🎯Today's Finance Pulse

Updated 28m agoWhat's happening: Atlassian taps LinkedIn CFO James Chuong as new finance chief

James Chuong, who has served nearly five years as LinkedIn’s chief financial officer, will become Atlassian’s CFO on March 30. His compensation package includes a $600,000 base salary, a 75% target bonus, a $22 million RSU grant and a $2 million signing bonus. The move follows the announced departure of long‑time Atlassian CFO Joe Binz this summer.

Also developing:

By the numbers: AlayaCare raises $50M growth capital facility

News•Feb 16, 2026

FastFinance: Cost Implications of New HOPD Reporting Rules; Election Year Opportunity on Affordability

HFMA’s FastFinance podcast highlights new off‑campus HOPD reporting requirements that could impose significant cost burdens on health systems. The episode also cites a "Weird Number"—a 3‑5% annual net revenue loss attributed to inefficient electronic health records and billing platforms. Additionally, a recent survey suggests that rising healthcare costs may become a pivotal issue in this year’s mid‑term elections, potentially creating a political opening for hospitals. Listeners are encouraged to subscribe for deeper financial insights.

By HFMA – Healthcare Financial Management Association

News•Feb 16, 2026

Big Financial Impacts From Off-Campus HOPD Rule Change

Effective Jan. 1 2028, the Consolidated Appropriations Act of 2026 requires hospitals to assign separate NPIs and submit two provider‑based attestations for each off‑campus hospital outpatient department (HOPD) or lose Medicare OPPS reimbursement. Compliance documentation can be extensive—up to 200 pages per...

By HFMA – Healthcare Financial Management Association

Social•Feb 16, 2026

Private Credit Bets on Software Amid AI Uncertainty

Five private credit firms just provided $1.4B for a software buyout of OneStream valued at $6.4B. Same week everyone’s asking whether AI will make these companies obsolete. The market is telling you software is at risk. The lenders are telling you...

By JunkBondInvestor

News•Feb 16, 2026

UK-Based Investor Independent Franchise Partners Takes 3% Stake in Universal Music Group Worth $1.2bn+

Independent Franchise Partners (IFP) has acquired a 3.01% stake in Universal Music Group (UMG), valued at roughly €1.09 billion ($1.29 bn). The holding makes IFP the sixth‑largest shareholder and adds to its existing positions in Vivendi, Rightmove and Warner Music, signalling a...

By Music Business Worldwide (MBW)

News•Feb 16, 2026

Fitch Ratings Assigns ‘a’ Rating to Lee County, Florida Airport Revenue Bonds Series 2026

Fitch Ratings assigned an ‘A’ rating to Lee County, Florida’s airport revenue bonds, Series 2026, and affirmed the rating on existing bonds with a stable outlook. The rating reflects a balanced carrier mix serving a leisure‑focused market and enplanements that...

By Airport Improvement Magazine

News•Feb 16, 2026

State Firms Told to Avoid Borrowing when Investing

Thailand's finance ministry has instructed state‑owned enterprises to fund new investments primarily from internal revenues, limiting reliance on borrowing that is classified as public debt. The policy follows a backdrop where public debt stands at 66.1% of GDP, close to...

By Bangkok Post – Investment (subset within Business)

Social•Feb 16, 2026

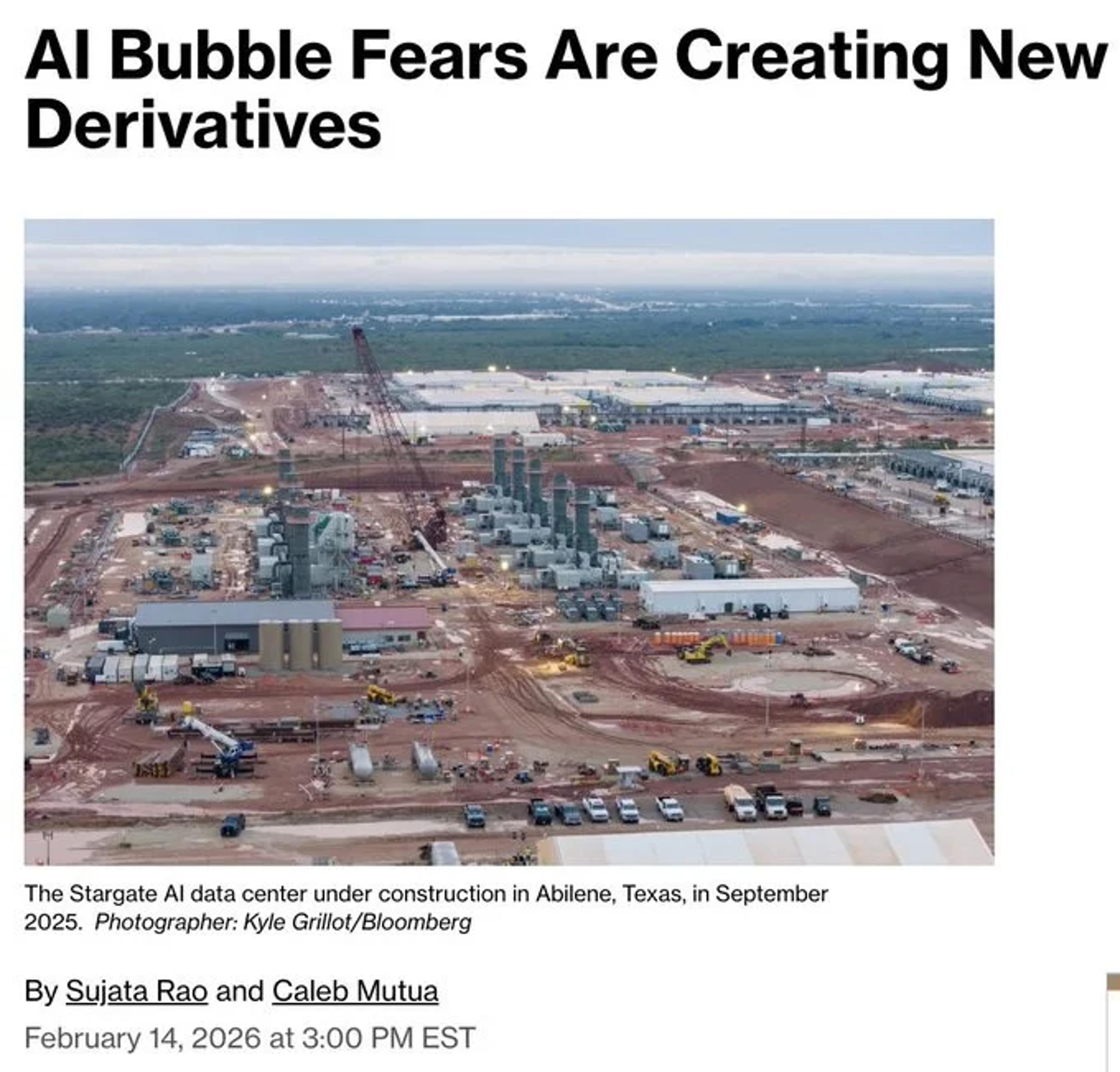

Alphabet and Meta CDS Explode From Zero to Top Traders

A year ago, CDS on Alphabet and Meta didn't exist. Now they're among the most actively traded single-name contracts in the US market Nobody creates a default insurance market for fun... $GOOG $META

By JunkBondInvestor

Social•Feb 16, 2026

AI Disruption Drives Widening Credit Spreads Ahead of Earnings

AI disruption is hitting IG credit spreads, not just stock prices. Concentrix: BBB-rated, 455,000 call center employees. Paid 130bps concession to refinance. Stock down 24% last week. Spreads doubled in February. Credit markets pricing obsolescence before it shows up in earnings.

By JunkBondInvestor

News•Feb 16, 2026

10 Stocks the Best European Fund Managers Have Been Buying and Selling

Leading European large‑cap equity funds rebalanced portfolios in December, increasing exposure to financial services, healthcare and, to a lesser extent, industrials. At the same time, allocations to basic materials, consumer defensive and technology stocks were trimmed. ASML emerged as the...

By Morningstar UK – News

News•Feb 16, 2026

Plus500 CEO, CFO, CMO to Sell 1.5M Shares

Plus500’s chief executive, chief financial officer and chief marketing officer announced the sale of 1,500,000 ordinary shares, representing roughly 2.14% of the company’s issued capital. The transaction will be executed on the secondary market through Goldman Sachs International, with Panmure...

By FX News Group — Feed

News•Feb 16, 2026

Crypto Cost Basis Gaps Create Civil and Criminal Tax Exposure

Crypto taxpayers are increasingly exposed to tax liabilities because many cannot substantiate the cost basis of their digital assets. When the IRS cannot verify basis, it treats the entire proceeds as taxable gain, potentially invoking civil penalties or criminal fraud...

By Accounting Today

Social•Feb 16, 2026

Eight Formulas Cut Reporting From Hours to Minutes

They told me their reports take 6 hours. I showed them 8 formulas. Now it takes 10 minutes. Join my free masterclass with Ramp on February 19th 👉 https://t.co/Aw0QFfIbL0 I've seen this pattern dozens of times. Smart FP&A teams. Good analysts. Solid finance...

By YourCFOGuy

News•Feb 16, 2026

Goldman Sachs Doubles Down on Aye Finance Despite Muted Debut; BofA Picks up Stake in EIL in Rs 100 Crore...

Goldman Sachs increased its stake in Aye Finance by buying 16.8 lakh shares for about Rs 22 crore, bringing its total exposure to roughly Rs 91 crore. The NBFC’s IPO was 97 % subscribed, yet the shares opened flat at Rs 128.80, just 0.16 % below the issue...

By The Economic Times – Markets

News•Feb 16, 2026

EU Crypto Reporting Goes Live and Netherlands Immediately Votes on 36% Bitcoin Tax – Even if You Don’t Sell

The Dutch House approved a Box 3 overhaul that will tax the annual change in value of liquid assets such as Bitcoin at a flat 36 % rate, effective Jan 1 2028 pending Senate approval. The regime treats crypto like a marked‑to‑market security, meaning...

By CryptoSlate

News•Feb 16, 2026

Cohu: Maintaining Bearish Stance Post Q4 Earnings Release

Cohu, Inc. posted a Q4 earnings miss despite a 34% surge in recurring bookings and over 12% revenue growth, keeping operating losses and margins under pressure. The company added $290 million of convertible debt, raising dilution concerns, while one‑time inventory charges...

By Seeking Alpha — Site feed

News•Feb 16, 2026

S&P Global: An Undervalued Dividend King For Long-Term Investors

S&P Global (SPGI) is a $133 billion market‑cap provider of credit ratings, benchmarks, analytics and workflow solutions. The company has raised its dividend for 53 consecutive years and trades at a 21.9× P/E, roughly 20% below its five‑year average, implying undervaluation....

By Seeking Alpha — Site feed

News•Feb 16, 2026

Brokers to Approach RBI as Tighter Norms Squeeze Funding for Proprietary Desks

The Reserve Bank of India’s new capital‑market exposure framework, effective April 1 2026, mandates 100 percent collateral backing for all bank loans to brokerage firms and bars banks from financing proprietary trading desks. Brokers plan to petition the RBI for clarifications as the...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Indian REITs Distribute ₹2,450 Crore to over 3.8 Lakh Unitholders in Q3

India’s five listed REITs paid out over ₹2,450 crore to more than 380,000 unitholders in Q3, covering 185 million square feet of Grade A office and retail space. Since inception, the trusts have distributed over ₹29,100 crore and now hold assets exceeding ₹2.5 lakh crore. The...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Sundaram AMC Launches Mid-Cap Fund in GIFT City

Sundaram Asset Management Company has launched the Sundaram India Mid Cap GIFT, a USD‑denominated offshore feeder fund that gives global investors direct exposure to India’s mid‑cap equities. The fund is domiciled in GIFT City’s International Financial Services Centre and invests...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Volkswagen Aims to Cut Costs by 20% by 2028 in Restructuring Plan, Report Says

Volkswagen announced a new restructuring plan aimed at cutting operating costs by 20% by 2028, building on a €10 bn savings target set three years ago. The initiative may involve plant closures and a further reduction of 35,000 jobs by 2030....

By The Guardian » Business

News•Feb 16, 2026

No One Has Cash to “Buy the Dip” But $7.7T Could Rotate Into Bitcoin if Prices Stay Beaten Down

A new analysis argues that most cash is already deployed, leaving little idle liquidity to "buy the dip" in risk assets. Retail portfolios show a cash allocation of 14.4% in January 2026, down from over 20% in 2022, while equity...

By CryptoSlate

News•Feb 16, 2026

Tract’s Fleet Data Centers Seeks $3.8bn to Fuel Nevada Build-Out

Fleet Data Centers, the development arm of Tract, announced a $3.8 billion senior secured note issuance to fund a 230 MW data center campus in Reno, Nevada. The facility, built on a 252‑acre site, is 100 percent leased to an unnamed investment‑grade tenant...

By Data Center Dynamics

News•Feb 16, 2026

Investment Fund for Wales Sees Largest-Ever Deal

British Business Bank’s £130 m Investment Fund for Wales has completed its largest single investment, a £3.5 m injection into engineering services firm Advantiv. The deal, executed by fund manager Foresight Group, marks the 102nd investment since the fund’s 2023 launch. Advantiv...

By UKTN (UK Tech News)

News•Feb 16, 2026

Metaplanet Operating Profit to Rise 81% in 2026 After Soaring 17-Fold Last Year on Options Writing

Metaplanet, Japan’s largest bitcoin treasury firm, posted a 17‑fold jump in operating profit to ¥6.28 bn in 2025, propelled by a surge in options‑writing premiums that lifted revenue 738% to ¥8.9 bn. Despite the earnings boom, a steep bitcoin price decline generated...

By CoinDesk

News•Feb 16, 2026

Eaglestone Management: Experience Forged in Global Infrastructure Finance

Eaglestone Management’s leadership team combines deep project‑finance banking experience with hands‑on infrastructure execution. CEO Pedro Neto brings over 30 years and involvement in more than €50 billion of global projects across energy, transport and concessions. Managing Partner Nuno Gil adds 25...

By CFI.co (Capital Finance International)

News•Feb 16, 2026

Broker’s Call: Ola Electric (Sell)

Emkay Global downgraded Ola Electric Mobility to Sell, slashing its target price by 60% to ₹20 from ₹50. The company posted a weak Q3, with revenue down 55% YoY and a 61% drop in unit volume to 32,000 units, pushing...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

FCA Exchanges Letters on Cooperation with India Regulator, IFSCA

The Financial Conduct Authority (FCA) has signed an Exchange of Letters with India’s International Financial Services Centres Authority (IFSCA), the regulator for GIFT City. The pact commits both bodies to share regulatory knowledge and best‑practice insights, aiming to strengthen links...

By UK FCA – News

News•Feb 16, 2026

Telkom Indonesia Revisits NeutraDC Sale Plans - Report

Telkom Indonesia is re‑engaging advisors to sell a majority stake in its data‑center subsidiary NeutraDC, targeting a valuation between $1 billion and $1.5 billion. The company previously explored a sale in 2022 and considered minority stakes in 2024, with Goldman Sachs and...

By Data Center Dynamics

News•Feb 16, 2026

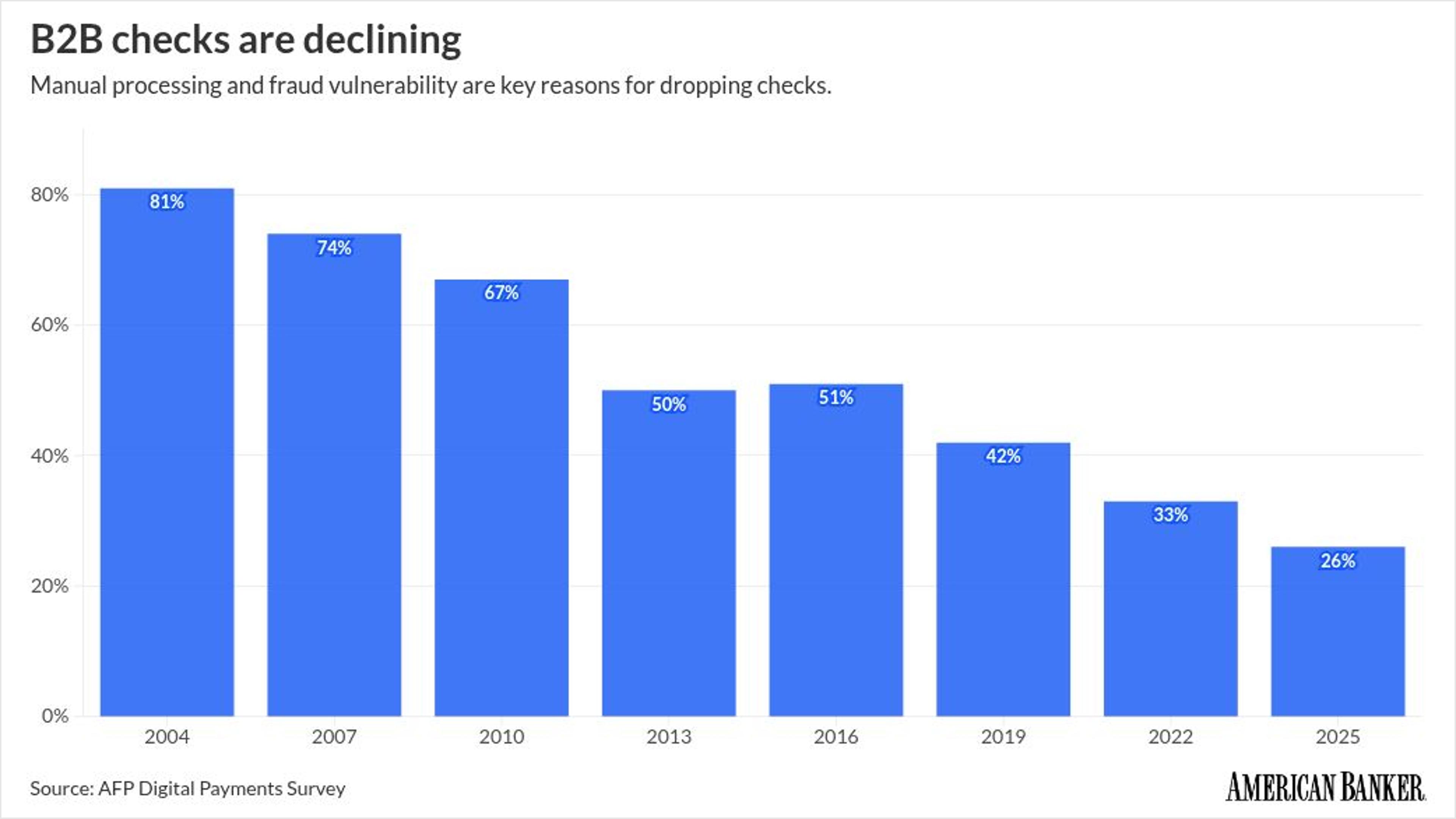

ACH Volume Is Soaring. Here's How that Threatens Banks.

ACH network volume surged in 2025, reaching 35.2 billion payments worth $93 trillion, a 5 percent rise year‑over‑year. Person‑to‑person transfers grew 19.8 percent and business‑to‑business payments rose 9.9 percent, while check usage in B2B fell to 26 percent. Nacha has proposed lifting the same‑day ACH transaction...

By American Banker

News•Feb 16, 2026

Software Maker Dassault Systèmes Falls 8% as AI Fears Persist; Europe Markets Edge Higher

European markets edged higher after the Munich Security Conference, but software giant Dassault Systèmes slumped 8% as lingering AI skepticism dampened investor sentiment. The conference underscored Europe’s push for greater defense spending and strategic autonomy, lifting defense‑related equities. Meanwhile, NatWest kicked...

By CNBC – US Top News & Analysis

News•Feb 16, 2026

EQS-CMS: Henkel AG & Co. KGaA: Release of a Capital Market Information

Henkel AG & Co. KGaA disclosed its weekly share‑buyback activity for 9‑13 February 2026, repurchasing 17,000 preferred shares and 18,000 ordinary shares on the XETR. The preferred‑share buyback cost €1.37 million at an average price of €80.56, while the ordinary‑share buyback cost €1.34 million...

By Business Insider – Markets Insider

News•Feb 16, 2026

Cregis at iFX EXPO Dubai 2026: Shaping the Next Era of Enterprise Payments and Digital Asset Infrastructure

Cregis showcased its upgraded Cregis Payment Engine at iFX EXPO Dubai 2026, positioning the solution as a multi‑chain, multi‑currency platform for enterprise payments. The engine promises near‑real‑time cross‑border settlement, automated routing, and real‑time compliance monitoring, targeting use cases such as...

By Business Insider – Markets Insider

News•Feb 16, 2026

Firms Report Improved Financial Performance Linked to Use of Embedded Finance

A new PYMNTS Intelligence study of 515 senior leaders shows embedded finance is now a strategic imperative for mid‑size and large firms. Nearly 90% of respondents prioritize strengthening customer and employee relationships, while 75% plan technology upgrades within the next...

By PYMNTS

News•Feb 16, 2026

Stablecoin Payments Show Up at Checkout Despite Crypto Markets Slump

Despite a broad crypto market downturn, stablecoin‑linked cards are gaining traction at U.S. checkout counters. Monthly payment flows through these cards have surpassed $1.5 billion, and annualized spend now tops $18 billion. The growth is driven by card networks embedding stablecoins as...

By PYMNTS

News•Feb 16, 2026

Rethinking SARs in the Fight Against Financial Crime

Suspicious Activity Reports (SARs) remain the cornerstone of global AML frameworks, yet many institutions misunderstand their purpose, treating them as accusations rather than suspicion flags. Regulatory pressure and soaring transaction volumes have driven firms to prioritize filing speed over narrative...

By Fintech Global

News•Feb 16, 2026

The Spreadsheet Trap in Financial Crime Risk

Spreadsheets have long been the default tool for financial crime risk assessments, prized for their flexibility and low cost. However, they cannot enforce governance, version control, or audit trails required by modern compliance frameworks. As institutions expand across products and...

By Fintech Global

News•Feb 16, 2026

A Practical Guide to Completing Identity Verification for Your Clients

In this Accountancy Age episode, the hosts walk listeners through the two‑step Companies House identity verification process that directors and persons with significant control (PSCs) must complete before filing confirmation statements. They explain how ACSPs report verifications, obtain the 11‑character...

By Accountancy Age

News•Feb 16, 2026

EToro Launches Shareholder Engagement Initiative in Partnership with Stockperks

eToro has launched a shareholder engagement initiative in partnership with Stockperks, a loyalty‑rewards marketplace for public companies. The program invites eligible eToro shareholders to receive exclusive educational content, event invitations, and direct access to company leaders and market experts. By...

By The Fintech Times

News•Feb 16, 2026

A Blueprint for the Predictive Firm: Moving Beyond Manual Data Reconciliation

The episode explores how leading accountancy firms are shifting from retrospective reporting to predictive, real‑time visibility by consolidating fragmented tech stacks into unified platforms. It highlights the £300k technology investment benchmark needed to eliminate manual data reconciliation, improve margin protection...

By Accountancy Age

Social•Feb 16, 2026

Open Architecture Drives Southeast Asian Wealth Management Transformation

Strategic Transformation in Southeast Asian #WealthManagement: The Case for Open Architecture – The most successful transformations share common elements: clear strategic positioning, authentic partnerships with #FinTech and #WealthTech platforms, and the courage to fundamentally rethink operating models. Read my latest article on...

By Urs Bolt

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Blog•Feb 16, 2026

A ‘Corruption Perceptions Index’ for Your Own Co.

Transparency International’s latest Corruption Perceptions Index shows a global decline in clean governance, prompting compliance leaders to look inward. The article proposes building a corporate‑level corruption perception index to gauge how employees view ethical standards and misconduct. It outlines the...

By Radical Compliance

Social•Feb 16, 2026

Master These 5 SaaS Metrics for Sustainable Growth

Every SaaS leader should master these 5 metrics. Bookings, retention, margins, OPEX, and efficiency — the core numbers behind durable growth and valuation. 🎥 https://t.co/ViVeSCTLXx #SaaS #SaaSMetrics https://t.co/bvoRB24XES

By Ben Murray

Social•Feb 16, 2026

Weekly S&P 500 Chart Review Highlights Key Trends

ICYMI: Weekly S&P500 #ChartStorm blog post https://t.co/B5a4uBC2Q4 Thanks + follow reco to chart sources @MarketCharts @topdowncharts @dailychartbook @MauiBoyMacro @KobeissiLetter @StealthQE4 @HayekAndKeynes

By Callum Thomas

Social•Feb 16, 2026

Sector Rotation Ends; Brace for Upcoming Volatility

Given I timed the sector rotation with precision in Nov & said it would likely run until Feb, and we are here, I'm gonna share what else I also told clients: IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY™️😉

By Samantha LaDuc

Social•Feb 16, 2026

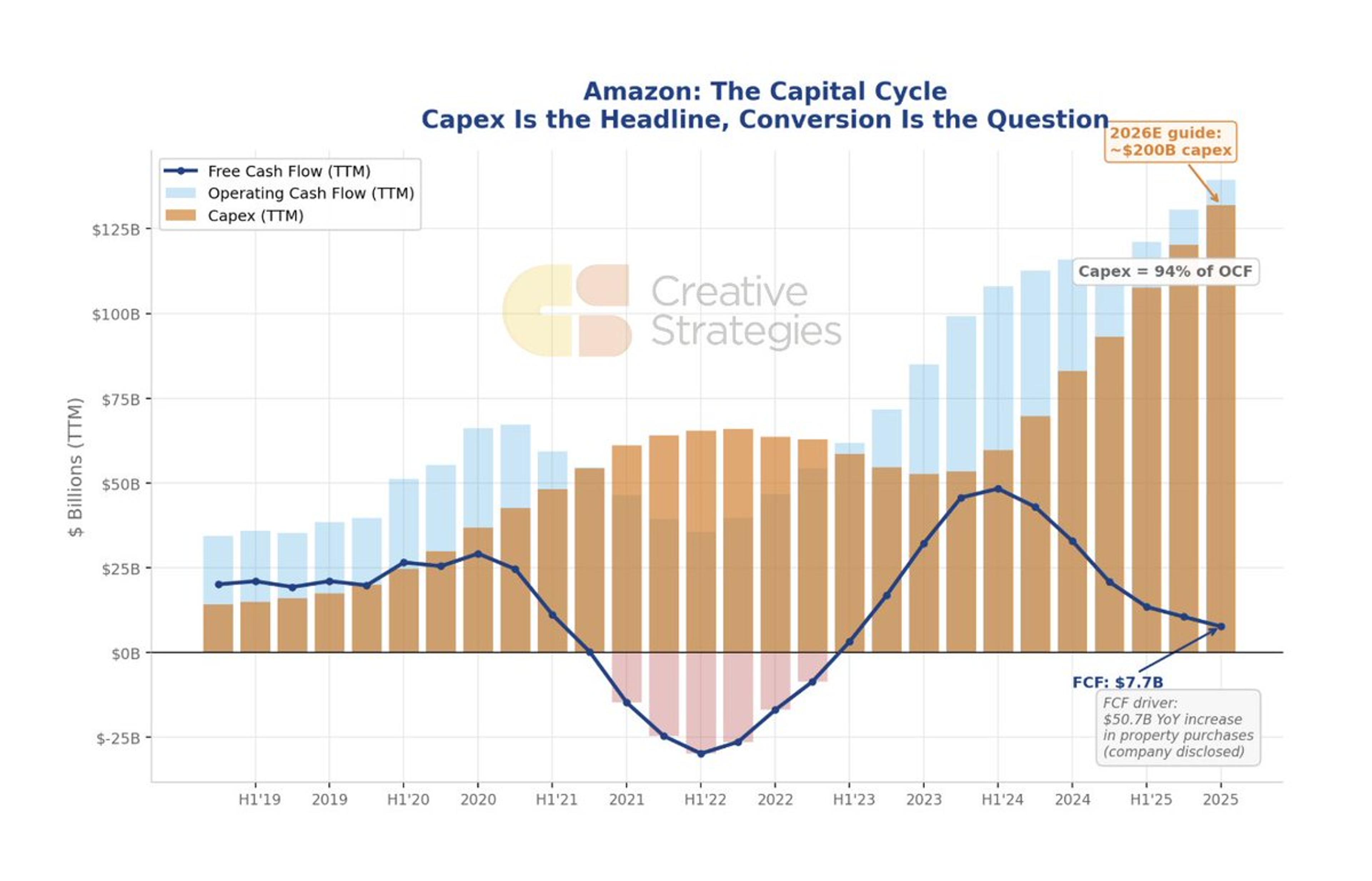

Amazon's High Capex-to-FCF Isn't New, Still Managed Well

Working on my $AMZN growth thesis report for this week, and just helpful to point out, that this high capex to FCF is not uncharted territory for Amazon. I get there is more competition this time than e-comm but they...

By Ben Bajarin

Social•Feb 16, 2026

Reeves Gains Momentum as UK Debt Interest Falls

UK’s Reeves is set to get a boost from falling debt interest https://t.co/iirQy0fcBA via @PhilAldrick https://t.co/R8A0t6Sj29

By Zöe Schneeweiss

Social•Feb 16, 2026

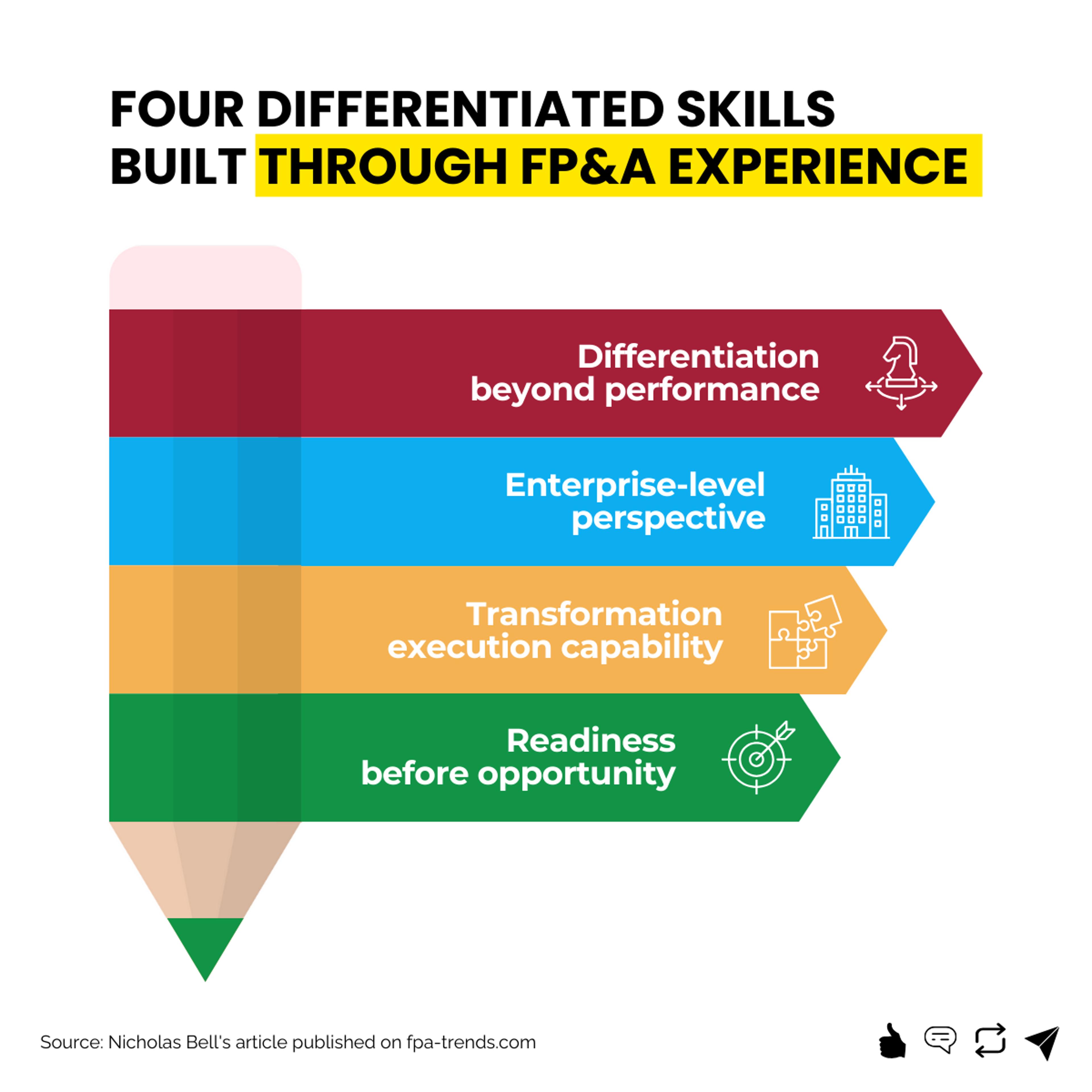

Stand Out in FP&A: Unique Capabilities Beat Plateau

Why do FP&A careers plateau? Not because of performance—but because, at promotion time, top finance talent starts to look alike. Nicholas Bell (Clyde & Co), on the capabilities that set him apart on his path to Head of FP&A. 🔗 https://t.co/w8xraVQKjD #fpatrends #FinanceCareers https://t.co/BYjczXwbsO

By Larysa Melnychuk

Social•Feb 16, 2026

Bobby Jain Launches $6B Multi‑strat Amid Portfolio Shift

Hedge fund portfolios are being shaped by the shift from banks, multi-manager scale, and public/private convergence. Bobby Jain (CEO/CIO, Jain Global) on launching a $6B multi-strat, talent & risk management, and portfolio construction. https://t.co/BfZsVcl2vY With thanks to @AlphaSenseInc, @MorningstarInc, and Ridgeline.

By Ted Seides

Social•Feb 16, 2026

Chamath's SPACs Crash: All Lose Over 90%

Meanwhile Chamath Palihapitiya’s SPAC track record - Chamath became the face of the SPAC boom through his Social Capital Hedosophia deals. Their performance since? • $SPCE: −95% • $OPEN: −98% • $CLOV: −90% • $SOFI: −45% • $AKLI: −95% •...

By Doug Kass