🎯Today's Finance Pulse

Updated 5m agoWhat's happening: ESMA fines trade repository REGIS‑TR €1.374 million for EMIR and SFTR breaches

The European Securities and Markets Authority imposed a €1.374 million penalty on REGIS‑TR after finding seven violations of the European Market Infrastructure Regulation and the Securities Financing Transactions Regulation. This is the first enforcement action involving SFTR breaches and the largest fine ever levied on a trade repository. ESMA said the sanctions underscore its commitment to market integrity.

Also developing:

News•Feb 18, 2026

Businesses Move to Rein In AI in the Shift to Autonomous Finance

Enterprises are granting AI agents authority to initiate payments, approve refunds, and orchestrate cross‑functional workflows, shifting from assistance to autonomous action. Security researchers warn that more than 1.5 million deployed agents could be exposed to misuse, expanding the attack surface faster than traditional controls. Companies are responding with identity‑centric governance, AgenticOps life‑cycle management, and guardian agents that monitor behavior in real time. At the same time, vendors like Noma Security and insurers such as AIUC are emerging to provide monitoring tools and risk‑transfer products for autonomous finance.

By PYMNTS

News•Feb 18, 2026

Eddie Bauer Files for Bankruptcy

Eddie Bauer announced a Chapter 11 bankruptcy filing in the District of New Jersey, attributing the move to a consumer shift toward online shopping, persistent inflation and higher tariffs. The filing, the company’s third, outlines a plan to sell some...

By Retail Customer Experience

News•Feb 18, 2026

Wells Fargo Sees ‘YOLO’ Trade Driving $150B Into Bitcoin and Risk Assets

Wells Fargo analyst Ohsung Kwon predicts that a surge in U.S. tax refunds could channel up to $150 billion into risk‑on assets, notably equities and Bitcoin, by the end of March. The influx is tied to a revival of the retail “YOLO”...

By Cointelegraph

News•Feb 18, 2026

FinScan Expands Real-Time AML Across Global Rails

FinScan, Innovative Systems' AML platform, has added real‑time screening for modern payment rails such as IACH and Fedwire ISO 20022, boosting its capacity to process over 100 million transactions daily. The upgrade introduces advanced conditional logic, API‑first data quality tools, and enhanced...

By Fintech Global

News•Feb 18, 2026

How Invoices Work Step by Step for Freelancers and Small Businesses

Invoicing is a critical financial and branding tool for freelancers and small businesses, turning completed work into a formal payment request and record. A professional invoice includes clear business and client details, a unique number, dates, itemized services, and payment...

By TechBullion

News•Feb 18, 2026

EBA Issues Opinion to the European Commission on the Draft Amended European Sustainability Reporting Standards

The European Banking Authority (EBA) has issued an Opinion to the European Commission on the draft amended European Sustainability Reporting Standards (ESRS) prepared by EFRAG. While the EBA welcomes the simplifications that reduce reporting costs, it warns that permanent reliefs...

By EBA – News

News•Feb 18, 2026

Lesser-Known Cryptocurrencies: A Guide for UK Traders

The article guides UK traders through the world of lesser‑known cryptocurrencies, highlighting assets like Cardano that offer niche technology and sustainability benefits. It explains how these tokens differ from Bitcoin and Ethereum in terms of market adoption, liquidity, and volatility....

By Finance Monthly

News•Feb 18, 2026

Extens-Backed Orthalis Picks up Dentalsoft

Orthalis, backed by private equity firm Extens, announced the acquisition of Dentalsoft, a specialist orthodontic software provider. The purchase creates a new entity, SignalSoft Développement, focused on delivering software services to orthodontic professionals. By integrating Dentalsoft’s tools, Orthalis expands its...

By PE Hub

News•Feb 18, 2026

Experience Economy Pushes Payments to $20B Super Bowl Test

The 2026 Super Bowl generated roughly $20.2 billion in experience‑economy spending, spanning tickets, merchandise, streaming and legal wagering. Paysafe’s CEO Bruce Lowthers highlighted the need for payment platforms that can process massive, real‑time transactions across multiple methods without friction. AI‑driven fraud...

By PYMNTS

News•Feb 18, 2026

Katie Collin on Why Female Leadership in the Top 100 Is Sliding

In this episode, Nikita Alexander talks with Ramsay Brown Partner Katie Collin about the recent drop in female leadership within the UK’s Top 100 firms, now down to just 12 % at senior levels. Collin attributes the decline to cyclical workload pressures that...

By Accountancy Age

News•Feb 18, 2026

Stop Overpaying For PDI

The PIMCO Dynamic Income Fund (PDI) is trading at roughly a 12% premium to its net asset value, delivering a near‑14% yield and monthly distributions. While its strong distribution history appeals to income investors, the fund’s leverage and sensitivity to...

By Seeking Alpha – ETFs & Funds

News•Feb 18, 2026

The Norwegian Group Delivers Record Results for 2025 and Increases Dividend

The Norwegian Group posted a record operating profit of NOK 3.732 billion for 2025, the highest in its history, and a NOK 21 million EBIT in Q4 after a loss the previous year. Passenger traffic rose to 27.3 million for the full year, with Norwegian’s...

By Breaking Travel News

News•Feb 18, 2026

Banco Itaú Teams Up with iCapital to Enhance Private Markets Offering with New Tech Solution

Banco Itaú International and Banco Itaú (Suisse) have expanded their partnership with fintech platform iCapital, embedding iCapital’s technology into the bank’s private‑markets offering. The integration delivers an end‑to‑end digital ecosystem covering marketing, onboarding, documentation, reporting and analytics, and introduces iCapital’s...

By Crowdfund Insider

Social•Feb 18, 2026

Shift to Equal‑weight, Financials, and Cyclical Assets

Wow, the goat is also rotating out of Megacap tech, long equal weight performance vs market cap, long financials for deregulation and curve steepening, and long real cyclical assets Feels good man

By Felix Jauvin

News•Feb 18, 2026

BIBL: Biblical Values-Focused Strategy Outperforming In 2026 Has Disadvantages, A Hold

The Inspire 100 ETF (BIBL) offers exposure to 100 U.S. large‑cap companies screened for biblical alignment. In 2026 the fund outperformed the S&P 500 benchmark IVV, largely because of a heavier tilt toward cyclical sectors and zero allocation to communications. Over the...

By Seeking Alpha – ETFs & Funds

News•Feb 18, 2026

LIC's Rs 17.5 Lakh Crore Portfolio Goes Against the Wind: IT Stocks in, Banks Out

Life Insurance Corporation of India (LIC), the nation’s largest domestic institutional investor, dramatically re‑balanced its ₹17.83 lakh crore portfolio in the December quarter. It poured roughly ₹5.4 billion into top IT names – TCS, HCL Technologies and Coforge – lifting IT holdings from...

By The Economic Times (India) – RSS hub

News•Feb 18, 2026

KCE: Not So Convinced By The AI Scare

The Valkyrie Trading Society argues that the State Street SPDR S&P Capital Markets ETF (KCE) is not materially threatened by the recent AI‑scare or large‑language‑model automation. While asset‑management revenues are already pressured by passive‑investment competition, AI is unlikely to accelerate...

By Seeking Alpha – ETFs & Funds

News•Feb 18, 2026

Heightened Volatility Calls for Active Management- #Wealth #AssetManagement #AssetFinance

Asian ultra‑high‑net‑worth individuals (UHNWIs) confront heightened market volatility in 2026, driven by geopolitical tensions and macro‑economic uncertainty. The turbulence is prompting a reassessment of traditional passive approaches. The article recommends active management strategies to navigate these risks and preserve wealth....

By The Asset – ETF tag

News•Feb 18, 2026

The Economics of the Kalshi Prediction Market

Kalshi, a CFTC‑approved designated contract market, operates a quote‑driven prediction platform where makers post offers and takers accept them. An analysis of over 300,000 contracts shows that prices generally track event probabilities but suffer a pronounced favourite‑longshot bias, with cheap...

By CEPR — VoxEU

Social•Feb 17, 2026

SKEW Below 140 Signals Institutional Hedge Unwind

SKEW just closed below 140. Falling $SKEW = institutions unwinding tail-risk hedges (OTM puts get cheaper) and/or quietly reducing equity exposure. Past cycles: Sustained declines often marked distribution phases — rallies fade as protection demand evaporates and complacency builds. If it...

By Kurt S. Altrichter

Blog•Feb 17, 2026

Armada Acquisition Corp. III (AACIU) Prices $225M IPO

Armada Acquisition Corp. III priced its $225 million initial public offering and will begin trading on Nasdaq under the ticker AACIU on February 18, 2026. The SPAC, led by CEO Stephen P. Herbert and CFO Douglas M. Lurio, will seek a target in...

By SPACInsider

News•Feb 17, 2026

Voting Rights and Shares Capital of the Company

Nanobiotix SA filed a regulatory disclosure on February 17 2026 detailing its capital structure as of January 31 2026. The company reported 48,450,358 shares outstanding, with a total of 50,153,460 theoretical voting rights and 50,131,342 exercisable voting rights. The filing complies with French Commercial...

By Euronext — News (RSS)

News•Feb 17, 2026

Pelagic Credit Plc: Update on Contemplated Private Placement and Listing on Euronext Growth Oslo

Pelagic Credit Plc issued an update on its planned private placement and intended listing on Euronext Growth Oslo. The company reports strong investor interest and is revisiting the offering’s structure, which could diverge from the February 9 outline. Size, timing and...

By Euronext — News (RSS)

Social•Feb 17, 2026

Rent to Your Business Tax-Free—Only With Proper Paperwork

Influencers: “Rent your house to your business and boom — tax-free money.” What they don’t tell you: 📂 Fair market rent. 📝 Real agendas and minutes. 👥 Actual humans in attendance. 💼 A separate legal entity. 📸 Documentation that doesn’t look like it was created during...

By Prof. Victoria J. Haneman

News•Feb 17, 2026

Genmab Announces Initiation of Share Buy-Back Program

Genmab A/S announced a share buy‑back program to repurchase up to 342,130 ordinary shares, representing a maximum spend of 725 million Danish kroner. The program, designed to fulfill obligations under its Restricted Stock Unit plan, will run from February 18 to March 31 2026...

By The Manila Times Business

News•Feb 17, 2026

PRESS RELEASE: BIGBEN ANNOUNCES IMPORTANT INFORMATION REGARDING THE PARTIAL REPAYMENT OF ITS BOND LOAN

Bigben Interactive announced that its banking pool unexpectedly refused to honor a drawdown notice for the partial refinancing of its senior bonds, leaving the company unable to execute the planned €43 million partial repayment on the February 19 maturity date. The...

By Euronext — News (RSS)

Social•Feb 17, 2026

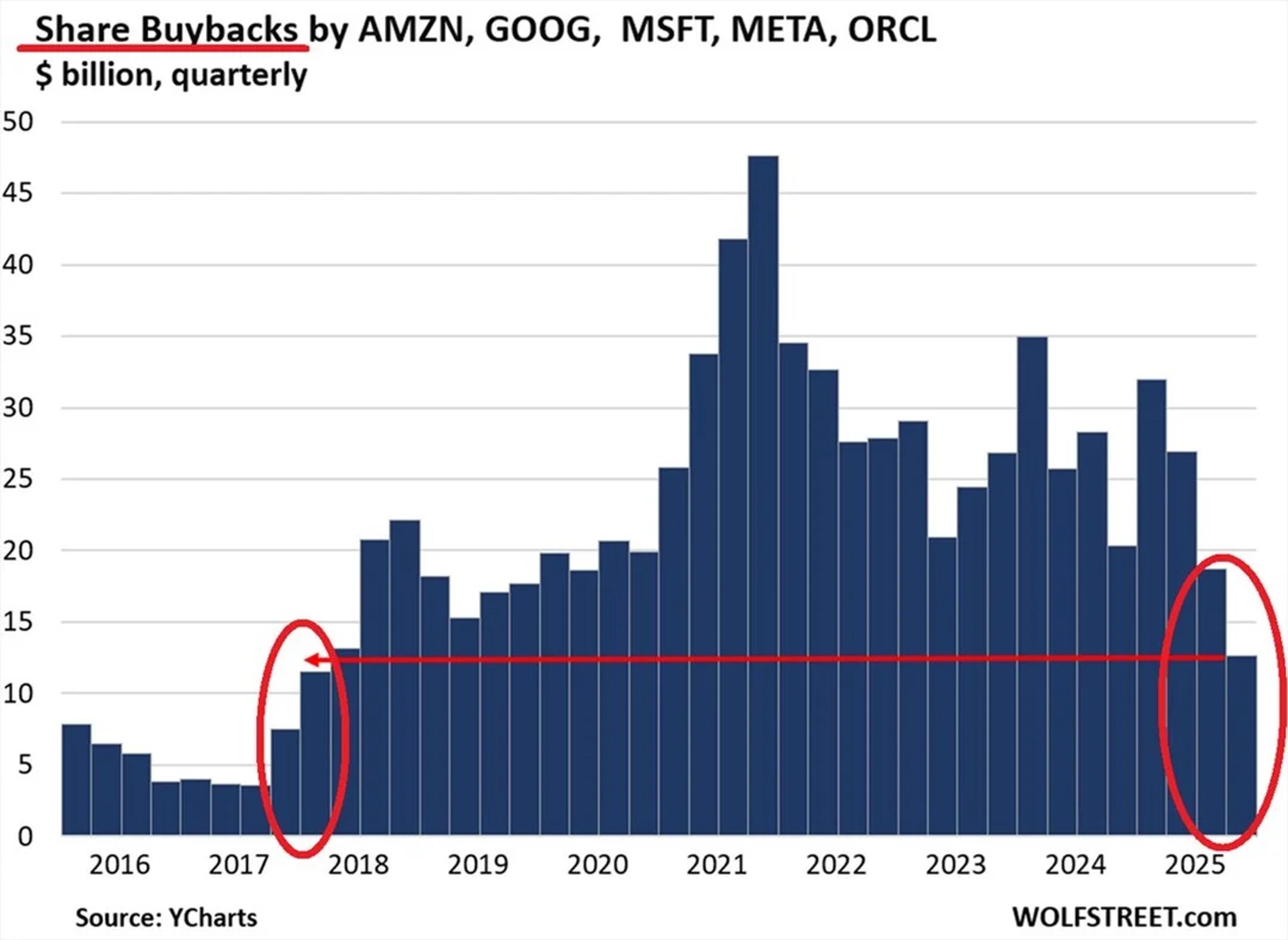

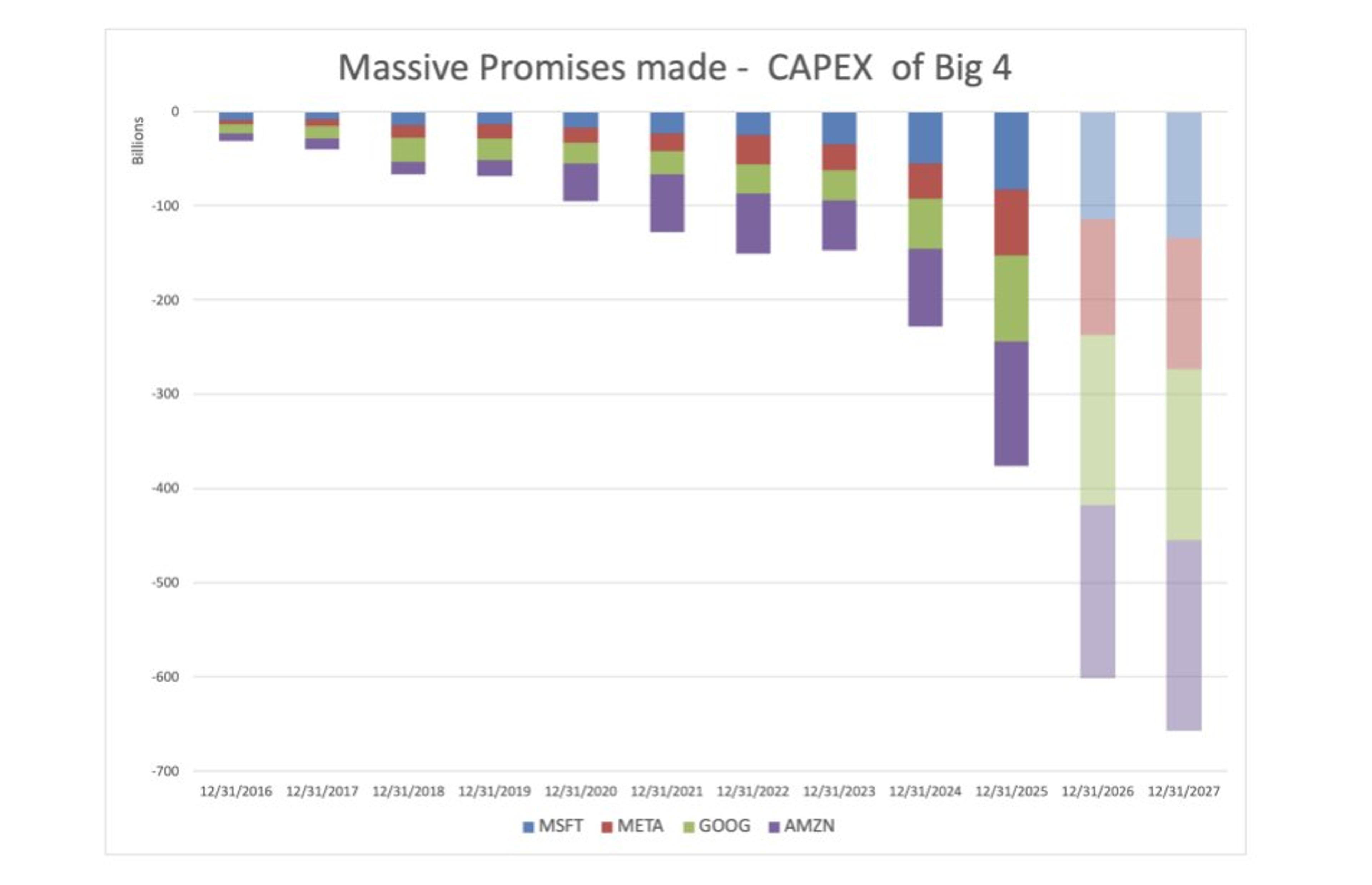

Big Tech Cuts Buybacks, Shifts to AI Spending

‼️The largest US stock buyer since 2009 is STEPPING BACK: Combined buybacks by Amazon, Alphabet, Microsoft, Meta, and Oracle fell to $12.6 billion in Q4 2025, the lowest in 7 YEARS. This marks the 3rd quarterly decline, a -70% DROP from the...

By Global Markets Investor (newsletter author)

Blog•Feb 17, 2026

Africa’s MTN Group to Acquire IHS Holding for $6.2 Billion in Cash

MTN Group announced a $6.2 billion cash acquisition of IHS Holding, offering $8.50 per share—a 2.53% premium to the prior close. The deal will be funded by $1.1 billion of MTN cash, $1.1 billion from IHS’s balance sheet, and a rollover of existing...

By Inside Arbitrage – Blog

News•Feb 17, 2026

Jefferson Posts $201M Operating Loss in H1

Thomas Jefferson University, owner of Jefferson Health, posted a $201 million operating loss for the first half of fiscal 2026, reflecting a -2.3% operating margin. The loss includes $64.7 million in restructuring expenses tied to a planned layoff of roughly 650 employees....

By Becker’s Hospital Review

News•Feb 17, 2026

Finance and Sales Teams Don’t Match up on Criteria for Deal Approvals

A CreditSafe survey of over 200 finance and sales leaders reveals a stark mismatch in deal‑approval criteria. While 49% of sales executives rate company size and revenue as very important, only 33% of finance leaders share that view, with finance...

By CFO.com

News•Feb 17, 2026

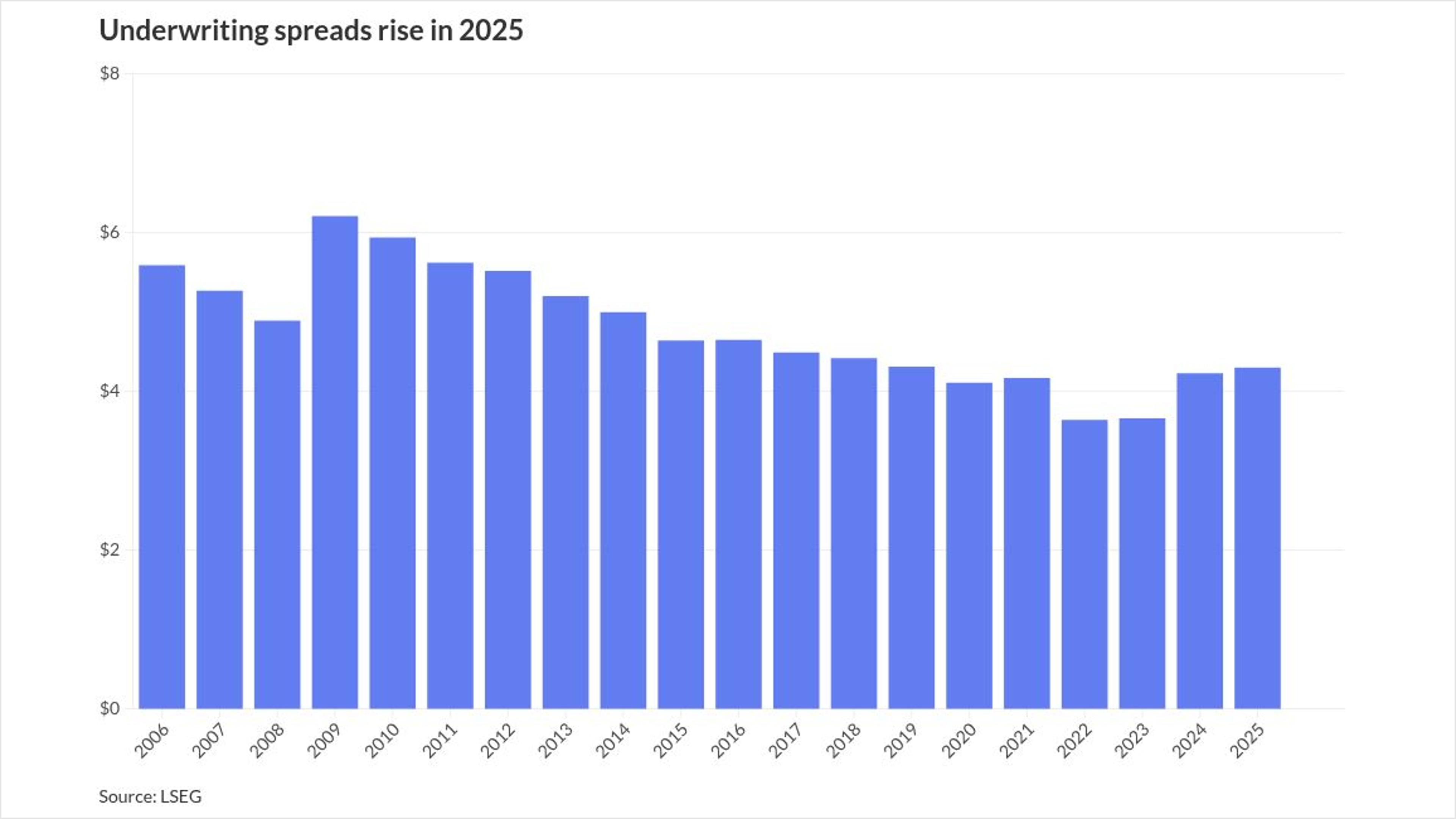

Underwriting Spreads Rise in 2025

Underwriting spreads for municipal bonds rose again in 2025, reaching an average of $4.30 per $1,000, up from $4.23 in 2024. Negotiated‑deal spreads increased to $4.64 while competitive‑deal spreads fell to $1.78. The uptick coincides with record issuance volumes—$586 billion in...

By The Bond Buyer (municipal finance)

News•Feb 17, 2026

International Business Briefs | Kennedy Wilson to Go Private in $1.5bn CEO-Led Deal

Kennedy Wilson agreed to a $1.5 bn CEO‑led buyout, offering a 10.2% premium and targeting a Q2 2026 close. Genuine Parts announced a split into two publicly traded entities—Automotive Parts Group and Industrial Parts Group—set to finalize in Q1 2027 after an activist‑driven settlement. Blackstone‑backed...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 17, 2026

IPO-Bound Kissht's NBFC Arm Gets Crisil Rating Upgrade on Strong Growth

Kissht’s NBFC subsidiary Si Creva Capital Services received a CRISIL rating upgrade, moving its long‑term rating to A‑/Stable and short‑term to A1. The upgrade follows a surge in assets under management, which climbed to Rs 5,533 crore by September 2025, driven by rapid expansion...

By The Economic Times – Markets

Social•Feb 17, 2026

Market Awaiting Decisive Breakout: Support or Resistance?

📺 THIS MARKET NEEDS RESOLUTION The market is stuck in a range. Breakouts fail, breakdowns bounce, and both longs and shorts get frustrated. We need a decisive move that breaks the range and sticks. That could mean: 🔻 A clean break below support $QQQ...

By Scott Redler

News•Feb 17, 2026

Cogent Biosciences Reports Recent Business Highlights and Fourth Quarter and Full Year 2025 Financial Results

Cogent Biosciences announced that its lead drug bezuclastinib is on track for multiple FDA submissions in 2026, including NDAs for non‑advanced systemic mastocytosis (Non‑AdvSM), advanced SM (AdvSM) and second‑line GIST. The company reported $901 million in cash, sufficient to fund operations...

By GlobeNewswire – Earnings Releases

News•Feb 17, 2026

Kite Realty Group Reports Fourth Quarter and Full Year 2025 Operating Results and Provides 2026 Guidance

Kite Realty Group (KRG) posted a dramatic turnaround in 2025, reporting net income of $298.7 million ($1.37 per diluted share) versus $4.1 million the prior year. The REIT leased roughly 4.6 million sq ft at a 13.8% comparable cash‑leasing spread and entered two joint‑venture partnerships...

By GlobeNewswire – Earnings Releases

News•Feb 17, 2026

SEALSQ Announces FY 2025 Key Preliminary / Unaudited Financials Metrics: Reports 66% Year Over Year Revenue Growth to $18 Million

SEALSQ Corp reported FY 2025 revenue of $18 million, a 66% year‑over‑year increase, while maintaining a cash balance above $425 million. The company posted a net loss of $30‑40 million, reflecting heightened R&D and integration expenses. It highlighted a $200 million plus business pipeline, including...

By GlobeNewswire – Earnings Releases

News•Feb 17, 2026

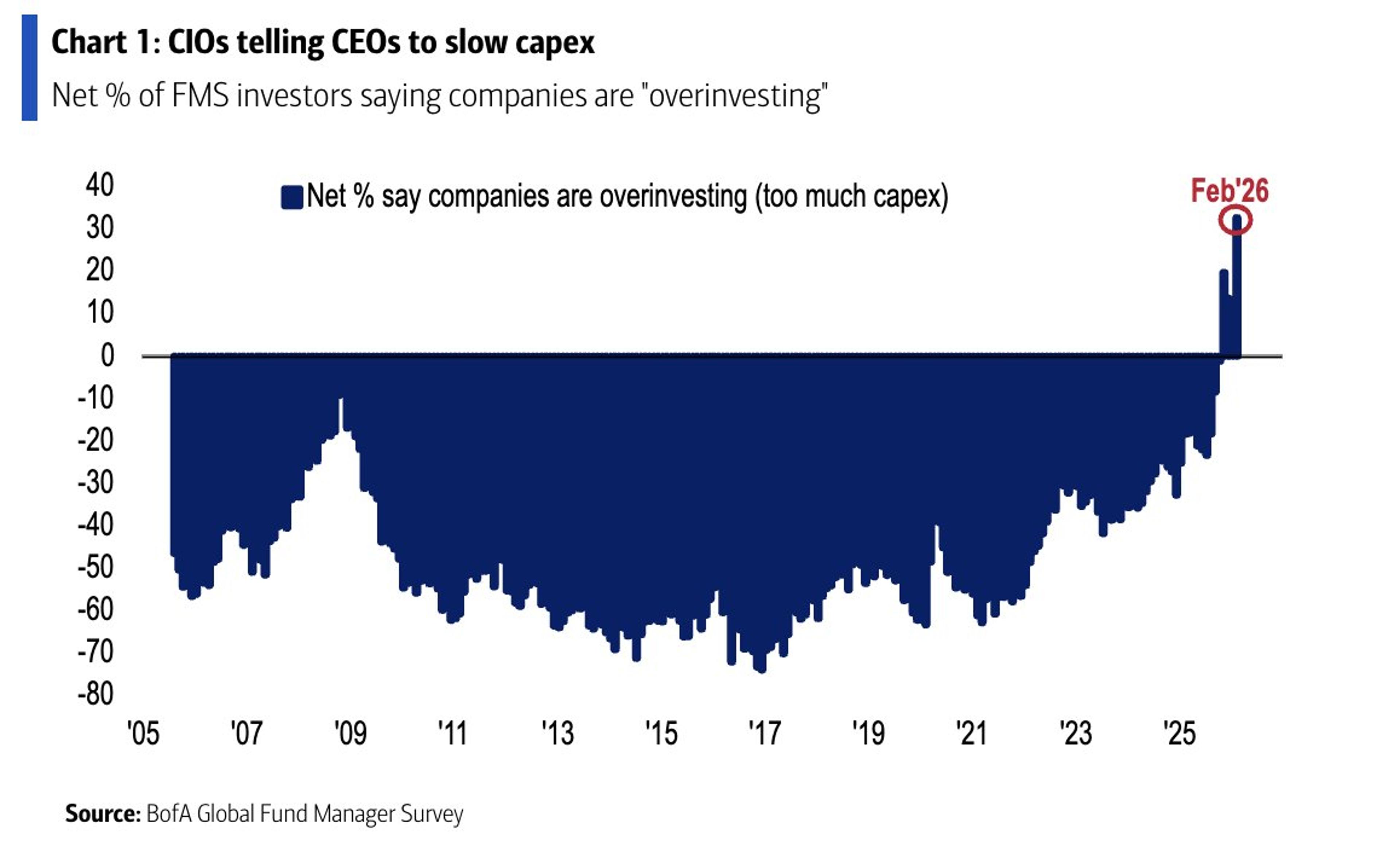

Fund Managers Alarmed over Corporate Spending Even as Optimism at Five-Year High

Fund managers are at a five‑year high of bullishness, yet a record share warn that corporate America is overspending on capital expenditures amid uncertain returns. In Bank of America’s February survey of 162 managers, cash balances rose in February, signaling...

By MarketWatch – Top Stories

Social•Feb 17, 2026

X Adds Finance Tools: Smart Cashtags and Visa‑backed Money

The platform that popularized ragebait is bringing you better gambling: 📉 @X will roll out Smart Cashtags, enabling users to view data on stocks and cryptocurrencies directly from their timeline. 💸 X Money is currently in closed beta with employees. A public...

By Nik Milanovic

Social•Feb 17, 2026

Onshore Secures $31M Series B for AI Tax Automation

Congrats to Onshore on their $31M Series B! Onshore is building an AI-native platform that replaces manual CPA workflows with continuous, automated tax intelligence. Instead of relying on spreadsheets and fragmented documentation, Onshore automates data collection and analysis while keeping expert...

By YCombinator

Blog•Feb 17, 2026

Getting Paid to Wait for Deleveraging

The episode examines a REIT's high‑yield bond, which trades above 7% with a 340‑basis‑point spread despite solid market fundamentals and improving leasing. Management is actively selling $280‑300 million of assets, using proceeds to cut debt and potentially buy back bonds, positioning...

By Fixed Income Beacon

Social•Feb 17, 2026

Massive M&A Premiums: MASI, KW, ZIM Deals

Today's M&A notes $MASI to be acquired by $DHR for $180.00 cash, 38.3% premium, $9.9 billion $KW to be acquired by $FFH.to for $10.90 cash, 45.9% premium, $6.5 billion $ZIM to be acquired by $HLAGF for $35.00 cash, 125.8% premium, $4.2 billion https://t.co/ayupP5Rv2J

By Julian Klymochko

Social•Feb 17, 2026

New DSR Highlights Debt‑Equity Promise for Hyperscalers

New DSR released to clients. Part 3 in the Hamburger Series - Hyperscalers. As a reminder the idea is that to get a hamburger today one needs to promise to repay (issue debt and equity) on tuesday. ...

By Andy Constan

News•Feb 17, 2026

Carlyle, BlackRock Buy Cheap Software Loans to Boost CLO Profits

Carlyle Group, BlackRock, Benefit Street Partners and Oak Hill Advisors are buying pools of low‑yield, software‑focused bank loans. The acquisitions are intended to seed new collateralized loan obligations (CLOs) after a year of compressed margins in the loan market. Buyers...

By Bloomberg — Business

Social•Feb 17, 2026

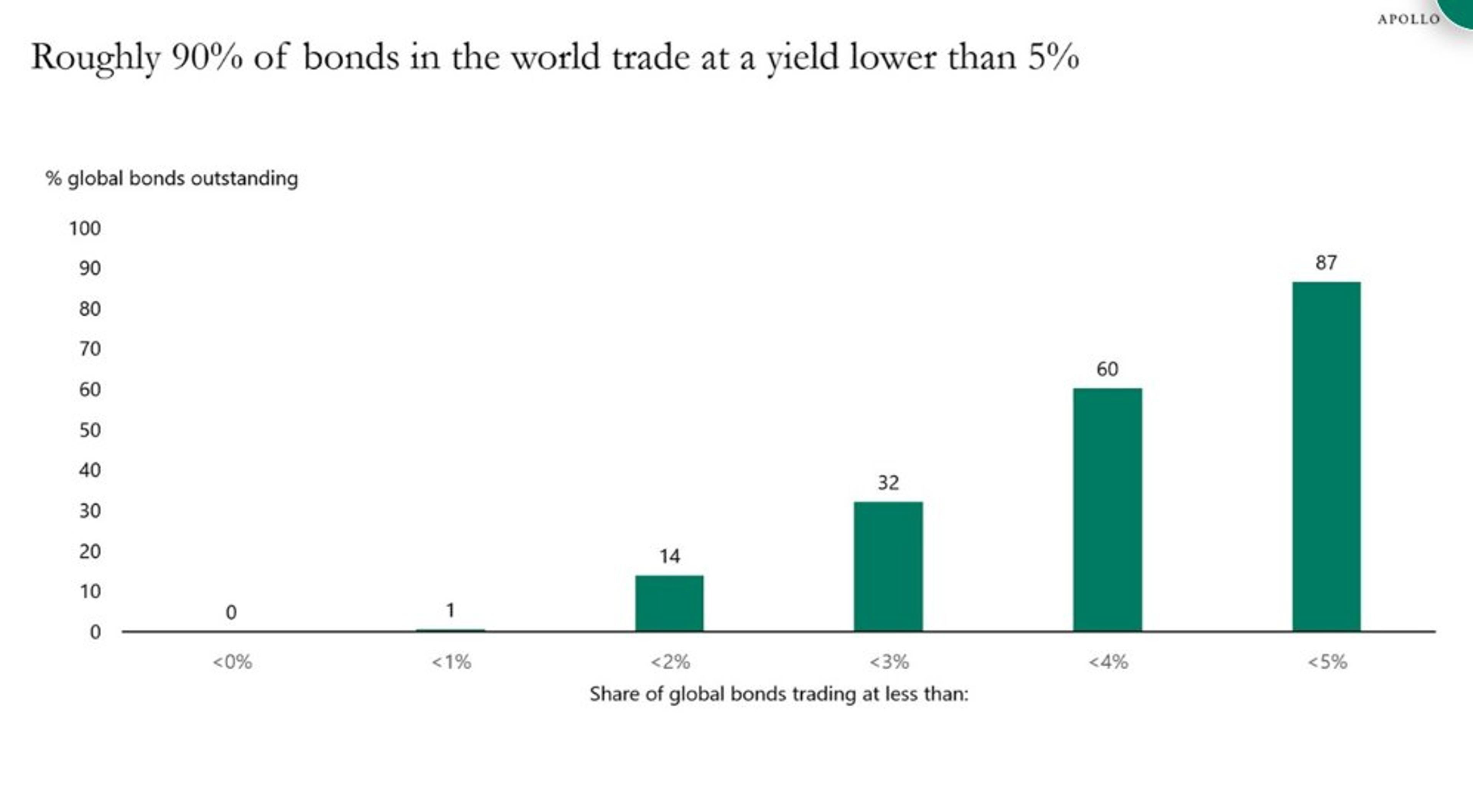

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

CIOs Push CEOs to Cut Capex, Strengthen Balance Sheets

"capex too hot right now …CIOs telling CEOs to improve balance sheets (35% from 26%) vs. increase capex (20% from 34%) as FMS investors saying corps 'overinvesting' at new record high" - BofA Global Fund Manager Survey https://t.co/ciu0wy6GZP

By Sam Ro

News•Feb 17, 2026

Toshiba Weighs Reducing Elevator Unit Stake as Kone Circles

Toshiba Corp. is weighing a partial or full divestiture of its roughly 80% stake in Toshiba Elevator & Building Systems, as Finland’s Kone Oyj signals renewed interest. Kone, which already owns just under 20% of the unit, has begun informal...

By Bloomberg — Business

News•Feb 17, 2026

CleanMax to Float ₹3,100 Crore IPO on Feb 23

CleanMax Enviro Energy Solutions announced a ₹3,100 crore IPO opening on Feb 23, with a price band of ₹1,000‑1,053 per share that values the company at up to ₹12,325 crore. The issue includes a ₹1,200 crore fresh issue and a ₹1,900 crore offer‑for‑sale by promoters,...

By The Hindu BusinessLine – Markets

News•Feb 17, 2026

What CFOs Need From Banks and FinTechs in Cross-Border Payments

Cross‑border payments are undergoing a structural shift as CFOs demand more predictable, liquid, and compliant solutions. FinTech firms have accelerated speed and API‑driven usability, opening new corridors and transparent pricing. At the same time, banks are investing in modern settlement,...

By PYMNTS

News•Feb 17, 2026

DCM Shriram Industries’ Demerger Entities Debut on Bourses

DCM Shriram Industries completed its demerger, launching DCM Shriram Fine Chemicals Ltd and DCM Shriram International Ltd on Indian exchanges. Fine Chemicals opened around 17% below its issue price, while International fell about 18% on the NSE but edged up...

By The Hindu BusinessLine – Markets