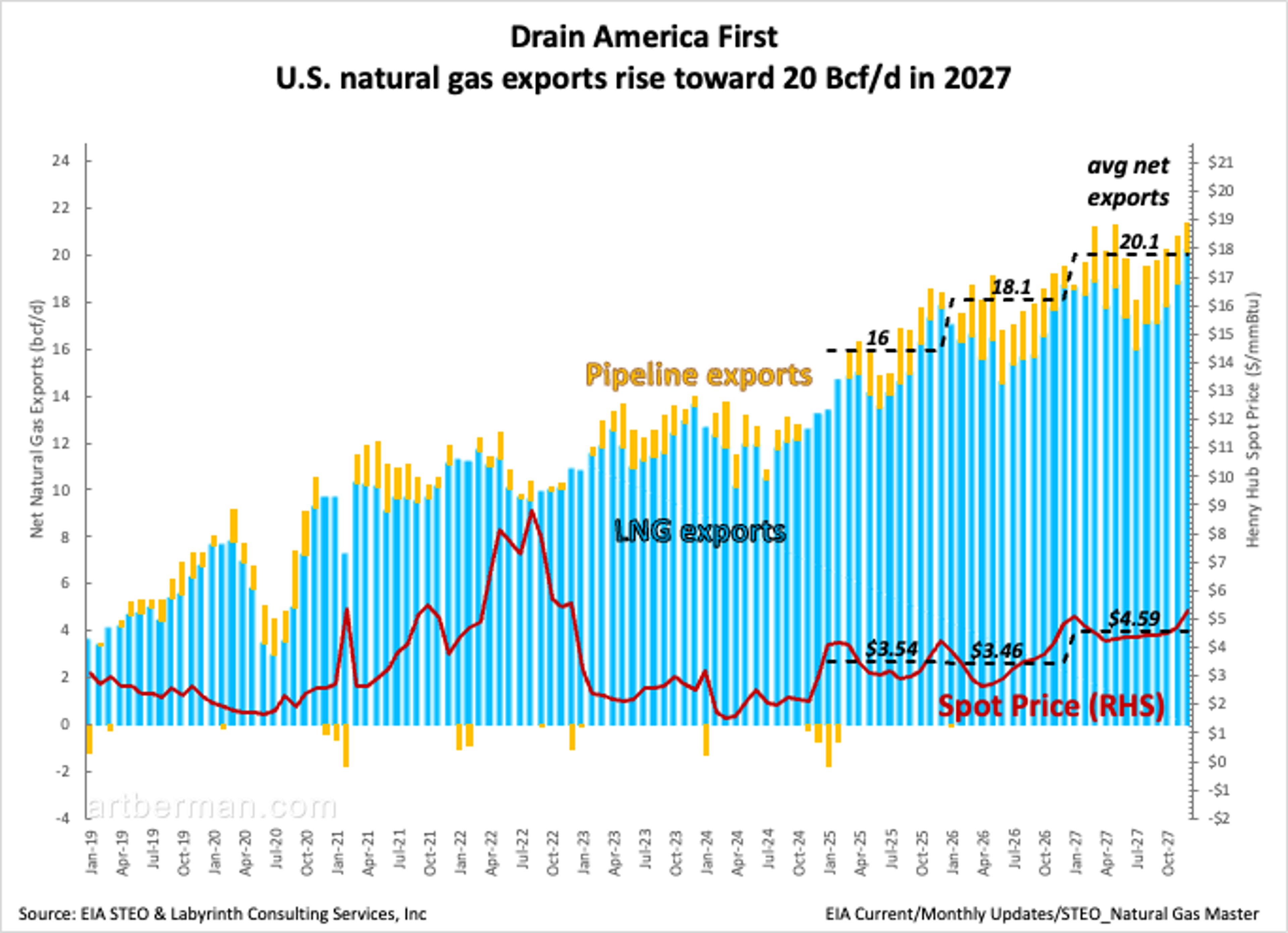

Permian Drives US Gas Growth as Others Stall

U.S. natural gas supply growth Is peaking @yagelski @websterdrake Permian is the only play that's growing Other shale gas plays are flat or declining & conventional gas is in terminal decline #NaturalGas #EnergySecurity #ShaleGas #Permian #EnergyInfrastructure #SupplyConstraints #USGas

By Art Berman Blog

Social•Feb 15, 2026

US Gas Demand Outpaces Infrastructure, Not Supply

Read your chart @yagelski It shows that the US is awash in natural gas DEMAND not supply Pipelines, storage & power-plant hookups lag demand, as they always do. This is an infrastructure problem, not a resource problem. #NaturalGas #EnergyInfrastructure #LNG #PowerMarkets #GridConstraints...

By Art Berman Blog

Social•Feb 15, 2026

Oil Glut Exists Only in Models, Not Markets

The oil “glut” exists in models, not in physical barrels, writes @MeesEnergy Backwardation holds, volatility stays calm, and the barrels everyone talks about don’t show up in stocks. Models say surplus. The market says otherwise. #OilMarkets #OPECplus #Backwardation #EnergySecurity #SupplyRisk #ChinaOil...

By Art Berman Blog

Social•Feb 14, 2026

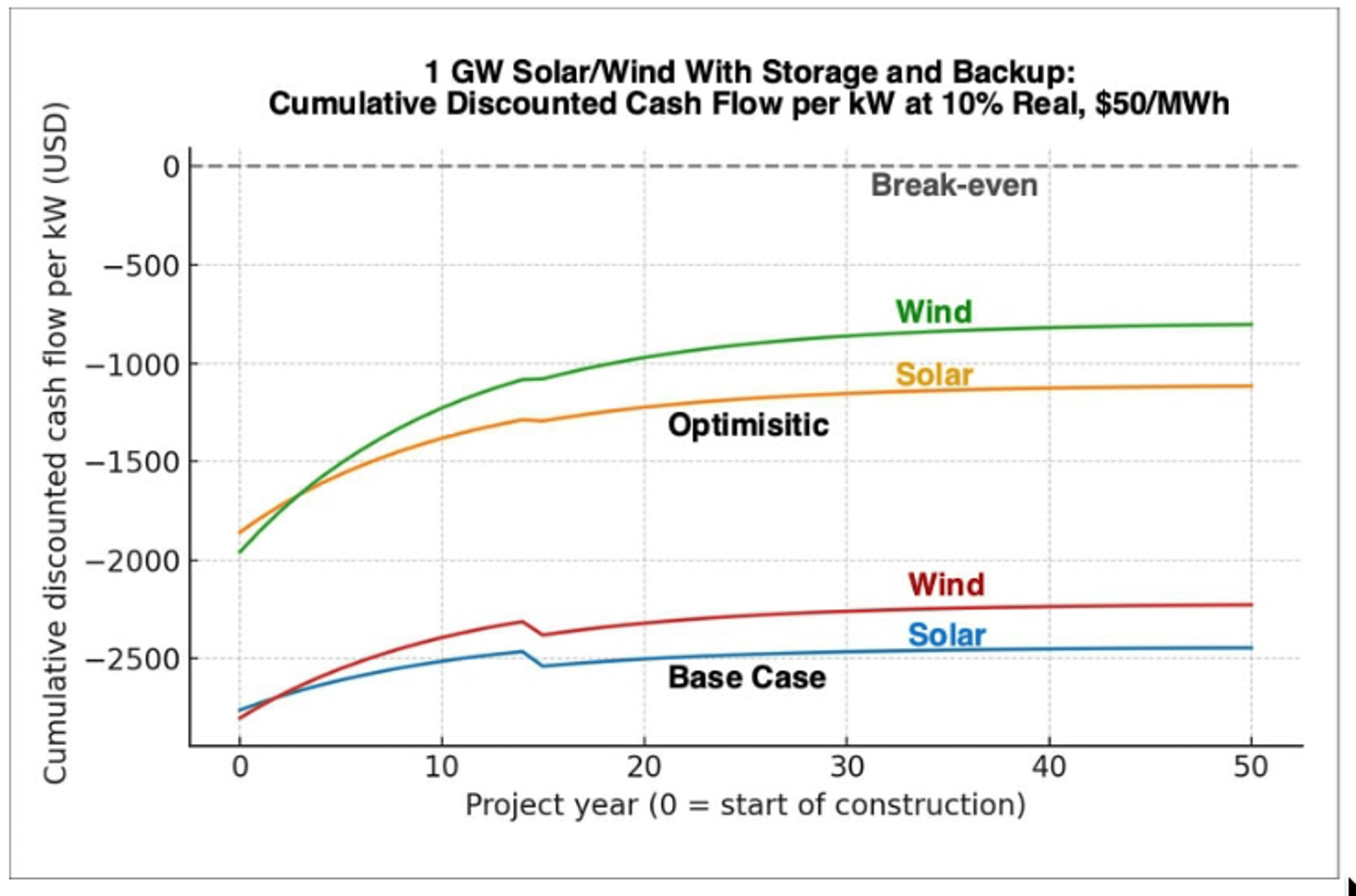

Wind Beats Solar for Reliable 24/7 Power

Solar sucks as a real power source even compared to wind. Wind is intermittent but at least blows some almost 24/7 so if you overbuild enough and add a lot of storage you get something resembling capacity. Solar disappears 1/2 the time...

By Alex Epstein

Social•Feb 14, 2026

Tesla Robotaxi Likely by 2026, Timeline Remains Uncertain

Tesla will get to a working robotaxi eventually, but it's difficult to say when. My 50th percentile is end of 2026, but the variance is high. It could be in a few months. It could be a few years. We'd...

By Ramez Naam

Social•Feb 14, 2026

China and US Slowdown Drag Global EV Sales

Global EV sales hampered by China, US slowdown in January "Global EV registrations, a proxy for sales, fell by 3% year-on-year to almost 1.2 million units in January, according to the data, which includes battery-electric and plug-in hybrid cars. They were down...

By Anas Alhajji

Social•Feb 14, 2026

Energy Now Core to Geopolitical Competition

Wrapping up a packed day @MunSecConf discussing how central energy now is to geopolitical competition—from AI & critical minerals to supply chain & infrastructure security, gas geopolitics, European competitiveness, and climate risk. Energy wasn’t peripheral this year—it was core https://t.co/IccslVsucN

By Jason Bordoff

Social•Feb 14, 2026

NGP's Analysis and Design Assets May Be Monetized First

This. Plus they also have an asset in all of the NGP project analysis, engineering, and design. They might well choose to monetize that asset rather than (or prior to) building the pipeline.

By Andrew Leach

Social•Feb 14, 2026

Rising Crude-on-Water Could Prevent Oil Price Collapse

Roses are red, violets are blue. You can avoid a price collapse despite an oil glut if crude on water's rising, too. 💘 Happy Valentine's Day, oil watchers.

By Rory Johnston

Social•Feb 14, 2026

US Ramps up Pressure, Threatens Chinese Oil Imports

Maximum Pressure 2: More max, more pressure, another round of threatening Chinese sanctioned oil imports. https://t.co/UNNBJOFLTx

By Rory Johnston

Social•Feb 14, 2026

Wind and Solar Never Reach Cost Break‑even, Says Chart

Your reply is incoherent @RogerESowell TRUE. This chart shows that wind and solar never break even. Show data to support a contrary view or STFU. https://t.co/7Yn3h6sVvg

By Art Berman Blog

Social•Feb 14, 2026

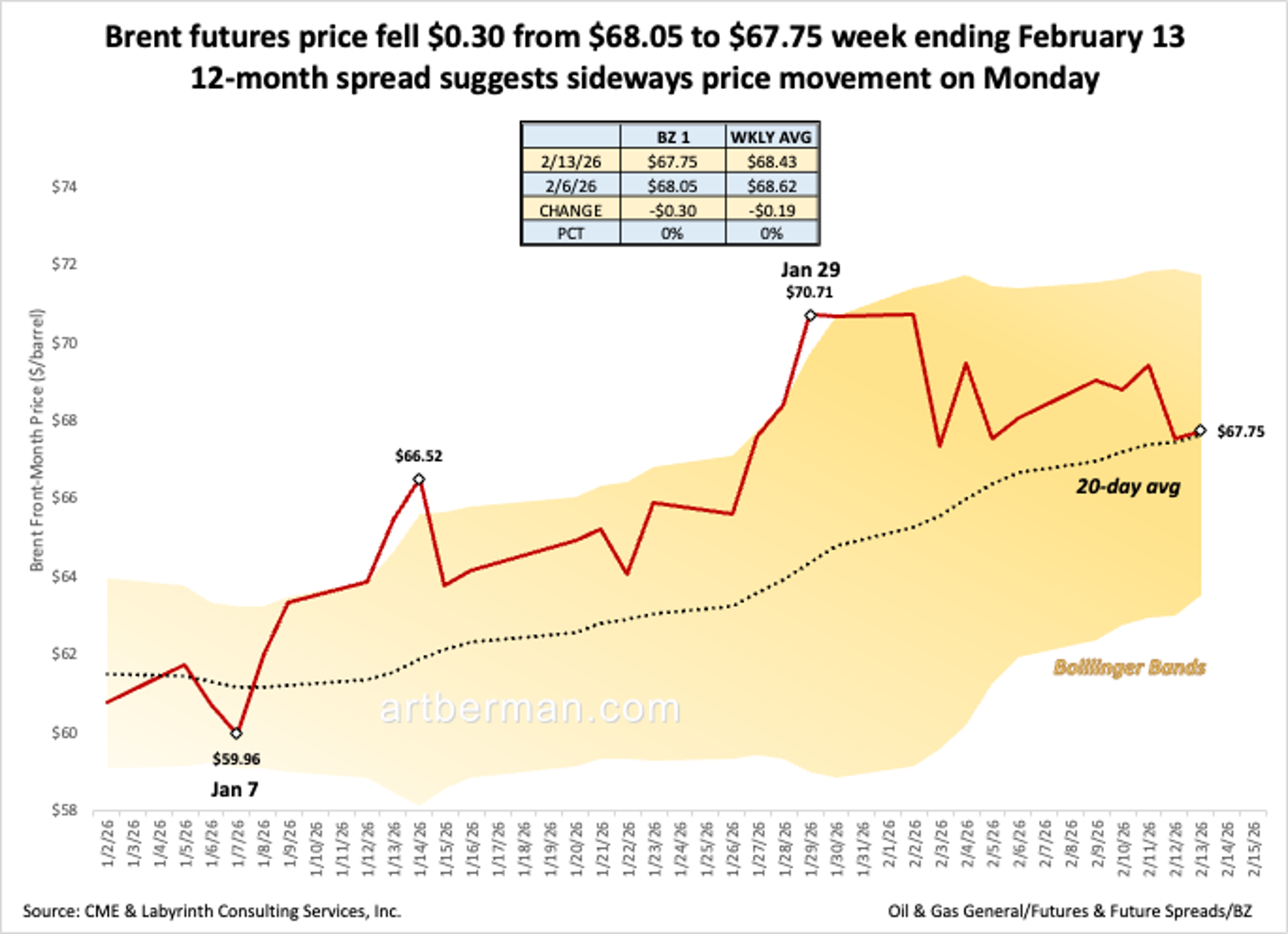

Brent Dips 30 Cents; 12‑month Spread Signals Flat Outlook

Brent futures price fell $0.30 from $68.05 to $67.75 week ending February 13 12-month spread suggests sideways price movement on Monday #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket https://t.co/hYd0O6d84E

By Art Berman Blog

Social•Feb 14, 2026

Globally, Half Solar Comes From Rooftops; US Lags

Lots of conservation organizations want the US to balance rooftop with large scale. Most other countries in the world are closer to 50% rooftop/parking lot solar.

By Jigar Shah

Social•Feb 14, 2026

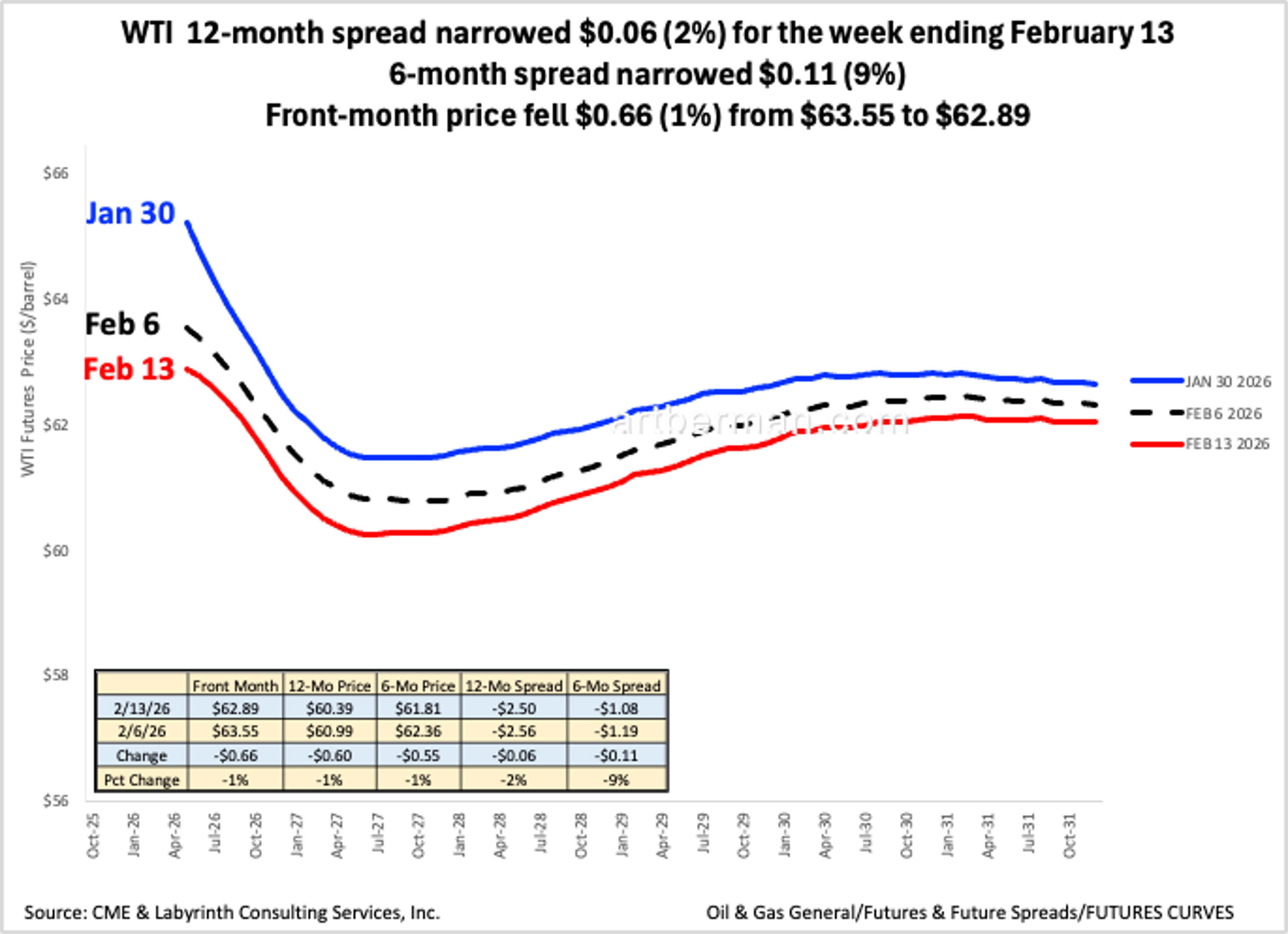

WTI Spreads Tighten as Front-Month Price Slips

Show me the glut WTI 12-month spread narrowed $0.06 (2%) for the week ending February 13 6-month spread narrowed $0.11 (9%) Front-month price fell $0.66 (1%) from $63.55 to $62.89 #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket https://t.co/1VHaA5PFZN

By Art Berman Blog

Social•Feb 14, 2026

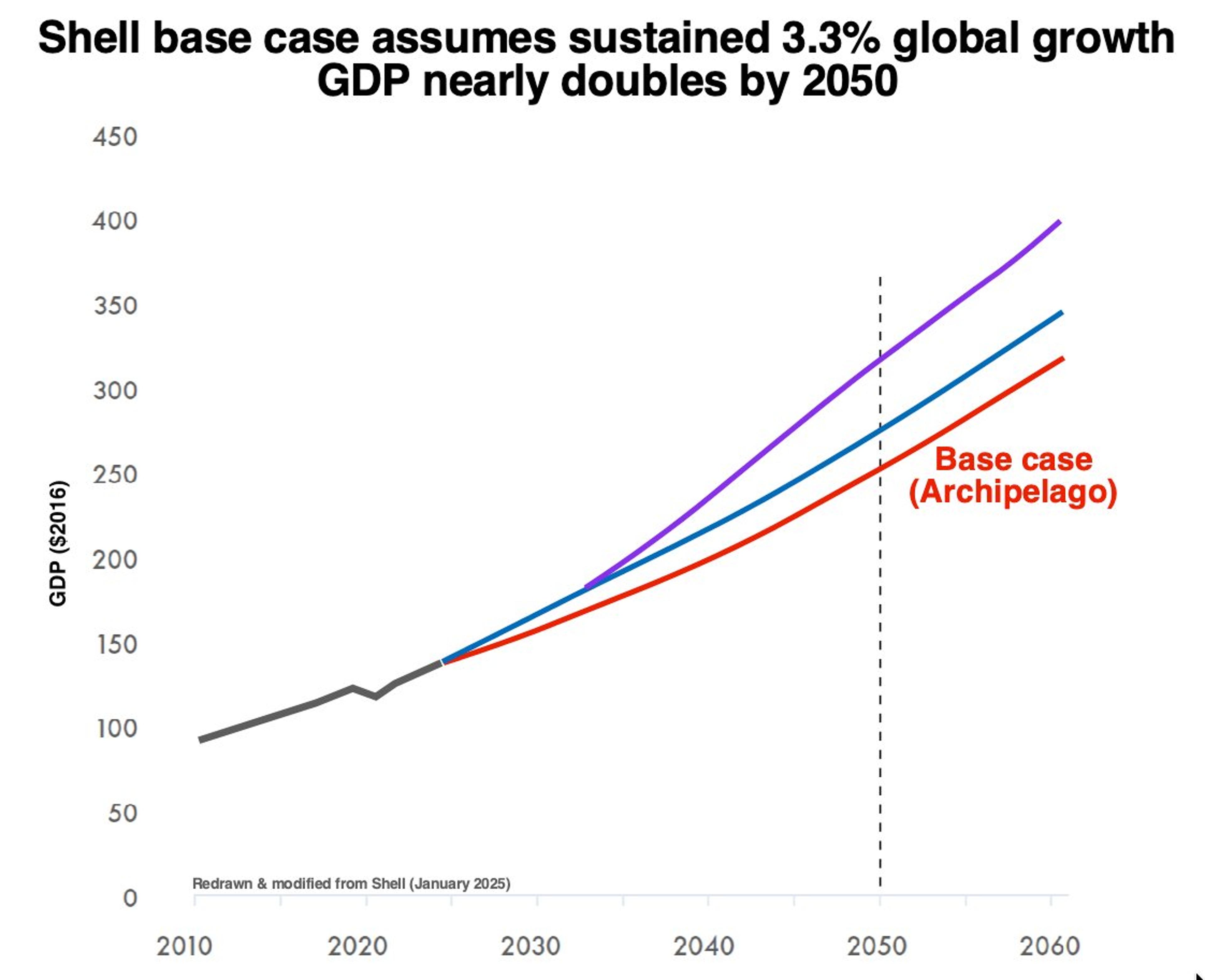

Shell Forecasts Global GDP to Double by 2050

Shell base case assumes sustained 3.3% global growth GDP nearly doubles by 2050 #GlobalGDP #EconomicGrowth #EnergyScenarios #Shell #Macroeconomics #GrowthAssumptions #LongTermForecasts https://t.co/meXF1PuaVe

By Art Berman Blog

Social•Feb 14, 2026

Europe Must Ditch Fossil Fuels to Protect Its Industry

"Reducing reliance on fossil fuels looks like Europe’s best shot at saving its domestic manufacturing and stopping other governments from pushing it around." Outstanding article in The Wall Street Journal. https://t.co/XbYr95c2nK https://t.co/rUtmRPTUST

By Jan Rosenow

Social•Feb 14, 2026

Solar Power Needs Fossil‑fuel Tech, Remains Uneconomic

The sun’s radiation that reaches earth is useless as an energy source without technology to convert it to work @Tinyweenybear The technology requires materials to work that all need fossil fuels. Grid scale solar is uneconomic & not fit for 24/7...

By Art Berman Blog

Social•Feb 14, 2026

Strengthening Critical Mineral Supply Chains Amid Geopolitical Fragmentation

Thanks @bmwfoundation for partnering w @ColumbiaUEnergy on such a substantive & productive session @MunSecConf on how to enhance critical mineral & energy supply chain security amid fragmenting geopolitics. Great insights from DOE’s @AlexFitzDC, @dan_brouillette & so many others. https://t.co/D1xRKHu7gO

By Jason Bordoff

Social•Feb 14, 2026

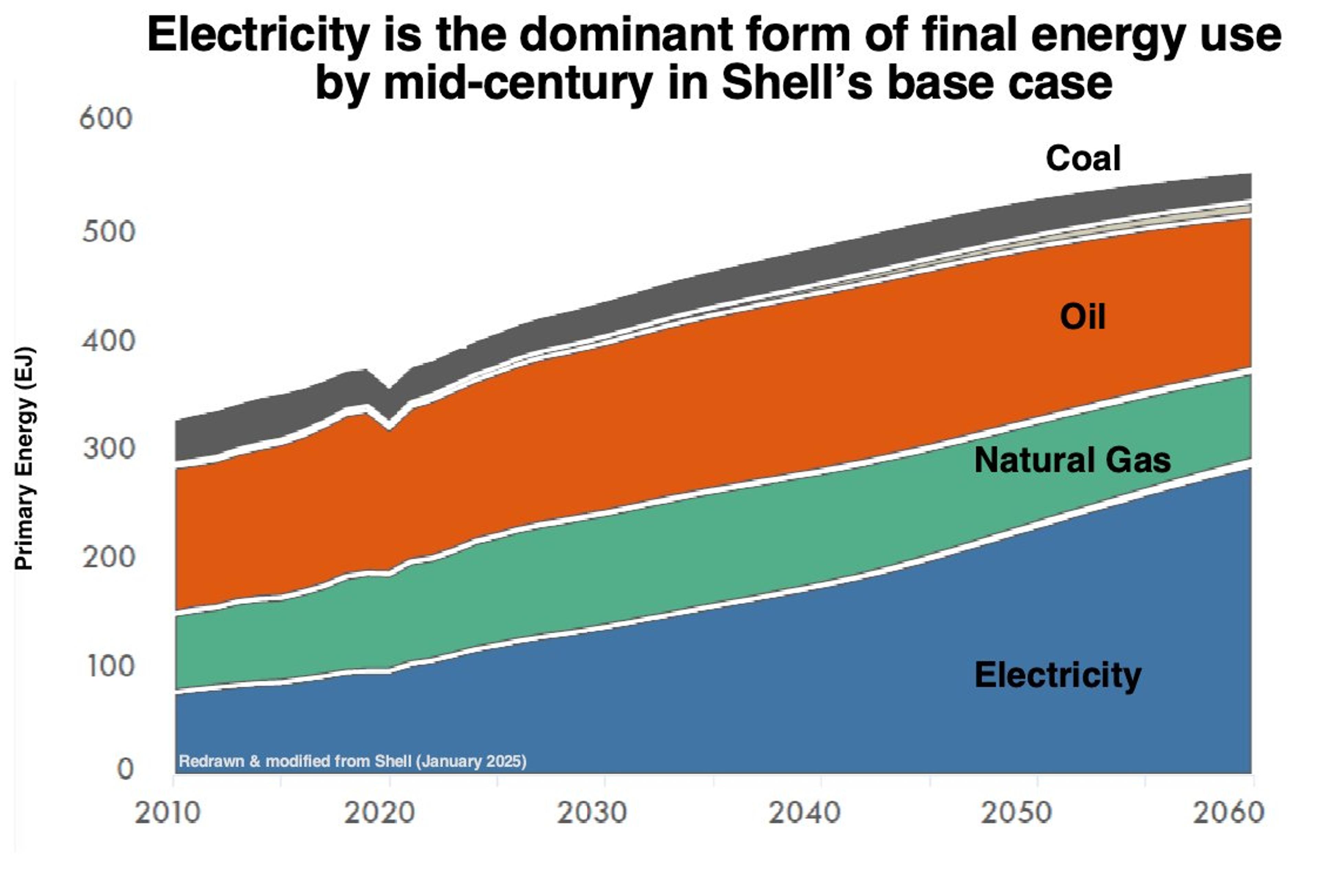

Electricity to Dominate Energy, Shell Downplays Obstacles

Electricity Exceeds 50% of Final Energy Use by Mid-Century Shell is good about listing the obstacles to its preposterous assumptions And then finding reasons to ignore them @zeroinputag #Electricity #EnergyTransition #EnergySystems #GridConstraints #EnergyReality #MidCentury #Decarbonization

By Art Berman Blog

Social•Feb 14, 2026

Canada’s $16.5B Carbon Capture Bet Faces Market Skepticism

Canada calls it “future-proofing.” Markets may call it wishful thinking. $16.5B on carbon capture with long timelines, big execution risk, and shifting global politics Take that bet to a Las Vegas oddsmaker. https://t.co/hU4uGD0r4d #CarbonCapture #EnergyPolicy #Canada #OilSands #EnergySecurity #StrandedAssets #CapitalRisk

By Art Berman Blog

Social•Feb 14, 2026

Enbridge Skips New Pipeline, Heeds Past Capital Losses

Enbridge won’t risk billions on a new Canadian oil pipeline Politics can change faster than steel gets laid. Capital remembers Northern Gateway The project was killed after hundreds of millions were sunk. https://t.co/Fd4PKMdjB5 #EnergyInfrastructure #Canada #Pipelines #RegulatoryRisk #EnergySecurity #CapitalDiscipline

By Art Berman Blog

Social•Feb 14, 2026

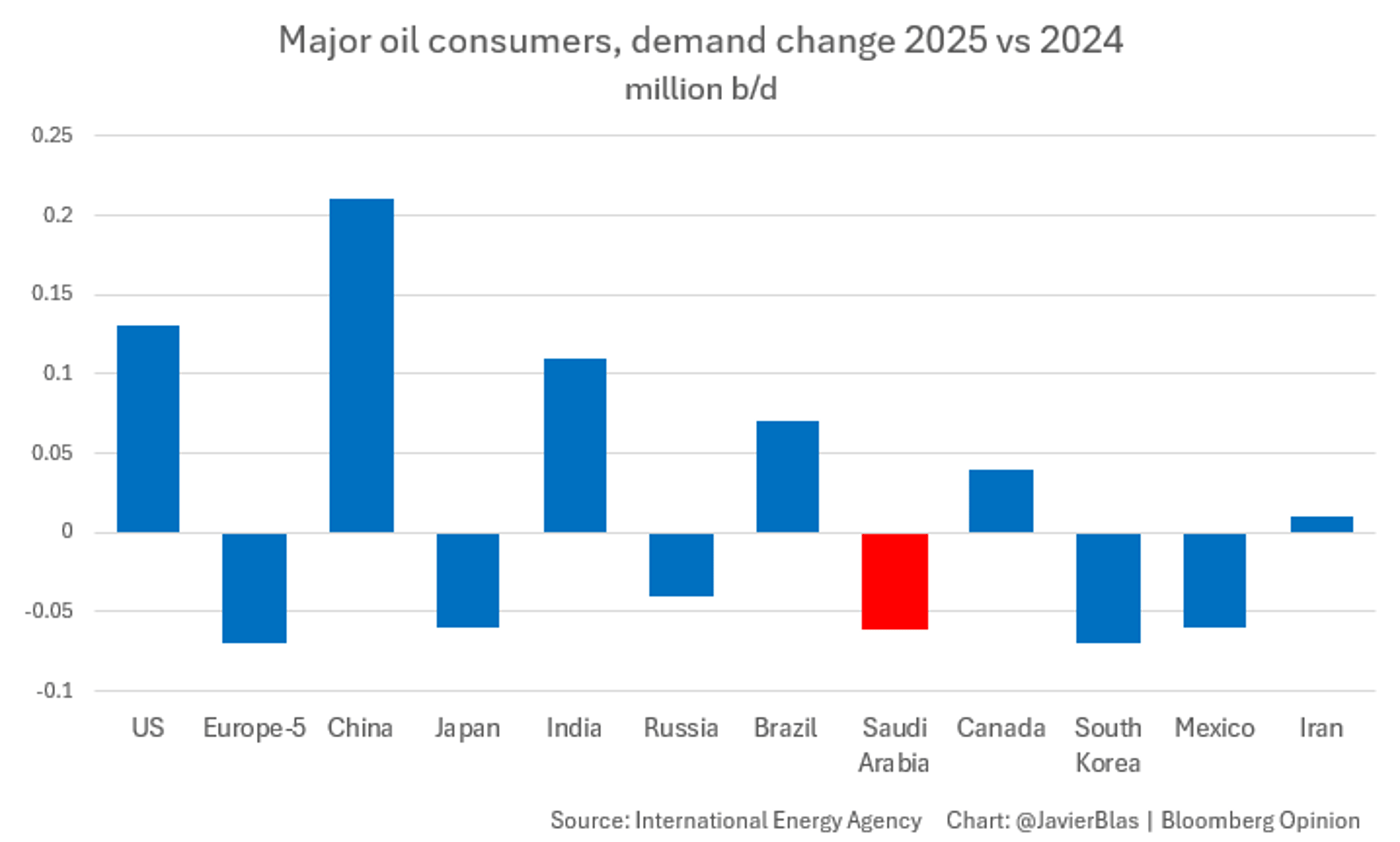

Saudi Arabia’s Oil Demand Plummets as Gas Powers Electricity

CHART OF THE DAY: Among the world's top oil consumers, a curious trend. The 2nd largest consumption drop last year ocurred in Saudi Arabia, where demand fell ~60,000 b/d (only South Korea saw a larger drop). The reason? Gas is...

By Javier Blas

Social•Feb 14, 2026

Pemex's Bond Return Shows State Risk, Not Confidence

Pemex is back in the bond market after six years — and demand was strong. This doesn't signal confidence in Pemex. Buyers are really underwriting the Mexican state. https://t.co/YRGXmzi4aW #Pemex #Mexico #OilMarkets #EnergySecurity #SovereignRisk #DebtMarkets #EmergingMarkets

By Art Berman Blog

Social•Feb 14, 2026

China's Cheap Middle East Oil Squeezes West African Sellers

China is pulling more cheap oil from the Middle East. That leaves W. African oil struggling to find buyers until it gets cheap enough to move again, writes @JuneGoh_Sparta In this tight market, the Middle East has the upper hand. Sorry oil...

By Art Berman Blog

Social•Feb 14, 2026

Shell’s Electric Utopia Meets Skeptical Reality

Shell imagines a future in which electricity is the dominant component of global energy. I assume that it is training elephants to fly. https://t.co/rAoZ1exs8H #EnergySecurity #Electrification #SystemicRisk #Geopolitics #EnergyReality #Infrastructure #CapitalConstraints #EnergyTransition #CriticalMaterials #GridLimits

By Art Berman Blog

Social•Feb 14, 2026

OPEC+ Plans April Production Hikes Amid Sanctions

OPEC+ may restart April hikes to catch peak summer and regain share as sanctions bite Russia/Iran. https://t.co/cILwlUi7h2 #OPECplus #Oil #IEA #SaudiArabia #UAE #Iran #Russia

By Art Berman Blog

Social•Feb 14, 2026

Enbridge Rejects West Coast Bitumen Pipeline Over Jurisdiction Risks

Enbridge a no on appetite to build proposed bitumen pipeline to Canada’s west coast “I don’t think investors or the infrastructure companies should be taking on the risk of development in jurisdictions that have historically created a challenge” Still some N Gateway...

By Rory Johnston

Social•Feb 13, 2026

No Bullish Catalyst for Oil in 2026, Repeat Likely

🚦From a pure fundamentals perspective, there's simply no bullish driver in sight capable of pushing oil prices into the high $70s—or higher—in 2026. ⚽️Betting your capital on a major war with Iran or any similar geopolitical shock to spike prices isn't...

By Anas Alhajji

Social•Feb 13, 2026

Evolving Energy Security Toolkit Amid Fragmented Order, EU‑US Distrust

Energy security is high on the @MunSecConf agenda. I’ve been discussing how the toolkit to deliver it must evolve—amid a fragmenting global order, the need to accelerate the clean transition, and a far deeper level of European distrust toward the...

By Jason Bordoff