🎯Today's Finance Pulse

Updated 5m agoWhat's happening: ESMA fines trade repository REGIS‑TR €1.374 million for EMIR and SFTR breaches

The European Securities and Markets Authority imposed a €1.374 million penalty on REGIS‑TR after finding seven violations of the European Market Infrastructure Regulation and the Securities Financing Transactions Regulation. This is the first enforcement action involving SFTR breaches and the largest fine ever levied on a trade repository. ESMA said the sanctions underscore its commitment to market integrity.

Also developing:

News•Feb 20, 2026

CFIB Survey: Tax Burden Tops Small Business Concerns in Canada as Retailers Cite Costs, Regulation and Crime

The Canadian Federation of Independent Business (CFIB) released its latest Members Opinion Survey, revealing that 72% of small and medium‑sized enterprises cite tax burden as their top concern. Regulation and labour shortages follow closely, each affecting roughly half of respondents, while retailers additionally flag crime and safety issues. The survey, conducted quarterly with about 7,500 participants, shows tax worries have persisted for over 25 years, rebounding toward a long‑term average of 78%. New challenges such as trade obstacles and public‑safety threats are now entering the priority list.

By Retail Insider Canada

Social•Feb 20, 2026

Most Weekly BDC Discounts Are Mispriced—Learn Why

Everyone has a BDC take this week. Most of them are wrong. If you don't understand how they trade, what drives the discount, or why NAV isn't what you think it is, start here. https://www.junkbondinvestor.com/p/the-bdc-primer-part-1

By JunkBondInvestor

Social•Feb 20, 2026

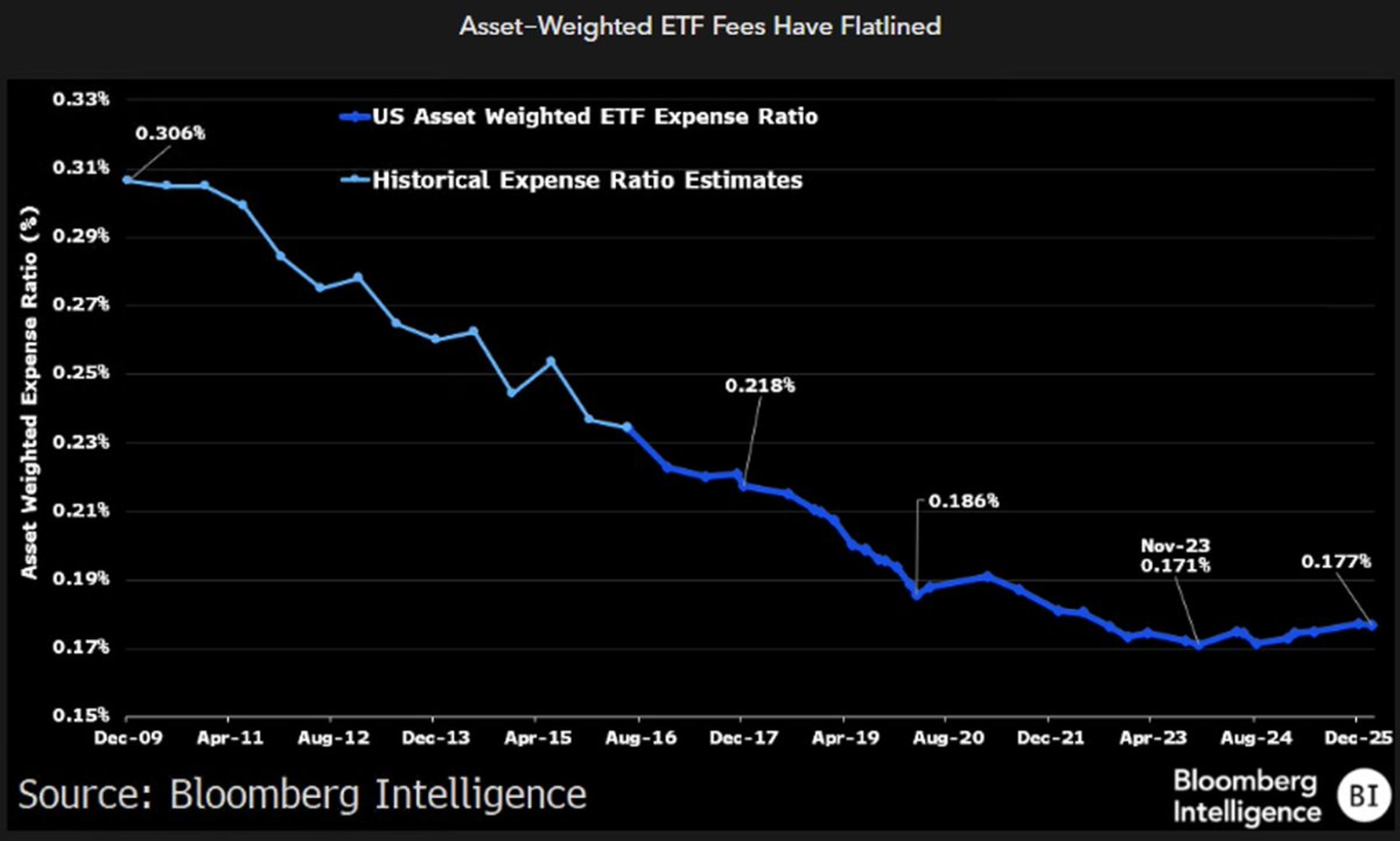

ETF Fees Halt Decline as Higher‑cost Products Gain Traction

The race to zero has hit a wall as the asset weighted average ETF fee has finally stopped its descent and even reversed a bit (this chart is one of the scariest, albeit slow moving ones for Wall St, equiv...

By Eric Balchunas

News•Feb 20, 2026

Reach for the Stars to Boost Britain's Space Industry

Orbex, a UK‑based rocket developer once valued at $220 million, entered administration after the government withdrew a planned funding round despite earlier £26 million support. The collapse underscores the repeated failure of state‑led investment in Britain’s nascent space sector. Meanwhile, the global...

By MoneyWeek – All

News•Feb 20, 2026

Can US Small Caps Survive the Software Selloff?

US software megacaps have slumped roughly 30% this year, dragging the S&P 500 to a modest 0.5% gain, while the MSCI ACWI ex‑USA rose 9.1%. By contrast, the S&P 600 small‑cap index posted a 7.9% rise, narrowing the performance gap with global...

By MoneyWeek – All

News•Feb 20, 2026

Build vs Buy: Why Pricing Strategy Choices Matter More in 2026

The article argues that the classic build‑vs‑buy debate in pricing modernization has shifted from technical feasibility to strategic resource allocation. Cloud platforms and open‑source tools now let banks prototype pricing engines in months, but maintaining custom systems diverts scarce engineering...

By Fintech Global

News•Feb 20, 2026

E Vehicle Infrastructure Financing for High Growth

Vietnam aims to host one million electric vehicles by 2030, rising to 3.5 million by 2040, creating a clear need for 100,000‑350,000 public chargers. The paper argues that a shift from a single‑operator, brand‑specific network to an open, interoperable ecosystem will...

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

Japanese Market 'More Dynamic' Than London, Says Apollo CEO

Apollo Global Management’s CEO Marc Rowan told Nikkei that Japan’s corporate finance market is becoming more dynamic than London’s, prompting Apollo to expand its private‑credit platform in the country. He highlighted the need for long‑dated funding to support infrastructure, energy...

By Nikkei Asia – Economy

News•Feb 20, 2026

All Global Experiences Useful for Vietnam S International Financial Hub

Vietnam aims to build an international financial centre by drawing on global precedents such as Dubai’s DIFC, China’s Shenzhen and Hangzhou, and Kazakhstan’s AIFC. Experts stress that independent, long‑term regulation, niche specialization in digital and green finance, and adaptive legal...

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

Africa Needs Patient Capital for the Long Term

Africa’s growth potential is hampered by a $350 billion SME financing gap and annual infrastructure needs of $130‑170 billion, far exceeding current investment. While the continent’s population tops 1.5 billion and GDP surpasses $3 trillion, capital flows remain fragmented and short‑term. The article argues...

By African Business

News•Feb 20, 2026

Google Bigger than India GDP? Sanjeev Bikhchandani Exposes the Flaw in that Viral Claim

A viral post claimed Google’s $4 trillion market capitalisation exceeds India’s GDP, prompting entrepreneur Sanjeev Bikhchandani to debunk the analogy. He explained that market cap is a stock measure reflecting investor expectations, while GDP is a flow metric tracking annual economic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

US Market | Credit Concerns Mount: Blue Owl Shake-Up Weighs on US Financial Stocks

Blue Owl Capital announced the sale of $1.4 billion of assets across three credit funds and permanently halted redemptions in one fund to return capital and reduce leverage. The announcement triggered a broad sell‑off in listed alternative‑asset managers such as Apollo,...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Indonesian Tycoon Mochtar Riady’s OUE REIT Seeks Buyers For Prime Singapore CBD Tower

OUE Commercial REIT, controlled by Indonesian tycoon Mochtar Riady, is seeking buyers for its flagship One Raffles Place tower in Singapore’s CBD. The sale, handled by CBRE and JLL, targets a reserve price of up to S$2.4 billion, roughly 24% above...

By Forbes – Business

News•Feb 20, 2026

Xerox Holdings Corporation Declares Dividend on Common and Preferred Stock

Xerox Holdings Corp. announced its board declared a quarterly cash dividend of $0.025 per common share, payable April 30, 2026 to shareholders of record March 31, 2026. The company also set a $20 per share quarterly dividend on its Series A...

By Business Wire — Executive Appointments

News•Feb 20, 2026

REIT Fears Could Give Way to Opportunity with This ETF

Commercial real‑estate REITs have recently slumped amid AI‑related worries, but the dip may create a buying window for investors. The NEOS Real Estate High Income ETF (IYRI) stands out with an almost 11% distribution rate and a 3.15% 30‑day SEC...

By ETF Trends (VettaFi)

News•Feb 20, 2026

Can MAS Financial Sustain Its Outperformance on Strong Growth Momentum?

MAS Financial Services (MFSL) posted double‑digit year‑on‑year growth in assets under management, revenue and net profit for the December 2025 quarter and the first nine months of FY 26, driving its stock up 9% versus the BSE Financial Services index. The...

By Economic Times — Markets

News•Feb 19, 2026

TIP Solar Raises $179.7 Million in ABS From Residential Solar, PPA Leases

TIP Solar, backed by GoodLeap’s residential solar leases and PPAs, has issued $179.7 million in asset‑backed securities. The ABS are collateralized by 7,812 leases held by Jaguar Solar Owner 2026‑1 and structured into A‑ and B‑tranches with anticipated repayments through March 2033 and...

By Asset Securitization Report

News•Feb 19, 2026

Booking Holdings Announces a Massive 25-for-1 Stock Split. Here's What Investors Need to Know

Booking Holdings announced its first-ever forward stock split, converting each share into 25 shares. The 25‑for‑1 split will take effect on April 6, 2026, after distribution on April 2, with shares trading on a split‑adjusted basis. The move follows a...

By Motley Fool Investing

Blog•Feb 19, 2026

4 Vital Steps to Become an M&A Analyst

The guide breaks down how recent graduates can land a coveted M&A analyst role, outlining core responsibilities such as valuations, research, and memorandum preparation. It details the educational background most banks prefer, from finance and economics to engineering, and recommends...

By DealRoom – Blog

Social•Feb 19, 2026

Buybacks Drop as Capex Takes Priority, ESO Dilution Fades

There are two reasons why buybacks are falling and likely to fall more 1. CApex as a use of FCF is deemed more important than share count reduction or SBC dilution offset 2. To the extent stocks fade the ESO awards provided...

By Andy Constan

Blog•Feb 19, 2026

New SPAC: NewHold Investment Corp. IV (NHIVU) Files for $175M IPO

NewHold Investment Corp. IV (NHIVU) has filed a Form S‑1 to raise $175 million through an initial public offering, positioning itself as the latest special purpose acquisition company targeting a merger within the technology sector. The filing, submitted on Feb 19 2026, lists...

By SPACInsider

News•Feb 19, 2026

Canadian Large Cap Leaders Split Corp. Declares Distribution

Canadian Large Cap Leaders Split Corp. announced a cash distribution of $0.18 per Class A share, payable on March 13, 2026 to shareholders of record as of February 27, 2026. The company also offers a commission‑free Distribution Reinvestment Plan (DRIP) that lets Class A investors automatically...

By The Manila Times Business

News•Feb 19, 2026

Roper Technologies Announces Dividend

Roper Technologies’ board approved a quarterly dividend of $0.91 per share, payable on April 22, 2026 to shareholders of record as of April 6, 2026. The announcement underscores the company’s ongoing commitment to returning excess cash to investors. Roper, a...

By The Manila Times Business

Blog•Feb 19, 2026

M&A Trends: Outlook for Healthcare, Tech, Banking, & More

Mergers and acquisitions in 2026 are being reshaped by several converging forces. Artificial intelligence is streamlining due‑diligence, while ESG considerations are increasingly factored into valuations and integration plans. Cross‑border activity is surging, especially in Asia‑Pacific, and private‑equity firms are expanding...

By DealRoom – Blog

News•Feb 19, 2026

Private Equity Deals Hit $2.6T in 2025

Private equity deal value surged to $2.6 trillion in 2025, a 19% increase over 2024 and the second‑largest total on record. The total number of deals fell 9%, continuing a post‑2021 decline in transaction volume. Holding periods have stretched, with the...

By CFO.com

News•Feb 19, 2026

Protos Security CFO on the Convergence of Finance and Operations

Anthony Escamilla, CFO of Protos Security, says the modern CFO has morphed from a budget keeper into a strategic leader who oversees finance, data analytics, technology, risk and even operational functions. He highlights the accelerating pace of decision‑making, with stakeholders...

By CFO.com

Social•Feb 19, 2026

Bipartisan Push for 3% GDP Deficit Cap Gains Momentum

I Love and Endorse the Bipartisan 3 % of GDP Budget Deficit Solution In the House of Representatives there is now a bipartisan bill in the works to enact, and a growing agreement that we need, a 3% cap on the budget...

By Ray Dalio

Social•Feb 19, 2026

Fuel Subsidy Masks Real Service Cost Surge

1.6% is a statistical illusion for the urban middle class While headline inflation is stable, the "unprotected" service sector is aggressive: Personal Care & Misc. → 6.6% Education → 3.2% Cause→Effect: Subsidized fuel (-0.7%) masks the reality of rising service labor costs. If you...

By David Chuah

News•Feb 18, 2026

Wyndham Takes $160 Million Hit After European Franchisee Files for Insolvency

Wyndham Hotels disclosed a $160 million charge after its largest European franchisee, Revo Hospitality Group, entered self‑administration in January. The charge covers uncollectible receivables, asset impairments and a write‑down of the Vienna House trademark acquired in 2022. Despite the setback, the...

By Skift – Technology

Social•Feb 19, 2026

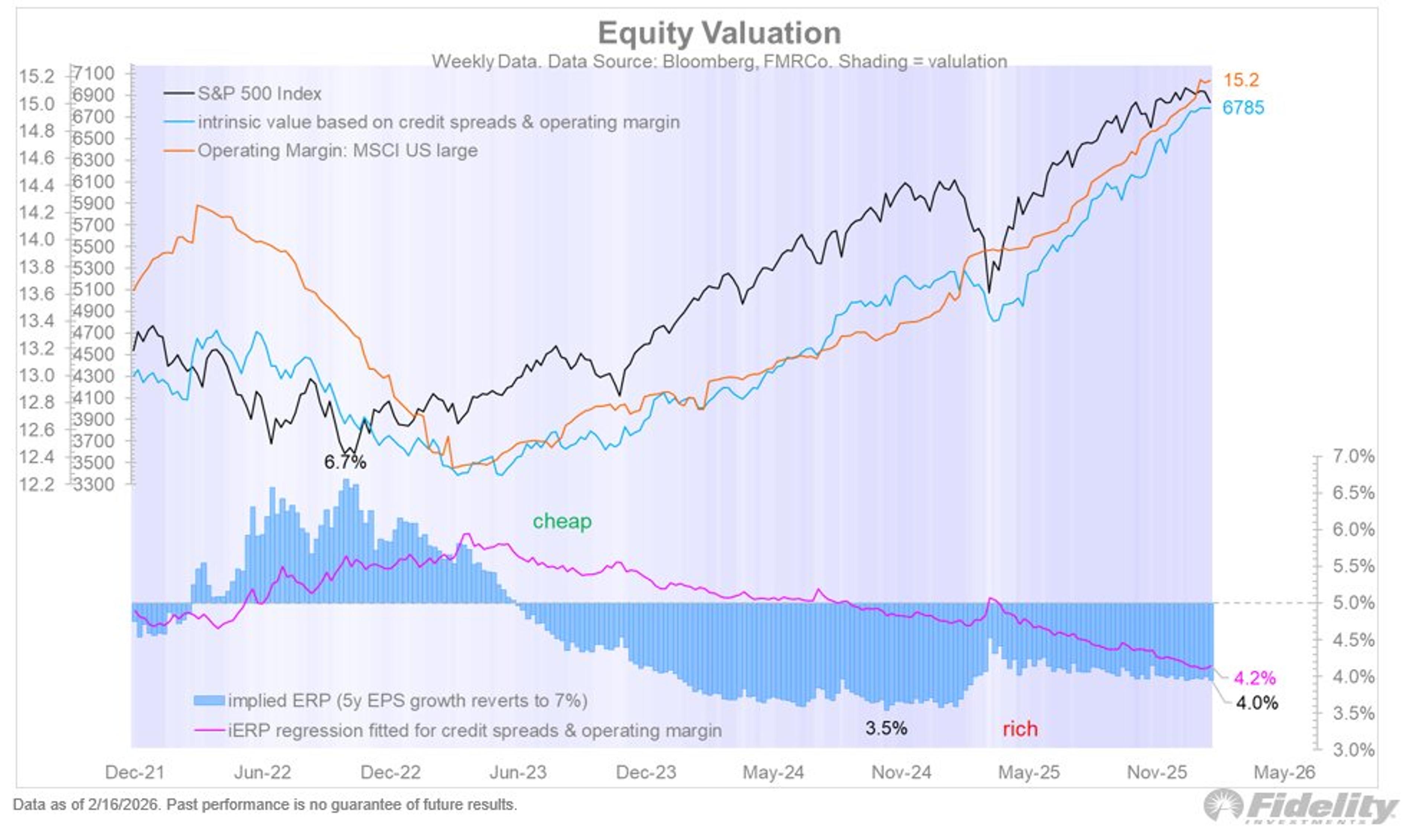

Rising Capex May Curb Buybacks, Pressure Valuations

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

Social•Feb 19, 2026

Japan Deep‑Value Activism: Why Now Is the Time

It was great to join @alxlowen and Dale Gillham of @Wealthwithin in the studio in Melbourne recently to discuss Senjin Capital’s Japan-focused deep value shareholder activist investment strategy for the The ALx Report and Talking Wealth. Dale brings a wealth...

By Jamie Halse

News•Feb 18, 2026

AI Connected to Slightly More Hiring, but Growth Favors Older Workers with Less Exposure

Payroll data from Gusto shows that small businesses that increase AI‑exposed work see modest revenue gains and a slight rise in hiring. For every 10‑point boost in AI exposure, monthly revenue climbs about 2.2% after six months, while headcount grows...

By Accounting Today

Social•Feb 19, 2026

Discussing 2026 Credit Outlook, Including Private Credit

I will be joining @CNBC's @michaelsantoli this afternoon at 430p ET for a discussion of the credit markets--including, yes, private credit. Snip from our Outlook 2026. https://t.co/u8NP4oAYoL https://t.co/umYLiLDzTY

By Guy LeBas

Social•Feb 19, 2026

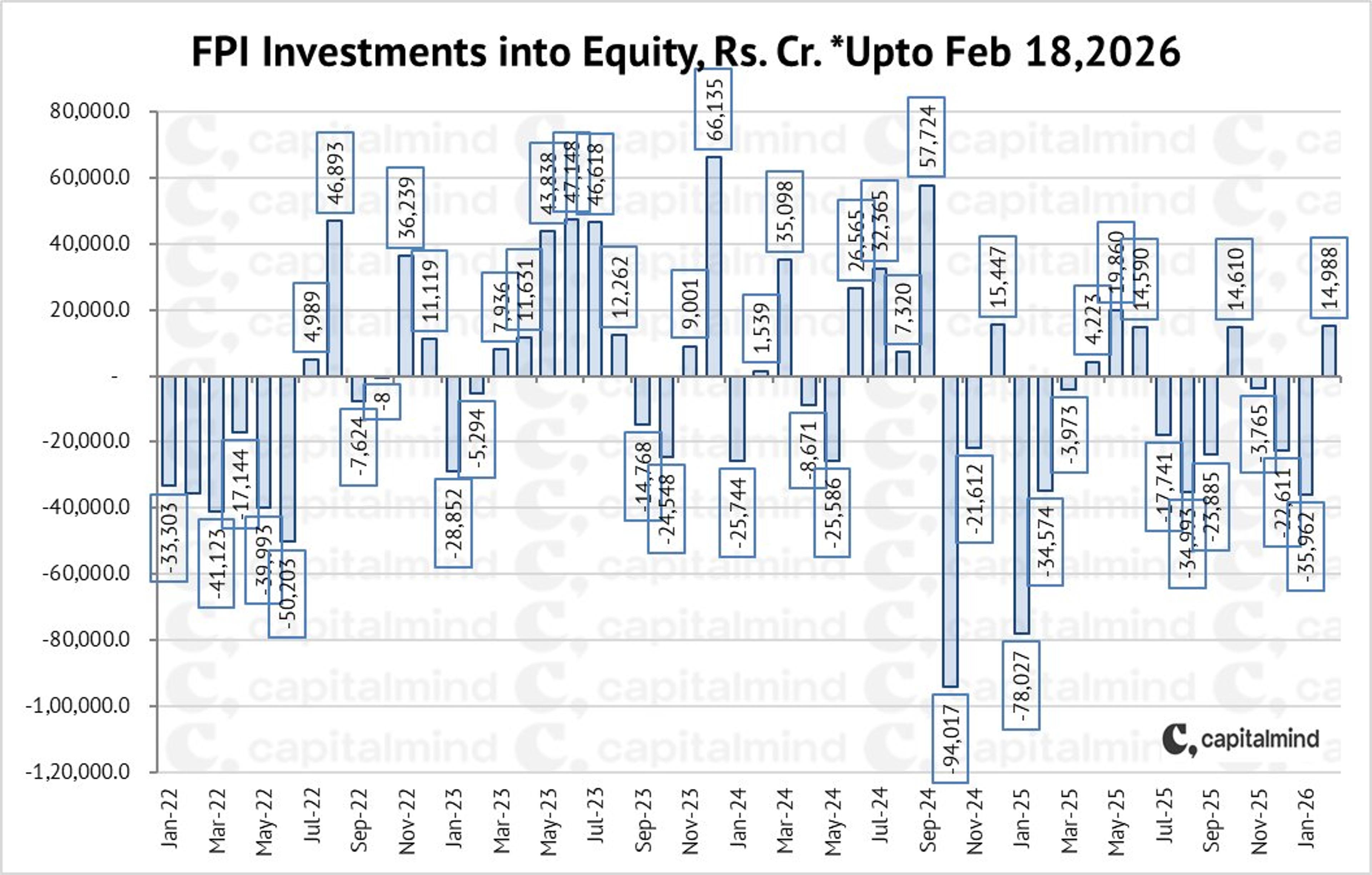

FPIs Add ₹14,000 Cr Equity in February

FPIs have finally started some buying, it looks like - in equity, they've added about 14,000 cr. in Feb this far: https://t.co/6Ag6kWbKnh

By Deepak Shenoy

News•Feb 18, 2026

Bloomberg Intelligence: Berkshire Slashes Amazon Stake (Podcast)

Berkshire Hathaway has cut its Amazon stake by 75%, reducing a once‑$15 billion holding to roughly $10 billion. The move, disclosed in a Bloomberg Intelligence podcast, reflects Warren Buffett’s bearish view on the e‑commerce giant’s growth prospects. It marks a rare portfolio...

By Bloomberg — Business

Social•Feb 19, 2026

Quant Hedge Fund Alpha Closes After 25 Years

A $2 billion quantitative hedge fund that recently added “Alpha” to its name, is calling it quits after three consecutive years of losses and roughly 25-year run https://t.co/69PJrwEni7

By Nishant Kumar

Social•Feb 19, 2026

Tencent's Tiny Wildlight Stake Dwarfed by Massive Cash Flow

Tencent's free cash flow last quarter was US$13B, so the amount they invested in Wildlight is (probably) minuscule for them. They and competitor Netease are in plenty of other deals that are not made public, both in the West...

By Serkan Toto

News•Feb 18, 2026

Japan Accounting Group Seeks to Ease Insurer Bond Loss Rule

The Japanese Institute of Certified Public Accountants (JICPA) has proposed treating life insurers' government‑bond holdings as held‑to‑maturity, removing the need for impairment accounting when certain criteria are met. Under current rules insurers must record a loss if market value falls...

By Accounting Today

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

SPAC Activity Slumps: 21 IPOs, Just One Deal

Month-to-date SPAC statistics: IPOs: 21 Definitive agreements: 1 As Jerry Seinfeld said, "That's not gonna be good for anybody."

By Julian Klymochko

News•Feb 18, 2026

You Can Invest in SpaceX Before Its IPO — but Should You?

Investors can now gain exposure to SpaceX through private secondary markets, specialty ETFs and pooled funds, sidestepping the wait for a public listing. The rocket company is valued at roughly $1.25 trillion, making it one of the most coveted private assets....

By MarketWatch – Top Stories

Social•Feb 18, 2026

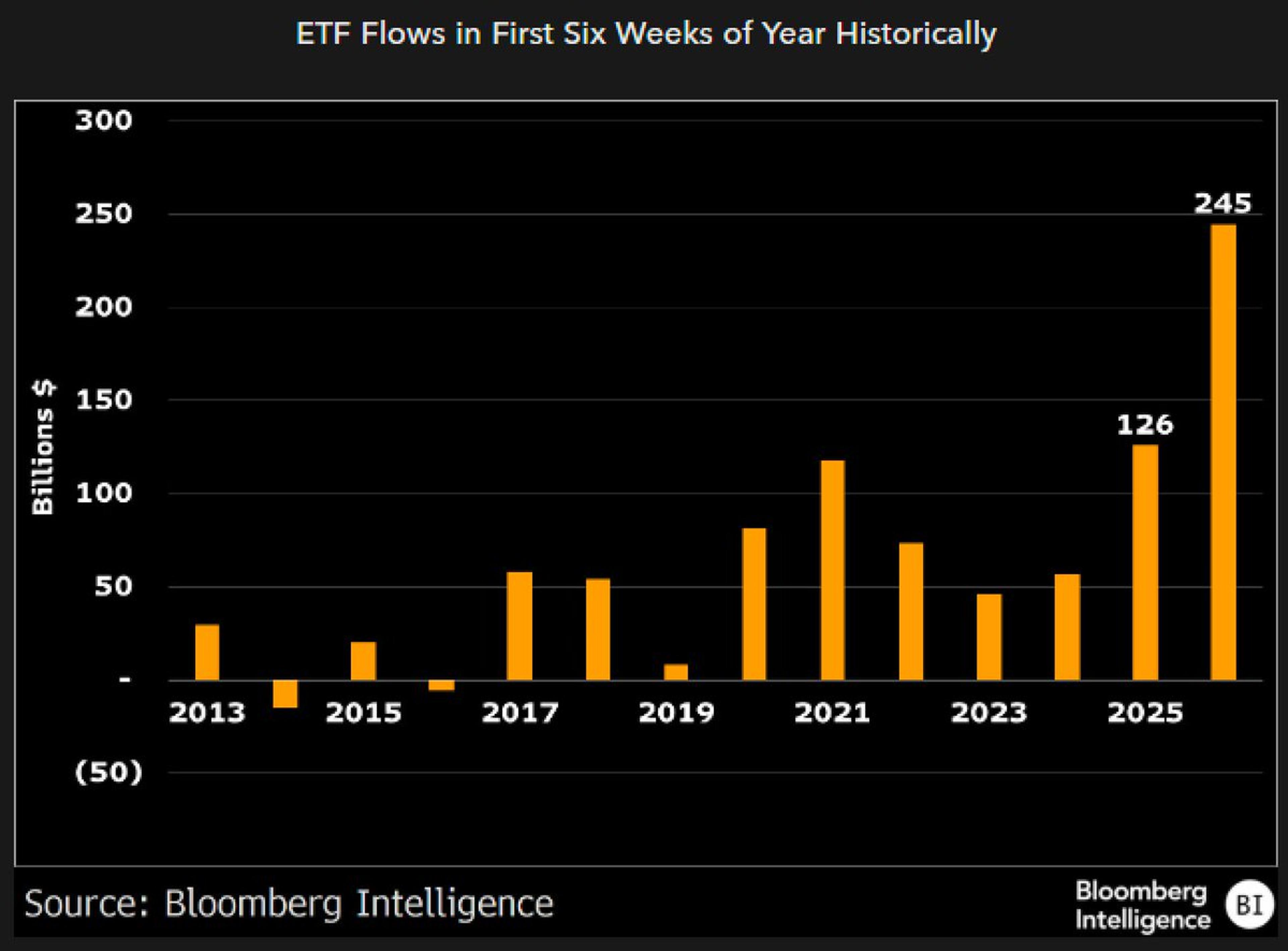

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

Social•Feb 18, 2026

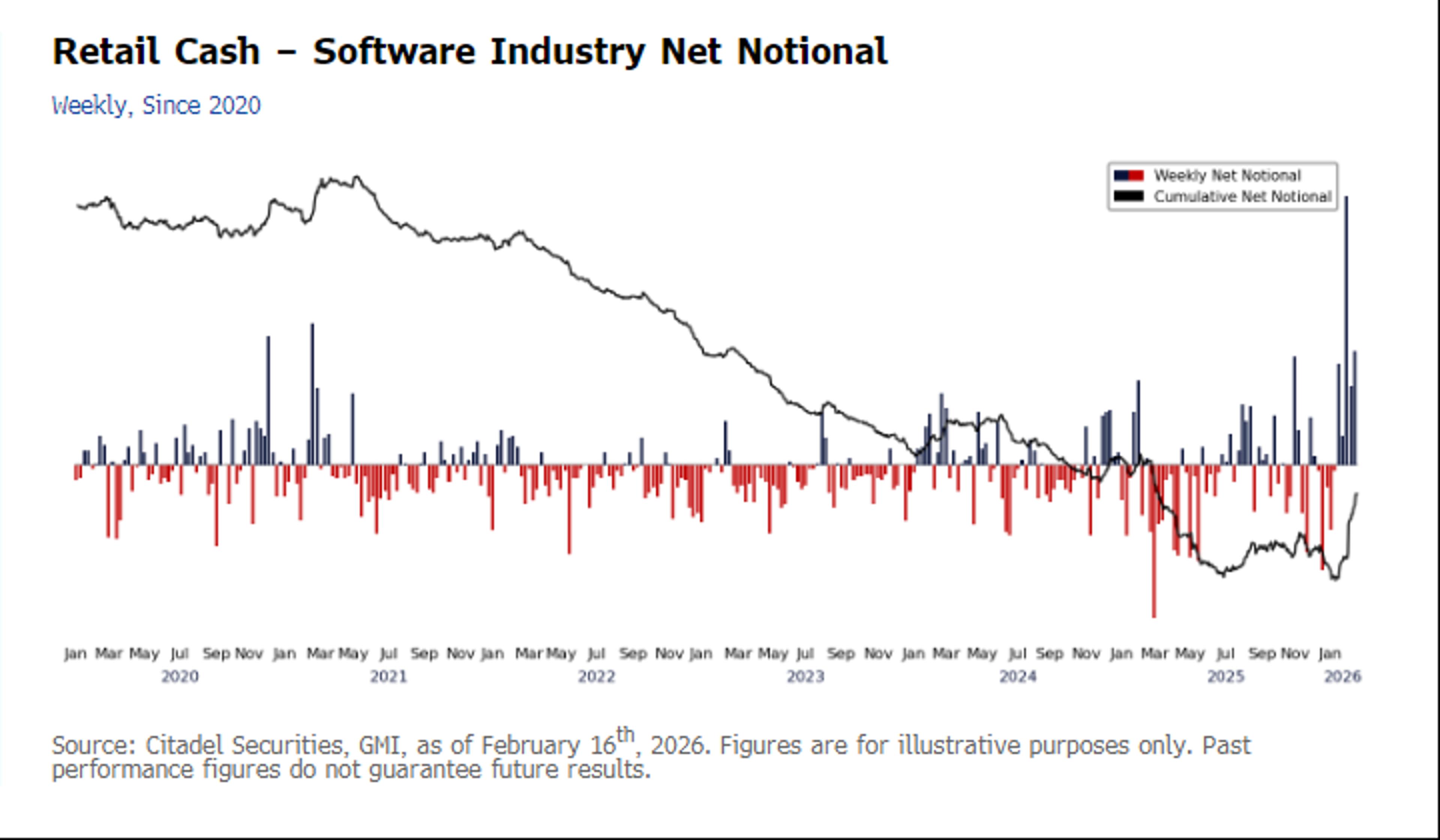

Retail Traders Set Record Demand on Citadel Platform

Citadel on flows, via Bbrg: Retail traders spent a record amount snapping up software shares on Citadel Securities’ platform, according to Scott Rubner, head of equity and equity derivatives strategy at the firm, which began tracking the data in 2017: “Net notional...

By MacroCharts

News•Feb 18, 2026

Isabel Schnabel: Fiscal Challenges Amid Geopolitical Uncertainty and Ageing Societies

Isabel Schnabel highlighted the euro area’s mounting fiscal pressures, noting that low debt levels often coincide with weak public investment. She examined Germany’s new defence and infrastructure package, showing it can lift GDP but also raise debt ratios under different...

By European Central Bank — Press/Speeches

Social•Feb 18, 2026

Lennar’s 13F Reveals 18.5M Opendoor

A note re: $OPEN and $Lennar --- if you back it out, Lennar held 18.5M shares of Opendoor at end of its Q3. The 13F likely indicates either they had some anti-dilution protections or participated in debt-for-equity swap, and that’s why...

By Luke Kawa

Social•Feb 18, 2026

March 2Y Futures Expected Heavy Amid Nasty Roll

Great reminder futures rolls (H25 to M26) are upon us. Bottomline March 2y futs should be heavy. Roll is nasty at -4.5 which should add to the flattening pressure along with front-end auctions next week.

By Ed Bradford

News•Feb 18, 2026

Five US Policy Shifts Could Reshape Financial Markets

The Trump administration is advancing five domestic policy initiatives that touch credit, housing, monetary policy, corporate governance, and digital‑asset regulation. Proposed credit reforms would tighten loan underwriting, while housing changes could modify the mortgage interest deduction. Monetary officials hint at...

By Project Syndicate — Economics

News•Feb 18, 2026

Market Trading Guide: Bank of India Among 2 PSU Bank Stocks Offering up to 8% Upside

The Nifty 50 logged a third straight gain, breaking above the 25,500 support and 25,800 resistance as consumer, financial and metal stocks led the rally. Bank of India and Bank of Maharashtra each posted decisive breakouts from consolidation zones, prompting...

By The Economic Times – Markets

News•Feb 18, 2026

RioCan REIT Reports ‘Strong Year’ for 2025 with 5 Million Square Feet of Leasing Activity

RioCan REIT reported a robust 2025, delivering 5 million square feet of leasing activity and a record‑high new‑lease spread of 37.3%. Blended leasing spreads rose to 21.1%, while same‑property NOI grew 3.6% for the year. The trust repatriated $741.7 million of capital,...

By Retail Insider Canada

News•Feb 18, 2026

American Crypto Holders Are Scared and Confused About This Year’s New IRS Tax Rules

A poll of 1,000 U.S. crypto investors shows more than half fear IRS penalties as the Treasury rolls out Form 1099‑DA, which forces exchanges to automatically report transaction proceeds. The new rule shifts tax compliance from self‑disclosure to broker‑driven reporting,...

By CoinDesk