🎯Today's Finance Pulse

Updated 1h agoWhat's happening: ESMA fines trade repository REGIS‑TR €1.374 million for EMIR and SFTR breaches

The European Securities and Markets Authority imposed a €1.374 million penalty on REGIS‑TR after finding seven violations of the European Market Infrastructure Regulation and the Securities Financing Transactions Regulation. This is the first enforcement action involving SFTR breaches and the largest fine ever levied on a trade repository. ESMA said the sanctions underscore its commitment to market integrity.

Also developing:

News•Feb 16, 2026

ACH Volume Is Soaring. Here's How that Threatens Banks.

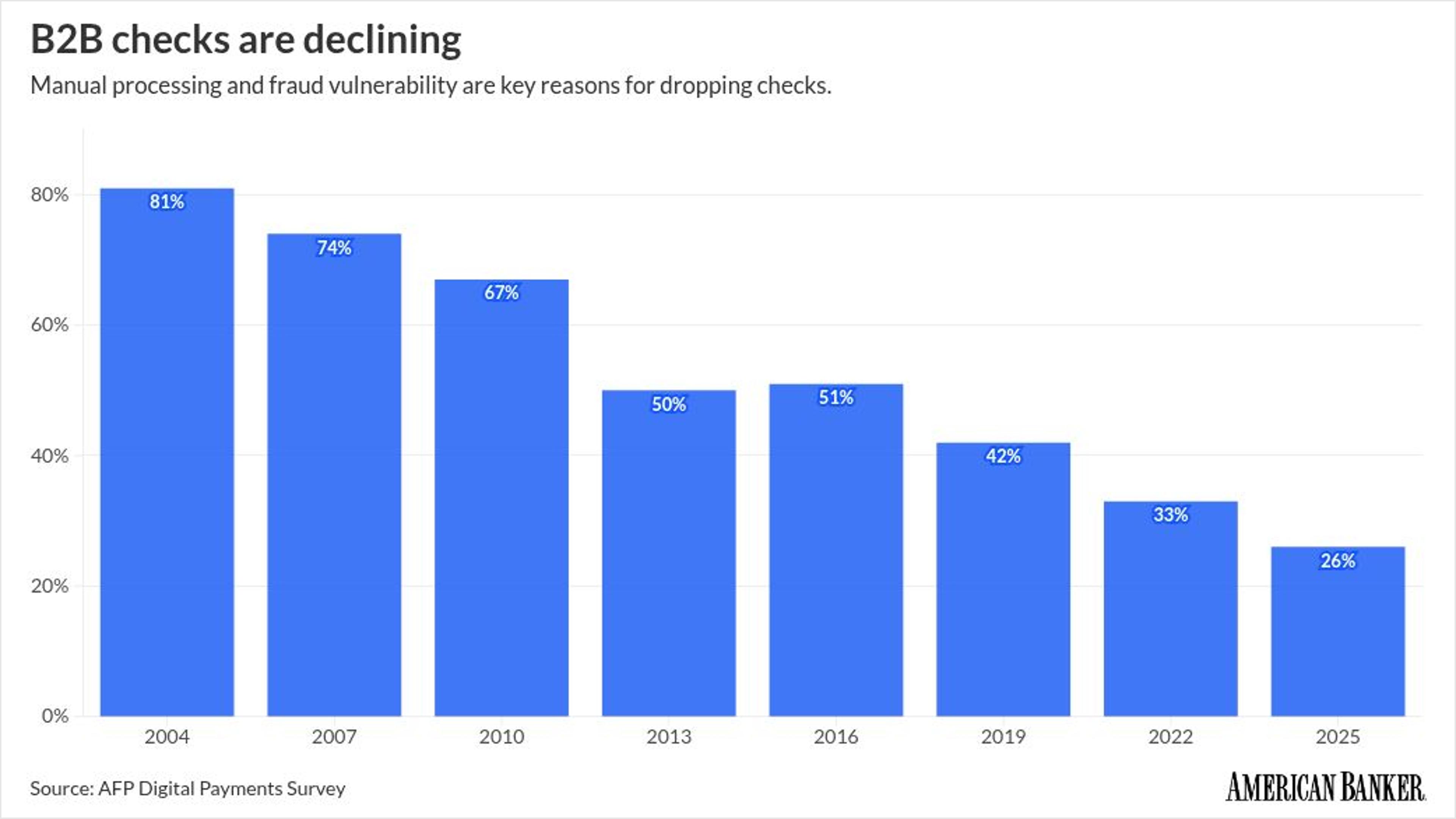

ACH network volume surged in 2025, reaching 35.2 billion payments worth $93 trillion, a 5 percent rise year‑over‑year. Person‑to‑person transfers grew 19.8 percent and business‑to‑business payments rose 9.9 percent, while check usage in B2B fell to 26 percent. Nacha has proposed lifting the same‑day ACH transaction limit from $1 million to $10 million, putting it on par with RTP and FedNow. The shift threatens traditional bank deposits and card‑based revenue as consumers and firms move money into digital‑wallet platforms.

By American Banker

News•Feb 16, 2026

Software Maker Dassault Systèmes Falls 8% as AI Fears Persist; Europe Markets Edge Higher

European markets edged higher after the Munich Security Conference, but software giant Dassault Systèmes slumped 8% as lingering AI skepticism dampened investor sentiment. The conference underscored Europe’s push for greater defense spending and strategic autonomy, lifting defense‑related equities. Meanwhile, NatWest kicked...

By CNBC – US Top News & Analysis

News•Feb 16, 2026

EQS-CMS: Henkel AG & Co. KGaA: Release of a Capital Market Information

Henkel AG & Co. KGaA disclosed its weekly share‑buyback activity for 9‑13 February 2026, repurchasing 17,000 preferred shares and 18,000 ordinary shares on the XETR. The preferred‑share buyback cost €1.37 million at an average price of €80.56, while the ordinary‑share buyback cost €1.34 million...

By Business Insider – Markets Insider

News•Feb 16, 2026

Cregis at iFX EXPO Dubai 2026: Shaping the Next Era of Enterprise Payments and Digital Asset Infrastructure

Cregis showcased its upgraded Cregis Payment Engine at iFX EXPO Dubai 2026, positioning the solution as a multi‑chain, multi‑currency platform for enterprise payments. The engine promises near‑real‑time cross‑border settlement, automated routing, and real‑time compliance monitoring, targeting use cases such as...

By Business Insider – Markets Insider

News•Feb 16, 2026

Firms Report Improved Financial Performance Linked to Use of Embedded Finance

A new PYMNTS Intelligence study of 515 senior leaders shows embedded finance is now a strategic imperative for mid‑size and large firms. Nearly 90% of respondents prioritize strengthening customer and employee relationships, while 75% plan technology upgrades within the next...

By PYMNTS

News•Feb 16, 2026

Stablecoin Payments Show Up at Checkout Despite Crypto Markets Slump

Despite a broad crypto market downturn, stablecoin‑linked cards are gaining traction at U.S. checkout counters. Monthly payment flows through these cards have surpassed $1.5 billion, and annualized spend now tops $18 billion. The growth is driven by card networks embedding stablecoins as...

By PYMNTS

News•Feb 16, 2026

Rethinking SARs in the Fight Against Financial Crime

Suspicious Activity Reports (SARs) remain the cornerstone of global AML frameworks, yet many institutions misunderstand their purpose, treating them as accusations rather than suspicion flags. Regulatory pressure and soaring transaction volumes have driven firms to prioritize filing speed over narrative...

By Fintech Global

News•Feb 16, 2026

The Spreadsheet Trap in Financial Crime Risk

Spreadsheets have long been the default tool for financial crime risk assessments, prized for their flexibility and low cost. However, they cannot enforce governance, version control, or audit trails required by modern compliance frameworks. As institutions expand across products and...

By Fintech Global

News•Feb 16, 2026

A Practical Guide to Completing Identity Verification for Your Clients

In this Accountancy Age episode, the hosts walk listeners through the two‑step Companies House identity verification process that directors and persons with significant control (PSCs) must complete before filing confirmation statements. They explain how ACSPs report verifications, obtain the 11‑character...

By Accountancy Age

News•Feb 16, 2026

EToro Launches Shareholder Engagement Initiative in Partnership with Stockperks

eToro has launched a shareholder engagement initiative in partnership with Stockperks, a loyalty‑rewards marketplace for public companies. The program invites eligible eToro shareholders to receive exclusive educational content, event invitations, and direct access to company leaders and market experts. By...

By The Fintech Times

News•Feb 16, 2026

A Blueprint for the Predictive Firm: Moving Beyond Manual Data Reconciliation

The episode explores how leading accountancy firms are shifting from retrospective reporting to predictive, real‑time visibility by consolidating fragmented tech stacks into unified platforms. It highlights the £300k technology investment benchmark needed to eliminate manual data reconciliation, improve margin protection...

By Accountancy Age

Social•Feb 16, 2026

Open Architecture Drives Southeast Asian Wealth Management Transformation

Strategic Transformation in Southeast Asian #WealthManagement: The Case for Open Architecture – The most successful transformations share common elements: clear strategic positioning, authentic partnerships with #FinTech and #WealthTech platforms, and the courage to fundamentally rethink operating models. Read my latest article on...

By Urs Bolt

Social•Feb 16, 2026

Chamath's SPACs Crash: All Lose Over 90%

Meanwhile Chamath Palihapitiya’s SPAC track record - Chamath became the face of the SPAC boom through his Social Capital Hedosophia deals. Their performance since? • $SPCE: −95% • $OPEN: −98% • $CLOV: −90% • $SOFI: −45% • $AKLI: −95% •...

By Doug Kass

Blog•Feb 16, 2026

A ‘Corruption Perceptions Index’ for Your Own Co.

Transparency International’s latest Corruption Perceptions Index shows a global decline in clean governance, prompting compliance leaders to look inward. The article proposes building a corporate‑level corruption perception index to gauge how employees view ethical standards and misconduct. It outlines the...

By Radical Compliance

News•Feb 16, 2026

Insurance Broker M&A Stabilizes After Surge

Insurance brokerage M&A activity has settled into a lower‑than‑peak but sustainable level. Total reported transactions fell 12% in 2025 to 691, aligning with a ten‑year average of 686 when the 2021‑22 surge is excluded. Private‑equity‑backed (PE‑hybrid) firms continue to dominate,...

By Business Insurance

News•Feb 16, 2026

Suits Arise as Tariff Questions Raise D&O Risk

Securities class-action lawsuits are emerging as tariff uncertainty under the Trump administration creates new D&O exposure. Although overall federal securities filings fell 10.7% in 2025, four suits specifically cited tariff‑related misstatements, targeting companies such as Dow, CarMax and Tronox. Insurers...

By Business Insurance

News•Feb 16, 2026

BI, Litmus Partner on Composite Insurer Ratings

Business Insurance has partnered with Litmus Analysis to publish a composite rating table for North American commercial‑line insurers. Litmus uses its proprietary Litmus Composite Score (LCS) to blend A.M. Best, Fitch, Moody’s and S&P ratings into a single numerical outcome,...

By Business Insurance

Blog•Feb 16, 2026

Crypto-Derivatives Regulation Is Too Fragmented

A new comparative study finds crypto‑derivatives regulation is highly fragmented across major financial hubs, despite the products mirroring traditional derivatives in structure and risk. Regulators have forced crypto‑derivatives into existing regimes, leading to divergent rules based on settlement method, underlying...

By CLS Blue Sky Blog (Columbia Law School)

News•Feb 16, 2026

Koxa, Bottomline Announce ERP Embedded Banking Partnership

Koxa and Bottomline have formed a partnership to embed banking services directly within ERP systems, leveraging Koxa’s platform and Bottomline’s Commercial Digital Banking API framework. The joint solution lets banks offer integrated payments, approvals, reconciliation and statement access without building...

By Crowdfund Insider

Social•Feb 15, 2026

Start with Reg D, Then Reg CF, Then Reg A+

How to raise capital online: 1: Start with Reg D 506(c) 2: Move into a Reg Cf 3: Move into a Reg A+ This is ordered by the fastest, easiest and most cost effective way to raise online. Companies with...

By Darren Marble

Podcast•Feb 15, 2026•40 min

1163: The Discipline Behind Transformational AI | Sue Vestri, CFO, CRIO

In this episode, Sue Vestri, CFO of CRIO, shares her journey from learning the clinical‑trial lexicon at Greenphire to scaling multiple growth‑stage companies, emphasizing the importance of disciplined finance embedded in the business. She recounts how she helped Greenphire expand...

By CFO THOUGHT LEADER

Social•Feb 15, 2026

Simplify Systems, Not Competition, to Grow Small Business

Most small businesses fail from chaos, not competition. Growth starts with simple systems, clear checklists, and tools for scheduling, invoicing, and bookkeeping. Know your best customers, ask for feedback, and speak in their words. Build a small circle of mentors, track cash flow,...

By Ask Dr. Brown

Blog•Feb 15, 2026

Silver Paper's Problem

The episode examines the severe liquidity crunch in both physical and paper silver, highlighted by a sharp drop in COMEX open interest and widening spreads that deter speculators. It explains how banks and traders are constrained by the high value...

By McleodFinance (Alasdair Macleod)

Social•Feb 15, 2026

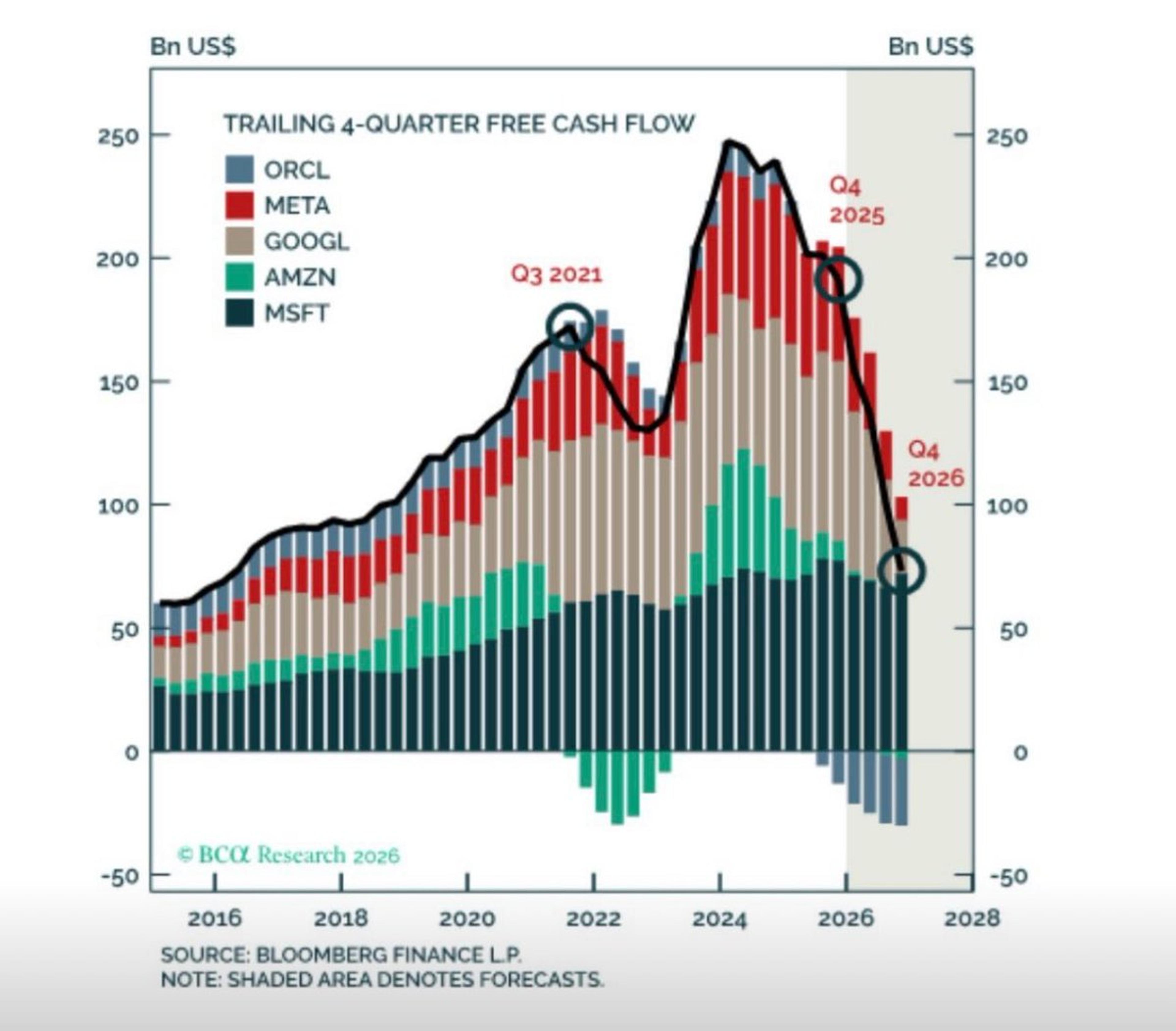

Strategists Misread CapEx, Overhype Free Cash Flow

I love how boomer strategists present the chart on free cash flows from the Mag 7 as rocket science. We learned on the first days at university that CapEx means less FCF in that year. Do these guys understand anything whatsoever...

By Andreas Steno Larsen

Social•Feb 15, 2026

Goldman Sachs Makes AI Core of Finance Operations

Goldman Sachs is embedding Anthropic’s Claude into accounting and compliance to automate high volume, rules based back office work. After six months of co building, executives were surprised that AI handled complex financial processes, not just coding tasks. The ambition is clear,...

By Spiros Margaris

Blog•Feb 15, 2026

Sellers Should Monitor How Shipping Costs Are Squeezing Their Margins

Ship.com warns that rising carrier surcharges will compress e‑commerce margins in 2026. It advises sellers to treat shipping expenses as part of COGS when evaluating product profitability. The firm highlights that base‑rate increases are less damaging than a growing web...

By EcommerceBytes

Social•Feb 15, 2026

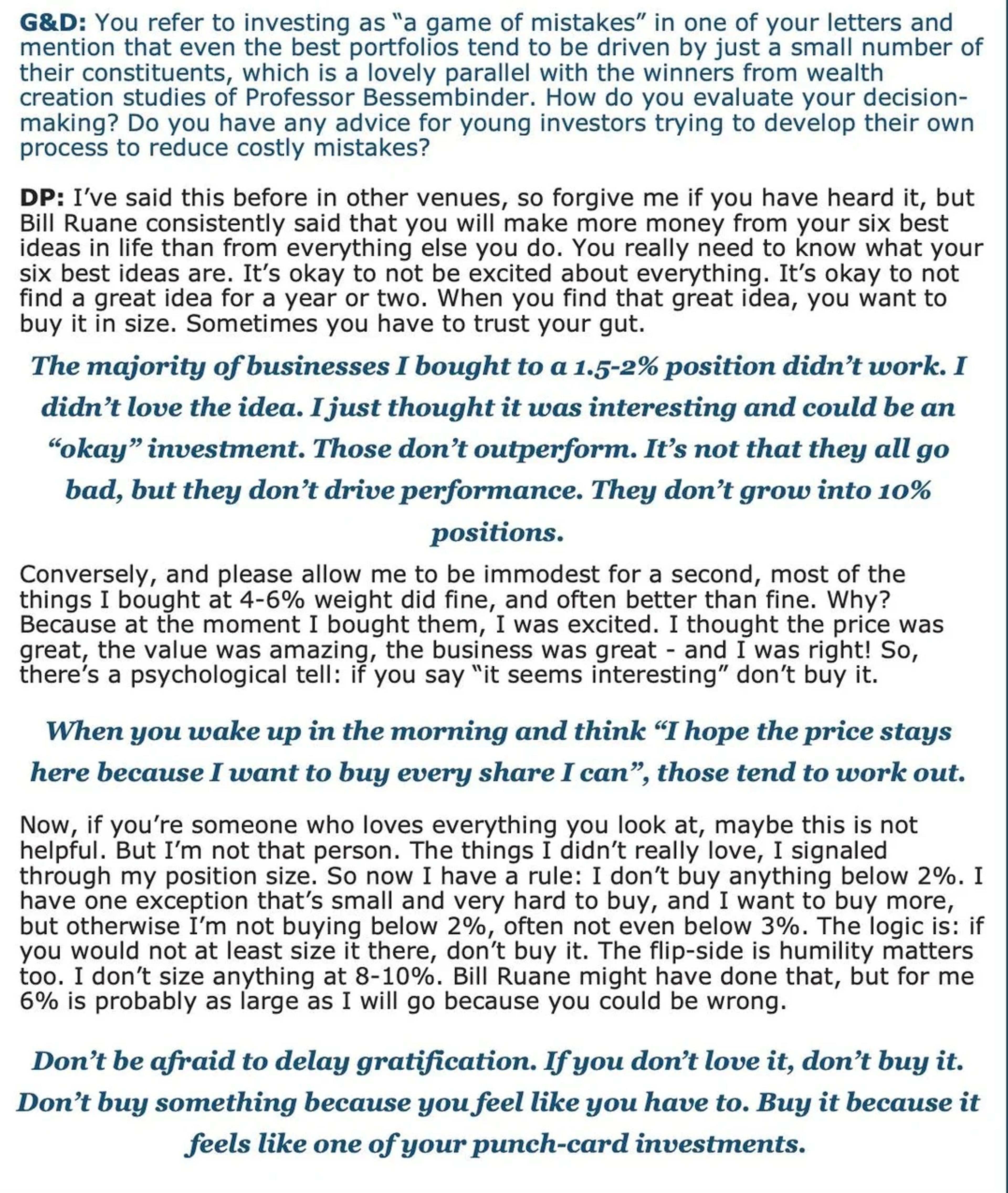

Bet Big on Your Six Best Ideas

David Poppe on capital allocation "You will make more money from your six best ideas in life than from everything else you do. When you find that great idea, you want to buy it in size."

By Matt Harbaugh

Social•Feb 15, 2026

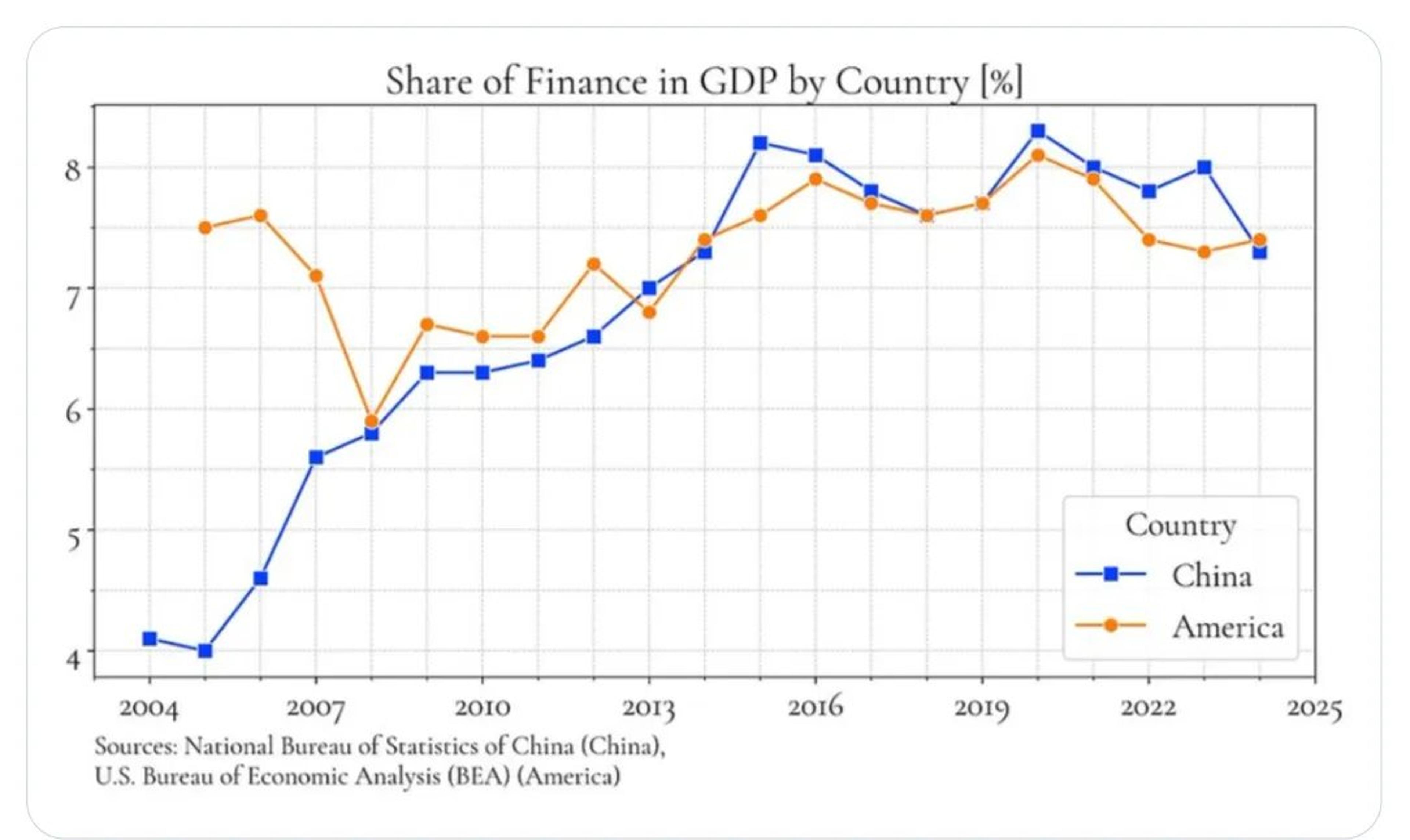

US‑China Gap Lies Beyond Financialization Share of GDP

Whatever the difference between the US and China may be and however you evaluate it, it isn’t in “financialization”, at least not as measured by the share of finance in GDP (h/t twitter account of devarbol for this graph). More...

By Adam Tooze

Social•Feb 15, 2026

S&P's Calm Mask Hiding Rising Dispersion and Volatility

The S&P 500 may appear calm on the surface, yet index-stock dispersion has increased dramatically and SPX has now slipped below the critical 6,900 level. With put skew rising and VIX expiration ahead, volatility risk is building. Read our latest...

By Brent Kochuba

Social•Feb 15, 2026

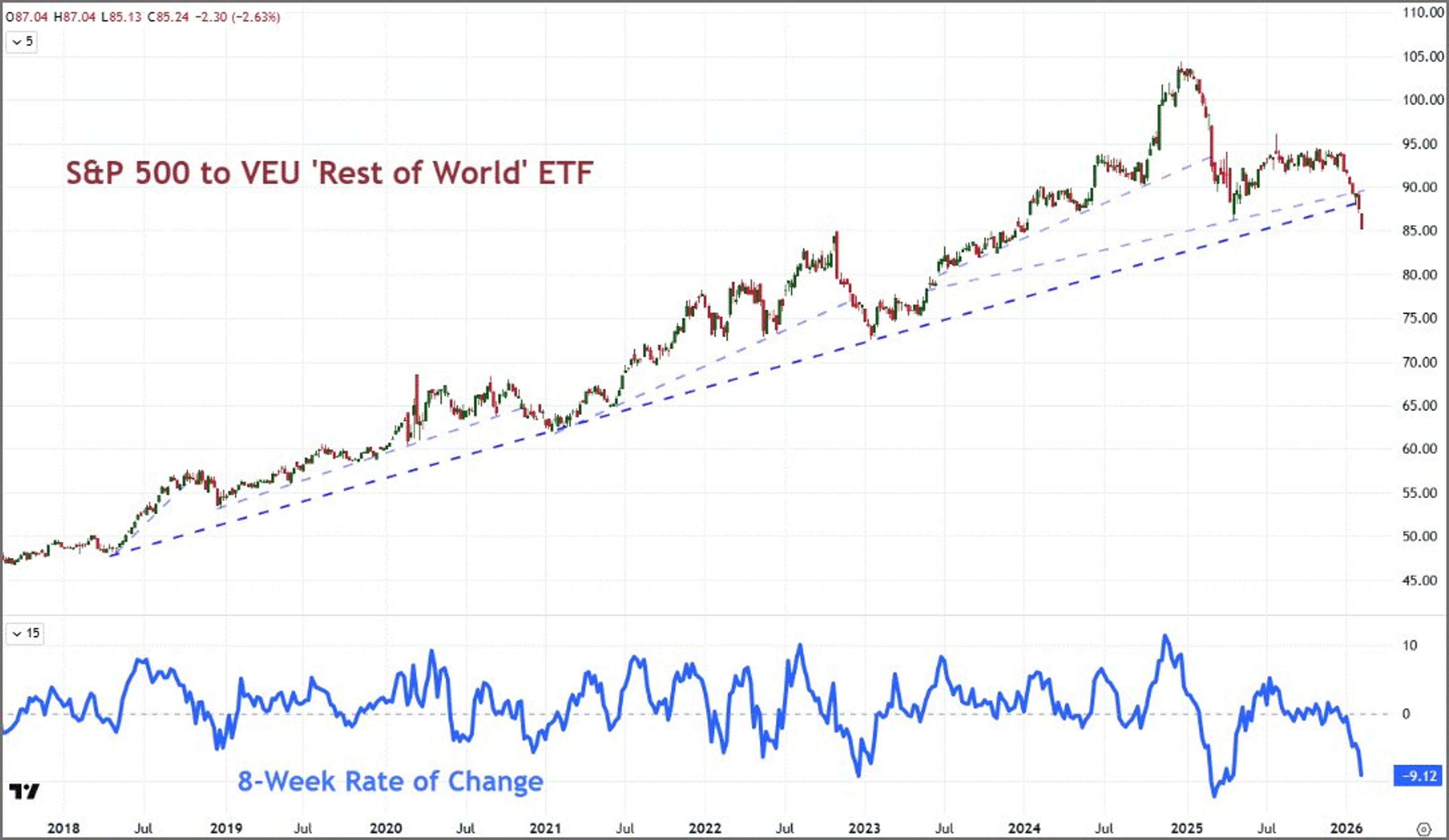

Volatility Rises, Liquidity Dips, US Premium Deflates

What's on tap for the week ahead? An increased frequency of volatility meets a holiday liquidity gap, while a run of event risk weighs in on the steadily deflating US premium. https://t.co/17IH2lFIn0 https://t.co/AlKhX25xxn

By John Kicklighter

Social•Feb 15, 2026

FTSE250 Awaits Breakout Above 23,585 Amid Sideways Trend

#FTSE250 needs Breakout 23585. Doji going sideways. Support 22816, 22226. RSI 62 not high. 13/21 day EMAs Bullish. Small Up Candle on Weekly and Sideways. Top Bollinger Band 23547. Midpoint Line 23330. Bottom Band 23118.

By WheelieDealer

Social•Feb 15, 2026

DAX Poised for Breakout as MACD Bull Cross Nears

#DAX doji Candle and Sideways. Resistance ATH 25508. Support 24272, 23924. On verge MACD Bull Cross. RSI 53 near Neutral. 13/21 day EMAs Bullish. Doji on Weekly and Sideways. Top Bollinger Band 25113. Midpoint Line 24800. Bottom Band 24500.

By WheelieDealer

Social•Feb 15, 2026

Warner Bros Eyes Paramount Deal Despite Netflix Matching Right

New: Warner Bros. is considering re-engaging with Paramount following its latest offer + pressure from some shareholders. WB still has a binding deal with Netflix, which would have the right to match any offer. Scoop with @MichelleF_Davis https://t.co/WLdpdeS0gc

By Lucas Shaw

Social•Feb 15, 2026

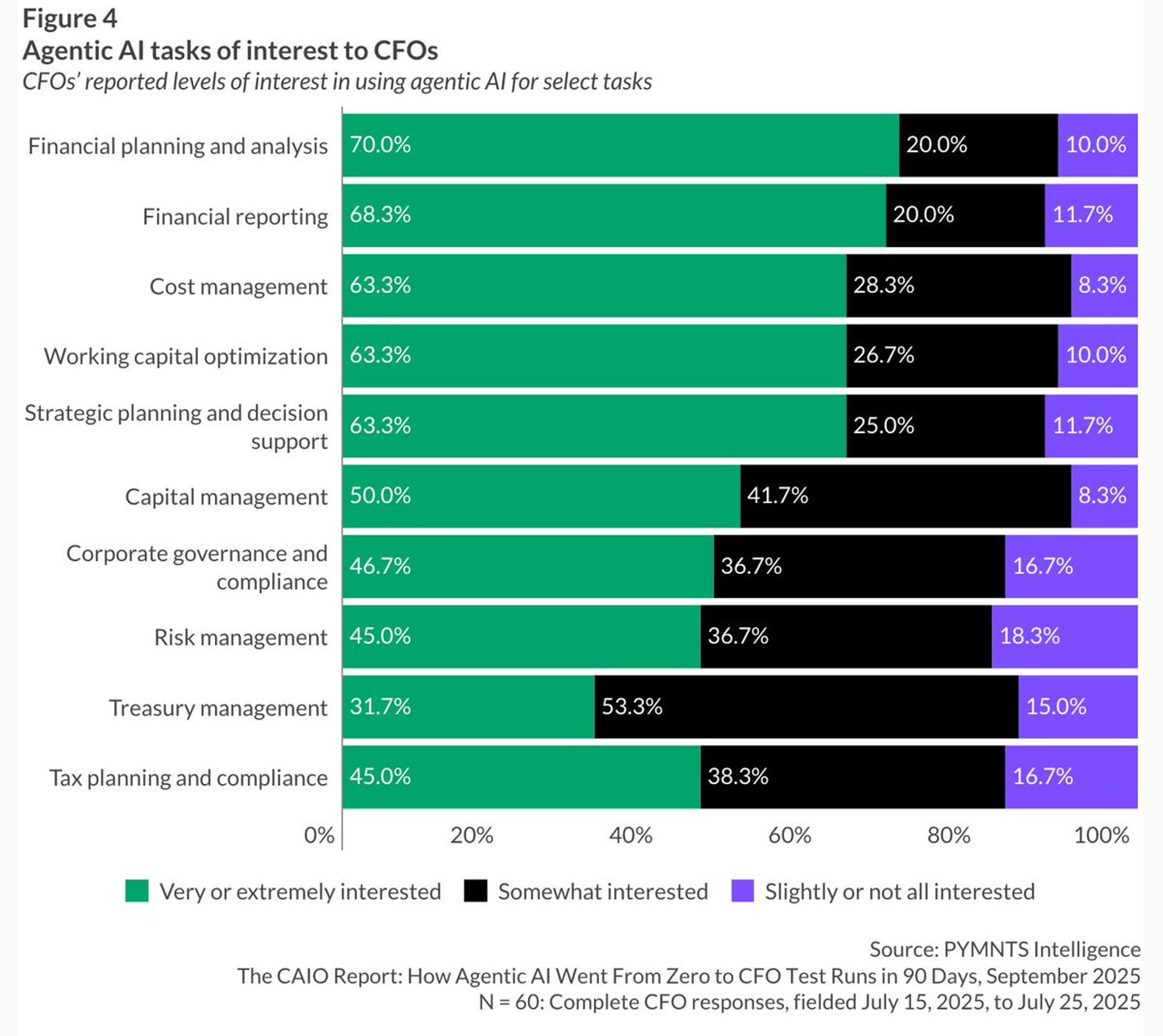

CFOs Embrace Agentic AI for Strategy, Shy From Treasury Risks

How Agentic AI Went From Zero to CFO Test Runs in 90 Days survey by @pymnts https://t.co/6MXgAdb3Fx Enterprise CFOs in the US are interested in using agentic AI for strategic planning, but cautious about using it for treasury, risk and compliance. https://t.co/2NioUOuMrE

By Efi Pylarinou

Social•Feb 15, 2026

AI-Powered Accounting Firm Launches Real-Time, Audit-Ready Service

.@Balance1189951 is an AI accounting firm for SMBs delivering real-time, audit-ready bookkeeping and accounting - run by AI, signed off by real accountants. Their agents pull in your financial context and automate your entire back-office finance. Congrats on the launch @mathiaslovring, @EmilMunkD,...

By YCombinator

Social•Feb 15, 2026

AI, Demographics, Trust Will Redefine Wealth Management by 2035

🇺🇸US #WealthManagement in 2035: Over the next decade, the convergence of #AI, demographic change, and evolving client trust will challenge wealth managers to reinvent how they compete and serve clients. @McKinsey. #WealthTech https://t.co/LYecpUeK0S

By Urs Bolt

Social•Feb 14, 2026

More Analysis, Fewer Dashboards: Solve the Real Problem

I've worked as a Sr. Director of BI and Analytics and I had to learn something the hard way. Despite what business stakeholders say, another dashboard is rarely the right answer to their needs. Why? Because what's behind the ask is a misconception...

By David Langer (Dave on Data)

Social•Feb 14, 2026

Gift High‑basis Assets Now, Transfer Low‑basis at Death

I can think of half a dozen reasons why it is NOT a mistake to gift a house to a child before passing. Why? Because these decisions are fact and portfolio dependent, and always/never advice is rarely reliable when it...

By Prof. Victoria J. Haneman

Social•Feb 14, 2026

REITs Hit Decade‑Low Valuations: Rare Investor Opportunity

REITs are currently trading at their lowest valuations in decades. The vast majority of investors are not positioned to take advantage of this historic opportunity. 🧵Here's a 'Mini Masterclass' on how to take advantage:

By Dividendology

Social•Feb 14, 2026

Buy Manappuram on Pullbacks Amid RBI

Macro: PE flows target Indian NBFCs. RBI cleared Bain's up to 41.7% in Manappuram; ₹43.85bn injected. Risk: regulatory scrutiny. Trading insight: buy Manappuram on pullbacks. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

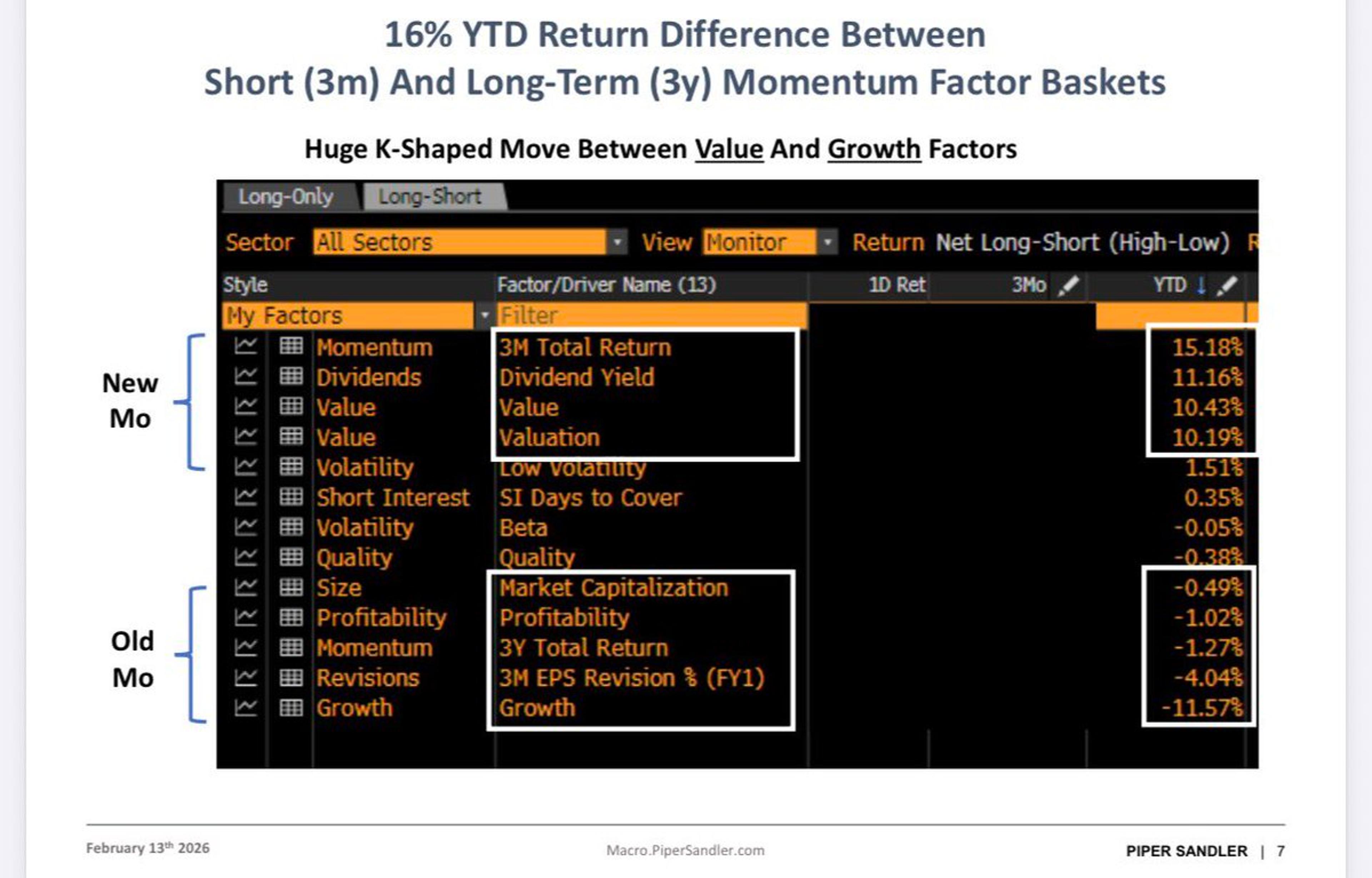

Value Tilt Gains as Momentum Spread Widens 16%

Classic monotonic pattern. When you see this pattern you know with a higher degree of certainty that it is one of THE drivers of how investors are positioning their portfolios. We’ve been recommending a value tilt since last fall, as...

By Michael Kantro

Social•Feb 14, 2026

Energy Leads US Sector Gains; Financials Fall

🇺🇸 US Sector Performance in 2026 📈 $XLE Energy up 22% $XLB Basic Materials up 18% $XLP Consumer Defensive up 16% $XLI industrials up 12.8% $XLU Utilities up 9% $XLRE Real Estate up 8% $XLV Healthcare up 2% $XLY Consumer Retail -2% $XLK Technology -2.5% $XLF Financials -5%

By Peter Sin Guili

Social•Feb 14, 2026

Turn Excel Into a Text Mining Powerhouse

Each week I send out a free analytics tutorial to 39,009 professionals. This week is Part 3 in a series on mining free-form text data using Python in Excel. Think about this for a second. Production quality, reproducible text mining inside an Excel...

By David Langer (Dave on Data)

Social•Feb 14, 2026

AI Threat Looms Over $3.5T Credit Market

Credit markets could be the next AI casualty. A UBS analyst flags the $3.5T leveraged loan and private credit space as vulnerable, with AI disruption moving faster than expected. Up to $120B in fresh defaults this year would turn the AI boom...

By Spiros Margaris

Social•Feb 14, 2026

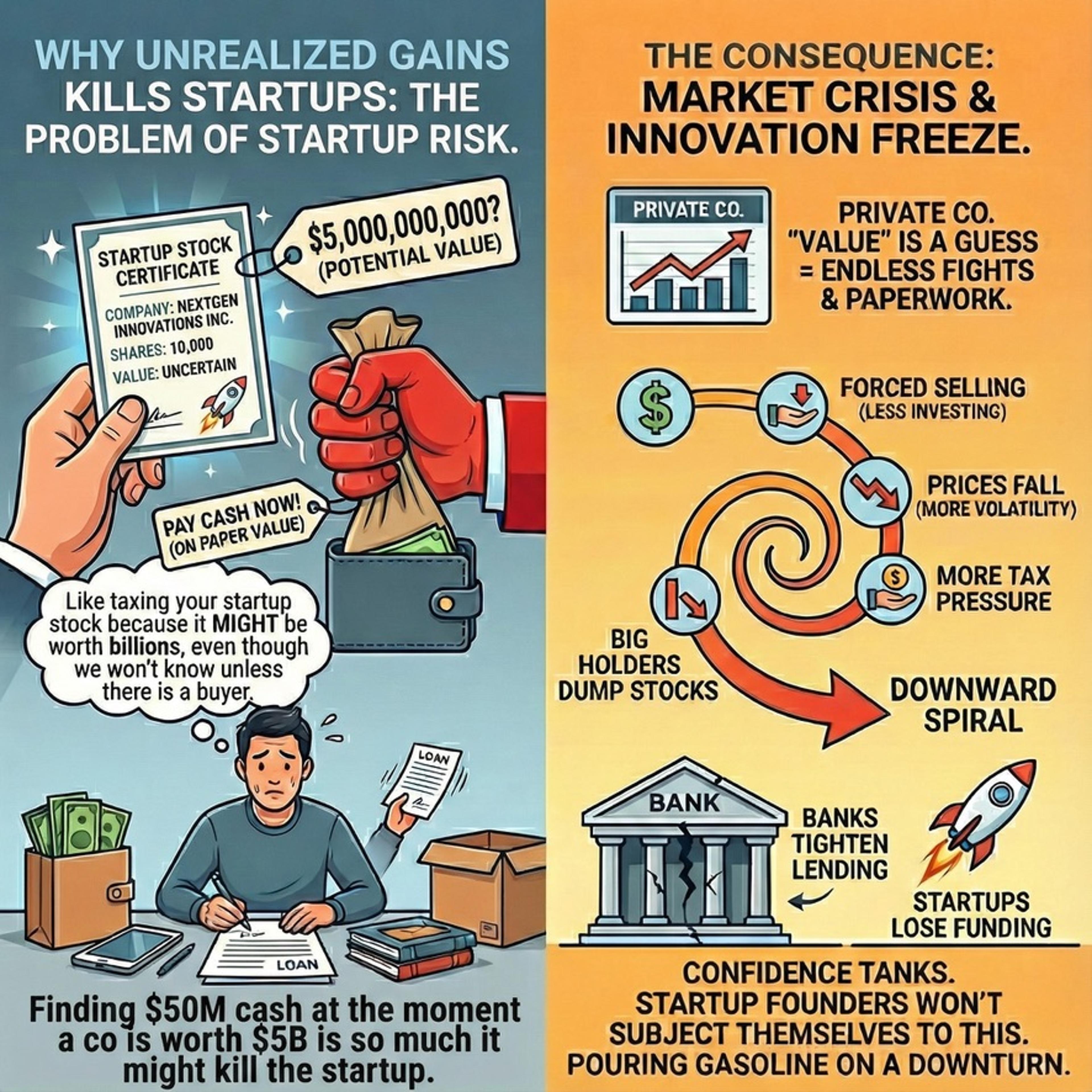

Unrealized Gains Tax Threatens New Investments Globally

Unrealized gains tax is a mega-drag on new investments. The same reason why the California Asset Seizure Tax by SEIU-UHW is going to destroy startups is happening in the Netherlands. https://t.co/jMgP3ieI2G

By Garry Tan

Social•Feb 14, 2026

Burn Rate Equals Risk; VC Burn Rates at Historic Highs

Burn rate = risk. So of course, this is true. These are the highest burn rates in history of VC. Simple fact. https://t.co/IrsIBd0qDC

By Bill Gurley

Social•Feb 14, 2026

Key Signals Founders Need Before Raising Next Round

$40M raised. Series A ready. Episode 232 dives into the real signals founders should look for before raising more capital 👇 https://t.co/0CcjGEIVb9 #SaaS #AI https://t.co/S1vxKwuxiB

By Ben Murray

Social•Feb 14, 2026

Stocks Are only Cheap During Economic or Business Crises

There are really only two times when stocks become "cheap": collectively, - usually when the health of the economy is in question, - and, more narrowly, when the viability of a business or its industry is in question. You...

By Lawrence Hamtil

Social•Feb 14, 2026

Provincial Revenues Forecast 2‑3% Growth, Lagging Economy

1/4 SCMP: "Major provinces are budgeting for 2 to 3 per cent growth this year in general public operating revenue, broadly in line with last year but below broader economic growth targets, Fitch Ratings said in a research note." https://t.co/HwyAPw042O

By Michael Pettis

Social•Feb 14, 2026

China Cracks Down on Hidden Corporate IOU Market

1/3 Very interesting Caixin article on attempts by Chinese regulators to get their arms around "the opaque market for corporate IOUs that has allowed big-name companies to defer payments to suppliers on a massive scale." https://t.co/FIJywKAtIX

By Michael Pettis